by | Feb 26, 2025 | Business

Get ready for a transportation revolution! Xpress is turbocharging the shift to sustainable mobility in the Philippines by teaming up with BYD, AC Mobility, and Cebuana Lhuillier’s Ka Negosyo Program. We’re electrifying our fleet with state-of-the-art electric and hybrid vehicles—and our groundbreaking 0% commission program with exclusive financing makes the leap to eco-friendly rides irresistibly rewarding. Industry leaders are buzzing with excitement over this game-changing move, heralding a future of cleaner, faster, and more efficient urban transport. Join us on this thrilling ride toward a sustainable tomorrow!

Cebuana

Lhuillier’s Ka Negosyo Program to Provide Exclusive Financing for Xpress Driver

Partners

0%

Commission to Support Drivers Transitioning to Hybrid & EVs

Manila, Philippines –

February 18, 2025 – The Xpress EV: Sustainable Rides, Pinoy Pride

event at Blue Leaf Pavilion, McKinley Hill, marked a major milestone in

Philippine transportation as Xpress, the country’s fastest-growing

ride-hailing platform, officially announced its partnership with BYD and

ACMobility to accelerate the shift to sustainable urban mobility.

BYD

and Xpress: Leading the Charge for Sustainable Mobility

Through this

collaboration, Xpress is taking a bold step toward electrifying its fleet,

integrating BYD’s industry-leading electric and hybrid vehicles into its

ride-hailing platform. The initiative aligns with Xpress’s long-term vision

of making EV adoption accessible, cost-effective, and beneficial for drivers

and passengers alike.

To further support

drivers making the transition from traditional vehicles to hybrid and electric

models, Xpress is rolling out a 0% commission program for a limited time.

During this transition period, drivers who operate EVs and hybrid

vehicles through Xpress will retain 100% of their earnings, helping

them recover their investment faster and realize the financial

benefits of sustainable mobility immediately.

Kickstarting

EV Adoption Through the Xpress Negosyo Program

Understanding that upfront

costs remain a major barrier to EV adoption, Xpress has launched the Negosyo

Program, securing the first batch of hybrid and electric vehicles to

provide drivers with an accessible pathway into the EV ecosystem.

Additionally, Xpress has

partnered with Cebuana Lhuillier’s Ka Negosyo Program, which is offering

exclusive financing options tailored for Xpress driver partners. This

initiative will provide affordable payment terms for EV and hybrid vehicle

purchases, focusing on drivers in Metro Manila and other key cities

nationwide.

Industry

Leaders Rally Behind Xpress’s EV Vision

During the event, Cliff

Cabungcal, President of Xpress, emphasized the transformational role of

this partnership in reshaping the ride-hailing industry.

“The future of

urban transport is sustainable, and Xpress is committed to leading this

transition. Our partnership with BYD allows us to integrate cutting-edge EV

technology into our platform, while our driver-support programs help ensure a

smooth and profitable transition for our partners,” said

Cabungcal.

Jaime Alfonso Zobel de

Ayala, CEO of ACMobility, expressed his excitement for the

partnership, stating:

“Xpress is the

first ride-hailing company in the Philippines to implement such a

forward-thinking program. Their commitment to sustainability and driver

empowerment aligns perfectly with AC Mobility’s vision. Through our investment

in EV charging infrastructure, we are ensuring that this transition is not just

possible, but practical and accessible for drivers nationwide.”

ACMobility has invested over

$100M in expanding EV charging networks, ensuring that Xpress EV drivers

will have access to reliable charging stations, even in previously

underserved areas.

Jean Henri Lhuillier,

Chairman of Xpress, reinforced Xpress’s role as a leader in EV adoption,

stating:

“The transition to

EVs is not just about sustainability—it’s about securing better earnings, lower

operating costs, and financial stability for our drivers as they become

entrepreneurs. That’s why Xpress is introducing a 0% commission program for a limited

time to support their transition. With the backing of Cebuana Lhuillier’s Ka

Negosyo Program, Xpress driver partners now have a pathway to EV ownership,

making this shift more accessible than ever.”

A

Game-Changer for Philippine Ride-Hailing

The Xpress EV

initiative represents a transformational shift in Philippine

ride-hailing, combining industry-leading EV technology, driver financing

solutions, and infrastructure investment to create a clean, efficient,

and driver-first mobility ecosystem.

With BYD’s proven EV

technology, ACMobility’s nationwide charging network, and Xpress’s

commitment to empowering drivers, this initiative paves the way for a new

era of sustainable transport in the Philippines.

by | Feb 26, 2025 | Business

Bitcoin’s price drops below $87K, sparking market turmoil. Explore the impact of memecoin crashes, the Bybit hack, investor sentiment, and economic uncertainty on BTC’s future trajectory.

Bitcoin investors have experienced a turbulent few weeks as the cryptocurrency has shed nearly 20% of its value since reaching an all-time high of $109,000 just five weeks ago.

The decline, which saw Bitcoin dip below $87,000 on Tuesday, is attributed to a mix of economic uncertainty, speculative excesses, and external market shocks.

The downturn began following a speculative frenzy surrounding memecoins, many of which were launched on the Solana blockchain.

The fervor reached its peak with the introduction of TRUMP and MELANIA tokens, which initially surged but quickly plummeted, leaving most investors with heavy losses.

Solana’s native token (SOL) has since dropped by more than 50%, leading the decline across the broader crypto market.

As of this writing on February 26, 2025, BTC is trading at $88,718 with various indicators declining. The current BTC RSI value is even below 30 which indicates a very high selling trend for this token. In fact, the BTC MACD line also continues to fall which indicates that Bitcoin bearish will really happen if the price continues to fall.

The Bybit Hack and Broader Implications

Bitcoin managed to hold steady despite the memecoin collapse, but another major blow came in the form of the Bybit hack.

The security breach, which led to the theft of $1.5 billion worth of digital assets, sent shockwaves through the crypto ecosystem.

While Bitcoin itself was not directly affected, the exploit exposed vulnerabilities in Ethereum-based systems, leading to a sharp sell-off in ETH and other cryptocurrencies, which in turn dragged BTC lower.

Investor Sentiment and Market Forecasts

The recent decline has led to divided opinions among analysts. Some, like the well-known Bitcoin bull StackHodler, argue that the market has yet to reach its cycle peak, predicting a rebound beyond $108,000 in 2025.

However, others, including Standard Chartered’s Geoff Kendrick, have warned that Bitcoin could fall to the low $80,000s before presenting an attractive buying opportunity.

Kendrick believes that before a meaningful rebound, the market will likely witness a significant day of ETF outflows, surpassing the current record of $583 million.

Economic Uncertainty and Federal Reserve Policy

Bitcoin’s struggles are not happening in isolation. Broader financial markets have also stumbled, with the S&P 500 experiencing its worst week since Donald Trump’s inauguration.

The NASDAQ has declined 5% from its December peak, as concerns about tariffs and economic policy have increased investor caution.

Trump recently reaffirmed his commitment to implementing tariffs on Mexico and Canada, a move that has raised fears of inflation resurgence.

Investors are closely watching the Federal Reserve’s response, particularly Friday’s core Personal Consumption Expenditures (PCE) report, which could influence expectations for future interest rate cuts.

The U.S. 10-year Treasury yield has fallen from 4.80% to 4.32% in anticipation of looser monetary policy, a shift that could ultimately be bullish for Bitcoin in the long term.

The Future of Memecoins and the Broader Crypto Market

The memecoin craze, which fueled much of the speculative fervor in early 2025, may be nearing its end.

Bitwise CIO Matt Hougan has suggested that the downfall of tokens like MELANIA and LIBRA marks the end of the memecoin boom, predicting that their popularity will fade within six months. Over the past 24 hours, LIBRA has dropped 20%, MELANIA 23%, and TRUMP 11%.

MicroStrategy’s Bitcoin Holdings and Market Speculation

One major Bitcoin holder feeling the heat is MicroStrategy (now rebranded as Strategy). The firm’s stock (MSTR) has dropped 11% in the past 24 hours, and its total decline from its November peak now stands at 55%. Strategy holds 499,096 BTC worth $43.7 billion, with an average purchase price of $66,350 per coin.

While some investors fear the company may be forced to liquidate its Bitcoin holdings, analysts argue that this scenario is unlikely given the structure of its 0% convertible notes, most of which do not mature until 2028.

Government Policy and Future Prospects

The Trump administration’s stance on cryptocurrency remains a key market driver. While initial excitement about a pro-crypto White House fueled Bitcoin’s rally past $100,000, skepticism has grown as concrete policies have yet to materialize.

A working group has been established to explore regulatory and legislative proposals, but any major policy shifts are likely months away.

Additionally, a proposed Strategic Bitcoin Reserve, which was speculated to include $20 billion in government-held Bitcoin, has yet to move beyond initial discussions.

Wyoming Senator Cynthia Lummis has suggested that the U.S. government should purchase 1 million BTC over five years, but Congressional approval remains a significant hurdle.

Conclusion: The Road Ahead

Bitcoin’s path forward remains uncertain, with key variables including regulatory developments, macroeconomic trends, and investor sentiment. While the recent dip has prompted caution among analysts, some see this as a necessary correction before a larger bullish cycle takes hold.

As the market digests recent events, Bitcoin investors will be watching closely for any signs of renewed strength or further weakness in the weeks ahead.

by | Feb 26, 2025 | Business

Teeth whitening is an effective way to enhance your smile, whether through in-clinic procedures or at-home methods. Professional teeth whitening involves the use of concentrated bleaching agents activated by light or lasers, delivering immediate and long-lasting results. This is ideal for those with moderate to severe discoloration. At-home options include custom trays, over-the-counter products, and natural remedies, which are best for mild stains but may take longer to show results.

Maintaining your results requires consistent oral care, such as brushing, flossing, and avoiding stain-causing foods like coffee and red wine. Quitting smoking, using whitening toothpaste, and scheduling regular dental cleanings can also help. Occasionally, touch-up whitening treatments may be needed. Teeth whitening is safe for most people, but a dentist’s consultation ensures it’s suitable for you. With proper care, you can achieve and maintain a bright, confident smile for years to come.

A radiant, white smile is often associated with confidence and good oral hygiene. However, teeth discoloration is a common concern due to aging, dietary habits, and lifestyle choices like smoking.

Fortunately, various teeth whitening options—both in-clinic and at home—can help restore the brightness of your smile. This guide explains how these procedures work, who can benefit from them, and how to maintain your results.

Understanding Teeth Discoloration

Before diving into teeth whitening options, it’s essential to understand why teeth become discolored. There are two main types of staining:

Extrinsic Stains: These occur on the tooth’s surface and are caused by external factors such as coffee, tea, red wine, tobacco, or pigmented foods.

Intrinsic Stains: These originate within the tooth and may result from aging, medication use, excessive fluoride exposure, or trauma.

While extrinsic stains are more responsive to whitening treatments, intrinsic stains often require professional intervention.

In-Clinic Teeth Whitening: A Professional Approach

For those seeking immediate and noticeable results, professional teeth whitening performed by a dentist is highly effective. Clinics use advanced techniques and specialized solutions to brighten teeth safely and efficiently.

How It Works

Professional whitening involves the use of concentrated hydrogen peroxide or carbamide peroxide gels. These active agents penetrate the enamel and break down discoloration molecules.

The procedure typically involves:

Preparation: Your dentist will examine your teeth and gums to ensure they are healthy enough for whitening. A protective barrier is applied to shield your gums from the whitening agent.

Application: The whitening gel is applied to the teeth and activated using a special light or laser. This accelerates the chemical reaction, lifting stains effectively.

Multiple Rounds: The gel may be reapplied multiple times during the session to achieve optimal results.

Who Should Consider In-Clinic Whitening?

Professional whitening is ideal for individuals with:

-Moderate to severe discoloration

-Time constraints, as it delivers fast results

-A desire for precise, uniform whitening under professional supervision

Benefits of In-Clinic Whitening

–Immediate and dramatic results

–Safe and customized to your needs

–Longer-lasting effects compared to at-home methods

At-Home Teeth Whitening: Convenient Options

For those who prefer whitening at their own pace, there are various at-home options available. While these may not be as potent as in-clinic treatments, they are still effective for mild to moderate stains.

1. Custom Whitening Trays

Dentists can provide custom-fit trays with professional-grade whitening gel. These trays are worn at home for a specified duration, typically over two weeks. The custom fit ensures even application of the gel and minimizes gum irritation.

2. Over-the-Counter Whitening Products

Products like whitening strips, toothpaste, and kits are readily available in pharmacies. These contain lower concentrations of bleaching agents, making them safer for unsupervised use but slower in delivering results.

3. Natural Remedies

Some people turn to natural alternatives like baking soda or activated charcoal. While these methods may help with surface stains, they are less effective for deeper discoloration and should be used cautiously to avoid enamel damage.

Who Should Consider At-Home Whitening?

-At-home options are suitable for:

-Individuals with mild discoloration

-Those looking for a more affordable solution

-People who are comfortable committing to longer treatment durations

Drawbacks of At-Home Whitening

-Results may take longer to appear

-Risk of inconsistent application or overuse

-Less effective for intrinsic stains

Maintaining a Bright Smile After Teeth Whitening

Whitening treatments are an investment, and maintaining your results requires consistent effort. Follow these tips to prolong the effects of your treatment:

1. Practice Good Oral Hygiene

Brushing twice daily with fluoride toothpaste and flossing regularly helps prevent the buildup of plaque and stains. Use a soft-bristled toothbrush to avoid damaging the enamel.

2. Avoid Stain-Causing Foods and Drinks

Limit your intake of coffee, tea, red wine, and other highly pigmented foods. If you do consume them, rinse your mouth with water or brush your teeth soon afterward.

3. Quit Smoking

Tobacco is a major culprit for yellowing teeth. Quitting smoking not only protects your smile but also benefits your overall health.

4. Use Whitening Toothpaste

Switch to a whitening toothpaste designed to maintain brightness. These products often contain mild abrasives or low levels of hydrogen peroxide to help combat daily staining.

5. Wear Retainers or Night Guards

If you use retainers or night guards, clean them regularly to prevent discoloration. Lingering bacteria or stains on these devices can transfer to your teeth.

6. Schedule Regular Dental Cleanings

Professional cleanings remove surface stains and tartar that can dull your teeth. Dentists recommend cleanings every six months, or more frequently if needed.

7. Consider Maintenance Whitening Treatments

For long-term upkeep, your dentist may recommend occasional touch-ups with whitening trays or in-clinic treatments.

Who Should Consider Teeth Whitening?

Teeth whitening is a viable option for individuals who:

-Have healthy teeth and gums

-Struggle with extrinsic stains from lifestyle habits

-Feel self-conscious about the color of their teeth

-Are preparing for special occasions like weddings or job interviews

However, whitening is not suitable for everyone. Pregnant or breastfeeding individuals, people with active gum disease, and those with extremely sensitive teeth should consult their dentist before proceeding.

Are Teeth Whitening Results Permanent?

While professional teeth whitening can deliver long-lasting results, it is not permanent. The longevity of the results depends on your lifestyle and oral care habits.

By following the maintenance tips outlined above, you can keep your smile bright for years.

Conclusion

Teeth whitening, whether performed in a clinic or at home, is a transformative procedure that can significantly enhance your smile and boost your confidence.

Professional in-clinic treatments offer fast, dramatic results, while at-home options provide a more flexible and budget-friendly approach. Maintaining your results requires commitment to good oral hygiene, mindful eating habits, and regular dental checkups.

If you’re considering teeth whitening, consult a dental professional to determine the best option for your needs. With the right approach, you can achieve and maintain a brighter, healthier smile for years to come.

by | Feb 25, 2025 | Business

Australia’s peak communications consumer body, ACCAN, welcomes the government’s announcement that requirements will be placed upon major mobile carriers to significantly expand mobile coverage across the country.

The Universal Outdoor Mobile Obligation (UOMO), announced today, is an important response from the Minister for Communications to the review of the Universal Service Obligation (USO) – which ACCAN, consumers and many in the telco industry regard as outdated and not reflective of modern consumer needs.

ACCAN CEO Carol Bennett said, “we welcome this announcement by Communications Minister Michelle Rowland to significantly expand Australian’s access to the mobile services they rely on for their health, wellbeing, work and safety.

“ACCAN has been calling for an expanded and modern USO that takes into account new technology and the increasingly volatile climate that is impacting connectivity in times of extreme weather events. Challenging times call for workable and accessible solutions. This initiative will improve access, choice and reliability to essential telco connectivity,” Ms Bennett said.

The development of Low Earth Orbit satellite (LEOSat) connectivity has made a major difference to many Australian consumers, particularly in regional, rural and remote areas. This technology has provided access to internet speed and low latency that was not possible through previous technologies. Until now, LEOSat connectivity has been limited to the internet. With trials of Direct-to-Handset connectivity well underway and a commercial rollout pending – now is the time to act on all of the reviews and consultations on telco services.

“While this initiative recognises next generation technology, it hasn’t ignored the importance of continued investment in existing terrestrial networks to underpin continued certainty especially in our regional, rural and remote regions where it is needed to guarantee continued productivity and safety,” Ms Bennett concluded.

by | Feb 25, 2025 | Business

Discover the latest XRP price predictions for March 2025. Will XRP surpass $4, or could it even hit $15? Explore key factors, technical analysis, and market trends driving its future trajectory.

The cryptocurrency market continues to be dynamic and unpredictable, with XRP again capturing the spotlight. Analysts have predicted that XRP could surpass $4 by March 2025, driven by regulatory clarity, increased adoption, and bullish technical indicators.

Let’s explore the factors influencing XRP’s price trajectory and whether it can reach its targets.

XRP’s Bullish Outlook: Breaking All-Time Highs?

XRP has long been a subject of speculation, but recent market trends suggest a bullish trajectory.

With increasing institutional adoption and Ripple’s expanding global partnerships, XRP is poised to break its all-time high (ATH) of $3.84, which was last seen in 2018.

Analysts forecast that by March 2025, XRP could rally past $4, largely due to its growing utility in cross-border payments and the resolution of Ripple’s legal battles.

Key catalysts for XRP’s price movement include:

- Mainstream adoption of XRP for financial transactions.

- Ripple’s legal victories against the SEC, paving the way for institutional investment.

- Technical analysis support, with strong resistance and support levels indicating a potential breakout.

Could XRP Reach $15 by March 2025?

Some analysts have made bold claims that XRP could surge to $15 by March 2025. This optimism is fueled by:

- The upcoming launch of Ripple’s RLUSD stablecoin.

-

Potential ETF approvals that could bring massive liquidity into the XRP market.

-

A favorable resolution to ongoing SEC litigation, boosting investor confidence.

However, while these factors could contribute to a bullish run, the technical indicators suggest a more measured approach. For XRP to hit $15, it would require significant institutional investment, a surge in utility adoption, and a continued positive regulatory environment.

Technical Analysis: Is XRP Set for a Breakout?

At the time of analysis on February 25, XRP is priced at $2.2729, maintaining stability despite market fluctuations.

1. Relative Strength Index (RSI): Currently at 22.24, indicating that XRP is nearing overselling territory but still has room for growth before a potential pullback.

2. Support Levels: XRP has found solid support at its 50-day moving average around $3.00.

3. Resistance Levels: Key resistance points are at $3.40 and $3.50, with a potential breakout leading to $4.40 (Fibonacci extension target).

If XRP falls below the $2.00 support, the next critical zone is around $1.80, which could trigger caution among traders. However, a successful breach of the $3.50 resistance could open doors for a rally towards $4.00 and beyond.

Historical Data & Market Sentiment: A March Rally in Sight?

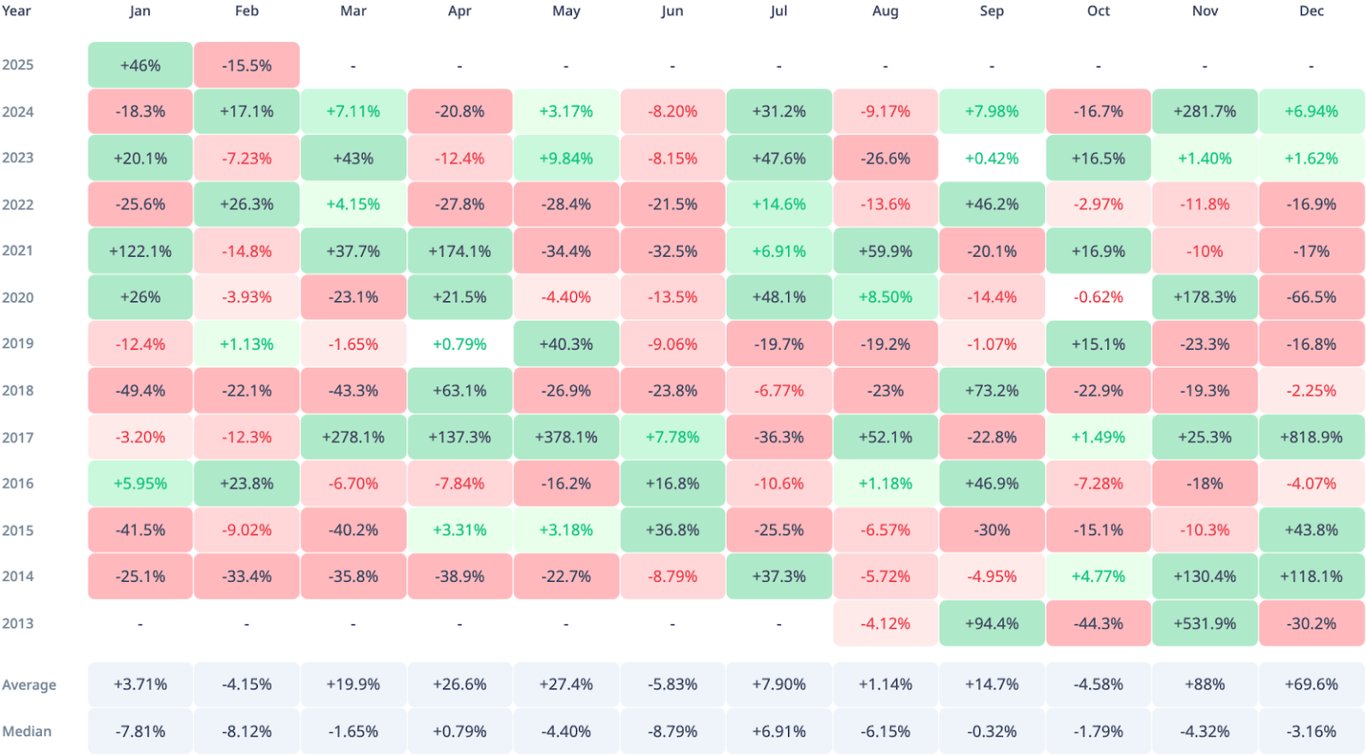

Historically, March has been a favorable month for XRP. According to CryptoRank, XRP has shown positive average returns during March, April, and May:

- March: +19.9%

-

April: +26.6%

-

May: +27.4%

However, the median returns tell a different story, with March showing a -1.65% drop, April barely scraping a +0.79% gain, and May seeing a -4.40% dip. These mixed signals indicate that while a bullish breakout is possible, caution is necessary.

Will the Ripple ETF Spark an XRP Price Explosion?

A significant development that could impact XRP’s future price is the speculation around a potential Ripple ETF.

With the SEC recently dropping its lawsuit against Coinbase, some analysts believe that Ripple’s legal battle could follow a similar trajectory.

If Ripple gains regulatory clarity, an XRP ETF could become a reality, leading to increased institutional investment and heightened market demand.

Polymarket data suggests that there is a 79% probability of an XRP Spot ETF approval by 2025, further fueling bullish sentiment.

Whale Activity & Market Movements

Large-scale transactions have also been observed, with Whale Alert recently flagging a 20,000,000 XRP (USD 51,849,820) transfer from Gemini to an unknown wallet.

Such movements often indicate institutional accumulation, hinting at an impending price surge.

Conclusion: Is XRP a Good Investment for 2025?

While XRP’s future remains subject to various factors, its technical and fundamental indicators suggest that a move beyond $4 by March 2025 is a strong possibility. However, claims of $15 per XRP seem overly optimistic unless major catalysts align perfectly.

Traders and investors should closely monitor:

- Regulatory developments, particularly Ripple’s ongoing case with the SEC.

- Institutional adoption and Ripple’s expanding global network.

- Technical breakout levels are around $3.50 and $4.00.

With March historically favoring XRP bulls and speculation around an XRP ETF heating up, the coming months could be crucial for XRP’s long-term market trajectory.

Whether XRP can rise to new heights or face another pullback will largely depend on the unfolding regulatory landscape and investor sentiment.

by | Feb 25, 2025 | Business

Is XRP a good investment for the future? With rising institutional interest, potential ETF approval, and regulatory clarity, XRP could see massive growth by 2030. Explore price predictions, risks, and key market trends in this in-depth analysis.

XRP, the native cryptocurrency of the Ripple network, has been making headlines recently with significant price movements and renewed interest from institutional investors.

With XRP trading at $2.2729—up an astounding 450% since November 2024—many analysts predict an even greater surge in the coming years. But is this the golden opportunity for investors to capitalize on XRP’s potential?

Let’s explore the factors shaping XRP’s future and whether it remains a strong long-term investment.

The ETF Effect: A Game-Changer for XRP?

One of the most influential catalysts for XRP’s growth could be the approval of a spot XRP Exchange-Traded Fund (ETF).

The U.S. Securities and Exchange Commission (SEC) is currently reviewing multiple ETF applications, including those from Bitwise and Grayscale, while Brazil has already set a precedent by approving the world’s first spot XRP ETF.

If the U.S. follows suit, institutional demand for XRP could skyrocket, driving prices significantly higher.

Historically, ETFs have played a crucial role in increasing the accessibility of digital assets to institutional investors. The approval of Bitcoin spot ETFs in January 2024 led to a 100% surge in Bitcoin’s value over the following year.

A similar trajectory for XRP could see its price double, or even more, within a short time frame.

The Legal Landscape: Will XRP Overcome Regulatory Hurdles?

Despite its growing popularity, XRP’s future still hinges on its legal standing in the U.S. The SEC’s lawsuit against Ripple Labs, which started in December 2020, has been a significant roadblock.

However, recent developments suggest that the regulatory climate is shifting in favor of cryptocurrency companies.

Judge Analisa Torres ruled in July 2023 that XRP’s indirect sales through exchanges did not violate securities laws, marking a partial victory for Ripple.

Furthermore, the appointment of Mark Uyeda as acting SEC chairman has led to a more favorable stance on cryptocurrency regulation. Given these factors, there is a strong possibility that the SEC may either drop its lawsuit against Ripple or approve regulatory clarity, further legitimizing XRP as a mainstream asset.

Technical Analysis: A Bullish Pattern Emerging?

Technical analysts have been closely monitoring XRP’s price movements, and many suggest that a breakout is imminent. Prominent crypto analyst JackTheRippler recently predicted that XRP could surge past $5 soon.

Supporting this claim, Fibonacci retracement levels and strong accumulation patterns indicate that institutional investors are positioning themselves for a long-term hold.

Additionally, Dom Kwok, a former Goldman Sachs analyst, suggested that XRP has the potential to flip Ethereum in market capitalization. While this remains speculative, XRP’s increasing utility in cross-border payments and decentralized finance (DeFi) applications cannot be ignored.

The Road Ahead: XRP’s Price Prediction (2025-2030)

Having overcome major legal battles, XRP is now in a phase of consolidation. Institutional adoption is steadily increasing, and the cryptocurrency market is showing signs of renewed interest in XRP’s utility as a fast, low-cost payment solution.

Price projections suggest XRP will maintain a strong support level around $2.50-$3.50, setting the stage for a major rally.

1. 2025-2026: The Breakout Years

As Ripple’s blockchain solutions gain widespread adoption, analysts predict a potential price surge to $5-$7. If an XRP ETF is approved and regulatory clarity improves, XRP could see unprecedented demand from both retail and institutional investors.

2. 2027-2028: Mass Adoption and Market Stability

By this period, XRP is expected to be deeply integrated into global financial systems. Ripple’s partnerships with central banks and fintech companies could push XRP’s value beyond $10.

At this point, XRP’s volatility may stabilize, making it a preferred digital asset for mainstream financial institutions.

3. 2029-2030: The Digital Finance Revolution

Looking towards the end of the decade, XRP could become a central component of the global financial system.

With blockchain technology reaching maturity, XRP’s use in cross-border payments, tokenization of real-world assets, and decentralized applications (dApps) could drive its price to $15-$25.

Risk Assessment: What Could Derail XRP’s Growth?

While the future looks promising, XRP is not without risks. The primary concerns include:

1. Regulatory Uncertainty: Any negative regulatory developments could dampen investor confidence.

2. Competition: Rival cryptocurrencies like Stellar (XLM) and central bank digital currencies (CBDCs) could challenge XRP’s dominance.

3. Market Volatility: As with any cryptocurrency, XRP remains susceptible to broader market trends, including global economic downturns.

Conclusion: Is XRP a Strong Investment?

With its strong fundamentals, increasing adoption, and improving regulatory landscape, XRP is well-positioned for long-term growth.

While predicting exact price points remains challenging, the convergence of institutional interest, ETF approval prospects, and Ripple’s expanding partnerships suggest that XRP is far from reaching its peak.

For investors looking to capitalize on the future of digital finance, XRP remains one of the most promising assets in the cryptocurrency space. Whether it reaches $10, $25, or beyond, the next decade could be transformative for XRP and its role in the evolving financial ecosystem.

by | Feb 25, 2025 | Business

Imus City Cavite, Philippines – On February 26, 2025,

Ofero, the global fashionable electric mobility brand, celebrated the opening

of its flagship store in Imus City. This layout expands Ofero’s footprint in

the Southeast Asian market, and provides Philippine consumers with green and

efficient travel options.

Relying on the synergy of the R&D center

in Wuxi, China and the local production base in the Philippines, Ofero’s

original Power Cloud energy management system improves vehicle performance by

97% and reduces the motor temperature by 20°C with the five-fold heat

dissipation area design of the Motor Cloud motor. The brand’s full range of

lithium batteries, motors and controllers are provided with double industry

standard warranty service, and the lithium battery warranty period reaches 24

months, reducing users’ long-term use costs.

During February 26-March 9, consumers can

enjoy additional benefits:

The flagship model Stareer3 (39,800 PHP) is equipped with an 1800W

high-power motor, a 100km range to meet the needs of long-distance travel. A

helmet, T-shirt and mobile phone holder are given when purchased;

The Magic3 Lit (35,800 PHP) is equipped with a hydraulic

damping system and ergonomic seat for a comfortable ride. A T-shirt and mobile

phone holder are given when purchased;

The lightweight and stylish Ledo3 Lit (25,800 PHP) is

suitable for short-distance travel, achieving a range of 45 kilometers and a

load capacity of 150 kilograms. A mobile phone holder is given when purchased;

The family-oriented Agila (69,800 PHP) has a large storage space,

spacious rear seats, and USB charging, providing you with a convenient and

comfortable travel experience. A waterproof curtain, T-shirt and mobile phone

holder are provided when purchased.

All of the above models enjoy the “Trade-in”

policy, with a maximum of 4,000 PHP for old cars, which can significantly

reduce the cost.

As a benchmark in the lithium mobility

industry with over 100,000 units shipped globally, Ofero has always been

providing consumers with outstanding product experiences with its core concept

of “Freedom, Reliability and Originality”. Consumers can check the

specifications on the official website (www.ofero.ph) or visit the flagship

store (Ground Floor, DRB Building Palico VI. Aguinaldo Highway, Imus City

Cavite) to enjoy the test drive service.

by | Feb 24, 2025 | Business

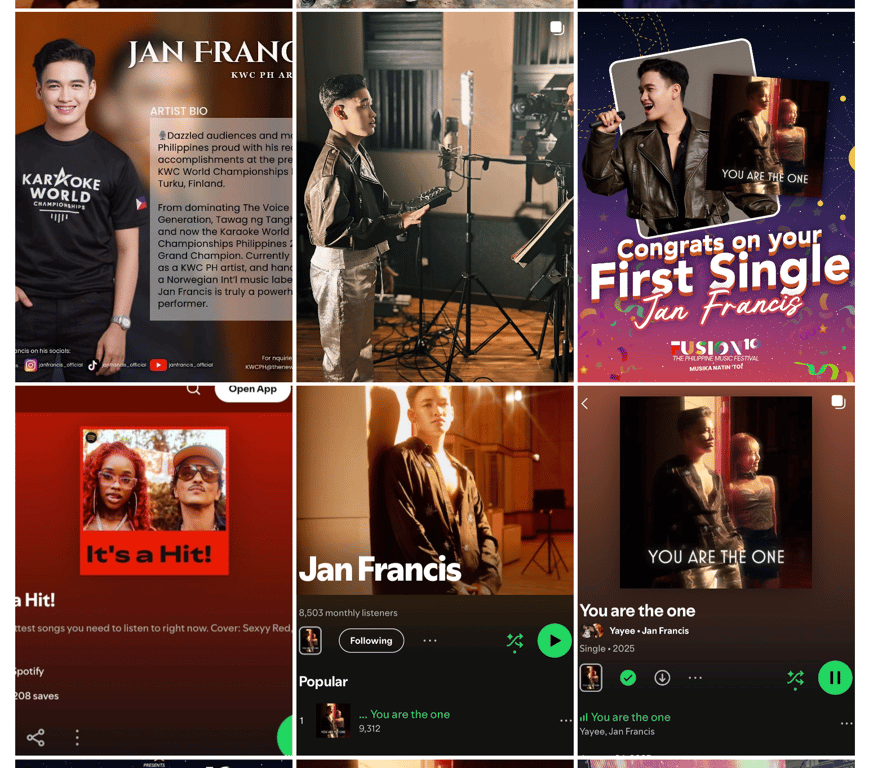

The Philippine music scene is witnessing the meteoric rise of Jan Francis, the Karaoke World Championships (KWC) PH Champion, whose debut single, “You Are The One” (YATO), and follow-up release, “Come Back To Me”, are rapidly gaining popularity on Spotify and capturing the hearts of listeners. This success marks an incredible feat for a newcomer, solidifying Jan Francis’s position as a rising star in the Original Pilipino Music (OPM) landscape.

Released on the 24th of January 2025, “You Are The One” immediately generated buzz and excitement. This vibrant track, a collaboration with Thai pop sensation Yayee, is more than just a song; it’s a powerful anthem for dreamers everywhere. With its catchy hooks, inspiring lyrics, and a unique fusion of Filipino and Thai pop influences, “You Are The One” resonates with listeners across cultures.

The song’s message, embodying the spirit of hope and aspiration, speaks to anyone who has dared to dream big, encouraging them to relentlessly pursue their passions. This universal theme, combined with the infectious melody, has contributed significantly to its widespread appeal.

The release of YATO was accompanied by a visually stunning music video, further enhancing the song’s impact. The video, released in the same week, complements the song’s uplifting message with beautiful visuals, creating a complete sensory experience for the audience.

The impact of “You Are The One” was immediately evident as it quickly climbed the Spotify charts. Within hours of its release, the song garnered thousands of streams and landed on at least 10 Spotify editorial playlists.

One of the most significant achievements for “You Are The One” was its inclusion in the “It’s a Hit!” playlist, a curated selection of the top 50 songs on Spotify. This placement exposed Jan Francis’s music to a wider audience, contributing to its continued growth in popularity. Furthermore, “You Are The One” has been trending on the “It’s a Hit!” playlist for three consecutive weeks.

Catch new things from Jan Francis on his IG account — https://www.instagram.com/janfrancis_official/

The KWC PH management team expressed their excitement upon learning that “You Are The One” had landed on multiple Spotify editorials on its release day. Apple Esplana-Manansala, a partner at KWC PH management, shared that the song placed 9th on Fresh Finds Philippines and received more than 3,000 streams within hours, calling it an amazing news for all of them who work tirelessly on Jan Francis’ music debut. In less than a month, YATO has received more than 100,000 streams on Spotify, almost 100k views of Youtube and almost 300k views of Facebook. “What an amazing accomplishment for Jan Francis, Yayee and the team,” she added.

Watch You Are The One’s Music Video on Facebook here

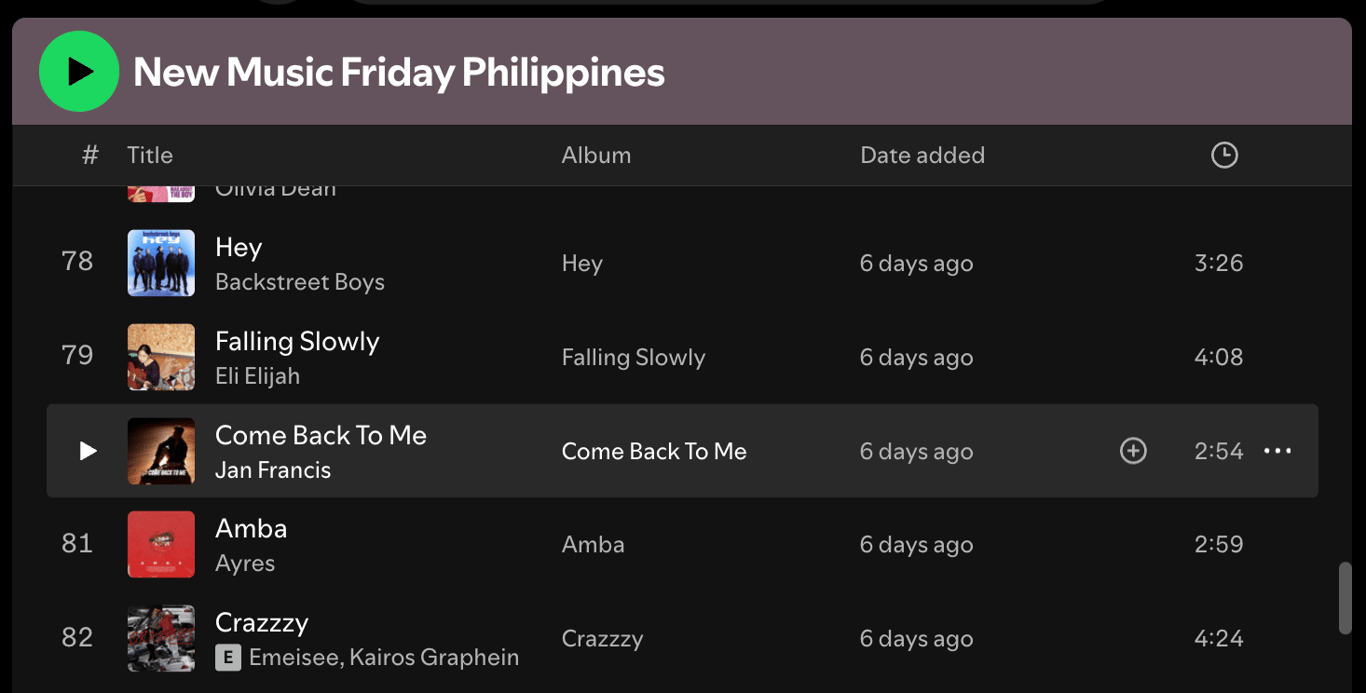

Following the acceptance of “You Are The One,” Jan Francis released his second single, “Come Back To Me,” on Valentine’s Day 2025. This heartfelt ballad showcases a different side of Jan Francis’s artistry, delving into themes of heartbreak and longing.

Watch the music video on Youtube

And follow Jan Francis on Spotify here

While specific chart information for “Come Back To Me” is not available in the provided search results, the release of a second single so soon after a successful debut indicates the momentum and demand for Jan Francis’s music.

The rapid rise of “You Are The One” and the subsequent release of “Come Back To Me” represent an incredible feat for a newcomer in the music industry. Achieving significant streaming numbers, landing on prominent Spotify playlists, and generating positive buzz within a short period is a testament to Jan Francis’s talent, hard work, and the support of his team.

David Soderholm of Up! Hit Music, the international label handling the song releases of Jan Francis shared how special this first collab for them with a Filipino artist. “The release of two songs so quickly one after the other, especially when the first, “You Are the One,” is still featured on major playlists is remarkable. It reminds me of the incredible amount of work that goes into this process. Jan Francis excels in both powerhouse and pop/R&B genres, and I’m excited to see how far his talent can go. What a fantastic journey it has been with Jan Francis, and his management team in the Philippines, “ he exclaims.

These accomplishments are particularly noteworthy given the competitive nature of the OPM scene. Jan Francis’s ability to break through the noise and connect with listeners on a personal level demonstrates his potential for long-term success.

Jan Francis’s success story highlights the importance of supporting local talent and original Filipino music. Streaming platforms provide crucial avenues for artists to reach audiences and build their careers. By engaging with Jan Francis’s music on Spotify, fans are not only enjoying great music but also contributing to the growth and sustainability of the OPM industry.

[Photo is c/o Fusion Music Festival IG Account ]

Sharing thoughts and engaging with fellow fans on social media using hashtags like #YouAreTheOne #JanFrancis #YATO helps create a sense of community around Jan Francis’s music and encourages others to join in on the excitement.

[Photo is c/o Billboard Philippines IG Account ]

The future looks bright for Jan Francis as he continues his musical journey. He will be participating in Fusion Manila, one of the Philippines’ premier music festivals, on March 15, 2025 together with other KWC PH artists. This festival, which celebrates OPM by uniting artists across genres and generations, provides a perfect platform for Jan Francis to showcase his talent alongside other great Filipino artists.

Fans can also look forward to more original songs from Jan Francis throughout 2025. KWC Philippines management has committed to releasing at least three new tracks within the year, indicating a promising trajectory for his career.

Jan Francis’s journey is an inspiration to aspiring artists everywhere. His dedication, talent, and the support of his community have propelled him to success in a short amount of time. As he continues to create and share his music, he is sure to make a lasting impact on the OPM landscape and beyond.

Stay tuned for more updates on Jan Francis’s musical journey by following him on his social media accounts: IG @janfrancis_official | TikTok @janfrancis_official | FB Jan Francis.

For inquiries, email KW***@***********el.com. For more info about KWC PH and the 2025 auditions, click www.kwcph.com

This story also came out on www.thenewchannel.com/highlights. Browse for more NEW Stories on TNC’s official website www.thenewchannel.com.

by | Feb 24, 2025 | Business

Global mining services provider Thiess has partnered with The University of Queensland (UQ) to co-design three new post-graduate qualifications to provide specialised training in mining disciplines and elevate the standard of mining education.

With two graduate certificates and a graduate diploma in resource development on offer, the program is tailored to engineers who want to gain formal qualifications in mining through real world, on the job learning.

Thiess Operations Director – Australia East Peter Rule said: “This partnership brings together Thiess as a leading mining services provider and UQ as a world class tertiary educator to deliver academically recognised qualifications for engineering professionals wanting to convert across from non-mining disciplines to the mining industry.

“Our inhouse learning and development centre, Thiess Institute, and our experience Technical Services professionals, have worked with UQ to shape and influence course content along with developing a flexible learning model to allow students to continue to work in the industry full-time while advancing their formal mining qualifications.”

Participants will gain advanced technical knowledge and practical skills directly applicable to the mining industry, learning from industry experts in a blended approach of remote and on-the-job learning, and on-campus intensive training.

As stated by Professor Ross McAree, Head of UQ’s School of Mechanical and Mining Engineering: “This collaborative initiative with Thiess represents a transformative approach to mining education, bridging the gap between academic knowledge and industry expertise. By co-designing these specialised post-graduate qualifications, we’re not just teaching mining disciplines – we’re developing the next generation of industry leaders who can drive innovation, safety, and sustainability in resource development.”

by | Feb 24, 2025 | Business

Explore XRP price predictions for 2025, the impact of SEC regulations, market trends, and Ripple’s growth opportunities. Will XRP surge or struggle? Find out now.

Few digital assets spark as much debate as XRP. Some see it as the future backbone of cross-border payments due to its efficiency, while others question its long-term viability.

The uncertainty surrounding XRP’s regulatory status and its close association with Ripple only adds to the intrigue.

Yet, beyond the controversies, one undeniable reality remains: XRP is among the largest cryptocurrencies by market capitalization, and any potential shift in its utility can significantly impact its price.

This article explores XRP’s current state, its market dynamics, and the factors that will shape XRP’s trajectory through 2025.

SEC Appeal and Regulatory Uncertainty

On February 23, uncertainty loomed over the SEC’s decision on whether to pursue an appeal against the ruling on Programmatic Sales of XRP in the Ripple case.

This speculation grew after the SEC dismissed its case against Coinbase (COIN), hinting at a possible withdrawal from the Ripple appeal. However, the complexity of court rulings in the Ripple case adds an additional layer of uncertainty.

The situation is further complicated by an ongoing investigation by the Office of Inspector General (OIG) into potential conflicts of interest within the SEC. Reports suggest that former SEC Chair Gary Gensler withheld these findings before stepping down on January 15.

Acting Chair Mark Uyeda and Commissioner Hester Peirce have since remained silent, leading to speculation that the findings could impact the SEC’s legal strategy against Ripple.

A withdrawal of the SEC’s appeal could propel XRP beyond its all-time high of $3.5505, whereas continued litigation might suppress prices below $1.50.

The Role of XRP in Cross-Border Payments

Ripple, the fintech company behind XRP, provides blockchain-based solutions for cross-border transactions. Through RippleNet, financial institutions can facilitate faster and cheaper global transfers.

XRP serves as a bridge asset within this ecosystem, enabling liquidity on demand and reducing reliance on pre-funded accounts.

Despite these advantages, XRP’s adoption remains uncertain. Some of Ripple’s partners use its software without utilizing XRP, raising concerns about whether the token is essential for Ripple’s vision.

Additionally, competition from stablecoins and Central Bank Digital Currencies (CBDCs) threatens XRP’s long-term utility.

OIG Investigation and Its Potential Impact

A key development in the Ripple case is the investigation into former SEC Director Bill Hinman. In 2018, Hinman stated that Bitcoin (BTC) and Ethereum (ETH) were not securities while allegedly maintaining financial ties with law firm Simpson Thacher, a proponent of Ethereum.

Court documents indicate that Hinman continued meeting with Simpson Thacher despite SEC ethics warnings. The SEC’s failure to protect related documents under attorney-client privilege further fuels allegations of bias.

If the OIG findings confirm conflicts of interest, the SEC may face pressure to withdraw its appeal, further strengthening Ripple’s position and potentially boosting XRP’s price.

XRP Price Trends and Market Outlook

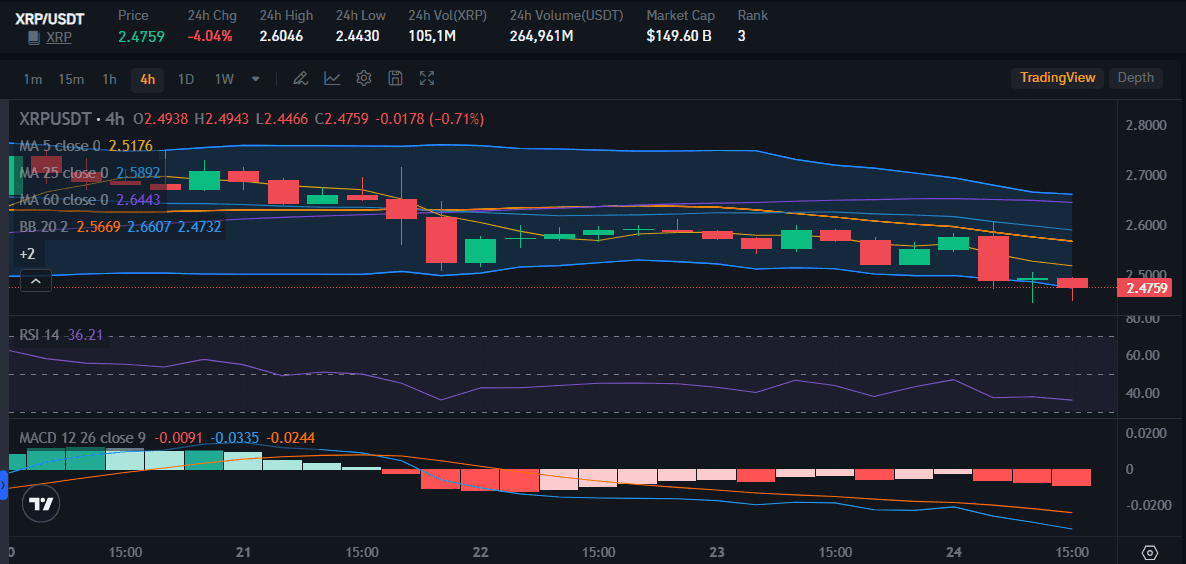

On February 24, XRP traded at $2.4759. While it remains below its January 16 high of $0.9399, key regulatory and market developments will determine its near-term trajectory.

1. SEC Appeal Outcome: A favorable outcome could drive XRP toward new highs, while continued legal battles may suppress investor confidence.

2. ETF Developments: Approval of an XRP-spot ETF could attract institutional inflows, potentially pushing prices toward $5.

3. Broader Market Trends: Economic indicators, Federal Reserve policies, and Bitcoin ETF trends will also influence XRP’s performance.

Institutional Adoption and Competitive Pressures

For XRP to sustain long-term growth, it must secure institutional adoption. Banks, fintech firms, and payment processors must integrate XRP into their liquidity solutions.

While Ripple has forged partnerships with financial institutions, the rising prominence of stablecoins and CBDCs presents a challenge.

Regulatory clarity will also play a crucial role. A decisive legal victory affirming that XRP is not a security could lead to its relisting on major U.S. exchanges, opening the door for new retail and institutional investors.

Technical Innovations and Market Trends

XRP’s competitive edge lies in its speed and low transaction costs. However, the blockchain landscape is evolving rapidly, with emerging Layer-2 solutions and new digital assets vying for market dominance.

Ripple must enhance its protocol, improve scalability, and build interoperability with other blockchain networks to maintain relevance.

Macroeconomic conditions also play a role. Interest rates, inflation, and investor sentiment influence capital inflows into cryptocurrencies. A bullish market environment could amplify positive developments for XRP, while economic downturns may limit its growth potential.

Analyst Predictions for 2025

Crypto analysts remain divided on XRP’s future, with bullish and bearish scenarios emerging.

1. Bullish Scenarios

- Increased institutional adoption by banks and remittance providers.

- Positive legal outcomes boosting investor confidence.

- Expansion into CBDCs, positioning XRP as a bridge currency.

2. Bearish Scenarios

-

Regulatory setbacks limiting XRP’s market accessibility.

-

Rising competition from stablecoins and next-generation blockchains.

-

Investor skepticism due to slow adoption of XRP-based solutions.

Opportunities for XRP Growth in 2025

Ripple’s ongoing engagement with central banks and its push into stablecoin initiatives could be a game-changer for XRP. If CBDCs and private-sector stablecoins integrate XRP for liquidity and cross-border settlements, the token’s utility could expand significantly.

However, regulatory uncertainty and competition from national digital currencies pose significant hurdles. Governments may opt for closed-loop systems, reducing the need for an external bridging asset like XRP.

Ripple must demonstrate that XRP’s speed, cost-efficiency, and interoperability offer a distinct advantage over fiat-backed alternatives.

Will XRP’s Price Rise or Fall in 2025?

XRP’s price trajectory will depend on regulatory clarity, institutional adoption, and macroeconomic trends. While its potential remains strong, skepticism is justified.

If Ripple secures major partnerships and regulatory victories, XRP could witness a sustained rally. However, continued legal uncertainties and competition from stablecoins and CBDCs may limit its upside.

Crypto analyst Dom recently noted that XRP’s 43% drop from its $0.9399 yearly peak might signal a major buying opportunity. Historically, XRP has rebounded sharply after deep corrections, as seen in the SEC lawsuit-induced plunge of 2020 and the COVID-driven crash.

Market expert Amonyx shares an optimistic outlook, predicting a major price surge based on historical trends. He highlights the Total 3 market cap metric (excluding BTC and ETH), which previously surged to $360 billion after a similar accumulation phase.

Conclusion

XRP’s journey remains uncertain, shaped by legal battles, market trends, and technological advancements. While regulatory clarity and institutional adoption could propel XRP to new heights, competition and skepticism persist.

Investors should closely monitor developments in the SEC case, ETF approvals, and Ripple’s partnerships to gauge XRP’s potential for 2025 and beyond.

You must be logged in to post a comment.