by | Jul 4, 2025 | Business

Office Chatani, Inc. (CEO: Masayuki Chatani) has announced the results of a survey they conducted on “intrapreneurs” in large companies, targeting those with over 1,000 employees. These results shed light on the actual state of business creation personnel in these companies.

Background

The world is currently in what has been called the VUCA age, where the business world is rapidly changing and uncertainty is growing. As the market and customers’ needs change by the second, companies are expected to respond to these needs with flexibility and innovation. Under these circumstances, business creation is an essential initiative to maintain and strengthen a company’s competitive position. On the other hand, due to the scale of resources and complexity of their decision-making process, managers cannot focus solely on the business environment, but must also face challenges such as rigid internal organization and a risk-averse culture while striving to generate new value. Among them, “intrapreneurs,” or one who creates new businesses while working within an organization, have been attracting attention. Large companies have a strong desire for individuals willing to go against the existing business structure and culture and generate new value within the company. To that end, Office Chatani, Inc. conducted a survey targeting managers within large companies regarding intrapreneurship in such companies.

Survey summary

– Among companies with over 1,000 employees, over half of them have personnel who are considered “intrapreneurs”

– The largest age group for “intrapreneurs” is 40-49

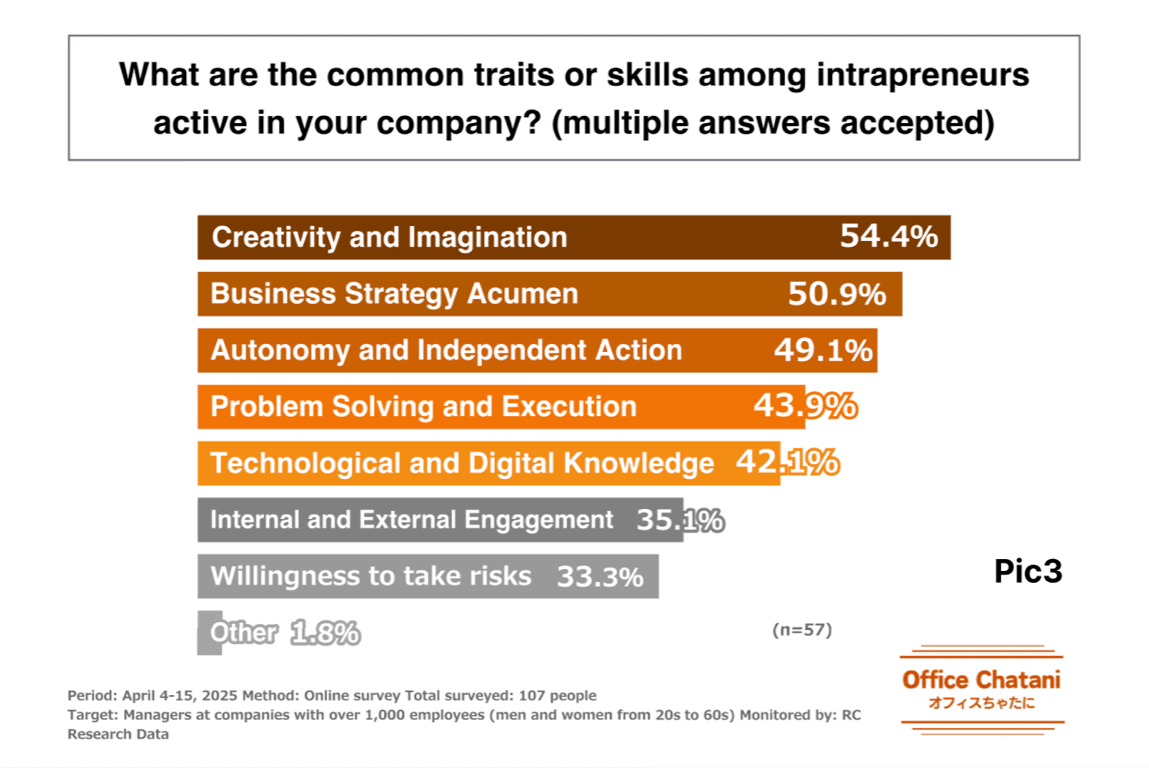

– The top three common skills among intrapreneurs are 1. Creativity and Imagination, 2. Business Strategy Acumen, and 3. Autonomy and Independent Action

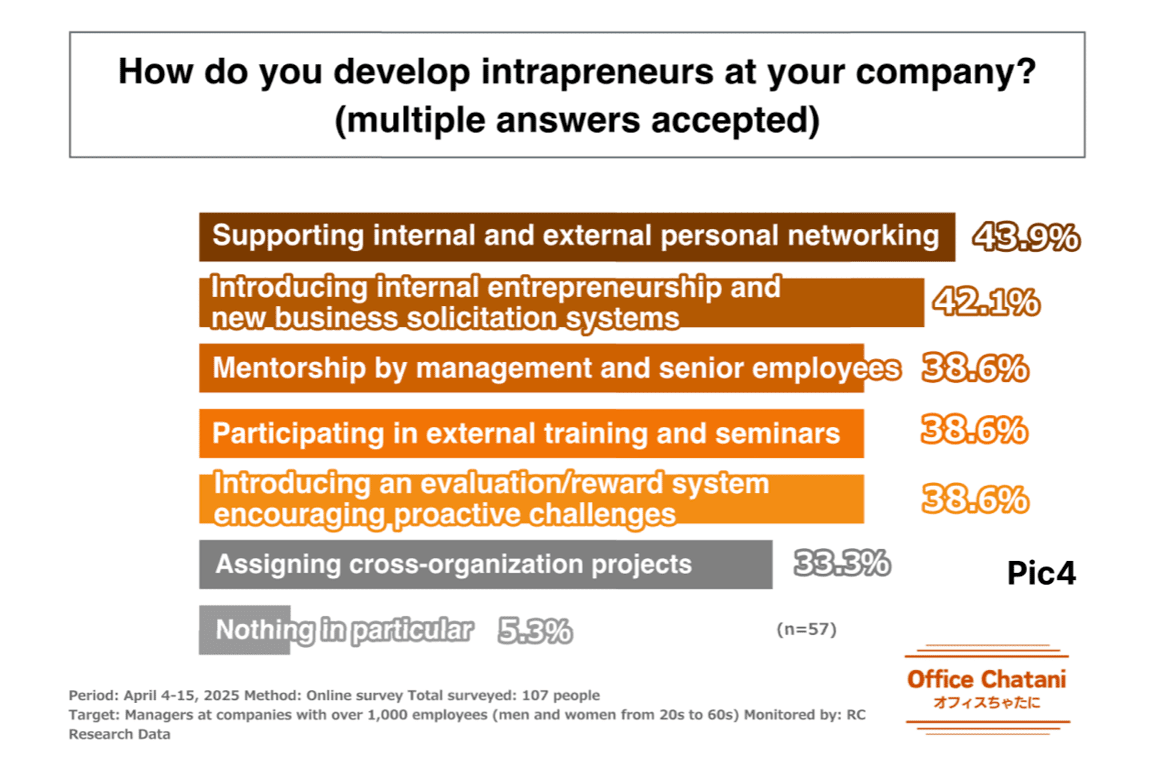

– Many companies are working on “supporting internal and external personal networking” for the purpose of developing intrapreneurs

– The most important environmental factor for successful intrapreneurship is considered to be “a corporate culture that is tolerant of new challenges”

– Among companies indicating that they did not have any “intrapreneurs,” over 70% were not taking initiatives to cultivate intrapreneurship in their company

– Among companies without “intrapreneurs,” many named “providing training and educational opportunities for new business” as an initiative for cultivating intrapreneurship

– Among companies without “intrapreneurs,” the top three challenges or obstacles for cultivating intrapreneurship were said to be 1. “Lack of a role model in the company”, 2. “Lack of internal resources (time, budget, personnel)”, and 3. “Lack of a system or culture to evaluate challenges.”

Survey overview

Period: April 4-15, 2025

Method: Online survey

Target: Managers at companies with over 1,000 employees (men and women from 20s to 60s)

Total surveyed: 107 people

Monitored by: RC Research Data

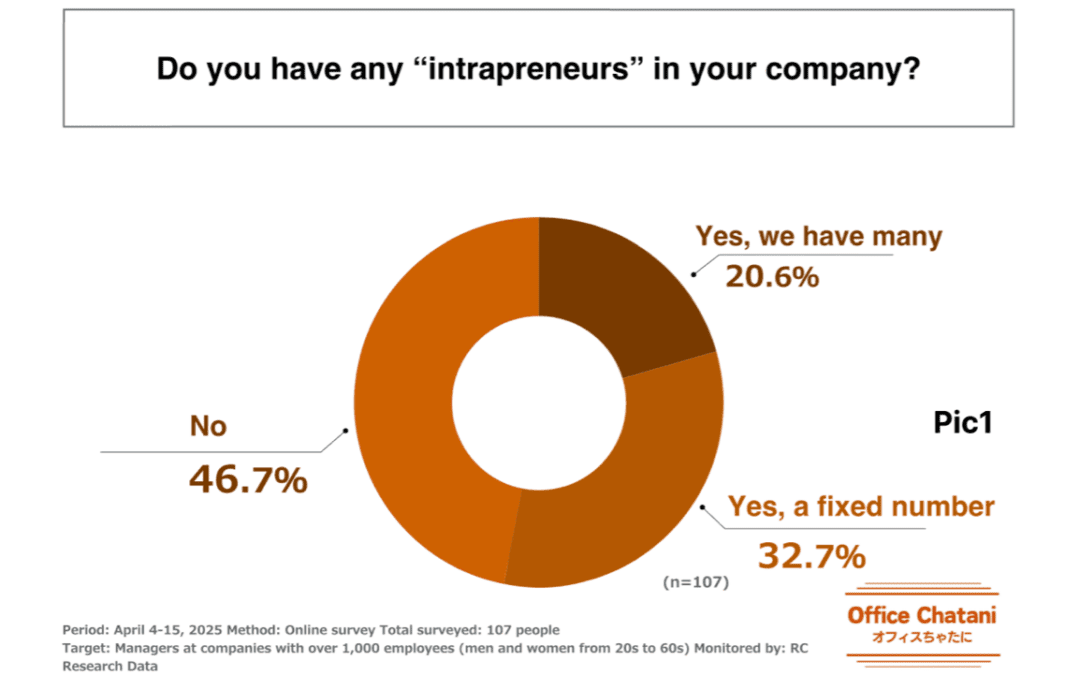

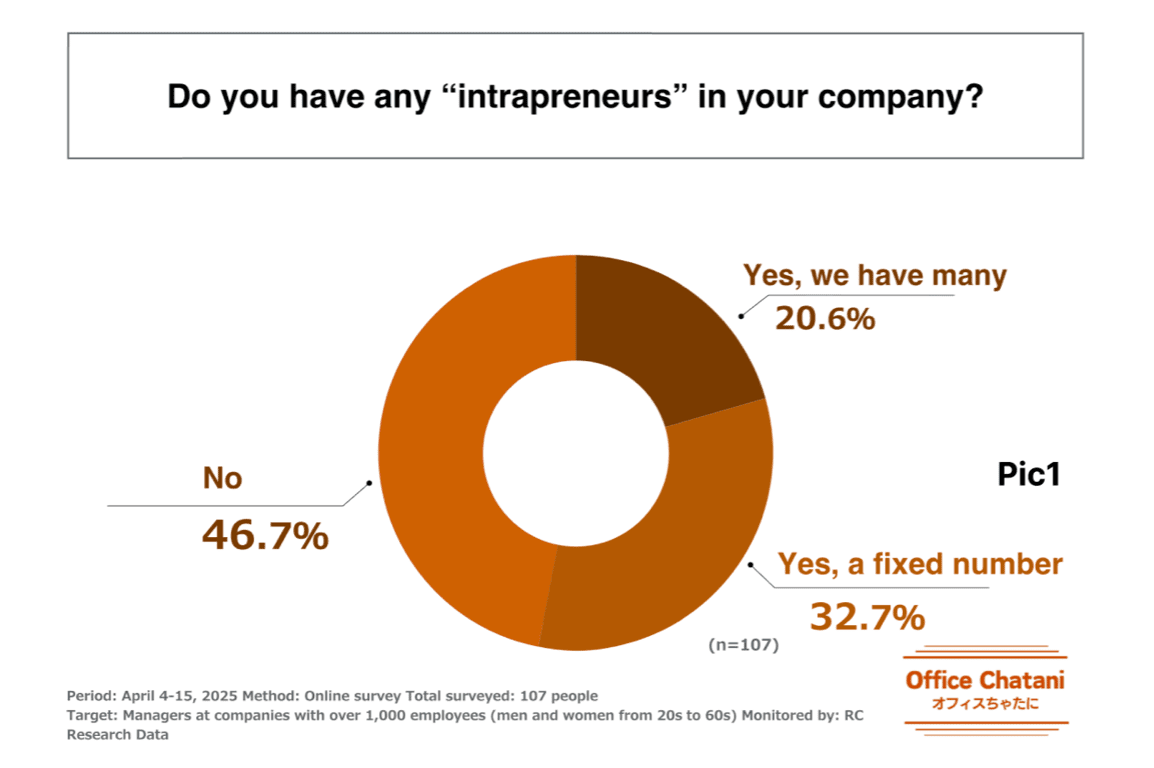

Among companies with over 1,000 employees, over half of them have personnel who are considered “intrapreneurs”

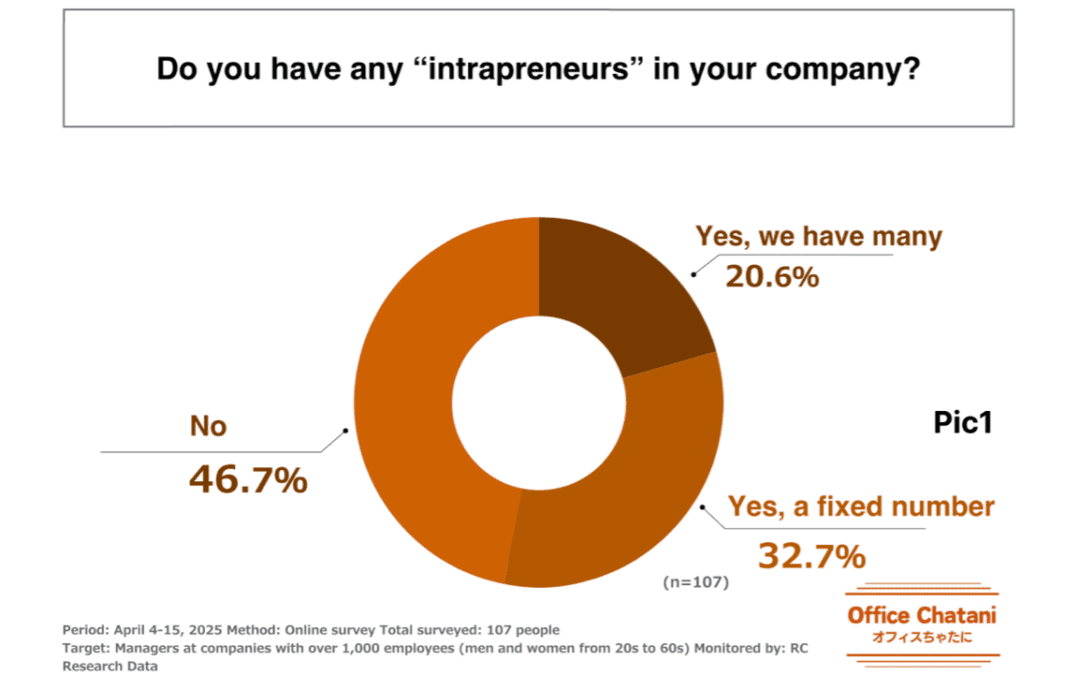

For the first question, “Do you have any “intrapreneurs” in your company?”, the top responses were “No.” with 46.7%, “Yes, a fixed number.” with 32.7%, and “Yes, we have many.” at 20.6%. Through these responses, it was found that more than half of companies with over 1,000 employees have intrapreneurs.

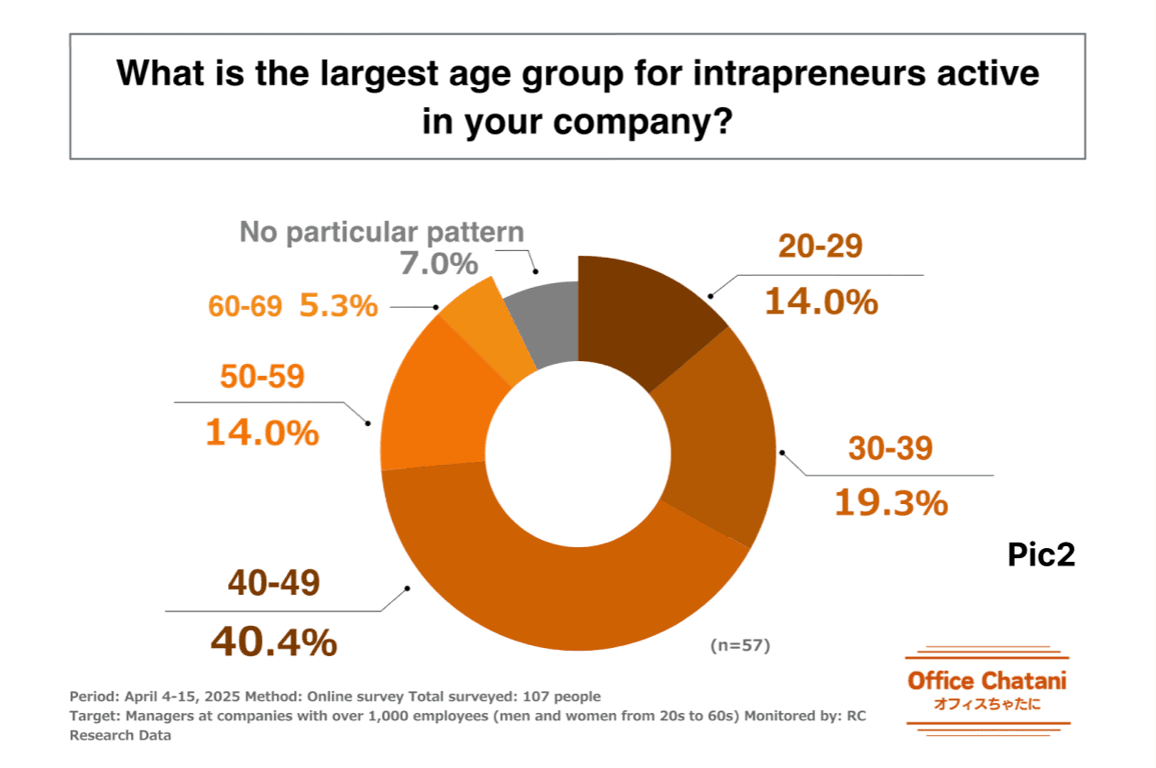

The largest age group for “intrapreneurs” is 40-49

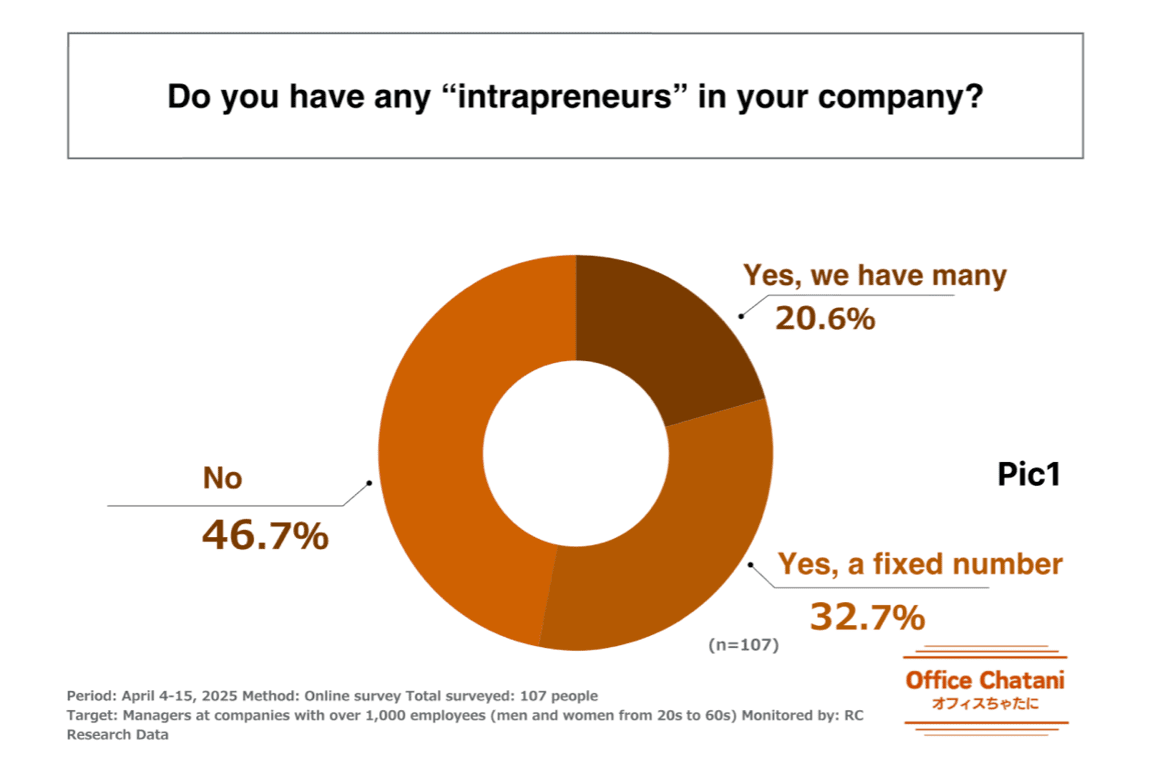

The next question was “What is the largest age group for intrapreneurs active in your company?” The top two responses were 40-49 (40.4%) and 30-39 (19.3%), so it was found that the most common age group for intrapreneurs was 40-49.

- The top three common skills among intrapreneurs are 1. Creativity and Imagination, 2. Business Strategy Acumen, and 3. Autonomy and Independent Action

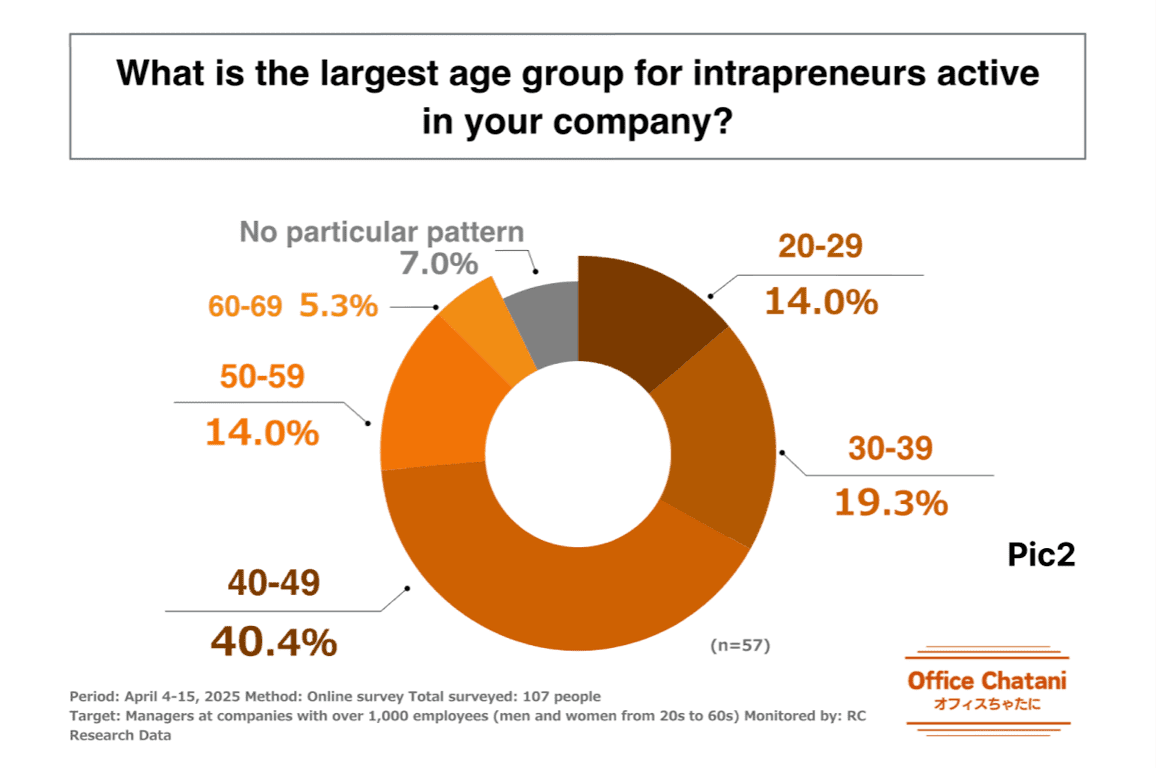

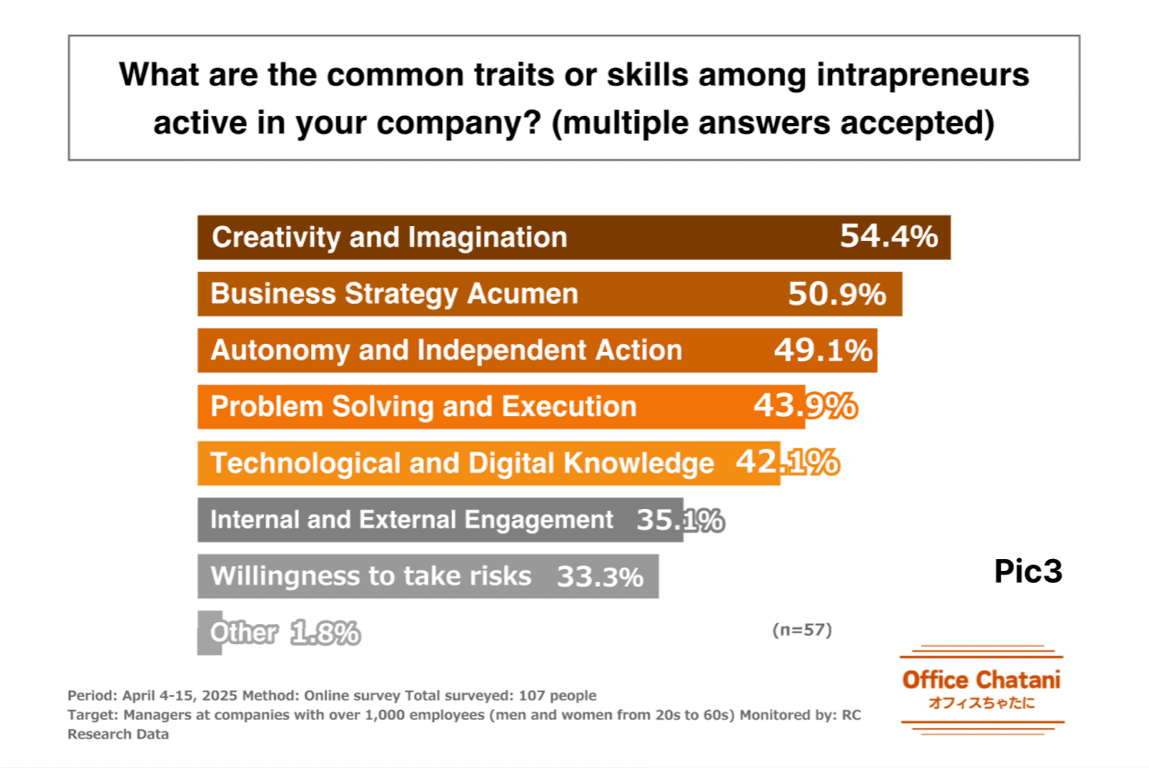

Following that, respondents were asked “What are the common traits or skills among intrapreneurs active in your company?” The top responses were “Creativity and Imagination” with 54.4%, “Business Strategy Acumen” with 50.9%, and “Autonomy and Independent Action” with 49.1%. In addition, a number of other options outside the top three exceeded 40%, meaning that a large number of traits and skills are common among intrapreneurs.

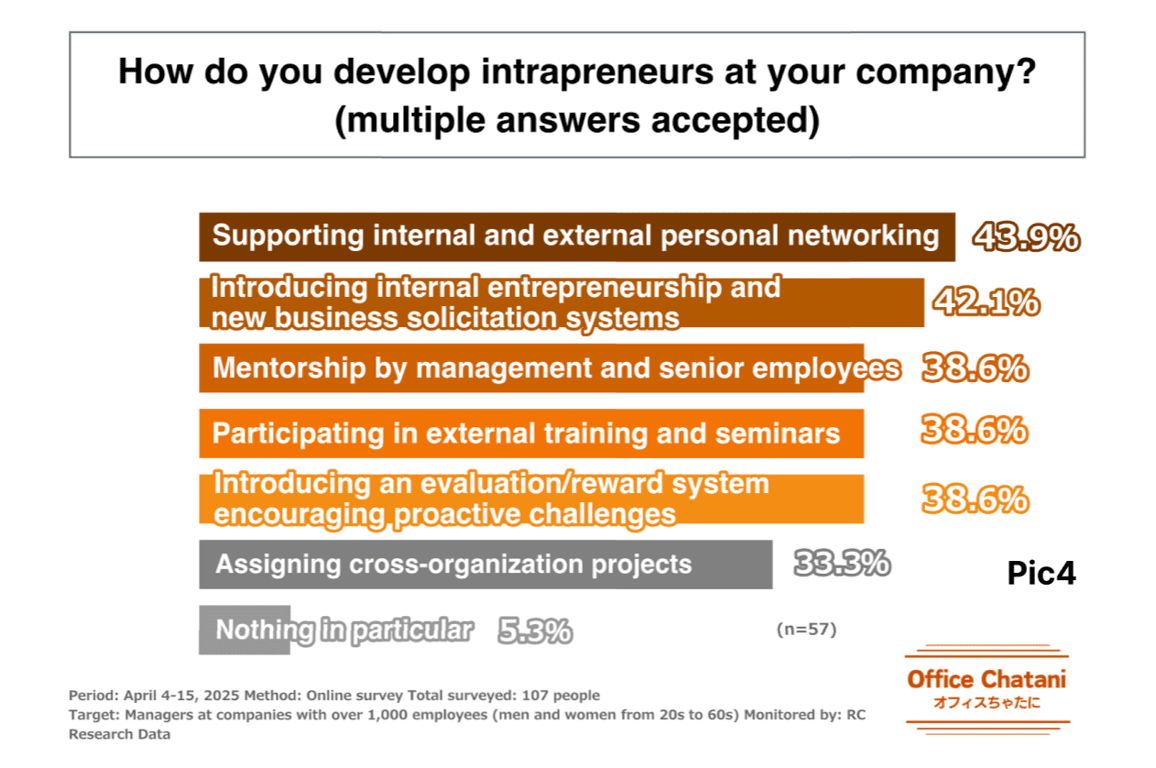

- Many companies are working on “supporting internal and external personal networking” for the purpose of developing intrapreneurs

Next, companies that indicated that they have intrapreneurs in their company were asked “How do you develop intrapreneurs at your company?”, with the top answers being “By supporting internal and external personal networking” with 43.9%, “By introducing an internal entrepreneurship system and new business solicitation system” with 42.1%, and “Through mentorship by management and senior employees,” “By participating in external training and seminars,” and “by introducing an evaluation and reward system that encourages proactive challenges” each tied at 38.6%. Based on these results, it was found that many companies are working on “supporting internal and external personal networking” for the purpose of developing intrapreneurs.

Continues in Part 2.

Survey conducted by:

Office Chatani, Inc.

Location: Tokyo

CEO: Masayuki Chatani

Description of business: Creative Management Support, Lectures, Writing, etc.

URL: https://www.office-chatani.com

Office Chatani, Inc. supports creative management.

CEO Masayuki Chatani, author of “Behind the Scenes at PlayStation: Former CTO Talks about 16 Years of Creation,” has previously served as CTO and EVP of a global video game business, an executive officer of an internet conglomerate, CEO of a professional firm’s digital group company, the Japan Head of the digital team at a strategic consulting firm, and other positions.

This Press Release has also been published on VRITIMES

by | Jul 4, 2025 | Business

Office Chatani, Inc. (CEO: Masayuki Chatani) has announced the results of a survey they conducted on “intrapreneurs” in large companies, targeting those with over 1,000 employees. These results shed light on the actual state of business creation personnel in these companies.

Background

The world is currently in what has been called the VUCA age, where the business world is rapidly changing and uncertainty is growing. As the market and customers’ needs change by the second, companies are expected to respond to these needs with flexibility and innovation. Under these circumstances, business creation is an essential initiative to maintain and strengthen a company’s competitive position. On the other hand, due to the scale of resources and complexity of their decision-making process, managers cannot focus solely on the business environment, but must also face challenges such as rigid internal organization and a risk-averse culture while striving to generate new value. Among them, “intrapreneurs,” or one who creates new businesses while working within an organization, have been attracting attention. Large companies have a strong desire for individuals willing to go against the existing business structure and culture and generate new value within the company. To that end, Office Chatani, Inc. conducted a survey targeting managers within large companies regarding intrapreneurship in such companies.

Survey summary

– Among companies with over 1,000 employees, over half of them have personnel who are considered “intrapreneurs”

– The largest age group for “intrapreneurs” is 40-49

– The top three common skills among intrapreneurs are 1. Creativity and Imagination, 2. Business Strategy Acumen, and 3. Autonomy and Independent Action

– Many companies are working on “supporting internal and external personal networking” for the purpose of developing intrapreneurs

– The most important environmental factor for successful intrapreneurship is considered to be “a corporate culture that is tolerant of new challenges”

– Among companies indicating that they did not have any “intrapreneurs,” over 70% were not taking initiatives to cultivate intrapreneurship in their company

– Among companies without “intrapreneurs,” many named “providing training and educational opportunities for new business” as an initiative for cultivating intrapreneurship

– Among companies without “intrapreneurs,” the top three challenges or obstacles for cultivating intrapreneurship were said to be 1. “Lack of a role model in the company”, 2. “Lack of internal resources (time, budget, personnel)”, and 3. “Lack of a system or culture to evaluate challenges.”

Survey overview

Period: April 4-15, 2025

Method: Online survey

Target: Managers at companies with over 1,000 employees (men and women from 20s to 60s)

Total surveyed: 107 people

Monitored by: RC Research Data

Among companies with over 1,000 employees, over half of them have personnel who are considered “intrapreneurs”

For the first question, “Do you have any “intrapreneurs” in your company?”, the top responses were “No.” with 46.7%, “Yes, a fixed number.” with 32.7%, and “Yes, we have many.” at 20.6%. Through these responses, it was found that more than half of companies with over 1,000 employees have intrapreneurs.

The largest age group for “intrapreneurs” is 40-49

The next question was “What is the largest age group for intrapreneurs active in your company?” The top two responses were 40-49 (40.4%) and 30-39 (19.3%), so it was found that the most common age group for intrapreneurs was 40-49.

- The top three common skills among intrapreneurs are 1. Creativity and Imagination, 2. Business Strategy Acumen, and 3. Autonomy and Independent Action

Following that, respondents were asked “What are the common traits or skills among intrapreneurs active in your company?” The top responses were “Creativity and Imagination” with 54.4%, “Business Strategy Acumen” with 50.9%, and “Autonomy and Independent Action” with 49.1%. In addition, a number of other options outside the top three exceeded 40%, meaning that a large number of traits and skills are common among intrapreneurs.

- Many companies are working on “supporting internal and external personal networking” for the purpose of developing intrapreneurs

Next, companies that indicated that they have intrapreneurs in their company were asked “How do you develop intrapreneurs at your company?”, with the top answers being “By supporting internal and external personal networking” with 43.9%, “By introducing an internal entrepreneurship system and new business solicitation system” with 42.1%, and “Through mentorship by management and senior employees,” “By participating in external training and seminars,” and “by introducing an evaluation and reward system that encourages proactive challenges” each tied at 38.6%. Based on these results, it was found that many companies are working on “supporting internal and external personal networking” for the purpose of developing intrapreneurs.

Continues in Part 2.

Survey conducted by:

Office Chatani, Inc.

Location: Tokyo

CEO: Masayuki Chatani

Description of business: Creative Management Support, Lectures, Writing, etc.

URL: https://www.office-chatani.com

Office Chatani, Inc. supports creative management.

CEO Masayuki Chatani, author of “Behind the Scenes at PlayStation: Former CTO Talks about 16 Years of Creation,” has previously served as CTO and EVP of a global video game business, an executive officer of an internet conglomerate, CEO of a professional firm’s digital group company, the Japan Head of the digital team at a strategic consulting firm, and other positions.

This Press Release has also been published on VRITIMES

by | Jul 3, 2025 | Business

Bitcoin surged past $109,000 backed by institutional inflows, macroeconomic optimism, and renewed trade deals, yet traders remain cautious. Stay updated with the latest insights via the Bitrue blog.

On July 3rd, Bitcoin (BTC) price soared by 2.05%, adding more than $2,900 to its value as it rallied from $106,300 to a peak of $109,862. The world’s largest cryptocurrency briefly pared gains to settle at $109,600, just under 3% shy of its all-time high of $111,970.

A surge in trading volume to $52.6 billion indicated that the move wasn’t speculative, it was driven by serious capital commitment, with Bitcoin accounting for nearly 45% of total crypto market activity.

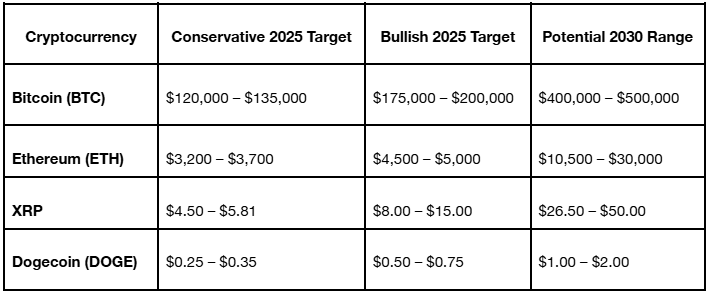

The rally reflects a rare convergence of macroeconomic shifts, improving liquidity, and bold investor behavior. Standard Chartered reaffirmed its bullish forecast, expecting Bitcoin to reach $135,000 by Q3 and $200,000 by the end of the year.

The bank attributes the momentum to a “new flow regime,” where spot ETFs, sovereign accumulation, and corporate treasury investments are displacing the post-halving slowdown narrative.

Institutional Demand Fuels Uptrend

In Q2 alone, institutional players added approximately 245,000 BTC to their holdings, with many new buyers emerging outside of known entities like MicroStrategy.

This trend is projected to accelerate, especially as passive ETF allocations gain traction and more public companies adopt Bitcoin as a treasury reserve asset.

This week’s successful launch of the REX-Osprey Solana + Staking ETF, which registered $20 million in day-one volume, further reinforced market appetite for crypto ETFs.

Bloomberg analyst Eric Balchunas labeled it a “top 1% debut,” and its success signaled growing confidence in altcoin-based products while bolstering Bitcoin’s standing as the sector’s foundation.

Macroeconomic Boost: Trade Deals and Policy Shifts

Bitcoin’s momentum also coincides with fresh macro tailwinds. U.S. President Donald Trump announced a trade agreement with Vietnam, Washington’s third such deal in recent weeks.

The new terms include a 20% tariff on Vietnamese exports and a 40% tariff on rerouted goods, but grant tariff-free access to U.S. exports.

This development, seen as part of Trump’s post-election economic pivot, lifted equities and risk assets across the board. The Nasdaq climbed 0.8%, and Bitcoin surged past the $109,000 mark.

Progress on U.S. trade fronts with India and China, as well as eased restrictions on chip exports, contributed to investor optimism. However, talks with Japan and South Korea have reportedly stalled.

A controversial tax bill is also under scrutiny in Congress, with some Republicans threatening to block its passage over fiscal concerns.

Amid all this, the market is closely watching U.S. labor data. A weaker-than-expected reading could prompt interest rate cuts from the Federal Reserve, adding further support for risk-on assets like Bitcoin.

Crypto Market Responds in Kind

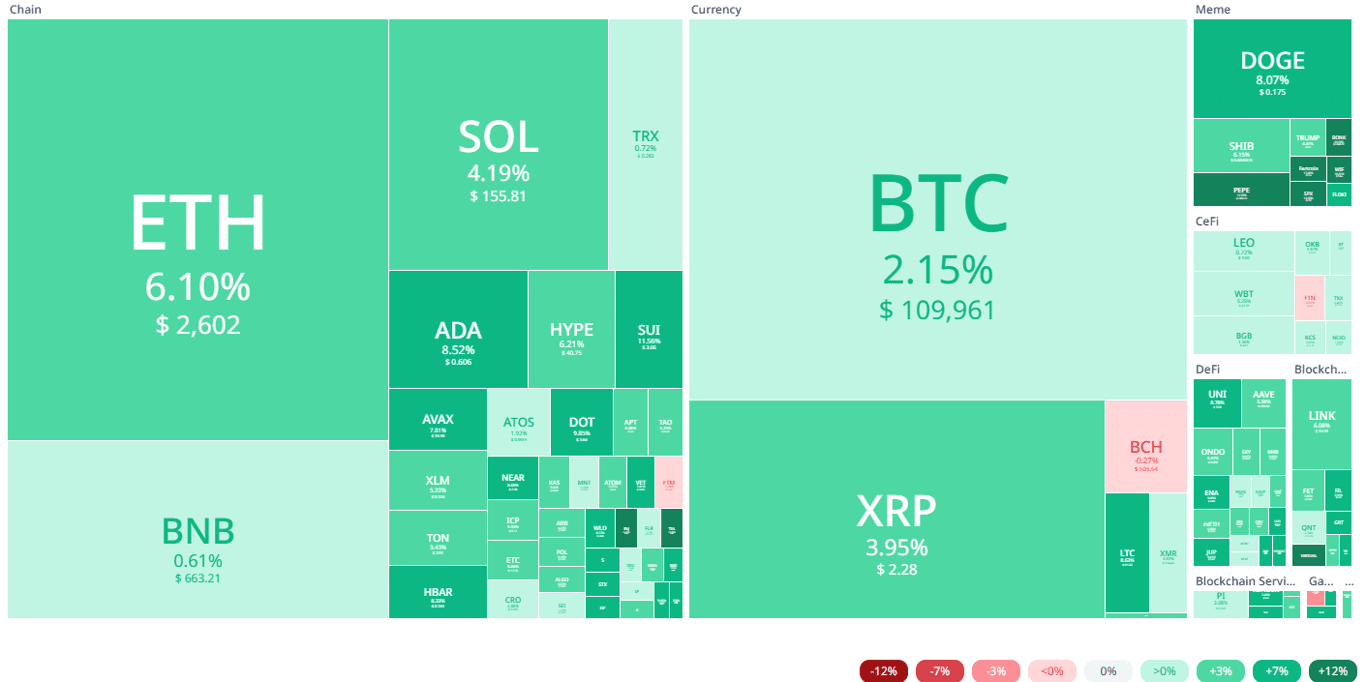

The bullish sentiment rippled through the broader crypto market.

- Ethereum (ETH) rose 6.1% to $2,592.85

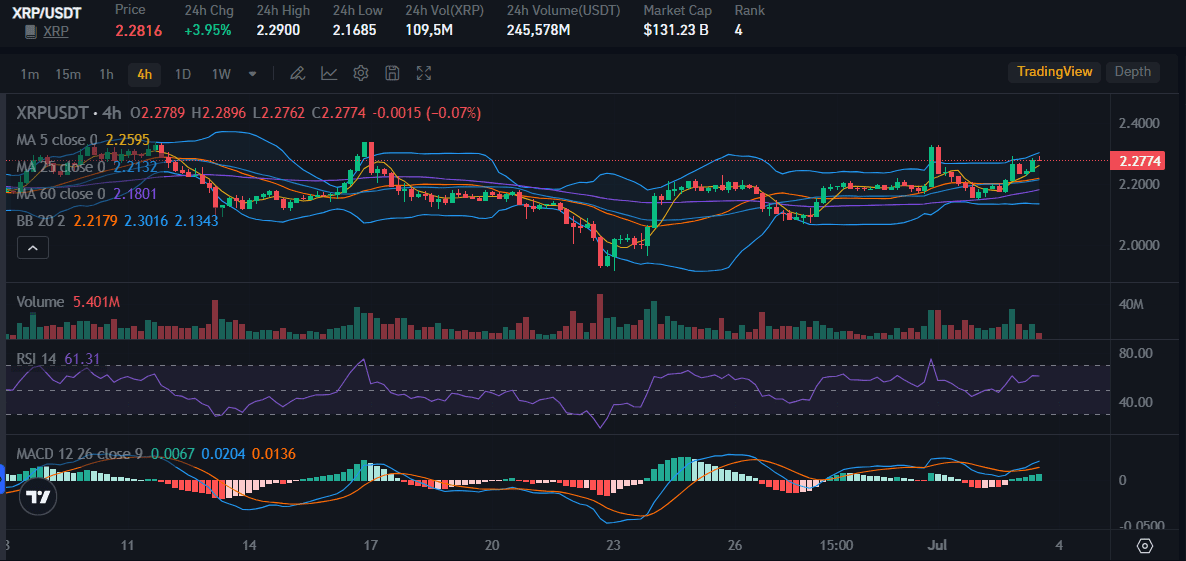

- XRP gained 3.7%

- Cardano (ADA) rebounded 7.8% after a sharp June decline

-

Solana (SOL) added 4.3%

-

Meme coins also saw action, with Dogecoin (DOGE) up 8.1% and $TRUMP climbing 4.4%

These gains suggest renewed investor confidence, particularly after a sluggish June.

Skepticism Lingers Despite Price Strength

Despite the bullish price action, derivatives data reveals a more cautious undertone. The BTC one-month futures premium remains below the 5% neutral mark, suggesting traders are not fully convinced of a sustained breakout.

This cautious sentiment began mid-June and continues even as Bitcoin retests levels near $110,000.

Additionally, the rally may have been partially driven by macro liquidity trends. Eurozone M2 money supply rose 2.7% year-over-year in April, echoing similar expansionary policies in the U.S.

Meanwhile, private payroll data from ADP revealed a drop of 33,000 jobs in June, adding to fears of an economic slowdown.

Options markets remain neutral as well. The 25% delta skew, which indicates risk perception in BTC options, stood flat at 0%, reflecting balanced sentiment on both upward and downward price moves.

While this is more optimistic than the bearish tone observed in late June, it still reflects market hesitancy.

China Market Signals Weak Confidence

Despite global bullishness, crypto sentiment in China tells a different story. A 1% discount on Tether (USDT) against the official CNY rate, its steepest since mid-May, suggests Chinese investors are exiting the market rather than buying in.

This divergence could indicate regional skepticism about the sustainability of Bitcoin’s rally.

Adding to the concern, spot Bitcoin ETFs saw $342 million in net outflows on Tuesday, further reinforcing market caution.

This Press Release has also been published on VRITIMES

by | Jul 3, 2025 | Business

Bitcoin and Ethereum prices soar as the crypto market hits $3.31 trillion. Discover key drivers behind the July 2025 rally, expert predictions, and what comes next for BTC, ETH, XRP, and DOGE.

The cryptocurrency market is riding a powerful bullish wave as we enter July 2025, with Bitcoin reclaiming ground near its all-time high and Ethereum posting double-digit gains.

Fueled by favorable macroeconomic signals, institutional adoption, and rising liquidity, the total global crypto market cap reached $3.31 trillion, reflecting increasing investor confidence across digital assets.

Bitcoin, Ethereum Lead the Charge

As of July 3, Bitcoin (BTC) price climbed 2.15% to $109,961, with Ethereum (ETH) advancing 6.10% to $2,602.

This surge was accompanied by rising open interest in Bitcoin futures, now worth approximately $75 billion, marking a significant return of institutional capital to the market.

Wednesday’s spike followed President Trump’s announcement of a landmark U.S.-Vietnam trade deal, alongside expanding M2 money supply in both the U.S. and Eurozone.

These developments boosted global liquidity, a critical ingredient for fueling asset price rallies, and sent shockwaves through the crypto space.

“Bitcoin touched $109,700, its highest in three weeks, buoyed by macro optimism and ETF flows,” said Pi42 Co-Founder Avinash Shekhar. “A breakout above $110K could trigger the next bull run.”

Ethereum, on the other hand, is gaining steam with a clearer technical setup. After breaking out from $2,375, ETH surged past $2,550 with resistance at $2,665 and a breakout target of $2,800 in sight.

“ETH holds a stronger setup than BTC,” noted Riya Sehgal of Delta Exchange. “Whale accumulation and staking inflows continue despite flat retail activity.”

Altcoins Join the Rally

The crypto market rally isn’t limited to Bitcoin and Ethereum. Altcoins also showed strong upward momentum:

- Solana (SOL) gained 4%, buoyed by the $12 million inflow into the new REX-Osprey Solana Staking ETF.

- XRP rose 3%, driven by improving regulatory clarity and cross-border adoption.

- Dogecoin (DOGE) surged over 9% across two days, reflecting high-risk appetite among investors.

-

Chainlink, Avalanche, Sui, and Tron (TRX) also posted gains of up to 11%, indicating widespread bullish sentiment.

Why Is Crypto Going Up Today?

Four primary factors are driving this market rally:

1. Global Liquidity Expansion

2. U.S.-Vietnam Trade Agreement

The easing of tariffs and opening of trade channels improved investor sentiment, leading to a spike in Bitcoin futures and broad-based gains across altcoins.

3. Spot Bitcoin ETF Inflows

$407 million poured into spot BTC ETFs on July 2, reversing previous outflows and confirming institutional buy-in.

4. Technical Breakouts

Bitcoin and Ethereum both broke key resistance levels. BTC is eyeing $110,900 next, while ETH targets $2,800.

July 2025 Crypto Price Forecast

- Bitcoin remains within a consolidation channel but is now poised to break higher if it clears $110,000.

-

Ethereum is showing more technical strength with increased staking and DeFi activity.

-

XRP could rally to new highs if it breaks the $2.30 resistance and benefits from further regulatory wins.

-

Dogecoin rides the meme coin wave but still needs to overcome major resistance at $0.20.

Conclusion

This week’s rally underscores the dynamic interplay between macroeconomics, institutional inflows, and technical breakouts in shaping the crypto landscape.

Whether you’re a long-term holder or a short-term trader, the momentum suggests that the bull cycle may still have room to run, though caution remains essential in a volatile market.

The crypto market is on fire, and the next wave of innovation and profits is already unfolding. Whether you’re HODLing, staking, or trading the breakout, staying informed is your ultimate edge.

Power up your crypto IQ with real-time insights, expert analysis, and future-defining updates.

Dive into the next chapter of crypto with the Bitrue Blog, your go-to hub for everything from Bitcoin breakouts to altcoin alphas.

This Press Release has also been published on VRITIMES

by | Jul 3, 2025 | Business

XRP rallies beyond $2.25 as Ripple seeks a U.S. banking license and gains exposure via a Grayscale ETF. Discover how these developments could impact XRP’s price and regulatory future.

The XRP market has come alive once again as the token surged past the critical $2.25 resistance level, boosted by Ripple’s bold regulatory moves and growing institutional recognition.

This price action, combined with Ripple’s pursuit of a U.S. national banking license and the SEC’s approval of XRP exposure in a major ETF, has reignited bullish sentiment for one of crypto’s most debated assets.

XRP Price Rallies Past $2.25 Resistance

On Thursday, XRP price surged almost 4% intraday to briefly touch $2.2816, its highest in weeks, before settling around $2.27.

This breakout was technically significant, pushing XRP above a long-standing resistance and catching the attention of traders and analysts alike.

However, technical indicators such as the Connors RSI (CRSI) now flash overbought conditions, raising caution about possible short-term corrections.

Still, the breakout’s momentum is backed by strong volume, and market participants are increasingly optimistic about XRP’s near-term direction.

Ripple Applies for U.S. National Banking License

In a strategic pivot toward regulatory integration, Ripple has officially applied for a U.S. national banking license through the Office of the Comptroller of the Currency (OCC).

If granted, Ripple would join the ranks of Circle and Coinbase, operating under a unified federal framework, thus bypassing the complexities of state-by-state licensing.

Ripple CEO Brad Garlinghouse emphasized that this move marks a “unique benchmark” for trust and compliance.

It also sets the foundation for Ripple to self-custody reserves for its RLUSD stablecoin, further expand Ripple Payments, and scale cross-border remittances using blockchain infrastructure.

Ripple Advances Stablecoin Strategy with OpenPayd

Ripple also announced a strategic partnership with OpenPayd to expand the reach of RLUSD.

This collaboration will enable seamless minting and burning of RLUSD and provide access to embedded accounts, trading, and cross-border payments in multiple fiat currencies via a unified API.

With these capabilities, Ripple aims to facilitate treasury management and stablecoin liquidity at scale, laying the groundwork for enterprise-grade adoption in global finance.

XRP Gains ETF Exposure: A Historic First

Perhaps the most symbolic victory for XRP came when the U.S. Securities and Exchange Commission approved Grayscale’s Digital Large Cap Fund to trade as an ETF on NYSE Arca.

This fund includes XRP in its portfolio alongside Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and ADA, granting regulated exposure to XRP for the first time on U.S. soil.

While XRP comprises just 4.8% of the fund, its inclusion signals a seismic shift in how regulators view the asset.

Bloomberg analysts now project a 95% chance of a standalone XRP ETF approval in 2025, highlighting Ripple’s rising credibility in the institutional space.

Legal Updates: Ripple vs. SEC Nears Climax

All eyes are now on July 3, when the SEC is expected to decide whether to formally withdraw its appeal in the Ripple case concerning XRP’s programmatic sales.

Ripple dropped its own cross-appeal on June 27, increasing the probability of a settlement or resolution in the near future.

Former SEC lawyer Marc Fagel noted that while a vote and procedural filings are still needed, the recent developments strongly suggest an end to the years-long legal uncertainty.

XRP Price Outlook: Resistance, Support, and Short Squeeze Signals

Despite the strong fundamentals, XRP remains in a volatile price zone. The token is hovering just below the 50-day and 100-day EMAs, which are creating short-term resistance at $2.20–$2.22.

A successful push beyond these levels could spark a rally toward $2.34, $2.65, and even the $3.40 peak of 2025.

Adding to the intrigue, on-chain analyst CryptoInsightUK has identified growing potential for a short squeeze.

Rising open interest, dense liquidity above the $2.40 level, and negative premium suggest that bears may soon be forced to cover, potentially accelerating upside movement.

Conclusion: XRP Poised at a Crossroads of Finance and Regulation

With Ripple’s bold regulatory playbook, the inclusion of XRP in a major ETF, and mounting bullish technical signals, XRP is rapidly transforming from a speculative asset into a legitimate bridge between crypto and traditional finance.

However, investors must stay alert. Overbought technicals, unresolved legal processes, and macro volatility continue to cast shadows of uncertainty. The coming weeks, especially around the SEC’s final appeal decision and ETF-related news, could determine whether XRP continues its ascent—or cools off before another leg higher.

Want to stay ahead of the curve on XRP, Ripple, and the evolving crypto market? Follow the latest updates, market insights, and expert analysis on the Bitrue Blog, your trusted source for everything crypto.

This Press Release has also been published on VRITIMES

You must be logged in to post a comment.