by | May 25, 2025 | Business

Inside Donald Trump’s $TRUMP meme coin dinner: a $394M crypto gala raising legal, ethical, and political alarms over foreign influence, campaign finance, and blockchain-era power plays.

On the evening of May 22, over 200 wealthy crypto enthusiasts, influencers, and foreign investors converged at Trump National Golf Club in Sterling, Virginia, for what was marketed as “the most exclusive invitation in the world.”

The event, a black-tie dinner hosted by President Donald Trump, was not a political fundraiser, at least not in name. It was a lavish reward for those who had invested millions into the volatile $TRUMP meme coin, a cryptocurrency intimately tied to Trump and his family.

While the evening featured filet mignon, halibut, a presidential appearance, and the flash of Richard Mille watches, the fallout from the event continues to stir legal, ethical, and political concerns.

These range from allegations of foreign influence and “pay-to-play” access to questions about cryptocurrency regulation and the future of political fundraising in the digital age.

A Crypto Contest for Presidential Access

In a modern twist on political patronage, the $TRUMP coin event promised exclusive dinner access to the 220 largest holders of the meme coin, with the top 25 receiving VIP perks including a private reception and a tour of the golf club.

According to blockchain analytics firm Nansen, these attendees spent a combined $394 million to qualify, with individual investments ranging from $55,000 to $37.7 million. On average, each participant shelled out nearly $1.8 million.

Although the event was ostensibly personal and not political, 80% of the $TRUMP coin is owned by two Trump-affiliated companies: CIC Digital and Fight Fight Fight LLC.

The companies collect transaction fees on every coin trade, generating almost $900,000 within two days of the dinner’s announcement.

Critics argue that this structure blurs the line between private gain and public office — especially when the main draw of the investment appears to be access to the President himself.

A Brief Appearance, Mixed Reactions

Despite the high price of entry, many attendees came away underwhelmed. Trump appeared for only 23 minutes, according to 25-year-old guest Nicholas Pinto. He delivered a short speech echoing previous crypto talking points before departing via helicopter without engaging meaningfully with most guests.

“He didn’t talk to any of the 220 guests, maybe the top 25,” said Pinto. “The food sucked. Wasn’t given any drinks other than water or Trump’s wine. I don’t drink, so I had water. My glass was only filled once.”

Phones were not restricted, and security was reportedly lax. After Trump’s departure, the atmosphere shifted noticeably. “Lots of people didn’t even hold the coin anymore,” Pinto added. “They were checking their phones during dinner to see if the price moved.”

Indeed, the price did move, and not in a favorable direction. Within hours of the dinner, $TRUMP’s value plummeted by 16%, casting a shadow over the event’s financial optimism.

Foreign Influence and Regulatory Red Flags

One of the most controversial aspects of the event is the heavy involvement of foreign investors. Bloomberg News reported that at least 56% of the top 220 coin holders used foreign crypto exchanges, all of which claim to ban U.S. users.

Crypto researcher Molly White estimates that 72% of the wallets tied to the contest winners likely belong to non-U.S. nationals.

The top holder, “Sun,” has been linked to Chinese-born crypto mogul Justin Sun, who faces paused SEC fraud charges and is tied to the offshore exchange HTX.

Sun’s holdings include over $22 million in $TRUMP and another $75 million in World Liberty Financial’s stablecoin project, USD1, a coin backed by U.S. Treasurys and heavily promoted by the Trump family.

This has raised serious ethical questions, as U.S. law prohibits campaign donations from foreign nationals.

While the White House insists the dinner was not a political event, critics argue it functions as a de facto fundraiser, one that bypasses campaign finance laws under the guise of a cryptocurrency promotion.

Political and Legal Backlash

Lawmakers across the political spectrum expressed concern. Democratic Senators Richard Blumenthal and Chris Murphy called the event a “pay-to-play scheme” and “the most brazenly corrupt thing a President has ever done.”

Even Republican crypto advocate Senator Cynthia Lummis admitted the event gave her “pause.”

“Congress should demand the President disclose who’s paying him tribute in the shadows,” said Tony Carrk, executive director of the watchdog group Accountable.US. “We have strict laws to prevent undue foreign influence. This event appears to mock them.”

Although presidents are largely exempt from conflict-of-interest laws that apply to other federal employees, watchdogs warn that Trump’s crypto ventures could set a dangerous precedent, blending personal profit with the aura and authority of the presidency.

Trump’s Growing Crypto Empire

This isn’t Trump’s first foray into monetizing his political persona. His family has intertwined their private businesses with his presidency before, and the $TRUMP coin represents the next iteration of that strategy, aided by blockchain anonymity and lax international enforcement.

The Trump family has heavily backed World Liberty Financial, which manages the USD1 stablecoin. Abu Dhabi’s MGX fund recently pledged $2 billion in USD1 to Binance, marking one of the largest single crypto investments to date.

Despite once calling Bitcoin a “scam against the dollar,” Trump’s administration has dismantled key crypto regulatory bodies, including the SEC’s crypto team and the Justice Department’s digital task force.

At the same time, it has promoted stablecoin legislation that could dramatically benefit Trump-affiliated ventures.

Conclusion: A Crypto Presidency?

As cryptocurrency continues to blur the lines between finance, politics, and personal branding, Donald Trump’s $TRUMP coin dinner has ignited a firestorm of questions that go well beyond digital tokens.

From foreign influence and campaign finance loopholes to regulatory rollback and potential corruption, the event illustrates how emerging technology is challenging long-standing democratic norms.

Whether this was a celebration of innovation or a symbol of systemic erosion depends largely on one’s political perspective. But one thing is clear: in the age of meme coins and blockchain politics, access to power is being redefined, one coin at a time.

by | May 25, 2025 | Business

Explore Brainrot (ROT) price predictions for 2025. Will this Solana-based meme coin regain momentum, or is high volatility a red flag for investors? Find out key forecasts, risks, and expert insights.

As meme coins continue to play a volatile yet attention-grabbing role in the cryptocurrency market, Brainrot (ROT) has emerged as a unique contender. Built on the Solana blockchain and fueled by viral internet culture, ROT represents both the unpredictability and potential of low-cap tokens.

With ROT currently trading around $0.00017 and exhibiting high volatility, many investors are asking: what lies ahead for Brainrot in 2025 and beyond?

What Is Brainrot (ROT)?

Brainrot is a low-cap meme token that rides the hype wave of internet slang and viral trends, particularly within the Solana ecosystem.

Despite its humorous branding, ROT has captured attention on platforms like Raydium—a popular decentralized exchange (DEX) on Solana. However, the project remains largely speculative, with limited information available regarding its roadmap, team, and technical whitepaper.

Current Market Status

1. Price: ~$0.00017

2. Market Cap: ~$172,000

3. 24h Volume: ~$306

4. Circulating Supply: ~999.32 million

5. Max Supply: ~999.41 million

6. Ranking: ~#5777 globally

The token is currently down nearly 55% year-to-date and trades approximately 98% below its all-time high of $0.01211.

Technical Analysis: May 2025 Overview

ROT’s current trajectory is bearish. Several key technical indicators reflect ongoing downward pressure:

1. RSI (Relative Strength Index): Current RSI: 0.00 (1-week timeframe). Indicates oversold conditions, but also reflects severe lack of buying momentum. The RSI needs to climb above 50 to signal a potential reversal.

2. Moving Averages (MA): The 50-day MA has crossed below the 200-day MA, a classic bearish signal. However, ROT’s price is trading slightly above both, suggesting neutral trend potential in the short term.

3. MACD (Moving Average Convergence Divergence): MACD shows bearish divergence with a negative histogram for the last 50 periods, indicating persistent selling pressure.

ROT Price Forecast 2025 and Beyond

1. 2025 General Forecast

While the average price suggests upside potential, short-term indicators still warn of bearish movements before any sustainable rally.

2. Monthly Price Predictions: June–December 2025

ROT may reach an annual average of $0.00008644 in 2025, implying potential recovery if macro conditions stabilize.

3. Expert Forecasts for Brainrot

1. 3Commas: Predicts a steady climb in ROT prices, with AI-assisted analysis projecting highs near $0.00020 by mid-2025.

2. TradingBeasts & Wallet Investor: Both forecast ROT’s minimum price to hover around $0.00015, with possible peaks just above $0.00020. Consensus average: $0.00017524641

Investment Outlook

According to current projections:

- Holding $1,000 in ROT may return approximately $604 profit (60.43% ROI) by December 2025—if bearish trends continue and short positions are strategically executed.

- However, predictions also show a possible drop to $0.00009503 by June 2025, a -45.23% loss if trends worsen.

Volatility remains a double-edged sword, offering both opportunity and high risk.

What Influences ROT’s Price?

Core Drivers:

1. Supply & Demand: With nearly all tokens in circulation, supply shocks are unlikely unless deflationary mechanisms are introduced.

2. Solana Network: Fast, cheap transactions make ROT easily tradable, which could aid adoption.

3. Community Hype: As with many meme coins, community engagement and viral momentum remain essential.

4. Institutional or Whale Activity: A single large sell order can drastically impact ROT’s price.

5. Regulatory Shifts: Future compliance requirements or delistings can affect market perception.

How High the Risk of ROT?

ROT is a high-risk, high-reward asset, primarily driven by speculation. With limited project documentation, unclear use cases, and very small daily trading volumes, it is not ideal for long-term conservative investors.

However, traders who understand meme coin cycles and market sentiment may find short-term opportunities in ROT’s price swings.

Conclusion

The future of brainrot (ROT) remains uncertain but not without potential. If viral traction returns, or if Solana meme coins re-enter mainstream interest, ROT could see a strong upside.

But investors should tread carefully, conduct independent research, and never invest more than they can afford to lose.

by | May 25, 2025 | Business

Bitcoin hits a historic $111K high in May 2025 amid regulatory breakthroughs and institutional demand. Explore key drivers, expert forecasts up to $1M, and what lies ahead on the road to $120,000.

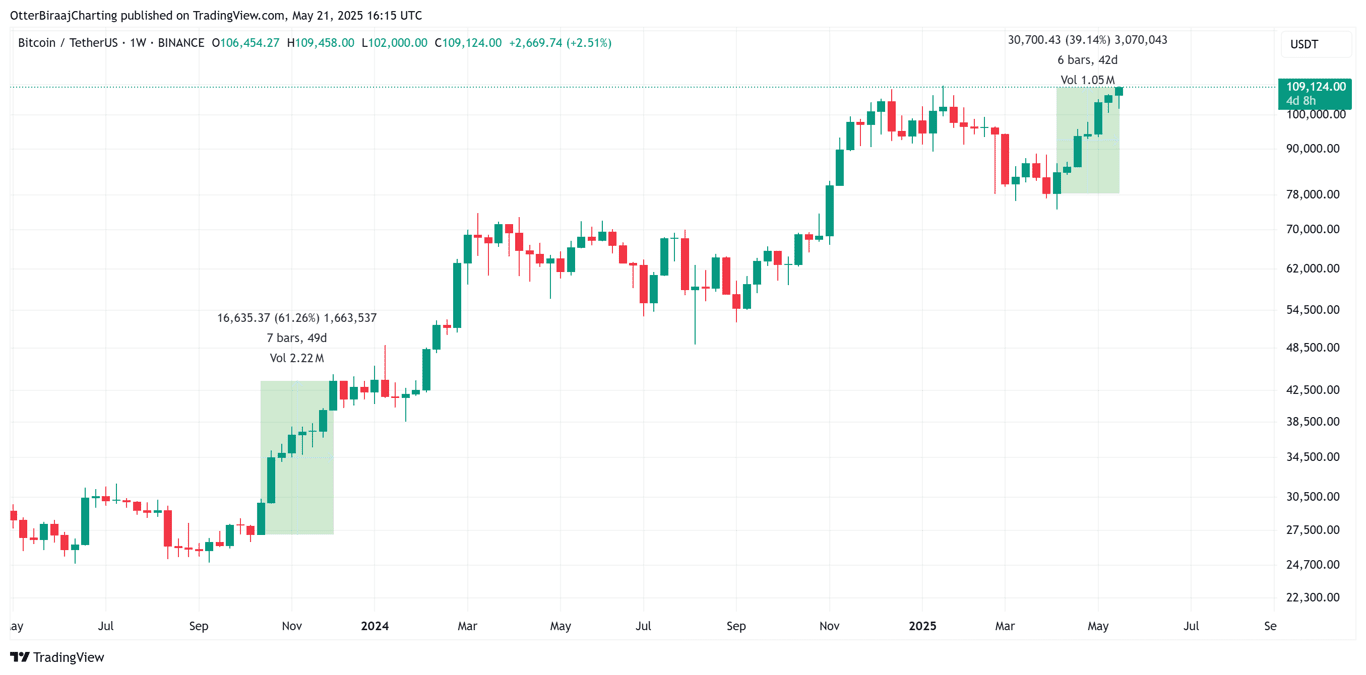

May 2025 has seen Bitcoin (BTC) not just reclaim its momentum but shatter records—rising above $110,000 for the first time in history and igniting fresh waves of institutional and retail interest.

In what many analysts are calling the beginning of a new supercycle, the world’s largest cryptocurrency appears to be entering uncharted territory, driven by legislative progress, corporate adoption, and favorable macroeconomic conditions.

Historic Surge: Bitcoin Tops $110K Amid Regulatory Wins and Institutional Demand

Bitcoin’s meteoric rise has captivated the financial world once again. On Wednesday, BTC soared past $110,000, hitting an all-time high of $111,999 before settling around $111,046.88—a gain of over 45% since its early April low of $76,000.

The rally marks seven consecutive weeks of green candles and pushes Bitcoin’s market capitalization to $2.17 trillion, with its realized cap reaching $911.5 billion, according to Glassnode.

This surge came on the heels of multiple bullish catalysts. Chief among them was the Senate’s advancement of the GENIUS Act, the first comprehensive stablecoin regulatory framework in the U.S., signaling a tectonic shift in how Washington approaches crypto.

President Trump, now in his second term, has made crypto regulation a legislative priority, with plans to sign the bill into law by August.

The regulatory optimism was further fueled by JPMorgan CEO Jamie Dimon’s announcement that the bank will now allow clients to purchase Bitcoin—a stunning reversal from one of crypto’s most vocal critics.

Corporate Treasuries and Institutional Adoption Fuel the Rally

Beyond policy, Bitcoin’s latest ascent is also deeply rooted in rising demand from corporate treasuries.

Michael Saylor’s MicroStrategy (MSTR) made headlines again after purchasing an additional $765 million in BTC last week, bringing its total holdings to over $63 billion.

Analysts note that such moves are no longer outliers; public companies now hold roughly 15% of the total Bitcoin supply—a 31% increase since the start of the year.

Bitcoin ETFs continue to gain traction, with consistent inflows and strong institutional engagement. Global ETPs (exchange-traded products) now manage a record volume of BTC, indicating a transition from speculative asset to strategic reserve.

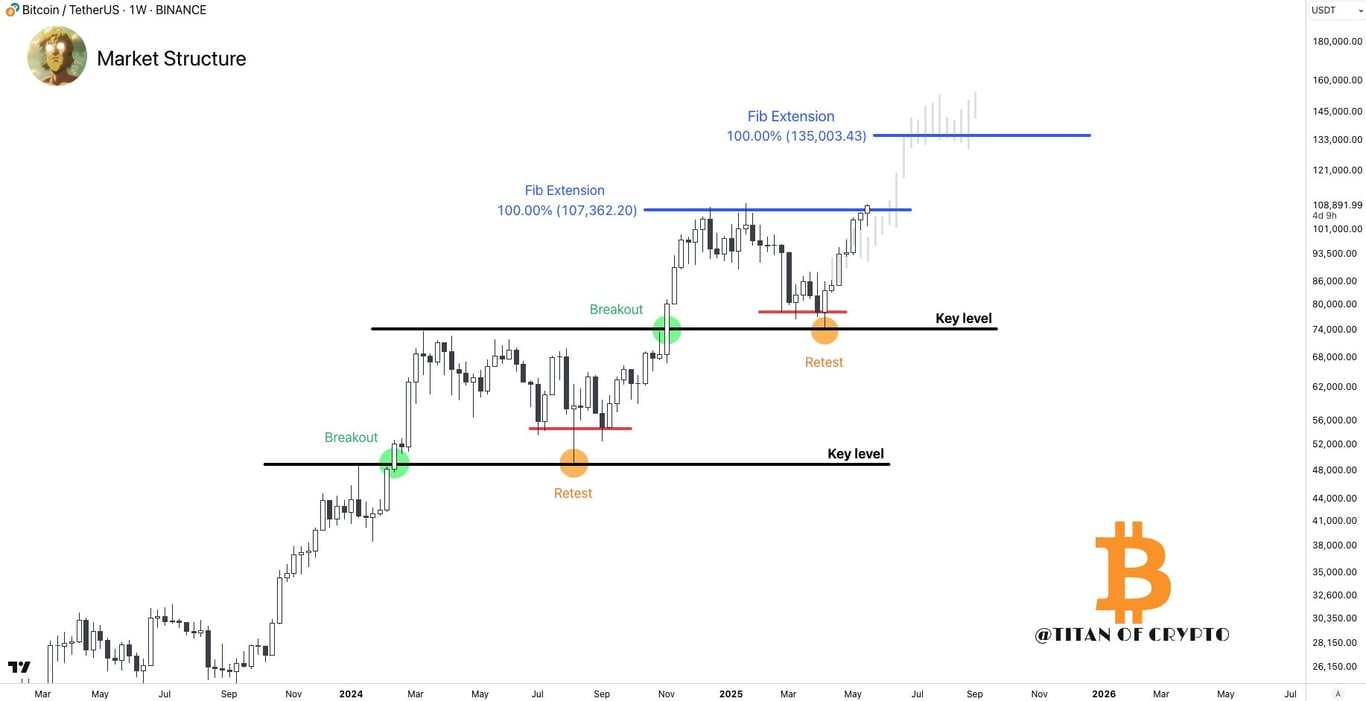

Technical Landscape: Wedges, Crosses, and Price Projections

Technically, Bitcoin’s price has been moving within a rising wedge pattern since bottoming in April. While wedges often signal potential reversals, the recent breakout above the upper trendline has coincided with bullish momentum indicators.

The 50-day moving average (MA) crossed above the 200-day MA this week—forming a golden cross, typically seen as a harbinger of sustained upside.

Using the bars pattern projection method, analysts have identified a near-term bullish target of $120,000, with longer-term projections stretching even further.

The 1.618 Fibonacci extension, a favored tool in crypto forecasting, suggests a move to $135,000–$140,000 is possible later this year.

Support Levels and Cautionary Notes

Despite the bullish momentum, key support levels remain crucial. Immediate support sits around $107,000, a level formed by former resistance in December and January.

Failure to hold this could prompt a pullback to $100,000, with deeper corrections potentially targeting $92,000—a zone of significant historical trading activity.

Analysts like João Wedson of Alphractal advise investors to stay cautious. Bitcoin’s heatmaps suggest a move into high-leverage zones, which could be ripe for liquidation traps. “Public euphoria around all-time highs can be dangerous,” he warned. “Risk management is essential.”

Analyst Forecasts: From $150K to $1 Million

The latest wave of bullish projections is as diverse as it is ambitious:

- Peter Brandt sees a top between $125,000 and $150,000 by late summer.

- Arthur Hayes forecasts $150,000 in 2025, citing aggressive central bank policies.

- Tim Draper boldly expects $250,000 by year-end, calling Bitcoin adoption a corporate imperative.

-

Standard Chartered and Bernstein both predict $200,000 within this bull run.

-

Adam Back, CEO of Blockstream, envisions a $500,000 to $1 million target in this cycle, especially as institutional money deepens.

-

BlackRock CEO Larry Fink floated a long-term projection of $700,000, emphasizing the impact of sovereign wealth fund allocations.

-

Coinbase CEO Brian Armstrong went further still, stating BTC could reach the “multi-millions” eventually, citing potential nation-state adoption.

The Macro Backdrop: Trade Easing, Fed Policy, and Inflation Hedges

Bitcoin’s rise is also reflective of larger macroeconomic shifts. A temporary easing in U.S.–China trade tensions and renewed interest in non-sovereign assets amid Moody’s downgrade of U.S. debt have pushed investors toward Bitcoin as a hedge.

Despite high Treasury yields and weak equity markets, Bitcoin has decoupled from traditional financial instruments, reinforcing its narrative as “digital gold.”

The Trump administration’s Strategic Bitcoin Reserve, established earlier this year, has also bolstered sentiment, underscoring federal support for the asset’s long-term integration into the U.S. financial system.

Altcoins Follow Suit

Bitcoin’s rally has lifted the broader crypto market. Ethereum rose 5% to $2,600, XRP climbed 3.9% to $2.42, and Solana, Cardano, and Polygon posted gains between 2% and 6%.

Meme tokens such as Dogecoin and $TRUMP also surged, the latter gaining 15% on the day.

Conclusion: The New Bitcoin Era Has Arrived

With strong institutional backing, favorable regulatory winds, and increasingly bullish technicals, Bitcoin appears to be entering a transformative phase.

While corrections are inevitable and risks remain, the broader picture suggests that BTC is no longer just a speculative asset—it’s fast becoming a foundational element of modern finance.

As we look ahead, the road to $120,000 and beyond seems increasingly likely—not a question of if, but when.

by | May 25, 2025 | Business

The first-ever Sports and Fitness Expo (SFE) in the Philippines will take place from 28-31 May 2025 at the Rizal Memorial Sports Complex, showcasing exhibitors from sports, health, and wellness industries. The event will also feature the International Sports Facilities Management Conference and Trade Show, covering topics like facility management, operations, and development, in partnership with the Philippine Sports Commission.

All eyes are on the first-ever Sports and Fitness Expo (SFE)

in the Philippines, set to launch on 28-31 May 2025 at the Rizal Memorial

Sports Complex, Malate, Manila.

Promising a lineup of exhibitors from across the sports,

health, and wellness industries, SFE aims to be the premier sports and health

business trade event in the country.

At its core, the event aims to put the spotlight on the

growing sports and fitness movement in the Philippines. This is backed by a

recent shift towards adopting a healthy and active lifestyle in the country.

As part of the expo, it will host the International Sports

Facilities Management Conference and Trade Show in partnership with the

Philippine Sports Commission.

Exploring topics from sport facility management, operations,

and development, among others, it’s a must-see for any manager, director,

coach, athlete, and sports enthusiast.

Mark your calendars and gear up to be a game-changer at the

first-ever Sports and Fitness Expo!

by | May 24, 2025 | Business

Arayat, Pampanga – WalterMart continues its mission in bringing the good life to more Filipino families with the grand opening of WalterMart Arayat last May 16, 2025 – a full-service one-stop-shop community mall that answers every Kapampangan’s daily needs in one destination.

Located at Brgy. San Jose Mesulo, the new WalterMart Arayat is a mall designed with the Kapampangan family in mind. Whether it’s grocery shopping, dining, errands, or family bonding time, the new mall offers a complete, hassle-free experience—making it a go-to destination for millions of customers annually.

A Major Milestone: The 50th WalterMart Supermarket

At the heart of WalterMart Arayat is the opening of the 50th WalterMart Supermarket—a flagship branch that proudly champions local love through its Palengke Fresh initiative, a “farm-to-table” campaign that brings fresh, high-quality produce, sourced directly from local farmers. This 50th WalterMart Supertmarket also showcases a diverse selection of both international and local products, catering to every shopper’s needs. It also carries a wide array of everyday essentials, and stylish family finds—providing branded value with one-stop-shop convenience.

A Complete Mix of Shopping, Dining, and Family Spaces

WalterMart Arayat brings together essential categories—from groceries, general merchandise, appliances, pharmacy, health and wellness, to quick service restaurants—all under one roof.

Knowing how Kapampangans enjoy a wide variety of delicacies, the mall also provides a diverse dining experience, with both well-loved fast food chains such as Jollibee, Mang Inasal, and KFC, as well as S&R Pizza, HapChan, and a mix of local and popular eateries housed within a comfortable and inviting food court section.

Shoppers are also treated with a convenient and world-class shopping experience. The new WalterMart Arayat offers FREE parking for all types of vehicles, making sure that each customer visit is hassle-free. With FREE Wi-Fi access, WalterMart Arayat also promotes interactive and engaging activities that foster social connections—bringing the community together in a warm, connected, and inclusive environment.

Committed to deliver best in class shopping experience and promote family bonding, the mall also features a dedicated play area for kids, Instagrammable green lounges and cozy seating area for friends and families to hang out and socialize, a comfortable customer lounge for relaxation, and an activity center designed to host weekend family workshops, worship services, and community-driven events.

Eco-Conscious and Future-Ready

WalterMart Arayat aims to be the most Eco-conscious commercial development in the province, operating with a solar-powered system, using solar lighting, and a waste management program that recycles over 80% of operational waste—paving the way for sustainable community mall operations.

More than a mall, WalterMart Arayat is an aspirational community destination—delivering branded value, lifestyle convenience, and warm service while staying true to WalterMart’s core of building WIN-WIN-WIN partnerships among its customers, local communities, and business partners.

WalterMart Arayat is hosting Grand Opening Sale, featuring Buy 1 Take 1 deals, 50% discount on selected items, and Sulit promos until May 25, 2025 and a Family Fiesta Activity on May 31, 2025.

Have a WalterMart near you? Visit WalterMart Community Malls and enjoy the same one-stop-shop destination in all of its 44 branches!

For more information, visit www.waltermart.com.ph or follow us on our official social media pages: WalterMart Mall.

by | May 23, 2025 | Business

Manila, May 23, 2025 — VRICrew officially launches as an innovative recruitment platform that emphasizes company culture and values as the core of the hiring process. Unlike traditional job postings that focus mainly on roles and qualifications, VRICrew allows candidates to truly experience the atmosphere and vibe of a company, making the job search more transparent and meaningful.

By showcasing company values, work environment, and team dynamics, VRICrew helps organizations build a unique narrative to strengthen their employer brand. Candidates can better assess their fit with the company culture, improving long-term retention and satisfaction.

“Company culture is the heart of any successful organization. With VRICrew, we aim to connect talents and companies not only based on skills but also shared values and a comfortable working environment,” said Ferry, Co-Founder of VRICrew.

The platform features interactive elements such as company profile videos, employee stories, and highlights of core values that make each company unique. This approach fosters a more authentic relationship between candidates and employers from the very beginning.

VRICrew is now accessible at https://vricrew.com/ and ready to support companies that want to prioritize culture as a key strength in attracting top talent.

With VRICrew, recruitment is not just about filling positions but building a competitive and solid work community.

by | May 23, 2025 | Business

Rabobank has announced a package of support measures that will be made available to farming clients dealing with the impacts of devastating floods along the NSW Mid North Coast.

Rabobank state manager for NSW Toby Mendl said the specialist agribusiness bank has a range of measures in place to support clients dealing with the “record-breaking floods” across the region.

He said this support would be extended to other parts of NSW, as needed, where flooding and localised intense rainfall is impacting other areas within the state.

Mr Mendl said the record-breaking rainfall had generated massive flooding in Mid North Coast rivers, with agricultural producers facing lost produce – chiefly milk, given restricted farm access – livestock losses and damage to farm infrastructure, fencing, pasture and crops.

“It is too early for many farmers to account for the full extent of the damage,” he said. “As farmers start the task of recovery and rebuilding from the floods in the coming weeks, the full scale of the damage will become clearer.”

“Livestock welfare is a key concern for farmers and the high-water levels are delaying farmers accounting for livestock,” Mr Mendl said. “Many rivers are still too high for farmers and support personnel to be able to access paddocks and assess stock and their condition.”

Mr Mendl said many farmers across the region have been isolated on their properties, experienced water through their homes and farm buildings and had non-fixed assets carried away by floodwaters.

“The challenge, particularly for dairy and beef farmers, in the flood-impacted areas will be sourcing fodder for their stock, as flood-damaged pastures will be slow to recover through the winter months,” he said.

Mr Mendl said additional concerns for farmers include potential damage, or loss of access, to road networks – which could affect the movement of goods into and out of the region and are critical to the local dairy sector.

Mr Mendl said while the full impacts on agricultural operations and production in the region wouldn’t be known until flood waters fully subside, Rabobank’s staff had been making contact with clients to determine how the bank could provide support.

He said the bank would work directly with individual clients whose farms or agribusinesses have been affected to provide support and offer a range of assistance measures in applicable circumstances.

These included:

‘carry on’ finance to keep viable operations running,waiver of break costs on early redemption of Farm Management Deposits to allow access to needed funds,deferral of scheduled loan payments andwaiver of fees on loan increases necessary for rebuilding operations.

Mr Mendl said Rabobank’s (All in One) rural loans were also specifically designed for farmers to provide financial flexibility to manage through times of difficulty by having the option to choose whether a repayment has the effect of reducing the loan limit and the option to apply for a fixed interest option over the whole or part of the facility.

“They are flexible, generally interest-only facilities, which allow agricultural operators to opt to pay principal reductions when they choose, which is of particular benefit in times of reduced cash flow due to adverse circumstances, such as floods,” he said.

Mr Mendl said while the bank’s rural managers were reaching out to clients in affected regions, he encouraged impacted clients to contact Rabobank where assistance was needed by contacting their local branch or phoning the bank on 1800 025 484.

by | May 23, 2025 | Business

MyGlit.com, a trusted Philippine-based recruitment portal with over 500,000 verified candidates and a domain authority of 50, has launched its next-generation AI-powered Applicant Tracking System (ATS). Built with a Trello-style interface and integrated with resume and Q&A automation, the platform is designed by Gratitude Inc.—a recruitment leader in India and the Philippines—to solve real-world hiring challenges in the BPO and IT sectors and bring speed in hiring while cutting costs as well.

Manila, Philippines – 23rd May 2025 – MyGlit.com, a job portal with over 7 years of market presence and a verified candidate database exceeding 500,000, has officially launched its AI-powered recruitment platform, built specifically for the BPO and IT hiring industry in the Philippines.

Developed by Gratitude Inc., a leading recruitment agency in India and the Philippines, the platform is a practical solution to the daily challenges faced by recruiters—offering speed, accuracy, and simplicity through automation.

“With AI taking care of resume reviews and Q&A scoring, hiring becomes focused, fast, and deeply efficient,” said Akhil Ahluwalia, Founder of MyGlit. “This platform is built for companies who want to hire smarter, and recruiters who want results—not clutter.”

What Sets MyGlit Apart

AI Instant Resume Review: Every uploaded CV is instantly analyzed against the job description, producing a 900-character summary with a verdict: Select / Reject / Consider.

AI-Powered Candidate Q&A Evaluation: If the Resume is a Select or consider the AI finds potential gaps in the CV compared to the JD and sends a list of unique 5-7 Questions to the Candidate via email. Every Answer by the candidate is also auto Analysed by our AI and automatically sent to Clients if AI finds it a perfect fit

Trello-Style Job Management: Each job opening is managed through a visual card interface, allowing recruiters to organize and collaborate efficiently. Card-level access control ensures recruiters only see jobs they’re assigned to.

500,000+ Verified Jobseekers :The platform hosts a massive pool of pre-screened BPO and IT candidates from the Philippines—growing daily. Unlike other Job Portals where the bulk of Database building is done by signups by Candidates, Myglit Candidates mostly come from our Recruitment teams and chat bots after evaluating a candidate thereby increasing the quality of Database

Global Freelance Recruiter Integration

MyGlit enables recruiters from India, the Philippines, Malaysia, and across Africa to submit candidates and earn per successful placement. The AI system helps manage large recruiter volumes efficiently.

Established Web Authority

With a domain authority of 50, MyGlit is already a recognized player in job search and recruitment, ensuring visibility and credibility with both clients and candidates.

Already used by several prominent MNCs and outsourcing firms, MyGlit is proving to be a scalable, AI-driven solution for businesses aiming to reduce hiring cycles and access a diverse, qualified talent pool.

Explore the future of recruitment at www.myglit.com

by | May 23, 2025 | Business

In

an era where digital lending is rapidly expanding in the Philippines, HappyCash

stands out as a platform committed not only to growth, but to responsible

lending practices, AI Credit decisioning, and the protection of consumers’

financial well-being.

Founded

with a mission to make access to credit simple, safe, and fair, HappyCash has

served over millions of users nationwide—many of whom are first-time

borrowers from underserved communities. By focusing on affordability and

transparency, the platform ensures that every loan product aligns with the

borrower’s actual capacity to repay.

AI Credit, Backed

by Data

HappyCash

utilizes a multi-layered credit assessment model that evaluates user behavior,

income signals, device security, and more to assign customized credit limits.

Instead of offering large loan amounts indiscriminately, the platform starts

with responsible limits and gradually increases based on repayment behavior.

This

credit model allows HappyCash to maintain a healthy balance between risk

control and inclusion, enabling safe lending even to first-time borrowers with

limited financial histories.

Aligned with

Consumer Protection Principles

As a

licensed lending entity regulated by the Philippine Securities and Exchange

Commission (SSEC), HappyCash strictly adheres with the Financial Products and

Services Consumer Protection Act and the Truth in Lending Act. Its core

consumer protection measures include:

–

Clear disclosures on fees and interest rates

- No

hidden charges or pre-payment penalties

–

Friendly reminders for due dates, with grace periods

–

Accessible customer support through multiple channels

–

Strong user data protection and secure cloud infrastructure

Educating Borrowers

HappyCash

also invests in borrower education, using its mobile platform to share simple

financial literacy content. The goal is to help users borrow confidently, repay

responsibly, and improve their long-term financial capability.

Looking Ahead

As

it grows, HappyCash continues to partner with industry-leading technology,

eKYC, and payment providers to ensure that its services remain secure,

scalable, and customer-friendly. With upcoming product enhancements focused on

more personalized credit and real-time fraud detection, the platform is

committed to being a leader in ethical and sustainable lending.

by | May 23, 2025 | Business

Bitcoin has hit a new all-time high near $111,000 amid bullish technical signals like a golden cross and favorable macro trends. Discover expert insights, price forecasts, and what this rally means for the broader crypto market.

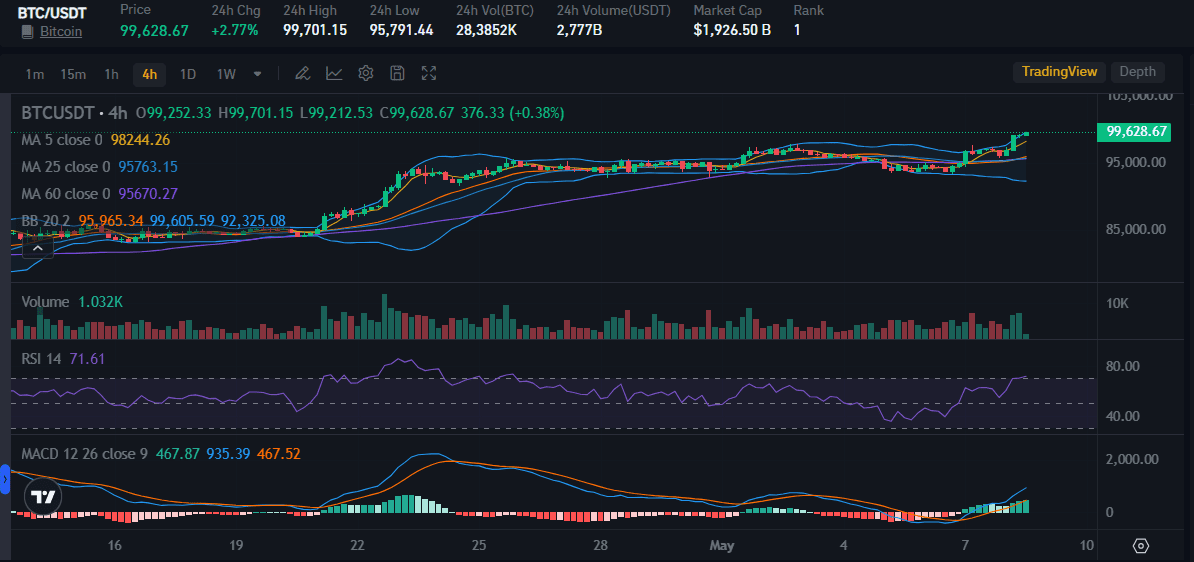

Bitcoin’s price resurgence continues and finally hit new ATH with the price hovering around $111,000 as of May 22 after crossing “golden cross” formation at $106.889.

Check out the explanation of the latest BTC prices in this article until the end.

Golden Crosses and Their Track Record

Bitcoin has previously responded positively to golden cross formations. According to analyst Benjamin Cowen, past occurrences led to 45%-60% price increases. For example:

- In October 2023, BTC surged 45% following a golden cross, buoyed by optimism surrounding spot Bitcoin ETFs.

- In September 2021, a similar crossover preceded a 50% rally.

- Following the 2024 U.S. presidential election, with Donald Trump re-elected, BTC posted a 60%+ gain, attributed in part to expected policy shifts.

However, it’s important to note that golden crosses are not infallible. In February 2020, just before the COVID-19 pandemic struck global markets, a golden cross was followed by a 62% crash—highlighting the need to consider broader economic indicators.

Current Technical Setup: Bullish but Cautious

As of mid-May 2025, Bitcoin’s 50-day SMA is trending upward and approaching a cross above the 200-day SMA. While the setup leans bullish, analysts are warning of a possible short-term correction before a full-fledged breakout.

Bitcoin’s Relative Strength Index (RSI) recently crossed above the overbought threshold of 70, often a precursor to pullbacks.

BTC could retest support levels around $115,400 to $120,000 before resuming its upward trend.

A bearish divergence between rising prices and falling RSI supports the case for a temporary dip.

Still, macro conditions appear favorable. Factors such as an expanding M2 money supply, easing U.S.-China trade tensions, and improved investor sentiment provide strong tailwinds.

Macro Tailwinds Support Bitcoin’s Ascent

Recent developments have added fuel to Bitcoin’s rally:

- President Trump has rolled back tariff threats, easing global trade tensions.

-

Traditional equity markets, like the S&P 500 and Nasdaq, have reacted positively, with BTC following suit as a risk-on asset.

-

Crypto liquidations have surged, with $233 million wiped out in the past 24 hours, over half from short positions—indicating growing upward pressure.

Other cryptocurrencies are also riding the wave. Over the past month:

- Ethereum (ETH) has climbed 58%,

-

Dogecoin (DOGE) is up 45%, and

-

Solana (SOL) has risen nearly 23%.

No Signs of a “Double Top” Reversal

Despite Bitcoin’s price hovering near its all-time high, concerns about a potential double top—a bearish reversal pattern—are being dismissed by some analysts.

Private wealth firm Swissblock Technologies notes that Bitcoin’s Fundamental Index (BFI) remains solidly neutral, showing no signs of weakening. Their on-chain analysis suggests BTC’s bullish structure is intact, with no bearish divergence to validate a major reversal.

Market Consolidation: A Healthy Pause

Bitcoin briefly dipped to $109,000 during the recent U.S. trading session but rebounded above $111,900, marking a modest daily decline amid broader profit-taking.

Market analyst Ruslan Lienkha of YouHodler describes this as a normal pullback within a medium-term uptrend, noting that anything below a 5% price fluctuation is often just “market noise.”

Kirill Kretov of CoinPanel adds that thin liquidity can exacerbate small sell-offs, making corrections appear more dramatic than they are.

Institutional Confidence Remains Strong

Analysts at K33 Research highlight that BTC recently exited a long stretch of below-neutral funding rates, suggesting a lack of speculative excess that often precedes market tops.

Meanwhile, Steno Research points to a stealth expansion of Western private credit as the true driver of the current crypto rally, not Chinese liquidity injections as previously thought. This quiet stimulus could continue supporting crypto prices through June and early July, though analysts warn that conditions may tighten again in late summer.

Forecast: New Highs Within Reach

According to network economist Timothy Peterson, historical data shows that when Bitcoin trades within 10% of its all-time high, it sets a new one 98% of the time within 50 days.

Based on this, Peterson expects BTC to hit at least $115,000 by late June, with some models projecting $125,000 or even $150,000 by the end of the summer.

Conclusion

With strong technical signals, robust macroeconomic tailwinds, and increasing institutional conviction, Bitcoin is well-positioned for a potential breakout to new all-time highs. While short-term volatility and corrections are likely, the broader outlook remains optimistic.

As Bitcoin nears the confirmation of its golden cross and inches closer to price discovery mode, traders and investors should remain attentive—but not overly reactive—to market noise, and instead focus on the evolving macro-technical landscape guiding this historic rally.

You must be logged in to post a comment.