by Penny Angeles-Tan | Oct 19, 2024 | Business

Ripple partners with leading exchanges to launch RLUSD! Learn how this stablecoin will change the global payments landscape and attract institutional investors.

Ripple USD (RLUSD), the new stablecoin from Ripple, has been anticipated since its first announcement. This stablecoin is designed to have an equivalent value to the US dollar and aims to facilitate cross-border transactions and provide stability in the digital asset ecosystem.

Understand fully about RLUSD, how it differs from other stablecoins, and when the RLUSD launch will be officially carried out by reading this article to the end.

What is RLUSD?

RLUSD is a type of cryptocurrency whose value is pegged to the US dollar. In contrast to cryptocurrencies such as Bitcoin whose value is very volatile, RLUSD is designed to have a stable value. This makes it a more reliable means of payment, especially for cross-border transactions.

How does RLUSD work? So, each RLUSD token is backed by US dollar reserves held in a separate account. This reserve will be regularly audited by a third party to ensure that the number of RLUSD tokens in circulation always corresponds to the value of US dollars held.

Some of the reasons why RLUSD was launched are:

1. Meet market needs: There is a high demand for stable and reliable stablecoins for various purposes, such as payments, asset tokenization, and DeFi.

2. Increasing adoption of blockchain technology: RLUSD is expected to accelerate the adoption of blockchain technology in the financial industry.

3. Connecting traditional and digital worlds: RLUSD can be a bridge between the traditional financial system and the world of digital assets.

RLUSD advantages

Capped by the US dollar, the value of RLUSD tends to be more stable than other cryptocurrencies. RLUSD is also backed by US dollar reserves guaranteed by the government.

Not only that, RLUSD can be used in various countries and regions through Ripple’s partner network. This stablecoin is designed to meet strict regulatory standards, providing more confidence to users. RLUSD can operate on multiple blockchains, including XRP Ledger and Ethereum.

Who Supports RLUSD?

Several major crypto exchanges have expressed support for RLUSD, including:

1. Uphold: Popular multi-asset trading platform.

2. Bitstamp: One of the oldest and most trusted cryptocurrency exchanges.

3. Bitso: Latin America’s leading cryptocurrency exchange.

4. MoonPay: Crypto payment infrastructure provider.

5. Independent Reserve: Australia-based cryptocurrency trading platform.

6. CoinMENA: A cryptocurrency exchange focused on the Middle East and North Africa.

7. Bullish: A cryptocurrency exchange backed by Peter Thiel.

The Future and Comparison of RLUSD with Other Stablecoins

With support from strategic partners and a focus on regulatory compliance, RLUSD has great potential to become one of the world’s leading stablecoins. RLUSD can accelerate the adoption of blockchain technology in a variety of sectors, including finance, commerce, and real estate.

To provide a clearer picture of RLUSD’s position in the market, we can make a comparison with other popular stablecoins such as USDT and USDC. Some aspects that can be compared include:

1. Guarantee Mechanism

RLUSD: Reportedly backed by US dollar reserves, short-term government bonds, and other cash assets. Ripple is committed to conducting monthly audits of these reserves.

USDT: Originally claimed to be fully backed by US dollars, however, there has been some controversy regarding the transparency of its reserves.

USDC: Reported to be fully backed by US dollars and equivalent assets, with monthly audits performed by major accounting firms.

2. Transparency

RLUSD: Ripple has expressed its commitment to transparency by conducting monthly audits of RLUSD reserves.

USDT: USDT’s transparency has been a subject of debate, especially after several reports cast doubt on their claims of full reserves.

USDC: USDC is considered to have a higher level of transparency than USDT, with monthly audits conducted by large accounting firms.

3. Market Adoption

RLUSD: Still relatively new and has not yet reached the same level of adoption as USDT or USDC. However, with the support of major exchanges and Ripple’s reputation, the adoption potential of RLUSD is huge.

USDT: USDT is the most widely used stablecoin in the world, with a huge market capitalization.

USDC: USDC is USDT’s closest competitor and has gained widespread adoption across DeFi platforms and exchanges.

4. Regulation

RLUSD: Ripple has stated that RLUSD is designed to meet strict regulatory standards, including oversight from the New York Department of Financial Services (NYDFS).

USDT: USDT has faced several regulatory challenges, especially regarding its reserve claims.

USDC: USDC is generally considered more regulatory compliant than USDT and has received approval from various regulators.

5. RLUSD Competitive Advantages

Ripple Support: Ripple has an extensive network and experience in the blockchain industry.

Focus on institutions: RLUSD is designed to appeal to institutions with an emphasis on security, transparency, and regulatory compliance.

Integration with Ripple ecosystem: RLUSD can be integrated with Ripple’s cross-border payment solutions and other products.

Potential Uses of RLUSD

Apart from cross-border payments, RLUSD has great potential for use in various other applications, such as:

1. DeFi (Decentralized Finance): RLUSD can be used as an underlying asset in various DeFi protocols, such as lending, borrowing, and yield farming.

2. Asset tokenization: RLUSD can be used to tokenize real-world assets, such as real estate, stocks, and commodities.

3. In-game payment: RLUSD can be used as currency in blockchain-based games.

Conclusion

The launch of RLUSD is an important step for Ripple and the cryptocurrency industry as a whole. With support from strategic partners and a focus on regulatory compliance, RLUSD has the potential to become one of the world’s leading stablecoins.

However, the success of RLUSD will also depend on several factors, such as market developments, regulatory changes, and Ripple’s ability to continue to innovate.

The creation of RLUSD will also have a positive impact on XRP price, especially when it is launched. If you are one of the XRP token holders, you can feel happy about this innovation from Ripple. However, don’t be careless buy XRP coins.

You still have to do research before deciding to invest completely in a token. Find out what the current condition is, and whether the value of XRP to USD is strengthening or not. Carry out a tactical strategy so you can invest according to your current financial condition.

by Penny Angeles-Tan | Oct 16, 2024 | Business

Will Donald Trump Vs. Kamala Harris’ candidacy in the 2024 US election have a positive impact on the crypto ecosystem? Read the full explanation in this article.

The United States presidential election has become a highlight among the crypto community. The reason is, that the United States is a region that often focuses on crypto regulations.

Therefore, the crypto community hopes that Donald Trump vs. Kamala Harris can get a detailed explanation of their plans for crypto regulation when they are elected.

Kamala Harris is considered to be more open to crypto if elected than her boss, Joe Biden. However, Kamala Harris remains behind Donald Trump, who from the start has paid full attention to the crypto ecosystem, even outspokenly wanting America to become a center for Bitcoin mining.

Donald Trump and His Interactions in the Crypto Ecosystem

Donald Trump is already “more experienced” in the crypto ecosystem than his opponent, Kamala Harris. Since his confirmation that he will be a presidential candidate in the 2024 US Election, he has been welcomed by the crypto community. Memes about him appeared to attract attention.

In his campaigns in various regions, Trump also loudly called for supporting cryptocurrencies and relaxing regulations. Last July, Donald Trump even promised to fire Gary Gensler, who is currently the head of the SEC. It is common knowledge that the SEC is often an obstacle to the development of the crypto ecosystem in America.

Increasingly gaining support from the crypto community, Trump is also increasingly strengthening his position to support the progress of cryptocurrency by becoming a figure who does it The first transaction is on a bar called PubKey. This transaction was carried out in mid-September and received a positive reaction from crypto circles.

Recently, Donald Trump also stole the attention of the crypto ecosystem by launching a platform called World Liberty Financial or WLFI. WLFI is a crypto platform that offers various financial activities, including lending, investment, and digital transactions.

Before its launch, WLFI even received more than 100,000 registrations and this fact is of course good news for Donald Trump in his candidacy in the 2024 US Election.

Kamala Harris and the Crypto Regulatory Framework

Not wanting to be left behind by Donald Trump, Kamala Harris also tried to attract the sympathy of the crypto community by stating that she also supports crypto. In her campaign in Erie, Pa., Kamala Harris outlined a big agenda in which she discussed Harris’ substantive policies on cryptocurrencies.

There is a crypto regulatory framework there. However, Harris did not explain in detail how he would create the regulatory framework.

There is no mention of Bitcoin, blockchain, or other digital assets in the regulations proposed for the crypto ecosystem. Due to this, the crypto community feels disappointed with Kamala Harris.

Conclusion: Trump Vs. Harris, Will Crypto Get the Benefit in the End?

No matter how sweet Donald Trump’s promises are and how Kamal Harris provides evidence of his support for crypto, the crypto community must remain careful about the existing political system. Every crypto observer must provide neutral criticism and suggestions without leaning towards either candidate to the extreme.

Policy in America will always be the basis for how crypto tokens are traded so that the results of the US election will determine future crypto developments.

You can do comprehensive analysis and research when you want to buy a coin. Know Bitcoin price, Ethereum, XRP, Solana, USDT, and other tokens. Use features on a trusted global exchange website, such as Bitrue, to find out crypto market conditions in real-time.

by Penny Angeles-Tan | Oct 16, 2024 | Business

Most crypto tokens are experiencing price increases today. How are the 5 major crypto tokens doing? Are they also experiencing increases?

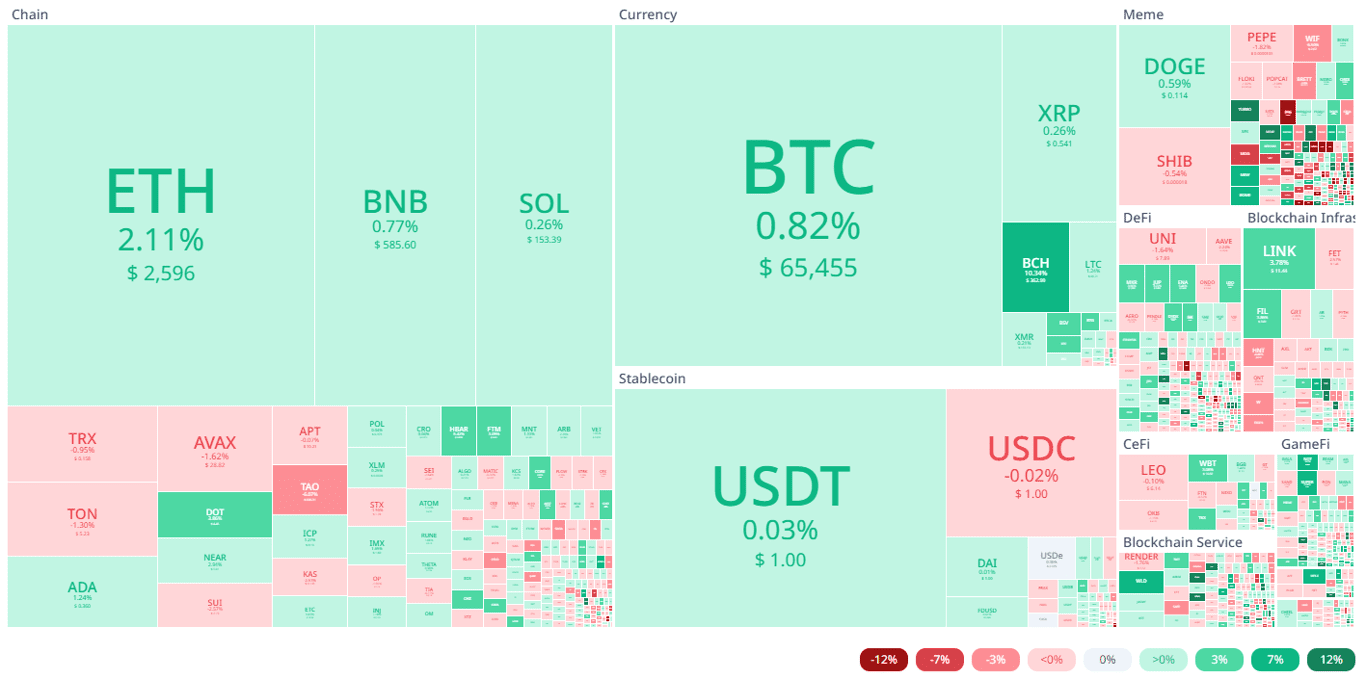

October is known as an exciting month for the crypto community due to its #Uptober tradition. This year, it is predicted that #Uptober will come in mid-October. And today, it is proven that the crypto ecosystem is in the green zone with the majority of tokens experiencing price increases.

In this article, we will discuss the condition of the 5 major tokens in the crypto ecosystem, namely Bitcoin, XRP, Solana, Ethereum, and USDT. These five tokens are often a guide to conditions in market crypto. Because, when the five experience an increase or decrease, it will definitely have an impact on other tokens.

Price Increase for 5 Major Tokens

The crypto community is experiencing excitement today because major tokens in the crypto market are experiencing price increases. Starting from Bitcoin, XRP, Ethereum, Solana, to Tether USDT, their prices have increased and reached their respective target price levels.

Bitcoin today is at the $65,000 level Moreover, it was even traded at more than $66,000 as its highest price in 24 hours. This increase is a breath of fresh air because Bitcoin experienced a price decline for quite a long time after its halving moment.

Ethereum, which is always seen as pessimistic because its price continues to fall, today also experienced a price increase of 2.11% and is now trading at $2,596.

Solana may only see a 0.26% gain. However, the SOL token price currently exceeded its resistance price of $148,500 and is now trading at $153.39.

XRP also increased by a similar percentage to Solana, namely 0.26% and is now at $0.541. USDT experienced the smallest price increase, namely only 0.03% and was trading at $1.00.

Rising Crypto Market Prices Sign of the Coming of #Uptober?

Many analysts predict #Uptober 2024 will come in mid-October after two weeks of stagnant crypto tokens at boring prices. With the increase in 5 major tokens today, it seems that this prediction is true.

Historically, #Uptober has never come directly at the beginning of October. In general, #Uptober only arrives in mid-October or even arrives in November. However, optimistically, the crypto market increase always comes in Q4 every year.

Several major crypto tokens have passed their resistance prices. If these prices persist long enough, a bullish trend for each token is bound to occur. If a major token experiences a bullish moment, it is not uncommon for other tokens to also be affected and experience increases as well.

Conclusion

That is an explanation of today’s crypto market conditions. You can continue to follow developments in information about the crypto ecosystem, starting from finding out Ethereum price, Bitcoin, XRP, Solana, USDT and various other meme-coins and tokens, Bitrue provides real time data for you.

You can even check price conversions from BTC, ETH, XRP, SOL, etc. from USDT to USD easily on the Bitrue website. The Bitrue blog also provides the latest information through articles written in real time, so you can follow crypto market conditions every day.

by Penny Angeles-Tan | Oct 15, 2024 | Business

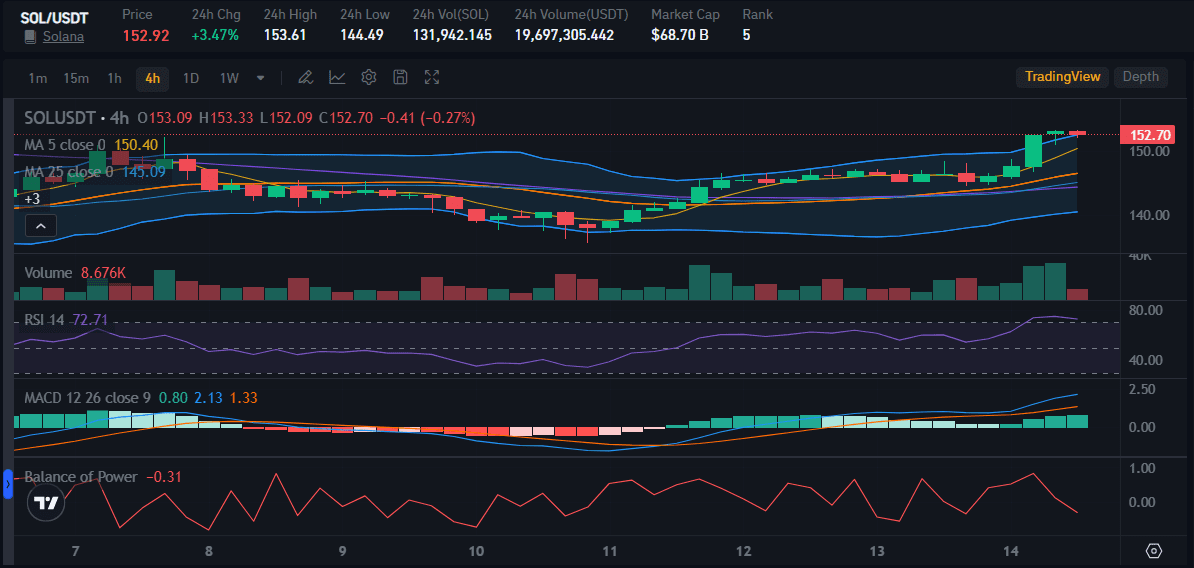

Is it true that Solana price will soon reach the $210 level? Check out the analysis in this article because it will explain in detail why Solana could experience an increase in the near future.

Solana has received positive news recently, ranging from an increase in the number of users to the potential for a price increase of hundreds of times. In this article, you will find out that the potential Solana price rise at $210 is true for five reasons that will be discussed.

Check out this article to find out exactly what Solana will look like in the future.

1. Solana Crosses Resistance Level

Solana is predicted to reach the $210 level no later than 2025. One of the conditions for Solana to reach this price is if SOL can pass the resistance level at $148.16.

And surprisingly, Solana can easily reach this resistance level. When this article was written on October 14, the SOL price was trading at $152.92, surpassing the price target of $210.

You can see, several indicators in Solana price chart The above also shows the positive side. SOL’s RSI is at 72, far exceeding 50 as the balance limit for buying and selling trends. However, this figure is a sign that Solana is in a phase that is prone to over-buying.

Solana’s MACD shows a rise from the boundary line. If it continues like this, Solana’s bullish trend will occur. Moreover, the value of the BoP figure is also close to positive with a value of -0.11, which means that although the selling market still dominates compared to the buying market, it will soon be at a positive figure. So, the bullish trend is also optimistic from the existing BoP data.

2. Solana has 100M Active Wallets

Recently, active wallets on Solana reached 100 million users. This number is of course a big achievement for Solana because previously, at the beginning of 2024, the number was only 509,000 active wallets and now it has increased many times.

However, unfortunately, as quoted from Solana Hello Moon, a number of wallets actually have empty balances. The number of empty wallets is not small, but 86 million users. In fact, 15.5 million users only have 1 SOL in their wallets and 1.5 million wallets only have 10 Solana tokens.

Even though many wallets were empty, Solana also saw an increase in active addresses on its network. From the initial number of 3 million active addresses, it increased by 15% and became 3.47 million.

This increase in active addresses indicates that Solana has increasingly strong fundamentals so more investors trust Solana.

3. Popularity of Memecoin in the Solana Ecosystem

Recently, various new meme coins have emerged from the TON network with the Telegram game concept. Despite this, the popularity of meme coins on the Solana network remains superior.

Quoted from Dune Analytics data, Pump.fun, one of the meme coins on Solana, even achieved cumulative revenue of up to $127.8 million. This figure is of course very large.

Conclusion: from #Uptober to Trump’s Popularity for Solana

October is always a good month for Solana. This is why Solana token holders are optimistic that SOL will experience a significant price increase shortly.

Not only that, Solana is also predicted to experience a price jump of up to 400x if Donald Trump is elected president of the United States in the next period. This is because Trump’s policy of supporting crypto is analyzed as being more likely to benefit Solana. If this happens, Solana could outperform Bitcoin and Ethereum.

If you are interested in buying Solana tokens, don’t just buy the token without doing some research. Find out what the current condition of Solana is, the price of SOL to USD, to thoroughly study the fundamentals of this token. That way, you can know what the risks are when investing in this token.

by Penny Angeles-Tan | Oct 10, 2024 | Business

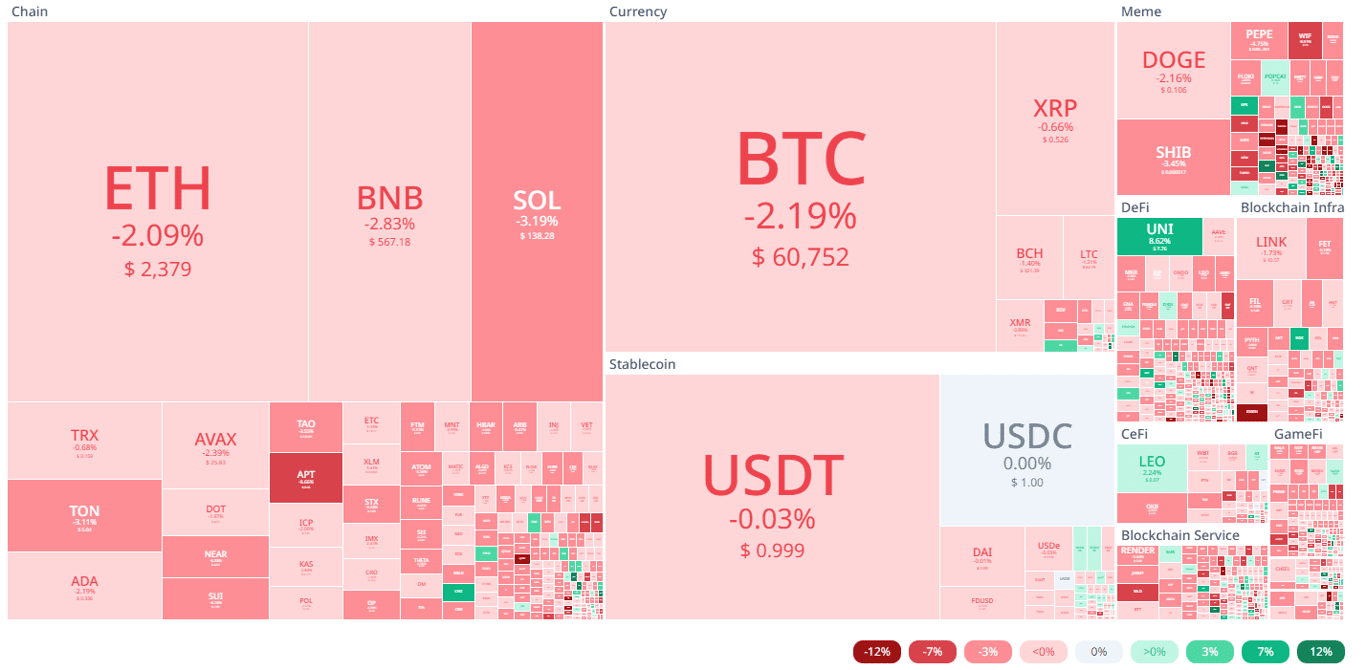

Top Altcoin assets are getting negative sentiment from the crypto community. This article will explain the current conditions of XRP, Solana, and Ethereum. Read the explanation until the end whether all three have the potential to increase in price.

Santiment, a crypto analysis company, stated that the crypto community is currently giving negative sentiment toward Altcoins, especially their major assets. However, this provides an opportunity for several major assets to experience price increases. Is that true?

You can see the analysis of several coins, namely XRP, Solana, and Ethereum in this article. The analysis will take the form of reading the price chart at the time this article was written so that you can get additional data to consider before buying these tokens.

Current Crypto Market Conditions

According to data from Santiment, the top 20 Altcoins receiving negative sentiment are:

Currently, the crypto market is experiencing a decline in prices for the majority of its tokens. Large tokens, such as BTC, Solana, Ethereum, XRP, and USDT price are currently in the red zone.

The size of the price drop varies, from -0.03% to Solana’s -3.19%. Of course, the reason for this price decline cannot be analyzed using just one indicator because there are many factors, ranging from global economic conditions, and conflicts between countries, to the most recent release of the HBO documentary about the revelation of the figure of Satoshi Nakamoto.

XRP: Potential to Break $12?

XRP Price today it is down by -1.03% so it is trading at $0.5251. Previously, XRP was at its highest price of $0.5345 in the last 24 hours.

XRP’s RSI value is below 50 so the selling trend is more dominant than the buying trend. The MACD line is also seen declining. With this data, the decline in XRP prices is natural.

However, the macroeconomic waves that are predicted to occur make XRP look positive for price increases. In fact, XRP holders and the community hope that the price of this token can reach the $12 level.

This high target price could be achieved because currently, XRP is applying for a second XRP-based ETF in the United States. If this ETF is approved, it is likely that XRP will experience a drastic price increase.

Solana: Price Rises if Trump Wins

A giant global banking company, Standard Chartered, predicts that Solana will experience a price increase of up to 5 times by 2025.

This prediction will allow Solana to outperform BTC and ETFs for its total market capitalization. And this prediction could happen if Donald Trump is elected as president of the United States for the next period.

Standard Chartered predicts that by 2025, SOL will rise 5x, ETH will rise 4x, and BTC will rise 3x. This is because the Trump administration with its regulations supports Solana more than all existing crypto assets.

At the moment, Solana price is experiencing a decline of -3.46% and is trading at $138.05. Even though the percentage decline in SOL is greater than other major assets, the RSI value of SOL is actually at 50.62, which means the buying and selling trends are balanced.

Even though the RSI value is still positive, Solana’s MACD line has dropped quite low which predicts a bearish trend could occur in the near future.

Ethereum: ETH Price Rises if Vitalik Buterin Wins Nobel Prize?

Vitalik Buterin is predicted to win the Nobel prize on October 14 as a figure who innovated a new currency. Vitalin Buterin is known as a figure who can revive the blockchain ecosystem and encourage Ethereum as a competitor to Bitcoin.

If the founder of Ethereum really gets the Nobel, Ethereum price can rise because many investors are interested in this cryptocurrency.

Currently, Ethereum is experiencing negative sentiment because its price continues to fall. An increase in the price of ETH did occur, but it did not last long and then immediately decreased again.

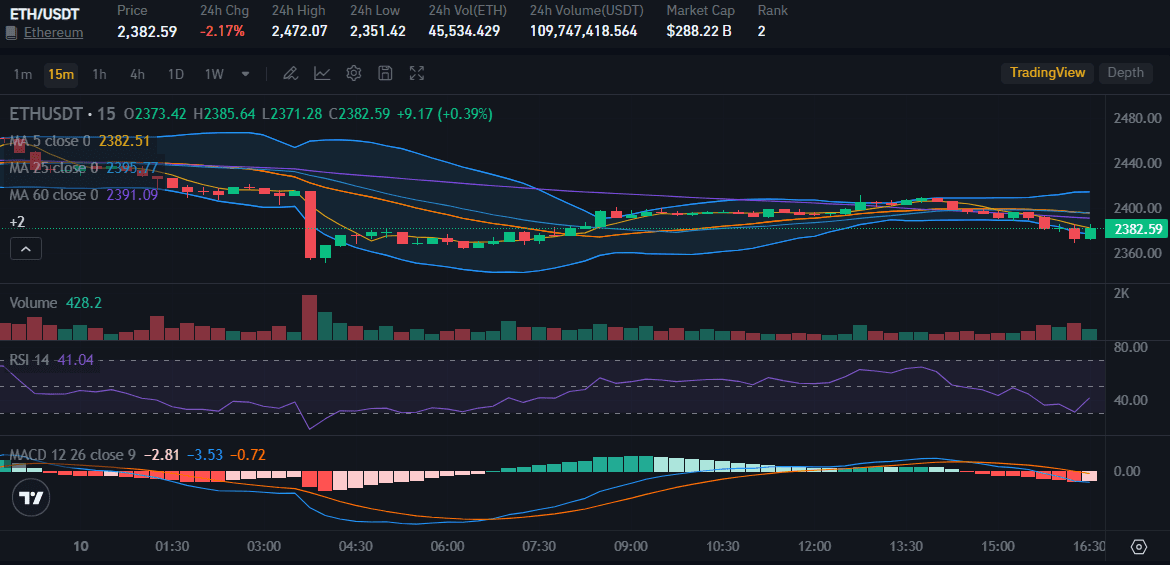

You can see from the price graph above, that ETH experienced a price decline of -2.17%. Currently, the price of Ethereum is $2,382 and was previously at a 24-hour high of $2,472.

Will Ethereum be free from negative sentiment and be able to penetrate the $2,600 level as crypto analysts predict?

Conclusion

That is an explanation of the current conditions of XRP, Solana, and Ethereum. For those of you who are interested in these three coins and want to do more in-depth research, you can check them on the Bitrue website.

You can use Bitrue features for free to check the price of crypto coins and keep up-to-date on the various projects in the crypto ecosystem.

You must be logged in to post a comment.