by | Jul 24, 2025 | Business

BTCMiner cloud mining is the first choice for passive income in 2025, with daily income of US$500-500,000

Trump promotes Bitcoin cloud mining: looking for new opportunities to “make America great again” in the global economic downturn

July 20, 2025 – Washington: Faced with the continued downturn in the global economy and the slowdown in the growth of traditional industries, US President Donald Trump has set his sights on the cryptocurrency cloud mining industry, viewing it as a new wealth engine to “make America great again”. Recently, Trump officially signed an executive order to allow $9 trillion in pension funds to invest in Bitcoin and cloud mining, aiming to allow ordinary American families to obtain new sources of income and wealth growth opportunities through the digital economy.

Bitcoin is a symbol of the free economy. I want more Americans to have their own wealth machine, Trump said publicly when signing the executive order.

BTC Miner, a world-renowned cloud mining platform, announced that it will fully upgrade its system to meet the needs of pension funds and institutional investors, and launch a number of national capital-level services, including:

Sign up and receive a $500 reward, zero technical threshold: ordinary people can participate with their mobile phones

Guaranteed principal and interest: principal protection, fixed income, daily settlement

Multi-currency payment: support BTC, ETH, USDT, XRP and other mainstream currencies

Green energy mining: using solar and wind energy to achieve both environmental protection and profitability

Instant withdrawal, instant arrival, does not affect user cash flow

Join BTC Miner now and enjoy policy benefits

Visit the official website to register→→https://btcminer.net

After registration, select the contract, you can get $500 to buy the contract, one-click order completion, 24-hour automatic settlement of income

Dozens of flexible contracts [1-30 days] meet the needs of different investors, especially 3-7 days are well received by many users

BTC Miner contract display,

Recommendation reward: invite friends and easily earn commissions

First-level recommendation: friends invest, you can get 7% reward

Second-level recommendation: friends of friends invest, you can also get 2% reward

BTC Miner platform overview

BTC Miner is a world-leading cryptocurrency cloud mining platform, dedicated to providing safe, convenient and environmentally friendly Bitcoin mining services to users around the world. No equipment or technology is required, users only need to register and select contracts to easily start daily stable passive income. The platform supports multi-currency payments and withdrawals such as USDT, BTC, ETH, XRP, etc., and funds are free and flexible.

BTC Miner-Let Bitcoin become your exclusive money printing machine!

Join BTC Miner now

Official website: https://btcminer.net

Official email: in**@******er.net

by | Jul 24, 2025 | Business

In the past 24 hours, XRP plunged 10%, sliding to approximately $3.18 amid a sudden market sell‑off (CoinCentral). At the same time, Bitcoin soared past $119,000 before pulling back 3%, Ethereum dipped 1.85%, and Solana fell 6.34%, underscoring the brutal volatility gripping crypto markets (AInvest, The Economic Times, aimsfx.com). Amid these wild swings, cloud‑mining innovator BTC Miner is carving out a “safe harbor” for investors, offering fixed, guaranteed daily returns of up to 7%, completely insulated from price fluctuations.

Why Fixed‑Rate Returns Matter Now

Traditional crypto strategies—buying, trading, or staking—leave investors exposed to every sharp downturn and flash crash. With major tokens capable of double‑digit drops in hours, many are exhausted by endless chart‑watching and FOMO‑driven trades. BTC Miner’s model decouples your income from coin prices: sign up, lock in your rate, and collect consistent yields—even when markets tumble.

What Sets BTC Miner Apart

Up to 7% Guaranteed Daily Returns

Lock in high‑yield income from day one—no variable APYs, no guesswork.

Full AIG Insurance

Every contract is fully insured, protecting both principal and profits.

Tier‑1 Bank Custody & SSL Security

User funds are held in top global banks under bank‑grade SSL, safeguarding against hacks and operational failures.

AI‑Optimized Efficiency & 40% Lower Costs

Proprietary algorithms dynamically allocate hashpower and hedge energy costs, reducing expenses by up to 40% and maximizing your net returns.

Multi‑Currency Flexibility

Deposit and withdraw in USDT, BTC, ETH, LTC, USDC, XRP, BNB, DOGE, BCH, SOL, and more—no forced conversions or hidden fees.

Instant Email Signup, Zero KYC

Get started in seconds with email registration—no lengthy identity checks or paperwork.

Boost Your Earnings with Zero Risk

New users receive $500 in trial credits upon signup, allowing you to experience BTC Miner’s platform risk‑free. Test features, watch guaranteed returns accrue, and decide when to upgrade. Plus, our referral program rewards you with 7% bonuses on friends’ investments and 2% on their referrals, turning your network into a passive income engine.

In a landscape defined by sudden crashes and relentless uncertainty, BTC Miner provides a rare blend of stability, security, and high yield. Don’t let another market plunge erode your portfolio—visit https://btcminer.net to claim your $500 trial credit and start earning up to 7% daily, risk‑free.

Contact Information:

Website: https://btcminer.net

by | Jul 24, 2025 | Business

A Trusted Answer to the Rising Cost and Complexity of Doing Business in the Philippines’ Premier CBD

Makati, Philippines – July 24, 2025 – Zeroten Park’s The Company announces the grand opening of its Makati flagship on August 1, 2025, redefining how innovative startups and international enterprises access and scale in Metro Manila’s most prestigious business district. As Makati continues to attract the world’s most forward-thinking organizations, the need for frictionless, globally connected workspace solutions has never been greater.

Overcoming Barriers, Unlocking Opportunity

Historically, the path to establishing a presence in Makati has been complex and capital-intensive. According to data from the Philippine Statistics Authority and consultancies like Leechiu and Colliers, new entrants routinely face upfront costs of PHP 250,000–300,000, from lease deposits and permits to fit-out and internet. Monthly operational outlays—rent, utilities, salaries, supplies—easily exceed PHP 120,000, with extra complications for foreign firms managing regulatory processes and service delays. Even “serviced offices” often fall short, adding hidden fees, steep deposits, and pay-per-use charges that disrupt business plans and cash flow.

The Company Makati: A Launchpad for Global Growth

The Company Makati offers a powerful alternative—tailored for both emerging founders and multinational teams. Its plug-and-play solution removes the usual barriers to entry, enabling immediate market presence with transparent, all-inclusive pricing:

Minimal Setup: Move in with just one month’s rent, deposit, and advance—well under half the traditional requirement.

Predictable Costs: The monthly rental of a private office for 1-person at The Company Makati starts at PHP 15,000/month, with all-in monthly costs (rent, internet, utilities, permits, furnishings, pantry.)

Business Class Infrastructure: Members receive fully furnished, secure offices, business-grade connectivity, backup power, compliance support, and access to flexible meeting rooms and pantry amenities.

Beyond Space: Business Matching and Global Connectivity

What sets The Company apart is its commitment to driving business growth—locally and internationally. Every membership includes not only workspace and operations support, but also proactive business matching services, delivered by a dedicated team of business producers and community professionals. Startups gain direct introductions to funding, partners, and clients. Multinational corporations are instantly connected to a curated network of local suppliers, regulators, and innovation leaders.

The Company’s USA and Asia-Pacific network, spanning Japan, Singapore, Vietnam, and Hawaii, offers unrivaled soft-landing opportunities for firms entering new markets. Whether scaling up, hiring locally, or seeking cross-border ventures, members can leverage The Company’s experience and relationships to accelerate progress.

As featured on ABS-CBN News Channel’s Business Outlook segment, Joy Garingo – Dela Serna (Country Manager, The Company Philippines) discussed the organization’s vision in an interview with renowned anchor Ron Cruz. She highlighted The Company’s unique approach to business: matching companies and entrepreneurs across all branches, creating opportunities for collaboration that reach beyond traditional workspace boundaries.

A Trusted Partner for Expansion

“Across my years in the industry, I’ve seen both the excitement and frustration that come with entering Makati,” says Jessel Lisondra, Branch Manager of The Company Makati. “Our vision is to remove the guesswork and give every founder and executive not just a desk, but a ready-built launchpad—complete with operational clarity, expert guidance, and an open door to our global network. Business matching is part of every service we offer because our members come here to grow.”

The Makati Advantage—Reimagined

Makati remains the nation’s commercial heart, with average office rents between PHP 900 and PHP 1,600 per square meter (Colliers Q2 2025), and a magnet for tech, BPO, finance, and consulting giants. Yet, as costs and complexity rise, flexibility and global connectivity are now non-negotiable. The Company Makati stands at the intersection of both: local expertise, international reach, and a track record of helping businesses—from the first hire to full-scale regional expansion.

Open Now: Experience What’s Next

The Company Makati is now accepting tours, inquiries, and membership applications for startups and MNCs seeking a smarter way to expand in the Philippines and beyond.

Make Makati your launchpad. Make The Company your partner.

About The Company Makati

The Company Makati is a workspace and business solutions hub by Zero-Ten Park, purpose-built to support startups and multinational companies expanding into the Philippines. Every membership includes premium office facilities, regulatory support, and global business matching across the USA and Asia-Pacific.

About Zero-Ten Park

Zero-Ten Park is an industry leader in international real estate and workspace management, renowned for pioneering flexible, high-impact office environments throughout Asia.

by | Jul 24, 2025 | Business

Kuala Lumpur, 24 July 2025 – Boost your technical skills in pressure equipment repair. PetroSync’s ASME PCC-2 training helps you ensure safe, efficient, and compliant repairs.

What Triggers the Use of ASME PCC-2?

In the world of pressure equipment, things don’t always go as planned. Whether you’re dealing with corrosion, cracking, deformation, or leakage, the ability to make safe and compliant repairs is essential. That’s where ASME PCC-2 comes into play.

This standard is used when pressure equipment like vessels, piping, or tanks suffer from defects but are still capable of being repaired rather than replaced. It acts as a roadmap, providing industry-approved repair methods that ensure structural integrity and safety without a full shutdown or costly replacement. If you’re responsible for equipment reliability, you’ll want to know exactly when to apply these guidelines—and how to do it right.

Repair Scenarios Covered Under ASME PCC-2

Not every situation warrants a full overhaul. ASME PCC-2 is typically used for:

Welded repairs on areas with cracks or corrosion

Mechanical clamps and enclosures as temporary or permanent solutions

Composite repairs for non-metallic or low-pressure systems

Weld overlays and flush patches in high-stress zones

Understanding which repair method suits your situation isn’t always straightforward. It requires not just technical knowledge but also sound judgment and an awareness of inspection results, operating conditions, and applicable codes.

PetroSync’s real-world case studies often show how applying the correct PCC-2 method can significantly extend equipment life and reduce downtime. Learning to recognize these scenarios early is key to keeping operations smooth and safe.

ASME PCC-2 vs. Replacement: Making the Right Choice

When a system flaw arises, many engineers ask: Should we repair or replace? The decision isn’t always black and white.

ASME PCC-2 provides a bridge between “patching up” and full equipment replacement. It helps you weigh the costs, risks, and time involved. For example, a corroded pressure vessel might look like a candidate for replacement. But if the damage is within acceptable limits, PCC-2-approved weld overlays or composite repairs might be a smarter, faster, and more budget-friendly solution.

Having access to these methods also means your team can act swiftly during unplanned outages—a key factor in avoiding production losses and safety incidents.

Explore Deeper with PetroSync’s Expert Training

The good news? You don’t have to navigate all this complexity alone. PetroSync offers a comprehensive ASME PCC-2 training course designed for engineers, inspectors, and maintenance professionals who want to make smarter repair decisions and stay fully compliant.

In this training, you’ll learn:

How to interpret the PCC-2 standard accurately

Decision-making frameworks for choosing the best repair method

Case studies from real industry applications

Risk assessment and documentation best practices

By joining PetroSync’s course, you’re not only learning from industry experts—you’re also gaining the confidence to apply ASME PCC-2 in critical situations. This can make all the difference between a costly shutdown and a quick, reliable fix.

Ready to elevate your repair decision-making? Discover more at PetroSync and start mastering the use of ASME PCC-2 today.

by | Jul 24, 2025 | Business

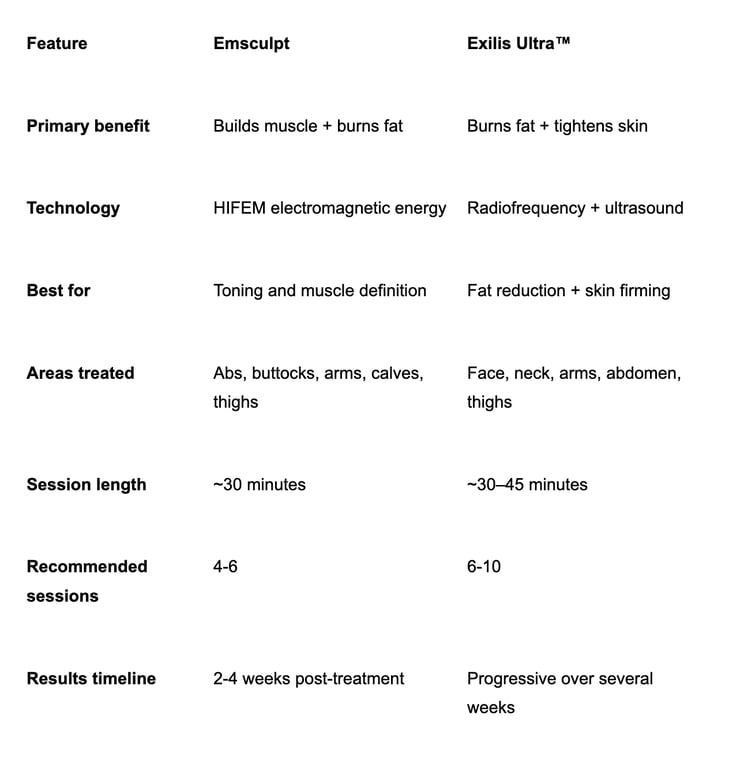

MOLD Manila’s latest article offers a clear, science-backed comparison between two top body contouring treatments: Emsculpt and Exilis Ultra™. Designed to empower individuals navigating post-pregnancy changes, weight loss, or body confidence struggles, the piece highlights how Emsculpt builds muscle through HIFEM technology, while Exilis Ultra™ combines radiofrequency and ultrasound to tighten skin and melt fat. The clinic underscores the importance of real, FDA-cleared machines and honest, pressure-free consultations—positioning both treatments not as vanity fixes, but as tools for self-care, strength, and renewed confidence.

In the Philippines, where confidence and care for one’s appearance are deeply valued, body contouring has become more than just a trend — it’s a way for many to reclaim their self-esteem and feel good in their skin. But with so many options, choosing the right path can feel overwhelming.

At MOLD Manila, with locations in Katipunan and North Quezon City (Baesa), we see it all the time: clients eager for real results but cautious about empty promises. Two of the most sought-after treatments today are Emsculpt and Exilis Ultra™. This guide will walk you through the facts, the science, and the emotional side of the decision — because looking and feeling your best should never feel confusing or out of reach.

The Quiet Pressure We All Feel

There’s a reality many don’t openly talk about: the pressure to “bounce back.” After pregnancy. After major weight loss. After a tough season where self-care took a backseat.

And let’s be honest — in our culture, choosing a little help like aesthetic treatments can sometimes come with judgment. “Cheating,” “arte lang,” or “pang-artista lang” — we’ve heard it all. But here’s the truth: at MOLD Manila, we believe body contouring isn’t about becoming someone else. It’s about enhancing what’s already beautiful and helping you feel stronger and more confident in your own skin.

Emsculpt: The Celebrity Treatment, But Not All Are Created Equal

If you’ve spent any time on Instagram, TikTok, or even seen lifestyle features in glossy magazines, you’ve probably noticed Emsculpt’s rise to fame. It’s a favorite among celebrities, featured heavily by top clinics like Aivee, where stars credit it for their defined abs, toned arms, or lifted glutes.

And why not? Emsculpt is a non-invasive powerhouse that uses HIFEM (High-Intensity Focused Electromagnetic) technology to deliver thousands of supramaximal muscle contractions — the kind your body simply can’t achieve on its own. A single 30-minute session is like doing 20,000 crunches or squats.

But here’s the part we need to highlight: not every clinic offering “Emsculpt” is offering the real thing.

As the demand for body contouring skyrocketed, so did the number of knockoff machines and untrained providers. Some places promote treatments under the Emsculpt name, but the devices they use are poor imitations. The results? Ineffective at best, risky at worst.

At MOLD Manila, we take this seriously. Our Emsculpt machines are authentic, certified, and operated by trained professionals who know how to use them safely and effectively. We’ve invested in real technology because our clients deserve real results — no shortcuts, no gimmicks.

So, if you’re considering Emsculpt because you’ve seen it work wonders for others, make sure you’re getting the genuine experience. At MOLD Manila, we promise: your safety and satisfaction always come first.

Exilis Ultra™: Fat Reduction Meets Skin Tightening

While Emsculpt shines in muscle building and fat burning, Exilis Ultra™ offers something different — a dual-action approach that combines radiofrequency (RF) and ultrasound energy to:

Melt stubborn fat in targeted areas

Stimulate collagen production for firmer, tighter skin

Smooth out uneven texture

Exilis is especially popular among clients who not only want to reduce fat but also address skin laxity — perfect after pregnancy or significant weight loss.

Pricing at MOLD Manila (2025)

Our Exilis Ultra™ packages are as follows:

BTL Exilis Ultra™ Cheek or Chin: ₱3,500 per session (Minimum of 10 session; one area per session)

Body contouring Exilis packages: start at ₱25,000 (for a series of customized sessions targeting specific body areas) 5 Sessions

Note: The ₱1,000/ml rate you may have seen on our menu applies to MOLD Fat Melt injectables, a separate fat-dissolving treatment. Exilis Ultra™ uses energy-based technology, not injectables.

Emsculpt pricing is provided during consultation and tailored to your goals, body area, and number of sessions required.

What to Expect

From your first consultation, we’ll guide you every step of the way:

We listen. Your body goals, lifestyle, and concerns shape the plan.

We customize. No one-size-fits-all packages — everything is tailored.

We treat. Emsculpt feels like a supercharged workout; Exilis feels like a warm massage. Both let you get on with your day right after.

Breaking the Myths

So many of our clients share the same hesitations:

“Isn’t this only for artistas?” No — it’s for anyone who wants to feel confident in their skin.

“Isn’t it cheating?” No — it’s science helping you in areas that diet and exercise alone can’t always address.

“Will I look fake?” No — when done right (and we take pride in doing it right), you’ll look like you — just a little more sculpted, a little more confident.

Why Choose MOLD Manila

At both our Katipunan and North Quezon City (Baesa) branches, we stand by three promises:

✅ We use authentic, medical-grade equipment — no imitations.

✅ Our team blends science and artistry to deliver natural-looking results.

✅ We put you first — no hard sells, no pressure, just honest guidance.

Final Thoughts

Body contouring isn’t about chasing perfection. It’s about helping you feel good in your own skin, on your terms. Whether you choose Emsculpt, Exilis, or a combination, MOLD Manila is here to provide the real solutions — safely, ethically, and effectively.

Ready to take that next step? Book your consultation with us today.

Read for full article: https://moldmanila.com/post/emsculpt-vs-exilis-which-body-contouring-treatment-is-best-for-you

You must be logged in to post a comment.