by Penny Angeles-Tan | Dec 7, 2024 | Business

Explore Ethereum’s (ETH) journey to $3,900 and beyond with bullish predictions for 2025 and 2030. Discover key drivers like institutional inflows, whale activity, DeFi growth, and network upgrades, alongside critical resistance levels and long-term outlooks.

As the second-largest cryptocurrency by market capitalization, Ethereum (ETH) continues to captivate the market’s attention. Amid broader volatility, ETH’s performance suggests strong bullish momentum, supported by institutional interest, increasing on-chain activity, and favorable market sentiment.

Recent Performance and Price Movement

At the time of writing, ETH is trading at $3,895 after experiencing a 5.06% increase with its highest price in 24 hours being $3,901. The current ETH RSI value is even at 72 which means the buying trend is more dominant than the selling trend, even tending to be overbought.

The daily trading volume surged by 4% to over $42 billion, reflecting heightened investor activity. ETH has rebounded above the critical $3,500 resistance level, with technical indicators like the 50-day EMA crossing above the 200-day EMA signaling potential for further gains.

The uptrend aligns with a broader market shift. Bitcoin (BTC) recently reached $100,000, boosting investor confidence across the altcoin market, including Ethereum. However, ETH’s price remains 21% below its all-time high (ATH) of $4,891, set in November 2021.

Institutional Activity and ETFs Driving Growth

Institutional interest in Ethereum has intensified, particularly through exchange-traded funds (ETFs). U.S.—based spot Ethereum ETFs reported eight consecutive days of net inflows, totaling $901.3 million as of early December.

Key contributors include BlackRock’s ETHA fund, with $65.3 million in inflows, and Fidelity’s FETH fund, with $73.7 million.

Despite outflows from Grayscale’s Ethereum Trust (ETHE), the overall inflow trend indicates growing confidence among institutional investors, further supporting Ethereum’s price trajectory.

Whale and Retail Activity Boost On-Chain Metrics

Ethereum whales have played a pivotal role in recent price movements. Whales holding 10K to 100K ETH increased their holdings by 460K ETH in the past week, while those with larger stakes (100K to 1 million ETH) reduced theirs by 490K ETH. This redistribution suggests a shift of ETH from institutions to retail whales.

On-chain activity has also intensified, with Ethereum registering a net outflow of $820 million from exchanges over seven days, indicating accumulation by long-term holders. The total number of Ethereum holders rose to 133.21 million on December 4, emphasizing rising retail interest.

DeFi and Network Growth

Ethereum’s decentralized finance (DeFi) sector continues to thrive, with total value locked (TVL) reaching $72.9 billion. This robust ecosystem supports broader adoption and reinforces Ethereum’s position as a foundational blockchain for DeFi, NFTs, and decentralized applications.

Furthermore, staking flows have seen consistent inflows, reflecting long-term investor confidence. A growing amount of ETH is being locked in staking protocols, reducing available supply and supporting price appreciation.

ETH Price Predictions in 2025 & 2030 and Market Sentiment

Industry experts and financial institutions are optimistic about Ethereum’s long-term potential:

- Deltec Bank predicts ETH could reach $10,000 by 2025 and $22,500 by 2030.

- Standard Chartered projects a 2025 target of $14,000, citing Ethereum’s network upgrades and potential scalability improvements.

- Gigantic-Cassocked-Rebirth (GCR) anticipates a $10,000 price point, driven by DeFi growth and adoption of Ethereum 2.0.

-

Finder analysts forecast an average price of $6,105 by 2025, underpinned by institutional investment and technological advancements.

Goldman Sachs has even suggested that Ethereum could surpass Bitcoin as a store of value, thanks to its extensive use in DeFi and its foundational role in blockchain innovation.

Challenges and Key Levels to Watch

While optimism abounds, Ethereum faces significant resistance at $4,000 and its ATH near $4,891. A clear break above these levels, supported by sustained volume and on-chain activity, could validate bullish patterns like the cup-and-handle formation, potentially driving ETH toward new highs of $7,000 or beyond.

However, a daily close below $3,400 could invalidate the current bullish thesis, sending ETH toward support levels around $2,817.

Conclusion

Ethereum’s recent rally is a confluence of institutional interest, strong on-chain metrics, and technological advancements. As it edges closer to the psychologically significant $4,000 mark, ETH appears poised for a defining move. While risks remain, the long-term outlook for the leading altcoin remains promising, with the potential to reclaim its ATH and embark on a new bullish cycle.

Investors should monitor critical resistance levels, market sentiment, and macroeconomic conditions to navigate the evolving landscape effectively.

This Press Release has also been published on VRITIMES

by Penny Angeles-Tan | Dec 6, 2024 | Business

Discover 17 exciting airdrop events happening in December 2024, including GOATS, Uniswap, Sonic Lab, MemeFi, and more. Learn how to participate and maximize your crypto earnings with millions of tokens and USDT prizes. Don’t miss out—start claiming your rewards today!

Getting maximum benefits in the crypto ecosystem is easy, one way is to participate in airdrop events. For you Airdrop Hunters, this article is written especially for you. It will explain about 17 airdrop events in December 2024 that you can participate in and maximize your profits.

Read this article until the end to find out the requirements for participating in the GOATS, Uniswap, Sonic Lab, MemeFi, Tomarket, and other airdrops with prizes of millions of crypto tokens.

1. GOATS Airdrop

At the end of November, the official GOAT account on Twitter announced that it would be listed on December 5, 2024. This listing schedule coincides with the airdrop event, which has been running since November 30 and will end on December 19, 2024. The prizes offered are 8,000,000 GOAT tokens and 70,000 USDT.

2. Avax Airdrop by Bitrue

Prizes of up to $30,000 USDT can be won at the “Trade AVAX Futures” airdrop event from Bitrue. You can trade AVAX futures to get USDT bonuses directly.

New and existing Bitrue users can participate in this event because it includes three airdrop activities: new user benefits, an AVAX futures trading competition, and an invitation to new traders to trade AVAX. This Bitrue airdrop event will run until December 9, 2024.

3. Uniswap Labs Airdrop

Uniswap Labs is launching a bug bounty program to improve the program into a more mature program later. You can participate in this bug bounty event by checking the Uniswap V.4 contract, which you can find in the Uniswap GitHub repository, and then participating in the airdrop event on the Uniswap blog with the description V4 Bug Bounty.

For this event, Uniswap is providing prizes of up to $ 15.5 million USD and is claimed to be the largest prize in DeFi history.

4. WAM Airdrop

You will compete for prizes of up to 1,000,000,000 WAM tokens for the airdrop event hosted by Wam. This event is a game tournament from the WAM play-to-earn platform where the combination of blockchain, AI, and games is available it.

To join, you can access wam.app which can be downloaded by iOS to Android, and then play arcade games in it.

5. GameFi Carnival Airdrop

The next airdrop event comes from the global crypto exchange, Bitrue, which is holding an airdrop event “GameFi Carnival Airdrop“. You have the chance to get $10,000 USDT.

This event can be followed by all Bitrue users, both existing users and new users in the period from November 26 to December 10.

6. Sonic Labs Airdrop

Sonic Labs is offering up to 200,000,000 $S tokens for this airdrop event. You can directly visit the Sonic Arcade Airdrop page on soniclabs.com and connect to your wallet to add the Sonic testnet. Later, you will immediately get 429 $TOKEN from the faucet by joining the game up to 20 times a day to collect lots of points.

7. Mega XRP & USDT Airdrop Event

Who doesn’t want to get XRP and USDT tokens for free? Bitrue allows you to get both tokens for free in the “Mega XRP & USDT Airdrop Event“. This airdrop event will be held on November 29 and ends on December 13, 2024.

There will be 2 contests in this airdrop event: Deposit Rewards and Trading Rewards with a raffle ticket system. The prizes provided are 2,000,000 XRP tokens and 200,000 USDT tokens.

8. Monad Airdrop

Monad Airdrop is held on monad.xyz by giving away $MONAD tokens. This Ethereum Layer 1 Blockchain requires participants to follow Monad’s social media on Twitter and Discord and then explore the accelerator program with the documentation available on the website.

9. MemeFi Airdrop

This Telegram game that just launched its token is holding an airdrop event on the memefi.club website. This airdrop event provides a prize of 50,000 $MEMEFI tokens through a referral system.

You can access this play to earn game from the Sui blockchain on the Telegram bot, then complete various tasks and connect your Sui wallet.

10. The Sandbox Airdrop

If you want to join The Sandbox airdrop event, you can directly contact the website sandboc.game/en/. There, you will get the chance to win $SAND token prizes as well as exclusive NFTs.

The requirements are very easy, you can immediately install the Sandbox Game Client to access the metaverse and then complete the available quests.

11. Tomarket Airdrop and Listing Date

This December airdrop event coincides with the launch of the Telegram Tomarket game token. Officially, Tomarket announced the launch of its token on December 20, 2024.

As is the usual practice for listing Telegram game tokens in general, Tomarket is certain to also hold a TOMA token airdrop on a date close to the token listing.

12. Vertus TGE & Airdrop

In the Vertus community group on Telegram, Vertus officially announced that it will hold a TGE on December 27, 2024 on 5 leading crypto exchanges. On the TGE schedule, rewards will also be distributed to Vertus players and the community to get $VERT tokens. So, make sure you play Vertus more often so that you have more opportunities to get VERT tokens.

13. WCoin Airdrop and Listing Date

WCoin is reported to be listing its token in December. However, the official date has not been confirmed so you still have plenty of time to continue playing the tap-to-earn game so you have a chance to get a bigger airdrop.

14. Time Farm Airdrop & TGE Launch

According to Time Farm’s plan, this Telegram game will launch the $SECOND token in Q4 2024. It is estimated to happen in mid-December, but the official date has not been announced so you can be more diligent in playing Time Farm to announce more coins that can be exchanged for $SECOND tokens when the airdrop event is launched.

15. Blum TGE and Airdrop Event

Blum is confirmed to list the BLUM token in December 2024. The official date has not been announced, but the certainty of the airdrop event at the end of the year will happen because the Blum roadmap project is explained to launch the product in Q3-Q4 2024.

16. Seed Airdrop & TGE Plan

After the rumor of a listing in November was refuted, it was reported that SEED would launch its token in December 2024. However, Seed has not yet confirmed the official date. If the Seed token listing happens in December, then the SEED airdrop event will also be held this month.

While waiting for certain information, you can continue playing the Seed game on Telegram and collect more points for a chance to get more airdrops.

17. Bird Ton TGE & Airdrop Event

In its official Twitter account, @BirdTonGame, Bird Ton announced the token listing schedule on December 26, 2024. Along with the listing date, the $BIRD token will also be distributed in the form of an airdrop for Bird Ton players and the community.

The steps for launching to the airdrop event are being prepared by Bird Ton and you can be more diligent in playing Bird Ton on Telegram to get more $BIRD tokens.

Conclusion

Those are 17 airdrop events in December 2024 that you can join. The more you join airdrop events, the more you can get free crypto tokens so you can get more money.

If you want to get the latest news from the crypto ecosystem, you can directly access the Bitrue website and get information for free.

This Press Release has also been published on VRITIMES

by Penny Angeles-Tan | Dec 3, 2024 | Business

Explore the impact of Bitcoin dominance dropping to 56.1%, signaling the start of altseason. Discover why altcoins like XRP and Ether are rallying, with XRP projected to hit $2.57 and Ether poised for a $4,000 surge by early 2025. Analyze key drivers, Bitcoin halving effects, ETF potentials, and market trends shaping the crypto landscape.

Bitcoin dominance, a critical indicator in the cryptocurrency market, has recently shown significant signs for altcoin investors. Its decline signals the beginning of altseason, creating opportunities for altcoins like XRP and Ether to rally as 2024 comes to a close and 2025 begins.

This article explores Bitcoin dominance, the concept of altseason, and the potential for altcoins to attract investor interest.

What is Bitcoin Dominance and Altseason?

Bitcoin dominance measures the percentage of Bitcoin’s market capitalization compared to the total cryptocurrency market. A drop in Bitcoin dominance often signals the start of an altseason, a period where altcoins outperform Bitcoin.

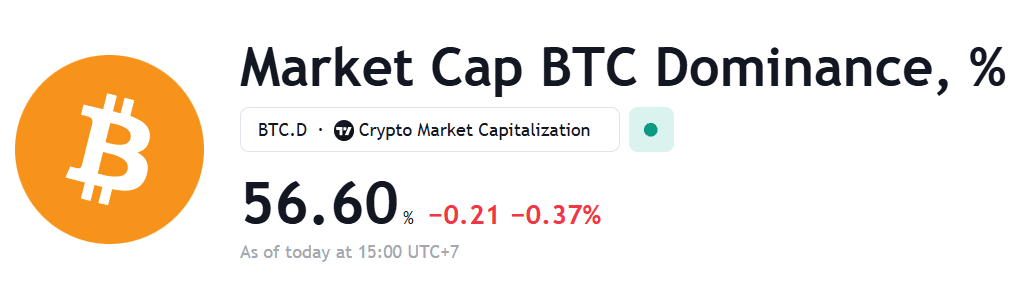

Bitcoin dominance has fallen to 56.60%, breaching its two-year support line. This shift suggests that the market has officially entered altseason, where smaller cryptocurrencies gain traction and value.

The decline in Bitcoin dominance typically occurs as investors take profits from their Bitcoin positions and reallocate funds to altcoins with higher growth potential. This flow of capital from Bitcoin to other assets provides increased liquidity and demand, propelling altcoins to new highs.

BTC Price Today

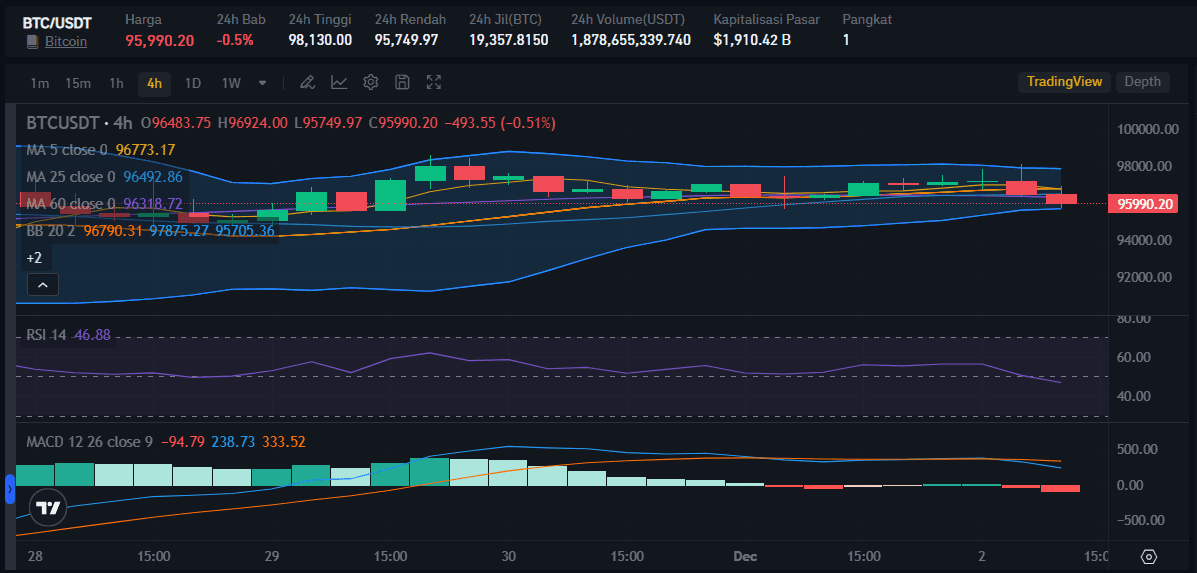

As of this writing on December 2, 2024, BTC price has decreased by 0.5% to trade at $95,990 with its highest price being $98,130 in the last 24 hours. the prediction of Bitcoin price reaching $100,000 could be achieved before 2025.

However, when Bitcoin dominance continues to decline and is replaced by Altseason, the dream of BTC price of $100K will have to wait longer.

Should you buy Bitcoin now when dominance and price are decreasing? You can do more research on whether Bitcoin will really experience a correction and the prediction of Altcoin Season will really come. Check the Bitcoin price and convert the BTC price to USD so you can find out your budget in more detail.

XRP: A Top Contender in Altseason

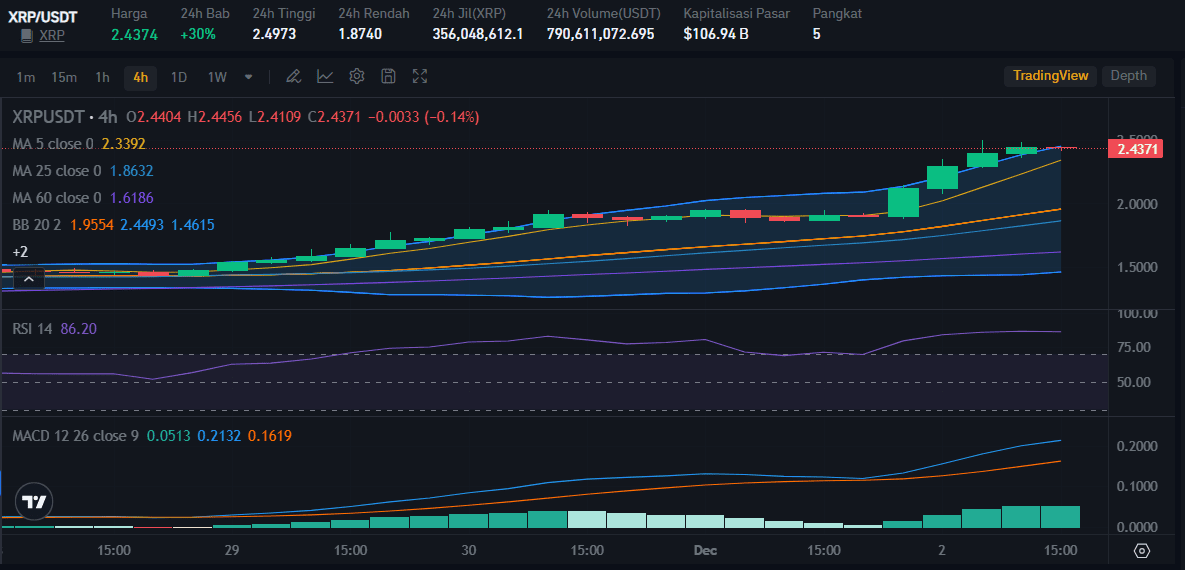

While BTC experienced a price drop, XRP price experienced a significant increase of up to 30%. Currently, XRP is trading at $ 2.4374 with an RSI value reaching more than 86 and is considered to be at the overbought point. The MACD line has increased drastically and shows signs of bullishness coming soon.

Among the altcoins expected to benefit from this trend, XRP stands out. As the world’s sixth-largest cryptocurrency, XRP is projected to see significant gains throughout the season. Ryan Lee, Chief Analyst at Bitget Research, predicts that XRP could reach $2.57 by December 2024.

Key Drivers for XRP’s Price Surge

1. Bitcoin Halving Effect: Historically, XRP has shown significant growth approximately 228 days after a Bitcoin halving event. With the most recent halving in 2024, XRP is positioned for a strong rally as the year ends.

2. Potential XRP ETF Approval: The filing for an XRP ETF by asset manager 21Shares with the U.S. Securities and Exchange Commission (SEC) could act as a major price catalyst. If approved, this ETF would enhance institutional trust and adoption of XRP.

3. Regulatory Changes: The anticipated departure of SEC Chair Gary Gensler in January 2025 is expected to bring more crypto-friendly regulations, potentially boosting XRP and other cryptocurrencies.

Ethereum: Another Rising Star

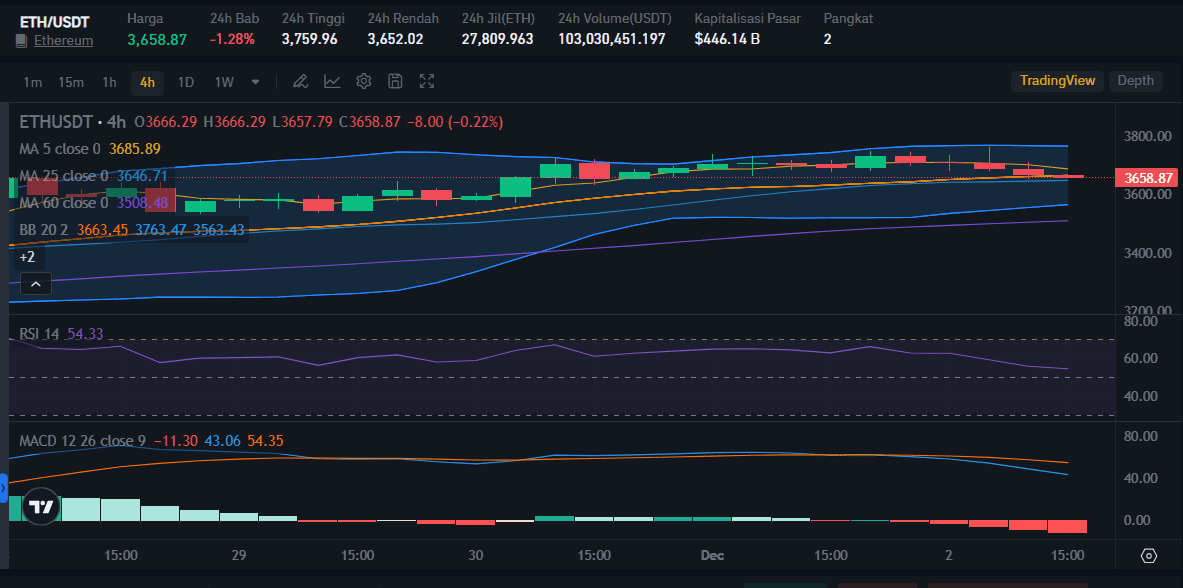

Ethereum (ETH), another major altcoin, is also drawing significant attention. Following Donald Trump’s victory in the 2024 U.S. presidential election, demand for leveraged Ethereum exchange-traded funds (ETFs) surged by over 160%. Analysts expect Ether to surpass $4,000 ahead of Trump’s inauguration in January 2025.

The increased interest in Ether ETFs signals strong institutional confidence in its long-term potential. Market optimism surrounding Trump’s inauguration and potential policy shifts could bolster investor risk appetite, benefiting Ether and other altcoins.

Currently, price of ETH is $3,658 with a decrease of 1.28%. Reaching the price of $4,000 does look quite difficult because the price of ETH often follows the price of BTC. However, the RSI value and MACD line are still above average, ETH’s optimism towards the resistance price remains high.

Key Milestones in January 2025

The first month of 2025 is expected to be pivotal for the cryptocurrency market due to several significant events:

1. Trump’s Presidential Inauguration: Likely to boost market confidence and risk-on sentiment.

2. SEC Chair Gensler’s Resignation: This could accelerate the approval of crypto-based ETFs and foster a more favorable regulatory environment.

3. Post-Bitcoin Halving Effects: Historically, Bitcoin halvings have a delayed impact, creating ripple effects for altcoins like XRP and Ether.

Conclusion

The decline in Bitcoin dominance marks the beginning of altseason, offering substantial growth potential for altcoins like XRP and Ether. With XRP expected to reach $2.57 by December 2024 and Ether potentially crossing $4,000 by early 2025, the coming months could be highly rewarding for cryptocurrency investors.

However, as with any investment, the cryptocurrency market remains highly volatile. Investors should conduct thorough research and implement risk management strategies to navigate the complexities of this evolving space.

This Press Release has also been published on VRITIMES

by Penny Angeles-Tan | Nov 29, 2024 | Business

Ethereum (ETH) surges past $3,545, breaking an 8-month downtrend. Explore bullish predictions, DeFi dominance, NFT trends, and key resistance levels driving its growth. Learn more now!

Ethereum (ETH), the world’s second-largest cryptocurrency, is experiencing a significant surge in price. After breaking out of an eight-month downtrend, ETH has climbed over 6% today, reaching $3,545. This rally follows a strong week with an 11.1% rise and a staggering 41% gain in the last 30 days.

Analysts Are Bullish on Ethereum’s Future

Analysts are optimistic about Ethereum’s future, predicting it could reach over $4,800 during this cycle. Several factors contribute to this bullish sentiment:

1. Technical Breakouts: ETH has broken free from a descending channel and descending triangle pattern, indicating potential for further price increases. Analysts have set targets as high as $4,700, bringing it close to its all-time high of $4,878.

2. Strong Momentum Indicators: Technical indicators like the Relative Strength Index (RSI) reaching 70 and Ethereum outperforming its moving averages suggest a robust upward trend.

3. Potential Golden Cross: A Golden Cross, where the short-term moving average crosses above the long-term one, is another bullish signal on the horizon.

Ethereum’s Dominance in DeFi

Ethereum remains a dominant force in the cryptocurrency space. It accounts for over half of the total value locked (TVL) in DeFi, solidifying its critical role in the ecosystem. Additionally, the success of ETH-based layer-two solutions further strengthens its position.

Possible Boost from Favorable Regulations

The possibility of pro-crypto legislation under the incoming Trump administration could also benefit Ethereum. If implemented, such policies could accelerate its growth and align its market price with its perceived intrinsic value.

Recent Price Action and Upcoming Resistance Levels

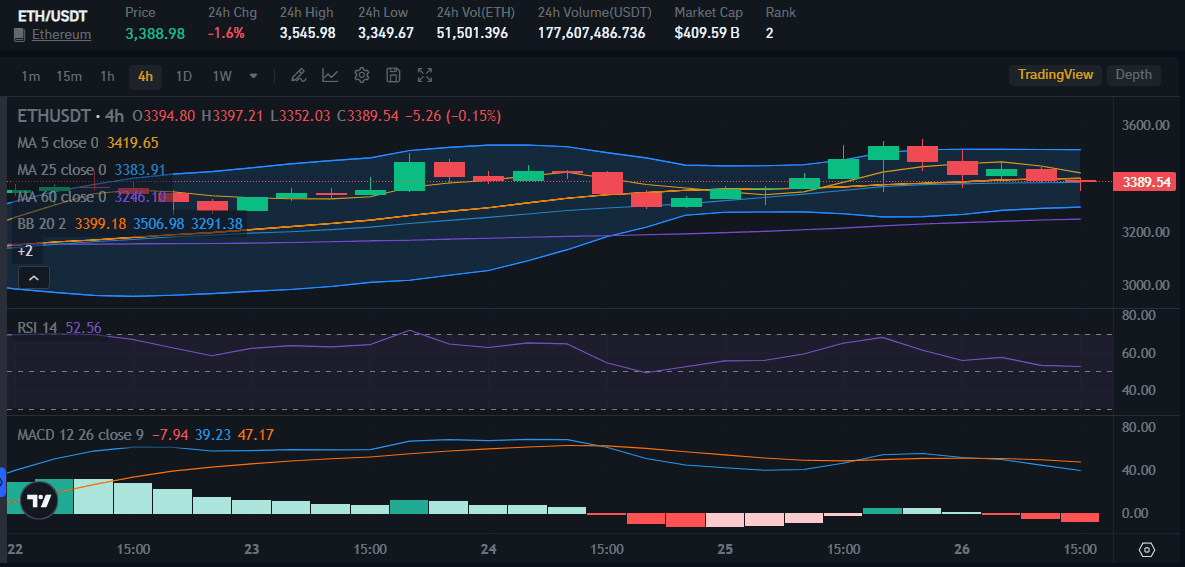

At the time of writing this article on November 26, Ethereum is priced at $3,388, which means it has decreased by 1.6% with its highest price being $3,545 in the last 24 hours.

Despite the price decrease, Ethereum’s RSI value is above 50, which means there is still hope for a price increase in the near future because the ETH buying trend is still dominant compared to the selling trend.

Increased weekend buying pressure and potential rotation away from Bitcoin have pushed Ethereum prices up. Analysts suggest a 30% rally is possible if ETH maintains bullish pressure above the key $3,400 level.

A successful break above $3,400 could see prices surge towards $4,189 and potentially reach $4,862.

NFT Market Update

While NFT sales have dipped slightly from the previous week, the overall trend remains positive, with a total volume of $158 million.

Ethereum remains the top network for NFT sales, followed by Solana. Interestingly, Solana is witnessing a surge in the number of NFT buyers.

Analyst Predictions on Altcoins

Popular analyst Altcoin Sherpa believes Ethereum might be nearing a cycle bottom relative to Bitcoin (ETH/BTC). He expects altcoins, including XRP, to perform well after Bitcoin completes its current rally.

Overall, Ethereum’s outlook is positive. With strong technical indicators, a dominant position in DeFi, and potential tailwinds from regulations, ETH seems poised for further growth.

Key Factors Driving Ethereum’s Growth

As Ethereum continues its bullish momentum, its dominance in the crypto market remains undeniable. Its robust network, extensive developer community, and innovative applications have solidified its position as a leading blockchain platform.

1. Layer-2 Solutions: The emergence of layer-2 solutions like Arbitrum and Optimism has significantly improved Ethereum’s scalability and transaction speed, addressing one of its major limitations.

2. DeFi Ecosystem: Ethereum remains the backbone of the decentralized finance (DeFi) ecosystem, offering a wide range of financial services, from lending and borrowing to derivatives trading.

3. NFT Market: Ethereum has a significant presence in the NFT market, with many popular NFT collections being minted and traded on the platform.

4. Institutional Adoption: Increasing institutional interest in Ethereum, with major financial institutions and corporations exploring blockchain technology, has further bolstered its credibility.

Potential Challenges and Risks

While Ethereum’s future looks promising, it’s important to acknowledge potential challenges and risks:

1. Network Congestion: Despite layer-2 solutions, Ethereum’s network can still experience congestion during peak times, leading to increased transaction fees.

2. Competition from Other Blockchains: Emerging blockchains like Solana and Cardano are vying for market share, offering faster transaction speeds and lower fees.

3. Regulatory Uncertainty: Regulatory uncertainty surrounding cryptocurrencies can impact the overall market sentiment and investment flows.

Conclusion

Ethereum’s strong fundamentals, coupled with its active developer community and growing ecosystem, make it a compelling investment opportunity. However, as with any investment, it’s essential to conduct thorough research and consider the potential risks involved.

You should always do thorough research before investing in the crypto ecosystem even if you are buying a leading token like Bitcoin, Ethereum, or Solana. Do your research using the features of the Bitrue website that you can access for free.

This Press Release has also been published on VRITIMES

by Penny Angeles-Tan | Nov 27, 2024 | Business

Learn 7 essential strategies to navigate cryptocurrency market crashes. Stay calm, assess market factors, embrace volatility, and protect your investments in this unpredictable yet promising digital asset space.

Cryptocurrency markets are notorious for their volatility. Prices can surge to new highs only to plummet shortly after, leaving investors and traders grappling with uncertainty.

Recent developments, including the approval of a spot Bitcoin ETF and the approaching Bitcoin halving in 2024, have boosted market sentiment, with Bitcoin reaching a record high on March 5, 2024. Yet, the history of crypto tells us that dramatic crashes can follow significant rallies.

To successfully navigate this unpredictable market, investors must understand the factors driving volatility, assess their investment strategies, and prepare for potential downturns.

What Drives Cryptocurrency Volatility?

There are many factors why the crypto market has fluctuating prices. Some of them are as explained below.

1. Market Sentiment and Speculation

Cryptocurrency prices are heavily influenced by trader sentiment. With no intrinsic cash flow to support valuations, cryptos rely on market perception and speculation. This makes them vulnerable to swings between optimism and despair.

For instance, Bitcoin fell nearly 23% in four days in June 2023, while Ethereum plunged 31%. Such movements attract professional traders using advanced algorithms but can be nerve-wracking for individual investors.

2. Macroeconomic Factors

Rising inflation, higher interest rates, and liquidity tightening by central banks can impact riskier assets like crypto. For example, the Federal Reserve’s decision to reduce monetary stimulus in 2021 triggered a prolonged downturn in the crypto market.

3. Regulatory Actions

Governments and regulatory agencies, such as the SEC, play a significant role in shaping the crypto landscape. Decisions to ban crypto-related services or enforce stricter controls, as seen in China’s crackdowns in 2017 and 2021, have caused significant price drops.

4. Institutional Moves and Market Events

Large-scale institutional activities and derivatives expiries can introduce volatility. Recent outflows from Bitcoin ETFs, contrasting with inflows into others, reveal divided market sentiment.

Additionally, catastrophic events like the collapse of FTX in 2022 ripple through the market, affecting not only exchanges but also coins and companies connected to them.

Has Crypto Crashed Before?

Yes, the crypto market has seen multiple crashes:

1. December 2017: Bitcoin peaked near $20,000 before falling below $3,500 by the end of 2018.

2. November 2021: Bitcoin’s record high of $69,000 was followed by a 75% drop within a year.

Each crash underscores the importance of cautious investing and diversification.

What Should Investors Do During a Market Crash?

To keep your financial condition safe when investing in the crypto ecosystem, you can do these 7 things when the crypto market is experiencing a decline.

1. Stay Calm and Avoid Emotional Decisions

When prices plummet, panic selling can lead to substantial losses. Instead, revisit your reasons for investing. Are you in for the long-term opportunity, or are you looking for short-term gains? This clarity will help you make rational decisions.

2. Assess the Situation

Analyze the root causes of the crash. Is it a regulatory development, macroeconomic factor, or market rumor? Understanding the context allows you to respond strategically rather than react impulsively.

3. Embrace Volatility

Volatility is inherent to the crypto market and attracts traders seeking profit opportunities. While nerve-wracking, it can also be lucrative if approached with a clear strategy.

4. Reevaluate Your Portfolio

Decide whether to buy more during dips, hold, or exit the market. Ensure these choices align with your financial goals and risk tolerance.

5. Use Secure Storage

With exchange collapses being a recurring risk, consider transferring assets to a secure crypto wallet. Both online and offline options exist, offering varying degrees of security.

6. Invest What You Can Afford to Lose

Crypto is a high-risk asset class. A general rule is to limit crypto investments to no more than 10% of your overall portfolio.

7. Maintain an Emergency Fund

An emergency fund ensures that you’re not forced to liquidate investments during unfavorable market conditions.

Conclusion: Preparing for the Future

With events like the Bitcoin halving and continued institutional interest, the crypto market holds potential for long-term growth. However, its unpredictable nature calls for a balanced approach:

- Diversify your portfolio across traditional and alternative assets.

- Keep updated with market developments and regulatory changes.

- Stick to a disciplined investment strategy, focusing on long-term goals.

Cryptocurrency investment is not for the faint of heart, but with the right strategies, it can be a rewarding part of a diversified portfolio. By understanding the market’s dynamics and preparing for its inherent risks, investors can navigate the turbulence and seize opportunities in this evolving space.

This Press Release has also been published on VRITIMES

You must be logged in to post a comment.