by | Jan 29, 2025 | Business

29 January 2025 – Kuala Lumpur, Malaysia – Nusantara Global Networks is pleased to announce a new strategic collaboration with VT Markets, a top global Forex broker, to introduce an exclusive Rebate VT Markets program for Forex traders. As part of this partnership, traders registered through Nusantara Global Networks will receive a generous rebate of USD25 per lot traded, giving them a great opportunity to reduce trading costs and boost profitability.

The Rebate VT Markets initiative is specifically designed to help traders cut down on trading expenses and enhance their net profits with every trade. This substantial commission rebate allows traders to maximize their profit potential without dealing with complex conditions or restrictions.

Key Advantages of the Rebate VT Markets Program:

USD25 Rebate per Lot: Traders will earn USD25 for each lot traded through VT Markets, significantly improving their net profit margins.

Leverage up to 1:1000: Traders can benefit from high leverage of 1:1000, enabling them to control larger trade volumes with smaller capital, increasing their profit potential.

MT4/MT5 Trading Platforms: VT Markets offers access to the widely-used MT4 and MT5 platforms, featuring advanced analysis tools and fast execution for an enhanced trading experience.

Cent Crypto Weekend Trading: In addition to Forex, traders can take advantage of weekend Cent Crypto trading, allowing them to remain active in the market even during non-trading days.

Lower Trading Costs: The Rebate VT Markets program helps traders minimize their transaction costs, offering a competitive edge to fine-tune their trading strategies with reduced expenses.

Simple Registration Process: Traders can easily participate by registering with Nusantara Global Networks and start trading on VT Markets to enjoy the rebate. There are no hidden terms or complicated steps involved.

“We’re excited to introduce this rebate program in partnership with VT Markets,” said the Chairman of Nusantara Global Networks. “With a USD25 rebate on every lot traded, high leverage of 1:1000, and the ability to trade Cent Crypto on weekends, we believe traders will gain a major advantage in boosting their profitability while keeping trading costs low.”

VT Markets shared their enthusiasm for the partnership. “This collaboration with Nusantara Global Networks reflects our commitment to offering innovative and competitive trading solutions for our clients,” said a representative from VT Markets. “The Rebate VT Markets program, combined with attractive leverage and weekend crypto trading options, provides traders with an exceptional opportunity to maximize their earnings efficiently.”

With the exciting Rebate VT Markets program, traders now have a greater opportunity to enhance their profits while enjoying secure and advanced trading platforms from VT Markets. Powered by cutting-edge technology and outstanding customer service, serious Forex traders looking to succeed in the markets should not miss this chance.

Please contact us for further information.

About VT Markets

VT Markets is a globally recognized Forex broker, offering a comprehensive range of trading instruments and advanced platforms. With state-of-the-art technology and extensive industry expertise, VT Markets remains a top choice for traders around the world.

by | Jan 29, 2025 | Business

Explore XRP’s market rebound, bullish technical patterns, regulatory shifts, and future outlook. Could XRP 10X by 2025? Read the full analysis now!

The cryptocurrency market has witnessed significant volatility in recent weeks, with XRP standing out as a leading player in the latest rebound. After a sharp decline from $3.10 to below $2.80 on January 27 due to market-wide turbulence, XRP quickly regained its footing and entered January 28 with strong bullish momentum.

Several factors, including technical patterns, regulatory developments, and macroeconomic expectations, have contributed to XRP’s resilience and potential future gains.

Factors Behind XRP’s Rebound

There are several factors why the price of XRP could soar in the future, such as:

1. Market-Wide Influence and DeepSeek’s AI Model

The broader crypto market downturn was triggered by the announcement of a new AI model by Chinese startup DeepSeek. This model, claimed to rival ChatGPT while operating on fewer resources, led to a major sell-off across digital assets.

However, XRP demonstrated remarkable strength by leading the recovery phase, suggesting strong investor confidence and underlying demand.

2. Political and Regulatory Developments

The prospect of a crypto-friendly stance under a Trump administration has fueled optimism within the XRP community.

Additionally, with the new Securities and Exchange Commission (SEC) leadership under acting Chair Mark Uyeda, market participants anticipate clearer regulatory guidelines, potentially benefiting XRP and the broader crypto ecosystem.

3. Bullish Technical Patterns

From a technical perspective, XRP has formed a bullish flag, an indicator that typically signals a continuation of an upward trend. The flag began forming around January 8 when XRP rallied from $2.20, reaching an all-time high of $3.40 on January 16.

The key resistance level remains at $3.20, and a breakout above this threshold could trigger another rally toward $4.50—a nearly 50% gain from current levels.

Interest Rate Expectations and Market Sentiment

Despite expectations that the Federal Open Market Committee (FOMC) will not cut interest rates in January, investors are optimistic that rates will be lowered in March and at least once more before the end of 2025.

Lower interest rates tend to drive investment into riskier assets, including cryptocurrencies. Further fueling market enthusiasm, former President Donald Trump has also suggested he would push for rate cuts, which could benefit XRP in the long run.

XRP’s On-Chain Metrics and Network Growth

XRP’s network activity has surged, with the number of active accounts approaching 50,000 and payment volume surpassing one billion XRP.

While an increase in on-chain transactions can precede significant price movements, investors remain cautious about whether this activity signals real adoption or temporary speculation.

The key support levels to watch are $3.00, $2.85, and $2.50, while resistance points include $3.50 and $3.80. A strong breakout above $3.50 could drive XRP toward even higher valuations.

Ripple vs. SEC: A Turning Point?

The ongoing SEC lawsuit against Ripple took an unexpected turn when the case seemingly disappeared from the SEC’s website. While some speculated this could indicate a resolution, legal experts clarified that the case remains active on the appellate court’s website.

Ripple’s legal team remains confident that the case will ultimately be dropped or settled under the new SEC administration. This ongoing battle has significant implications for XRP’s price trajectory, as a favorable ruling could provide a major boost to investor confidence.

XRP’s Long-Term Outlook: Could It 10X by 2025?

Following the SEC’s recent legal setbacks, speculation has emerged about whether XRP could achieve a 10X rally by 2025. XRP is currently trading around $3.14, and technical analysis suggests a bullish pennant pattern that could push it to $4.66 in the near term.

Price predictions for 2025 vary widely, with estimates ranging from $1.80 to $8.40. A 10X surge would require XRP to reach approximately $31.40, a level that seems ambitious but not entirely impossible given favorable market conditions and broader adoption.

Conclusion

XRP’s recent rebound and bullish outlook highlight its resilience in a volatile market. The combination of technical patterns, regulatory optimism, and increasing network activity positions XRP for further gains in 2024 and beyond.

However, investors should remain cautious and monitor key support and resistance levels, as well as broader market developments, before making trading decisions.

While a 10X rally by 2025 remains speculative, XRP’s growing adoption and favorable macroeconomic conditions could play a crucial role in determining its long-term success.

by | Jan 29, 2025 | Business

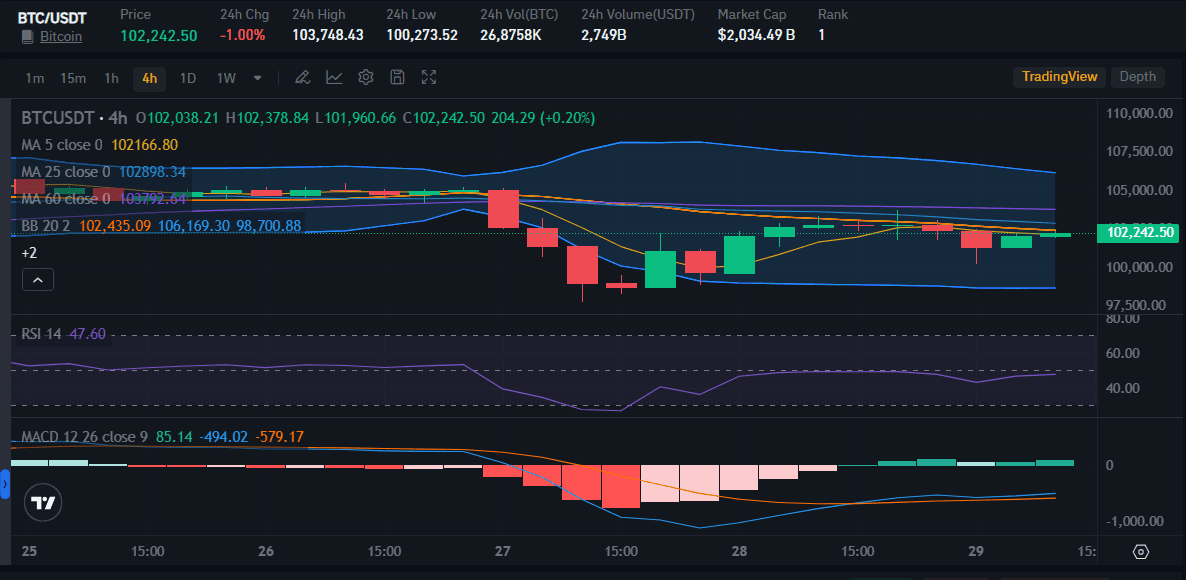

Bitcoin price prediction for February 2025: Can BTC reach $122,000? Explore expert forecasts, FOMC impacts, and market trends shaping Bitcoin’s trajectory, with potential highs of $200K by year-end.

Bitcoin (BTC) has continued its volatile trajectory, briefly dropping below $100,000 before closing at $102,315 on January 29, 2025.

Despite this temporary dip, the cryptocurrency remains above the six-figure threshold as market participants anticipate the upcoming Federal Open Market Committee (FOMC) meeting.

Analysts and investors are closely watching Federal Reserve Chair Jerome Powell’s statements, which could significantly influence BTC’s price action.

FOMC Meeting and Bitcoin’s Price Movements

According to CME’s FedWatch tool, there is a 99.5% probability that the Federal Reserve will maintain interest rates at 4.25% to 4.50%. Market sentiment suggests that BTC’s price may have already “priced in” this decision, shifting focus to the tone of Powell’s remarks.

If Powell adopts a hawkish stance, Bitcoin could experience bearish volatility, with downside targets around $94,000. A breach of this level could push BTC further downward toward $88,900, signaling a bearish directional shift.

Conversely, a dovish tone from Powell—suggesting potential rate cuts in 2025—could drive Bitcoin higher. A confirmed breakout above $107,000 would invalidate bearish concerns and potentially propel BTC into a new price discovery phase above $110,000.

Market expectations of reduced interest rates, coupled with easing inflation concerns, could contribute to sustained bullish momentum in the coming months.

Trump’s Influence on Federal Reserve Policy

A significant factor in the upcoming FOMC meeting is its context within Donald Trump’s newly inaugurated administration. Trump has publicly urged the Federal Reserve to lower interest rates, citing declining oil prices as justification.

However, the Federal Reserve remains an independent institution, and its decisions are not necessarily influenced by political pressure. Nonetheless, market analysts believe that any dovish signals from Powell could drive BTC to new highs.

Bitcoin’s Short-Term and Long-Term Price Targets

1. Short-Term Targets (February 2025)

Bitcoin is currently trading around $105,000, just 3% below its all-time high (ATH) of $109,356 reached on January 20, 2025. Analysts forecast that BTC could hit $122,000 in February, driven by bullish market sentiment and macroeconomic factors such as easing inflation and dovish Fed policies.

2. Mid-Term and Long-Term Projections

Market analysts, including those from 10x Research and VanEck, predict that BTC could reach $180,000 by mid-2025, with some projections extending to $200,000 by year-end.

Institutional investments, growing ETF adoption, and improving macroeconomic conditions are expected to fuel this growth. Standard Chartered even suggests that BTC could approach $200,000, contingent on continued institutional inflows and regulatory clarity.

Potential Risks and Corrections

Despite bullish expectations, BTC remains susceptible to corrections. Some analysts, including Arthur Hayes of BitMex, anticipate a correction to $70,000–$75,000 in response to macroeconomic uncertainties.

Additionally, the rising influence of AI-driven stock market movements—such as the surge in China-based AI firm DeepSeek—has introduced volatility across financial markets, including cryptocurrencies.

Market Sentiment and Institutional Involvement

Bitcoin has demonstrated resilience compared to traditional assets, with institutional players like BlackRock discussing BTC investments with sovereign wealth funds.

Meanwhile, regulatory shifts under Trump’s administration, including the formation of a cryptocurrency working group, could shape BTC’s future landscape.

Conclusion: Bitcoin’s Trajectory in 2025

Bitcoin’s price trajectory remains highly dependent on macroeconomic factors, Federal Reserve policies, and investor sentiment. While projections indicate a potential rise to $122,000 in February and possibly $200,000 by year-end, short-term corrections could present buying opportunities for investors.

As the cryptocurrency market matures, BTC’s performance will likely be influenced by institutional participation, regulatory changes, and global economic trends. Investors should remain cautious and monitor key developments, particularly in relation to Fed policy and broader financial market conditions.

by | Jan 28, 2025 | Business

January 28, 2025 – Kuala Lumpur, Malaysia – Nusantara Global Networks is proud to announce its strategic partnership with MTrading to offer a unique opportunity for Forex traders across Malaysia through the self rebate program. This program provides a 65% rebate on transaction commissions with no conditions related to pips or minutes.

The self rebate program is designed to provide traders with higher returns on every trade they make. Unlike traditional rebate programs that often tie traders down with strict conditions, this new offer provides more flexibility, allowing traders to enjoy greater profits without worrying about additional requirements.

Key Benefits of the Rebate MTrading Program:

65% Self Rebate: Traders will receive a 65% rebate on the commission paid to MTrading, without any minimum pips or time requirements to meet.

No Additional Conditions: This program is designed to be simple and transparent, with no constraints such as minimum pips or trade duration, allowing traders to focus on maximizing their profits.

Increase Your Profit Potential: The rebate received can help reduce trading costs and increase overall profitability, giving traders a competitive edge.

“We believe that convenience and flexibility are crucial to delivering a better trading experience. With the Rebate MTrading program, we aim to provide traders with more opportunities to optimize their earnings, free from unnecessary restrictions,” said the Chairman of Nusantara Global Networks.

How to Join the Rebate MTrading Program

Traders can simply register on the MTrading platform through Nusantara Global Networks and start trading to enjoy the benefits of the self rebate program. There is no complicated application process, and rebates will be automatically credited to eligible traders.

About MTrading

MTrading is one of the top brokers in the Forex industry, offering a wide range of services and trading tools designed to help traders succeed. With its advanced platform and superior customer support, MTrading provides a seamless and secure trading experience for all users.

For more information about the Rebate MTrading program or to register, visit the official websites of Nusantara Global Networks and MTrading.

by | Jan 28, 2025 | Business

Kuala Lumpur, Malaysia – January 28, 2025 – Nusantara Global Networks is proud to announce a strategic partnership with MTrading to launch a game-changing program for Forex traders in Malaysia. The new Rebate MTrading initiative offers a generous 65% rebate on transaction commissions, with absolutely no conditions related to pips or trading minutes.

This unique Rebate MTrading program is designed to provide traders with more profitable opportunities by eliminating the common restrictions found in traditional rebate programs. With this offering, traders can enjoy enhanced returns on every trade, all while benefiting from greater flexibility and fewer constraints.

Key Benefits of the Rebate MTrading Program:

65% Self Rebate: Traders can enjoy a 65% rebate on commissions paid to MTrading, with no minimum pips or time limits required.

No Hidden Conditions: Unlike traditional programs, the Rebate MTrading program is simple and transparent. There are no hidden conditions such as minimum pips or trade durations, allowing traders to focus on maximizing their trading potential.

Increased Profitability: The rebate provides traders with an effective way to reduce their trading costs, boosting their overall profitability and offering a competitive advantage in the market.

“We are excited to offer the Rebate MTrading program as it empowers traders to achieve greater profits without being restricted by additional requirements,” said the Chairman of Nusantara Global Networks. “Flexibility and ease are at the heart of this program, which aims to provide traders with a superior and more rewarding trading experience.”

How to Participate in the Rebate MTrading Program

Getting started with the Rebate MTrading program is simple. Traders can register on the MTrading platform through Nusantara Global Networks and start trading immediately. There is no complicated application process, and rebates will be automatically credited to eligible traders.

About MTrading

MTrading is one of the leading Forex brokers, offering a comprehensive range of trading tools and services to help traders achieve success. With its innovative platform and exceptional customer support, MTrading delivers a seamless and secure trading environment for all users.

For more information on the Rebate MTrading program or to sign up, please visit the official websites of Nusantara Global Networks and MTrading.

You must be logged in to post a comment.