by | Apr 9, 2025 | Business

Bitget, the leading cryptocurrency exchange and Web3 company, has published an open letter by its Chief Legal Officer, Hon Ng, which highlights the exchange’s efforts in global regulatory compliance and expansion. The CEX continues to grow in the global crypto market by securing regulatory approvals and expanding its operations. With a strong focus on compliance, Bitget is navigating evolving regulatory landscapes with over eight licenses obtained while ensuring that users have access to a secure and transparent trading environment.

Hon Ng, Chief Legal Officer at Bitget, has addressed the company’s strategic direction in an open letter, providing plans to grow Bitget’s regulatory standing across multiple jurisdictions. His statements show the importance of regulatory dialogues and highlight upcoming initiatives that will shape the platform’s future.

“The regulatory environment surrounding digital assets is becoming more defined, and Bitget is taking proactive steps to work alongside authorities to ensure responsible growth. Compliance is not an obligation it’s a necessity; it’s about setting a standard for the industry and building a sustainable ecosystem for users,” said Hon Ng, Chief Legal Officer at Bitget.

Bitget has already secured registrations and approvals in several key markets, including Australia, Italy, Poland, Lithuania, the UK, the Czech Republic, and El Salvador. These achievements align with the company’s strategy of working within legal frameworks and supporting initiatives that promote advanced security and user protection. The legal and compliance teams are working closely to obtain additional licenses in jurisdictions that will further enhance the platform’s accessibility and credibility.

One of the primary objectives for the upcoming year is to refine the company’s compliance protocols. A strong Know Your Customer (KYC) process is being implemented to optimize user verification while adhering to anti-money laundering and counter-terrorism financing regulations. In parallel, Bitget is investing in advanced transaction monitoring tools to detect and prevent illicit activity, ensuring that all operations adhere to the highest standards of financial integrity.

Collaboration with regulators and law enforcement agencies remains a key aspect of Bitget’s compliance efforts. The company has established direct communication channels with authorities to facilitate transparent reporting and improve response times in cases of suspicious activity. By adopting new technological solutions, Bitget aims to enhance global cooperation while safeguarding user privacy.

In addition to regulatory advancements, Bitget is focused on introducing innovative products that align with compliance requirements. Bitget is already building even stronger user protection, risk management features, and enhanced security measures that strengthen the platform’s durability and credibility. This is in line with the company’s targets of maintaining a secure, compliant, and user-centric trading platform.

As part of its commitment to responsible operations, Bitget strictly adheres to international sanctions controls. Users from restricted regions are prohibited from accessing the platform, ensuring that all activities remain within legal boundaries. A dedicated compliance team continuously monitors global regulatory developments to adjust policies as needed.

Bitget’s legal and compliance strategy is designed to adapt to the rapidly changing digital asset landscape. With regulatory discussions evolving worldwide, the company is prepared to adjust its framework to align with new policies and emerging industry standards. The legal team remains engaged in conversations with policymakers to contribute to the responsible development of crypto regulations.

“Compliance is a continuous process that requires foresight and collaboration. Our goal here is simple: we comply, expand, operate, and grow. Our focus remains on making crypto accessible to everyone globally, and each license and approval is a step closer to it,” added Ng.

Bitget’s ongoing expansion and compliance efforts reaffirm its role as a leading player in the crypto market. By staying ahead of regulatory changes and implementing rigorous security measures, the company indeed plans to keep its title of being one of the top most trusted crypto exchanges globally.

by | Apr 8, 2025 | Business

XRP faces a pivotal moment as whale sell-offs stir fear, yet bullish forecasts, ETF approval, and Ripple’s $1.25B Hidden Road acquisition fuel optimism. Will XRP rally past $2—or fall further before rebounding?

The cryptocurrency market is flashing green today, with many digital assets experiencing moderate gains. Yet amidst the optimism, XRP—the native token of Ripple—finds itself at a critical juncture.

The coin has seen significant whale movement, bullish predictions from top analysts, and a game-changing acquisition that could reshape Ripple’s future in institutional finance.

Whale Moves Stir Market Anxiety

A significant event that sent ripples through the market was the transfer of 200 million XRP tokens, valued at approximately $355.6 million, from an unidentified wallet to Binance, the world’s largest crypto exchange.

Such a move is typically interpreted as a prelude to large-scale selling, signaling possible loss of confidence among whales—holders of substantial XRP reserves. The result?

A sharp drop in XRP’s price, falling to $1.60, igniting concerns about increased short-term volatility.

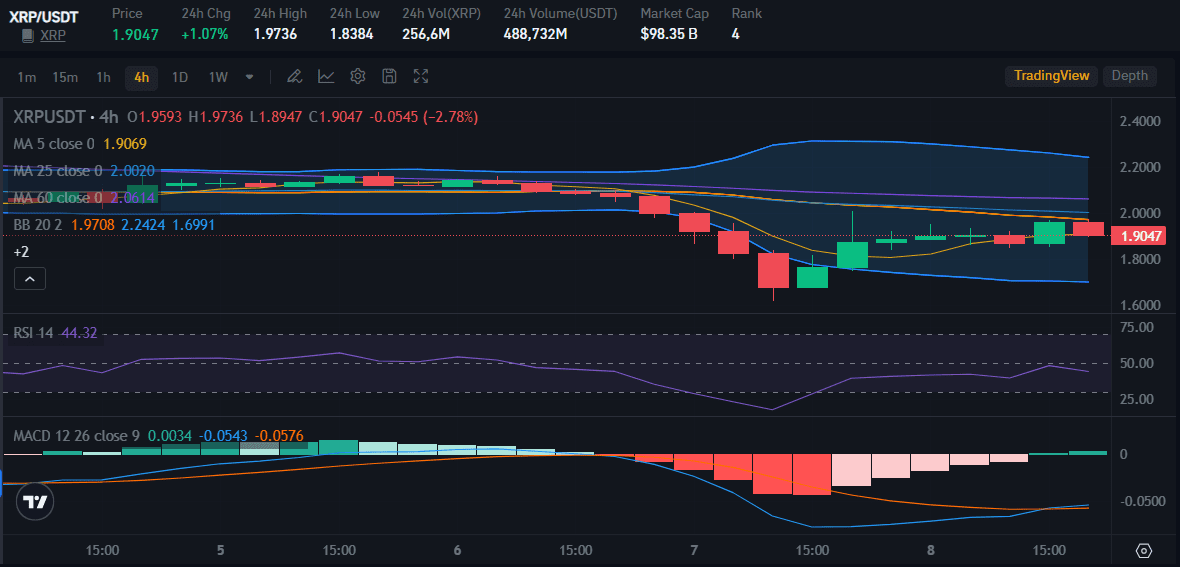

Technical Indicators Show Mixed Signals

Despite the bearish implications of the whale sell-off, technical analysts remain divided. Well-known analyst Dark Defender maintained his bullish stance, citing the firm hold of the $1.8815 level on XRP’s monthly chart.

Other analysts suggest that this might be a “boom or bust” moment, where XRP either rebounds significantly or dips further.

Crypto expert Ali Martinez pointed to a potential breakdown from a head-and-shoulders pattern, projecting a short-term bearish scenario that could see XRP drop to $1.30 if current support levels fail.

Bullish Forecasts: Will XRP Hit $2 and Beyond?

Not all outlooks are grim. Prominent analyst CredibleCrypto views XRP’s recent dip into the $1.61–$1.79 range as a possible demand zone, suggesting that consolidation here might lay the groundwork for a full-scale reversal.

Similarly, Casi Trades emphasized the importance of the $1.55 level, which coincides with the 618 Fibonacci retracement, as a strong potential rebound point.

If XRP bottoms around $1.55, Casi believes it could reignite the bullish case for a surge toward $8 to $13, although such targets are long-term aspirations.

In the short term, a break above $1.97 to $2.17 resistance levels is crucial to see XRP push past the psychological $2 mark, with higher resistance zones identified at $2.72 and $3.70.

At the time of writing this article on April 8, the price of XRP was $1.9047 with an increase of 1.07%. Indeed, the increase was weakened where during the day the crypto market was very strong, even XRP increased by almost 10%.

However, XRP is one of the tokens that remains green when other strong tokens, especially BTC, are declining again.

Macro Factors & Institutional Moves Fuel Optimism

One of the most notable bullish catalysts came from Standard Chartered, which predicted XRP could climb from $2 to $12 over the next four years, potentially boosting Ripple’s market cap from $113 billion to over $600 billion.

The bank cited Ripple’s growing influence in the cross-border payments sector, a domain historically dominated by SWIFT.

Ripple offers a faster, cheaper, and more transparent alternative—with transaction fees under $1 and settlement times measured in seconds.

Another key driver of optimism is the approval of Teucrium’s 2X Long Daily XRP ETF by NYSE Arca, which signals growing institutional interest and could improve XRP’s visibility in traditional financial markets.

Ripple’s $1.25 Billion Gamble on Hidden Road

Perhaps the most transformative development is Ripple’s acquisition of crypto prime broker Hidden Road in a landmark $1.25 billion deal.

This acquisition expands Ripple’s footprint in the institutional space, giving it access to Hidden Road’s 300 institutional clients and its ability to clear $3 trillion in annual transactions.

The deal brings strategic advantages:

1. Capital injection: Ripple plans to inject billions into Hidden Road’s operations.

2. XRP Ledger integration: Settlement and trade recording may occur on the XRP Ledger, increasing on-chain utility.

3. Use of RLUSD: Ripple’s RLUSD stablecoin, now with a $300M market cap, will be used as collateral for trades.

Ripple CEO Brad Garlinghouse stated, “We need the infrastructure in place to appeal and expand to a larger segment of the biggest bracket institutions.”

Challenges Ahead: Death Cross, Bear Traps, and Privacy Concerns

Despite the bullish fundamentals, XRP isn’t out of the woods yet. The token has already formed a death cross—a bearish technical signal where the 50-day moving average falls below the 200-day moving average—indicating the possibility of a further drop below $1 before recovery.

There’s also concern that the recent price bounce could be a “dead cat bounce”, a temporary recovery before further decline. XRP recently retested the $2 resistance, but unless it establishes strong support above it, a break-and-retest pattern could confirm more downside.

Institutional privacy concerns also persist. If Hidden Road relies on the public XRP Ledger for settlement, institutions may hesitate to fully engage due to transparency issues.

Solutions like Layer 2 privacy protocols or a private version of the XRP Ledger may be necessary to fully onboard traditional finance giants.

Conclusion: XRP at a Pivotal Moment

XRP stands at a high-stakes moment. While whale activity and bearish technical patterns suggest caution, positive fundamentals—including ETF approvals, major acquisitions, and bullish institutional forecasts—paint an optimistic longer-term picture.

The coming weeks will be crucial as XRP attempts to hold support levels, retest critical resistance zones, and prove whether it can indeed rally past $2—or fall further before a true rebound.

As Ripple expands its institutional presence, and as the regulatory climate continues to evolve in its favor, the real question might not be if XRP will rally—but when.

by | Apr 8, 2025 | Business

Bitcoin rebounds above $80,000 after a sharp drop amid U.S. tariff tensions. Explore expert analysis, technical signals like the “death cross,” institutional resilience, and what to watch next for crypto markets.

Bitcoin, the world’s largest cryptocurrency, surged back above the $80,000 level on Tuesday, recovering from a five-month low as traders bought the dip.

However, investor sentiment remains fragile in light of escalating trade tensions driven by U.S. President Donald Trump’s aggressive tariff policies.

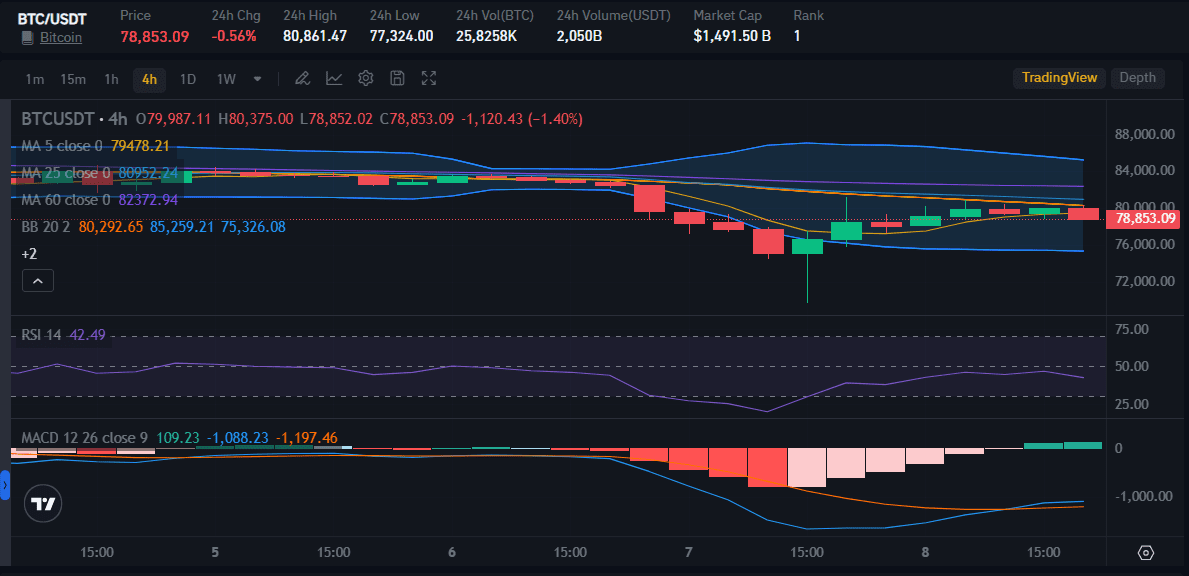

Bitcoin Rises Amid Market Rebound

By 09:31 ET (13:31 GMT) today, Bitcoin had gained 2.4% to trade at $80,285. This followed a volatile weekend during which the digital asset plunged to lows near $74,420, shedding over $10,000 in value as fears of a tariff-induced global recession sent shockwaves through financial markets.

At 7:32 AM on April 8, data from CoinMarketCap placed Bitcoin at $80,559.88, up 2.09% over the past day, with a market cap of $1.59 trillion and 24-hour trading volume of $88.59 billion.

While broader markets, including major Wall Street indices and Asian equities, began to stabilize following Monday’s steep losses, the recovery remains tentative. U.S. stock index futures pointed higher in Asian trading, helping support Bitcoin’s rebound.

However, when this article was written that evening, the price of BTC had again fallen by 0.56% and was trading at $78,853.

Trump’s Tariffs and Market Uncertainty

The renewed volatility stems from President Trump’s announcement of sweeping reciprocal tariffs targeting major economies. These measures, exceeding prior market expectations, rattled investors and drove a flight from risk assets—including cryptocurrencies.

Over the weekend, Trump doubled down on his stance, threatening even steeper duties on Chinese imports unless Beijing backs down from its own retaliatory measures.

Further uncertainty looms as the tariffs are set to take effect on Wednesday. Additional threats include potential levies on pharmaceutical and semiconductor imports — sectors critical to global supply chains.

Technical Warning: Bitcoin Confirms ‘Death Cross’

Despite Tuesday’s bounce, technical indicators remain bearish. Bitcoin recently formed a “death cross,” a key signal that occurs when the 50-day moving average falls below the 200-day moving average.

This pattern often precedes short-term weakness, particularly in markets lacking strong bullish catalysts.

Investing.com data confirmed the crossover this week, suggesting that Bitcoin could remain under pressure unless macroeconomic conditions improve or significant bullish triggers emerge.

Adding to concerns, several long-term Bitcoin holders have recently moved their holdings onto exchanges — often a precursor to selling.

Institutional Resilience and a Changing Investor Base

Despite recent price weakness, some analysts point to a more resilient foundation for Bitcoin. According to Bernstein analyst Gautam Chhugani, Bitcoin’s 26% pullback — though steep—is considerably milder than past crypto crashes, which sometimes saw losses of 70% or more.

Chhugani attributes this stability to the growing presence of institutional capital, including ETFs and corporate treasury allocations, which now dominate retail participation.

He views Bitcoin as a “probabilistic gold”—offering higher liquidity and volatility than traditional safe-haven assets like physical gold.

Indeed, year-to-date ETF inflows remain positive at approximately $770 million, suggesting continued confidence among larger players.

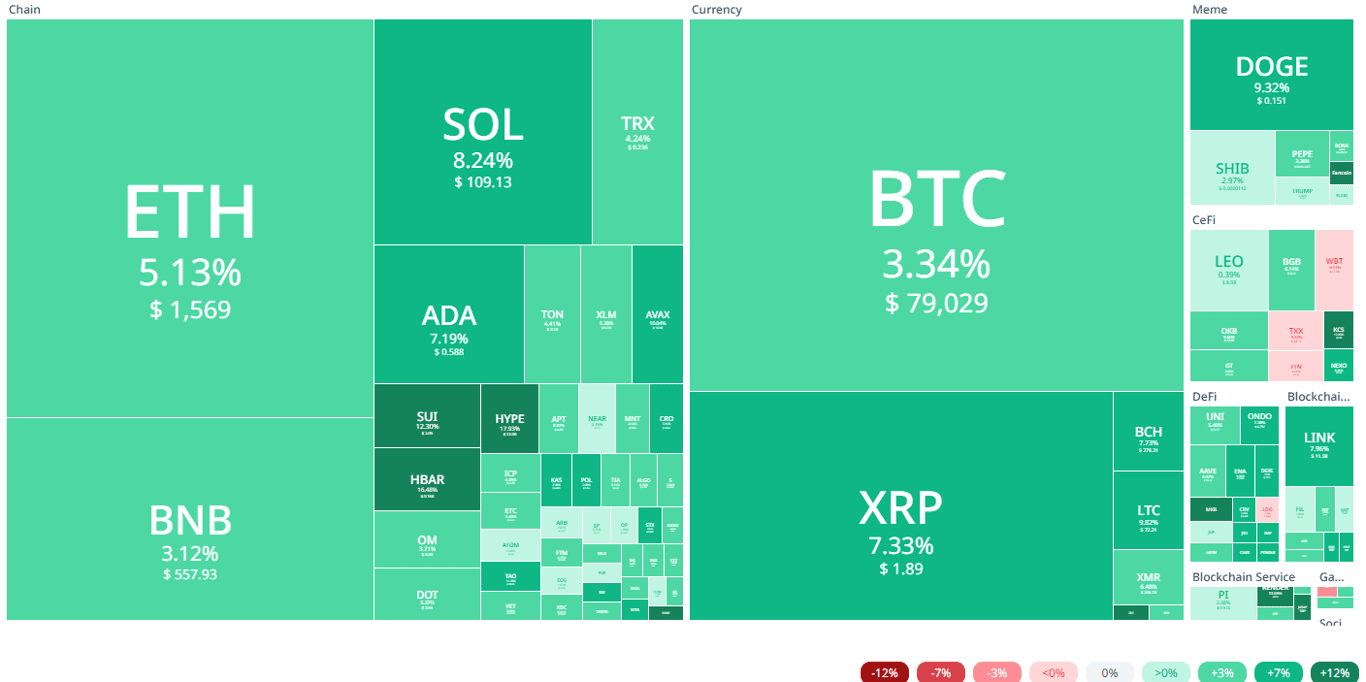

Altcoins Follow Bitcoin’s Lead

Broader cryptocurrency markets mirrored Bitcoin’s partial recovery. Ethereum, the second-largest cryptocurrency, climbed over 5% to $1,569, rebounding from a two-year low.

Solana, Cardano, Polygon, and XRP posted gains between 8% and 13%. Meme coins also saw movement, with Dogecoin soaring more than 9% and the politically-themed $TRUMP token rising 4.6%.

CoinSwitch Markets Desk reported Bitcoin briefly touched $74,600 before rebounding to around $80,800, with approximately $377 million worth of Bitcoin liquidated in the process. Altcoins posted more modest gains, with XRP up 1.6%, SOL up 4.9%, TRX up 2.3%, and ADA up 4.6%.

As of April 8, the global cryptocurrency market capitalization stands at $2.55 trillion, up 1.55% over the past 24 hours, while total market volume surged to $200.99 billion — a staggering 89.81% increase, reflecting heightened trading activity and volatility.

Looking Ahead: CPI Data and Market Sentiment

All eyes are now on upcoming U.S. Consumer Price Index (CPI) data, which could heavily influence market direction. A softer-than-expected inflation reading may ease investor concerns and catalyze a broader recovery across risk assets, including crypto.

Alankar Saxena, CTO and Co-founder of crypto investment platform Mudrex, noted that Bitcoin is currently testing resistance at $84,000 with key support at $75,900.

He emphasized the growing conviction among long-term holders, saying that Bitcoin, Ethereum, and Solana have rebounded as much as 15% from recent lows.

“Amid prolonged trade fragmentation and geopolitical strain, Bitcoin’s role as a potential safe-haven asset is being re-evaluated,” Saxena said. “This could add to its upward momentum, especially if traditional markets continue to remain volatile.”

Market Risks Still Loom

Still, risks remain elevated. According to data from Coinglass, around $1.5 billion in bullish crypto positions were liquidated in the last 24 hours — the largest such flush in 2025.

FalconX’s head of APAC derivatives, Sean McNulty, warned that options markets are now signaling sustained selling pressure, with demand for put options rising considerably.

Will Clemente, former co-founder of Reflexivity Research, expressed caution: “While I think we’re closer to the end of this correction than the beginning, market uncertainty remains high, and Bitcoin is not immune when investors must sell assets to meet margin calls or internal risk thresholds.”

Conclusion

Bitcoin’s bounce above $80,000 provides some relief to crypto markets rattled by global trade tensions, but the road ahead remains murky.

As investors digest tariff fallout and await crucial inflation data, Bitcoin’s ability to hold current levels—and possibly reclaim higher resistance—will depend on broader risk sentiment and macroeconomic signals.

Until then, traders should brace for continued volatility and remain attuned to shifting geopolitical developments that could further influence the trajectory of digital assets.

by Ferry Bayu | Apr 7, 2025 | Business

Discover the latest CPEN price predictions as the token prepares for its listing on global crypto exchange. Will CPEN hit $0.15? Explore analysis, tokenomics, market sentiment, and key milestones for the cPen Network’s blockchain-powered social media revolution.

As the blockchain space continues to evolve, the cPen Network is emerging as a fresh contender with a clear mission: to build a sustainable, community-centric blockchain ecosystem that effectively bridges digital assets with real-world applications.

The project is not just focused on mining and token trading, but also envisions becoming a next-generation Web3-based social media platform — think of a decentralized TikTok or Instagram with fairer rules and real ownership.

Now that CPEN has completed several development phases and is on the brink of being listed on exchanges like BitMart and WEEX, many are asking the big question:

What is the real value of the CPEN token at launch, and what does the future hold for its price?

What is cPen Network?

The cPen Network (CPEN) is a blockchain project that enables users to mine tokens directly from their smartphones. Its primary goal is to provide a practical and user-friendly blockchain infrastructure that encourages real adoption and narrows the technology gap.

Its standout feature lies in its community-first tokenomics—no presales, no private investors, and the majority of tokens are distributed to early contributors through mining and engagement.

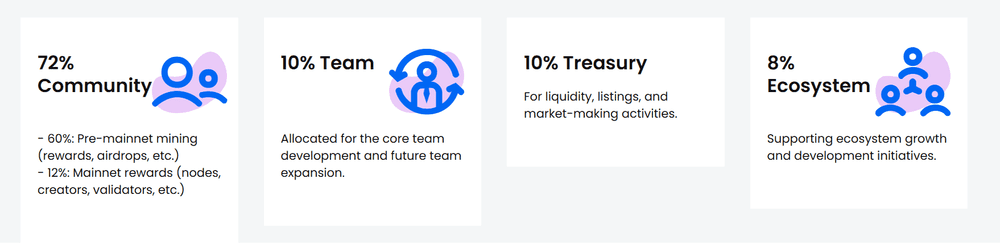

CPEN Tokenomics: A Transparent, Community-Focused Model

The tokenomics of CPEN reflect the project’s grassroots ideology:

1. Total Supply: 3,379,482,446.18 CPEN

2. Total Mined So Far: 2,027,689,467.71 CPEN

3. Token Allocation:

- 72% – Community Allocation: 60% for pre-mainnet mining and airdrops & 12% for mainnet participation (validators, node operators, content creators)

- 10% – Core Team

- 10% – Treasury (for listings, liquidity, etc.)

- 8% – Ecosystem Development and Partnerships

This model not only encourages decentralized participation but also minimizes the risk of early investor dumps—a common issue in many altcoin launches.

CPEN Token Rebranding: $PEN to $CPEN

In preparation for broader exposure, the cPen Network officially rebranded its token ticker from $PEN to $CPEN. This move is designed to avoid confusion with other similarly named assets. The rebranding is being reflected across apps and social media, though both tickers may temporarily appear interchangeably during the transition.

It’s important to note that this rebranding does not affect token balances or smart contract functionality, which has yet to be officially deployed.

CPEN Listing: Market Sentiment vs. Official Valuation

While the official listing price stated by the cPen app is $0.311, and its target or “asking” price is $1, the reality observed on exchanges like BitMart paints a different picture.

Early Exchange Data:

- @big_random_ shared a BitMart screenshot: 11,385 CPEN ≈ $34 → ~$0.00298/token

- @Harry_paul07 confirmed a similar price: 802.96 CPEN ≈ $2.41 → ~$0.003/token

- Official cPen post mentioned $0.311 listing, but no trades at this level have been observed.

These early indicators suggest the actual launch price is likely around $0.0028 – $0.003, substantially below the team’s stated valuation.

CPEN Price Prediction: Scenarios to Consider

1. Bullish Scenario – $0.005 to $0.15

If CPEN listings gain traction on WEEX and BitMart, and community support is strong, the token could surge, possibly reaching $0.05 to $0.10 in the coming months—especially if Binance or OKX listings follow.

2. Neutral Scenario – $0.002 to $0.008

A stable launch with moderate demand could see CPEN maintain a price range between $0.002 and $0.008, with slow but steady growth as awareness spreads.

3. Bearish Scenario – $0.001 to $0.003

If early miners rush to sell, a temporary dip may bring CPEN down to $0.001, before finding a stable floor. This would represent a natural correction phase ahead of potential long-term growth.

Key Influencing Factors for CPEN Price

Several critical factors will influence CPEN’s price movement in the short and long term:

1. Token Supply vs. Demand: A large circulating supply may suppress price unless demand catches up.

2. Exchange Liquidity: Listings on BitMart and WEEX will determine how smoothly CPEN trades.

3. Community Activity: The more engaged the users, the more valuable the ecosystem becomes.

4. Mainnet Launch: Scheduled for Q1 2026, the transition to the Open Network Blockchain could significantly boost token utility and value.

5. Exchange Listings: A Binance listing would likely act as a major catalyst, potentially pushing the price above $0.05.

Important Dates of CPen

1. March 29, 2025 – Deadline to submit BSC Wallet addresses

2. March 30, 2025 – CPEN token distribution begins

3. Early April 2025 – Expected listings on decentralized exchanges (DEX)

4. Q1 2026 – cPen Network Mainnet launch

With the KYC process completed, and app version updates rolled out (v1.2.20+), the platform is now in its final phase of preparation for full public trading.

Conclusion

The cPen Network is setting the stage for something bold: a blockchain-based social media revolution with fair token distribution and real-world application. Its early price may be modest compared to the team’s aspirations, but community support, strong tokenomics, and planned listings provide fertile ground for future growth.

If you’re considering getting involved with CPEN, now might be the time to stay extra tuned in. Follow their official channels, watch exchange listings, and keep an eye on market sentiment. Whether you’re a miner, investor, or blockchain enthusiast, CPEN could be a name to watch in the coming months.

by Ferry Bayu | Apr 7, 2025 | Banking and Finance

Exciting crypto news: Babylon’s $BABY token is launching on Bitrue, featuring staking rewards and airdrop events! Discover its utilities and token distribution, and learn how to benefit from the Babylon Protocol.

The crypto ecosystem is constantly evolving, bringing new opportunities for users. This week, one of the major stories comes from Bitrue, which is set to launch the Babylon $BABY token and hold a deposit contest.

What are the details, and what benefits will users receive? Read this article to find out!

Get to Know about Babylon $BABY

Before we discuss the launch of the $BABY token on Bitrue, let’s get to know Babylon first. The $BABY token is the native cryptocurrency of Babylon Genesis, which is the inaugural token of the Bitcoin Secured Network (BSN). This network is specifically designed to protect and manage various blockchain systems. The $BABY token has four main utilities: Governance, Network Security, Transaction Utility, and Rewards and Incentives.

Later, Babylon token holders can be involved in forming the direction of the protocol, which means users have a voice in the network.

Babylon token holders also support validator operations and maintain consensus.

Babylon tokens will later be used to pay network transaction fees.

$BABY tokens will later be distributed as staking rewards to $BABY and $BTC token stakers while promoting active participants in the network.

These four utilities demonstrate that networks built from this segment of Bitcoin will also incorporate smart contracts and staking, features that were previously absent in Bitcoin. As a result, users can feel assured that staking on the Babylon network is both safe and trustworthy.

In a post from the official Babylon Foundation account (@bbn_foundation), Babylon will conduct a $BABY token airdrop event as part of the Phase 1 transition. This airdrop program will be available to stakers during Phase 1.

A total of 6% of the Babylon supply, which amounts to 600 million BABY tokens, will be allocated for the Babylon airdrop program. The airdrop will be distributed alongside the launch of the Babylon Genesis blockchain. There are five categories for the Babylon airdrop program, which are as follows:

Stake Participation Airdrop

In this category, 30 million BABY tokens will be allocated for stakers who meet the requirements. There are three types of prize recipients in this category:

- Cap 1 participants with a total of 550 $BABY tokens received. In this first type, a total of 16.5 million BABY tokens were distributed.

- Cap 2 participants with a total of 150 BABY tokens with a total of 2.25 million BABY tokens

- Cap 3 participants with a total of 100 BABY tokens for each participant and a total of 11.2 BABY tokens distributed.

Base Staking Reward Airdrop

There are a total of 335 million $BABY tokens distributed in this category. Every eligible staker will receive a fixed allocation of BABY tokens for each BTC block. For more details, please refer to the following table.

Bonus Staking Reward Airdrop for Phase 2 Transition

The third category consists of 200 million BABY tokens that will be distributed to eligible recipients. Active stakers on March 31, 2025 will receive an airdrop bonus in addition to the second category if they successfully transition to Phase 2.

To receive this bonus, users must continue staking, register to stake on Babylon Genesis within 4 weeks of Network Launch, and continue staking for at least 100 consecutive days after registration.

The fourth category is aimed at NFT Pioneer Pass holders with a BABY token count of 30 million. Each holder will receive 300 BABY tokens per NFT. The block that will be taken as a requirement is Polygon 68305555.

GitHub Developer Recognition Program

A total of 5 million $BABY tokens will be distributed to users in this fifth category. A snapshot was taken at 8 AM UTC on February 23rd. If there are not enough eligible users, the tokens will be returned to the community allocation.

Babylon $BABY Launch on Bitrue: Coming Soon

Babylon will be launched on Bitrue on April 10, 2025. Many programs, such as launchpoo, staking, and power piggy, will provide benefits for Bitrue users.

In order not to miss the events that Bitrue will hold before or during the Babylon listing, you can immediately register as a Bitrue user. Later, you will join the community and become a targeting Bitrue core user who will receive the latest information.

by | Apr 6, 2025 | Business

XRP surges past $2.14 amid SEC regulatory shifts, Ripple lawsuit updates, and growing XRP ETF momentum. Explore price analysis, bullish vs bearish scenarios, and what’s next for investors.

XRP continues to gain ground amid a changing regulatory landscape, a positive market outlook for exchange-traded funds (ETFs), and technical indicators pointing toward a possible breakout.

Following a strong performance in early April, the cryptocurrency has caught the attention of investors once again, driven by speculation over U.S. Securities and Exchange Commission (SEC) decisions, ongoing Ripple litigation, and the potential entry of institutional giant BlackRock into the XRP-spot ETF space.

XRP Extends Gains Amid Broader Market Weakness

On Saturday, April 5, XRP posted a 0.73% gain, closing at $2.1443 after surging 3.21% the previous day.

This marked the third consecutive daily increase for the token, outperforming the broader crypto market, which declined by 0.44%. This brought the total cryptocurrency market capitalization to $2.64 trillion.

However, when this article was written on April 6, 2025, the price of XRP had actually fallen by 2.83% and is currently trading at $2.0913.

Despite near-term bearish signals from the charts, XRP continues to show resilience—driven by regulatory optimism and ETF speculation.

SEC Developments Spark Investor Optimism

A key driver behind XRP’s upward momentum lies in recent statements from SEC Acting Chair Mark Uyeda, who cited Executive Order 14192, focused on deregulation to spur prosperity.

Uyeda urged the Commission’s staff to review guidance related to digital assets, including the 2019 framework on Investment Contract Analysis—a document heavily relied upon in past enforcement actions such as SEC v. Ripple.

This review could lead to modifications or even a rescindment of the framework, a development that journalist and CryptoAmerica host Eleanor Terrett says might signal the SEC’s evolving stance.

Such a shift would likely ease regulatory pressure on XRP and similar assets, potentially paving the way for broader institutional acceptance.

Ripple Lawsuit Update: Settlement Discussions Progress

The Ripple vs. SEC legal battle remains central to XRP’s price trajectory. While Ripple CEO Brad Garlinghouse stated in March that the SEC planned to withdraw its appeal over the Programmatic Sales of XRP ruling, the agency has yet to confirm this move.

In response to this uncertainty, XRP retreated by 28% from its March 19 high of $2.5925.

However, Ripple has initiated a cross-appeal withdrawal and announced a potential settlement that includes:

- A reduced penalty of $50 million (down from $150 million),

- Removal of the injunction on institutional XRP sales in the U.S.

- The finalization of this settlement hinges on whether the SEC formally drops its appeal, leaving investors in suspense.

XRP-Spot ETFs: A Key Catalyst for Future Gains

One of the most significant drivers for XRP’s long-term value lies in the pending approval of XRP-spot ETFs. Currently, 18 applications are under SEC review.

While BlackRock has yet to file, analysts at AP Abacus suggest the firm is preparing to enter the space—potentially mirroring its successful Bitcoin ETF launch in January.

BlackRock’s entry could be transformative. The firm’s iShares Bitcoin Trust (IBIT) has already garnered $39.9 billion in net inflows, underscoring its influence in attracting institutional capital.

Should BlackRock file for an XRP ETF, institutional demand could surge, accelerating XRP’s path toward mainstream adoption.

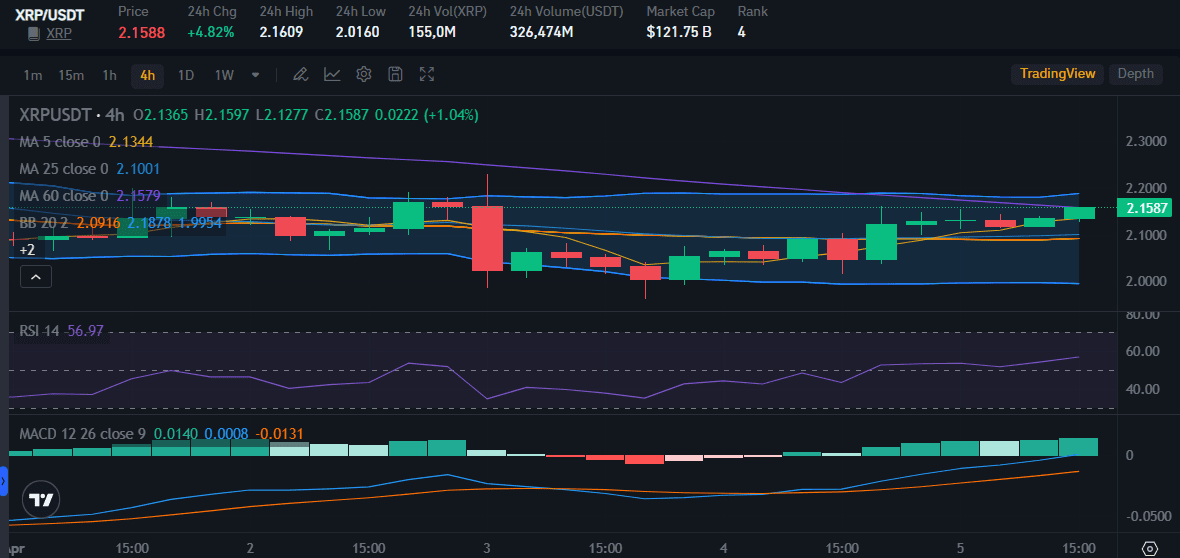

XRP Technical Outlook: Bullish Indicators Take Shape

From a technical standpoint, XRP is approaching a breakout. According to analyst Triparna Baishnab (via TradingView), XRP’s current price action shows bullish momentum:

- XRP trades at $2.1375, nearing key resistance at $2.14–2.15.

-

The MACD indicator has formed a golden cross, while the RSI stands at 60.36, reflecting growing but sustainable bullish pressure.

Should XRP break through the $2.15 resistance, it could climb toward the $2.17–2.18 range. However, failure to break out may lead to a temporary pullback toward the $2.10–2.11 support zone. Volume confirmation during a breakout will be critical to validating the next leg up.

XRP Price Scenarios: What Could Happen Next?

1. Bullish Case

- SEC formally withdraws its appeal in the Ripple case.

-

A final settlement is reached, lifting legal uncertainty.

-

Approval of XRP-spot ETFs triggers institutional buying.

-

XRP could test $2.5925, the March high, followed by $3.3999 (January high), and potentially reach its record high of $3.5505. With ETF momentum, XRP may even aim for $5.00.

2. Bearish Case

- Delays or lack of SEC action on appeals and ETF approvals.

-

Renewed legal wrangling or cross-appeals dampen sentiment.

-

A rejection from resistance and declining macro sentiment (e.g., Fed hawkishness or worsening trade tensions) could drag XRP below $2.00, with $1.9299 and $1.50 as potential support levels.

Macroeconomic and Market Conditions

XRP’s price action is also influenced by global macroeconomic factors. As tariff tensions between the U.S. and China escalate, markets have become increasingly volatile.

While equity markets tumbled, Bitcoin (BTC) and other cryptocurrencies have shown relative resilience, bolstering investor confidence in digital assets as alternative stores of value.

BTC, for instance, held near $83,828 after a week of volatility, while XRP outpaced BTC in recent gains. However, both assets are susceptible to changes in US inflation data, Federal Reserve policy, and crypto-related legislation.

Conclusion: XRP Poised at a Pivotal Moment

XRP’s current performance reflects a confluence of legal developments, technical indicators, and institutional momentum. With regulatory guidance under review, settlement talks advancing, and the prospect of ETFs on the horizon, XRP stands at a decisive crossroad.

- Investors should monitor:

- Any official SEC withdrawal of its appeal.

- Progress on Ripple’s settlement terms.

-

Announcements regarding XRP ETF applications, especially by BlackRock.

-

Broader economic indicators and legislative developments in the U.S.

If these catalysts align, XRP could embark on a significant rally. For now, cautious optimism prevails as the crypto market waits for clarity.

by Ferry Bayu | Apr 6, 2025 | Business

As Hari Raya approaches, Karaoke Manekineko is adjusting its pricing for a limited period to accommodate the festive demand. From March 31 to April 6, 2025, customers can expect temporary price changes across all karaoke sessions. Plan ahead and check the updated rates to enjoy a seamless and fun-filled karaoke experience during the holiday season!

In

line with the upcoming Hari Raya celebrations, Karaoke Manekineko

has implemented a temporary price adjustment for its karaoke sessions,

which will be in effect from March 31 to April 6, 2025. During this

period, customers are advised to check the updated pricing structure

before planning their visits to ensure a smooth and enjoyable karaoke

experience.

Adjusted Pricing for Hari Raya (Per Pax):

Promotion Period: March 31 – April 6, 2025

Available Time: 11 AM – Closing

(Daily)

Exclusive Raya Pricing (Per Pax):

✔ 1 Hour:

– RM15++ (Normal)

– RM13++ (Member)

– RM12++ (Student/Senior)

– RM7.50++ (Children 7-12 Y/O)

– FREE (Children 6 & below)

✔ 2 Hours:

– RM30++ (Normal)

– RM26++ (Member)

– RM24++ (Student/Senior)

– RM15++ (Children 7-12 Y/O)

– FREE (Children 6 & below)

✔ 3 Hours:

– RM35++ (Normal)

– RM33++ (Member)

– RM31++ (Student/Senior)

– RM17.50++ (Children 7-12 Y/O)

– FREE (Children 6 & below)

Why Celebrate Hari Raya at Karaoke Manekineko?

Free Flow Drinks & Tidbits – Stay refreshed with our

unlimited beverage selection and delicious tidbits.

Perfect for Families – With free entry for kids aged 6 and

below, it’s the perfect activity for the whole family!

Convenient Locations – Visit any of our branches and experience

the ultimate karaoke celebration.

Note: Prices are subject to 8% SST and a 10% service charge.

Don’t miss this opportunity to create joyful memories this Hari

Raya! Gather your loved ones, choose your favorite songs, and let the

celebrations begin! ✨

This press release has also been published on VRITIMES

by Ferry Bayu | Apr 6, 2025 | Business

Get ready to celebrate Hari Raya with Karaoke Manekineko’s Festive Special Delight! From March 28 to April 15, 2025, enjoy a delicious feast for three paired with a 3-hour karaoke session, complete with free-flow drinks and tidbits. Indulge in authentic Malaysian flavors while singing your heart out—this is the perfect way to make your festive gathering extra special!

Looking for the perfect way to celebrate Hari Raya with friends and family? Karaoke Manekineko presents its Festive Special Delight, an exclusive package that brings together delicious festive cuisine and fun-filled karaoke sessions.

Available

from March 28 to April 15, 2025, this limited-time offer is perfect for

groups of three, offering a delightful meal set paired with an exciting 3-hour

singing session.

️ A Feast Fit for the Festive Season

For just RM 98++ per set, you and your group can indulge in a selection of traditional Malaysian favorites, featuring:

✅ Ayam Masak Merah

with steamy rice – a rich, spicy tomato-based chicken dish

✅ Kapitan

Chicken Curry with fragrant rice – a creamy, aromatic curry with a unique

blend of spices

✅ Chicken

Cooked with Coconut Milk with white rice – a comforting, creamy

coconut-infused dish

✅ Durian

Mochi-Mochi – a delightful dessert featuring the king of fruits wrapped in

soft mochi

More Than Just a Meal – A Karaoke Experience!

Along with this festive feast, every set comes with a 3-hour

karaoke session, allowing you to sing your heart out while enjoying your

meal. Plus, you’ll get free-flow drinks and tidbits to keep you

refreshed and energized throughout your session!

Book Your Festive Celebration Now!

Celebrate Hari Raya in a unique way—with great food, endless

fun, and unforgettable karaoke moments. Gather your loved ones and reserve

your spot at Karaoke Manekineko today before this special promotion ends!

This press release has also been published on VRITIMES

by Penny Angeles-Tan | Apr 5, 2025 | Advocacy

The time, effort, and dedication required to train for a race or marathon make crossing the finish line incredibly rewarding for many runners. Similarly, creating a greener, more sustainable future demands a collective commitment of the same magnitude.

The first-ever GCash Eco Run transformed the streets of Ayala Avenue in Makati into a platform for this eco-movement. Over 12,000 eco-runners laced up their shoes—not just to achieve personal records but to make a lasting impact on the environment. Thanks to the support of event sponsors and sustainability partners, this milestone initiative has already resulted in the planting of 76,000 trees across 11 hectares in the Negros region, showcasing the powerful effects of our collective actions.

A race that goes beyond the finish line

In support of the South Negros Reforestation Initiative, which is a long-standing partnership between Silliman University and GCash, each sign-up for the GCash Eco Run contributed to the planting of a grey stilted mangrove tree in Negros Occidental. GCash doubled its commitment by pledging an additional tree for every participant. As a result, the runners contributed to the planting of a total of 24,000 new trees.

Grey stilted mangroves play a vital role in environmental conservation. They help mitigate the impacts of extreme weather, sequester carbon, and provide habitats for marine life. Consequently, mangrove forests are among the most effective natural ecosystems for carbon storage today, making them a crucial asset in the fight against climate change.

In line with its commitment to using technology for good, the GCash Eco Run served as a platform to raise awareness about sustainable living. The event brought together partner organizations and eco-conscious brands to share their initiatives and inspire collective action.

Various organizations championing different sustainability causes participated in the event. For example, Berdeng Kalaw collects paper and metal for recycling, while Caritas Manila converts clothing donations into funds for scholarships. Zolo specializes in reselling and recycling e-waste, and Aling Tindera focuses on gathering plastic waste for recycling.

Attendees had the opportunity to explore products from partner eco-merchants including Cut the Craft, Bukid ni Bogs, Wonderhome Naturals, Eco Shift, and Commune. They also received GCash VISA cards made from 100% recycled plastic.

GCash facilitates positive change by connecting partners with Silliman University, turning commitments into tangible action. With the support of eight collaborating companies for a greener future, a total of 52,000 trees will be planted in Negros, in addition to the 24,000 trees planted by the eco runners.

Nuvali Run Club members joined the 10KM race of the GCash Eco Run

Runners gather at the starting line of the first-ever GCash Eco Run, taking strides for sustainability and mangrove restoration–planting over 76,000 trees in the Negros region.

Continue taking steps for the environment with GForest

GCash is committed to making sustainable living easier and more accessible for every Filipino. Through its GForest initiative, users earn green energy points with every transaction on the GCash app, whether it’s cashing in, sending money, paying bills, buying load, or even taking 20,000 steps a day. These points can be redeemed to plant virtual trees and contribute to a greener future.

In collaboration with various partner organizations, GCash transforms these virtual trees into real ones planted in key areas across the country. This demonstrates how GForest serves as a platform for technology that promotes positive change.

“Much like how GForest turns virtual trees into actual ones, the GCash Eco Run brings together our community of Green Heroes, driven by a shared purpose to create real-world impact—one step, one tree, and one action at a time,” said CJ Alegre, GCash Head of Sustainability.

The largest digital eco-movement is growing even bigger. Every step we take, every action we make, and every tree we plant brings us closer to a greener future. Become a green hero today by signing up on the GForest feature in your GCash app dashboard.

The GCash Eco Run is proudly supported by corporate partners who have also committed to planting trees, including IKEA Philippines, Globe At Home, Pay & Go, and eTap Solutions. This initiative enhances Silliman University’s efforts in mangrove reforestation.

About GCash

GCash is the leading finance super app in the Philippines. Through the GCash app, users can easily perform various financial transactions, such as purchasing prepaid airtime, paying bills through a network of partner billers nationwide, and sending or receiving money anywhere in the Philippines, even to other bank accounts. Users can also shop from over 6 million partner merchants and social sellers. Additionally, GCash provides access to savings, credit, loans, insurance, and investment opportunities, all from the convenience of their smartphones.

The mobile wallet operations of GCash are managed by G-Xchange, Inc. (GXI), which is a wholly-owned subsidiary of Mynt— the first and only “duacorn” in the Philippines.

GCash is a strong advocate for the United Nations Sustainable Development Goals (SDGs), especially focusing on SDGs 5, 8, 10, and 13. These goals promote safety and security, financial inclusion, diversity, equity, and inclusion, as well as urgent action to combat climate change and its effects.

by | Apr 5, 2025 | Business

Stay updated on the latest XRP news, including Ripple’s legal battle with the SEC, market performance, and future price predictions. Explore expert insights on ETF prospects, regulatory developments, and key technical levels impacting XRP’s trajectory. Don’t miss out on what’s next for XRP!

On March 19, Ripple CEO Brad Garlinghouse revealed that the U.S. Securities and Exchange Commission (SEC) intends to withdraw its appeal against Judge Torres’ ruling on Programmatic Sales of XRP. However, the SEC has yet to formally comment on the matter, leaving uncertainty in the market.

In response, Ripple’s Chief Legal Officer, Stuart Alderoty, outlined proposed settlement terms that include:

- A reduction in the penalty from $150 million to $50 million. Initially, the SEC had sought $2 billion.

- The removal of an injunction restricting XRP sales to institutional investors.

The SEC’s next closed meeting, scheduled for April 3, could be pivotal in finalizing the appeal withdrawal. In the meantime, XRP has faced heavy selling pressure, plummeting 19% to $2.1088. If the SEC delays its vote, XRP could slip below $2.

Legal Experts Weigh In on the SEC Withdrawal Process

While optimism is high, legal analysts caution that a formal withdrawal may take time. Pro-crypto attorney Fred Rispoli suggested that the SEC Commission might vote on the matter within 30 days, with Judge Torres potentially vacating the injunction within the same timeframe.

“At most, we are 60 days out from this being 100%, formally, legally, and spectacularly over,” Rispoli stated.

XRP Market Performance and Outlook

On April 1, XRP rose by 2.35%, reversing its 2.24% loss from the previous day to close at $2.1389. However, it underperformed the broader crypto market, which saw a 2.81% gain, raising the total market capitalization to $2.7 trillion.

XRP’s future trajectory depends on several key factors:

1. SEC vs. Ripple Filings: Any motions related to the withdrawal of injunctions or case resolution could significantly influence market sentiment.

2. XRP Spot ETF Prospects: The potential approval of an XRP spot ETF in the U.S. could propel prices toward $3.5505. Conversely, delays in approval could limit gains.

3. Macro Risks: Economic factors such as trade tensions and recession concerns could push XRP down to $1.7938, while easing risks could support a rebound above $3.

Despite these considerations, technical indicators suggest bearish trends for XRP in the near term.

XRP Price Struggles Below Key Levels

XRP dropped over 5% on March 31 to a low of $2.06, increasing the risk of breaking below the crucial $2 threshold. The 200-day EMA at $1.94 is the last line of defense, and historically, falling below this level has led to accelerated declines.

XRP’s current technical structure is concerning, with a descending triangle pattern signaling an imminent breakdown. If support at $2 fails, the next major levels lie between $1.85 and $1.80. To reverse this trend, XRP must reclaim the $2.30–$2.40 range with strong volume.

Ripple Escrow Strategy and Supply Control

Ripple continues its strategic management of XRP supply, recently locking 700 million tokens in escrow. The firm releases 1 billion XRP monthly for institutional sales, operational costs, and liquidity but often returns a significant portion to escrow to stabilize the market.

In March, Ripple Labs opted not to release the scheduled 1 billion XRP, instead sending 700 million back into escrow. Analysts believe this move aims to control selling pressure and maintain price stability.

Ripple’s ongoing control over more than 40% of the total XRP supply remains a topic of debate. While some investors see this as strategic supply management, critics argue it centralizes influence over the token’s value.

SEC Case Resolution and Regulatory Impact

Ripple’s legal battle with the SEC has shaped its market performance. A U.S. court previously ruled that XRP sales on public exchanges were not securities, but institutional sales required compliance.

In January 2025, the SEC appealed, arguing that Ripple’s promotional efforts led to profit expectations, classifying XRP as an unregistered security under the Howey Test. However, with President Donald Trump’s pro-crypto stance, the SEC dismissed its appeal, and Ripple agreed to pay a reduced $50 million fine.

Broader Crypto Market Trends

The crypto market remains volatile, with macroeconomic factors adding uncertainty. On April 1, Bitcoin surged 3.20% to $85,150 but remains at risk due to ongoing U.S.-China trade tensions.

Key Market Themes to Watch:

- SEC vs. Ripple case resolution.

-

U.S. tariff developments and potential retaliatory actions.

-

Progress on the Bitcoin Act and broader crypto regulations.

-

U.S. labor market and inflation reports.

-

Institutional ETF inflows and outflows.

Conclusion: What’s Next for XRP?

At the time of writing this article on April 5, 2025, XRP was trading at $2.1588 with a gain of 4.82%. XRP’s near-term outlook remains uncertain, with potential downside risks if the SEC delays its case withdrawal. The $2 mark remains a crucial psychological and technical level.

If XRP fails to maintain support, further declines to $1.80 are possible. Conversely, positive regulatory developments and ETF progress could help push XRP toward $3.

Investors should remain cautious and monitor key legal and macroeconomic developments that could shape XRP’s future price action.

You must be logged in to post a comment.