by Penny Angeles-Tan | Jan 16, 2025 | Food & Beverage

As the Chinese New Year approaches, The Manila Hotel invites guests to celebrate the Year of the Snake. Join the festivities and experience the rich traditions that may bring good fortune and joy to everyone.

Signature Tikoy for a Sweet Start

To celebrate this auspicious occasion, The Manila Hotel is offering its signature Tikoy, also known as Nian Gao, from now until February 2, 2025. These traditional Chinese New Year cakes are available in two delightful flavors: Almond and Red Bean. They make a thoughtful gift or a wonderful addition to your holiday feast. Each box is priced at Php 988 net.

To celebrate this auspicious occasion, The Manila Hotel is offering its signature Tikoy, also known as Nian Gao, from now until February 2, 2025. These traditional Chinese New Year cakes are available in two delightful flavors: Almond and Red Bean. They make a thoughtful gift or a wonderful addition to your holiday feast. Each box is priced at Php 988 net.

Take advantage of our Early Bird Offer and enjoy a 30% discount when you purchase a minimum of five (5) boxes by January 19, 2025. For bulk orders placed between January 20 and 31, 2025, the following discounts will apply:

- 10% off for orders of 5 to 9 boxes

- 15% off for orders of 10 to 19 boxes

- 20% off for orders of 20 boxes or more

Festive Lunar Celebrations

Join us in celebrating the vibrant traditions of Chinese New Year at The Manila Hotel! On January 29, 2025, prepare to be amazed by the Lion and Dragon Dance, a lively performance that wards off evil spirits and invites good fortune. To enhance the festive spirit, guests dining at the hotel on January 28 and 29, 2025, will receive an Ang Pao filled with golden chocolate coins and fortune cookies.

Chinese New Year Set Menu at Red Jade

Celebrate the Year of the Snake with an indulgent special set menu at Red Jade, featuring a selection of exquisite dishes. The menu includes:

- Prosperity Yee Sang (Lo Hei)

- Roast Peking Duck with Black Truffle Sauce

- Shredded Chicken with Dried Scallops and Shark’s Fin Soup

- Tower Mei Cai Pork with Black Sea Moss

- Assorted Seafood with Baby Abalone in a Hot Pot

- Braised Wawa Cai with Morel Mushroom

- Pan-fried Sea Bass with Soy Sauce

- Stir-fried Crab with Chili Sauce

- Fukien Cha Misua

- Pan-Fried Tikoy

- Mango Sago

This sumptuous set menu will be available for lunch and dinner from January 27 to 31, 2025. It is priced at Php 3,888 net per set, with a minimum of six (6) sets required per table.

Raise a Glass to Good Fortune

Enhance the celebration with Shǒuyè, a cocktail that combines the smoothness of cognac with the refreshing zing of ginger ale. Guests can enjoy Shǒuyè at the Tap Room, Lobby Lounge, and Pool Bar throughout January.

Celebrate at Home with the Chinese New Year Hot Box

If you prefer to celebrate at home, M Takeout is offering the Chinese New Year Hot Box, which includes a delicious serving of Pork Knuckles with Hot Buns. This convenient and flavorful option is available from January 15 to 31, 2025, and is priced at Php 3,688 net, making it ideal for sharing with family and friends.

For more information and reservations, please call +632 85270011 or ++632 5301 5500 or email re************@************el.com.

About The Manila Hotel

The Manila Hotel is conveniently located beside Kilometer Zero (0), the point where the City of Manila begins, and is within walking distance of well-known landmarks such as Rizal Park, Intramuros, and the National Museums. Renowned for its rich history, elegance, and world-class service, The Manila Hotel has been the preferred choice for distinguished guests since 1912, continuously offering exceptional services and amenities for a truly memorable experience.

The hotel boasts over 500 well-appointed rooms and 22 function rooms, including three ballrooms. Guests can enjoy five-star relaxation with experiences at the Manila Hotel Spa, along with access to adult and children’s pools and the Manila Hotel Health Club. Additionally, the hotel features the Heritage Museum, a treasure trove of priceless memories that narrates its illustrious history, and an Art Gallery that offers insight into contemporary art through the perspectives of various artists.

Dining at The Manila Hotel provides a unique culinary adventure across six different outlets: Café Ilang-Ilang, a favorite for its extensive selection of international buffet delights; the Champagne Room, renowned for its Old European style fine dining and regarded as the most romantic venue in Manila, specializing in European cuisine; the Tap Room, which has an Old English pub atmosphere with live music in the evenings; the Lobby Lounge, perfect for casual dining, aperitifs, post-dinner nightcaps, or leisure meetings; Red Jade, a fine dining restaurant that serves authentic Chinese cuisine; and the Delicatessen, offering the hotel’s signature pastries, bread, chocolates, and pralines.

by Penny Angeles-Tan | Jan 15, 2025 | Business

The Chamber of Cosmetics Industry of the Philippines, Inc. (CCIP) recently held its fourth General Membership Meeting (GMM), themed “Cocktail Night,” at the Revel at the Palace in Taguig City.

The event was led by the CCIP Board of Trustees, including President Christine Reyes from Amway Philippines, who presented her annual report. She highlighted CCIP’s mission to accelerate, elevate, and champion the cosmetics industry in the Philippines. Christine expressed excitement about continuing to grow the Chamber’s legacy with the unwavering support of its member companies.

“In response to the dynamic and ever-changing business and regulatory landscape, CCIP is dedicated to advancing the cosmetics industry by fostering adaptability and providing swift, strategic solutions to market shifts. By nurturing creativity, we aim to drive sustainable growth and meaningful change, reinforcing our leadership in the industry. Building on the momentum of our 50th anniversary, our next step is clear: to elevate CCIP to the next level as we pave the way for the cosmetics industry to achieve unprecedented excellence in 2025 and beyond,” she stated.

Joining Christine at the year-end festivities were fellow board members: Jacqueline Lim from First Asia Manufacturing, Monina Leslie Ferrer from Snoe Beaute Produits Inc., Denice Sy from Ever Bilena Cosmetics, Inc., Dennies Ladia from Environatural Corporation, Dr. Janina Tan from Jradiance Corporation, and Shirley Cayago from Splash Corporation.

The event, co-hosted by Denice Sy, Dominic Plana, and Tin Guiao, was filled with energy, entertainment, and camaraderie among members. Guests enjoyed great drinks, lively music, and the excellent company of colleagues from across the industry.

A significant highlight of the night was the announcement of the election results for CCIP’s new Board of Trustees for 2025. These new trustees will work alongside the current board members.

The Election Committee, led by Gladys Conopio from DKSH Philippines, Inc., Lessie Galindo from Brenntag Ingredients, Inc., and Faye Muñoz from Chemrez Technologies, Inc., announced the newly appointed trustees: Aio Nery from CCT Chemicals Inc., Jellie Marie Villamor from GT Cosmetics in Cebu, Maria Roberta Estacio from Harem Inc., Ramon Claridad from Rainiers Research and Development Institute, John Robinson Uy from Unilever Philippines, Michael Zotomayor from ZLab International Corporation, and Kimberly Sablayan from Lifestrong Marketing, Inc.

As the Chamber moves into 2025 with a dynamic and visionary board, CCIP reaffirms its commitment to empowering the local cosmetics industry and fostering collaboration among its diverse and vibrant membership.

by Penny Angeles-Tan | Jan 10, 2025 | Food & Beverage

The Manila Hotel’s Champagne Room offers a unique culinary experience, transporting guests to the historical Saga Prefecture in Japan through an exceptional six-course dinner, masterfully prepared by The Manila Hotel’s esteemed Japanese Chef Oseki Nobu and paired with a curated selection of Yamazakura Japanese Whisky, chosen by renowned whisky expert Mr. Johnssen Li.

Scheduled for January 16, 2025, at the iconic Champagne Room, this elegant evening promises a harmonious blend of flavors, combining the unparalleled quality of Saga Wagyu with the nuanced profiles of premium Japanese whisky.

The Culinary Experience

Chef Oseki Nobu has designed a six-course menu that highlights the distinctive qualities of Saga Wagyu, known for its exquisite marbling, tenderness, and delicate flavor. The menu includes Saga Tataki with Watercress Ohitashi, Thinly Sliced Saga in Beef Consommé, Sesame Tofu in Saga Beef Roll, Pan-seared Saga on Mushroom Risotto, Saga Beef with Black Garlic Sauce, Panna Cotta with Plum Wine Jelly, and Saga Beef Jerky in Dark Chocolate.

Each whisky has been meticulously selected by Mr. Johnsson Li of Grand Cru Wines and Spirits, known for its fine quality and international acclaim, to enhance the dining experience of our guests.

This one-night-only event is a rare opportunity to savor the finest Japanese beef alongside premium whisky in the elegant setting of The Manila Hotel’s Champagne Room. With limited seats available, priced at Php 11,625 net per person, we encourage you to secure your reservation at your earliest convenience. Standard discount tiering applies for Prestige cardholders.

This event is presented in partnership with Saga-Gyu and Mayon Consolidated Inc.

For inquiries and reservations, call +632 85270011 or +632 53015500 or send an email to re************@************el.com.

The Manila Hotel is located beside kilometer zero (0), where the City of Manila begins, and is within walking distance from the Philippines’ known landmarks: Rizal Park, Intramuros, and National Museums. Defined by its history, elegance, and world-class service, The Manila Hotel is the choice hotel for the most distinguished clientele.

Since 1912, The Manila Hotel has continuously provided the best services and amenities for a truly memorable experience. It has more than 500 well-appointed rooms and 22 function rooms, including three (3) ballrooms. Apart from these, the hotel offers five-star relaxation and wellness experiences with the Manila Hotel Spa, adult and children’s pools, and the Manila Hotel Health Club. The hotel is home to the Heritage Museum, a treasure trove of priceless memories that narrate its illustrious past.

It also has an Art Gallery that offers a window into a contemporary world, captured through the objective point of view of different artists. It has six (6) dining outlets, each offering a unique culinary adventure: Café Ilang-Ilang, which is a favorite spot for its extensive selection of International buffet delights; Champagne Room with its Old European style fine dining and also hailed as the most romantic room in Manila — it features European cuisine in a posh, fine-dining setting; Tap Room, an Old English pub-inspired outlet where one can enjoy an evening of live music; Lobby Lounge which is ideal for casual dining, aperitif, post-dinner nightcaps, or leisure meetings; Red Jade, a fine dining restaurant that serves authentic Chinese cuisine; and Delicatessen that offers the hotel’s signature pastries, bread, chocolates, and pralines.

by Penny Angeles-Tan | Dec 28, 2024 | Business

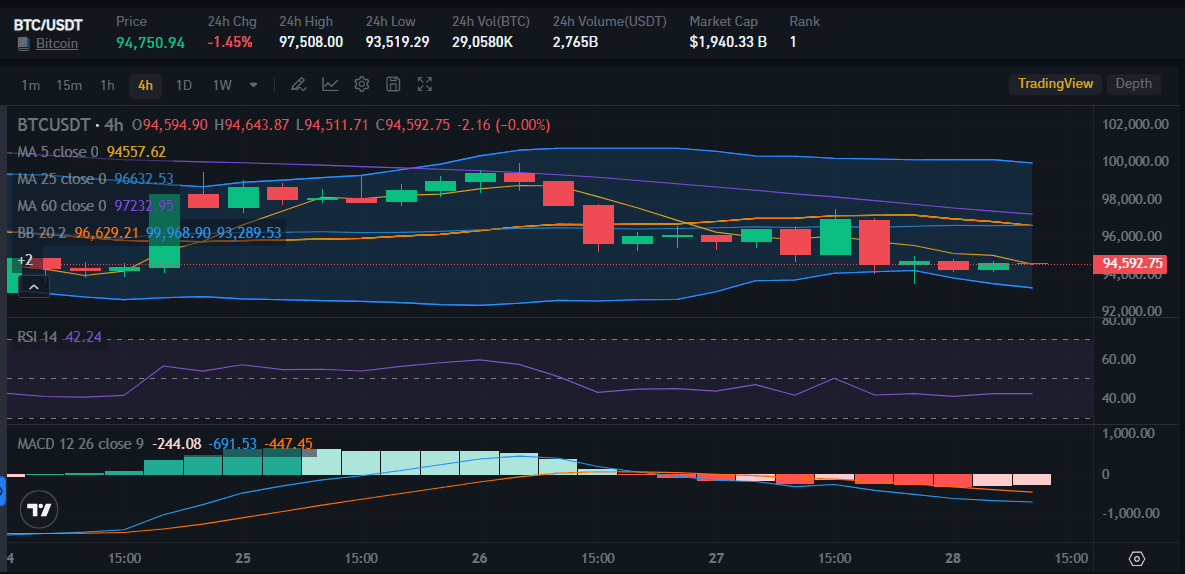

Explore Bitcoin’s price trends as it hovers below $95,000. Analysts weigh in on a potential correction to $60,000 or a bullish surge beyond $110,000, with key indicators and market insights shaping the cryptocurrency’s future trajectory.

As Bitcoin hovers below $95,000 after two weeks of declining prices, analysts express growing concern about the cryptocurrency’s future trajectory. While the flagship digital asset has shown resilience in past cycles, market dynamics suggest a potential correction to $60,000 is not off the table.

Here’s a comprehensive analysis of Bitcoin’s current state, the bearish and bullish outlooks, and what it could mean for the broader cryptocurrency market.

Current Market Performance

Bitcoin has dropped 1.45% in the past 24 hours, hitting an intraday low of $95,134. This extends its fortnight losses to 3.7%, with the market capitalization falling to $1.9 billion.

Despite efforts by bulls to defend the critical $95,000 support level, market sentiment remains cautious as analysts highlight the risk of a deeper correction.

Key Indicators:

1. On-Chain Activity: Over 33,000 BTC, valued at $3.23 billion, were transferred to exchanges in the past week, signaling potential sell pressure.

2. Profit-Taking: On December 23, Bitcoin holders realized $7.17 billion in profits, a strong indicator of declining confidence.

3. Long Positions: The percentage of long-position traders dropped significantly, from 66.73% to 53.6%, reflecting waning bullish sentiment.

Bearish Outlook: Potential for a Massive Drop

Several market experts warn that failure to hold the $95,000 support level could result in Bitcoin’s price plummeting to $60,000 or lower.

Key Predictions:

1. Ali Martinez

- Highlights a critical support range between $93,806 and $97,041.

- Predicts a drop to $70,085 if this zone fails to hold.

2. Peter Brandt

Cites a bearish “broadening triangle” pattern, indicating a potential fall to $70,000.

3. Benjamin Cohen and Mark Newton

Suggest Bitcoin could drop to $60,000, especially around significant events such as Donald Trump’s inauguration on January 19.

4. Jesse Olsen

Predicts a 30% pullback, citing historical patterns tied to the MACD bearish crossover. Targets include $92,000, $85,000, and $70,000.

Contributing Factors:

- Holiday season liquidity constraints.

-

Increased volatility from the expiration of $14.2 billion in Bitcoin options.

-

Reduced institutional activity, leaving retail investors to steer the market.

Bullish Case: A Temporary Setback

Not all analysts are pessimistic. Some argue that Bitcoin’s current correction is necessary to consolidate before the next upward rally.

Optimistic Predictions:

1. Titan of Crypto

- Reaffirms a long-term bullish target of $110,000.

-

Views the current correction as a precursor to the next bullish wave.

-

Considers $87,000 as the “maximum pain” threshold to maintain bullish momentum.

2. Georgii Verbitskii

3. Sentiment Report

Notes increased stablecoin movement to exchanges by whales, which could indicate the impending large-scale of BTC’s buying activity.

4. Technical Patterns

Other Market Trends

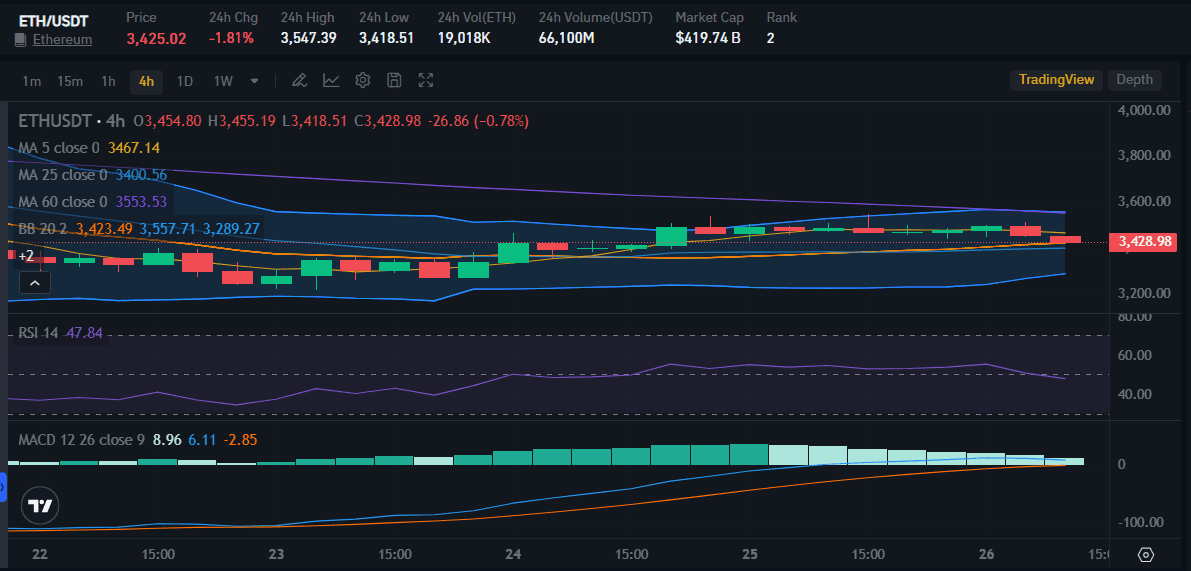

Bitcoin isn’t the only cryptocurrency facing turbulence. Ether (ETH) dropped 2.3% in the past 24 hours, trading at $3,375 globally and $3,658 on Indian platforms. Other major cryptocurrencies, including Ripple, Binance Coin, and Solana, also recorded losses.

Expert Insights:

– Edul Patel (Mudrex CEO): Notes reduced institutional activity and anticipates retail-driven volatility.

– Avinash Shekhar (Pi42 CEO): Emphasizes caution, highlighting Bitcoin’s history of strong rebounds.

What’s Next for Bitcoin?

As Bitcoin navigates this critical juncture, market participants should closely monitor key support and resistance levels.

The $93,806-$97,041 range remains pivotal. A sustained break below this zone could accelerate the drop to $70,000 or lower, while a rebound above $95,000 might rekindle bullish sentiment.

Investor Strategies:

– Short-Term Traders: Consider hedging positions or reducing exposure during periods of heightened volatility.

– Long-Term Holders: Use potential dips as buying opportunities, keeping an eye on macroeconomic trends and institutional activity.

Conclusion

Bitcoin’s current correction phase underscores the cryptocurrency market’s inherent volatility. While a significant price pullback appears likely in the short term, the long-term outlook remains bullish, driven by institutional interest and robust market fundamentals. Investors should always remain vigilant and prioritize risk management in this dynamic environment.

by Penny Angeles-Tan | Dec 26, 2024 | Business

Explore 7 key factors shaping Ethereum’s price in 2025. This in-depth analysis examines whale accumulation, institutional investment, market trends, and upcoming upgrades, providing insights into potential price targets and market outlook for ETH.

The Ethereum (ETH) market is demonstrating strong signals of potential growth, driven by whale accumulation, institutional interest, and technological advancements.

This comprehensive analysis explores the critical factors shaping Ethereum’s trajectory and outlines predictions for the future.

1. Whale Accumulation: A Bullish Signal

The number of Ethereum whales—wallets holding at least 1,000 ETH—has reached its highest level since September, currently standing at 5,631. This increase from 5,565 on November 26 signifies renewed confidence among large investors.

Whale activity often acts as a leading indicator for market trends due to the substantial influence these holders exert on price stability and upward momentum.

Key Implications:

– Accumulation as Confidence: The rise in whale holdings suggests bullish sentiment, as major players position themselves for anticipated price gains.

– Price Impact: Accumulation could support price stability and fuel upward momentum, providing a foundation for Ethereum’s strength in the coming months.

2. Current Price Trends and Resistance Levels

Ethereum’s resistance at $3,523 is pivotal for its short-term price movements. Breaking this level could pave the way for testing $3,763 and eventually $4,100, signaling a continuation of the uptrend.

Conversely, failure to break $3,523 could result in a pullback to key support levels at $3,256 or even $3,096.

Historical Context:

- The $4,000 resistance zone has consistently acted as a psychological barrier, halting bullish advances over the past year.

- Previous rejections at $4,000 triggered sell-offs and liquidations, highlighting the significance of this threshold in shaping market sentiment.

Current Outlook:

- Ethereum is consolidating within the $3,500–$4,000 range. This phase of stabilization could precede another bullish attempt to retest the $4,000 resistance.

3. Market Momentum and Indicators

The Directional Movement Index (DMI) reveals a weakening uptrend, with the Average Directional Index (ADX) dropping from 46 to 27 in just two days.

Despite reduced momentum, the positive directional indicator (D+) at 21.1 remains higher than the negative directional indicator (D-) at 16, signaling sustained buying pressure.

ADX Analysis:

- Strength of Trend: An ADX value of 27 indicates a moderately strong trend. While the decline suggests reduced momentum, it also hints at market consolidation, potentially setting the stage for a renewed rally.

4. Whale Activity and Selling Pressure

Recent whale transactions have contributed to market fluctuations:

– Nexo-related transactions: Over 114,262 ETH ($423.3M) deposited into Binance since December 2.

– Profit-taking behavior: A whale deposited 22,740 ETH ($77.7M) earlier this month, cashing out $137.8M in stablecoins.

Implications:

5. Institutional Interest: A Growing Catalyst

Institutional adoption of Ethereum is accelerating, with ETF inflows highlighting its appeal:

– December 23 data: Bitcoin ETFs saw outflows of $226.5M, while Ethereum ETFs attracted $130.8M in fresh investments.

– Leading ETFs: BlackRock’s ETHA led inflows with $89.51M, followed by Fidelity’s FESH at $46.37M.

Expert Predictions:

Analyst Matt Houghan projects Ethereum could reach $7,000 by 2025, supported by increasing institutional confidence and technological advancements.

6. Fundamental Catalysts for Growth

Several key factors are poised to drive Ethereum’s growth in 2025:

a. Technical Upgrades

The Pectra upgrade, scheduled for early 2025, aims to enhance Ethereum’s scalability and security by increasing validator capacity from 32 ETH to 2,048 ETH. This upgrade is expected to:

b. Regulatory Tailwinds

A favorable regulatory environment, including a potential pro-crypto shift in U.S. leadership, could reduce legal hurdles and foster innovation within Ethereum’s ecosystem.

c. Ecosystem Expansion

Ethereum’s role in key crypto trends—stablecoin growth, asset tokenization, and AI integration—positions it as a cornerstone of blockchain innovation. Layer-2 expansions and partnerships with major institutions further solidify its standing.

7. Price Projections and Market Outlook

Rising from $2,350 to $3,478 year-to-date, Ethereum has gained 53.5%. While this lags behind some rivals, analysts view it as a buildup for a significant breakout.

a. Short-Term Targets:

b. Long-Term Vision:

Surpassing the $4,000 resistance could trigger a rally toward $7,000 by 2025, driven by institutional adoption and ecosystem growth.

Conclusion

Ethereum is at a pivotal juncture, with whale accumulation, institutional interest, and upcoming technical upgrades laying the groundwork for potential growth. While short-term challenges persist, the long-term outlook for ETH appears increasingly bullish.

As the second-largest cryptocurrency continues to innovate and attract significant investment, Ethereum may well become the “comeback kid” of 2025, surpassing its all-time highs and solidifying its position as a leader in the blockchain space.

To celebrate this auspicious occasion, The Manila Hotel is offering its signature Tikoy, also known as Nian Gao, from now until February 2, 2025. These traditional Chinese New Year cakes are available in two delightful flavors: Almond and Red Bean. They make a thoughtful gift or a wonderful addition to your holiday feast. Each box is priced at Php 988 net.

To celebrate this auspicious occasion, The Manila Hotel is offering its signature Tikoy, also known as Nian Gao, from now until February 2, 2025. These traditional Chinese New Year cakes are available in two delightful flavors: Almond and Red Bean. They make a thoughtful gift or a wonderful addition to your holiday feast. Each box is priced at Php 988 net.

You must be logged in to post a comment.