by | Nov 20, 2024 | Business

Kuala Lumpur, Malaysia – 21/11/2024 – Nusantara Global

Network, a leading digital marketing and business development company, is proud

to announce a strategic partnership with renowned online broker, CXM Direct. This joint

venture aims to strengthen the Introducing

Broker (IB) program across Southeast Asia, giving brokers access to

opportunities and technology capable of bringing significant business

improvement.

The collaboration between Nusantara Global Network and CXM

Direct marks an important step in strengthening their position in the regional

financial market. Nusantara will leverage its extensive experience in digital

marketing to help CXM Direct develop a more dynamic and user-friendly IB

program, as well as provide brokers with the various benefits and support

needed to succeed.

Opportunities and Benefits for Introducing Brokers

Introducing Brokers (IB) who join the program will enjoy a

variety of benefits including access to a sophisticated trading platform,

competitive spreads, and fast execution. Furthermore, IB will be provided with

comprehensive support such as personalized promotional materials and technical

guidance from both Nusantara Global Network and CXM Direct.

“We are very excited to partner with CXM Direct, a

broker committed to innovation and providing high-quality services to

clients,” said the CEO of Nusantara Global Network. “This partnership

allows us to empower Introducing Brokers in Southeast Asia, as well as give

them the tools they need to thrive in an increasingly challenging trading

market.”

CXM Direct: Commitment to the Best Trading Experience

CXM Direct is known in the online trading industry for its

commitment to the best customer experience, providing a wide range of financial

instruments from Forex to commodities and indices. Advanced technology and

competitive trading conditions make CXM Direct a top choice for Introducing

Brokers who want to offer more value to their clients.

“We are very happy with this collaboration with

Nusantara Global Network. This is an opportunity to expand our reach in the

Southeast Asia region and provide Introducing Brokers with exceptional

support,” said CXM Direct. “We are confident that this synergy will

bring great benefits to the brokers who join our program and provide their

clients with a better trading experience.”

Increase Awareness and Access to Trading Opportunities

Southeast Asia is a dynamic market with huge growth

potential in online commerce. This collaboration aims to open up more

opportunities for Introducing Brokers who want to participate in this rapidly

growing industry. CXM Direct, with strategic support from Nusantara Global

Network, will empower brokers with strong skills, technology, and marketing

support to maximize their potential.

About CXM Direct

CXM Direct is an online broker that provides access to

various asset classes such as Forex, commodities, and indices. This broker is

known for its user-friendly trading platform, attractive trading conditions,

and excellent customer support, making it a top choice among traders and

Introducing Brokers.

by Penny Angeles-Tan | Nov 20, 2024 | Business

Ethereum’s price has broken through $3,100, sparking bullish potential as it approaches new highs. Explore the factors driving Ethereum’s growth, including its diverse ecosystem, technical indicators, and upcoming network upgrades. Is Ethereum on track for $4,000? Find out in this analysis.

Ethereum, the world’s second-largest cryptocurrency by market capitalization, has been making significant strides in recent times. Despite experiencing a recent pullback, the underlying fundamentals and technical indicators suggest a promising future for the Ethereum ecosystem.

Today, Ethereum’s price is even stronger again. The increase of almost 2% occurred with a promising price. Will Ethereum’s bullish potential bring it to a new ATH? Or is the hope of $ 4,000 just a dream?

The Ethereum Ecosystem

The Ethereum ecosystem is vast and diverse, encompassing a wide range of projects and applications. Some of the most prominent include:

- DeFi Protocols: Platforms like Uniswap, Aave, and Curve Finance have transformed the way people interact with financial services.

- NFTs: Ethereum is the leading platform for NFTs, with marketplaces like OpenSea facilitating the buying and selling of unique digital assets.

- DApps: Decentralized applications built on Ethereum provide a wide range of services, from gaming to social media.

A Resilient Network

One of the key factors driving Ethereum’s resilience is its robust and ever-evolving network. The Ethereum community is constantly working on upgrades and innovations to enhance the platform’s scalability, security, and user experience.

The upcoming Shanghai upgrade, which will enable the withdrawal of staked ETH, is a significant milestone that could further bolster the network’s strength.

Ethereum’s Bullish Outlook

Technical analysis indicates a potential bullish trend for Ethereum. The recent price correction has provided an opportunity for investors to accumulate ETH at a relatively lower price. As the market recovers, Ethereum could experience a significant upward movement.

On-chain data also supports a bullish outlook. The increasing accumulation of ETH on exchanges suggests that investors are preparing for a potential price surge. Additionally, the growing interest in decentralized finance (DeFi) and non-fungible tokens (NFTs) on the Ethereum network is driving demand for the cryptocurrency.

Looking at the data from the chart above, when this article was written on November 18, Ethereum experienced an increase of 0.42% and was trading at $3,112. However, the ETH RSI value is actually below 50, which means that the selling trend is still dominant compared to the buying flow. The MACD line has also decreased because it is currently sloping.

Conclusion: The Road Ahead

While the future of Ethereum is promising, it’s important to acknowledge the challenges that lie ahead. The competition from other blockchain platforms and the potential for regulatory hurdles could impact the cryptocurrency’s growth.

However, with a strong community, innovative technology, and a growing ecosystem, Ethereum is well-positioned to maintain its dominance in the blockchain industry.

As an investor, it’s crucial to conduct thorough research and consider the risks involved before investing in cryptocurrencies. While Ethereum has shown significant potential, the market remains highly volatile, and prices can fluctuate rapidly.

By staying informed about the latest developments in the cryptocurrency market and making informed decisions, investors can navigate the complexities of the crypto landscape and potentially reap the rewards of long-term investment in Ethereum.

by Penny Angeles-Tan | Nov 19, 2024 | Business

Donald Trump’s media company, TMTG, is in advanced talks to acquire cryptocurrency platform Bakkt, signaling his deeper involvement in the crypto space. This acquisition could mark a pivotal moment for both Trump’s business ventures and the future of cryptocurrency regulation in the U.S. Read on to explore how Trump’s moves could impact the crypto ecosystem.

During the campaign, Donald Trump firmly made 11 promises for the crypto ecosystem to gain support for votes in the 2024 US Election. After declaring his victory, Donald Trump showed his seriousness. Donald Trump made a breakthrough by holding serious discussions to acquire Bakkt and meeting with the CEO of Coinbase.

Are Donald Trump’s steps a good sign for the sustainability of the crypto ecosystem? Or maybe it’s just Trump’s gimmick to get clear support for his inauguration later? Let’s see the explanation in this article.

TMTG’s Strategic Push into Cryptocurrency

Donald Trump’s media and technology company, Trump Media & Technology Group (TMTG), is reportedly in advanced negotiations to acquire Bakkt, a prominent cryptocurrency trading platform.

This move marks a significant expansion of Trump’s business interests into the burgeoning cryptocurrency sector and highlights his ongoing efforts to capitalize on digital assets.

The reported acquisition has caused a surge in both companies’ stock prices, with shares of TMTG rising by over 16% and Bakkt’s stock soaring by an astounding 162%, triggering multiple trading halts due to volatility.

While the deal’s specifics remain unclear, sources suggest that it would be an all-share transaction, underscoring the value of TMTG’s stock despite its relatively modest earnings in the past year.

If finalized, this potential deal would serve as a key moment in Trump’s post-presidential ventures, positioning TMTG at the center of a fast-growing industry that aligns with Trump’s increasing involvement in cryptocurrency.

Trump’s interest in cryptocurrency is not new. Just weeks before the November 2024 presidential election, he announced the launch of a new crypto venture, World Liberty Financial (WLF), which would issue a token tied to the company’s activities.

The deal to acquire Bakkt would expand TMTG’s portfolio, giving the company a foothold in the cryptocurrency trading and services market, which could complement its existing plans to develop digital financial products.

A key figure in both Trump’s political network and Bakkt’s history is Kelly Loeffler, the former CEO of Bakkt and a former U.S. Senator for Georgia. Loeffler’s ties to Trump are significant. She co-chaired Trump’s inaugural committee in 2017 and has remained a close ally of the former president.

Trump’s Broader Crypto Strategy: Shaping Policy and Regulation

Trump’s push into cryptocurrency goes beyond business acquisitions. Reports suggest that his administration is planning to establish a “Bitcoin and crypto presidential advisory council” in the first 100 days of his presidency.

This council would aim to provide much-needed regulatory clarity for the cryptocurrency industry, which has long struggled with inconsistent rules and enforcement actions from agencies like the Securities and Exchange Commission (SEC).

Trump’s interest in cryptocurrency regulation is underscored by the involvement of key figures from the industry. Coinbase CEO Brian Armstrong is reportedly set to meet with Trump to discuss key appointments related to financial regulation and digital assets. This meeting aligns with Trump’s goal of appointing pro-crypto advocates to leadership positions within his administration.

Other figures reportedly under consideration for positions in Trump’s administration include Elon Musk, Vivek Ramaswamy, and Robert F. Kennedy Jr., all of whom have expressed favorable views on blockchain and cryptocurrencies.

Furthermore, Howard Lutnick, the CEO of Cantor Fitzgerald and a known advocate for Bitcoin, is rumored to be in the running for Treasury Secretary. These moves signal that Trump’s administration may take a more favorable stance on cryptocurrencies, potentially driving market growth.

Implications for the SEC and Future Crypto Regulation

One of the most significant areas of interest for the cryptocurrency industry is the leadership of the SEC, which has faced increasing criticism for its tough stance on digital asset regulation.

Trump has openly stated that he plans to replace Gary Gensler, the current SEC chair, on his first day in office. Gensler has faced backlash from crypto advocates due to his enforcement-focused approach, which many believe stifles innovation in the space.

Industry leaders like Armstrong and Ripple CEO Brad Garlinghouse have long called for clear, fair, and consistent guidelines for digital assets. Trump’s proposed advisory council and his discussions with crypto leaders suggest that the incoming administration is actively engaging with the industry to craft a more favorable regulatory environment.

Conclusion

The advanced talks between Trump Media & Technology Group and Bakkt represent more than just a corporate acquisition—they signal a strategic shift towards cryptocurrency and digital finance that could reshape Trump’s business empire and influence U.S. regulatory policy.

As Trump gears up for his return to the White House, the cryptocurrency industry is watching closely, anticipating a potential sea change in how digital assets are regulated and integrated into the broader financial ecosystem.

With key figures like Kelly Loeffler and Brian Armstrong involved, and with Trump’s administration likely to feature pro-crypto voices, the next few years could witness a transformative era for the cryptocurrency market, one that may be shaped by the policies of the 45th president of the United States.

Get the latest information about the crypto ecosystem to updates on the steps taken by Donald Trump only on the Bitrue website. Bitrue also provides various features that you can use to do research before buying your target crypto token.

by Penny Angeles-Tan | Nov 19, 2024 | Business

The crypto market has been volatile following Donald Trump’s 2024 election victory. With Bitcoin hitting new all-time highs, will another crypto winter follow? Learn what a crypto winter is, why it happens, and strategies like dollar-cost averaging and diversification to survive and thrive during these challenging market conditions.

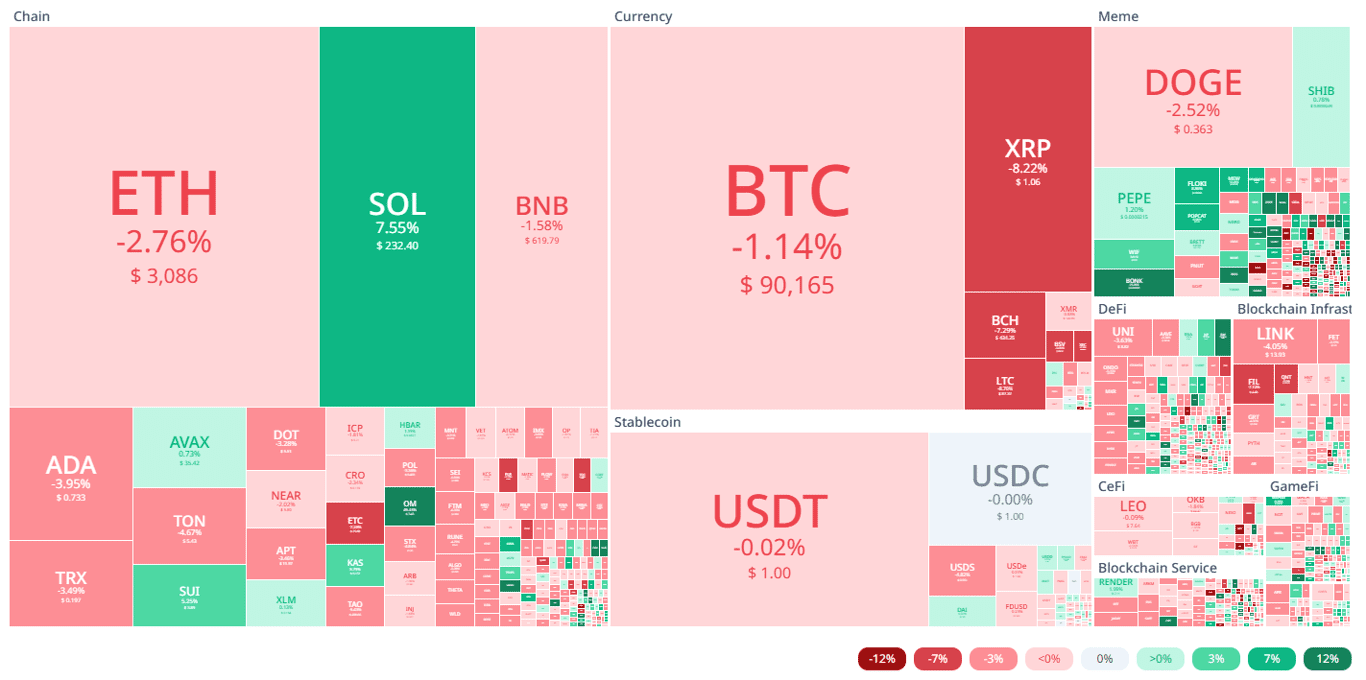

In the two weeks of November, the crypto ecosystem has been like a roller coaster. Starting from Donald Trump’s victory in the 2024 US Election, the crypto ecosystem has suddenly strengthened.

Bitcoin’s price has even always reached a new ATH every day, starting from $87,000 to over $90,000. However, in the last few days, the majority of crypto tokens have suddenly turned red. BTC is still at a price of over $90,000, but its condition continues to decline.

Will the crypto ecosystem experience another crypto winter like in 2022-2023? Let’s discuss it together in this article.

Understanding the Beast: What is a Crypto Winter?

The cryptocurrency market, known for its wild swings, has experienced periods of intense volatility, often called “crypto winters.” These extended periods of declining prices can be challenging and rewarding for investors.

While it’s impossible to predict a crypto winter’s exact timing and duration, understanding its dynamics and employing effective strategies can help you navigate these turbulent times.

A crypto winter is essentially a prolonged bear market in the cryptocurrency space. It’s characterized by a significant and sustained decline in the prices of most cryptocurrencies, often accompanied by reduced trading volumes and investor sentiment.

These downturns can be triggered by various factors, including economic downturns, regulatory uncertainty, or even a loss of confidence in the underlying technology.

Surviving the Freeze: Strategies for a Crypto Winter

While crypto winters can be daunting, they also present unique opportunities for those who are prepared. Here are some strategies to help you weather the storm:

1. Dollar-Cost Averaging (DCA)

One of the most effective strategies to mitigate the impact of market volatility is dollar-cost averaging. This involves investing a fixed amount of money in cryptocurrency at regular intervals, regardless of the price.

By consistently buying, you reduce the average cost of your investment and smooth out the impact of price fluctuations.

2. Diversification

Don’t put all your eggs in one basket. Diversifying your portfolio across multiple cryptocurrencies and blockchain projects can help spread risk. Consider investing in different sectors, such as DeFi, NFTs, and blockchain infrastructure, to reduce exposure to any single asset or technology.

3. Risk Management

Risk management is crucial during a crypto winter. Setting stop-loss orders can help limit potential losses by automatically selling your cryptocurrencies at a predetermined price.

Additionally, taking profits when prices rise can secure your gains and reduce your exposure to further downside.

4. Long-Term Perspective

The cryptocurrency market is still in its early stages, and long-term trends often outweigh short-term fluctuations. By maintaining a long-term perspective, you can weather the storms and focus on the underlying potential of the technology.

5. Explore Alternative Income Streams

Crypto winters can be an opportunity to explore alternative income streams within the crypto ecosystem. Staking, lending, and yield farming are some popular ways to generate passive income with your cryptocurrency holdings.

6. Community Engagement

Joining online communities and forums can help you stay informed, connect with other crypto enthusiasts, and gain valuable insights. Engaging with the community can also boost your morale and provide support during challenging times.

Conclusion: Navigating the Bear Market

While crypto winters can be a daunting experience, they are a natural part of the market cycle. By understanding the underlying factors, employing sound investment strategies, and maintaining a long-term perspective, you can navigate these periods with confidence.

Remember, the key to surviving and thriving in a crypto winter is to maintain a long-term perspective, diversify your portfolio, and adapt to changing market conditions.

If you want to know how the crypto ecosystem is doing every day, you can visit the Bitrue blog directly. There are many articles for you to read so that you are always updated with the developments in the crypto and blockchain world.

by | Nov 18, 2024 | Business

XRP has surged to $1, driven by optimism over regulatory changes, legal progress, and rising institutional interest. Explore the factors behind XRP’s rally, its bullish technical outlook, and what the future holds for this cryptocurrency in a volatile market.

XRP, the cryptocurrency associated with Ripple, has recently experienced a significant surge, capturing the attention of investors and analysts alike. This resurgence can be attributed to a confluence of factors, including potential regulatory changes, increased institutional interest, and strong community support.

XRP: The Spark Igniting the Rally

One of the primary catalysts for XRP’s rally has been the anticipation of a more crypto-friendly regulatory environment in the United States.

With the potential for a change in the leadership of the Securities and Exchange Commission (SEC), investors are optimistic about a more favorable regulatory landscape for cryptocurrencies. This optimism has fueled a wave of buying pressure, driving XRP’s price to new heights.

The Ripple Effect

Ripple’s ongoing legal battle with the SEC has been a major concern for XRP holders. However, recent developments, including the potential for a favorable resolution, have boosted investor sentiment.

As the legal uncertainty surrounding Ripple diminishes, it could pave the way for increased adoption and broader acceptance of XRP.

Institutional Interest and Market Adoption

Institutional investors have increasingly shown interest in cryptocurrencies, and XRP is no exception. The growing recognition of XRP’s potential as a cross-border payment solution has attracted institutional capital, further fueling its price appreciation.

Technical Analysis: A Bullish Outlook

From a technical perspective, XRP’s recent price action is quite promising. The cryptocurrency has broken out of a long-term consolidation pattern, indicating a potential shift in market sentiment.

Key technical indicators, such as the Relative Strength Index (RSI), suggest that XRP is overbought, but this could be a temporary condition as the market consolidates before the next upward move.

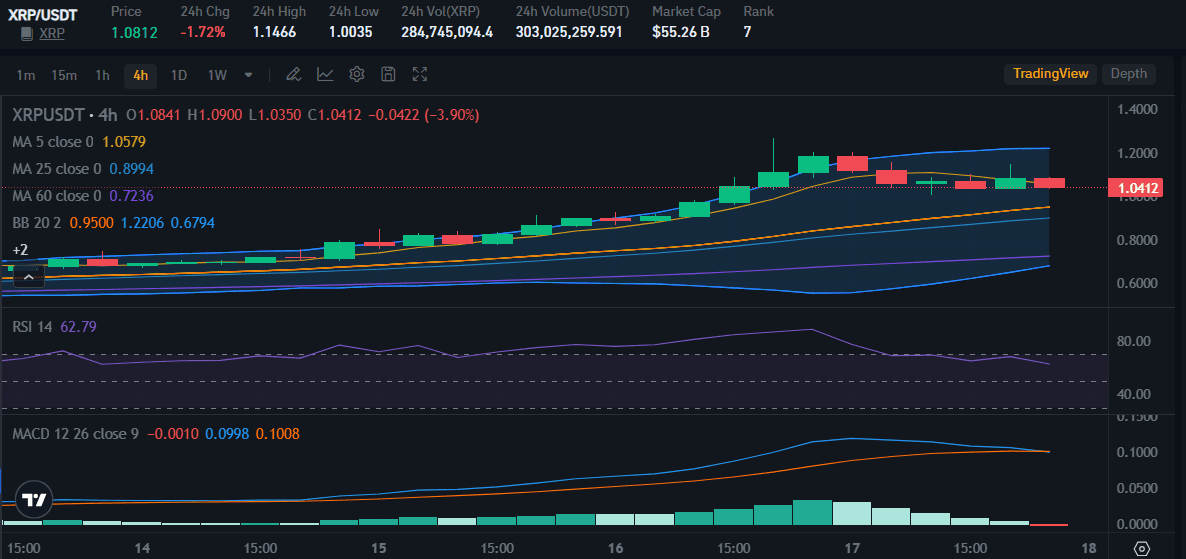

At the time of writing, XRP is trading at $1.0812 after a 1.72% drop. Previously, XRP reached $1.1466 in 24 hours.

Despite the price drop, the XRP RSI value is above 50, which means that there is still a more dominant buying trend than the selling trend. The XRP MACD line does show a decline but is still above the limit line so there is still bullish potential when there is a real strategy from XRP.

The Road Ahead

While XRP’s recent rally has been impressive, it’s important to maintain a realistic perspective. The cryptocurrency market is inherently volatile, and price fluctuations can occur rapidly. Investors should conduct thorough research and consider consulting with financial advisors before making investment decisions.

In conclusion, XRP’s resurgence is a testament to the potential of blockchain technology and the growing acceptance of cryptocurrencies.

As the regulatory landscape evolves and institutional adoption continues, XRP may emerge as a significant player in the global financial system. However, investors should approach this market with caution and be prepared for potential volatility.

XRP’s Unique Value Proposition

XRP’s underlying technology, RippleNet, offers a solution to the challenges of cross-border payments. By leveraging blockchain technology, RippleNet enables faster, more efficient, and more cost-effective transactions.

This has attracted the attention of financial institutions worldwide, particularly those seeking to streamline their payment operations.

The Future of XRP

As the regulatory landscape for cryptocurrencies continues to evolve, XRP’s future remains uncertain. However, the recent price surge and positive market sentiment suggest that cryptocurrency has significant potential.

Key factors that could further propel XRP’s growth include:

1. Increased Institutional Adoption: As more financial institutions embrace blockchain technology, XRP could benefit from increased demand.

2. Regulatory Clarity: Clear and favorable regulations can provide a solid foundation for the growth of the cryptocurrency market, including XRP.

3. Technological Advancements: Continued advancements in blockchain technology could enhance XRP’s functionality and efficiency.

4. Strong Community Support: A dedicated and passionate community can drive adoption and support the long-term success of XRP.

While XRP’s recent rally has been impressive, it’s crucial to approach investments in cryptocurrencies with caution. The market is highly volatile, and prices can fluctuate rapidly. Investors should conduct thorough research and consider consulting with financial advisors before making any investment decisions.

By staying informed about industry trends, technical analysis, and fundamental factors, investors can make informed decisions and navigate the dynamic world of cryptocurrencies.

Conclusion

The price of XRP is predicted to continue to strengthen in the future, especially when the crypto ecosystem experiences “confidence” like when Donald Trump won the US Election in early November. However, you shouldn’t just FOMO to buy this token. You should study carefully how XRP performs, and do detailed technical and fundamental analysis.

If you are confused about doing research, you can directly visit the Bitrue website and use the features there. Check the XRP market price in real-time to easily convert the XRP price to USD. Also, check the projects that XRP is currently working on to find out how developers innovate by reading the articles on the Bitrue blog.

You must be logged in to post a comment.