by | Jan 28, 2025 | Business

Discover how DeepSeek, a Chinese AI startup, disrupted global markets with its cost-efficient R1 chatbot, surpassing ChatGPT and shaking U.S. tech dominance. Explore the ripple effects on industries, financial markets, and the future of AI innovation.

The recent emergence of DeepSeek, a Chinese artificial intelligence (AI) company, has sent shockwaves through the global technology industry and financial markets.

Its R1 chatbot model, reportedly developed for a fraction of the cost incurred by competitors like OpenAI’s ChatGPT and Google’s Gemini, has sparked debates about the future of AI innovation and U.S. dominance in the field.

A Wake-Up Call for U.S. Tech

President Donald Trump described DeepSeek’s launch as a “wake-up call” for American industries. Trump highlighted the company’s ability to achieve high performance with significantly fewer resources, noting, “You don’t have to spend as much money… I view that as a positive, as an asset.”

DeepSeek’s R1 chatbot has already surpassed ChatGPT in downloads from Apple’s App Store, demonstrating its widespread appeal. The company’s ability to challenge well-funded AI giants has led to market turmoil, with U.S. tech stocks plummeting on Monday.

Nvidia, a leading chipmaker, saw $600 billion wiped from its market value—the largest single-day loss in U.S. stock market history.

What Sets DeepSeek Apart?

DeepSeek’s breakthrough lies in its ability to deliver competitive AI performance with lower costs and hardware requirements. According to its founder, Liang Wenfeng, the company spent just $5.6 million on computing power for its R1 model, a stark contrast to the billions spent by U.S. firms.

Liang, who previously ran a hedge fund using AI for stock predictions, founded DeepSeek in 2023 in Hangzhou, China.

The R1 model has outperformed industry benchmarks, surpassing OpenAI’s o1-mini model and ranking higher than models developed by Google, Meta, and Anthropic.

Its cost-efficient approach has raised questions about the sustainability of the current high-cost model of AI development in the U.S.

Market Repercussions

The ripple effects of DeepSeek’s announcement were immediate and severe. The Nasdaq fell 3.1%, while the broader S&P 500 dropped 1.5%. The sell-off was concentrated in technology stocks, with Nvidia, Meta, Alphabet, and other AI-driven companies bearing the brunt.

The downturn extended beyond the U.S. Asian markets also reacted, with Japan’s Nikkei share average falling 1.3%. Prominent Japanese tech firms like Advantest and Tokyo Electron saw significant declines, exacerbating the global impact of DeepSeek’s rise.

Cryptocurrency Market Volatility

The cryptocurrency market wasn’t spared either. DeepSeek’s surge in popularity led to the creation of speculative tokens, including the Solana-based “DeepSeek AI Agent,” which saw dramatic price increases.

However, these tokens are unrelated to the company, highlighting the speculative frenzy surrounding its success.

Meanwhile, established cryptocurrencies like Bitcoin and Ethereum faced downward pressure as broader market sentiment shifted. Bitcoin, which had recently surpassed $100,000, experienced a brief dip before stabilizing around $101,856.

The AI “Sputnik Moment”

Marc Andreessen, a prominent U.S. venture capitalist, likened DeepSeek’s launch to the Soviet Union’s 1957 launch of Sputnik, calling it AI’s “Sputnik moment.” The analogy underscores the existential challenge DeepSeek poses to U.S. technological supremacy.

The Road Ahead

Despite the immediate market reaction, industry leaders like OpenAI’s Sam Altman remain optimistic. Altman acknowledged DeepSeek’s achievements but expressed confidence in the U.S. industry’s ability to innovate and stay ahead.

“DeepSeek’s R1 is an impressive model… but we will deliver much better models,” Altman said.

However, questions remain about DeepSeek’s long-term impact. Analysts caution that the company’s claims, particularly regarding costs, need further scrutiny. Additionally, U.S. firms are expected to accelerate their development efforts to maintain their competitive edge.

Conclusion

The rise of DeepSeek has disrupted global markets and challenged long-standing assumptions about AI development. Its success highlights the potential for innovation in unexpected places, even amid geopolitical tensions and resource constraints.

As the race for AI dominance intensifies, DeepSeek’s achievements serve as both a challenge and an inspiration, prompting industry players to rethink their strategies and push the boundaries of what’s possible in artificial intelligence.

The long-term implications for global markets, technology, and geopolitics are only beginning to unfold.

by | Jan 28, 2025 | Business

Discover XRP’s future potential in this detailed analysis. From Ripple’s groundbreaking partnerships to legal victories and market predictions, explore how XRP aims to revolutionize global finance. Can it hit $10 by 2025? Dive into the latest trends, technical insights, and expert opinions shaping the cryptocurrency’s journey.

In the ever-evolving world of cryptocurrency, XRP continues to make waves. With groundbreaking partnerships, innovative financial solutions, and a focus on transforming cross-border payments, XRP is strengthening its position as a key player in global finance.

As it navigates the challenges and opportunities of the market, the question remains: can XRP hit the $10 milestone by 2025? Here’s a deep dive into XRP’s current landscape, technical analysis, and future potential.

Ripple’s Global Ambitions

Ripple, the company behind XRP, has set its sights on becoming a leader in affordable and fast cross-border payments.

Collaborations with major financial institutions, such as Santander in the U.K. and the Canadian Imperial Bank of Commerce, highlight Ripple’s commitment to enhancing the efficiency and cost-effectiveness of global transactions.

Ripple’s launch of its stablecoin, RLUSD, further cements its innovative approach to blockchain technology. Unlike Bitcoin, which remains primarily a store of value, Ripple has ventured into areas like smart contracts, institutional finance, and scalable blockchain applications.

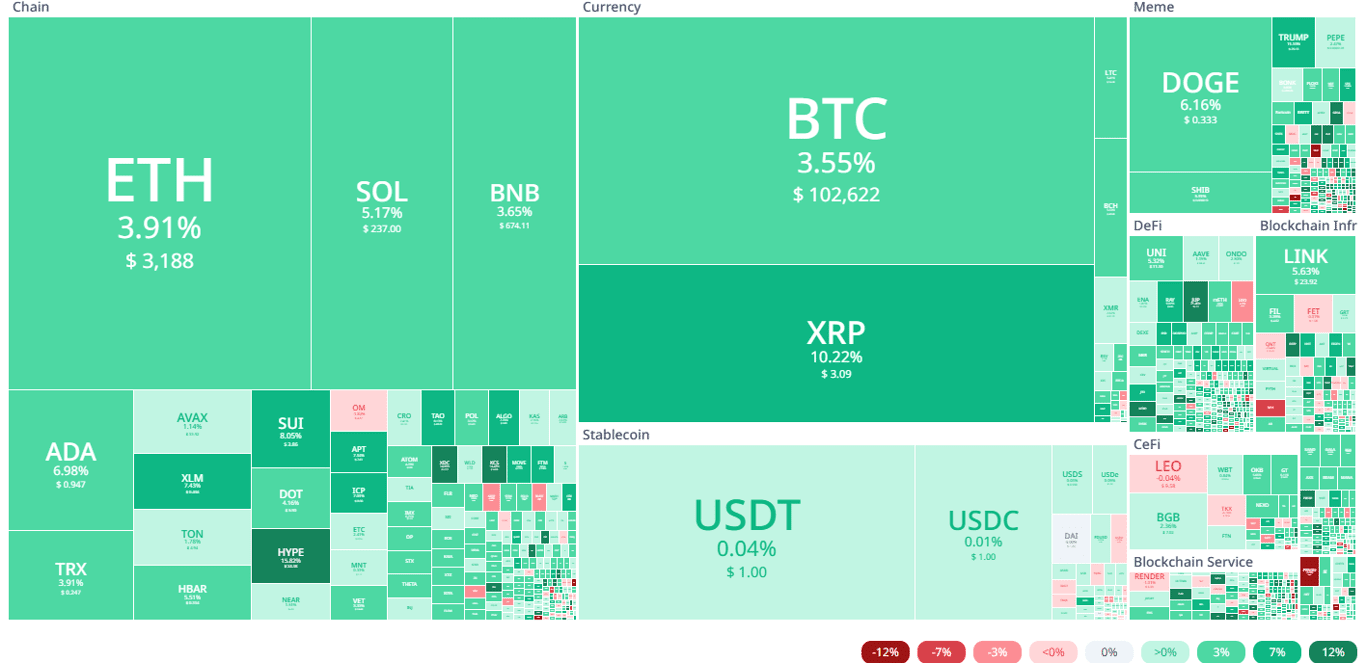

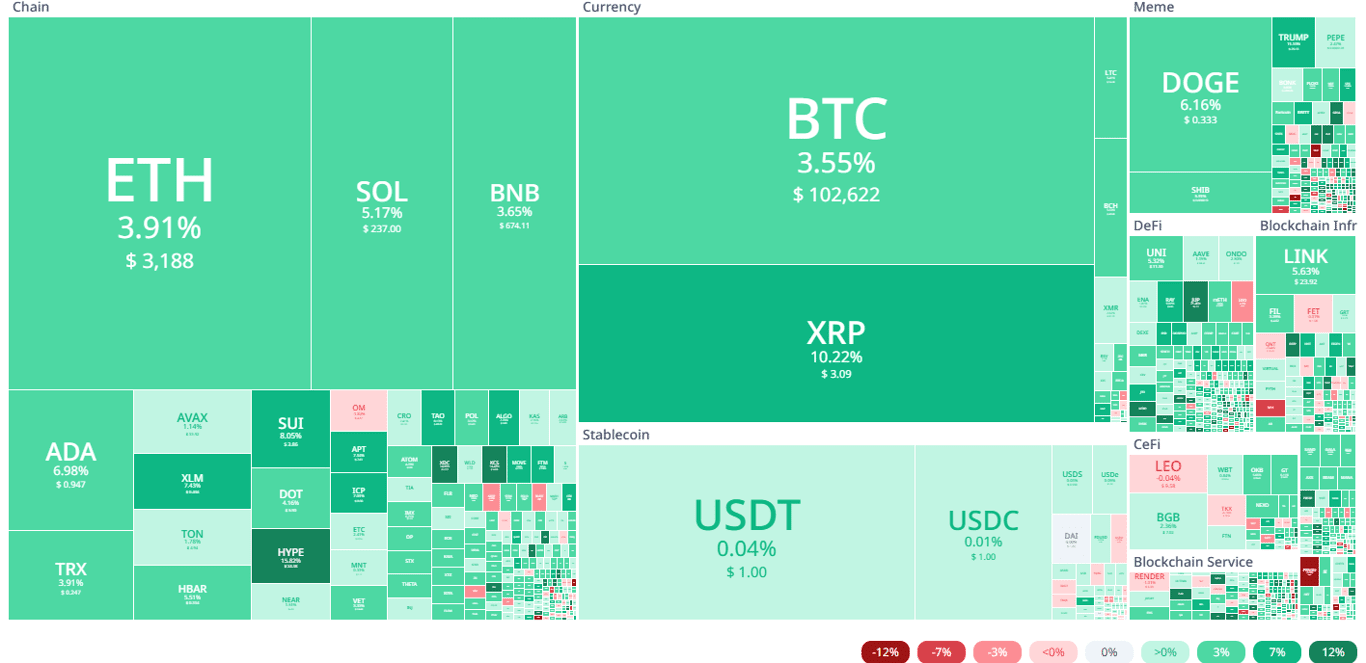

XRP’s Performance and Market Standing

As of January 28, 2025, XRP trades at approximately $3.1719, with a market capitalization of $178.16 billion, making it the fourth-largest cryptocurrency.

This is a remarkable recovery from its all-time low of $0.002802 in 2014 and a testament to its resilience, despite being 18.3% below its January 2018 peak of $3.84.

Technical analysis reveals key resistance levels at $3.17, $3.26, and $3.33, while support levels are observed at $3.02, $2.95, and $2.86.

The Relative Strength Index (RSI) hovers around 64, signaling a neutral market stance. However, a bullish pennant pattern suggests a potential 50% rally, targeting $4.66 if confirmed by high trading volumes.

Legal and Regulatory Developments

Ripple’s recent legal victory over the U.S. Securities and Exchange Commission (SEC) has been a pivotal moment. This triumph not only boosted investor confidence but also positioned Ripple as a leading blockchain company capable of navigating regulatory challenges.

Ripple’s acquisition of Money Transmitter Licenses (MTLs) in New York and Texas further strengthens its foothold in the U.S. market. These licenses allow Ripple to manage end-to-end cross-border payments for customers, showcasing its ability to adapt and expand amidst regulatory scrutiny.

Partnerships and Institutional Adoption

Ripple’s growing network of partnerships is a cornerstone of its success. Collaborations with global financial giants have bolstered its reputation, while the increasing use of XRP for cross-border transactions underscores its utility.

Rumors of XRP being considered for the U.S. Strategic Crypto Reserve have also fueled speculation. President Donald Trump’s recent executive order emphasizing blockchain technology has drawn attention to XRP’s efficiency and potential role in safeguarding national interests.

XRP vs. Bitcoin: The Battle Continues

The XRP/BTC trading pair remains a hot topic in the crypto market. Recent fluctuations have showcased XRP’s volatility, with the token losing 9% against Bitcoin before rebounding significantly.

XRP’s ability to recover and climb above key levels, such as the middle curve of the Bollinger Bands, highlights the strength of its buyers.

If XRP maintains its upward trajectory against BTC, it could see a 16% rise, with potential targets around 0.0000335 BTC. However, the historic high of 0.000245 BTC, set in 2017, appears unlikely to be reached again, as it would imply an astronomical valuation for XRP.

Market Predictions and Whale Activity

Market analysts offer a range of predictions for XRP in 2025. Some foresee prices between $5 and $7, while others suggest a broader range of $5 to $100, depending on market conditions and adoption rates.

Achieving a 10X increase to $31.40, however, would require unprecedented growth and widespread institutional support.

Whale activity has also been a driving force behind XRP’s recent price movements. Large investors have accumulated over 120 million XRP during price dips, reducing circulating supply and potentially triggering future rallies.

Challenges and Opportunities

Despite its momentum, XRP faces challenges, including market volatility and the lingering effects of its legal battles. However, its growing adoption, strategic partnerships, and innovative solutions position it well for long-term success.

The decline in XRP held on exchanges suggests a shift toward self-custody, reducing immediate selling pressure and indicating bullish sentiment among investors.

Conclusion: Can XRP Hit $10?

While the idea of XRP reaching $10 by 2025 remains speculative, its current trajectory is undeniably promising. Ripple’s technological advancements, legal victories, and expanding network of partnerships create a strong foundation for growth.

However, achieving such a milestone would require favorable market conditions, regulatory clarity, and continued adoption.

For now, XRP’s resilience and innovation keep it in the spotlight, with its potential to transform global finance drawing attention from investors and institutions alike. Whether it reaches $10 or not, XRP’s journey is a testament to the evolving landscape of cryptocurrency and blockchain technology.

by | Jan 28, 2025 | Business

Moonleaf is elevating the excitement with its partnership with Mobile Legends: Bang Bang (MLBB) to celebrate the launch of its brand-new in-game feature, the Neighborhood Map.

Get ready to rank up your game because Moonleaf and Mobile Legends: Bang Bang (MLBB) have teamed up to bring you something epic with the Neighborhood Map! This exciting new feature in MLBB connects the virtual world with real-life Moonleaf branches, giving players the chance to earn exclusive rewards while exploring the game and sipping on their favorite drinks.

Starting TODAY, MLBB players can unlock exciting perks at Moonleaf branches by completing in-game tasks in the Neighborhood Map. Whether you’re a hardcore gamer, a milk tea enthusiast, or both, this campaign provides a fun way to play, sip, and win.

Participants can follow these simple steps to claim their rewards:

- Open the MLBB app and tap on the Neighborhood Map feature.

- Locate the nearest Moonleaf branch in your area.

- Complete the required in-game tasks and visit the branch to claim your reward!

Players can earn rewards such as Free Upsize, 30 pesos off, and Buy 1 Get 1 offers. For more reward details, visit the Neighborhood Map via the MLBB app now!

Moonleaf and MLBB are preparing additional exciting surprises for loyal players and milk tea lovers. Announcements and exclusive events will be revealed throughout the campaign period.

Join the excitement and share your experience by tagging Moonleaf and Mobile Legends with the hashtags #NeighborhoodMap and #TaraMoonleaf. The adventure is just getting started, and exclusive rewards are waiting for you, both in-game and at Moonleaf branches across the country!

###

by | Jan 28, 2025 | Business

Explore the dynamic shifts in the cryptocurrency market ahead of India’s Budget 2025. From Bitcoin’s volatility to calls for progressive regulations, discover global trends, key challenges, and the expectations driving the crypto sector’s future.

As the announcement of India’s Budget 2025 looms, the cryptocurrency sector is brimming with anticipation. Rising Bitcoin prices and President Donald Trump’s supportive stance on digital assets have set the stage for potentially groundbreaking developments.

However, the volatile state of the global crypto market and uncertainties surrounding regulations present a mixed picture.

Optimism in India’s Crypto Community

Prominent industry leaders are calling for progressive reforms in the upcoming Union Budget. Nikhil Sethi, Founder and MD of Zuvomo, highlighted the pressing need for a regulatory framework aligned with global standards.

He emphasized that ambiguity in compliance and regressive tax policies, such as the 30% tax on crypto income and the 1% TDS mechanism, have stifled innovation and pushed talent abroad.

“Decentralization cannot be banned, only regulated,” he stated, urging India to follow in the footsteps of countries like the U.S., Singapore, and South Korea, which have embraced crypto-friendly policies.

Similarly, Raj Karkara advocated for recognizing crypto as a formal asset class with clear classifications. He believes that regulatory clarity would not only protect investors but also provide a stable foundation for the industry to thrive.

Kavitha Kanaparthi, Founder and CEO of Soulverse, stressed the importance of simplifying tax rules to allow offsetting losses from one cryptocurrency against another. She argued that a robust framework addressing anti-money laundering (AML) and counter-terrorist financing (CTF) would benefit investors and governments alike.

Global Crypto Trends: Challenges and Opportunities

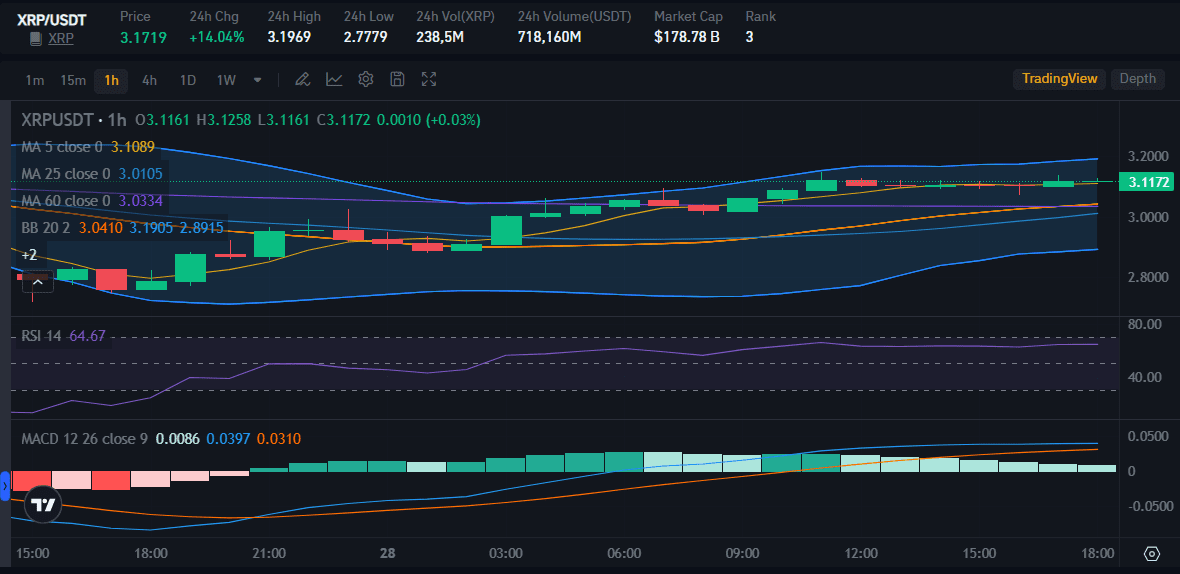

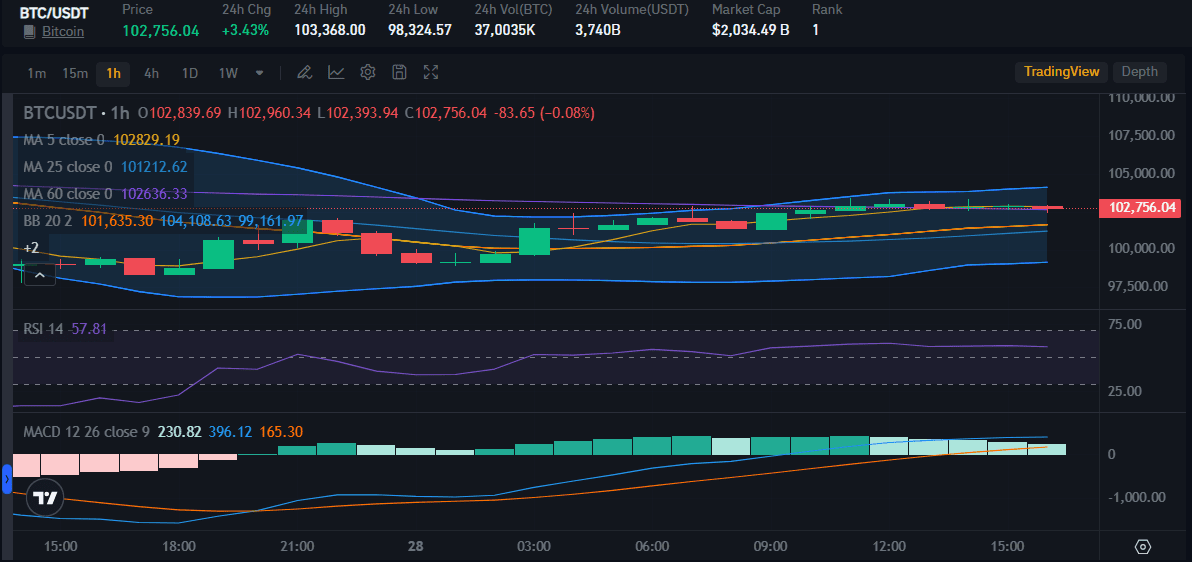

Globally, the crypto market has witnessed turbulence, with Bitcoin and major altcoins experiencing sharp declines.

Bitcoin, which recently approached its all-time high of $109,114, fell 5.1% over the past 24 hours to trade just above $99,000. However, as of this writing on January 28, 2025, the price of BTC has already risen back above $100,000.

This drop coincided with a broader market sell-off driven by several factors:

1. DeepSeek’s AI Innovation and Its Ripple Effects

A Chinese startup, DeepSeek, announced the development of a competitive AI model at a fraction of traditional costs. This sparked concerns about U.S. dominance in AI and caused a sell-off in tech stocks, which had a cascading effect on cryptocurrencies.

The Nasdaq fell 3%, with Bitcoin miners like Core Scientific and Terawulf suffering losses of over 29%.

2. Trump’s Executive Orders and Market Reaction

President Donald Trump’s recent executive orders, including the creation of a “Presidential Working Group on Digital Asset Markets,” aimed to establish federal regulations for digital assets.

This move boosted investor confidence, with global crypto funds attracting $1.9 billion in net inflows last week, as reported by CoinShares.

However, Trump’s lack of direct mention of Bitcoin in his orders has raised skepticism about his commitment to establishing a Bitcoin reserve.

3. Market Sensitivity to Macroeconomic Forces

The crypto market’s rapid shift into bearish territory highlights its sensitivity to macroeconomic changes.

With the U.S. Federal Reserve’s upcoming policy meeting, investor uncertainty has deepened, resulting in a 5.2% drop in the total crypto market cap, now standing at $3.42 trillion.

The Role of Industry Leaders and Institutional Investments

MicroStrategy, a key player in institutional Bitcoin investments, continues its aggressive accumulation strategy. The company recently acquired 10,107 BTC, bringing its total holdings to 471,107 BTC. This move underscores the growing role of institutional players in shaping the crypto market.

Meanwhile, altcoins such as Ethereum, XRP, Solana, and Cardano mirrored Bitcoin’s losses, with declines ranging from 7% to 11%. Memecoins like $TRUMP have also faced volatility, raising ethical questions about market manipulation.

The Road Ahead: Expectations from Budget 2025

India’s crypto community is hopeful that Budget 2025 will usher in reforms to support innovation and growth. Simplified taxation policies, clear regulatory guidelines, and recognition of cryptocurrencies as a formal asset class are among the top demands.

Such measures would not only protect consumer interests but also attract institutional investments and foster a favorable environment for startups.

As global trends reveal both the opportunities and vulnerabilities of the crypto market, India has a chance to position itself as a leader in the digital asset revolution. By aligning its policies with international standards, the country can unlock the full potential of this transformative technology.

In conclusion, while the crypto market remains volatile, the anticipation surrounding Budget 2025 offers a glimpse of optimism for the future. The coming days will reveal whether India can rise to the occasion and set a precedent for progressive crypto regulations.

by | Jan 28, 2025 | Business

The introduction of mandatory and enforceable service standards for all large APRA-regulated superannuation funds is welcome but long overdue.Community has high expectations around release of superannuation benefits at a time of death, illness, or injury.

CPA Australia’s Superannuation Lead, Richard Webb, today said that while the Government’s introduction of mandatory and enforceable service standards for all large APRA-regulated superannuation funds is a welcome reform to the superannuation system, it is long overdue.

“These reforms to superannuation have been long overdue and something CPA Australia has been calling for. There are standards for other matters, but the most sensitive of queries in the event of death or disability have been left out,” Mr Webb said.

“Insurance and death benefits are key features of superannuation which have routinely been forgotten about. This is a welcome reform to important and necessary features of superannuation in Australia.

“The community has the highest expectations around the release of superannuation benefits at the time of death, illness or injury, and rightly so as these are serious events.

“It’s crucial that information at a time of death or disability is completely clear, with minimal delays. Sensitivity during this time is of upmost importance.

“Ensuring that this process has robust service standards in place ensures that fund members know exactly what to expect from their fund – and what their fund expects from them – when one of these life changing events occurs,” Mr Webb added.

Mr Webb said CPA Australia looks forward to engaging with the Government to ensure these reforms are handled in a way the community expects.

You must be logged in to post a comment.