by Ferry Bayu | Nov 8, 2024 | Banking and Finance

Explore how Donald Trump’s 2024 election win is boosting the crypto ecosystem. Learn about Bitcoin’s price surge, altcoins’ growth, and Trump’s crypto-friendly policies that could shape the market’s future. Stay updated on the latest crypto trends and predictions!

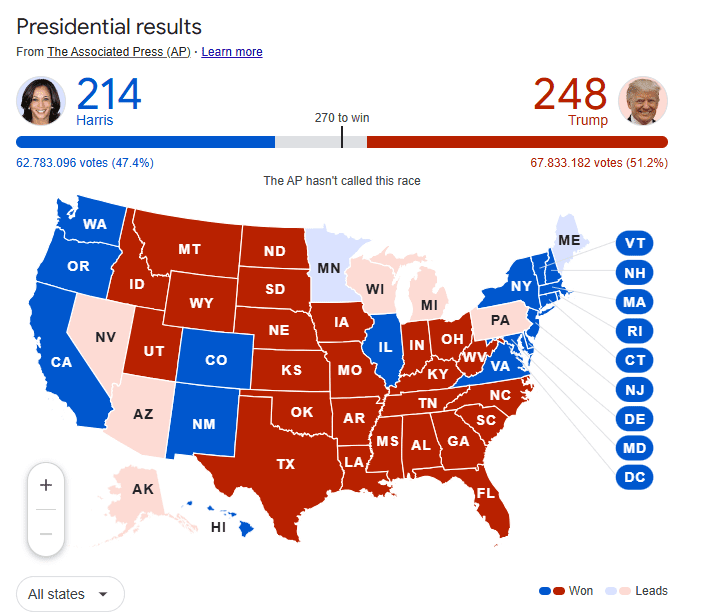

Donald Trump was declared superior to Kamala Harris in the 2024 US Election held on November 5. Trump received 50.9% of the vote while Kamala only received 47.6%, with Trump’s voter area being much more dominant.

This victory is good news for the crypto ecosystem. Evidently, due to Donald Trump’s superiority, the price of crypto tokens has skyrocketed, and Bitcoin has even become a new ATH.

Check out the detailed explanation of the crypto ecosystem, which has strengthened again due to Donald Trump’s victory in the 2024 US Election.

Bitcoin Predicted to Hit $100,000 in Q! 2025

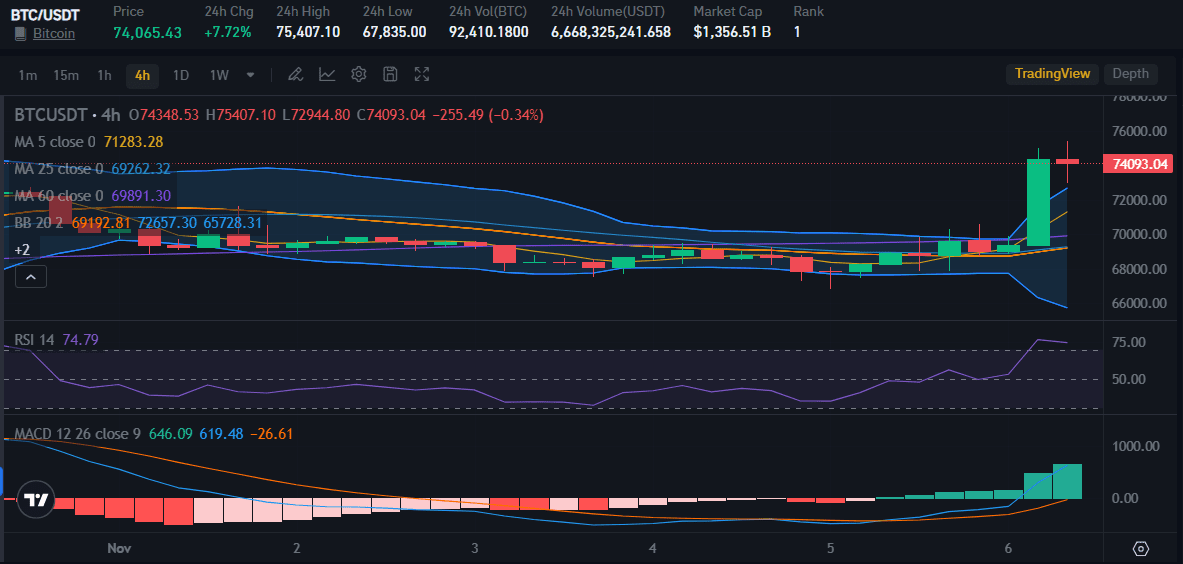

After yesterday BTC recorded a price of more than $75,000, today the price of Bitcoin even touched $76,391 its highest price in 24 hours. When this article was written on November 7, BTC was trading at $75,216, with an increase of 3.05%. This price is, of course, very amazing and has only happened during this US election period.

You can see from the screenshot of the Bitrue price chart above. The BTC RSI value is at 71.74, which means the buying trend is still strong like yesterday, but if it is higher, it will be overbought.

The Bitcoin MACD indicator also shows a bullish trend that could continue to climb along with Donald Trump’s victory celebration. Because of these very positive BTC indicators, many crypto observers say that BTC could touch a price of $ 100,000 in Q1 2025.

As reported from TradingView, Bitcoin’s current dominance is at 60.05%, which is much higher than BTC’s dominance on normal days, which is only in the 50s.

Crypto is Greening

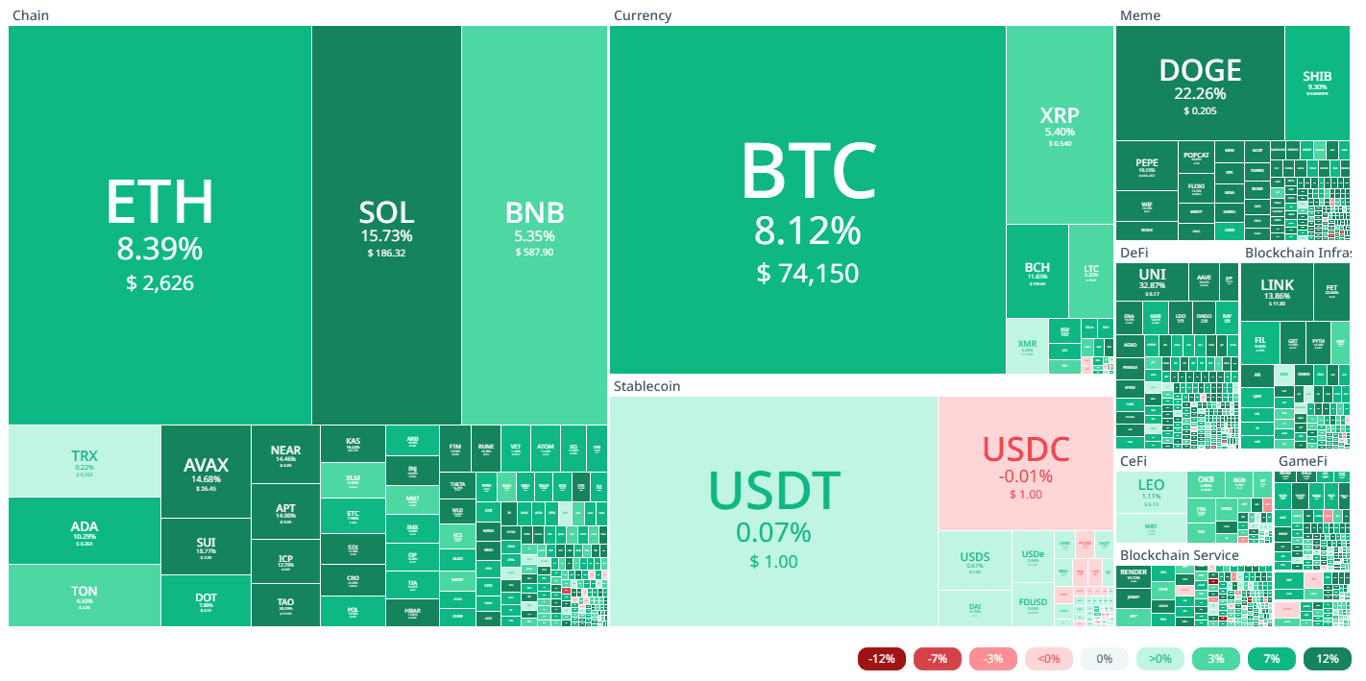

The crypto ecosystem has been green since yesterday. Not only Bitcoin but various Altcoins and meme coins have also experienced significant increases.

Ethereum continues to strengthen its price at $2,821, with an increase of more than 8%. In fact, in 24 hours, ETH touched a price of $2,878. Just like BTC, Ethereum’s RSI value is also very high at almost 80, with a MACD line that has jumped significantly, indicating that ETH’s bullishness is happening and will be more positive in the future.

SOL is also no different. The SOL MACD line indicates a positive bullishness. No mistake, SOL’s price also touched its highest price at $191.90 in the last 24 hours.

Why Crypto Ecosystem Supports Donald Trump

Donald Trump has indeed attracted the sympathy of crypto investors. This is because, during the campaign, Donald Trump seemed serious about supporting this ecosystem. Trump was also recorded as stating 11 points to support crypto:

- Fire SEC Chairman Gary Gensler on Day 1

- Establish a “National Bitcoin Stockpile”

- Make the United States the “Bitcoin and cryptocurrency capital of the world”

- Retain 100% of the 203,650 BTC$BTC ($14.95B) currently held by the U.S. government

- Eliminate capital gains tax on Bitcoin

- Support U.S. Bitcoin mining

- End regulatory crackdowns (the “anti-crypto crusade”)

- Launch a “Bitcoin and crypto presidential advisory council”

- Protect individuals’ rights to self-custody digital assets

- No CBDC

- Commute Ross Ulbricht’s double-life sentence, the founder of Silk Road.

Conclusion

Will the crypto ecosystem strengthen in the future during Donald Trump’s leadership in the United States? Will Trump’s promise to make crypto regulations easier and more protected, as Trump mentioned during the campaign?

To find out, you can access the Bitrue website. There, you will find out all the updates about the crypto ecosystem in real-time, wherever you are.

by Penny Angeles-Tan | Nov 6, 2024 | Business

Explore the 2024 US Election battle between Donald Trump and Kamala Harris, and how their policies impact the crypto ecosystem. Discover Trump’s pro-crypto stance and his potential to shape the future of Bitcoin mining, along with the latest market reactions. Plus, join Bitrue’s Election Forecast contest for a chance to win 10,000 USDT!

The United States General Election has attracted the attention of the global community, including crypto activists. During the campaign period, investors in the crypto ecosystem highlighted the views of the latest US presidential candidates, namely Donald Trump and Kamala Harris, on crypto. Donald Trump is indeed more open to the crypto ecosystem, including his plan to make America a center for Bitcoin mining.

So, who is superior in the 2024 US Election? Is Donald Trump still wanted to be the next US President compared to Kamala Harris by crypto activists? Or is Kamala Harris now superior in electability and able to attract the attention of crypto activists at the last second of the election?

Read the full and detail explanation in this article. You also have the opportunity to win 10,000 USDT in the Election Forecast contest currently being held by Bitrue.

US Election Battle: Donald Trump Vs. Kamala Harris

On November 5 local time, the US Election was officially held. Eligible Americans flocked to cast their votes for the candidate they wanted to become US President in the upcoming period. Donald Trump and Kamala Harris finally officially competed after campaigning for the past few months.

In the live report of the US Election when this article was written, it was known that Donald Trump was ahead in the vote acquisition by a fairly narrow value, namely 51.2% compared to 47.4%.

In the recording of this temporary report, Trump was seen to be ahead in various regions, such as Texas, Mississippi, Florida, and others. Meanwhile, Kamala Harris was ahead in more flashy areas, such as New York, California, and Washington DC.

For information about the Election system in the United States, today’s US Election voting is not the end. The elected president will be determined from the election conducted by the Electoral College where its members are also elected today. The election by the Electoral College will be held in December 2024.

Is Donald Trump More Pro Crypto Ecosystem?

The crypto ecosystem highlights in detail about the 2024 US Election. This is because the newest President of the United States is the one who determines how new regulations in the crypto and blockchain world will be in the future. Moreover, the SEC is often highlighted because of its very complicated rules regarding crypto licensing.

During the campaign, Donald Trump received a lot of praise from crypto activists. His plan to remove SEC members, his desire to make America a center for Bitcoin mining, and even his action of making payments at a pub using Bitcoin received a lot of praise.

On the other hand, Kamala Harris received less attention in the crypto ecosystem. Kamala Harris is not as old-fashioned as Joe Biden, but her plans for the crypto ecosystem have disappointed many. Especially when she explained about crypto and blockchain regulations during the campaign but did not use terms related to these things at all.

However, during the US Election campaign, there were many movements to support both candidates. Both Donald Trump and Kamala Harris received donation support for campaign costs. In fact, Joe Biden, one of the early candidates before Kamala Harris who later withdrew, also received “tips” from crypto activist groups.

Bitcoin Price Rises Significantly on Donald Trump’s Lead

As predicted, the 2024 US Election contest is indeed a determinant of how the ecosystem will run in the future. Big investors flocked to show support for their favorite candidates and this caused the crypto ecosystem to experience significant price changes in the last 24 hours.

Surprisingly, Bitcoin price today even experienced a drastic increase and recorded its latest ATH, which was at $ 75,000, whereas previously BTC’s ATH was at $ 73,800. Many investors are betting and along with Donald Trump’s superiority, crypto tokens are experiencing price strengthening.

At the time of writing, Bitcoin is trading at $74,065 with a 7.72% increase. In 24 hours, BTC was at its latest ATH, which was $75,407. As can be seen in the price chart above, the BTC RSI value is very high at 74.79, which means the buying trend is very high and can result in overbought.

Not only Bitcoin, various other tokens also experienced a significant increase in price. Ethereum recorded its latest price at $2,626 after experiencing an increase of 8.39%. Solana’s price increase even reached 15.73% so that it is now trading at $186.32.

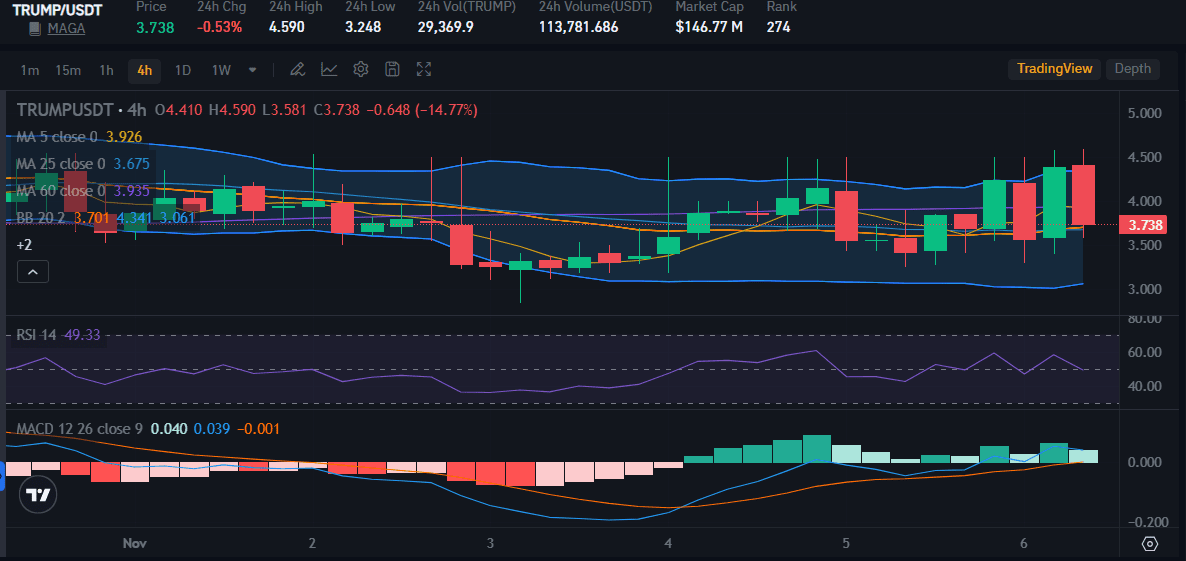

Don’t forget about memecoin which also received sharp attention during the campaign period. Moreover, there is a meme token as a parody of Donald Trump, namely $TRUMP. However, unfortunately, currently, the TRUMP token has actually experienced a price decrease of 0.53% so that it is traded for $3,738.

Conclusion

Donald Trump Vs. Kamala Harris in the 2024 US Election will indeed determine the fate of the crypto ecosystem in the future. Crypto activists support one of the candidates, including major investors. If the candidate is elected, will the crypto ecosystem have friendlier and clearer regulations than now?

For those of you who want to participate in the 2024 US Election, but are not American citizens, you don’t need to be sad. Because, you can guess who will be elected as the next US president by following the Election Forecast currently being held by Bitrue.

You can choose Donald Trump or Kamala Harris as your champion. And if your choice is correct, you have the chance to win 10,000 USDT! How to participate? Immediately see the contest “Who Will Be Elected U.S. President, Trump or Harris?” which is on the Bitrue website right now!

by Penny Angeles-Tan | Nov 4, 2024 | Business

Confused about Solana futures and leverage? This guide breaks down the concept of Solana futures trading in simple terms. Learn how to profit from both rising and falling Solana prices, understand the risks involved, and explore Solana’s potential to rival Ethereum.

Are you interested in starting crypto trading but feel confused by terms such as futures and leverage? This article will be a complete guide for those of you who want to understand the concept of trading Solana futures.

In this article, we will explain in simple and detailed terms what Solana futures are, how they work, and the associated benefits and risks.

What are Solana Futures?

Solana futures are contracts that provide the right and obligation to buy or sell a specified amount of Solana (SOL) at a predetermined price in the future. The Solana futures market offers two main features for cryptocurrency traders:

1. Leverage: Purchasing Solana futures allows traders to control more Solana tokens using leverage (usually 10x to 50x).

2. Profit from price reduction: Selling Solana futures allows traders to profit from downturns in SOL price.

Solana futures traded on most cryptocurrency exchanges today do not have an expiration date, so they are also referred to as Solana perpetual futures or Solana perpetual swaps.

Solana vs. Ethereum

Solana is starting to attract attention as a serious competitor to Ethereum, even though its market capitalization is about four times smaller than that of the leading smart contract platform.

On October 23, the SOL/ETH trading pair reached a new record high of around 0.0692 ETH. The move is part of a bullish trend that has risen 600% since 2023.

Solana’s rise against Ethereum has sparked discussions about its potential to surpass Ethereum’s market capitalization in the not-too-distant future.

At the center of Solana’s bullish outlook is increased network usage and an upcoming update that could potentially reduce Ethereum’s dominance in blockchain.

Can SOL Defeat ETH?

The possibility of Solana surpassing Ethereum in terms of technical capabilities and market valuation may increase as Solana meme-coins have been a key driver of Solana’s recent growth.

Historically, meme-coins have thrived in bull market conditions when speculation runs high, but they have faced severe corrections during market downturns.

Currently, Solana needs to grow 3.5 times its current market cap to reach Ethereum’s $304 billion valuation. However, analysts at VanEck speculate that Solana could reach 50% of ETH’s value in the next few years if it continues to outperform Ethereum in terms of daily active users and transaction volume.

Meanwhile, Bitfinex analysts suggest that Solana’s success depends on expanding its user base beyond speculative traders. To achieve sustainable long-term growth, Solana needs to attract DeFi enthusiasts, traditional financial institutions, and enterprises.

They noted that a Firedancer update in 2025, which aims to increase Solana’s capacity to handle up to 1 million transactions per second, could potentially make its network more attractive to larger investors and institutions.

Solana Continues Uptrend with 13.58% Monthly Gain

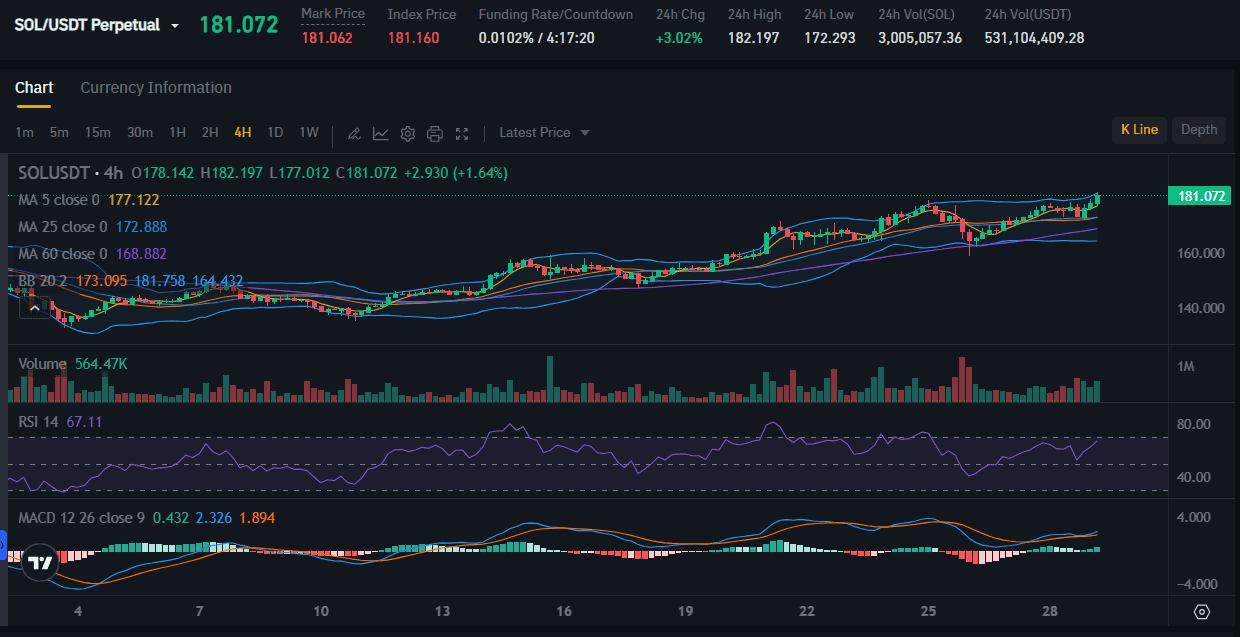

2024 has been a fantastic year for Solana investors as this premier altcoin has risen 481% since November 2023. Although Solana’s growth has slowed, it is still amid a bullish trend with Solana currently trading at US$181,072 with growth of 3.02% in the last 24 hours.

It can be seen from the Solana futures price chart above. The RSI, MACD, and Bollinger Bands indicators show the positive side. Solana’s RSI is at 67.11, which means the buying trend is greater than the selling trend in the sense that it is positive, not overbought. The MACD line is also above the boundary line so the bullish signal is very strong at the moment.

Conclusion: Buying Solana Futures

You buy Solana futures if you want to profit from Solana price increases in the future. This trading strategy is also known as opening a long Solana futures position.

With 10x leverage, buying a $100 Solana futures contract would allow you to ‘own’ $1,000 worth of Solana. However, please note that if the price of SOL falls by more than 10%, you will lose your entire $1,000 investment as your position will be liquidated.

Simple example:

Suppose SOL is trading at 10 USDT per token. A trader futures Solana bullish and decides to open a long Solana futures position at that price by purchasing 1,000 Solana futures contracts with 10x leverage.

With each contract having a contract size of 1 SOL, the initial margin required to open this position is 1,000 x $10 / 10 = $1,000. Depending on the price performance of SOL, traders can make a lot of money or lose their entire investment.

However, the most important thing is that before deciding to invest in Solana futures, you must also carry out in-depth research on this investment instrument. Moreover, crypto is an investment instrument with prices that are so volatile that price changes are common. Checking prices regularly will help you assess how stable a token will be in the future.

Conduct detailed research by utilizing various Bitrue features, starting from the price feature, and price conversion from SOL to USD, to reading articles on the Bitrue blog to find out about the projects being carried out by the token network you are looking for.

by Penny Angeles-Tan | Oct 27, 2024 | Business

Bitcoin futures open interest hits record high! In-depth analysis of its impact on the price of Bitcoin and the cryptocurrency market as a whole. Learn the risks and opportunities of Bitcoin futures trading.

Bitcoin futures trading, as per a report from Coinglass, has hit a new record high with open interest (OI) reaching $40.5 billion on October 21. These trades are carried out by various global crypto exchanges.

This article will provide detailed information regarding market analysis and the Bitcoin futures trading process. That way, you can do personal research before investing.

Bitcoin Hits $70,000

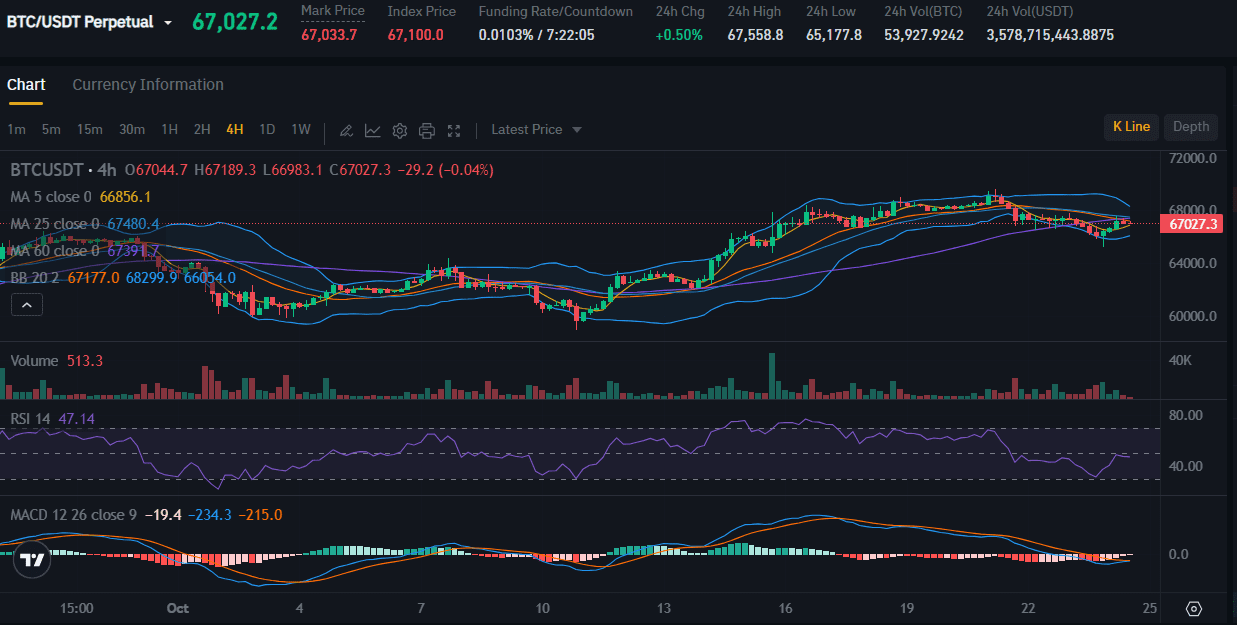

The increase in open interest coincides with Bitcoin price approaching $70,000, more precisely $67,027 with an increase of +0.50%. Open interest refers to the total value or number of futures contracts that have not yet expired. It serves as a leading indicator of market activity and investor engagement in Bitcoin derivatives.

An increase in OI can signal increased leverage in the system, potentially leading to greater market volatility. Periods of high open interest can cause significant market movements, especially when prices shift sharply. Such conditions can trigger chain liquidations, resulting in forced selling in the spot market and causing a sudden drop in Bitcoin prices.

A similar event occurred in August when Bitcoin prices plunged nearly 20%, dropping below $50,000 in just two days. On October 21, Bitcoin hit $69,380 in early trading but faced resistance, pulling back to around $69,033. As of now, the cryptocurrency is still 6.4% short of its record high of $73,738, according to CoinGecko.

Additionally, altcoins such as Ethereum and Solana have outperformed Bitcoin in recent daily gains. Ethereum naik by 3.5%, reaching $2,750, while Solana saw a 6% gain, nearing $170. Both assets have seen a slight decline from recent record highs.

Ethereum and Solana Rally as Bitcoin Dominates

While Bitcoin has been making headlines, this has not been the case for newer altcoins like Ethereum and Solana with daily gains. Ether rose by 3.5 percent to $2,750, meanwhile, Solana rose more than 6 percent to $170. Both assets have pulled back slightly from recent record highs.

The combined dynamics of the bitcoin and altcoin markets add a layer of complexity as altcoin performance can be impacted. Bitcoin may be the star, but investors are increasingly bullish on altcoins to increase returns. As the market grows, so does interest in alternative digital assets.

However, with Bitcoin futures open interest rising, altcoins also have risks to worry about. If Bitcoin prices swing wildly, so can altcoins. For this reason, market participants should continue to check Bitcoin and altcoins for possible price movements in the coming weeks.

US Election Triggers Bitcoin Surge Amid Uncertainty

The US presidential election drove Bitcoin’s recent surge. Before November 5, market players considered how the election results might affect the cryptocurrency market. Donald Trump’s increasingly crypto-friendly policies paved the way for Bitcoin, which has increased its poll numbers and lifted Bitcoin.

Under the Trump administration, higher US interest rates could boost Bitcoin by weakening other currencies, according to market analysts. ‘The fact that the dollar has been strong is a factor in recent market moves, prompting traders to look for ways to hedge currency risks.’

Traders are now considering whether to prepare for election-related trading, as with 15 days until voting day, they can make that decision.

Bitcoin Prospects

Bitcoin has seen its price drop in recent weeks. This is largely due to the bearish sentiment in the cryptocurrency market as a whole. However, some special factors have also influenced the price of Bitcoin.

One of these factors is the increase in mining activity. When more miners join the Bitcoin network, this can increase the supply of new BTC. Increased supply could put downward pressure on prices.

Even though Bitcoin has experienced a price decline in recent times, many analysts are still bullish on its long-term prospects. Bitcoin was the first cryptocurrency and is still the most famous. This platform has a strong ecosystem and continues to grow.

One factor supporting Bitcoin’s prospects is the increasing adoption of blockchain technology. The more companies and organizations start using blockchain, the more likely it is that Bitcoin will become the platform of choice.

Additionally, Bitcoin is developing several technical improvements that could increase its efficiency and scalability. This can increase the interest of users and investors.

Bitcoin Futures Trading Strategy and Risks

If you are interested in trading Bitcoin futures, there are several strategies you can use. One strategy is to use technical analysis to identify trading opportunities. Technical analysis involves studying price charts to look for patterns and trends.

Another strategy is to use fundamental analysis. Fundamental analysis involves studying factors that can influence the price of Bitcoin, such as mining activity, transaction costs, and technological developments.

Bitcoin futures trading can be very risky. Leverage can magnify both profits and losses. It is important to understand the risks before starting to trade.

Conclusion

Bitcoin is an attractive digital asset with long-term growth potential. However, like all investments, Bitcoin futures trading also carries risks. It is important to do research and understand the risks before starting to trade.

Bitrue has various features that you can use to do in-depth research before investing. You can check prices in real-time, check converting from BTC to USD easily, to find out about the latest BTC projects that are being carried out through the latest articles on the Bitrue blog.

by Penny Angeles-Tan | Oct 26, 2024 | Business

Ethereum experiences a price drop. This article will provide an in-depth analysis of the factors influencing the price of ETH, including short-squeeze, institutional flows, and long-term prospects.

Ethereum (ETH) experienced two consecutive days of declines on Tuesday, October 22, after facing rejection at levels around $2,700 the previous day. The decline was supported by mild outflows of over $20 million in US spot Ethereum Exchange Traded Funds (ETFs).

Moreover, the Estimated Leverage Ratio is high in the market futures ETH indicating an increased likelihood of a short-squeeze scenario occurring.

Is it true Ethereum could experience a short-squeeze?

Ethereum may experience a short-squeeze as the Estimated Leverage Ratio (ELR) increases and trades at 0.39 the highest level since early July. This rising ELR indicates that the futures market is overheating making Ethereum vulnerable to a potential short-squeeze event that could trigger impulse buying and significantly push the price up in the event of an unexpected rise.

Institutional flows also fell slightly at the start of the week. According to Coinglass data, US spot Ethereum ETFs recorded mild outflows of $20.80 million on Monday. CryptoQuant’s Coinbase Ethereum Premium Index data shows signs of weakness and remains below neutral levels.

In Ethereum’s case, the metric currently stands at -0.039, below the neutral level of zero. For the Ethereum price to rally, the metric must rise above the neutral value of zero.

Ethereum Price Shows Signs of Weakness

At the time of writing on October 24, Ethereum has continued its price decline to now trade around $2,522. If ETH continues its retracement, it could fall further to retest its daily support level of around $2,461.

The Relative Strength Index (RSI) momentum indicator is showing 31, a very low number because the selling trend is much higher than the buying trend. Currently, ETH can even be considered to be experiencing overselling. With the MACD line continuing to decline, Ethereum is certain to experience bearishness shortly.

Conversely, if ETH breaks the descending trend line and closes above $2,820, Ethereum’s price could rally to retest the next daily resistance at $2,927.

Ethereum Price Analysis

Ethereum has experienced a price decline in recent weeks. This is largely due to the bearish sentiment in the cryptocurrency market as a whole. However, some special factors have also influenced the price of Ethereum.

One of these factors is the increase in mining activity. When more miners join the Ethereum network, this can increase the supply of new ETH. Increased supply could put downward pressure on prices.

Additionally, increasing gas fees have been a concern for Ethereum users. Gas fees are transaction fees paid to miners for processing transactions. When gas fees are high, this can reduce users’ interest in using the Ethereum network, which can hurt the price of ETH.

Ethereum Prospects

Even though Ethereum has experienced a price decline in recent times, many analysts are still bullish on its long-term prospects. Ethereum is the most widely used blockchain platform for decentralized applications (dApps). This platform has a strong ecosystem and continues to grow.

One factor supporting Ethereum’s prospects is the increasing adoption of blockchain technology. The more companies and organizations start using blockchain, the more likely it is that Ethereum will become the platform of choice.

Additionally, Ethereum is developing Ethereum 2.0, which is a major update to the platform. This update is expected to improve Ethereum’s efficiency and scalability. This can increase the interest of users and investors.

Ethereum Futures Trading Strategy and Risks

If you are interested in trading Ethereum futures, there are several strategies you can use. One strategy is to use technical analysis to identify trading opportunities. Technical analysis involves studying price charts to look for patterns and trends.

Another strategy is to use fundamental analysis. Fundamental analysis involves studying factors that can influence the price of Ethereum, such as mining activity, gas fees, and the development of Ethereum 2.0.

Ethereum futures trading can be very risky. Leverage can magnify both profits and losses. It is important to understand the risks before starting to trade.

Conclusion

Ethereum is an attractive digital asset with long-term growth potential. However, like all investments, Ethereum futures trading also carries risks. It is important to do research and understand the risks before starting trading by checking Ethereum prices regularly on the Bitrue website.

You can also compare prices from ETH to USD easily. Apart from that, you can also do thorough research by staying up to date on the latest Ethereum information via the Bitrue blog.

You must be logged in to post a comment.