by | Feb 20, 2025 | Business

Can XRP break through $5? XRP is surging amidst positive news, including the SEC acknowledging Grayscale’s XRP-spot ETF application and potential shifts in regulatory policy. Get the latest XRP news and price analysis here.

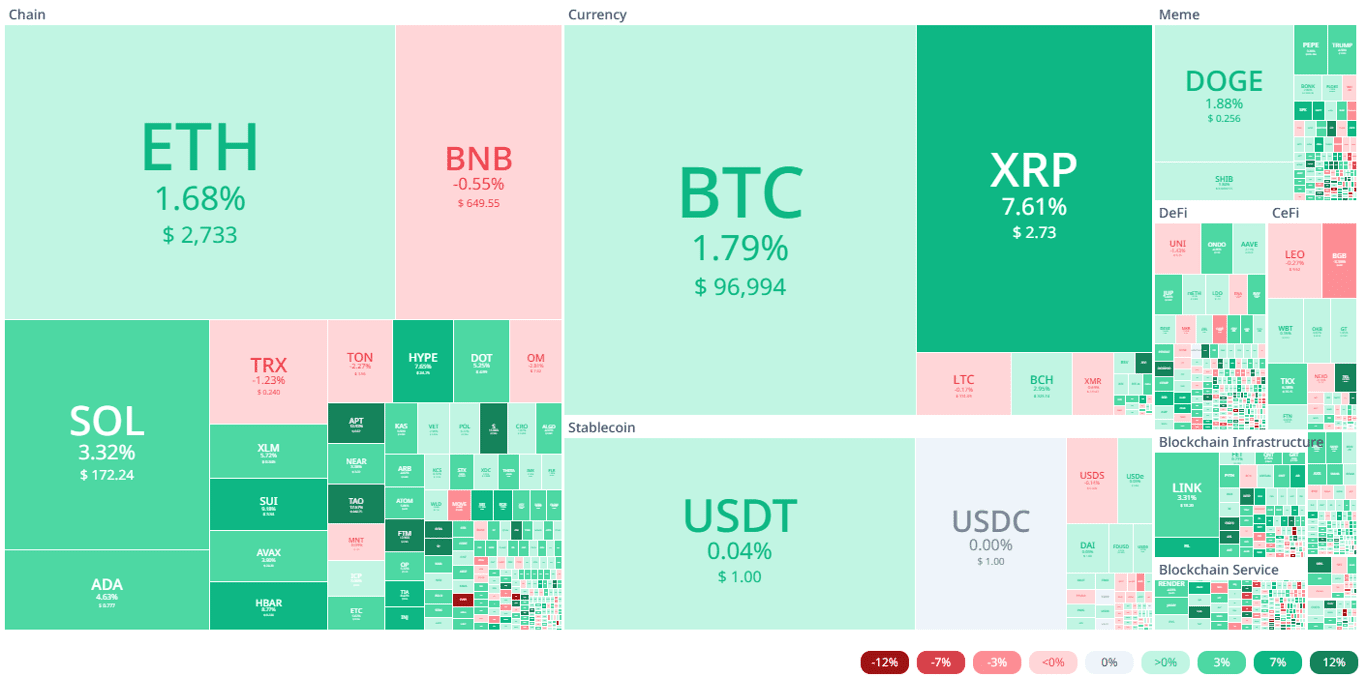

Today’s crypto market is green after being in the red zone for several days. Giant tokens, such as BTC, Solana, and Ethereum have experienced price increases, including XRP.

The increase in the price of XRP is higher than other major tokens? Is it because of the development of the XRP ETF project that Greyscale is currently working on?

Let’s discuss together the latest news about XRP today and its price prediction which is projected to touch $5 soon.

SEC Acknowledges Grayscale’s XRP-Spot ETF Application

On Thursday, February 13, the U.S. SEC officially acknowledged Grayscale’s application to convert its XRP trust into an exchange-traded fund (ETF).

While this acknowledgment does not guarantee approval, it marks a significant milestone for XRP. Leading ETF analyst Nate Geraci described the move as an “enormous message” in his X post.

Grayscale originally launched its XRP trust in September and applied to convert it into an ETF in January.

Although the SEC could reject the filing, the fact that it acknowledged the application instead of dismissing it outright suggests a possible shift in regulatory stance.

This development has fueled optimism in the cryptocurrency community, particularly among XRP investors.

SEC Litigation and Policy Adjustments

While the SEC remains engaged in litigation with Ripple, the company associated with XRP, the agency has also shown signs of shifting its approach to crypto enforcement.

On Wednesday, February 19, the newly revamped SEC and its Crypto Task Force continued addressing regulatory challenges and enforcement cases related to digital assets.

Fox Business journalist Eleanor Terrett reported a major court development regarding the SEC’s expansion of the Dealer Rule.

Under Acting Chair Mark Uyeda, the SEC voluntarily dismissed its appeal against a lawsuit brought by the Blockchain Association and the Crypto Freedom Alliance of Texas (CFAT).

This lawsuit challenged the SEC’s broad application of the Dealer Rule, which sought to classify high-frequency trading firms and certain crypto hedge funds as dealers.

The dismissal of the appeal is seen as a victory for innovators and entrepreneurs in the crypto space.

The Blockchain Association celebrated this move, stating: “Today, under new leadership at the agency, the SEC voluntarily dismissed its appeal, marking a total victory in the case not only for us, but for the innovators, entrepreneurs, and builders across America.”

The SEC’s appeal withdrawal follows recent court filings on enforcement actions against Binance, Coinbase, and Lejilex.

These filings requested stays, arguing that extensions would allow the SEC’s Crypto Task Force to develop a regulatory framework that could lead to better resolutions.

Ripple Case and Regulatory Priorities

Despite these positive developments, investors hoping for the SEC to withdraw its appeal of the Programmatic Sales of XRP ruling in the Ripple case may be disappointed.

The next deadline in the Ripple case is April 16, when Ripple must file its appeal-related reply brief. With no filings expected until then, it appears the SEC is prioritizing enforcement cases with tighter deadlines.

Eleanor Terrett noted: “I’m told by multiple legal sources that the SEC has been prioritizing cases with imminent court deadlines.”

Some experts speculate that the SEC may be waiting for Paul Atkins’ confirmation as SEC Chair before formally withdrawing from certain non-fraud crypto cases.

Current deadlines for major crypto lawsuits range from March 14 to April 16, allowing time for regulatory adjustments before the Crypto Task Force finalizes its approach.

XRP Price Trends: ETF Optimism and Market Response

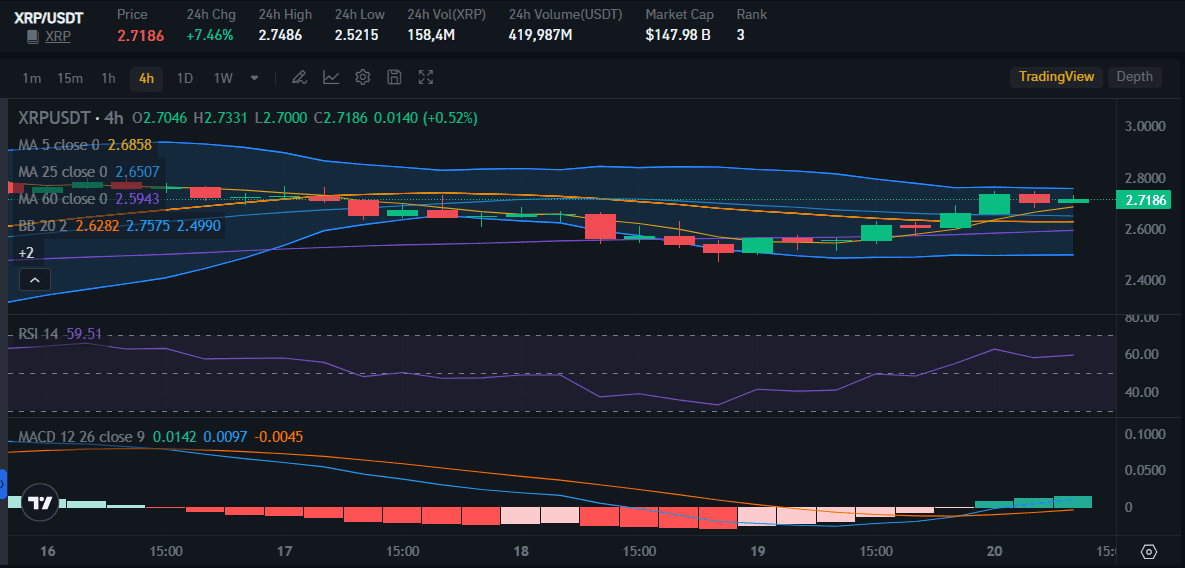

XRP has shown significant price movements in response to the latest regulatory developments. On February 20, XRP surged 7.46% and now trading at $2.7186.

This increase outperformed the broader crypto market, which gained 1.30% and reached a total market cap of $3.14 trillion.

Market analysts attribute XRP’s rally to speculation surrounding a potential SEC withdrawal from the Ripple case appeal and progress on the approval of XRP-spot ETFs. Key price scenarios include:

- Bullish Case: If the SEC withdraws its appeal, XRP could break past its all-time high of $3.5505.

- ETF Catalyst: An XRP-spot ETF approval could push prices toward $5, driven by institutional inflows.

- Bearish Case: A continued SEC appeal and an ETF rejection could send XRP below $1.50.

XRP analysts remain divided on the long-term price outlook. Some, like XRP Captain and Egrag Crypto, predict a massive rally to $250 or even four-digit price targets.

However, more conservative analysts suggest that XRP must first break key resistance levels, such as $3.40, to confirm a new all-time high.

Institutional Adoption and the Future of XRP

Ripple’s continued expansion and the potential approval of XRP-spot ETFs are expected to drive institutional adoption.

The company is actively securing new financial services partnerships, launching new financial products, and expanding its workforce in the U.S. These developments signal a broader acceptance of XRP in the global financial system.

Meanwhile, the U.S. government’s approach to crypto regulation remains a key factor. The Trump administration’s pro-crypto stance, combined with the SEC’s evolving enforcement strategy, suggests that regulatory clarity for XRP and other digital assets could be on the horizon.

With market optimism growing and regulatory shifts taking place, the next few months will be critical for XRP’s future.

Investors will closely watch the SEC’s next moves, as well as any updates on XRP-spot ETF approvals and Ripple’s legal battle, to determine the token’s trajectory in 2025 and beyond.

by | Feb 20, 2025 | Business

ASCARO invites investors to partake in the ASCARO Padel & Social Club expansion journey, with as little as RM4,550 on equity crowdfunding platform pitchIN.

KUALA LUMPUR, 20 February 2025 – ASCARO has officially launched an equity crowdfunding (ECF) campaign on pitchIN to raise RM20 million to execute ASCARO’s plans to open four state-of-the-art padel clubs across Kuala Lumpur and Jakarta by 2025.

Starting at RM4,550 – the lowest-tier of investment – investors will also be given an additional perk of free membership at ASCARO Padel & Social Club with higher investment amounts.

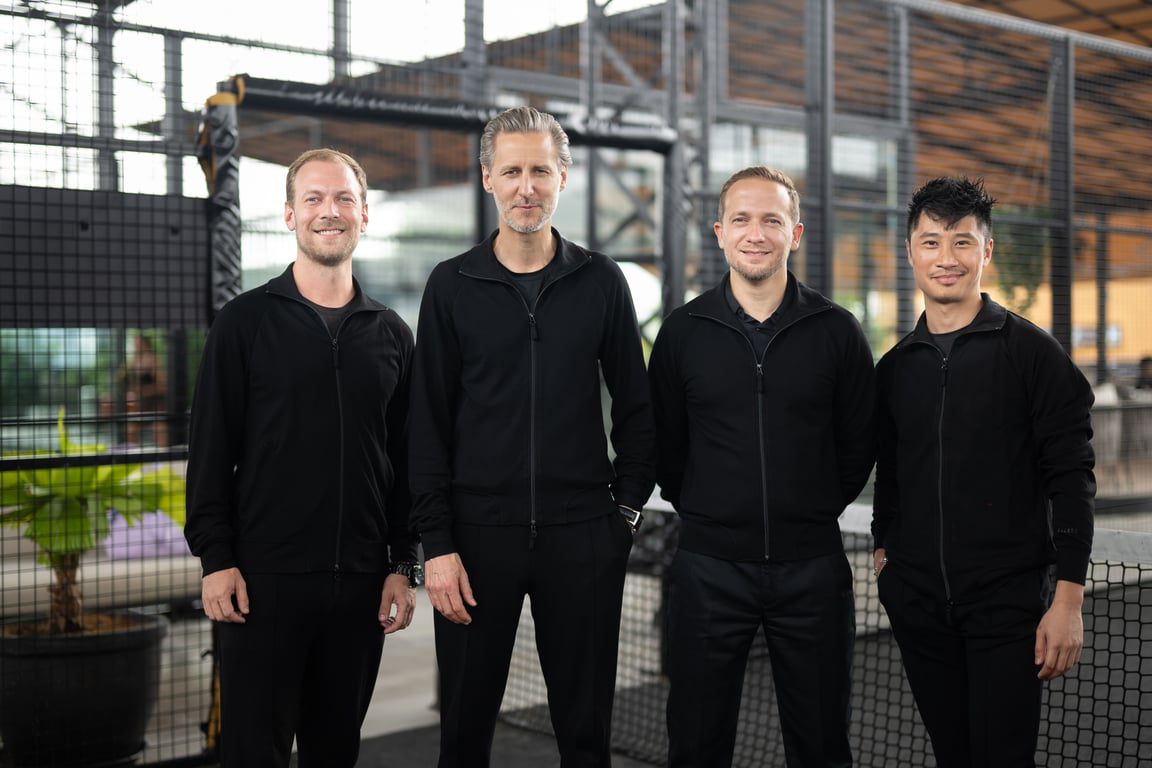

“Padel has grown fast in Southeast Asia and ASCARO is going beyond merely filling a market gap. We are crafting an entirely new paradigm for urban recreation and networking, creating a unique blend of athletic pursuit and luxury lifestyle,” said Daniel Liljekvist, Managing Director and Partner at ASCARO. “You can be part of this wave and leverage ASCARO’s unique platform in accelerating the growth of padel in the region.”

WHY PADEL? THE BASIC NUMBERS

While padel has been steadily building a reputation on the global sports scene with 25 million players across 110 countries, the potential for padel in Southeast Asia is immense yet largely unrealized for this fast-paced social sport that blends the best of tennis and squash. Globally, there are 20,000 padel clubs while there are only about 30 clubs so far in Kuala Lumpur, Bangkok and, Jakarta combined.

The promising emerging markets region boasts rapid economic growth, with the Asian Development Bank forecasting the region’s economy to grow by 4.5% and 4.7% in 2024 and 2025 respectively. This could signal rising disposable incomes leading to demand for premium experiences to continue to increase. Furthermore, the appetite for sports and social activities in these markets are voracious, with Malaysia at 48% for a weekly sports participation rate (International Journal of Human Movement & Sports Sciences, 2024) and Thailand with a 25% growth in mass participation sports events in 2024 (PR Newswire, March 2024).

ASCARO’s pioneer club at 1 Utama has set the stage with its impressive performance of turning a profit within its first year with average utilization rate of less than 50%, which increased to a steady state of over 90% by mid 2024. This is further highlighted with ASCARO’s revenue growth from RM1.8 million in 2023 to RM4 million in 2024.

What has propelled ASCARO’s success so far has been its diversified revenue model with robust streams such as memberships, court rentals, events, sponsorships, coaching and merchandise – ensuring financial resilience.

WHAT INVESTORS NEED TO KNOW

ASCARO’s expansion plan comes with solid financial foundations. With increased interest from corporate sponsors, coupled with cost reduction from spreading overheads over multiple clubs, each ASCARO Padel & Social Club is expected to comfortably generate an average of RM3 million in annual cashflow. This will enable ASCARO to continue launching new clubs at an expected cost of RM3-5 million per club. The projected number is 15 clubs by 2027, with an expected group-wide profit of over RM40 million. By this time, a clear exit strategy has also been charted, targeting a sale or an IPO (initial price offering) at a valuation of at least RM400 million, based on a relatively conservative multiple of 10x earnings.

With the pre-money valuation of RM91 million, this would make the RM20 million investment equivalent to a 18.02% stake, where investors can expect to make a 4x return on their money within 3 to 4 years.

For more risk-averse investors, however, a fixed investment is presented as an alternative offer: a preferred share option with 15% annual dividends for 4 years and a redemption at 150% of the investor’s initial investment at the end of 4 years. This is equivalent to approximately 2x return in 4 years.

Finally, what this fundraising exercise will achieve will be the building blocks of the ASCARO experience – intersecting sport, luxury, and lifestyle. Helming this journey forward is a team of seasoned professionals with backgrounds in fashion, luxury hospitality, marketing and technology, supported by high-profile advisors and investors.

The Premium Padel Experience is equipped with Spanish black courts from Padel Galis, professional coaching and tournaments and an app. Luxury wellness facilities will be introduced with high-end gyms, yoga and meditation spaces and spa and recovery services. As for the social aspect of the space, gourmet restaurants and cocktail bars together with networking lounges and co-working areas would be created.

Stan Zabolotsky, Co-Founder added: “ASCARO stands for ‘And So Came A Revolution’. Not only has ASCARO pioneered padel in Malaysia, it has also meticulously crafted a unique approach that seamlessly blends the worlds of sports and socializing. Through this crowdfunding initiative, we are inviting our community to become co-owners of this exciting next step in our journey.”

To learn more about ASCARO’s Equity Crowdfunding campaign on pitchIN, and how investors can take secure their stake in this exciting venture, visit https://www.pitchin.my/equity/ascaro-sea

by | Feb 19, 2025 | Business

DOGEN surges 500% post-DEX listing, drawing investor attention amid meme coin hype. With a CEX listing on the horizon, can DOGEN reach a $100M market cap? Read more!

In the volatile world of cryptocurrency, seasoned traders often recognize that panic in the market can present lucrative opportunities. Currently, the meme coin sector is experiencing a surge in interest, particularly with DOGEN, a token that has witnessed an extraordinary rise.

As Bitcoin’s market turbulence continues, investors are seeking alternatives, and DOGEN appears to be one of the standout candidates.

DOGEN Soars 500% After DEX Listing: What’s Next with CEX on the Horizon?

DOGEN, a meme token designed for individuals who never settle for less, has shown remarkable momentum both technically and fundamentally. Launched with an “alpha” mindset, DOGEN has already amassed a strong community of over 30,000 followers on X.

Since its listing on Raydium DEX on February 4th, DOGEN has performed exceptionally well. The token reached an all-time high (ATH) of $0.0066 before stabilizing around $0.002, representing a 566% increase from its presale price of $0.0003.

During its presale, DOGEN raised a substantial $5.5 million, demonstrating strong early investor interest.

Currently, DOGEN’s fully diluted valuation (FDV) stands at $28 million, with projections indicating a potential rise to $40 million. If DOGEN breaks the key resistance level of $0.0032, analysts anticipate a bullish surge toward $0.0056, aligning with previous resistance points.

A major upcoming catalyst is DOGEN’s impending listing on a centralized exchange (CEX). This move could significantly enhance the token’s accessibility, liquidity, and demand.

With only 1 billion tokens in circulation (10% of the total supply), DOGEN’s price remains highly sensitive to market demand, which could drive increased volatility in favor of bullish trends.

Community Buzz and DOGEN’s Path to a $100M Market Cap

DOGEN’s post-listing performance and robust presale have garnered widespread attention.

Crypto influencer eezzy’s journal, boasting over 50,000 subscribers, has highlighted DOGEN as a potential market leader on the Solana blockchain, with a trajectory toward a $100M+ market cap.

Given DOGEN’s past performance and rapid community growth, speculation about its potential to retest its $0.005 ATH—or even surpass it—continues to intensify.

If momentum remains strong, DOGEN could enter a parabolic price discovery phase, further fueling its ascent.

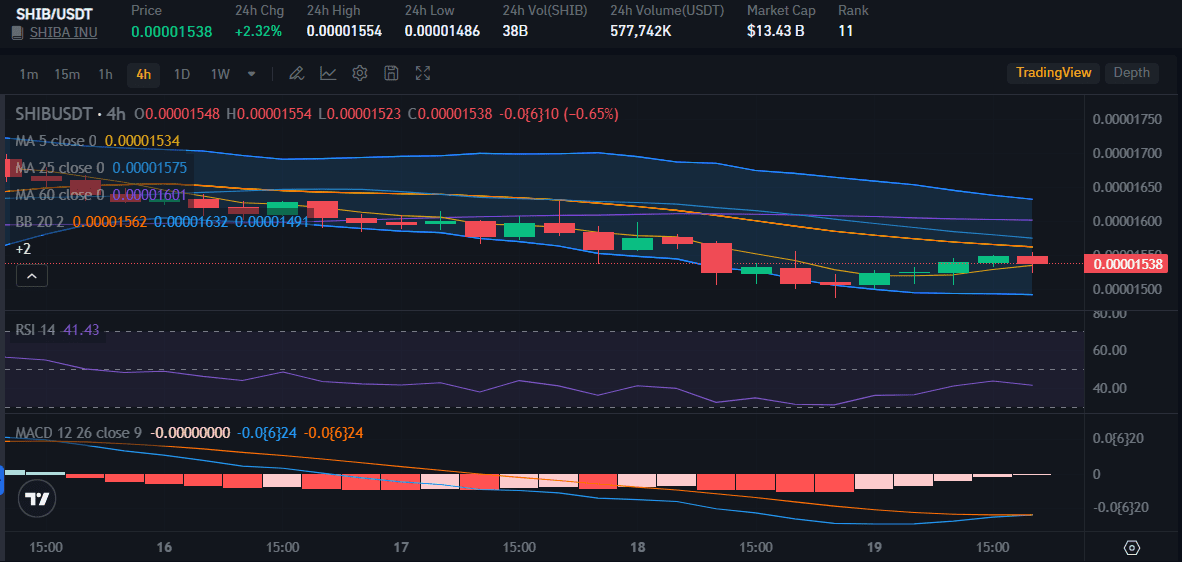

Meme Coins on the Move: PEPE, SHIB, DOGE, and BONK

While DOGEN has been the center of attention, other meme coins have also been showing signs of activity.

Pepe (PEPE) is trading between $0.00000930 and $0.00001060. Despite a recent 52% monthly decline, its 2% weekly gain suggests a possible recovery. A break above $0.00001151 could push PEPE toward $0.00001319, marking a 30% increase. However, failure to sustain momentum may lead to further declines.

Shiba Inu (SHIB) remains range-bound between $0.00001505 and $0.00001712. It faces resistance at $0.00001826, and a breakthrough could push it to $0.00002033. Despite a one-month decline of 34.2%, SHIB has gained 16.62% over six months, indicating long-term strength.

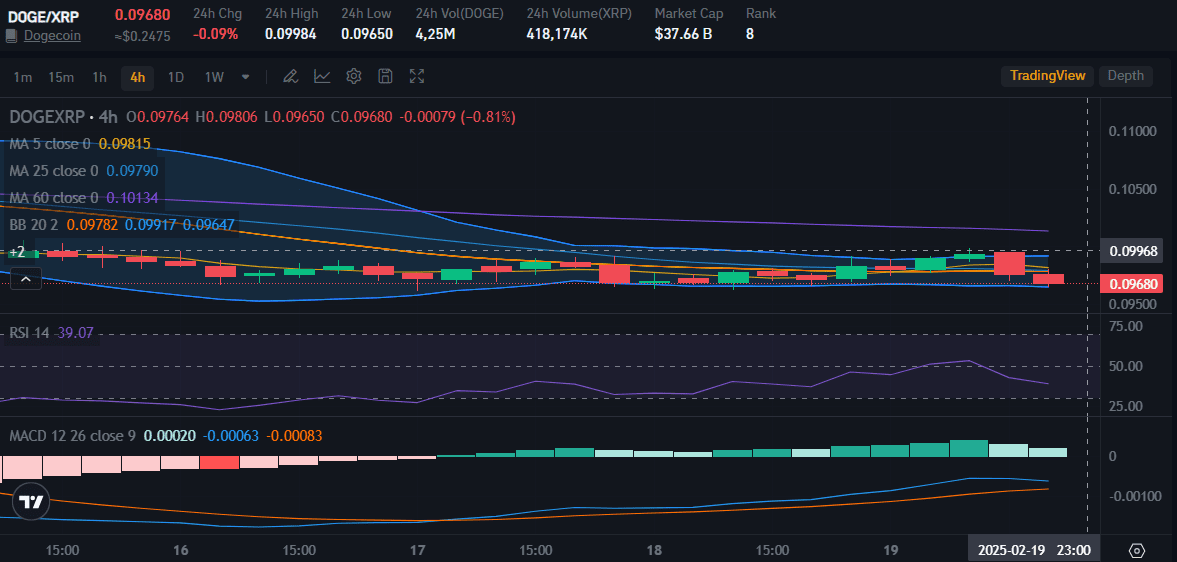

Dogecoin (DOGE) is currently fluctuating between $0.2418 and $0.2882. The key resistance level at $0.311 poses a challenge, but if surpassed, DOGE could target $0.3574, representing a potential 25% gain. Its six-month gain of over 155% suggests another breakout could be imminent.

Bonk (BONK), having lost 48% in the past month, is trading between $0.00001608 and $0.00001924. If it breaks above $0.00002106, a move toward $0.00002422 (a 25% increase) could follow. However, conflicting technical signals indicate the need for substantial buying pressure to trigger a rally.

DOGEN vs. Established Players: A Paradigm Shift?

DOGEN’s rapid ascent has led some investors to reconsider their positions in more established meme coins like DOGE and XRP. Dogecoin has recorded a modest 6.31% weekly gain, with potential for a breakout past $0.293.

Meanwhile, XRP has posted a 13.67% increase, currently trading between $2.40 and $2.82, with analysts eyeing a rally toward $4.32.

With DOGEN’s unique positioning, strong technical performance, and increasing visibility, it is emerging as a serious contender in the meme coin market.

While risks remain, its bullish trajectory suggests that it could continue to dominate discussions in the cryptocurrency space in the near future.

As the market evolves, investors will closely watch whether DOGEN can sustain its momentum and carve out a lasting presence among the top meme coins. For now, it remains one of the most exciting and promising tokens in the space.

by | Feb 19, 2025 | Business

What does the Pi Network’s Open Mainnet launch mean for the future of cryptocurrency? Find out about the key features, potential impact, and challenges facing Pi Network as it transitions to a tradable and interoperable blockchain.

The cryptocurrency world is abuzz with anticipation as Pi Network, the mobile-based mining platform, announces the official launch of its Open Mainnet on February 20, 2025.

This milestone marks a significant step in Pi Network’s journey from a novel concept to a potentially disruptive force in the digital currency landscape.

From Mobile Mining to Global Cryptocurrency

Pi Network was conceived with the vision of making cryptocurrency mining accessible to anyone with a smartphone.

Unlike traditional mining methods that demand powerful hardware and consume vast amounts of energy, Pi Network allows users to mine Pi coins simply by running a lightweight app on their mobile devices.

This approach has resonated with millions worldwide, attracting a massive user base eager to participate in the future of finance.

The Significance of Open Mainnet

The Open Mainnet launch is a pivotal moment for Pi Network. It signifies the transition from a closed, controlled environment to a fully functional blockchain that can interact with the broader cryptocurrency ecosystem.

This means that Pi coins will become tradable on cryptocurrency exchanges, opening up a world of possibilities for users and developers alike.

Key Features and Expectations

1. Trading: Pi coins will be listed on cryptocurrency exchanges, allowing users to buy, sell, and trade them freely.

2. Interoperability: The Open Mainnet will enable Pi Network to connect with other blockchain networks, expanding its utility and potential use cases.

3. Ecosystem Growth: Developers will have the opportunity to build decentralized applications (dApps) on the Pi Network, further enhancing its functionality and attracting new users.

Potential Impact and Challenges

The launch of Pi Network’s Open Mainnet has the potential to:

1. Democratize Cryptocurrency: By making mining accessible to anyone with a smartphone, Pi Network could bring cryptocurrency to a wider audience, including those previously excluded from the financial system.

2. Drive Innovation: The open nature of the Mainnet will encourage developers to create innovative applications, potentially leading to new and exciting use cases for cryptocurrency.

However, Pi Network also faces challenges:

1. Price Volatility: Like any cryptocurrency, Pi coins are likely to experience price volatility, especially in the initial stages after the Open Mainnet launch.

2. Adoption: The success of Pi Network will depend on its ability to attract users and developers, as well as its acceptance by merchants and businesses.

The Road Ahead of Pi Network

The Open Mainnet launch is just the beginning of Pi Network’s journey. The project has the potential to revolutionize the way we think about money and finance, but it also faces significant challenges.

The next few months and years will be crucial in determining whether Pi Network can live up to its promise and become a major player in the cryptocurrency world.

Conclusion

The launch of Pi Network’s Open Mainnet is a significant event in the cryptocurrency space. It represents a bold attempt to democratize access to digital currencies and empower individuals around the world.

While the future of Pi Network remains uncertain, its potential impact on the financial landscape is undeniable. As the project evolves, it will be fascinating to watch how it shapes the future of cryptocurrency and its role in the global economy.

by | Feb 19, 2025 | Business

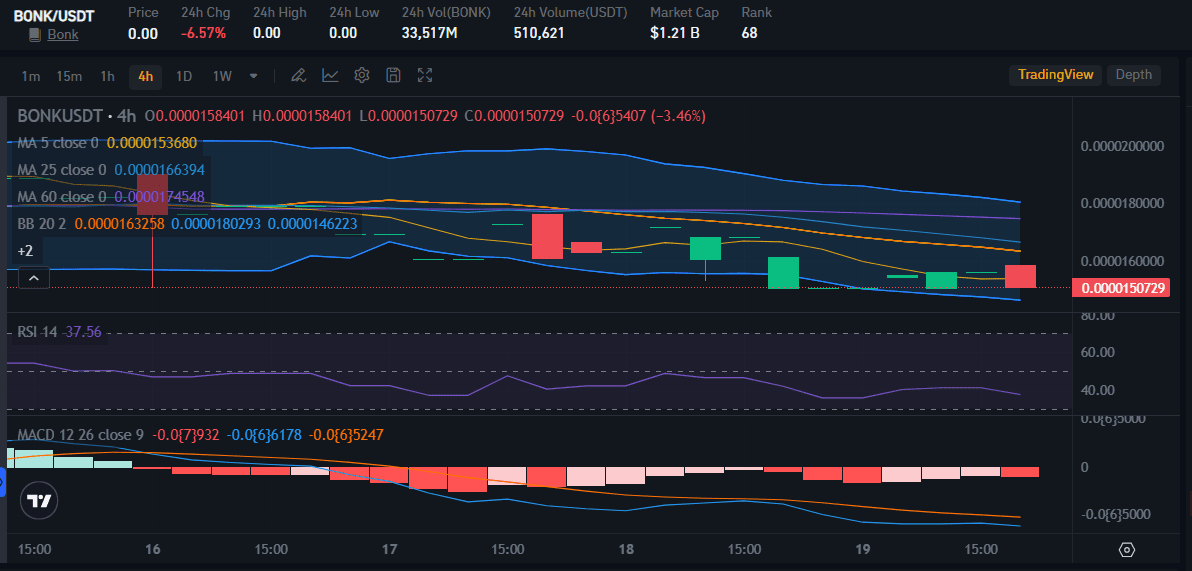

Straight teeth are essential for oral health, chewing efficiency, and self-confidence. Misaligned teeth can lead to dental problems, including cavities, gum disease, and jaw discomfort. Invisalign, a modern orthodontic solution, offers a discreet and effective way to correct mild to moderate alignment issues such as overbites, underbites, and crowded teeth. Made from comfortable SmartTrack material, Invisalign aligners gradually shift teeth into place. The process includes a consultation, 3D treatment planning, and periodic aligner changes.

For busy patients, Invisalign Virtual Care allows progress monitoring remotely, ensuring convenience. Invisalign is preferred over traditional braces for its aesthetic appeal, comfort, and flexibility, with treatment durations ranging from 6 to 18 months. Other alignment options include traditional braces, lingual braces, retainers, and veneers for cosmetic fixes.

Teeth alignment procedures like Invisalign benefit individuals facing chewing difficulties, jaw pain, or low confidence due to crooked teeth. Post-treatment care, such as wearing retainers, ensures long-term results.

Having straight, well-aligned teeth is not just about aesthetics. Proper teeth alignment is essential for optimal oral health, effective chewing, and clear speech. Misaligned teeth can lead to a host of problems, such as difficulty in cleaning teeth, higher risk of cavities, gum disease, and even issues with jaw pain. Fortunately, advancements in dental procedures, particularly Invisalign, have revolutionized the way people can achieve better teeth alignment. This article delves into how Invisalign works, the benefits it offers, and other dental solutions for teeth alignment.

Understanding Invisalign: A Modern Orthodontic Solution

What is Invisalign?

Invisalign is a cutting-edge orthodontic treatment that utilizes custom-made, clear aligners to straighten teeth. Unlike traditional braces, Invisalign aligners are virtually invisible, making them a popular choice for individuals who want a discreet way to correct their teeth. These aligners are made from SmartTrack material, a patented thermoplastic designed for comfort and precision.

How Invisalign Works

Consultation and Planning: The process begins with a comprehensive consultation where your dentist evaluates your teeth and creates a digital 3D model using advanced imaging technology. This allows for a customized treatment plan tailored to your unique dental needs.

Aligner Fabrication: Based on the treatment plan, a series of aligners is created. Each aligner is designed to gradually shift your teeth into their optimal position.

Wearing the Aligners: Patients wear the aligners for 20-22 hours a day, removing them only to eat, drink, brush, and floss. The aligners are replaced every one to two weeks as the teeth progressively move.

Regular Checkups: Periodic visits to the dentist ensure that the treatment is on track and adjustments are made if necessary.

Who Should Consider Invisalign?

Invisalign is ideal for individuals with mild to moderate alignment issues such as:

It is also suitable for teenagers and adults who prefer a less conspicuous orthodontic solution.

Invisalign Virtual Care: A Convenient Option

For those with busy schedules, Invisalign Virtual Care offers an innovative way to stay on top of your treatment. This digital platform allows patients to share updates and progress photos with their dentist remotely. It minimizes the need for frequent in-office visits, making the treatment process more convenient while ensuring consistent monitoring.

Why Choose Invisalign Over Traditional Braces?

Aesthetic Appeal: Clear aligners are virtually invisible, allowing users to straighten their teeth without drawing attention.

Comfort: The absence of metal brackets and wires reduces irritation to the gums and cheeks.

Flexibility: Aligners can be removed for eating and oral hygiene, promoting better dental care during treatment.

Predictable Results: The 3D digital planning provides a clear overview of the expected outcomes, offering patients a sense of assurance.

How Fast Can You Fix Crooked Teeth?

The duration of teeth alignment treatment depends on the severity of the misalignment and the type of procedure chosen.

Invisalign typically takes 6 to 18 months to deliver noticeable results, which is comparable to or faster than traditional braces for similar cases.

Patients with minor alignment issues can sometimes see improvements in as little as three months.

In cases where quicker results are desired, other options such as accelerated orthodontics may be explored. These involve supplementary treatments like micro-osteoperforation or vibration therapy to speed up tooth movement.

Additional Dental Solutions for Teeth Alignment

While Invisalign is highly effective, it may not be suitable for everyone. Other dental procedures for correcting teeth alignment include:

Traditional Braces:

Metal or ceramic braces are a tried-and-tested solution for severe alignment issues. They involve brackets and wires that are periodically tightened to shift teeth.

Lingual Braces:

These braces are attached to the back of the teeth, offering an alternative for patients seeking a discreet option.

Retainers:

Often used post-treatment, retainers help maintain the alignment of teeth after the primary orthodontic procedure.

Dental Veneers:

For minor misalignments or gaps, veneers can be applied to create the appearance of straight, well-aligned teeth. While this is not a corrective treatment, it is a cosmetic solution for immediate results.

Who Should Opt for Teeth Alignment Procedures?

Teeth alignment treatments are beneficial for individuals who experience:

-Difficulty chewing or biting

-Speech impediments due to misaligned teeth

-Increased wear and tear on certain teeth

-Jaw pain or discomfort caused by improper alignment

-Low confidence due to crooked or gapped teeth

Invisalign is particularly suited for those who value convenience and aesthetics. However, more severe cases may require traditional braces or surgical interventions.

A thorough consultation with a dentist is essential to determine the most appropriate course of action.

Maintaining Your Results

Completing an Invisalign treatment is a significant step towards achieving a beautiful, well-aligned smile. However, maintaining that perfect smile requires consistent care and attention. Post-treatment, wearing retainers as prescribed by your dentist is crucial to prevent your teeth from shifting back to their original positions. Retainers help stabilize your teeth while the surrounding gums and bones adjust to their new alignment.

Proper oral hygiene practices are essential for preserving your smile. Brush and floss daily to keep your teeth clean and your gums healthy, minimizing the risk of cavities or gum disease. Regular dental checkups are equally important. These visits allow your dentist to monitor your teeth’s alignment and overall oral health, catching any potential issues early.

Additionally, be mindful of your diet. Avoid overly sugary or acidic foods and drinks that can weaken enamel. Limiting habits like smoking or excessive coffee consumption helps prevent staining, ensuring your smile remains bright. Lastly, if you notice any discomfort or misalignment with your retainers, consult your dentist immediately to avoid complications.

A more convenient way to straighter teeth

Achieving straight teeth is no longer a daunting process, thanks to advancements like Invisalign.

This innovative solution provides a comfortable, discreet, and effective way to correct teeth alignment while accommodating modern lifestyles.

Combined with other dental procedures, Invisalign ensures that patients can achieve their dream smile in a way that suits their individual needs.

If you are considering teeth alignment procedures, consult a trusted dental professional like Gentle Smile Dental Studio to explore your options and create a treatment plan tailored to your goals.

by | Feb 18, 2025 | Business

Stay updated on the latest cryptocurrency market trends as Bitcoin, Ethereum, and major altcoins face a broad decline amid market correction, regulatory uncertainty, and macroeconomic pressures. Explore key price movements, investor sentiment, and upcoming events shaping the crypto landscape.

The cryptocurrency market is undergoing a widespread decline, with major digital assets such as Bitcoin (BTC), Solana (SOL), Ethereum (ETH), and Binance Coin (BNB) experiencing losses.

Various factors contribute to this downturn, including market correction, macroeconomic pressures, leverage shakeouts, regulatory uncertainty, and weak investor sentiment.

Market Correction Following a Recent Rally

After a period of strong upward momentum, cryptocurrencies were due for a pullback. Many traders took profits at key resistance levels, triggering a temporary wave of selling pressure.

Such corrections are a common occurrence in highly volatile markets, and while they may cause short-term panic, they often provide opportunities for long-term investors.

Macroeconomic Pressures Affecting Crypto Markets

Global financial markets have been facing uncertainty due to concerns over rising interest rates, inflation, and overall economic stability.

As monetary policies tighten, risk assets, including cryptocurrencies, often face downward pressure. Investors tend to shift toward safer investments, leading to capital outflows from crypto markets.

High Leverage and Liquidations Causing Market Volatility

The crypto market’s high leverage trading environment often results in sharp price movements. A wave of liquidations can create cascading sell-offs, amplifying losses across the board.

This pattern has been observed multiple times in the crypto space, where excessive leverage leads to significant price corrections.

Regulatory Uncertainty Weighs on Sentiment

Governments and regulatory bodies in major markets such as the U.S. and Europe continue to explore stricter regulations on cryptocurrency trading, taxation, and institutional involvement.

The uncertainty surrounding potential new policies has created fear among investors, leading to risk-off sentiment and market instability.

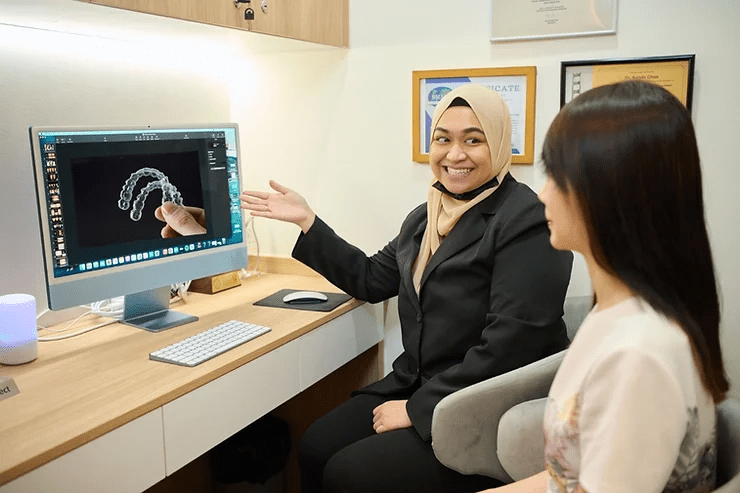

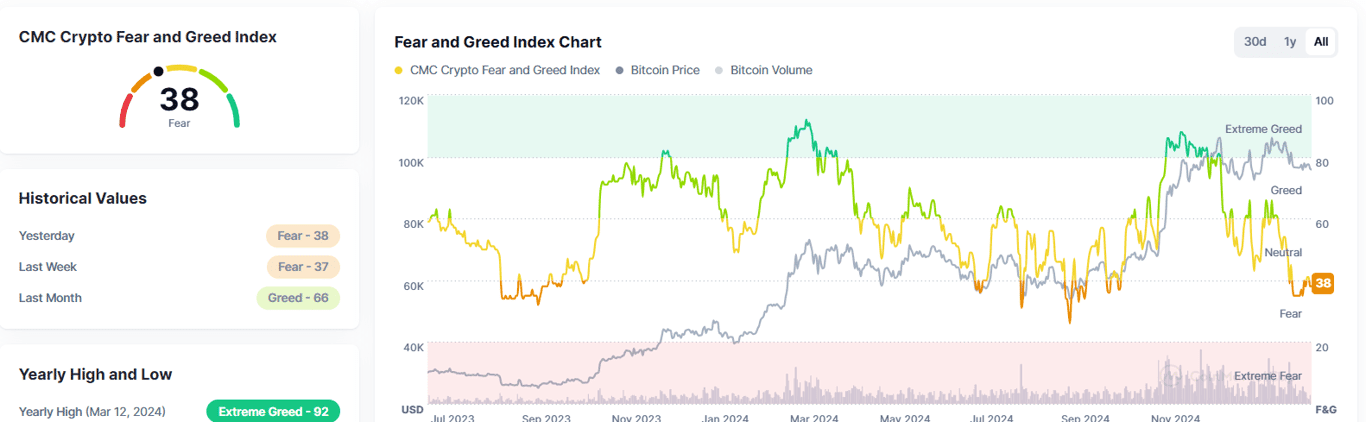

Weak Market Sentiment and Fear Factor

The crypto market is highly susceptible to sentiment-driven movements. When leading cryptocurrencies such as BTC and ETH show losses, panic selling among retail investors often follows, exacerbating the downturn.

The Market Fear & Greed Index stood at 38 (Fear) out of 100, according to CoinMarketCap, reflecting cautious investor sentiment.

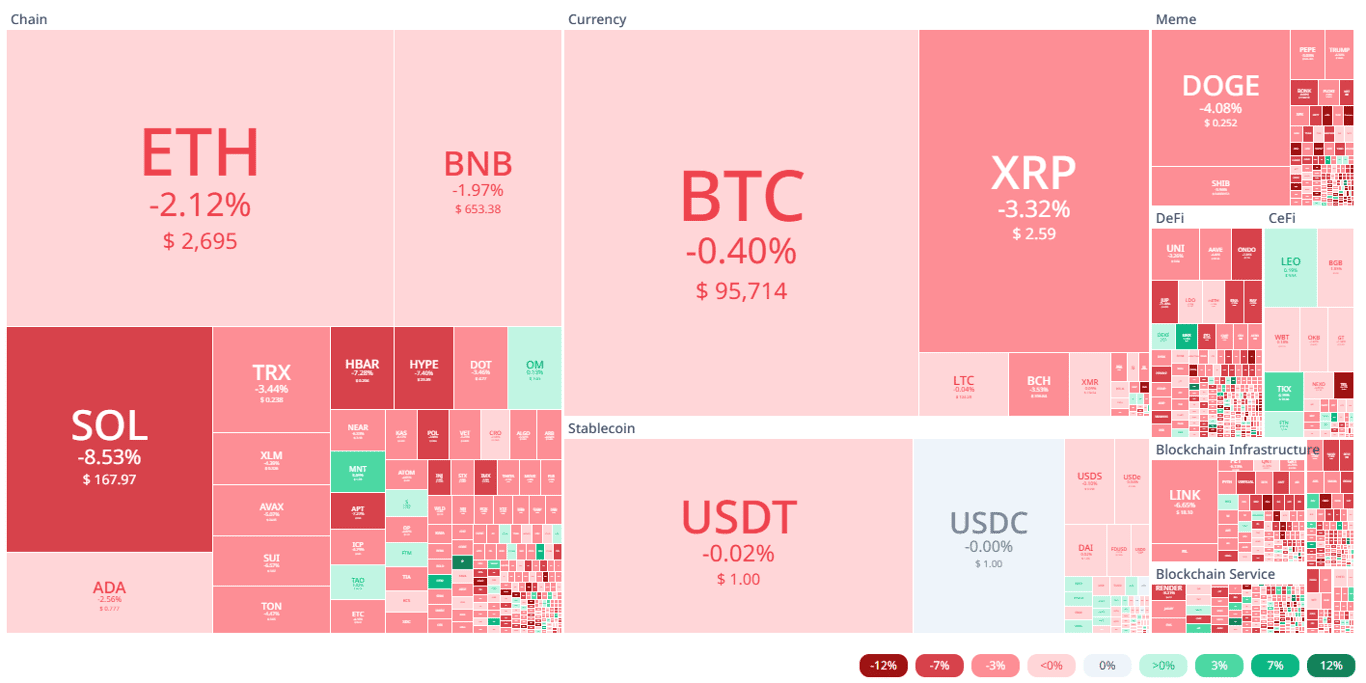

Current Crypto Market Overview

As of the latest market data, Bitcoin (BTC) remains below the $96,000 mark, while popular altcoins such as Solana (SOL), Ethereum (ETH), Ripple (XRP), and Dogecoin (DOGE) are also trading in the red.

- Bitcoin (BTC): $95,714 (-0.40%)

- Ethereum (ETH): $2,695 (-2.12%)

- Dogecoin (DOGE): $0.252 (-4.08%)

-

Ripple (XRP): $2.59 (-3.32%)

5, Solana (SOL): $167.97 (-8.53%)

The global crypto market capitalization stands at $3.14 trillion, reflecting a 24-hour dip of 1.75%.

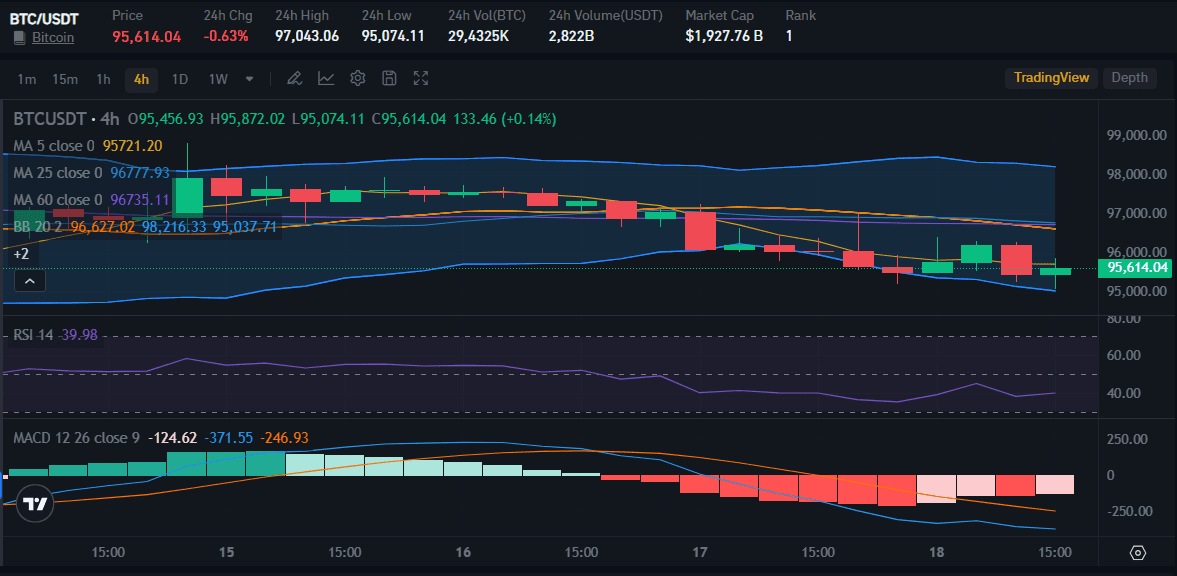

Bitcoin and Ethereum Holding Key Levels

Bitcoin has been consolidating between $94,000 and $100,000 over the past two weeks, with investor sentiment remaining indecisive. The U.S. Bitcoin Spot ETFs saw a net drain of $580.2 million last week, indicating weakening institutional demand.

However, on-chain data suggests accumulation, with an inflow/drain ratio of 30DMA replacement at 0.98, signifying that outflows slightly exceed inflows.

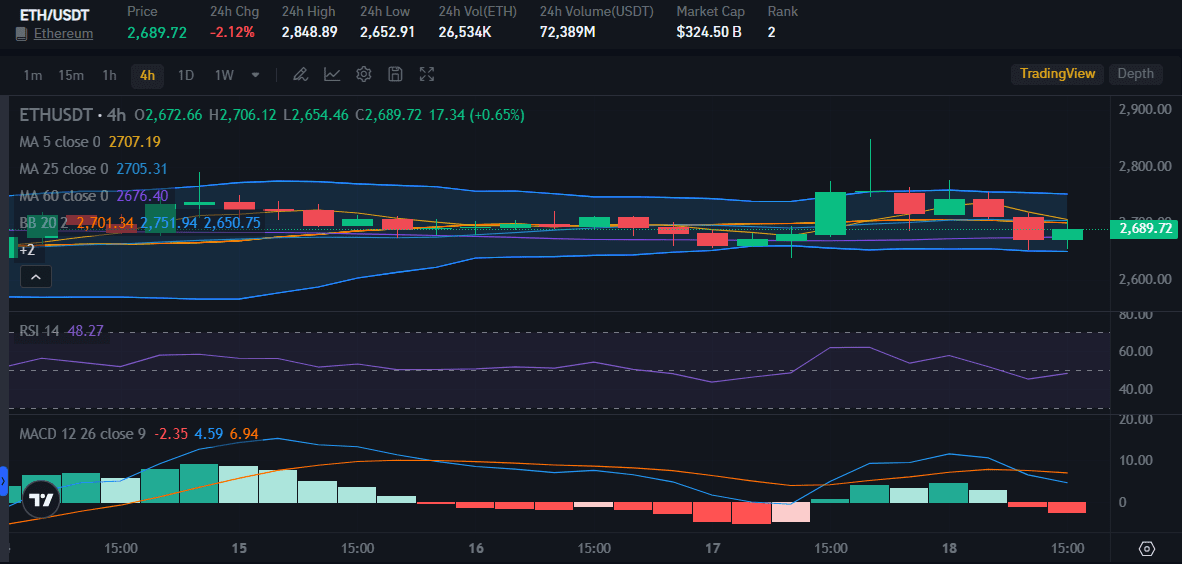

Ethereum is trading near the key resistance level of $2,750. Analysts predict that if ETH holds this level, it may break out toward $3,000.

Investors have also shown increased interest in Ethereum ETFs, recording net inflows of $393 million this month, compared to Bitcoin ETFs, which saw $376 million in outflows.

Argentina’s President Faces Legal Trouble Over LIBRA Token Promotion

In a significant development, Argentine President Javier Milei is facing impeachment calls and legal action over his promotion of the Solana-based LIBRA cryptocurrency.

Milei’s social media endorsement caused the token’s price to surge before plummeting within hours, leading to massive investor losses. Critics have labeled the incident a “rug pull,” and Argentina’s Anti-Corruption Office is investigating potential fraud.

The LIBRA debacle has further tarnished Solana’s memecoin ecosystem. The token suffered a 90% drop from its peak market capitalization of $4.5 billion.

Despite Milei’s claims of non-involvement, blockchain analysis links LIBRA’s creators to previous failed crypto projects, intensifying scrutiny.

South Korea Suspends DeepSeek App Amid Privacy Concerns

Regulatory scrutiny isn’t limited to cryptocurrencies. South Korea’s Personal Information Protection Commission (PIPC) has suspended downloads of the Chinese-developed DeepSeek app due to concerns over its data handling practices.

The app’s ChatGPT-like chatbot, launched on January 27, raised privacy red flags, prompting regulators to conduct on-site inspections to ensure compliance with domestic laws.

Looking Ahead: What’s Next for the Crypto Market?

Despite the current downturn, the crypto market remains highly volatile, and rebounds can occur swiftly.

Analysts are closely monitoring key support levels, particularly for Bitcoin at $95,600 and $99,900. If BTC holds these levels, a potential rally toward the psychological $100,000 mark could be expected.

Meanwhile, Ethereum’s Pectra upgrade, set for April 8, could boost ETH’s value, making it a key asset to watch in the coming months.

In the short term, cautious trading and regulatory developments will likely shape market movements. Long-term investors may see the current dip as an opportunity to accumulate assets, while traders should remain vigilant about market fluctuations.

As uncertainty persists, the cryptocurrency industry continues to evolve, with regulatory policies, macroeconomic trends, and technological upgrades playing critical roles in shaping its future trajectory.

by | Feb 18, 2025 | Business

As Malaysia rises as a premier data center hub, Custommedia Academy has been appointed the exclusive local partner for Uptime Institute’s globally recognized Uptime Education training programs. This collaboration will equip 400 professionals by 2025 with the expertise to design, operate, and manage cutting-edge digital infrastructure—ensuring Malaysia’s workforce is ready to meet the demands of billion-dollar tech investments from giants like Google, Microsoft, and AWS.

NEW YORK, NY – February 12, 2025 – Uptime Institute today announced an

agreement with Custommedia Sdn Bhd as the exclusive local partner in

Malaysia to offer its Uptime Education courses through the Custommedia Academy.

This partnership combines Custommedia Academy’s local expertise with Uptime

Institute’s globally recognized training programs and standards for digital

infrastructure performance. The collaboration aims to enhance the knowledge and

skills of data center professionals in Malaysia, providing them with essential

tools to efficiently design and operate data centers. Key benefits of these

training programs include improved operational efficiency, risk minimization,

and alignment with industry best practices.

“Malaysia is fast emerging as a premier data center

hub in Southeast Asia, fuelled by strategic initiatives and transformative

investments that are reshaping the nation’s digital landscape. This is part of

a broader digital economy strategy to boost the sector’s GDP contribution to

25.5% by 2025,” said Aidinorazri, Chief Marketing Officer, Custommedia. “Our

partnership with Uptime Institute will enable Custommedia Academy to contribute towards achieving Malaysia’s national

digital aspirations by ensuring the workforce is well-prepared to design,

build, operate and manage increasingly complex

digital infrastructures. To help achieve this, we intend to train 400 data

center professionals by the end of 2025,” he added.

Aidinorazri continued that among the standout projects

being undertaken in Malaysia currently include the Bandar Teknologi Maju Perlis

in Padang Besar—a massive 600-acre development featuring cutting-edge AI-driven

data centers and high-performance computing supported by sustainable energy

infrastructure. In parallel, the Johor-Singapore Special Economic Zone (JS-SEZ)

showcases the region’s vast potential, positioning Malaysia as a critical

economic and digital innovation hub.

“These developments, alongside major investments from

global tech giants such as Google, Microsoft, AWS, Nvidia, and NTT Data, inject

billions into Malaysia’s digital economy, driving an ever-growing demand for

skilled data center professionals.”

“Addressing the talent shortage is crucial to sustaining

growth and ensuring Malaysia’s competitiveness in the global digital

economy,” said Patrick Chan, Vice President for South Asia at Uptime

Institute. “As Malaysia positions itself as an important and strategic

destination for international investment in digital infrastructure, our Uptime

Education training unit is poised to work with Custommedia Academy to train and

develop the skilled workforce of today and tomorrow. Custommedia Academy’s

proven expertise in training ISTQB, IREB, and ASAQB certified professionals,

along with its alignment with Malaysia’s digital economy initiatives, makes it

an ideal partner for this collaboration. Together, we aim to bridge the gap

between global standards and local industry needs, ensuring Malaysia’s

workforce is equipped to meet the demands of a rapidly evolving digital

infrastructure landscape.”

The training

begins with Uptime Education’s Data Center Fundamentals course, an entry level course

designed to provide a structured overview of the data center environments, what

data centers are, what they do and why we need them. The course provides an

overview of basic design and design philosophies and the essential factors of

data center management including operational processes, energy management and

facility management. Additional courses will also be available including Certified

Data Center Technician Professional (CDCTP®); Accredited Sustainability

Advisor (ASA); Accredited Tier Designer (ATS);

Accredited

Operations Specialist (AOS); Accredited Tier Specialist (ATS);

and

Certified Data Center Management Professional® (CDCMP®).

Course

information and schedules can be found on the Custommedia

Academy website .

by | Feb 18, 2025 | Business

Tokyo – Japan, January 20, 2025 – Vector Inc.

(Headquarters: Tokyo; Chairman and CEO: Keiji Nishie; TYO: 6058) has been actively supporting startup growth through

investments and PR/IR assistance. To date, Vector Inc. has invested in

approximately 250 domestic companies and has backed 32 companies achieve IPOs

and sustatin post-listing growth.

As part of it’s pioneering expansion into

overseas investments, Vector Inc. has decided to invest in bythen, an Indonesian-based AI startup, and

enter into a capital and business alliance.

The Global IP market has been experiencing

rapid growth, reaching approximately USD 315.5 billion in 2021-threee times its

size a decade ago. Additionally, the rise of social media has fuled the

expansion of the “creator economy,” where individuals can develop and

montize their own original IP.

bythen empowers users to creative AI-powered

digital twins, produce engaging content, and live stream, unlocking new

opportunites to elevate their online presence and monetize influence. The

platform democratizes access to virtual influencers, leveraging AI-driven content

generation to enbale 24/7 automated engagement across social media platforms. bythen

is poised to disrupt the $325 billion creator economy and empower over 200

million global content creators.

Kevin Mintaraga, the founder of bythen, is a

globally recognized serial entrepreneur. He previously built Magnivate, which

was acquired by WPP in 2012, and Bridestory, which was acquired by Tokopedia in

2019.

Looking ahead, the Vector Inc. will continue

to expand its focus beyond domestic companies to include overseas companies, driving

business and economic growth by investing in companies with cutting-edge

technologies and world-leading services.

Profile of Kevin Mintaraga, CEO of bythen

・Co-founded Magnivate, a digital agency

(now Mirum Agency), in 2008.

・Sold Magnivate to WPP, the world’s

largest advertising and marketing company, in

2012 and served as the youngest subsidiary CEO in WPP’s history until

2013.

・Founded Bridestory in 2013, which grew

into Indonesia’s largest wedding

marketplace and was acquired by Tokopedia in 2019.

・Served as CMO of Tokopedia (now part of

the GoTo Group) from 2019.

・Featured on Campaign Asia’s Power List

for four consecutive years.

Comment from Kevin Mintaraga

“Japan is a global leader in the virtual influencer industry and a

powerhouse of IP content. Receiving investment from Vector, Asia’s largest PR

company with a vast domestic and international network, is a great honor.

Vector’s strong reputation and customer network in Japan and the broader

Asian region will play a pivotale role in helping bythen promote its avatar

collections and solutions. Furthermore, this partnership opens the possibility

for collaborations between bythen and Japan’s iconic IPs.

Until now, the rights to virtual influencer IPs were typically owned by

companies, limiting individuals’ freedom to customize and adapt them. bythen aims

to democratize virtual influencer IPs globally by providing users with tools and

solutions to build and grow their digital presence.”

Profile of Ryo Umezawa, Vice President of New

Business Development and Global M&A, Vector Inc.

・Spent ten years in the Philippines before graduating from Sophia

University with a Bachelor of Arts, majoring in International Business

and Economics, in 2007.

・Interned at J-Seed during university, contributing

to business launches

and marketing activities from 2005.

・Worked at Traffic Gate (now LinkShare

Japan) from 2008, building smartphone ad network businesses and developing voice

recognition search app

・Co-founded two startups, a mobile

marketing company and a coupon aggregation business

・Served as the CEO of HAILO Japan, a

taxi-hailing app, and held executive roles

at HomeAway Japan, Tinder Japan, and investment funds East Ventures and

Antler.

・Appointed as Vice President of New

Business Development and Global M&A at Vector Inc. in 2024.

Comment from Ryo Umezawa

“It is a great honor to support an entrepreneur embarking on his

third venture with a vision of democratizing AI virtual characters and pursuing

global expansion. This initiative will showcase Japan’s content and culture

globally, unlock creators’ full potential, and contribute to the growth of the

sharing economy.”

by | Feb 18, 2025 | Business

Tokyo – Japan, January 20, 2025 – Vector Inc.

(Headquarters: Tokyo; Chairman and CEO: Keiji Nishie; TYO: 6058) has

been actively supporting startup growth through investments and PR/IR

assistance. To date, Vector Inc. has invested in approximately 250 domestic

companies and has backed 32 companies achieve IPOs and sustatin post-listing growth.

As part of it’s pioneering expansion into

overseas investments, Vector Inc. has decided to invest in bythen, an Indonesian-based AI startup, and

enter into a capital and business alliance.

The Global IP market has been experiencing

rapid growth, reaching approximately USD 315.5 billion in 2021-threee times its

size a decade ago. Additionally, the rise of social media has fuled the

expansion of the “creator economy,” where individuals can develop and

montize their own original IP.

bythen empowers users to creative AI-powered

digital twins, produce engaging content, and live stream, unlocking new

opportunites to elevate their online presence and monetize influence. The

platform democratizes access to virtual influencers, leveraging AI-driven content

generation to enbale 24/7 automated engagement across social media platforms. bythen

is poised to disrupt the $325 billion creator economy and empower over 200

million global content creators.

Kevin Mintaraga, the founder of bythen, is a

globally recognized serial entrepreneur. He previously built Magnivate, which

was acquired by WPP in 2012, and Bridestory, which was acquired by Tokopedia in

2019.

Looking ahead, the Vector Inc. will continue

to expand its focus beyond domestic companies to include overseas companies, driving

business and economic growth by investing in companies with cutting-edge

technologies and world-leading services.

Profile of Kevin Mintaraga, CEO of bythen

・Co-founded Magnivate, a digital agency (now Mirum

Agency), in 2008.

・Sold Magnivate to WPP, the world’s largest advertising

and marketing company, in 2012 and

served as the youngest subsidiary CEO in WPP’s history until 2013.

・Founded Bridestory in 2013, which grew into

Indonesia’s largest wedding

marketplace

and was acquired by Tokopedia in 2019.

・Served as CMO of Tokopedia (now part of the GoTo

Group) from 2019.

・Featured on Campaign Asia’s Power List for four consecutive

years.

Comment from Kevin Mintaraga

“Japan is

a global leader in the virtual influencer industry and a powerhouse of IP

content. Receiving investment from Vector, Asia’s largest PR company with a vast

domestic and international network, is a great honor.

Vector’s

strong reputation and customer network in Japan and the broader Asian region

will play a pivotale role in helping bythen promote its avatar collections and

solutions. Furthermore, this partnership opens the possibility for

collaborations between bythen and Japan’s iconic IPs.

Until now, the

rights to virtual influencer IPs were typically owned by companies, limiting

individuals’ freedom to customize and adapt them. bythen aims to democratize

virtual influencer IPs globally by providing users with tools and solutions to

build and grow their digital presence.”

Profile of Ryo Umezawa, Vice President of New

Business Development and Global M&A, Vector Inc.

・Spent ten years

in the Philippines before graduating from Sophia

University

with a Bachelor of Arts, majoring in International Business and Economics, in

2007.

・Interned at J-Seed during university, contributing to

business launches

and marketing activities

from 2005.

・Worked at Traffic Gate (now LinkShare Japan) from

2008, building smartphone ad network businesses and developing voice

recognition search app

・Co-founded two startups, a mobile marketing company

and a coupon aggregation business

・Served as the CEO of HAILO Japan, a taxi-hailing app,

and held executive roles

at HomeAway

Japan, Tinder Japan, and investment funds East Ventures and Antler.

・Appointed as Vice President of New Business

Development and Global M&A at Vector Inc. in 2024.

Comment from Ryo Umezawa

“It is a

great honor to support an entrepreneur embarking on his third venture with a

vision of democratizing AI virtual characters and pursuing global expansion.

This initiative will showcase Japan’s content and culture globally, unlock

creators’ full potential, and contribute to the growth of the sharing

economy.”

by | Feb 18, 2025 | Business

Tokyo – Japan, January 20, 2025 – Vector Inc.

(Headquarters: Tokyo; Chairman and CEO: Keiji Nishie; TYO: 6058) has been actively supporting startup growth through

investments and PR/IR assistance. To date, Vector Inc. has invested in

approximately 250 domestic companies and has backed 32 companies achieve IPOs

and sustatin post-listing growth.

As part of it’s pioneering expansion into

overseas investments, Vector Inc. has decided to invest in bythen, an Indonesian-based AI startup, and

enter into a capital and business alliance.

The Global IP market has been experiencing

rapid growth, reaching approximately USD 315.5 billion in 2021-threee times its

size a decade ago. Additionally, the rise of social media has fuled the

expansion of the “creator economy,” where individuals can develop and

montize their own original IP.

bythen empowers users to creative AI-powered

digital twins, produce engaging content, and live stream, unlocking new

opportunites to elevate their online presence and monetize influence. The

platform democratizes access to virtual influencers, leveraging AI-driven content

generation to enbale 24/7 automated engagement across social media platforms. bythen

is poised to disrupt the $325 billion creator economy and empower over 200

million global content creators.

Kevin Mintaraga, the founder of bythen, is a

globally recognized serial entrepreneur. He previously built Magnivate, which

was acquired by WPP in 2012, and Bridestory, which was acquired by Tokopedia in

2019.

Looking ahead, the Vector Inc. will continue

to expand its focus beyond domestic companies to include overseas companies, driving

business and economic growth by investing in companies with cutting-edge

technologies and world-leading services.

Profile of Kevin Mintaraga, CEO of bythen

・Co-founded Magnivate, a digital agency

(now Mirum Agency), in 2008.

・Sold Magnivate to WPP, the world’s

largest advertising and marketing company, in

2012 and served as the youngest subsidiary CEO in WPP’s history until

2013.

・Founded Bridestory in 2013, which grew

into Indonesia’s largest wedding

marketplace and was acquired by Tokopedia in 2019.

・Served as CMO of Tokopedia (now part of

the GoTo Group) from 2019.

・Featured on Campaign Asia’s Power List

for four consecutive years.

Comment from Kevin Mintaraga

“Japan is a global leader in the virtual influencer industry and a

powerhouse of IP content. Receiving investment from Vector, Asia’s largest PR

company with a vast domestic and international network, is a great honor.

Vector’s strong reputation and customer network in Japan and the broader

Asian region will play a pivotale role in helping bythen promote its avatar

collections and solutions. Furthermore, this partnership opens the possibility

for collaborations between bythen and Japan’s iconic IPs.

Until now, the rights to virtual influencer IPs were typically owned by

companies, limiting individuals’ freedom to customize and adapt them. bythen aims

to democratize virtual influencer IPs globally by providing users with tools and

solutions to build and grow their digital presence.”

Profile of Ryo Umezawa, Vice President of New

Business Development and Global M&A, Vector Inc.

・Spent ten years in the Philippines before graduating from Sophia

University with a Bachelor of Arts, majoring in International Business

and Economics, in 2007.

・Interned at J-Seed during university, contributing

to business launches

and marketing activities from 2005.

・Worked at Traffic Gate (now LinkShare

Japan) from 2008, building smartphone ad network businesses and developing voice

recognition search app

・Co-founded two startups, a mobile

marketing company and a coupon aggregation business

・Served as the CEO of HAILO Japan, a

taxi-hailing app, and held executive roles

at HomeAway Japan, Tinder Japan, and investment funds East Ventures and

Antler.

・Appointed as Vice President of New

Business Development and Global M&A at Vector Inc. in 2024.

Comment from Ryo Umezawa

“It is a great honor to support an entrepreneur embarking on his

third venture with a vision of democratizing AI virtual characters and pursuing

global expansion. This initiative will showcase Japan’s content and culture

globally, unlock creators’ full potential, and contribute to the growth of the

sharing economy.”

You must be logged in to post a comment.