by | Jan 8, 2025 | Business

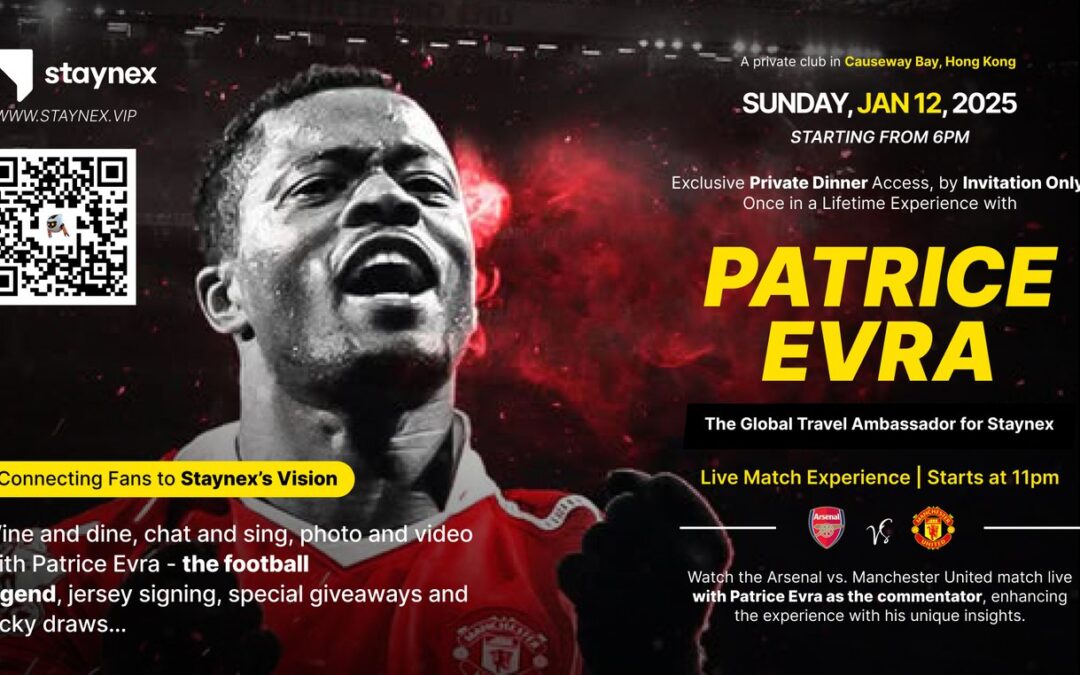

Staynex is proud to announce an exclusive private dinner hosted by Patrice Evra in Causeway Bay, Hong Kong, on January 12th!

Staynex is proud to announce an exclusive private dinner hosted by Patrice Evra in Causeway Bay, Hong Kong, on January 12th!

Location: Hong Kong

Tickets: Limited JetSET Passes are now available for auction. Don’t miss this once-in-a-lifetime opportunity to be part of an exclusive travel and hospitality event with Patrice Evra, the football legend and Staynex’s Travel Ambassador.

About the Event

The private VIP event on January 12 is the highlight of this exclusive experience, but winners of the JetSET Pass will enjoy a 2-day package that includes:

2-night hotel stays at premium accommodations in Hong Kong.

Event details here:https://bit.ly/4gK0qpqRisk Disclaimer: Investing in cryptocurrencies involves significant risks. Please understand that your funds are your responsibility. Always Do Your Own Research (DYOR) before making investment decisions.#Staynex#JetSETPass#PatriceEvra#ExclusiveEvent#LuxuryExperience#FootballLegends#Web3#TravelInnovation

by | Jan 8, 2025 | Business

Discover how unexpected U.S. economic data and Federal Reserve rate concerns drove sharp declines in crypto and traditional markets. Explore detailed analysis on Bitcoin, Ethereum, altcoins, equities, and the broader economic impacts in our latest report.

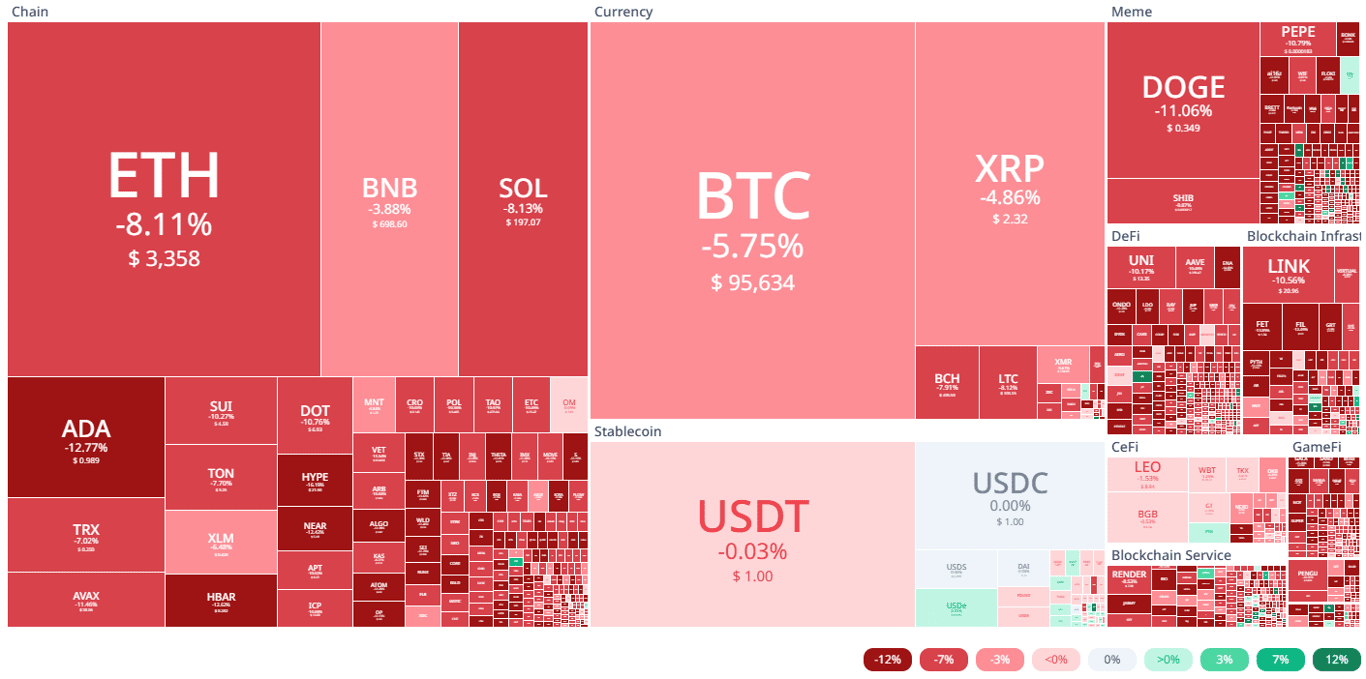

On January 7, 2025, the cryptocurrency and traditional markets experienced sharp declines, driven by stronger-than-expected U.S. economic data that raised concerns about the Federal Reserve’s rate cut timeline.

Market participants had been anticipating rate cuts in 2025, but the latest data has prompted a reassessment, leading to widespread sell-offs across risk-driven assets.

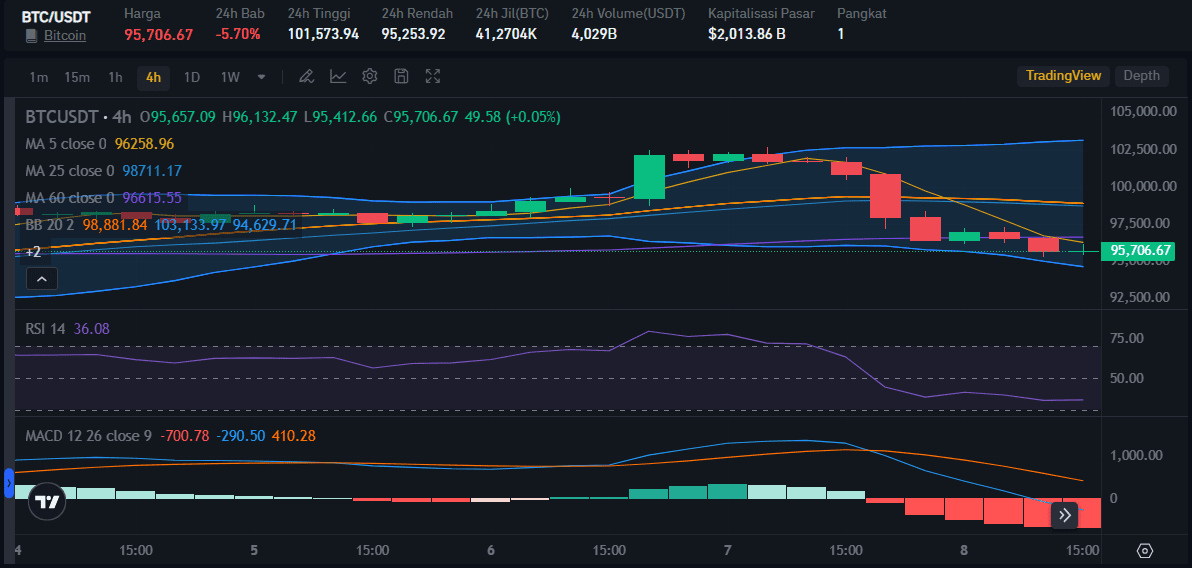

Bitcoin and Major Cryptocurrencies

Bitcoin price dropped over 5% in the past 24 hours, settling at $95,706. According to Coinglass, more than $483.44 million in long positions were liquidated within this period.

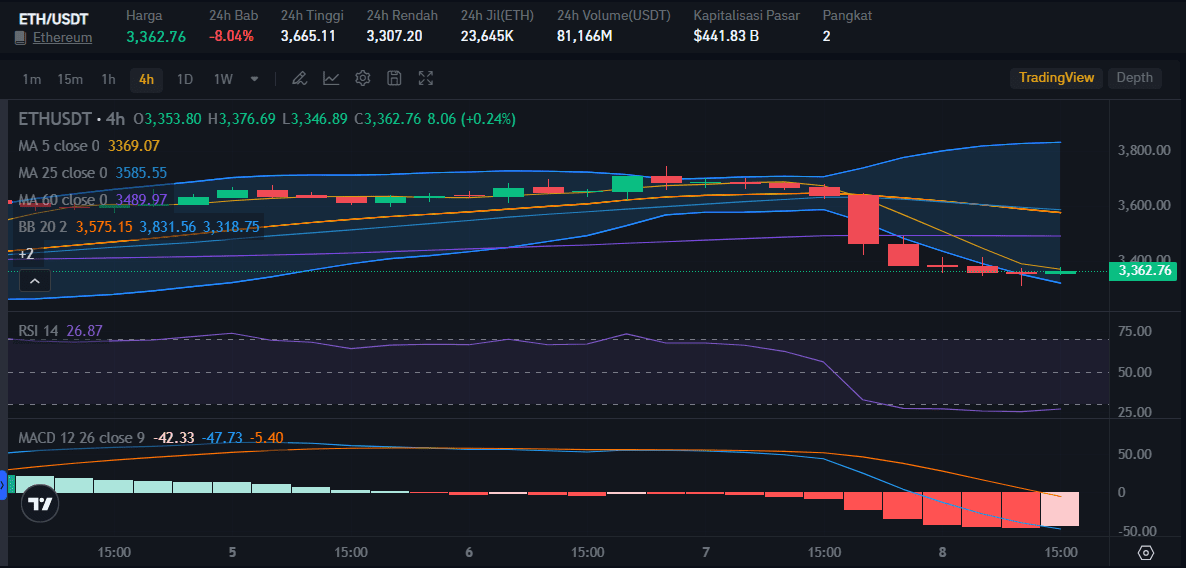

Other cryptocurrencies followed suit, with Ethereum falling over 8% and Solana declining by more than 8%.

Altcoins saw steeper losses than Bitcoin. Ethereum price slid to $3,362.76, a drop of 8.04%, while XRP price and Solana price fell 2%–8.13%, respectively. Meme tokens like Dogecoin tumbled 11,06%, illustrating the pervasive impact of macroeconomic pressures on speculative assets.

Crypto-related equities also suffered significant losses. Coinbase shares fell more than 8%, while MicroStrategy dropped nearly 9%. Bitcoin miners Mara Holdings and Core Scientific were down by about 7% and 6%, respectively.

Economic Data Sparks Concerns

The primary catalyst for the market downturn was the release of two critical economic reports. The Institute for Supply Management (ISM) revealed a December Purchasing Managers’ Index (PMI) of 54.1, up from November’s 52.1 and surpassing the consensus forecast of 53.5.

This data pointed to unexpected resilience in the private service sector, raising concerns about persistent inflation.

Additionally, the November Job Openings and Labor Turnover Survey (JOLTS) indicated higher-than-expected job openings, despite a decline in hiring.

The quit rate, a measure of worker confidence, fell to 1.9% from October’s 2.1%. These indicators suggest a robust labor market, complicating expectations for the Federal Reserve’s monetary policy.

Federal Reserve Outlook

Investors are now recalibrating their expectations for rate cuts, with less than a 50% chance of any reduction before June. The Federal Reserve is widely expected to maintain current interest rates during its upcoming January meeting.

Fed officials have reiterated concerns about sticky inflation and the resilience of the labor market, aligning with the central bank’s December statement that rate cuts in 2025 will be cautious and measured.

Higher interest rates generally bode poorly for speculative assets like cryptocurrencies, as they reduce liquidity and increase borrowing costs. This dynamic has been a recurring challenge for the crypto market, which struggled through much of 2022 and 2023 due to tightening monetary policy.

Broader Market Impacts

The stock market mirrored the crypto market’s decline, with the S&P 500 falling 1.1% and the Nasdaq Composite dropping 1.9%.

Shares of tech giants and companies heavily invested in AI, such as Nvidia, fell 6.2%, despite announcements of new initiatives. These movements underscore the pervasive risk aversion affecting all speculative assets.

Trump’s Presidency and Crypto Market Sentiment

Bitcoin’s recent rally past $100,000 in late 2024, driven by optimism surrounding Donald Trump’s presidential election victory and his promises of crypto-friendly policies, was entirely wiped out by the latest downturn.

As Trump’s inauguration on January 20 approaches, market participants are eagerly awaiting more details on his administration’s crypto policy plans.

Conclusion

The steep declines in both crypto and traditional markets highlight the sensitivity of speculative assets to macroeconomic indicators and monetary policy expectations.

While Bitcoin and altcoins saw significant losses, the underlying market sentiment remains tied to broader economic conditions and Federal Reserve actions.

Investors will closely monitor upcoming data, such as the December nonfarm payrolls report, for further insights into the U.S. labor market and inflation trends.

Bitrue can help you in doing in-depth research before investing in the crypto market. Use indicators such as RSI, Bollinger Bands, to MACD to do a comprehensive technical analysis. You can use all of these indicators for free without registering for premium.

by | Jan 8, 2025 | Business

Kuala Lumpur, Malaysia, 8/1/2025 — Nusantara Global Network, a leading financial services provider in Asia, has partnered with Broker Valetax, a global brokerage firm renowned for its premium trading services, to launch the Valetax Rebate system. This collaboration aims to enhance the trading experience by offering traders substantial rebates, thus maximizing profitability while reducing costs.

The Valetax Rebate system offers traders attractive incentives, providing 12 USD per lot for gold trades and 9 USD per lot for currency trades. This initiative allows traders to significantly reduce trading expenses, increasing their overall profitability while benefiting from a smoother trading experience across various financial markets.

Key Benefits of the Valetax Rebate System

By combining Nusantara Global Network’s expertise in the Asian financial markets with Broker Valetax global platform, the Valetax Rebate program is set to transform trading practices. Through this rebate system, traders can earn rebates on every trade, promoting increased trading volumes and fostering trader loyalty.

“The partnership with Broker Valetax is transformative for our clients,” said the CEO of Nusantara Global Network. “We are dedicated to offering cutting-edge tools that empower traders. The Valetax Rebate system will help traders reduce costs and improve the overall trading experience.”

Traders using the Valetax Rebate system will automatically receive rebates based on their trading volume. The attractive rebates on both gold and currency trades make this system a lucrative choice for both retail and institutional traders looking to maximize their earnings.

Valetax Rebate Aligns with Market Demand

As the financial services industry moves toward more cost-efficient and transparent solutions, the Valetax Rebate program addresses these shifting demands. The combination of automated rebates with advanced trading technology offers traders a more profitable and streamlined trading environment.

“At Broker Valetax, our priority is delivering value to our clients,” said a representative from Valetax. “The Valetax Rebate system will enable traders to lower transaction costs and increase profitability, positioning them for long-term success.”

For traders seeking to reduce trading costs and boost profitability, the Valetax Rebate program offers an exceptional opportunity to optimize their trading strategies and achieve greater success.

For information please contact here.

About Broker Valetax

Broker Valetax is a global brokerage firm offering a wide range of trading services, including forex, commodities, and indices. Known for its advanced trading platform, low spreads, and customer-focused approach, Broker Valetax equips traders with the tools they need to succeed in the highly competitive global markets.

by | Jan 8, 2025 | Business

Kuala Lumpur, Malaysia, 8/1/2025 — Nusantara Global Network, a trusted financial service provider across Asia, has entered into a strategic partnership with Broker Valetax to unveil the Valetax Rebate program. This system is designed to give traders significant financial advantages by offering rebates on their trades, enhancing overall profitability.

The Valetax Rebate program offers 12 USD per lot on gold trades and 9 USD per lot on currency trades, allowing traders to reduce trading costs and maximize their returns. This model is aimed at creating a more efficient and rewarding trading experience across a variety of financial markets.

Valetax Rebate: The Key Benefits

Combining Nusantara Global Network’s deep knowledge of the Asian markets with Broker Valetax’s advanced trading platform, the Valetax Rebate system enables traders to save more on each trade. This partnership is expected to drive higher trading volumes and long-term client loyalty.

“Our focus with the Valetax Rebate system is to provide an innovative solution for traders seeking to reduce costs,” stated the CEO of Nusantara Global Network. “It’s a game-changer for enhancing trading profitability.”

Traders using the Valetax Rebate system will automatically receive rebates linked to their trading volume, which helps them increase their earning potential while maintaining efficiency.

A Solution to Market Shifts

As the financial industry evolves, the Valetax Rebate system comes in response to traders’ increasing demand for transparent, cost-efficient trading. This system is positioned to offer traders an automated rebate experience that boosts profitability and reduces expenses in a seamless manner.

“At Valetax, our priority is enhancing the trading experience for our clients,” commented a Valetax representative. “The Valetax Rebate system is a strategic tool designed to help traders achieve more.”

Please don’t hesitate to contact us

About Broker Valetax

Broker Valetax is an international brokerage firm that provides a diverse range of trading services, including forex, commodities, and indices. Renowned for its cutting-edge trading platform, competitive low spreads, and client-centric approach, Broker Valetax empowers traders with the essential tools to thrive in the highly competitive global financial markets.

by | Jan 8, 2025 | Business

Explore a detailed XRP price analysis and 2025 forecast, highlighting bullish patterns, potential gains, and risks. Learn about resistance levels, market dynamics, and key indicators shaping XRP’s future trajectory.

XRP started 2025 on a high note, climbing 5% year-to-date to $2.46 as of January 7. With technical indicators and market analysis pointing toward significant potential gains, XRP enthusiasts and investors have reasons to remain optimistic.

However, caution is warranted, as the cryptocurrency faces critical resistance levels and the potential impact of macroeconomic events.

XRP Price Today

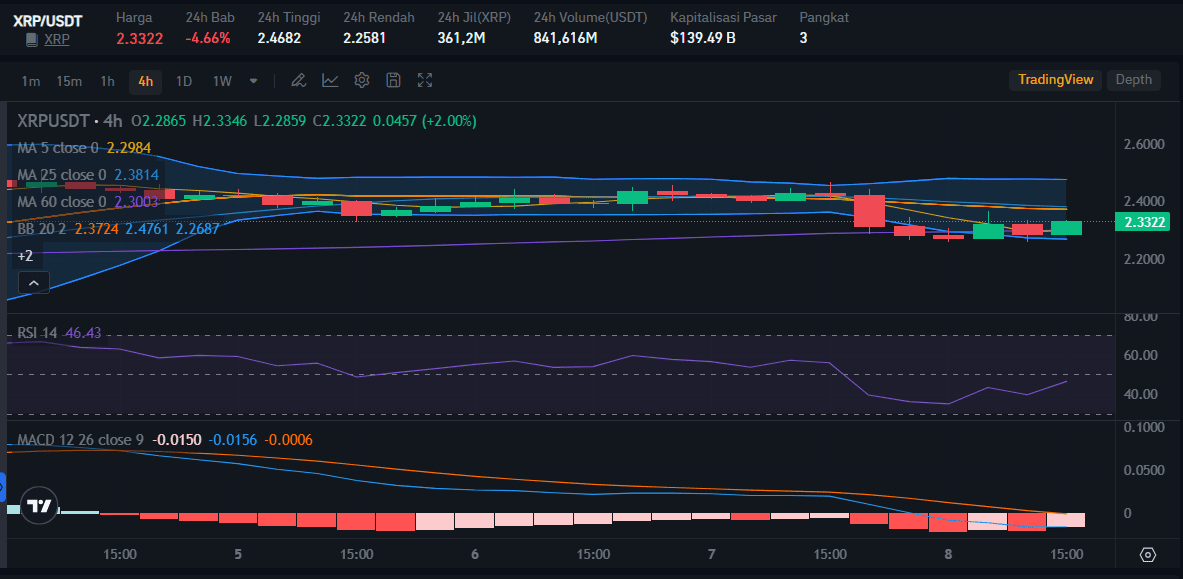

At the time of writing this article on January 8, the price of XRP has decreased by 4.66% to trade at $2.3322. Previously, the price of XRP experienced its highest point at $2.4681 and its lowest price at $2.2581 in 24 hours.

According to the XRP price chart above, the XRP RSI value is also relatively low because it is below 50, which means that the selling trend is more dominant than the buying trend. The XRP MACD line has also fallen quite clearly so that bearish potential could occur in the future.

Bullish Indicators for XRP

1. Bull Flag Formation Suggests 70% Upside

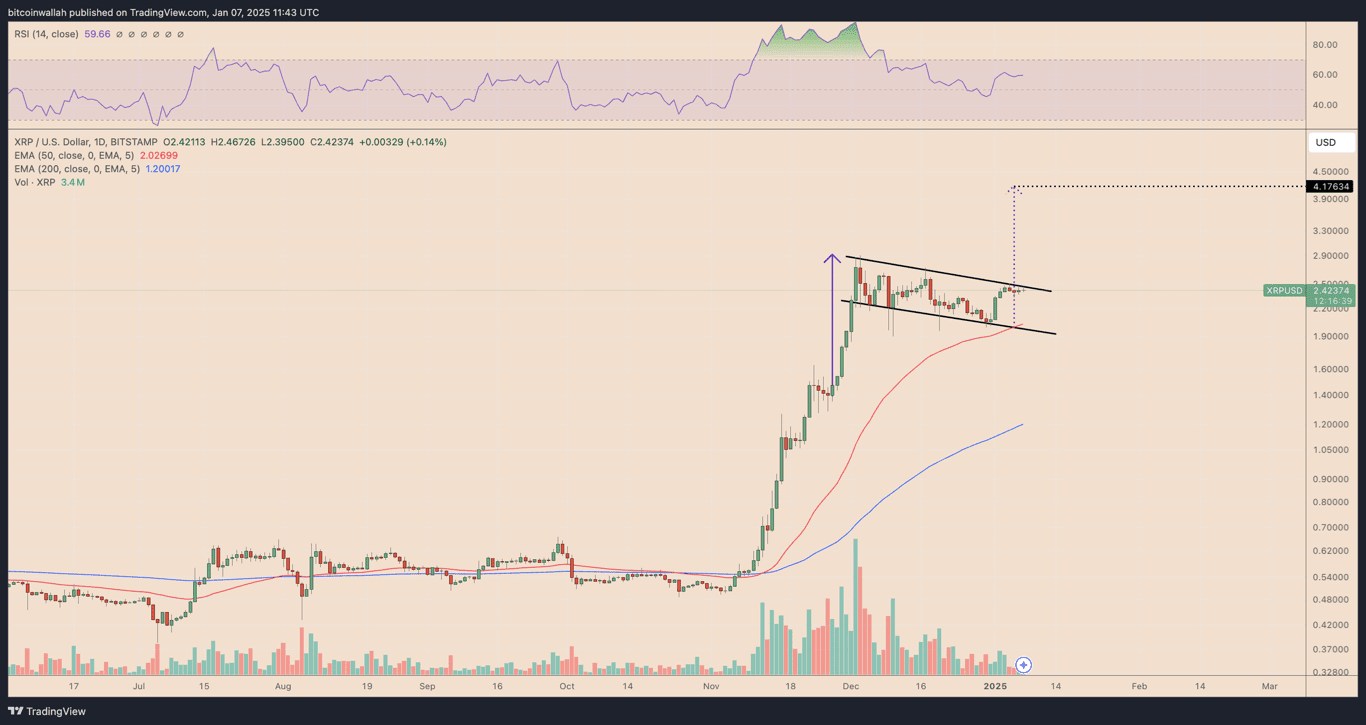

XRP’s price chart reveals a classic bull flag pattern, characterized by a sharp upward movement followed by a consolidation phase. After a 105% rally in November and December 2024, XRP has been consolidating near $2.42, testing the upper boundary of this pattern.

If XRP breaks out above this level, the price could rally toward $4.17—an impressive 72% increase from its current level. Supporting this bullish outlook:

1. Relative Strength Index (RSI): Currently near 60, indicating room for upward momentum without being overbought.

2. 50-Day EMA: XRP remains above this key support level at $2.03, reinforcing the bullish case.

2. Half-Mast Flag Predicts 260% Surge

Veteran trader Peter Brandt identifies a half-mast flag formation on XRP’s weekly chart, which could propel the token’s market cap to $500 billion, equating to a price of $6.40—262% higher than current levels. However, Brandt cautions that the pattern must resolve within six weeks to avoid a bearish outcome.

3. Open Interest Surge Indicates Renewed Investor Activity

XRP’s Open Interest (OI) skyrocketed from $2.71 billion to $4.49 billion on January 7. Historically, such spikes in OI have preceded significant price rallies, including a 107% surge in July 2023 and a 100% rally in December 2024.

If this trend holds, XRP could see a 100% rise to $4.90 by March 2025.

4. Market Cycle Insights

Prominent analyst Maelius predicts XRP could reach $10-$13 during its third wave (W3) of the market cycle. His analysis links XRP’s price movements to market dominance, suggesting that if dominance reaches resistance levels around 12%, XRP could climb toward $13.

While a stretch target of $26 exists, Maelius advises investors to exercise caution and consider taking profits as prices approach $10-$13.

Potential Risks and Challenges

1. Resistance Levels

XRP faces immediate resistance between $2.48 and $2.60. A failure to break above these levels could invalidate the bullish patterns and lead to further consolidation or a potential downtrend.

2. Selling Pressure from Long-Term Holders

On-chain data shows long-term holders sold over $467 million worth of XRP between January 4 and January 7. This selling pressure has contributed to the token’s inability to reclaim the $2.50 level, signaling potential downward risks.

3. Macroeconomic and Political Events

The upcoming inauguration of Donald Trump and associated regulatory changes could impact XRP’s price trajectory. While pro-crypto policies may create tailwinds, uncertainties remain.

4. Key Support Levels

If XRP fails to maintain support at $2.10, the next critical level is $1.33. A breach of these supports could trigger a bearish breakdown, overshadowing the bullish outlook.

XRP Price Forecast

1. Short-Term Targets

– Bullish Scenario: A breakout above $2.60 could lead to a rally toward $3.74, as suggested by Fibonacci extensions.

– Bearish Scenario: Failure to hold $2.10 could see XRP decline toward $1.33.

2. Long-Term Potential

– Conservative Estimates: $4.17 to $6.40, based on technical patterns and market dynamics.

– Optimistic Targets: $10 to $13, contingent on market dominance growth and broader crypto market expansion.

Conclusion

XRP remains a key player in the cryptocurrency market, with promising technical setups and bullish market dynamics pointing to substantial upside potential in XRP 2025.

However, investors should remain cautious, monitoring resistance levels, macroeconomic developments, and on-chain activity for signs of a potential reversal.

Adopting a strategic exit plan, as suggested by analysts, could help maximize gains while mitigating risks.

In addition to the XRP token price that you can check in real time on the Bitrue website, you can also check the XRP to USD conversion price easily. That way, you can estimate the funds that must be allocated when you want to invest in the XRP crypto token.

Staynex is proud to announce an exclusive private dinner hosted by Patrice Evra in Causeway Bay, Hong Kong, on January 12th!

You must be logged in to post a comment.