by | Feb 6, 2025 | Business

Kuala Lumpur, Malaysia — February 6, 2025 – Nusantara Global Network is excited to announce a new collaboration with CXM Direct, introducing the highly anticipated Self Rebate CXM Direct Program. This program offers traders the unique opportunity to increase their earnings by receiving rebates on every trade, transforming the trading experience with greater profitability and unmatched benefits.

The Self Rebate CXM Direct Program is specifically designed to reward traders by giving them rebates of up to $35 per lot traded. Through this strategic collaboration, Nusantara Global Network and CXM Direct are empowering traders to maximize their profit potential while benefiting from a highly advanced trading platform and top-notch trading tools.

“We are thrilled to partner with CXM Direct to offer this exclusive Self Rebate CXM Direct Program,” said the Head of Nusantara Global Network. “This initiative allows traders to significantly boost their earnings, while taking advantage of the many features offered by CXM Direct.”

Self Rebate Earnings: Earn up to $35 per lot traded, giving traders a direct boost to their income with every transaction.

Advanced Trading Platform: Access to CXM Direct’s state-of-the-art trading platform ensures a seamless trading experience.

Unlimited Leverage: Amplify your trading potential with leverage up to 1.

Low Spreads: Enjoy competitive spreads, making every trade more profitable.

Swap-Free Accounts: Ideal for traders seeking interest-free trading, in line with personal or religious financial practices.

Minimum Deposit: Begin trading with as little as $10, opening the doors for both novice and experienced traders.

Rapid Execution: Benefit from lightning-fast order execution for optimized trading performance.

Negative Balance Protection: Stay protected from losing more than your deposited balance, ensuring a safer trading experience.

“The Self Rebate CXM Direct Program is a game-changer,” said a spokesperson for CXM Direct. “This partnership gives traders the tools and financial rewards to reach their maximum trading potential, supported by our innovative platform.”

This initiative is designed to meet the needs of modern traders, combining flexibility, profitability, and cutting-edge technology. The Self Rebate CXM Direct Program not only enhances earnings but also delivers an exceptional trading environment that helps traders grow their portfolios with confidence.

About CXM Direct

CXM Direct is a globally recognized brokerage firm, renowned for delivering high-quality trading services. With a focus on customer satisfaction, CXM Direct offers a wide range of trading products and features, including forex and CFDs, ensuring traders have access to everything they need for success.

by | Feb 6, 2025 | Business

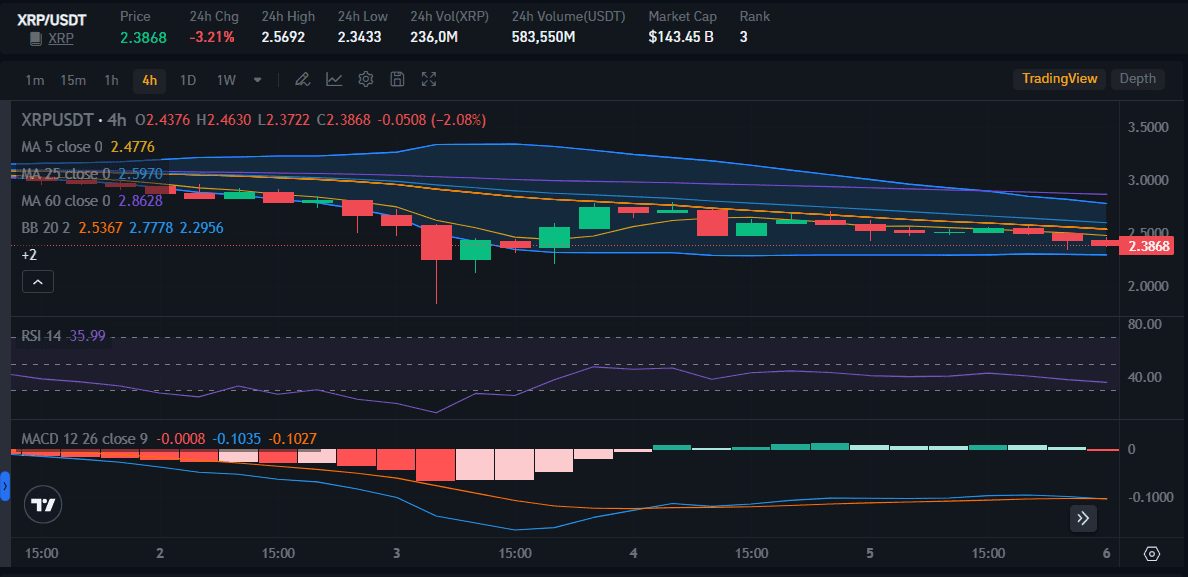

XRP price faces volatility amid weakening buying pressure and declining network activity. With a potential death cross forming, will XRP drop below $2 or rebound above key resistance levels? Explore the latest analysis, price predictions, and market factors shaping XRP’s trajectory.

The XRP market is experiencing significant volatility, with prices under pressure as key technical indicators signal potential downside risks. Following a recent 64-minute outage, investor confidence remains subdued.

Meanwhile, XRP’s Chaikin Money Flow (CMF) remains positive but has weakened, and network activity has seen a sharp decline. With a potential death cross forming on its EMA lines, XRP could test lower support levels unless renewed buying pressure pushes it back above key resistance zones.

XRP’s CMF Weakens but Remains Positive

XRP’s Chaikin Money Flow (CMF) currently stands at 0.19, down from 0.26 two days ago. After briefly dipping to -0.22 three days ago, it has since stabilized. This decline suggests a weakening buying pressure, though a positive CMF still indicates capital inflows.

The CMF is a volume-weighted indicator that tracks money flow into or out of an asset. A drop below 0.15 may indicate increasing weakness, while a recovery above 0.25 could signal renewed buying strength.

If XRP consolidates at these levels, price stability could follow. However, if capital inflows continue to decline, further downside risks may emerge.

Declining Network Activity Raises Concerns

XRP’s active addresses have seen a sharp decline, dropping nearly 50% from their December peak. Currently, the 7-day active address count stands at 256,000, down from 407,000 nearly two weeks ago. While this remains high relative to most of 2024, the decline suggests reduced demand and transaction volume.

Active address count is a critical metric as it reflects user engagement and network activity. A sustained decline could indicate waning investor interest, while a rebound might signal renewed enthusiasm for XRP.

XRP Price Prediction: Will It Drop Below $2?

A potential death cross on XRP’s EMA lines suggests bearish momentum may continue. If XRP loses support at $2.32, it could fall to $2.20 or lower. A decline in active addresses and weakening CMF could push XRP below $2, with key support at $1.99. This would confirm a deeper bearish trend, making recovery more difficult.

Conversely, if XRP breaks the $2.60 resistance, it could test $2.82. A further rally could push it above $3, with bullish targets at $3.15 and even $3.40. For this scenario to play out, network activity and buying pressure must improve significantly.

At the time of writing, XRP price is down 3.21% to $2.3868. Previously, XRP’s highest price in 24 hours was $2.5692. XRP’s RSI indicator is also below 40, indicating that bearish potential will indeed occur soon.

XRP’s Market Turmoil: External Factors at Play

XRP’s sharp 15% decline in one day underscores its vulnerability to external influences. The downturn followed bullish predictions from SBI CEO Yoshitaka Kitao but was overshadowed by broader market turbulence.

Bitcoin’s slip below $100,000, driven by geopolitical tensions, exacerbated XRP’s losses, sending it to $2.53.

External forces such as regulatory uncertainty and macroeconomic shifts continue to shape XRP’s price movements. The cryptocurrency’s ability to hold above the $2 threshold will determine its near-term trajectory.

Is XRP’s Future in Jeopardy?

Key Factors Influencing Volatility

- Regulatory Challenges: XRP’s legal battle with the SEC remains a major source of uncertainty. A favorable resolution could boost investor confidence, while adverse outcomes could dampen enthusiasm.

2. Institutional Adoption: Regulatory clarity and institutional involvement will be key in shaping XRP’s long-term prospects. Governments and financial institutions remain cautious about digital assets.

3. Market Sentiment: Broader cryptocurrency trends, particularly in Bitcoin and Ethereum, could impact XRP’s trajectory.

Potential for Recovery

- Legal Resolutions: A favorable court ruling could reignite interest in XRP.

2. Technological Innovations: Ripple’s continued investment in cross-border payments and DeFi applications could strengthen XRP’s utility and adoption.

- ETF Approval: The upcoming ETF upgrade for XRP represents a potential milestone, though its long-term impact remains uncertain.

Technical Analysis: XRP’s Golden Pocket Support

XRP is currently trading at a key Fibonacci retracement level known as the Golden Pocket, which often acts as strong support. According to analysts, this presents a potential buying opportunity. If XRP holds above this level, it could trigger a rally towards $3.43.

Key Buy Levels to Watch

- $2.50 Support: A primary accumulation zone offering a 6-7% discount from current prices.

- $2.25 – $2.30: A safer entry point, particularly if Bitcoin remains above $95,000.

- $1.90 – $2.00: A deep discount level in case of further market declines.

Conclusion: What Lies Ahead for XRP?

XRP remains at a crossroads, facing both significant downside risks and potential for a bullish rebound. Key factors such as regulatory developments, market sentiment, and network activity will determine its trajectory.

While technical indicators point to potential further declines, the Golden Pocket support could offer a strong foundation for a future rally. Investors should monitor these key levels closely and adopt a cautious but strategic approach to XRP trading.

by | Feb 6, 2025 | Business

STEPS officially launched its Skills for Education and Employment (SEE) Program and its range of NDIS Services in Hervey Bay on Thursday 6 February.

The SEE Program is aimed at giving people the opportunity to improve their language, literacy, numeracy and digital literacy skills through individually contextualised learning.

“With expertise formed from providing training opportunities for almost 20 years, we are incredibly proud to offer inclusive and engaging course content, practical and inspiring work and learning experiences, and access to qualified, dedicated and passionate trainers,” said Carmel Crouch AM, Managing Director of STEPS Group.

“Here at STEPS, we believe that when people enrol in a course, they join a community like no other.”

Through STEPS’ SEE Program, participants can learn the skills necessary to build a pathway to employment, go further in their current career path or build their confidence to undertake further study.

“STEPS has a proven track record of delivering the SEE Program in parts of Northern Queensland and the Northern Territory, successfully creating meaningful outcomes for participants and providing them with the skills needed for further study and employment within their communities,” Ms Crouch said.

STEPS’ NDIS Services empower individuals through personalised support and community connection, fostering confidence, skills, and independence through services such as Employment Support, Supported Independent Living (SIL), Recreational Activities, and more.

“It is such an honour to expand our programs and bring these life-changing learning opportunities to the people of Hervey Bay and the greater Wide Bay region.”

Eligible participants can begin their learning journey and take advantage of the free courses offered through the SEE Program by applying online via the STEPS website.

Participants and employers wishing to access STEPS’ range of NDIS Services can reach out to the STEPS team on 1800 312 742 for enquiries or support.

The Skills for Education and Employment (SEE) Program is funded by the Australian Government Department of Employment and Workplace Relations.

by | Feb 6, 2025 | Business

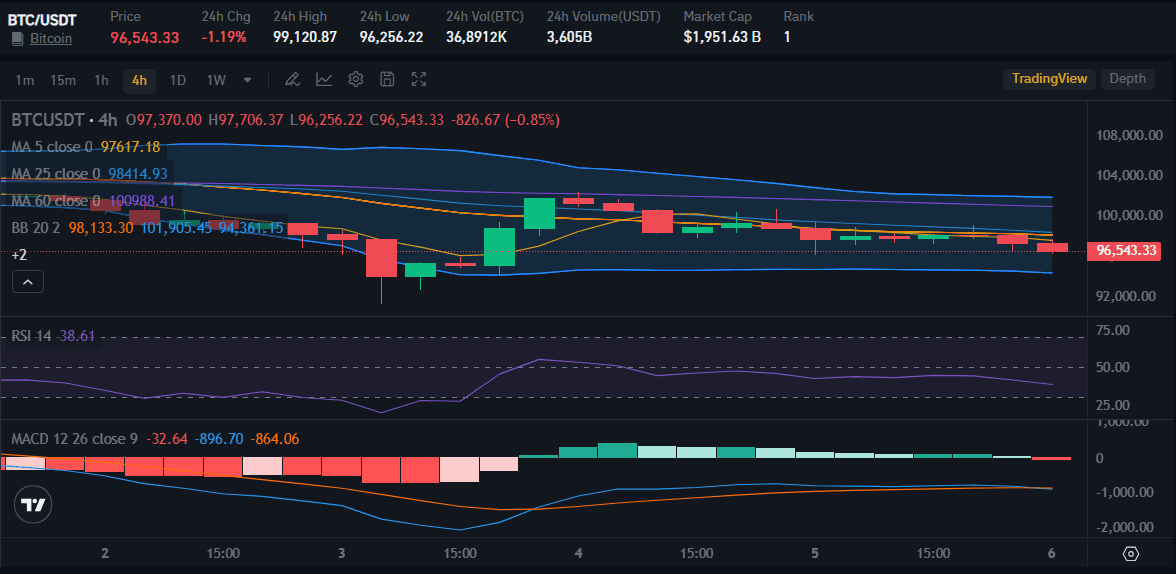

Bitcoin faces market turbulence as its price drops below $100K, triggering $2B in liquidations. Will BTC fall below $50K? Explore key factors, technical analysis, and institutional impact shaping Bitcoin’s future.

Bitcoin (BTC) is undergoing a period of uncertainty, with its price dropping below the $100,000 mark and triggering a market-wide liquidation event exceeding $2 billion.

The market reaction has been influenced by various factors, including government policies, whale activities, and historical patterns of consolidation and breakout cycles.

Bitcoin’s Price Action and Market Sentiment

As of now, Bitcoin is trading at $96,543, marking a significant drop from its recent highs. The digital asset had initially rallied beyond $100,000, fueled by speculation surrounding the U.S. government’s stance on a Bitcoin Strategic Reserve.

However, following a press conference by Trump administration crypto czar David Sacks on February 4, market sentiment turned bearish.

Sacks emphasized that the administration is merely “evaluating” the feasibility of a Bitcoin reserve, which some argue contradicts Trump’s campaign promises.

This announcement led to a decrease in the perceived likelihood of a national Bitcoin reserve in 2025, with PolyMarket reducing the odds to 47%.

The market downturn also coincided with the movement of 49,700 BTC from the 6-12 month spent output age band (SOAB), indicating potential selling pressure and further volatility.

Technical Analysis: Bearish Sentiment and Potential Rebound

Bitcoin has been trading within a symmetrical triangle on the 1-hour chart, with a critical liquidity zone around $100,000. Analysts suggest that BTC may revisit this zone before testing lower-order blocks between $94,100 and $92,600.

Historically, large BTC movements have been linked to whale activity and market manipulation, often leading to retail sell-offs.

Despite this bearish sentiment, investment analysis platform Alphractal suggests that such conditions present buying opportunities for long-term investors.

The platform advises waiting until market sentiment turns deeply negative before making substantial purchases, countering the herd mentality prevalent in the crypto market.

Institutional Influence and Market Liquidity

One of the most significant drivers of Bitcoin’s price action is institutional involvement. MicroStrategy, a pioneer in corporate Bitcoin accumulation, has inspired 78 publicly listed companies to hold BTC in their treasuries.

Pharmaceutical and advertising firms have followed suit, recognizing Bitcoin as a hedge against inflation and a way to bolster their stock prices.

MicroStrategy’s aggressive BTC acquisitions have resulted in a market capitalization of $87 billion—almost double the value of its Bitcoin holdings. The company’s founder, Michael Saylor, has reaffirmed his commitment to Bitcoin, stating, “We are going to Mars.”

Other companies, including KULR Technology and Semler Scientific, have also adopted Bitcoin as their primary treasury asset, leading to significant stock price increases.

Macroeconomic Factors and Liquidity Constraints

The broader economic landscape has also played a role in Bitcoin’s market movements. The U.S. Treasury General Account (TGA) balance has risen from $623 billion to $800 billion in just four weeks, tightening liquidity conditions.

A similar scenario in early 2023 led to increased risk-taking in equity and crypto markets, but this time, liquidity appears to be drying up, posing challenges for Bitcoin and other risk assets.

Anddy Lian, a blockchain expert, highlighted the potential implications, stating, “Key liquidity sources are being more tightly controlled, which could slow economic activity and create a more challenging environment for crypto.”

Technical Indicators and Future Projections

Bitcoin’s technical indicators suggest a precarious position. The 14-week Relative Strength Index (RSI) is showing a bearish divergence, similar to the 2021 market peak. If RSI remains below its falling trendline, it could indicate a continuation of downward momentum.

However, if Bitcoin closes above $100,000, it could invalidate the bearish outlook and push prices higher.

Short-term indicators show mixed signals. While BTC has rebounded from $96,147 and is consolidating between $98,500 and $99,000, the Moving Average Convergence Divergence (MACD) remains bearish.

If Bitcoin holds above $98,000, a push toward $104,000-$109,000 is possible. However, a breakdown below $96,000 could trigger a deeper correction toward $91,000.

Conclusion: Navigating Bitcoin’s Volatile Landscape

Bitcoin remains at a crossroads, facing uncertainty from regulatory policies, liquidity constraints, and technical market structures.

While institutional adoption continues to provide a strong foundation, short-term market movements will likely be dictated by whale activity and macroeconomic factors.

Investors should remain cautious, leveraging technical indicators and historical patterns to navigate the evolving landscape of the crypto market.

by | Feb 6, 2025 | Business

Verde Two, developed by Farpoint and Asia Green Real Estate,

has successfully attained the highest level of certification offered by EDGE: the EDGE

Zero Carbon. EDGE (Excellence in Design for Greater Efficiencies) is an internationally

recognized green building certification system developed by the International Finance Corporation (IFC), a

member of the World Bank Group.

Advantages and Benefits of EDGE Zero Carbon Certification

The EDGE Zero Carbon status of Verde Two offers substantial

benefits for all stakeholders. Tenants enjoy reduced utility costs and a healthier living environment. For property agents, this achievement provides market differentiation, increased

demand, and enhanced property value.

In addition, the milestone solidifies the industry

leadership of Farpoint and Asia Green Real Estate, ensuring long-term value, and reinforcing their commitment to environmental responsibility. At the same time, it sets a precedent for

sustainable real estate practices in Indonesia, aligning with both national and global carbon

reduction targets, and contributing to the vision of a zero-emission nation by 2060.

FARPOINT has partnered with Asia Green Real Estate as a

strategic partner who shares its dedication to sustainability and environmental

responsibility.

Tatang Widjaja, CEO of Farpoint, stated: “We are

incredibly proud that Verde Two became the first high-rise residential complex in Indonesia to achieve

the EDGE Zero Carbon certification.

This milestone reflects our unwavering commitment to

sustainability and provides our residents with a superior, eco-friendly living experience.”

Alex Buechi, Managing Partner at Asia Green Real Estate,

said: “The EDGE Zero Carbon certification for Verde Two is a testament to our commitment

to creating value through sustainable real estate investments. We believe that green buildings not

only benefit the environment but also enhance the health and well-being of their occupants. With

the EDGE Zero Carbon certification, Verde Two stands as a benchmark for green buildings in the

region.“

About Verde Two

Verde Two is a high-rise residential complex known for its

innovative design, high quality, and commitment to sustainability. It is the first building in

Indonesia equipped with an advanced AC system with PM2.5 double filtration technology for tenants. Located in the heart of Kuningan CBD, Verde Two offers residents a blend of elegance and

eco-friendly living, setting a new benchmark for luxury condominiums.

You must be logged in to post a comment.