by Penny Angeles-Tan | Nov 21, 2024 | Business

Explore what happens if Bitcoin hits $100K, from market reactions and profit-taking to a potential altcoin season. Understand the factors driving Bitcoin’s rise, including institutional support, political developments, and halving events, as the cryptocurrency nears this historic milestone.

As we approach the end of 2024, all eyes are on Bitcoin (BTC) as it nears the psychological and historic milestone of $100,000. Many analysts are speculating on whether Bitcoin will break this barrier by the close of the year, with some saying it’s a matter of “when,” not “if.”

While the digital currency is currently trading above $92,000, questions about the impact of such a surge, on both the market and its broader influence, remain.

In this article, we will explore what could happen if Bitcoin reaches $100K, including the likely market reactions, the potential for an altcoin season, and the catalysts that might drive Bitcoin’s price to unprecedented heights.

Bitcoin: The Road to $100K

Bitcoin’s surge toward $100,000 is not happening in a vacuum. It is the result of a confluence of factors that are propelling it higher. Institutional support has been a major driver, with financial giants like BlackRock investing heavily in Bitcoin and launching Bitcoin ETFs (Exchange Traded Funds) that have opened the door for traditional investors.

The approval of these ETFs has brought significant inflows into the crypto market, with Bitcoin ETFs alone attracting $2.6 billion post-2024 U.S. electioncal developments also play a crucial role.

The election of Donald Trump has led to increased optimism about a more crypto-friendly U.S. government, which could potentially propel Bitcoin prices even higher in the near future.

The idea of Bitcoin being integrated into national financial systems has generated optimism, with some predicting a Bitcoin reserve, similar to gold reserves, being established by governments worldwide .

Furtalving event earlier in 2024—where the reward for mining new Bitcoin blocks was cut in half—has led to a tighter supply of the digital asset. As history has shown, halving events tend to precede price increases as reduced supply meets ongoing demand .

Bitcoin Price Today

As we can see from the chart above, the price of Bitcoin is rising again today. If a few hours ago Bitcoin was still at $92,000, when this article was written on November 21, Bitcoin was traded at $94,753, very close to $100,000.

The prediction that Bitcoin will rise to $100,000 will not be just a fantasy at the end of the year. If Bitcoin continues to consistently increase by 1-2%, even at the end of November, the price of $100K can be achieved immediately and it is possible that it could reach more than $150K at the beginning of the year.

Both Bitcoin futures and trading, all prices have experienced similar increases. This increase in Bitcoin will be a trigger for other crypto tokens to soar.

What Happens When Bitcoin Hits $100K?

If Bitcoin does hit the $100K mark, several dynamics will unfold, shaping the future trajectory of the cryptocurrency market.

1. Market Reactions and Profit-Taking

Historically, when Bitcoin hits significant milestones, it attracts attention from both institutional and retail investors. This surge in interest often leads to a rush of profit-taking, with some investors choosing to sell and lock in their gains.

This could trigger a temporary selloff in the short term, followed by consolidation as the market digests the new price levels.

On the other hand, if Bitcoin can maintain its momentum above $100K, it could solidify its status as a mainstream asset, attracting even more capital into the crypto space. Bitcoin’s success could reignite broader interest in digital assets, which have somewhat lagged behind Bitcoin in recent years.

2. Renewed Interest in Altcoins

Bitcoin’s success in reaching $100K could spark renewed interest in altcoins. While Bitcoin has been the dominant force in the crypto market, altcoins have not mirrored its success to the same degree.

Ethereum (ETH), for example, has shown strong potential due to its foundational role in decentralized finance (DeFi) and the growing importance of smart contracts. But despite Bitcoin’s surge, Ethereum and other altcoins have lagged behind.

Historically, Bitcoin’s rallies have been followed by an “altcoin season“, where lesser-known cryptocurrencies experience exponential growth. In 2021, for example, when Bitcoin’s price surged, altcoins like Solana and Polygon saw dramatic increases. This phenomenon could repeat once Bitcoin breaks the $100K barrier, with altcoins potentially following suit.

Some of the more innovative and niche projects could see outsized growth as a result of Bitcoin’s success. For example, projects like XYZVerse (XYZ), an all-sport meme coin, could capitalize on the renewed market excitement by offering unique opportunities to investors. XYZVerse seeks to tap into the sports and meme coin intersection, leveraging the growing enthusiasm for both sectors .

3. Increased Retail and Institutioipation

As Bitcoin’s price rises and crosses new thresholds, retail investors are likely to re-enter the market. The $100K price point could reignite interest among casual investors who have been sitting on the sidelines.

Additionally, institutional investors, who are already getting involved in Bitcoin through ETFs and direct investments, may increase their exposure to the cryptocurrency as they see it reaching a new level of maturity and acceptance.

This influx of capital could further push Bitcoin’s price higher, creating a self-reinforcing loop of demand and growth. It also validates Bitcoin’s role as a store of value, much like gold, and could lead to it being seen as an essential asset class in institutional portfolios.

Will $100K Bitcoin Trigger Altcoin Season?

A key question surrounding Bitcoin’s price surge is whether it will trigger a full-fledged altcoin season. The answer to this depends on the overall market sentiment, as measured by indicators like the Fear and Greed Index.

Historically, extreme levels of greed in the market, as seen in 2019 and early 2024, have coincided with brief surges in Bitcoin’s price but didn’t lead to a prolonged altcoin rally.

However, if Bitcoin breaks through $100K and the market sentiment continues to show high levels of greed, it could lead to a more sustainable rally, similar to what happened during the late 2021 bull run.

Potential Risks and Challenges

While the outltcoin reaching $100K is generally positive, there are risks that could hinder its progress. A significant short-term correction could occur, especially with the large options expiry of $11.8 billion in December 2024, which could introduce volatility in the market.

Additionally, market speculation and leveraged trading may c fluctuations, even if the longer-term outlook for Bitcoin remains strong.

Another potential challenge is the risk of over-reliance on political or macroeconomic events, such as Trump’s victory. While political developments have spurred bullish sentiment, experts like Lorien Gamaroff caution against putting too much faith in any one figure, given their unpredictable nature .

Conclusion

The prospect of Bitcoin hitting $100,000 represents milestone in the evolution of cryptocurrency. If Bitcoin achieves this target, it could serve as a catalyst for renewed interest in the crypto space, triggering higher levels of institutional and retail participation.

The potential for an altcoin season would also grow, as investors seek to capitalize on the broader market rally that could follow Bitcoin’s surge.

The key question now is not whether Bitcoin will hit $100K, but when. While 2024 remains a likely candidate, early 2025 may be another realistic timeline.

Regardless of the exact timing, the fundamental drivers of Bitcoin’s price—institutional investment, political developments, and its increasingly established role as a store of value—suggest that the $100K target is well within reach.

However, short-term volatility and the potential for corrections are inevitable as Bitcoin’s meteoric rise continues. In any case, Bitcoin’s journey to $100K will likely leave a lasting impact on the broader crypto landscape, with far-reaching consequences for the financial world.

This Press Release has also been published on VRITIMES

by Penny Angeles-Tan | Nov 20, 2024 | Business

Ethereum’s price has broken through $3,100, sparking bullish potential as it approaches new highs. Explore the factors driving Ethereum’s growth, including its diverse ecosystem, technical indicators, and upcoming network upgrades. Is Ethereum on track for $4,000? Find out in this analysis.

Ethereum, the world’s second-largest cryptocurrency by market capitalization, has been making significant strides in recent times. Despite experiencing a recent pullback, the underlying fundamentals and technical indicators suggest a promising future for the Ethereum ecosystem.

Today, Ethereum’s price is even stronger again. The increase of almost 2% occurred with a promising price. Will Ethereum’s bullish potential bring it to a new ATH? Or is the hope of $ 4,000 just a dream?

The Ethereum Ecosystem

The Ethereum ecosystem is vast and diverse, encompassing a wide range of projects and applications. Some of the most prominent include:

- DeFi Protocols: Platforms like Uniswap, Aave, and Curve Finance have transformed the way people interact with financial services.

- NFTs: Ethereum is the leading platform for NFTs, with marketplaces like OpenSea facilitating the buying and selling of unique digital assets.

- DApps: Decentralized applications built on Ethereum provide a wide range of services, from gaming to social media.

A Resilient Network

One of the key factors driving Ethereum’s resilience is its robust and ever-evolving network. The Ethereum community is constantly working on upgrades and innovations to enhance the platform’s scalability, security, and user experience.

The upcoming Shanghai upgrade, which will enable the withdrawal of staked ETH, is a significant milestone that could further bolster the network’s strength.

Ethereum’s Bullish Outlook

Technical analysis indicates a potential bullish trend for Ethereum. The recent price correction has provided an opportunity for investors to accumulate ETH at a relatively lower price. As the market recovers, Ethereum could experience a significant upward movement.

On-chain data also supports a bullish outlook. The increasing accumulation of ETH on exchanges suggests that investors are preparing for a potential price surge. Additionally, the growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs) on the Ethereum network is driving demand for the cryptocurrency.

Looking at the data from the chart above, when this article was written on November 18, Ethereum experienced an increase of 0.42% and was trading at $3,112. However, the ETH RSI value is actually below 50, which means that the selling trend is still dominant compared to the buying flow. The MACD line has also decreased because it is currently sloping.

Conclusion: The Road Ahead

While the future of Ethereum is promising, it’s important to acknowledge the challenges that lie ahead. The competition from other blockchain platforms and the potential for regulatory hurdles could impact the cryptocurrency’s growth.

However, with a strong community, innovative technology, and a growing ecosystem, Ethereum is well-positioned to maintain its dominance in the blockchain industry.

As an investor, it’s crucial to conduct thorough research and consider the risks involved before investing in cryptocurrencies. While Ethereum has shown significant potential, the market remains highly volatile, and prices can fluctuate rapidly.

By staying informed about the latest developments in the cryptocurrency market and making informed decisions, investors can navigate the complexities of the crypto landscape and potentially reap the rewards of long-term investment in Ethereum.

This Press Release has also been published on VRITIMES

by Penny Angeles-Tan | Nov 15, 2024 | Business

Is altcoin season on the horizon? With Bitcoin hitting new highs, key indicators suggest an altcoin boom may be approaching. Learn what to watch for and when the next altcoin surge could happen.

The cryptocurrency market is buzzing with excitement as Bitcoin reaches new heights. On November 14th, 2024, Bitcoin surged past its previous high of $73,000 in March 2024, reaching a staggering $90,250. This surge has many investors wondering: when will the next altcoin season arrive?

Some experts attribute Bitcoin’s recent success to the U.S. presidential election results. However, the bigger question for many is whether altcoins will experience a similar boom.

Understanding Altcoin Season

While Bitcoin season signifies a period of high demand and rising prices, altcoin season refers to a surge in interest and value for alternative cryptocurrencies, such as Solana (SOL) and Ethereum (ETH).

Multiple factors can indicate an altcoin season, including:

1. Increased Altcoin Dominance: This metric measures the combined market capitalization of all altcoins compared to Bitcoin. A dominance level exceeding 75% for altcoins over three months is often considered a sign of an altcoin season.

2. Rising Trading Volumes: Increased trading activity for altcoins suggests growing investor interest.

3. Coin Price Breakouts: Altcoins experiencing significant price increases can signify the beginning of a season.

4. Altcoin Season Index: Third-party tools track various factors to generate an altcoin season index.

Is Altcoin Season Here?

As of November 11th, 2024, the altcoin season index suggests we are not yet in an altcoin season with its altcoin rating at 37. However, several indicators suggest it could be on the horizon:

1. Total Market Cap Excluding BTC and ETH: This metric focuses on the overall market capitalization of altcoins, excluding Bitcoin and Ethereum’s influence. A recent breakout in this metric could indicate an altcoin surge.

2. Dogecoin’s Fibonacci Level: Dogecoin (DOGE) is often considered a barometer for the altcoin season. DOGE’s recent rise above its key 50% Fibonacci level can be interpreted as a positive sign.

3. U.S. Dollar Strength: A weak U.S. Dollar (USD) often coincides with a strong crypto market. The USD’s inability to break past its 50% Fibonacci level suggests continued strength for cryptocurrencies.

Cardano (ADA) and Dogecoin (DOGE): A Tale of Two Altcoins

Cardano (ADA) is a utility-focused altcoin experiencing steady growth. ADA price sits around $0.5797, with a healthy trading volume. While short-term sentiment may be cautious, long-term prospects for Cardano appear promising.

Dogecoin (DOGE), on the other hand, faces a potential decline. While still actively traded, investor focus seems to be shifting towards altcoins with real-world applications. Data suggests a high concentration of DOGE ownership among a small group, potentially impacting price stability.

The Future of Altcoins

With Bitcoin reaching record highs, expectations for a robust altcoin season are rising. Investors should monitor key indicators and conduct thorough research before making investment decisions in any cryptocurrency.

1. Regulatory Impact on Altcoins

Government regulations can significantly impact the cryptocurrency market. Favorable regulations can boost investor confidence and lead to increased market participation. Conversely, stringent regulations can stifle innovation and hinder market growth.

The U.S. Securities and Exchange Commission (SEC) plays a crucial role in shaping the regulatory environment for cryptocurrencies. The SEC’s stance on cryptocurrencies, particularly regarding security tokens, can influence the trajectory of altcoins.

2. Institutional Adoption of Altcoins

Institutional investors, such as hedge funds, pension funds, and endowments, have the potential to significantly impact the cryptocurrency market. As more institutions adopt cryptocurrencies, it could lead to increased market liquidity and price stability.

However, institutional adoption is often hindered by regulatory hurdles, security concerns, and a lack of understanding of the underlying technology. As the regulatory landscape evolves and institutional investors become more comfortable with cryptocurrencies, we may see increased interest in altcoins.

Conclusion

While the current market conditions seem favorable for an altcoin season, it’s essential to approach with caution. The cryptocurrency market is highly volatile, and prices can fluctuate rapidly. Investors should conduct thorough research and consider the risks involved before making any investment decisions.

By staying informed about market trends, regulatory developments, and technological advancements, investors can make informed decisions and potentially capitalize on the opportunities presented by the altcoin market.

Stay updated with everything in the crypto ecosystem by continuing to visit the Bitrue website and reading articles on the Bitrue blog. Bitrue also has many features, such as checking crypto token prices in real-time, knowing how to convert crypto token prices to USD easily, and participating in various events with crypto token prizes so you can get maximum benefits.

This Press Release has also been published on VRITIMES

by Penny Angeles-Tan | Nov 12, 2024 | Business

The seven tokens that will be discussed in this article are AIOZ, AMC, PIXFI, GME, EQ9, DEGEN, and ACT. Here is the analysis and discussion.

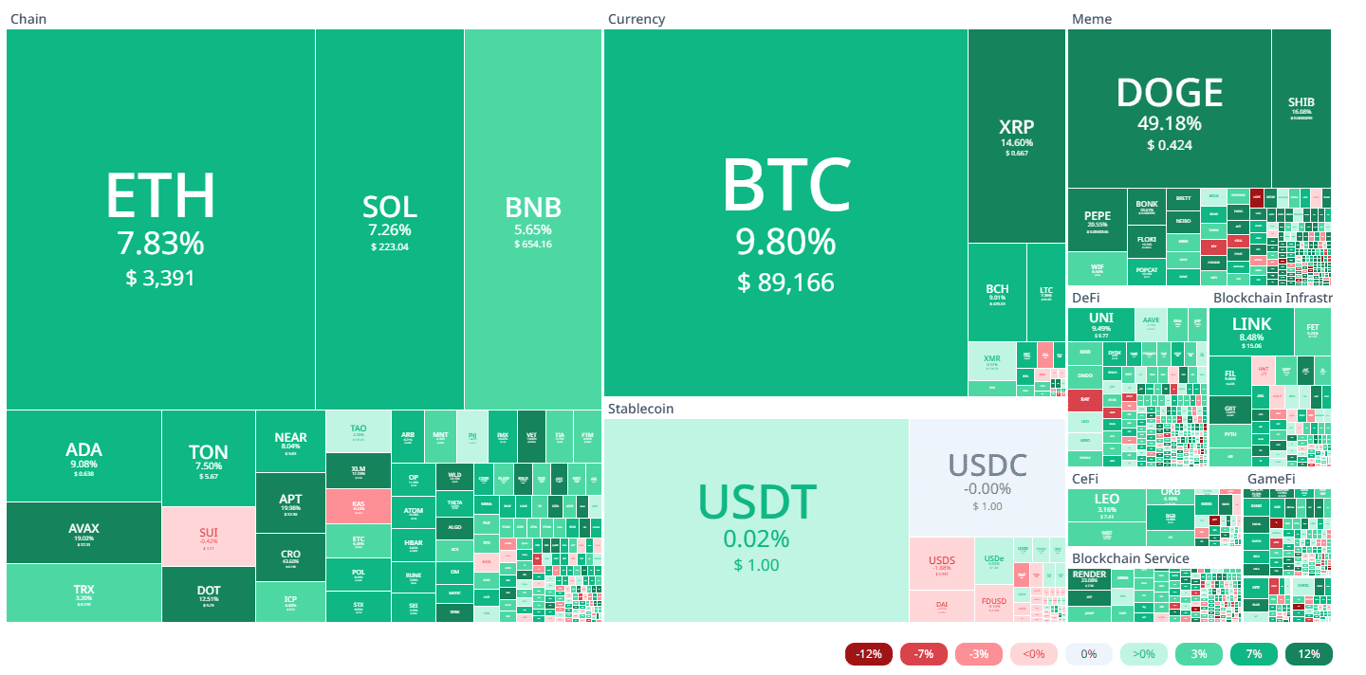

In today’s crypto heatmap on Cryptorank, the crypto ecosystem is greening up. In the joy of crypto investors who see major tokens such as BTC, ETH, SOL, XRP, to USDT experiencing significant increases, other alternative tokens are no less positive.

In this article, you will find out what are the 7 crypto tokens that have increased by more than 50%. It will be presented specifically for you how the price charts of the seven crypto tokens so that you can do their technical analysis.

7 Crypto Tokens with More Than 50% Increase

Today, BTC has again set a record with its new ATH. With a 9.80% increase, Bitcoin is currently trading at $89,166, up more than $8,000 from yesterday’s price of only $81,000.

Other major tokens such as Ethereum, Solana, XRP, and USDT have also experienced significant increases. The price of Ethereum today has even reached almost $4,000 with an increase of 7.83%. Solana is even at $223.04 with an increase of 7.26%.

In addition to the major tokens, other altcoins have also experienced a very significant increase of more than 430%. The token is Act I: The AI Prophecy which is currently on the rise.

The seven tokens that will be discussed in this article are AIOZ, AMC, PIXFI, GME, EQ9, DEGEN, and ACT. Here is the analysis and discussion.

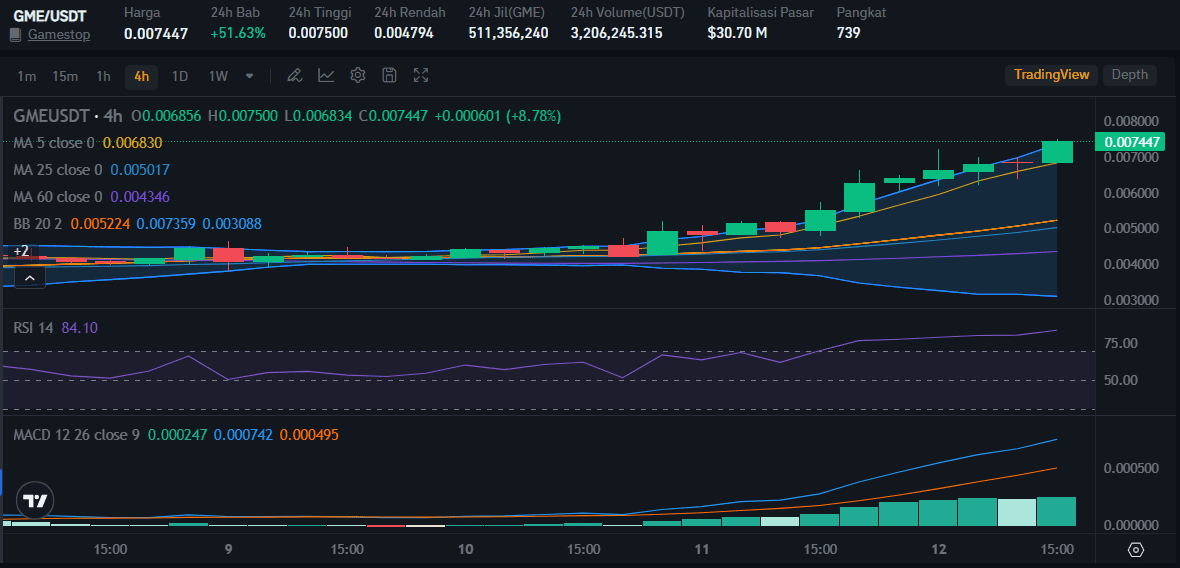

1. Gamestop (GME)

Percentage increase: 51,63%

Sector: Gaming, Memes, Solana Ecosystem

Market Capitalization: $52.12M

Total supply: 6.89B GME

The crypto token with the ticker GME went viral in 2021 due to its unexpected price spike. Roaring Kitty, an online broadcaster, was the cause of GameStop’s rally at that time.

Now, GME is experiencing an increase that cannot be underestimated. With an increase of more than 51%, GME is currently trading at $0.007447 with its highest price in 24 hours being $0.007500. GME’s market capitalization has also increased by 65.86% currently.

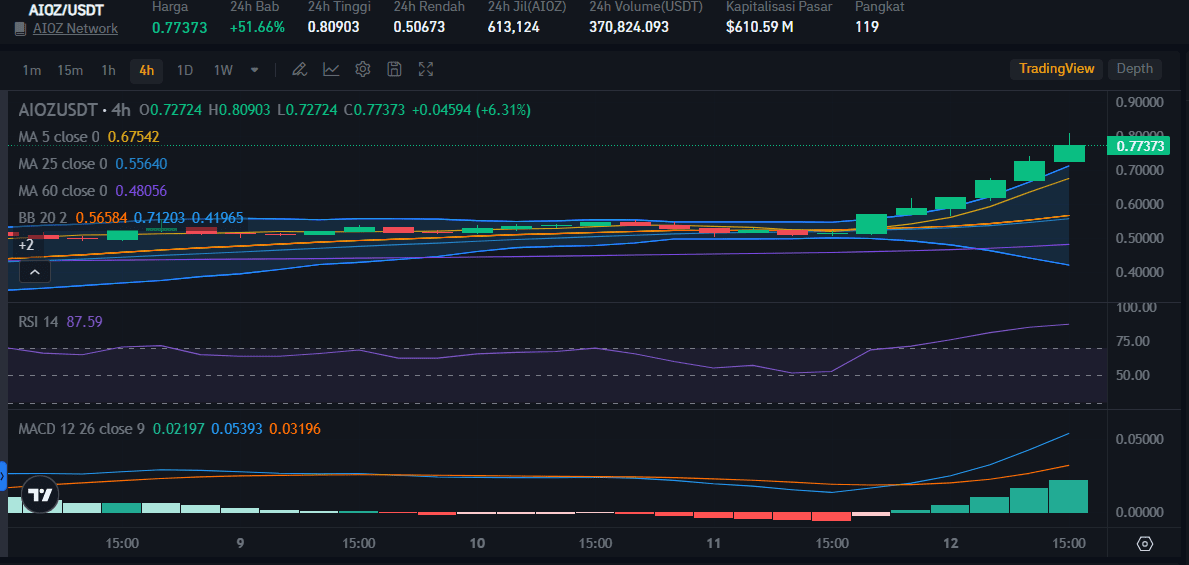

2. AIOZ Network (AIOZ)

Percentage increase: 51,66%

Sector: Media, Platform, AI & Big Data

Market Capitalization: $847.21M

Total supply: 1.14B AIOZ

AIOZ Network is currently focusing on building its AIOZ W3AI V3 with a focus on AI training with Decentralized Federated Learning to Spaces for building AI dApps.

AIOZ has more than 7 years of experience in its active development and will continue to update to broader development in the blockchain ecosystem, nodes, to infra.

Today, the AIOZ token has increased by 51.66% so that the current AIOZ price is $0.77373. The AIOZ RSI value is already in the overbought stage because it is at 87.59.

3. Dogecoin (DOGE)

Percentage increase: 53,15%

Sector: Mineable, PoW, Scrypt

Market Capitalization: $62.45B

Total supply: 146.76B DOGE

Dogecoin today is experiencing an increase of up to 53.15% so it is now for $ 0.42597. Previously, in 24 hours, DOGE was at its highest price of $ 0.43744.

This Shiba Inu-inspired memecoin has Dogecoin Core which is open-source and community-driven software. The development process is very open to the public so that everyone can see, discuss, and even develop the software.

4. Pixelverse (PIXFI)

Percentage increase: 64,02%

Sector: Gaming, Toncoin Ecosystem, Tap To Earn (T2E)

Market Capitalization: $7.98M

Total supply: 5B PIXFI

Pixelverse, which started from a successful Telegram game, has indeed received high support since its launch. With its PIXFI token, Pixelverse has succeeded in strengthening its presence in the crypto ecosystem.

In its mini-game on Telegram, Pixelverse has many interesting features, ranging from PvP Battles, Referral programs, Daily Combo, to Daily Rewards.

Now, the price of PIXFI has reached $0.007378 and is one of the crypto tokens from the Telegram game with a very high increase in this exciting week of crypto. With an increase of more than 64%, PIXFI is increasingly showing its ability to be bullish.

5. Degen (DEGEN)

Percentage increase: 77,55%

Sector: Memes, Base Ecosystem

Market Capitalization: $245.10M

Total supply: 36.97B DEGEN

DEGEN is currently trading at $0.01891 after experiencing a 77.55% increase. DEGEN’s RSI figure is very high at 86.56 which means there is already a red code because it is overbought. The MACD line is undoubtedly increasing by a fairly large distance which means that there is currently a bullish trend.

DEGEN was created in the realm of strong meme culture. Degen also has Degen Chain which is a pioneer of L3s in the Base network. There, users can build and use Degen apps.

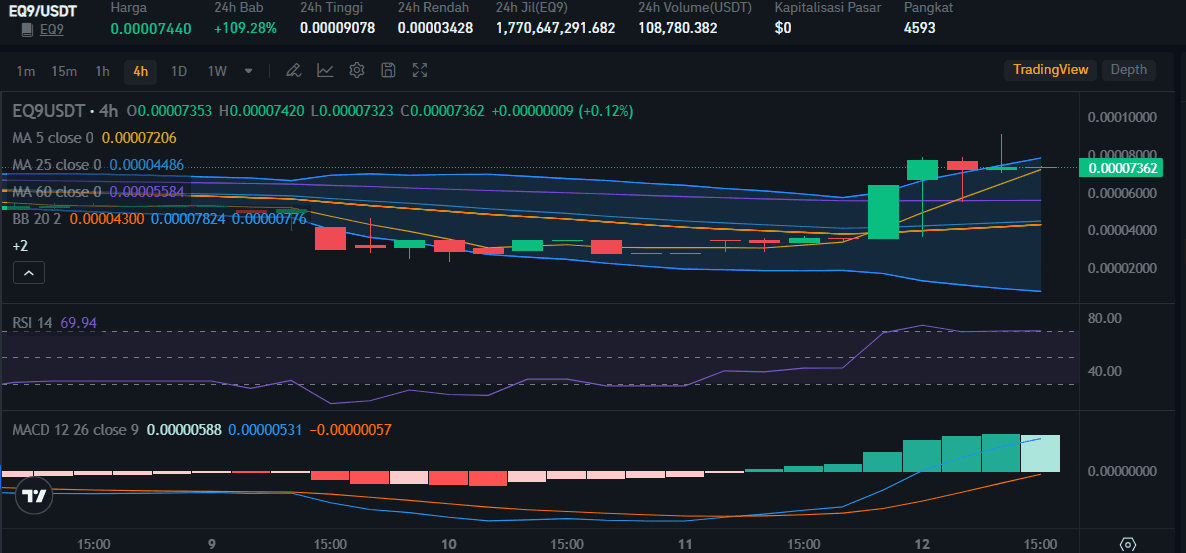

6. EQ9 (EQ9)

Percentage increase: 109,28%

Sector: dApps

Market Capitalization: $30.65K

Total supply: 1.80B EQ9

EQ9 created by a company called EQUALS9 ENTERPRISES & PARTNERSHIPS is a corporation from Brazil. This company focuses on controlling its various subsidiaries in various sectors. This company then created the EQ9 token as a bridge in the integration of their business ecosystem with blockchain.

When this article was written on November 12, EQ9 experienced a surprising increase because the percentage increase was more than 109%. Now, EQ9 is trading at $0.0007440 in 24 hours.

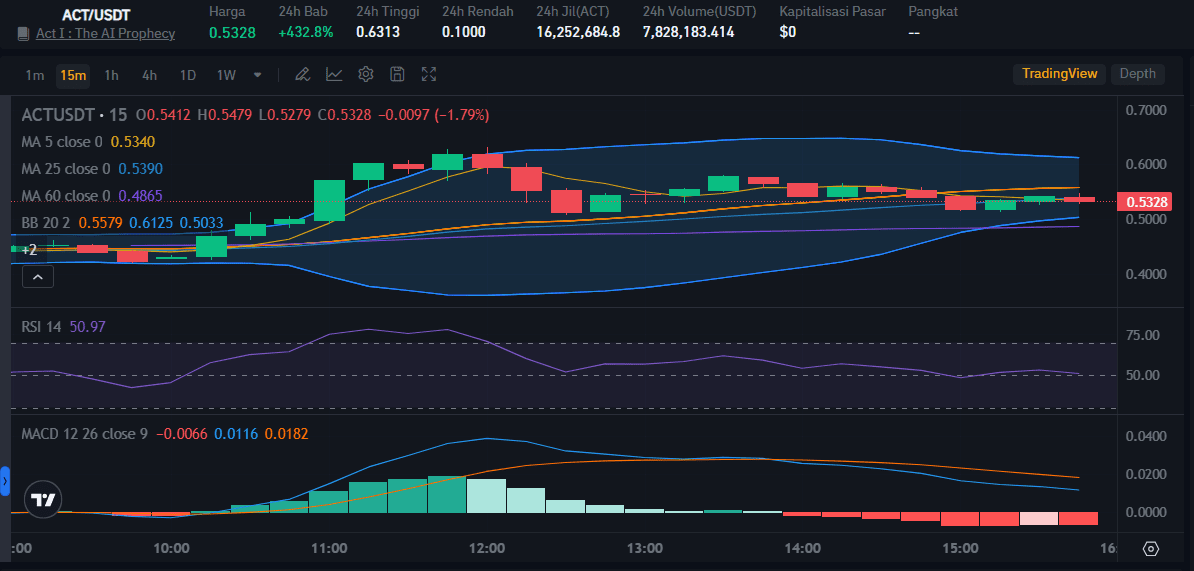

7. Act I: The AI Prophecy (ACT)

Percentage increase: 432,8%

Sector: Memes, Solana Ecosystem, AI Memes

Market Capitalization: $507.58M

Total supply: 948.25M ACT

Act I: The AI Prophecy (ACT) is currently experiencing hype due to its launch on various global crypto exchanges. ACT is a decentralized open-source project. Its goal is to create an interactive AI ecosystem. Users can freely interact with AI.

Because of this promising system, the ACT token has received high support. Currently, ACT has even experienced a very fantastic price increase of 432.8% so it is currently traded for $ 0.5328.

The ACT RSI value even tends to be normal with a more dominant buying trend than the selling trend. The MACD line looks down, but it does not eliminate the possibility that ACT will experience a greater bullish shortly.

Conclusion: DYOR

That’s an explanation of the 7 crypto tokens that have increased by more than 50% today. Always remember to do in-depth research before trading crypto. That way, you will know the risks of each token. Crypto prices are volatile, so strategize so you can get maximum profit in crypto investment.

Bitrue can help you in doing research. You can check prices, convert prices from token prices to USD, and check the latest information on every project in the crypto ecosystem.

This Press Release has also been published on VRITIMES

by Penny Angeles-Tan | Nov 9, 2024 | Business

Discover everything you need to know about MemeFi’s upcoming token launch on November 12. Learn about its transition to the Sui Network, the airdrop, and where to buy MEMEFI tokens on global crypto exchanges like Bitrue. Stay updated on the latest developments in the MemeFi ecosystem!

MemeFi is one of Telegram’s tap-to-earn games that will soon launch tokens and circulate on various global crypto exchanges, including Bitrue. This popular mini-game has officially announced its token release date on November 12.

If you are one of the MemeFi players and plan to buy this token when it is listed on a crypto exchange later, you should read this article until the end.

In this article, you will learn everything about MemeFi, from the MemeFi network to estimates of whether MemeFi will reap praise or vice versa like previous Telegram games that launched tokens.

MemeFi’s transition to Sui Network

At the end of October, MemeFi developers made an official announcement that the mini-game was moving to Sui Network from Linea, Ethereum’s layer-2. This announcement was quite surprising because, from the start, MemeFi was built on Linea.

However, the collaboration between MemeFi developers and Mysten Labs, the creator of Sui Network, made the game decide to move networks when its token was launched in the second week of November. Telegram games have been very popular lately.

Many mini-games have launched tokens, such as Notcoin, Hamster Kombat, and Catizen. The majority of token launches from these games are on TON as Telegram’s official network.

The mapping of MemeFi’s plan to launch tokens on the Sui network has indeed stolen attention. However, Telegram supports it. MemeFi’s collaboration on the Sui Network is expected to help the integration between Sui and Telegram even closer so that later various cool collaborations can be created that can be useful for users.

MemeFi Token Launch and Airdrop

This game, launched on Telegram in April 2024, has gained a lot of popularity. There are currently 23,048,161 monthly active users playing MemeFi.

This popularity may be below Hamster Kombat players in terms of numbers, but each unique character in MemeFi makes users feel at home playing it. The large number of users has enlivened the enthusiasm for the launch of the MemeFi token and airdrop on November 12.

As MemeFi’s gratitude to the community that has accompanied it since the beginning, MemeFi will allocate 90% of the total MemeFi tokens to the community in the form of an airdrop.

MemeFi has taken a snapshot for the airdrop on November 6. Later, the final allocation will be distributed by the developer on November 8.

Until now, MemeFi has not officially announced which other crypto exchanges will list the MEMEFI token on November 12. It is planned that Bitrue will enliven the launch of the MEMEFI token later with other global crypto exchanges.

Conclusion

For those of you who can’t wait for the launch of the MEMEFI token, you can visit the Bitrue website to find out the latest developments in the launch of the MemeFi token. When it is officially launched later, you can also directly check the MEMEFI price on the Bitrue website and even find out the price conversion from MEMEFI to USD.

Don’t miss the latest news in the crypto ecosystem. Check out the latest crypto news for free and easily by simply visiting the Bitrue blog.

This Press Release has also been published on VRITIMES

You must be logged in to post a comment.