by Penny Angeles-Tan | Dec 26, 2024 | Business

Explore 7 key factors shaping Ethereum’s price in 2025. This in-depth analysis examines whale accumulation, institutional investment, market trends, and upcoming upgrades, providing insights into potential price targets and market outlook for ETH.

The Ethereum (ETH) market is demonstrating strong signals of potential growth, driven by whale accumulation, institutional interest, and technological advancements.

This comprehensive analysis explores the critical factors shaping Ethereum’s trajectory and outlines predictions for the future.

1. Whale Accumulation: A Bullish Signal

The number of Ethereum whales—wallets holding at least 1,000 ETH—has reached its highest level since September, currently standing at 5,631. This increase from 5,565 on November 26 signifies renewed confidence among large investors.

Whale activity often acts as a leading indicator for market trends due to the substantial influence these holders exert on price stability and upward momentum.

Key Implications:

– Accumulation as Confidence: The rise in whale holdings suggests bullish sentiment, as major players position themselves for anticipated price gains.

– Price Impact: Accumulation could support price stability and fuel upward momentum, providing a foundation for Ethereum’s strength in the coming months.

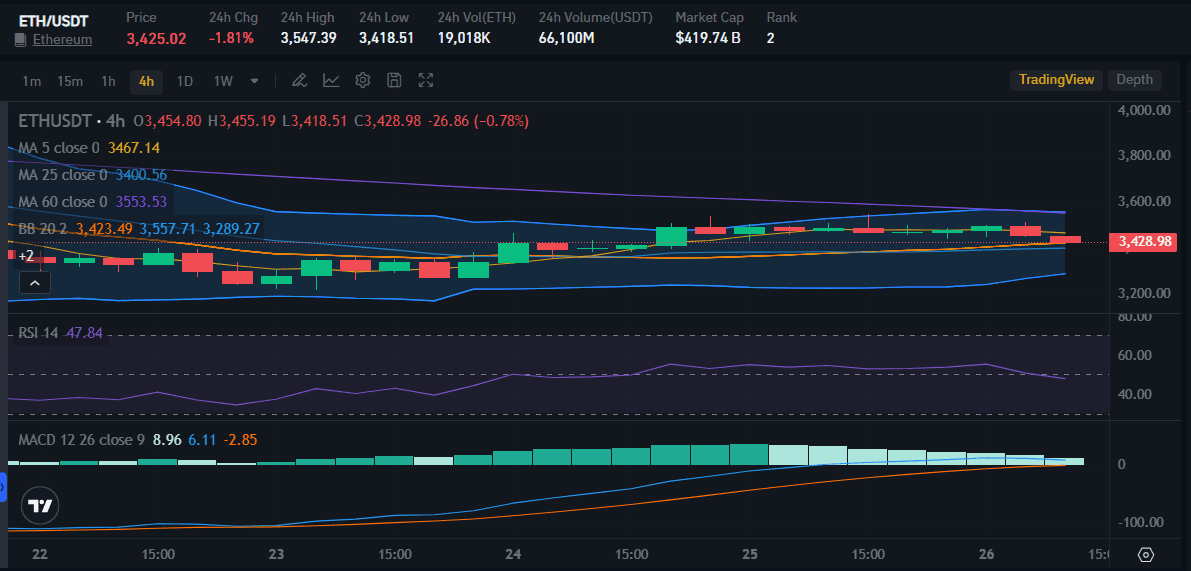

2. Current Price Trends and Resistance Levels

Ethereum’s resistance at $3,523 is pivotal for its short-term price movements. Breaking this level could pave the way for testing $3,763 and eventually $4,100, signaling a continuation of the uptrend.

Conversely, failure to break $3,523 could result in a pullback to key support levels at $3,256 or even $3,096.

Historical Context:

- The $4,000 resistance zone has consistently acted as a psychological barrier, halting bullish advances over the past year.

- Previous rejections at $4,000 triggered sell-offs and liquidations, highlighting the significance of this threshold in shaping market sentiment.

Current Outlook:

- Ethereum is consolidating within the $3,500–$4,000 range. This phase of stabilization could precede another bullish attempt to retest the $4,000 resistance.

3. Market Momentum and Indicators

The Directional Movement Index (DMI) reveals a weakening uptrend, with the Average Directional Index (ADX) dropping from 46 to 27 in just two days.

Despite reduced momentum, the positive directional indicator (D+) at 21.1 remains higher than the negative directional indicator (D-) at 16, signaling sustained buying pressure.

ADX Analysis:

- Strength of Trend: An ADX value of 27 indicates a moderately strong trend. While the decline suggests reduced momentum, it also hints at market consolidation, potentially setting the stage for a renewed rally.

4. Whale Activity and Selling Pressure

Recent whale transactions have contributed to market fluctuations:

– Nexo-related transactions: Over 114,262 ETH ($423.3M) deposited into Binance since December 2.

– Profit-taking behavior: A whale deposited 22,740 ETH ($77.7M) earlier this month, cashing out $137.8M in stablecoins.

Implications:

5. Institutional Interest: A Growing Catalyst

Institutional adoption of Ethereum is accelerating, with ETF inflows highlighting its appeal:

– December 23 data: Bitcoin ETFs saw outflows of $226.5M, while Ethereum ETFs attracted $130.8M in fresh investments.

– Leading ETFs: BlackRock’s ETHA led inflows with $89.51M, followed by Fidelity’s FESH at $46.37M.

Expert Predictions:

Analyst Matt Houghan projects Ethereum could reach $7,000 by 2025, supported by increasing institutional confidence and technological advancements.

6. Fundamental Catalysts for Growth

Several key factors are poised to drive Ethereum’s growth in 2025:

a. Technical Upgrades

The Pectra upgrade, scheduled for early 2025, aims to enhance Ethereum’s scalability and security by increasing validator capacity from 32 ETH to 2,048 ETH. This upgrade is expected to:

b. Regulatory Tailwinds

A favorable regulatory environment, including a potential pro-crypto shift in U.S. leadership, could reduce legal hurdles and foster innovation within Ethereum’s ecosystem.

c. Ecosystem Expansion

Ethereum’s role in key crypto trends—stablecoin growth, asset tokenization, and AI integration—positions it as a cornerstone of blockchain innovation. Layer-2 expansions and partnerships with major institutions further solidify its standing.

7. Price Projections and Market Outlook

Rising from $2,350 to $3,478 year-to-date, Ethereum has gained 53.5%. While this lags behind some rivals, analysts view it as a buildup for a significant breakout.

a. Short-Term Targets:

b. Long-Term Vision:

Surpassing the $4,000 resistance could trigger a rally toward $7,000 by 2025, driven by institutional adoption and ecosystem growth.

Conclusion

Ethereum is at a pivotal juncture, with whale accumulation, institutional interest, and upcoming technical upgrades laying the groundwork for potential growth. While short-term challenges persist, the long-term outlook for ETH appears increasingly bullish.

As the second-largest cryptocurrency continues to innovate and attract significant investment, Ethereum may well become the “comeback kid” of 2025, surpassing its all-time highs and solidifying its position as a leader in the blockchain space.

This Press Release has also been published on VRITIMES

by Penny Angeles-Tan | Dec 26, 2024 | Business

Explore Solana’s price outlook and potential for reaching $500 in 2025. This analysis delves into current market trends, on-chain fundamentals, macroeconomic factors, and technical analysis to assess SOL’s future trajectory.

The cryptocurrency market has seen significant activity around Solana (SOL), particularly as it attempts to stage a recovery during the holiday season. SOL’s performance, coupled with macroeconomic and on-chain fundamentals, paints a nuanced picture of its short-term and long-term potential.

Current Market Trends: Solana’s Modest Rebound

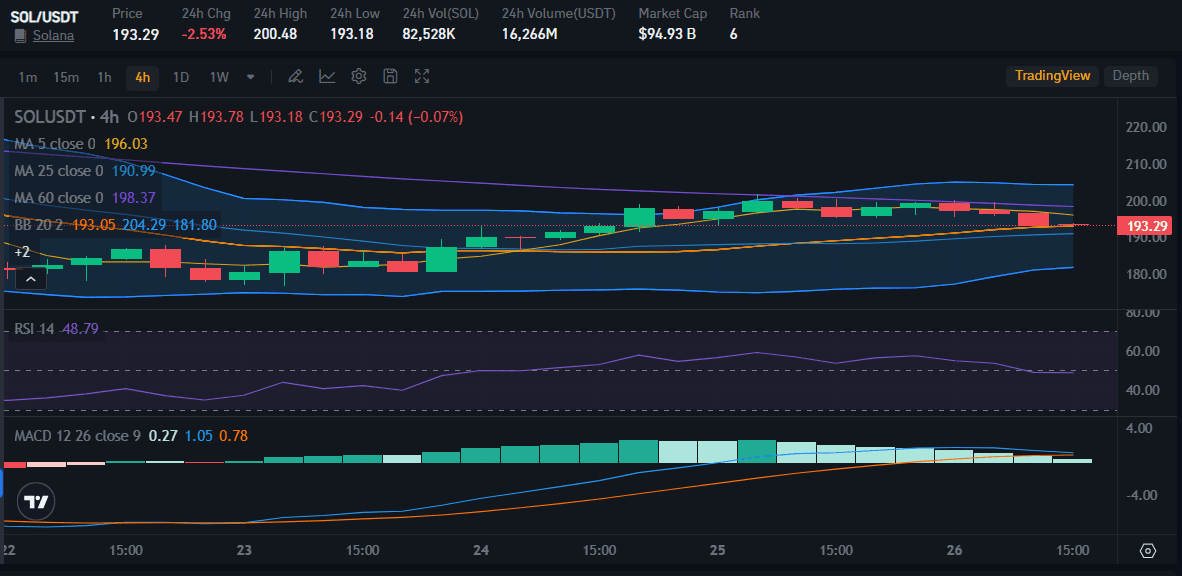

As of Christmas Day 2024, Solana’s price is making a modest recovery, trading just below the critical $200 mark. The asset has rebounded by 13% from its multi-week lows around $175, yet it remains significantly lower than its recent peak in the $260s.

However, despite the recent uptick, SOL is still trapped in a broader downtrend. Both the 21-day and 50-day moving averages (DMAs) suggest persistent bearish momentum, with analysts emphasizing that a meaningful break above $220 is necessary to confirm a trend reversal.

At the time of writing this article on December 26, 2024, Solana is trading at $193.29 with a decrease of -2.51%. The RSI value is below 50 which means the selling trend is higher than the buying trend.

Impact of Macroeconomic Factors

The Federal Reserve’s hawkish policy stance, signaling only two interest rate cuts in 2025, has dampened confidence in risk assets, including cryptocurrencies.

However, bullish indicators, such as the continued strength of the U.S. economy and the incoming pro-crypto Trump administration, provide a counterbalance.

This favorable regulatory and macroeconomic environment could usher in a “golden age” for the U.S. crypto industry, potentially driving renewed investor interest in assets like Solana.

Why Solana Could Retest $260 and Beyond

Solana, despite recent market volatility, exhibits strong on-chain fundamentals and presents a compelling case for a potential retest of $260 and beyond.

Robust network activity, indicated by rising trading volumes and transaction counts, coupled with a relatively low market capitalization compared to Ethereum, suggests significant room for growth.

While a direct comparison to Ethereum is unlikely, analysts predict a substantial price appreciation driven by Solana’s scalability advantages and increasing adoption within the DeFi and NFT sectors.

1. Strengthening On-Chain Fundamentals

Solana’s blockchain metrics remain robust, with trading volumes, transaction counts, and Total Value Locked (TVL) showing strong upward trends, according to DeFi Llama.

These indicators highlight increasing network usage, which could support future price gains.

Solana’s market cap of $94 billion, about 25% of Ethereum’s, suggests ample room for growth. While it is unlikely to surpass Ethereum this cycle, analysts predict a potential 4-5x increase from current levels, driven by Solana’s exceptional scalability and growing adoption in decentralized finance (DeFi) and non-fungible tokens (NFTs).

2. Short-Term Technical Analysis

Key Levels to Watch

– Support: $173.42 (61.8% Fibonacci level) has emerged as a critical base for SOL. If this level holds, it could signal the end of a corrective phase and the start of a bullish reversal.

– Immediate Resistance: $193.20 (50% Fibonacci level) serves as the first hurdle for upward momentum.

– Higher Resistance: $209.93 (38.2% Fibonacci) and $230.64 (23.6%) are subsequent levels to watch for a sustained breakout.

- Downside Target: Failure to hold the $173 support could push SOL toward the $152.65 level (78.6% Fibonacci).

3. Elliott Wave Analysis

Solana appears to be in the final stages of a corrective W-X-Y wave structure. A bullish reversal is plausible if the “C” wave concludes near the $173 support zone. A successful rebound could target $230 and potentially set the stage for higher highs.

Long-Term Price Outlook: Could Solana Reach $500?

Despite current struggles, many analysts remain optimistic about Solana’s future. As the crypto market transitions to a new cycle in 2025, several factors could propel SOL toward the ambitious $500 mark:

1. Pro-Crypto Regulatory Shift: The incoming U.S. administration is expected to create a favorable environment for blockchain innovation, benefitting major projects like Solana.

2. Ecosystem Expansion: Solana continues to attract new projects, enriching its ecosystem with advanced decentralized applications, tokenization initiatives, and cutting-edge solutions.

3. Bull Market Potential: Historical patterns suggest that Solana, like other major cryptocurrencies, has yet to enter the most explosive phase of its bull market, with significant upside remaining.

Risks and Challenges

1. Low Trading Volume: Recent declines in trading activity signal reduced investor confidence, potentially hindering price recovery.

2. Macroeconomic Uncertainty: Continued Fed hawkishness and other global economic factors could limit risk appetite for speculative assets.

Conclusion

Solana’s price action reflects a market in flux, caught between bearish trends and bullish fundamentals. While the short-term outlook suggests consolidation, the long-term narrative remains promising, driven by strong on-chain activity, ecosystem growth, and favorable macroeconomic shifts.

If Solana can break key resistance levels and sustain momentum, a retest of $260 appears likely, with the $500 target in 2025 firmly within reach.

This Press Release has also been published on VRITIMES

by Penny Angeles-Tan | Dec 17, 2024 | Business

XRP hits a new all-time high as Ripple launches the RLUSD stablecoin, reshaping the $200B stablecoin market. Explore record-breaking crypto inflows, Bitcoin ETF momentum, and Ripple’s strategic moves driving XRP adoption in 2024-2025.

The digital asset investment market continues to shatter records in 2024, as inflows into cryptocurrencies reached unprecedented levels. Bolstered by surging investor interest, pro-crypto regulatory signals, and key ecosystem developments, Bitcoin, Ethereum, and XRP have dominated the spotlight.

Ripple’s new RLUSD stablecoin launch adds yet another dimension to the fast-growing crypto market, particularly in the stablecoin space.

Digital Asset Inflows Surge to $44.5 Billion in 2024

Digital asset investment products, including spot Bitcoin and Ethereum ETFs, witnessed inflows of $3.2 billion last week alone. This milestone brought year-to-date (YTD) inflows to a staggering $44.5 billion, quadrupling any previous annual records, according to CoinShares data.

The week’s $3.2 billion inflow represents the 10th consecutive week of positive flows into digital asset products. It follows a record-breaking $3.85 billion from the prior week, signaling robust investor confidence. Notably, Bitcoin accounted for $38.5 billion of the YTD inflows, representing 87% of total investments.

The launch of spot Bitcoin ETFs, coupled with Donald Trump’s recent electoral victory in the U.S., has reinvigorated institutional and retail interest in Bitcoin. Trump’s pro-crypto stance has set the stage for a potentially friendlier regulatory environment, spurring optimism across the crypto market.

Ethereum and Altcoin Inflows Gain Momentum

While Bitcoin dominated inflows, Ethereum and other altcoins saw notable activity last week. Ethereum investment products recorded $1 billion in inflows, lifting YTD totals to $4.4 billion. This surge comes despite Ethereum’s underperformance relative to other major cryptocurrencies.

Analysts believe the launch of federal cryptocurrency legislation could stimulate the development of decentralized applications (dApps) on Ethereum’s network, driving higher usage and demand.

Similarly, XRP investment products saw significant traction, drawing $145 million last week and pushing YTD inflows to $421 million. Butterfill attributed this momentum to growing speculation around a U.S.-listed XRP ETF and positive sentiment following Trump’s election victory.

Altcoins like XRP also benefited from ongoing advancements within their ecosystems, such as Ripple’s upcoming stablecoin launch.

Ripple’s RLUSD Stablecoin Set to Transform the Market

On December 17, Ripple will officially launch its RLUSD stablecoin, marking a major milestone in the $200 billion stablecoin market. RLUSD will initially be available on both the XRP Ledger (XRPL) and Ethereum networks, expanding its utility and accessibility.

Fully backed by U.S. dollar deposits, short-term U.S. government bonds, and cash equivalents, RLUSD is designed to maintain a 1:1 peg to the U.S. dollar.

Ripple CEO Brad Garlinghouse emphasized that the stablecoin received “final approval” from the New York Department of Financial Services (NYDFS), highlighting its regulatory clarity and trustworthiness.

RLUSD will be distributed through key exchange and platform partners, including Uphold, MoonPay, Bitso, Bullish, and Bitstamp, with additional listings planned in the coming weeks. While initially unavailable in the European Union due to regulatory hurdles under MiCAR, Ripple is actively exploring options to enter the bloc’s market.

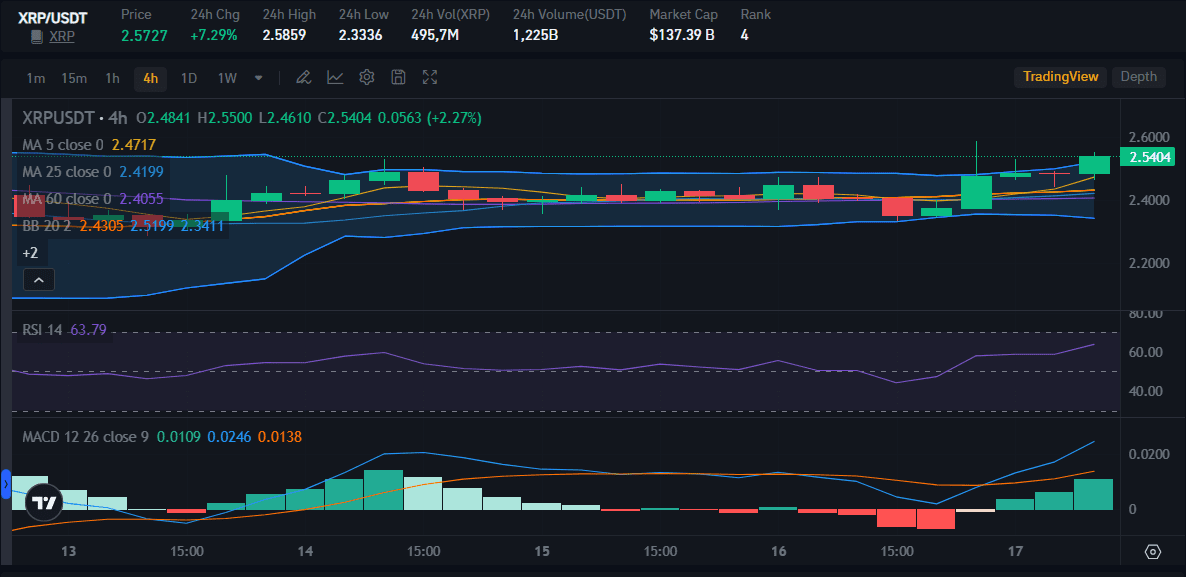

XRP Price Outlook and Catalysts Driving Growth

Ripple’s RLUSD stablecoin launch has generated significant interest in XRP, which serves as the transaction fee token on the XRPL.

XRP’s price surged to a seven-year high of $2.90 on December 3, 2024, before entering a corrective phase. As of this article is written on December 17, XRP trades at $2.5727—an 7,29% pullback after tripling its value in the past six weeks.

The hype surrounding RLUSD, coupled with growing adoption, is expected to support XRP’s long-term price trajectory. Analysts, including Georgios Vlachos, co-founder of Axelar, predict that RLUSD adoption in emerging markets for transactions and savings will drive XRP demand throughout 2025.

From a technical perspective, XRP has formed a bullish flag pattern, indicating potential upside. Analysts project a target of $15—a 520% increase from current levels—as the market stabilizes and bullish sentiment grows.

Regulatory Shifts and Institutional Interest

Trump’s pro-crypto stance has created optimism for a favorable regulatory landscape in the U.S., particularly as Republican lawmakers take key positions. Crypto-friendly Rep. French Hill (R-AH) was recently appointed to lead the House Financial Services Committee, signaling a potential shift toward clearer regulations for digital assets.

Amid this changing environment, leading asset managers such as WisdomTree and 21Shares have filed applications for XRP ETFs, reflecting growing institutional interest.

While XRP spot ETFs remain unavailable in the U.S., international markets continue to see strong demand, accounting for 92% ($3.5 billion) of last week’s inflows.

Switzerland and Germany emerged as key contributors, with inflows of $159 million and $116 million, respectively.

RLUSD Volatility Concerns and Investor Guidance

Despite its dollar peg, RLUSD’s launch may experience short-term price volatility due to high demand and limited supply. Ripple CTO David Schwartz warned traders against speculation, cautioning against paying inflated prices driven by hype.

Instances of traders offering exorbitant amounts—up to $1,200 for a fraction of RLUSD—highlight the fervor surrounding its launch. Schwartz reassured investors that such anomalies are temporary, and the stablecoin’s price will settle close to $1.

Conclusion

As 2024 concludes, the digital asset market is witnessing historic inflows, driven by institutional demand, regulatory optimism, and major ecosystem advancements. Bitcoin continues to dominate the landscape, but Ethereum and XRP are emerging as key players amid developments like Ripple’s RLUSD stablecoin.

With RLUSD poised to disrupt the stablecoin market and broader adoption of XRP expected in 2025, Ripple’s strategic focus on regulatory compliance and innovation could further solidify its position.

As the crypto industry enters 2025, the combination of pro-crypto policies, growing institutional interest, and increasing utility sets the stage for sustained growth across digital assets.

This Press Release has also been published on VRITIMES

by Penny Angeles-Tan | Dec 13, 2024 | Business

Ripple Labs achieves a milestone with NYDFS approval for its RLUSD stablecoin, boosting XRP’s price by over 23%. Explore how RLUSD is reshaping the stablecoin market with full transparency, regulatory compliance, and global accessibility.

Ripple Labs has achieved a breakthrough with its stablecoin, RLUSD, receiving approval from the New York Department of Financial Services (NYDFS). This regulatory milestone solidifies Ripple’s position as a key player in the cryptocurrency sector and has significantly impacted the value of its native token, XRP.

RLUSD: A New Challenger to Tether and Circle

Introduced in April, RLUSD is designed to rival popular stablecoins such as Tether’s USDT and Circle’s USDC. Backed by NYDFS approval, RLUSD enters the market with the distinct advantage of full compliance with U.S. financial regulations.

Key features of RLUSD include:

1. Full Collateralization: Backed entirely by U.S. Treasury bonds.

2. Regulatory Compliance: Adheres to GAAP, Basel III, and Dodd-Frank regulations.

3. Transparency: Ripple offers real-time audits to maintain investor confidence.

RLUSD is structured for financial stability, with its underlying assets stored in regulated institutions, ensuring safety and trust for users.

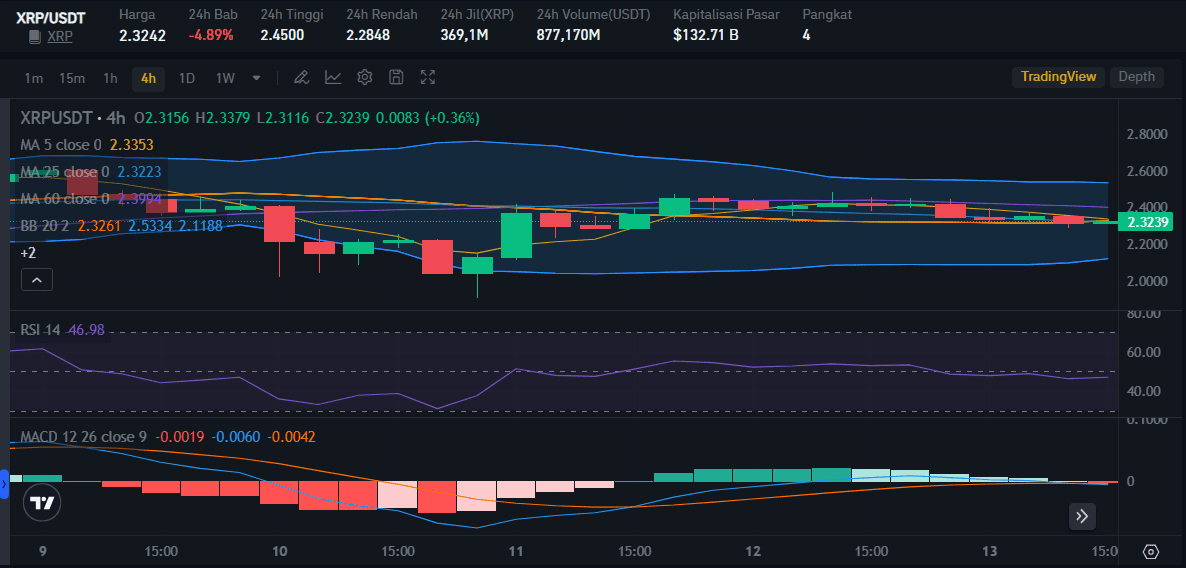

Impact on XRP and Ripple’s Ecosystem

The NYDFS approval fueled a sharp rise in XRP’s value, surging 23% from $2.03 to $2.40 within hours. This increase reflects the market’s optimistic sentiment toward Ripple’s innovation.

At the time of writing this article on December 13, 2024, the price of XRP has decreased by 4.89% to trade at $2.3242. This price is certainly not much different from the highest price of XRP in 24 hours of $2.45.

Ripple CEO Brad Garlinghouse announced plans to make RLUSD accessible on global platforms such as Bitstamp, Uphold, and MoonPay. This accessibility is expected to drive decentralized finance (DeFi) adoption, utilizing RLUSD in liquidity pools and automated market makers (AMMs) on the XRP Ledger.

RLUSD and the Future of Global Stablecoins

RLUSD is projected to reach a $2 trillion market capitalization by 2028, with its growth supported by extensive cross-network testing on Ethereum and XRP Ledger since August.

Crypto analyst Vincent Van Code highlights RLUSD as one of the most transparent and secure stablecoins available. This sets it apart from USDT and USDC, which have faced scrutiny over regulatory gaps.

The Road Ahead: Challenges and Opportunities

While RLUSD has immense potential, it also faces challenges:

1. Competition with Established Players

Competing with USDT and USDC requires Ripple to continually innovate and differentiate RLUSD through unique use cases and partnerships.

2. Market Volatility

As stablecoins are increasingly scrutinized, maintaining transparency and adherence to regulatory standards will be critical for RLUSD’s credibility and growth.

3. Regulatory Landscape

Despite gaining NYDFS approval, Ripple must navigate varying regulations in other jurisdictions to ensure RLUSD’s seamless global adoption.

Political Shifts and Market Support

Recent political developments in the United States are further bolstering Ripple’s momentum. Donald Trump’s re-election and the appointment of crypto-friendly Paul Atkins as SEC Chair signal a more supportive regulatory environment for cryptocurrencies.

At the Bitcoin MENA 2024 conference, Eric Trump announced tax exemptions for U.S.-based cryptocurrencies, including XRP. This initiative aims to position the U.S. as a global cryptocurrency hub, enhancing Ripple’s growth prospects.

Conclusion

With NYDFS approval and a robust framework, RLUSD is poised to become a formidable competitor in the stablecoin market. Its regulatory compliance, transparency, and financial stability give Ripple a significant edge in building a decentralized and inclusive financial ecosystem.

This achievement not only instills renewed hope in the XRP community but also sets a precedent for stablecoins, proving that innovation aligned with regulatory standards is the key to long-term success in the rapidly evolving crypto landscape.

If you think XRP is worth considering as a token that is worthy of being your investment instrument, don’t forget to do in-depth research before buying the token. Take advantage of Bitrue’s various features to find out today’s XRP price and its conversion price from XRP to USD.

Bitrue also has an event that will give you maximum rewards when buying XRP tokens. Take advantage of this event opportunity to get rewards of up to 66,666 USDT. This event can be followed by anyone by logging in to the Bitrue website and application. Don’t miss it because you can get the maximum benefit from XRP on December 24, 2024.

This Press Release has also been published on VRITIMES

by Penny Angeles-Tan | Dec 8, 2024 | Business

Bitcoin surpasses $100,000 for the first time, marking a historic milestone in cryptocurrency’s evolution. Explore its institutional adoption, political support under President-elect Trump, and future prospects in the financial mainstream.

In a historic moment for the financial world, the price of Bitcoin surged past $100,000 for the first time on Wednesday, peaking at $103,844.05. This milestone reflects a dramatic increase of over 45% since November 5 and more than 140% year-to-date in 2024.

The rise comes amid an increasingly crypto-friendly political environment, fueled by President-elect Donald Trump’s promises to support the industry.

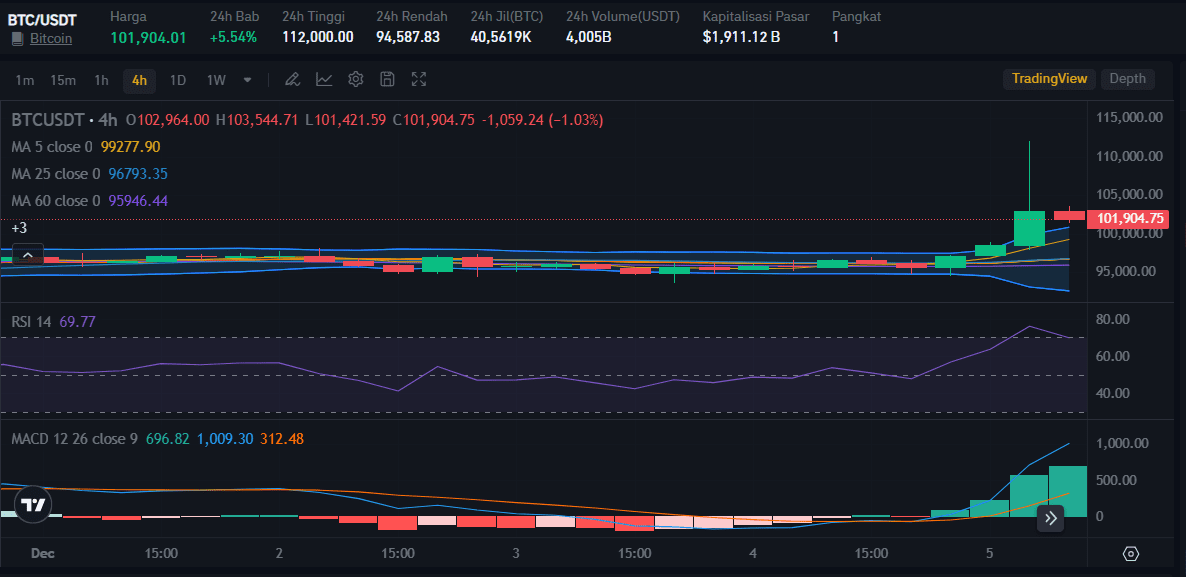

As you can see from the price chart above, at the time of writing this article on December 5, Bitcoin was at $101,904 with a 5.54% increase. In fact, in the last 24 hours, the price of BTC reached $112,000.

A New Chapter for Bitcoin

Bitcoin, launched 15 years ago by an unknown entity under the pseudonym Satoshi Nakamoto, has transcended its origins as an experimental digital currency. Initially envisioned as a peer-to-peer payment system, many now view Bitcoin as a store of value and a hedge against geopolitical instability and inflation.

Institutional interest in cryptocurrency has skyrocketed, with exchange-traded funds (ETFs) playing a pivotal role.

BlackRock’s iShares Bitcoin Trust ETF, the largest of its kind, has seen significant growth since its launch in January, now valued at over $45 billion.

“There’s growing interest across institutional and wealth-management spaces,” said Jay Jacobs, BlackRock’s U.S. head of thematic and active ETFs. ETFs have simplified Bitcoin investment, allowing mainstream and institutional investors to capitalize on its volatile yet lucrative price movements.

Political Winds Favoring Crypto

President-elect Donald Trump’s surprising pivot from crypto skepticism to advocacy has invigorated the industry. During his campaign, Trump pledged to establish a U.S. Bitcoin “strategic reserve,” eliminate taxes on crypto transactions, and create policies to encourage domestic Bitcoin mining.

His pick of Paul Atkins, a known crypto advocate, as the next SEC Chair signals a likely shift toward lighter regulation, contrasting with the strict enforcement under outgoing Chair Gary Gensler.

Trump’s engagement with the crypto community extends beyond policy. From headlining the Bitcoin Conference in Nashville to using Bitcoin for a high-profile purchase in Manhattan, he has actively courted the crypto demographic.

His administration also plans to establish a dedicated crypto policy role in the White House, marking an unprecedented move in U.S. financial governance.

Market Reactions and Future Prospects

Bitcoin’s rally has sparked renewed interest in the broader cryptocurrency market. Altcoins like Ethereum Classic (ETC) and Bitcoin SV (BSV) have seen double-digit percentage gains, reflecting broader market enthusiasm.

Experts suggest the bull market is far from over, with eToro’s Josh Gilbert noting, “This feels like the early stages of a sustained rally.”

However, Bitcoin’s notorious volatility remains a cautionary tale. Market analysts warn against overexuberance, emphasizing the potential for price corrections. Pav Hundal of Swyftx remarked on the momentum but advised caution, noting that “assets rarely rise in a straight line forever.”

A Paradigm Shift in Financial Markets

Bitcoin’s ascent has drawn comparisons to gold, with Federal Reserve Chair Jerome Powell describing it as a “digital competitor to gold” rather than a rival to traditional currencies. Institutional players like Fidelity, Invesco, and Charles Schwab are preparing to enter the crypto market, underscoring Bitcoin’s growing legitimacy.

Mike Novogratz, CEO of Galaxy Digital, summed up the sentiment: “We’re witnessing a paradigm shift. Bitcoin and the entire digital asset ecosystem are on the brink of entering the financial mainstream.”

Looking Ahead

As Trump prepares to take office in January, the cryptocurrency community is optimistic about a regulatory environment that fosters innovation and mainstream adoption. While challenges remain—from security concerns to potential regulatory hurdles—Bitcoin’s milestone signals a transformative moment for the financial landscape.

The road ahead may not be smooth, but with institutional adoption rising and political support strengthening, Bitcoin’s journey from a niche asset to a global financial staple appears inevitable. Whether this surge heralds a new era or is merely another peak in its volatile history, one thing is clear: Bitcoin has cemented its place in the financial world.

Conclusion

The strengthening of support for Bitcoin has made cryptocurrency more trusted and investors with traditional investment instruments are slowly looking at crypto. If you are one of those people, make sure to always do in-depth research, from technical to fundamental crypto tokens must be checked carefully.

You don’t need to be confused about how and where to do this reliable research. Because, Bitrue can help you. There are many features that you can use to do independent research, from checking BTC prices in real time, converting BTC prices to USD easily, to reading the latest information on the crypto ecosystem for free on the Bitrue blog.

Bitrue will be your reliable crypto investment buddy. In fact, Bitrue often holds airdrop events and deposit contests so you can get maximum benefits in investing.

This Press Release has also been published on VRITIMES

You must be logged in to post a comment.