by Penny Angeles-Tan | Dec 17, 2024 | Business

XRP hits a new all-time high as Ripple launches the RLUSD stablecoin, reshaping the $200B stablecoin market. Explore record-breaking crypto inflows, Bitcoin ETF momentum, and Ripple’s strategic moves driving XRP adoption in 2024-2025.

The digital asset investment market continues to shatter records in 2024, as inflows into cryptocurrencies reached unprecedented levels. Bolstered by surging investor interest, pro-crypto regulatory signals, and key ecosystem developments, Bitcoin, Ethereum, and XRP have dominated the spotlight.

Ripple’s new RLUSD stablecoin launch adds yet another dimension to the fast-growing crypto market, particularly in the stablecoin space.

Digital Asset Inflows Surge to $44.5 Billion in 2024

Digital asset investment products, including spot Bitcoin and Ethereum ETFs, witnessed inflows of $3.2 billion last week alone. This milestone brought year-to-date (YTD) inflows to a staggering $44.5 billion, quadrupling any previous annual records, according to CoinShares data.

The week’s $3.2 billion inflow represents the 10th consecutive week of positive flows into digital asset products. It follows a record-breaking $3.85 billion from the prior week, signaling robust investor confidence. Notably, Bitcoin accounted for $38.5 billion of the YTD inflows, representing 87% of total investments.

The launch of spot Bitcoin ETFs, coupled with Donald Trump’s recent electoral victory in the U.S., has reinvigorated institutional and retail interest in Bitcoin. Trump’s pro-crypto stance has set the stage for a potentially friendlier regulatory environment, spurring optimism across the crypto market.

Ethereum and Altcoin Inflows Gain Momentum

While Bitcoin dominated inflows, Ethereum and other altcoins saw notable activity last week. Ethereum investment products recorded $1 billion in inflows, lifting YTD totals to $4.4 billion. This surge comes despite Ethereum’s underperformance relative to other major cryptocurrencies.

Analysts believe the launch of federal cryptocurrency legislation could stimulate the development of decentralized applications (dApps) on Ethereum’s network, driving higher usage and demand.

Similarly, XRP investment products saw significant traction, drawing $145 million last week and pushing YTD inflows to $421 million. Butterfill attributed this momentum to growing speculation around a U.S.-listed XRP ETF and positive sentiment following Trump’s election victory.

Altcoins like XRP also benefited from ongoing advancements within their ecosystems, such as Ripple’s upcoming stablecoin launch.

Ripple’s RLUSD Stablecoin Set to Transform the Market

On December 17, Ripple will officially launch its RLUSD stablecoin, marking a major milestone in the $200 billion stablecoin market. RLUSD will initially be available on both the XRP Ledger (XRPL) and Ethereum networks, expanding its utility and accessibility.

Fully backed by U.S. dollar deposits, short-term U.S. government bonds, and cash equivalents, RLUSD is designed to maintain a 1:1 peg to the U.S. dollar.

Ripple CEO Brad Garlinghouse emphasized that the stablecoin received “final approval” from the New York Department of Financial Services (NYDFS), highlighting its regulatory clarity and trustworthiness.

RLUSD will be distributed through key exchange and platform partners, including Uphold, MoonPay, Bitso, Bullish, and Bitstamp, with additional listings planned in the coming weeks. While initially unavailable in the European Union due to regulatory hurdles under MiCAR, Ripple is actively exploring options to enter the bloc’s market.

XRP Price Outlook and Catalysts Driving Growth

Ripple’s RLUSD stablecoin launch has generated significant interest in XRP, which serves as the transaction fee token on the XRPL.

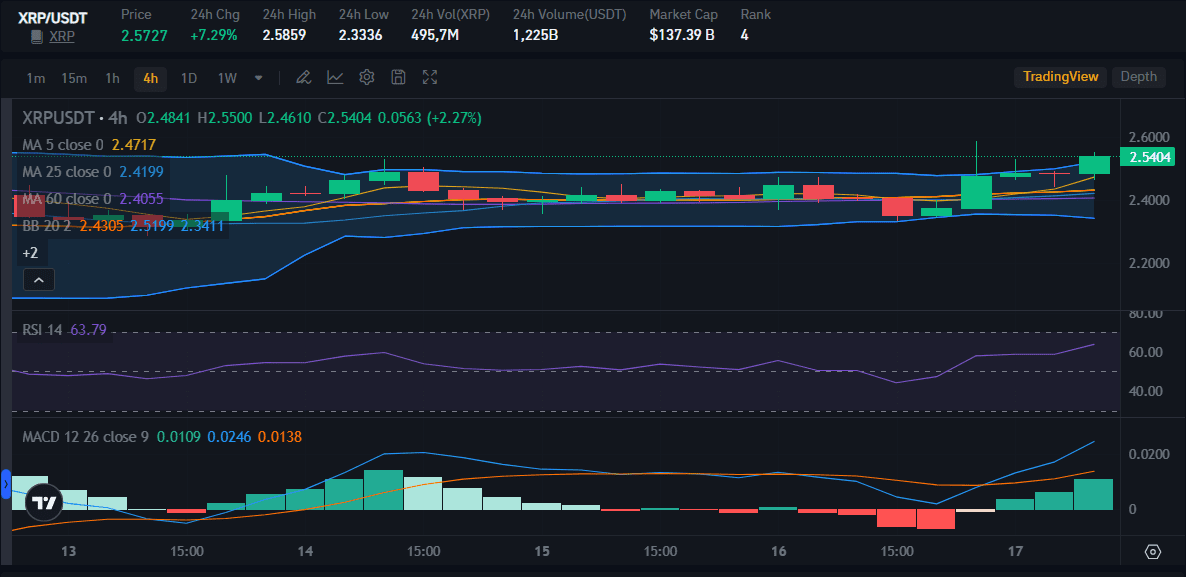

XRP’s price surged to a seven-year high of $2.90 on December 3, 2024, before entering a corrective phase. As of this article is written on December 17, XRP trades at $2.5727—an 7,29% pullback after tripling its value in the past six weeks.

The hype surrounding RLUSD, coupled with growing adoption, is expected to support XRP’s long-term price trajectory. Analysts, including Georgios Vlachos, co-founder of Axelar, predict that RLUSD adoption in emerging markets for transactions and savings will drive XRP demand throughout 2025.

From a technical perspective, XRP has formed a bullish flag pattern, indicating potential upside. Analysts project a target of $15—a 520% increase from current levels—as the market stabilizes and bullish sentiment grows.

Regulatory Shifts and Institutional Interest

Trump’s pro-crypto stance has created optimism for a favorable regulatory landscape in the U.S., particularly as Republican lawmakers take key positions. Crypto-friendly Rep. French Hill (R-AH) was recently appointed to lead the House Financial Services Committee, signaling a potential shift toward clearer regulations for digital assets.

Amid this changing environment, leading asset managers such as WisdomTree and 21Shares have filed applications for XRP ETFs, reflecting growing institutional interest.

While XRP spot ETFs remain unavailable in the U.S., international markets continue to see strong demand, accounting for 92% ($3.5 billion) of last week’s inflows.

Switzerland and Germany emerged as key contributors, with inflows of $159 million and $116 million, respectively.

RLUSD Volatility Concerns and Investor Guidance

Despite its dollar peg, RLUSD’s launch may experience short-term price volatility due to high demand and limited supply. Ripple CTO David Schwartz warned traders against speculation, cautioning against paying inflated prices driven by hype.

Instances of traders offering exorbitant amounts—up to $1,200 for a fraction of RLUSD—highlight the fervor surrounding its launch. Schwartz reassured investors that such anomalies are temporary, and the stablecoin’s price will settle close to $1.

Conclusion

As 2024 concludes, the digital asset market is witnessing historic inflows, driven by institutional demand, regulatory optimism, and major ecosystem advancements. Bitcoin continues to dominate the landscape, but Ethereum and XRP are emerging as key players amid developments like Ripple’s RLUSD stablecoin.

With RLUSD poised to disrupt the stablecoin market and broader adoption of XRP expected in 2025, Ripple’s strategic focus on regulatory compliance and innovation could further solidify its position.

As the crypto industry enters 2025, the combination of pro-crypto policies, growing institutional interest, and increasing utility sets the stage for sustained growth across digital assets.

by | Dec 17, 2024 | Business

Elwyn.ai, an AI-powered learning platform developed by Indonesian edtech company Primeskills, achieved runner-up status at the 2024 Asia Pacific ICT Alliance (APICTA) Awards in Brunei. This platform uses realistic role-playing simulations to enhance soft skills and interdepartmental communication for professionals and higher education students.

Bandar Seri Begawan, Brunei Darussalam – December 11, 2024 – Primeskills, a leading educational technology company from Indonesia, proudly announces the success of its flagship product, Elwyn.ai, in securing the runner-up position at the prestigious Asia Pacific ICT Alliance (APICTA) Awards 2024 in Brunei. This achievement solidifies Indonesia’s position as a key innovator in professional learning and higher education technology on a global scale.

Elwyn.ai, an AI-based learning platform, is revolutionizing the world of professional education and higher learning. By delivering realistic role-playing simulations, Elwyn.ai helps professionals and advanced students hone their soft skills and inter-departmental communication through scenarios that mirror real workplace situations.

“We are thrilled with this recognition at APICTA 2024,” stated William Irawan, CEO of Primeskills. “This achievement is not just a win for Primeskills, but also tangible proof that Indonesian learning technology can compete at an international level. We are committed to continuously driving innovation in professional education and higher learning, while showcasing the immense potential of Indonesian startups on the global stage.”

Elwyn.ai’s excellence lies in its seamless integration with various systems that have become industry standards across institutions and companies. The platform utilizes sophisticated AI algorithms trained on thousands of real-world scenario data, a result of Primeskills’ five years of experience in developing soft skills training modules for higher education institutions and leading companies.

APICTA itself is a prestigious event involving 16 member economies from the Asia-Pacific region. In 2023, the awards involved more than 250 nominations from 165 participating teams, representing countries such as Australia, China, Taiwan, Hong Kong, Brunei, Sri Lanka, Thailand, Indonesia, Malaysia, Myanmar, Pakistan, and Singapore.

The APICTA 2024 judges praised Elwyn.ai’s innovative approach in addressing challenges in the modern professional world. Higher education institutions and organizations that have adopted Elwyn.ai report significant improvements in aspects of communication, teamwork, and work readiness.

Elwyn.ai’s success at APICTA 2024 not only highlights Primeskills’ achievement but also illustrates the rapid development of the edtech ecosystem in Indonesia. This accomplishment further solidifies the position of Indonesian technology companies as key innovators actively shaping the future of higher education and professional development on a global level.

Looking ahead, Primeskills plans to expand Elwyn.ai’s reach to international markets, focusing on higher education institutions and multinational organizations. “We are in the process of forging partnerships with several leading universities and organizations to implement Elwyn.ai in various countries,” added William. “Our goal is to establish Elwyn.ai as a global standard in AI-based professional education and higher learning.”

For more information, visit www.primeskills.id

by | Dec 17, 2024 | Business

SECHA Home, based in Indonesia, is recognized for its innovative approach to delivering fully customized, move-in ready homes with affordable mortgage plans. This milestone highlights its global growth potential.

Jakarta,17 December 2024 – SECHA Home, a proptech redefining the homeownership experience in Indonesia, is incredibly honored to announce its inclusion in this year’s Select 200 Companies with Global Business Potential – DGEMS 2024, recognized by Forbes India and D Globalist.

This remarkable achievement marks a significant milestone in SECHA Home’s journey to transform the real estate landscape. The company’s mission to deliver fully customized, move-in ready homes—by seamlessly integrating design, renovation, and furnishing—into an affordable mortgage plan has gained tremendous momentum, earning international recognition and acclaim.

“We are thrilled to be globally recognized for our efforts,” said Josephine Petra Lovensa, Co-Founder/CEO. “This milestone reaffirms our vision to redefine homeownership in Indonesia and inspire innovation on a global scale. We’re deeply grateful to Forbes India and D Globalist for this honor and to our amazing key backers—Antler, Bonbillo, and Startupbootcamp—for their unwavering support and belief in us since Day Zero.”

A Celebration of Innovation and eXtrepreneurship

The recognition ceremony in Delhi was a momentous occasion, bringing together trailblazing innovators and visionaries from across the globe. The team celebrated alongside fellow eXtrepreneurs, sharing ideas and drawing inspiration from industry leaders tackling global challenges.

Secha Home: Transforming Homeownership

By integrating the traditionally fragmented processes of design, renovation, and furnishing, SECHA Home simplifies and accelerates the path to homeownership. Their innovative, tech-enabled model empowers homeowners by providing a single, streamlined solution—all packaged within a single, affordable mortgage plan.

Backed by leading accelerators and investors, SECHA Home is poised to scale its impact beyond Indonesia, addressing global housing needs with a solution that’s efficient, customer-focused, and future-ready.

by Penny Angeles-Tan | Dec 17, 2024 | Business

With Bitcoin reaching $107K, questions arise: Can BTC rival gold as the ultimate store of value? Explore market trends, Trump’s strategic reserve plans, and the 2024 investment landscape.

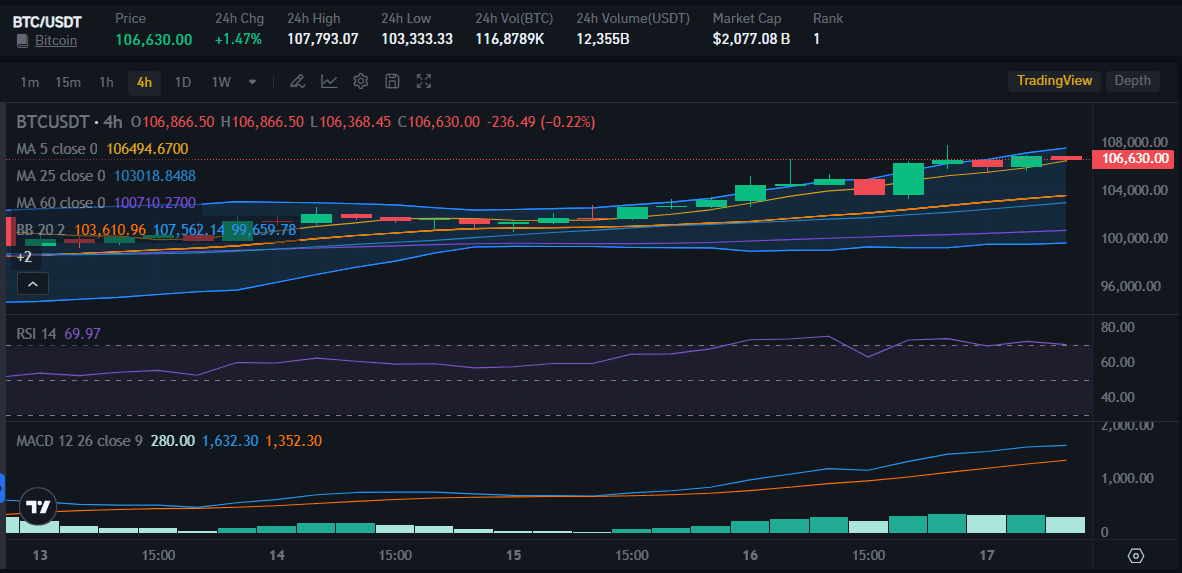

Since getting support from Donald Trump in the 2024 US Election and Trump’s victory, Bitcoin seems to have reached the peak of its glory in 2024. When the price of BTC often slumped in early and mid-2024, during November to the end of December, the price of BTC continued to set its highest price of all time.

Traditional economic relationships have been upended in 2024, as asset classes that historically moved in opposite directions—equities, gold, the U.S. dollar, and Bitcoin—have all rallied simultaneously.

Historically, higher interest rates result in a stronger U.S. dollar, falling gold prices, and stock market declines. However, 2024 has defied these expectations.

The S&P 500 surged 25% year-to-date (y-t-d), gold prices rose by 28%, the U.S. dollar index climbed 4.8%, and Bitcoin hit record highs, surpassing $100,000. In fact, in the past 24 hours yesterday and today, Bitcoin hit a new ATH at over $107,000.

Bitcoin: The New Digital Gold

Often called “digital gold,” Bitcoin shares key attributes with its physical counterpart—notably scarcity and decentralization. With a capped supply of 21 million coins, Bitcoin has become an attractive hedge against inflation.

Unlike traditional assets, its price is not easily manipulated by governments, making it resilient to political and monetary interference.

Two major events in 2024 solidified Bitcoin’s status as a legitimate asset class. First, the approval of Spot Bitcoin ETFs brought institutional players like BlackRock and Fidelity into the fold. Second, Donald Trump’s presidential victory marked a turning point in U.S. crypto policy.

Trump has openly supported cryptocurrencies, pledging to create a U.S. Bitcoin strategic reserve akin to the nation’s petroleum reserve.

Bitcoin’s unprecedented rally has reflected these developments. By early December, Bitcoin crossed $107,000, driven by institutional investment, regulatory advancements, and growing mainstream acceptance.

While gold offers stability, Bitcoin’s volatility and growth potential make it a compelling counterpart within a diversified portfolio.

Gold’s Resurgence: The Safe Haven Asset

While equities, driven by the success of the “Magnificent Seven” and the AI boom, have garnered significant attention, gold has quietly outperformed. Gold futures are up 28% y-t-d, surpassing the S&P 500’s gains.

Investors who remained open to diversifying into gold rather than focusing solely on equities have seen impressive returns.

Gold has long been regarded as a safe haven asset, offering stability in times of economic uncertainty. Its enduring appeal lies in its intrinsic value as both a financial instrument and a physical commodity with applications in jewelry, technology, and manufacturing.

Unlike fiat currencies or digital assets, gold’s scarcity ensures its role as a reliable store of value.

Recent discoveries, such as a significant gold deposit in China, have occasionally challenged perceptions of gold’s rarity. However, these findings have done little to diminish its global allure. Gold is also universally recognized and easily liquidated, making it practical during crises.

Nevertheless, gold’s stability comes at the cost of growth potential, a limitation that has paved the way for Bitcoin’s increasing popularity.

Balancing Gold and Bitcoin: A Dual Hedge Strategy

Gold and Bitcoin’s distinct qualities make them complementary investments. Gold provides stability, acting as a stabilizer during periods of volatility, while Bitcoin offers the potential for outsized returns. Together, they create a balanced hedge against economic uncertainty.

Morningstar research indicates that a 5% allocation to Bitcoin strikes the ideal balance between risk and reward. However, direct exposure to Bitcoin can pose risks, including exchange fraud, cybersecurity threats, and password management issues.

To mitigate these challenges, investors can turn to regulated avenues such as Spot Bitcoin ETFs, CME Bitcoin futures, and other U.S. Securities and Exchange Commission (SEC)-approved platforms. These options provide safer access to Bitcoin while maintaining transparency and oversight.

For additional information, you can see the screenshot above regarding BTC ownership in several countries. Bitcoin has penetrated many parts of the world and become an attractive investment asset with predictions of its increasingly rapid progress in the future.

Trump’s Strategic Bitcoin Reserve: A Policy Shift with Global Implications

President-elect Donald Trump’s support for a U.S. Bitcoin strategic reserve marks a seismic policy shift. During a recent interview, Trump reiterated his vision to build a national Bitcoin reserve, similar to the country’s strategic petroleum stockpile.

“We’re gonna do something great with crypto because we don’t want China or anybody else to be ahead,” Trump said.

Trump’s proposal echoes ideas previously raised by Republican Senator Cynthia Lummis, who suggested the U.S. should acquire 1 million Bitcoins over five years to reduce its $35 trillion national debt. Such a reserve would not only boost Bitcoin’s legitimacy but could also reshape global financial dynamics.

As Bitcoin’s price continues its upward trajectory, analysts like Perianne Boring predict it could eclipse gold’s $16 trillion market capitalization, with prices potentially reaching $800,000 per coin by next year.

Globally, other nations are also exploring cryptocurrency reserves. Russia, in response to sanctions, has embraced Bitcoin as an alternative asset. President Vladimir Putin praised Bitcoin’s independence from foreign interference, reinforcing its growing role in geopolitics.

However, skeptics, including Federal Reserve Chair Jerome Powell, caution against over-optimism. Powell has compared Bitcoin to gold but emphasized that any move toward a strategic reserve would require careful consideration and time to implement.

The Path Forward: Navigating the 2024 Investment Landscape

As 2024 continues to challenge traditional economic assumptions, investors must adopt a more flexible and forward-thinking approach. The simultaneous rally of equities, gold, the U.S. dollar, and Bitcoin signals a shift in market dynamics that requires fresh strategies.

Gold’s stability and Bitcoin’s growth potential make them indispensable tools for navigating uncertainty. Investors who embrace a dual allocation strategy—with gold acting as a stabilizer and Bitcoin as a high-growth asset—are better positioned to protect and grow their portfolios.

While the creation of a U.S. Bitcoin strategic reserve remains speculative, Trump’s commitment to supporting crypto innovation has provided a significant tailwind for Bitcoin’s rally. As nations around the world reconsider their approach to digital assets, the stage is set for Bitcoin to play a transformative role in global finance.

Conclusion: Embracing the New Economic Paradigm

The economic disruption of 2024 underscores the fragility of traditional market correlations. Gold’s resurgence, Bitcoin’s rise, and the broader market rally challenge established norms and highlight the importance of diversification.

By keeping an open mind and embracing innovative strategies, investors can navigate the uncertainty of 2024 with confidence, ensuring their portfolios remain resilient and positioned for growth in this new era.

by | Dec 17, 2024 | Business

Kuala Lumpur, Malaysia – December 17, 2024 – Nusantara Global Network, a leading business development and digital marketing agency, is excited to announce a strategic partnership with HF Markets, a globally respected broker. This collaboration aims to empower traders in Southeast Asia by providing access to advanced trading tools and competitive conditions for crypto CFDs.

Through this partnership, Nusantara Global Network will leverage HF Markets comprehensive platform, which offers state-of-the-art crypto trading solutions. This includes ultra-fast execution, leverage of up to 1:50 on selected cryptocurrencies, and the flexibility to trade 24/5. The focus of this collaboration is to expand trading opportunities and deliver premium services to clients in the region.

Empowering Crypto Traders with Advanced Tools

As the cryptocurrency trading market continues to grow rapidly, Nusantara Global Network and HF Markets are committed to providing traders with a platform that ensures fast and efficient execution. Traders will benefit from low spreads, negative balance protection, and the ability to profit from both rising and falling markets.

“This partnership is an exciting opportunity for us to extend our offerings to clients, especially in the fast-evolving world of crypto trading,” said a representative from Nusantara Global Network. “With HF Markets’ cutting-edge platform and expertise in the financial markets, we are confident that we can deliver a superior trading experience and give traders a competitive edge.”

The partnership is designed to support traders at all levels, offering leverage of up to 1:50 on selected cryptocurrencies, enabling them to maximize their potential while maintaining control over their trades.

A Seamless Trading Experience

Traders using HF Markets’ platform can trade across various devices, including desktop, mobile, and web, ensuring they never miss a market opportunity. This seamless experience, combined with fast execution, provides traders with the tools they need to make informed and timely decisions.

A spokesperson from HF Markets commented, “We are thrilled to partner with Nusantara Global Network to bring our crypto CFD trading platform to a broader audience in Southeast Asia. Our platform is designed to offer maximum flexibility, competitive conditions, and access to the tools traders need to succeed in the fast-changing crypto markets.”

Leading the Market in Southeast Asia

With the increasing demand for crypto trading in Southeast Asia, this partnership positions both companies as leaders in the region, offering a world-class platform that supports both novice and experienced traders. As interest in digital assets continues to grow, Nusantara Global Network and HF Markets are committed to providing innovative solutions that meet the evolving needs of this dynamic market.

About HF Markets

HF Markets is a global online broker providing traders access to a wide range of asset classes, including Forex, commodities, and indices. Known for its user-friendly platform and excellent customer support, HF Markets is committed to empowering traders with the tools and resources needed for successful trading.

You must be logged in to post a comment.