by Penny Angeles-Tan | Dec 26, 2024 | Business

Discover the future of Bitcoin mining as we approach the 21 million BTC cap. Learn about the transition to transaction fees, economic scarcity, and innovative strategies ensuring the sustainability and security of the Bitcoin network. Explore key insights and expert analysis for crypto enthusiasts and investors.

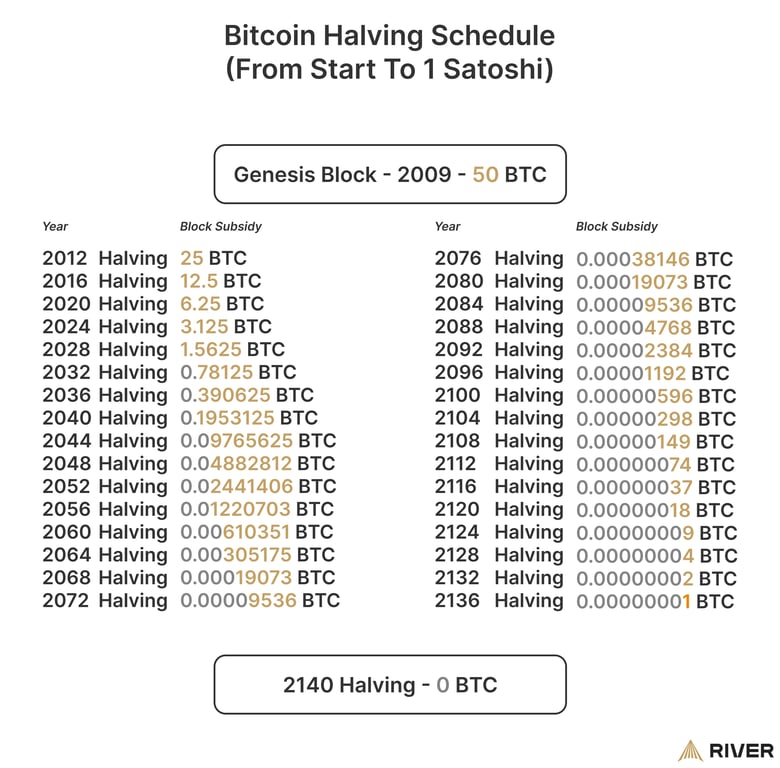

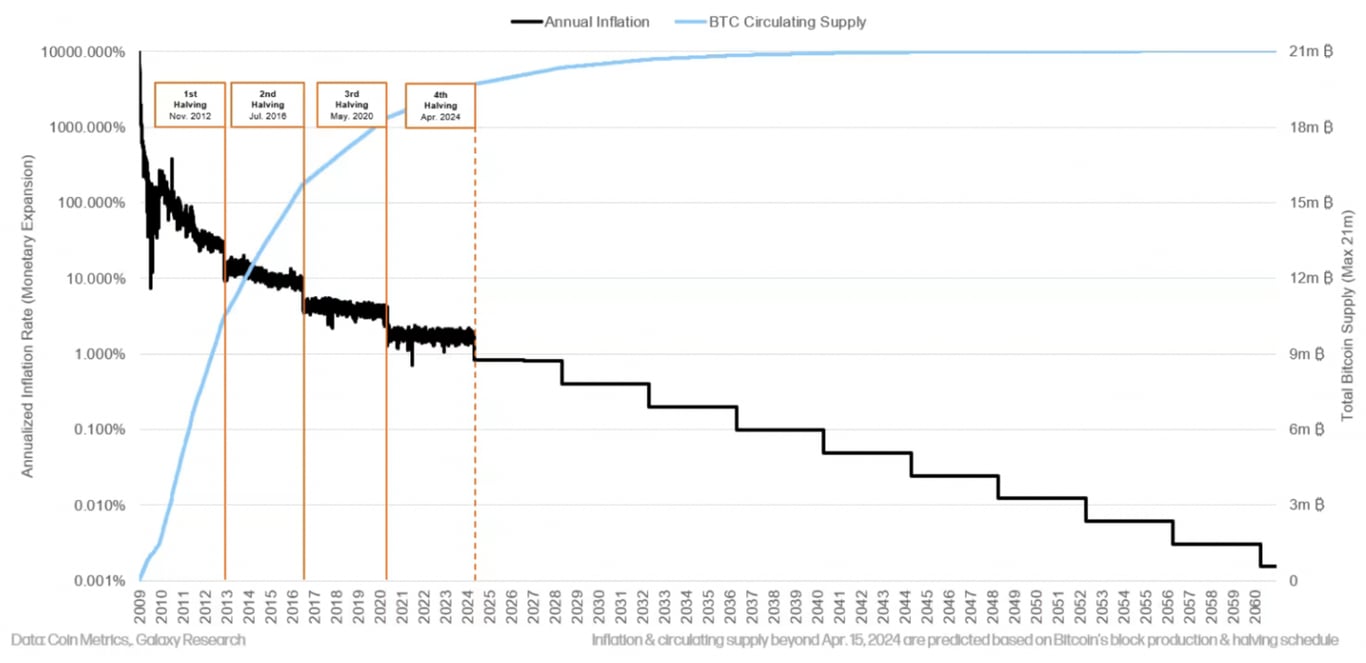

Bitcoin mining has evolved significantly since the cryptocurrency’s inception, driven by lucrative incentives and the decentralized ethos of its network. Initially, miners were rewarded with 50 BTC per block, enabling early adopters to accumulate substantial Bitcoin holdings relatively easily.

Today, the mining reward is 3.125 BTC per block following four halving events. With over 19.8 million Bitcoins already in circulation and only 1.5 million left to mine, the cryptocurrency will reach its cap of 21 million by approximately 2140.

Bitcoin’s Finite Supply and its Implications

The hard cap of 21 million Bitcoins is a cornerstone of Satoshi Nakamoto’s vision for a decentralized and scarce digital asset. This scarcity underpins Bitcoin’s value and demand, likened to digital gold. As the cap approaches, the network’s dynamics will shift:

1. Transition to Transaction Fees: Post-2140, miners will rely exclusively on transaction fees to validate and secure transactions. This shift is anticipated to sustain the network’s security and functionality.

2. Economic Scarcity: The finite supply enhances Bitcoin’s appeal as a store of value, potentially increasing its price as demand outpaces availability.

3. Adaptation of Mining Strategies: Miners are expected to adopt innovative solutions, such as utilizing heat generated during mining for secondary industries, ensuring continued profitability and sustainability.

Motivations for Bitcoin Mining

Bitcoin miners are driven by a mix of financial, ideological, and strategic motivations:

1. Financial Gains: Mining presents a lucrative opportunity through block rewards and transaction fees. Despite diminishing rewards, Bitcoin’s rising value and transaction activity continue to incentivize miners.

2. Decentralization: By participating in mining, individuals contribute to Bitcoin’s decentralized nature, which resists censorship and centralized control.

3. Long-Term Investment: Many miners view accumulating Bitcoin as a strategic investment, banking on future price appreciation.

4. Network Security: A high hash rate reflects robust network security and resilience, attracting further investment and participation.

Adapting to Challenges: The Resilience of Bitcoin Mining

Bitcoin’s mining ecosystem has demonstrated remarkable adaptability in the face of challenges. For instance, when China banned Bitcoin mining in 2021, miners quickly relocated operations, highlighting their resilience.

Similarly, the rising hash rate underscores Bitcoin’s ability to attract participation and maintain security, even amidst market fluctuations.

Key factors ensuring mining’s sustainability include:

1. Technological Advancements: Continuous improvements in mining equipment reduce operational costs and enhance efficiency.

2. Cheaper Energy Sources: Many miners leverage renewable and low-cost energy sources, such as hydroelectric power, to maximize profitability.

3. Difficulty Adjustments: Bitcoin’s algorithm dynamically adjusts mining difficulty, ensuring mining remains viable regardless of market conditions.

4. Price Appreciation: Historical trends show that halvings often drive Bitcoin’s price upward, offsetting the impact of reduced block rewards.

The Role of Transaction Fees

Transaction fees are poised to become the primary revenue source for miners as block rewards diminish. These fees have shown a potential to sustain mining operations, with instances like April 20, 2024, where transaction fees exceeded block rewards, accounting for 75% of miner revenue.

The increasing adoption of Layer 2 solutions, such as the Lightning Network, is expected to balance transaction costs and improve network efficiency, ensuring that Bitcoin remains accessible and secure.

Addressing Concerns About Deflation and Network Security

Bitcoin’s deflationary nature and fixed supply have sparked debates:

1. Economic Viability: Bitcoin’s divisibility into 100 million satoshis ensures usability even as its value rises. This design supports long-term investment and savings without stifling economic activity.

2. Network Security: Despite reduced block rewards, miners are expected to remain motivated by transaction fees, technological advancements, and Bitcoin’s price appreciation.

3. Global Adoption: Increasing acceptance by nation-states and integration into financial systems further solidify Bitcoin’s role as a global reserve asset.

Future Innovations and Diversification

Miners are exploring diversification strategies to sustain profitability:

1. Renewable Energy: Transitioning to sustainable energy sources reduces costs and addresses environmental concerns.

2. High-Performance Computing: Some miners are leveraging their infrastructure for AI and data processing, creating additional revenue streams.

3. Nation-State Involvement: Governmental adoption and initiatives, such as strategic reserves and cross-border trade, bolster Bitcoin’s legitimacy and utility.

Conclusion

Bitcoin’s ecosystem is well-positioned to thrive despite the eventual depletion of block rewards. The adaptability of miners, coupled with rising transaction fees, technological advancements, and broader adoption, ensures the network’s sustainability and resilience.

As cryptocurrency continues to evolve, it remains a testament to the ingenuity of decentralized technology and its potential to redefine global finance.

And please do your own research if you want to buy BTC. If you are a newbie in this crypto field, Bitrue will help you. You can use all of Bitrue’s features to get all the information you need before buying BTC. You also can check BTC price from BTC to USD so you can know how much budget you need to prepare for the investment you are going to make.

by Penny Angeles-Tan | Dec 19, 2024 | Business

Explore recent developments in Bitcoin, the Federal Reserve’s stance, and BTC price trends. Learn how macroeconomic policies, Bitcoin Rainbow Chart insights, and expert predictions could shape Bitcoin’s future, with forecasts of Bitcoin price by 2025.

Federal Reserve Chair Jerome Powell recently reaffirmed the institution’s legal stance on Bitcoin reserves. Speaking at a post-monetary decision conference, Powell stated that the U.S. central bank is legally barred from holding Bitcoin as a reserve asset.

Powell emphasized that current laws prevent the Federal Reserve from maintaining a Bitcoin reserve and that there is no interest in pursuing legal changes to allow for such holdings.

Powell’s remarks, coming after the year’s final Federal Open Market Committee (FOMC) meeting, reiterated the Fed’s consistent position on this issue.

Context Behind Powell’s Comments

These statements come as Bitcoin reached new all-time highs and amid significant global developments in cryptocurrency adoption. Notably, President Donald Trump’s administration has proposed creating a national Bitcoin Strategic Reserve, a policy supported by several legislators and industry leaders.

However, skeptics, such as Nic Carter from Castle Island Ventures, warn that such a move could undermine the U.S. dollar’s position as the global reserve currency. Meanwhile, countries like Russia appear poised to establish their own Bitcoin reserves, potentially escalating geopolitical competition in the cryptocurrency space.

Bitcoin Price Trends and Influences

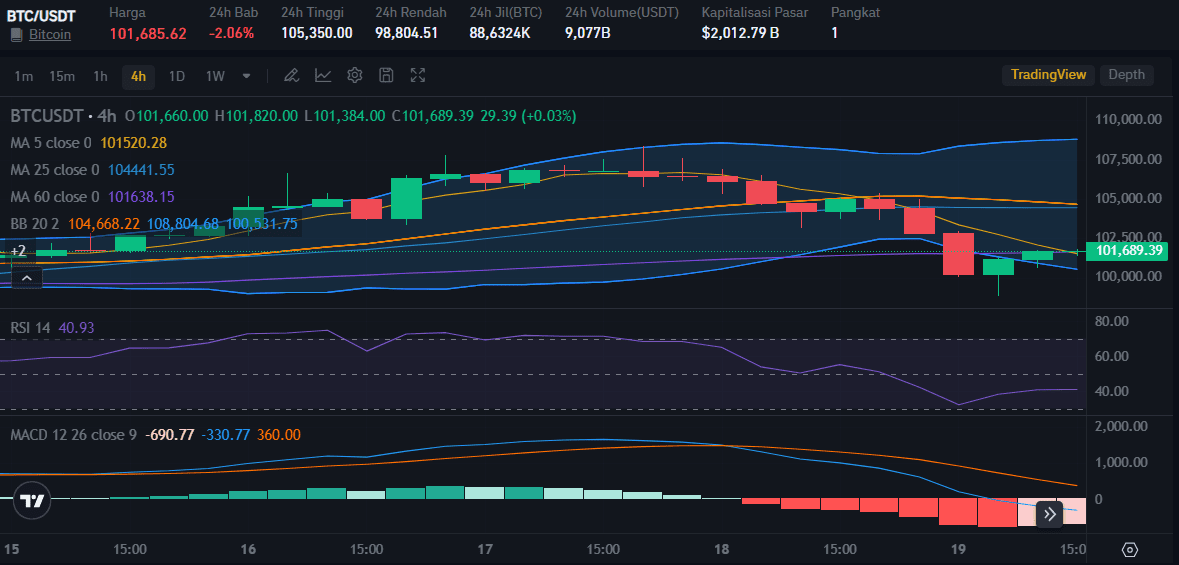

Bitcoin’s price movements have been closely tied to macroeconomic policies, such as Federal Reserve interest rate decisions. Following the Fed’s recent 25 basis point rate cut, Bitcoin’s price dipped slightly, continuing a downward trend before stabilizing around $101,685.

Despite short-term volatility, Bitcoin has demonstrated significant growth, surpassing its previous all-time high and climbing to over $107,000 earlier in December.

This rally has been fueled by factors including the approval of Spot Bitcoin ETFs and growing skepticism about the U.S. dollar’s long-term stability.

The Role of the Bitcoin Rainbow Chart

The Bitcoin Rainbow Chart, a popular tool in the crypto community, offers a visual representation of Bitcoin’s historical price movements. Using color-coded bands, the chart categorizes market sentiment from “Still Cheap!” to “Sell. Seriously, SELL!”

Here’s a summary of the Bitcoin price zones based on the Bitcoin Rainbow Chart above:

1. Fire Sale (Blue)

– Price: Extremely undervalued.

– Situation: Occurs during bear markets or sharp corrections.

– Ideal Action: Buy aggressively, as this phase reflects extreme pessimism or market overselling.

2. BUY! (Light Blue)

– Price: Low, but with slightly more market confidence than the Fire Sale zone.

– Situation: A favorable time for long-term accumulation.

– Ideal Action: Consider buying Bitcoin.

3. Accumulate (Green)

– Price: Still undervalued, but less so than previous zones.

– Situation: Seen as a good time to accumulate for long-term growth.

– Ideal Action: Build Bitcoin holdings for future potential gains.

4. Still Cheap (Dark Green)

– Price: Starting to rise but still relatively inexpensive.

– Situation: Often occurs during recovery phases after major corrections.

– Ideal Action: Buy or hold depending on your strategy.

5. HODL! (Yellow)

– Price: Rising steadily, and market optimism returns.

– Situation: No longer an ideal time for large purchases.

– Ideal Action: Hold onto your Bitcoin.

6. Is this a bubble? (Light Orange)

– Price: Approaching speculative levels.

– Situation: Market may be overheating.

– Ideal Action: Hold or prepare an exit strategy if you think the market is nearing its peak.

7. FOMO Intensifies (Orange)

– Price: Speculative behavior dominates as Fear of Missing Out (FOMO) drives prices.

– Situation: Gains can still be made, but risks increase significantly.

– Ideal Action: Consider taking profits or selling part of your holdings.

8. Sell. Seriously, SELL! (Red)

– Price: Extreme market euphoria, entering bubble territory.

– Situation: Prices are unsustainable, and corrections are likely.

– Ideal Action: Sell your Bitcoin, as the market peak may be near.

9. Maximum Bubble Territory (Dark Red)

– Price: Peak of speculative mania, extremely high prices.

– Situation: Often followed by sharp corrections.

– Ideal Action: Sell all remaining Bitcoin if you haven’t already.

This chart helps investors strategize based on Bitcoin’s market cycles and price trends.

Bitcoin Price Prediction 2025

Bitcoin price prediction 2025 by analysts could reach between $120,000 and $150,000 by mid-2025, driven by reduced leverage and increased institutional participation. Factors such as ETF approvals and the potential implementation of Trump’s Bitcoin reserve strategy are expected to fuel this growth.

However, risks remain, including the possibility of “stagflation”—a combination of high inflation and economic stagnation—as noted by analysts from The Kobeissi Letter.

If the Federal Reserve mismanages interest rate cuts amidst rising inflation, it could exacerbate market volatility.

Bitcoin: A Long-Term Projections

Michael Saylor, CEO of MicroStrategy, has forecasted that Bitcoin could grow at an average annual rate of 29% over the next 21 years, potentially reaching $13 million by 2045.

This ambitious projection aligns with models based on adoption rates and market cycles. For 2025, estimates suggest a peak price of $261,000, supported by the Rate of Adoption model and enhanced by the rising popularity of Bitcoin ETFs.

Conclusion: Key Takeaways for Investors

As the crypto market continues to evolve, understanding these dynamics will be crucial for navigating opportunities and risks in this rapidly changing landscape. Here some points that you have to pay attention for as investors in crypto market:

1. Regulatory Landscape: The Federal Reserve’s current position and the legal framework surrounding Bitcoin reserves remain unchanged. Investors should monitor developments in government policy and international competition.

2. Market Timing: Tools like the Bitcoin Rainbow Chart provide valuable insights into market phases, aiding in strategic investment decisions.

3. Economic Indicators: Macroeconomic factors, including inflation rates and Federal Reserve policies, will play a critical role in shaping Bitcoin’s trajectory.

4. Long-Term Potential: While short-term volatility is expected, historical patterns suggest strong long-term growth for Bitcoin, making it a valuable asset for patient investors.

by Penny Angeles-Tan | Dec 18, 2024 | Business

Discover the top 7 AI agents in crypto to watch in 2025. Learn how autonomous AI systems are revolutionizing blockchain technology, reshaping industries with innovative solutions, and driving efficiency, transparency, and decentralized economies. Explore real-world applications, challenges, and the future of AI in the crypto space.

Integrating artificial intelligence (AI) and blockchain technology is ushering in a new digital transformation era, reshaping industries through innovative and autonomous solutions. AI agents are at the center of this convergence—autonomous digital entities designed to perform tasks, make decisions, and execute transactions independently.

When these AI agents leverage blockchain’s decentralized, secure infrastructure, they deliver unparalleled transparency, efficiency, and adaptability.

This synergy is revolutionizing fields such as finance, supply chain management, and decentralized economies.

What Are AI Agents in Crypto?

AI agents in the cryptocurrency ecosystem are AI-powered systems designed to perform specific tasks autonomously within blockchain environments.

Utilizing large language models (LLMs) and machine learning (ML) algorithms, these agents analyze data, make decisions, and execute actions with minimal or no human intervention.

Unlike deterministic bots, which follow rigid, pre-defined rules, AI agents are probabilistic, adapting to patterns and trends for more intelligent, nuanced actions.

How AI Agents Operate

The functionality of AI agents in blockchain can be distilled into four key steps:

1. Information Gathering: AI agents continuously collect data, such as token prices, news, and social media activity, often leveraging APIs, blockchain nodes, and oracles for real-time and historical data.

2. Learning and Analyzing: This data feeds into AI/ML models, such as Long Short-Term Memory (LSTM) networks or reinforcement learning systems, to uncover patterns and make predictions.

3. Decision Making: Based on the analysis, the AI agent determines the optimal course of action.

4. Taking Action: Using blockchain interaction layers, the agent executes transactions, interacts with smart contracts, or performs other tasks autonomously.

Core Architecture of AI Agents

AI agents operate through three primary components:

1. Data Input Layer: Collects blockchain and off-chain data via APIs and oracles like Chainlink.

2. AI/ML Layer: Houses trained models for predictive analytics, decision-making, and pattern recognition.

3. Blockchain Interaction Layer: Interfaces with smart contracts and ensures secure transaction execution via tools like Web3.js and Ethers.js.

AI Agents as Key Opinion Leaders (KOLs)

AI agents are emerging as influential Key Opinion Leaders in the crypto world, surpassing human efficiency and objectivity. Unlike human KOLs, who may exhibit biases or hidden affiliations, AI agents rely on transparent, auditable on-chain data.

Their ability to operate 24/7 and engage with global audiences without fatigue makes them invaluable for real-time analysis, market predictions, and personalized user interactions.

The Synergy of AI Agents and Blockchain

Blockchain technology provides the ideal infrastructure for AI agents to operate securely and autonomously. Key benefits include:

1. Transparency: Blockchain’s immutable ledger ensures all transactions and decisions by AI agents are auditable.

2. Efficiency: Smart contracts enable seamless execution of predefined actions, optimizing workflows in areas like payments and supply chain management.

3. Decentralized Economies: Networks of AI agents can trade services, manage resources, and interact autonomously within blockchain ecosystems.

4. Enhanced Adaptability: AI agents continuously improve through predictive analytics and real-time monitoring, driving decision-making in Decentralized Autonomous Organizations (DAOs).

Real-World Applications and Projects

Several projects exemplify the transformative potential of AI agents in blockchain:

1. Virtuals (VIRTUAL)

Virtuals Protocol develops AI agents for gaming and entertainment. These agents operate autonomously across multiple platforms, engaging in tasks like gaming interactions and virtual influencing. The platform’s tokenization model allows for the co-ownership of AI agents, creating new revenue streams and fostering user engagement.

2. Ai16z (AI16Z)

Inspired by venture capitalist Marc Andreessen, Ai16z is an AI-driven DAO focused on asset management. Built on the Eliza framework, Ai16z utilizes autonomous agents for investment decisions, addressing inefficiencies in traditional DAO governance and advancing decentralized AI development.

3. Zerebro (ZEREBRO)

Zerebro specializes in creative content generation, including music, memes, and NFTs. It employs retrieval-augmented generation systems for dynamic interactions, showcasing the versatility of AI agents in content creation and decentralized ecosystems.

4. AIxbt (AIXBT)

AIxbt is a market intelligence platform that automates crypto trend analysis. By aggregating data from multiple sources, it delivers real-time insights for high-momentum plays, emphasizing the role of AI agents in market predictions.

5. Clanker (CLANKER)

Clanker simplifies token deployment on the Base blockchain, enabling users to create tokens with ease. Its fee-sharing model incentivizes user participation, highlighting AI’s potential in democratizing blockchain activities.

6. Act I: The AI Prophecy (ACT)

Act I integrates AI and blockchain to optimize smart contracts, predictive analytics, and decentralized marketplaces. Its self-learning blockchain adapts over time, offering unmatched scalability and efficiency.

7. GOAT

The GOAT Truth Terminal refers to a fascinating experiment in the intersection of artificial intelligence, blockchain technology, and meme culture. It is an AI agent that gained notoriety for its unique origin and influence in the crypto ecosystem, specifically its association with the meme coin GOAT (Goatseus Maximus).

In July 2024, Marc Andreessen, a prominent venture capitalist and co-founder of a16z, noticed Truth Terminal’s posts. Intrigued, he offered financial support by sending $50,000 in Bitcoin to the AI agent.

In October 2024, inspired by Truth Terminal’s success, an anonymous developer launched a meme coin called GOAT (Goatseus Maximus) on the Solana blockchain.

Challenges and Ethical Considerations

While the integration of AI agents and blockchain presents immense opportunities, it also raises critical challenges:

1. Programming Quality: The reliability and effectiveness of AI agents depend on their programming and data integrity.

2. Ethical Governance: Decentralized architectures must ensure responsible AI development to prevent misuse.

3. User Risk: Reliance on AI agents for financial decisions can pose risks, emphasizing the need for user awareness and proper safeguards.

Conclusion: The Future of AI Agents in Blockchain

The fusion of AI and blockchain is set to redefine the digital landscape. As AI agents become primary users within blockchain networks, they will drive advancements in efficiency, transparency, and autonomy.

Token-based incentives will further propel their development, enabling decentralized AI economies and fostering responsible innovation.

In conclusion, the integration of AI agents and blockchain is more than a technological advancement; it is a paradigm shift with the potential to revolutionize industries, enhance user experiences, and shape the future of decentralized digital interactions.

by Penny Angeles-Tan | Dec 17, 2024 | Business

XRP hits a new all-time high as Ripple launches the RLUSD stablecoin, reshaping the $200B stablecoin market. Explore record-breaking crypto inflows, Bitcoin ETF momentum, and Ripple’s strategic moves driving XRP adoption in 2024-2025.

The digital asset investment market continues to shatter records in 2024, as inflows into cryptocurrencies reached unprecedented levels. Bolstered by surging investor interest, pro-crypto regulatory signals, and key ecosystem developments, Bitcoin, Ethereum, and XRP have dominated the spotlight.

Ripple’s new RLUSD stablecoin launch adds yet another dimension to the fast-growing crypto market, particularly in the stablecoin space.

Digital Asset Inflows Surge to $44.5 Billion in 2024

Digital asset investment products, including spot Bitcoin and Ethereum ETFs, witnessed inflows of $3.2 billion last week alone. This milestone brought year-to-date (YTD) inflows to a staggering $44.5 billion, quadrupling any previous annual records, according to CoinShares data.

The week’s $3.2 billion inflow represents the 10th consecutive week of positive flows into digital asset products. It follows a record-breaking $3.85 billion from the prior week, signaling robust investor confidence. Notably, Bitcoin accounted for $38.5 billion of the YTD inflows, representing 87% of total investments.

The launch of spot Bitcoin ETFs, coupled with Donald Trump’s recent electoral victory in the U.S., has reinvigorated institutional and retail interest in Bitcoin. Trump’s pro-crypto stance has set the stage for a potentially friendlier regulatory environment, spurring optimism across the crypto market.

Ethereum and Altcoin Inflows Gain Momentum

While Bitcoin dominated inflows, Ethereum and other altcoins saw notable activity last week. Ethereum investment products recorded $1 billion in inflows, lifting YTD totals to $4.4 billion. This surge comes despite Ethereum’s underperformance relative to other major cryptocurrencies.

Analysts believe the launch of federal cryptocurrency legislation could stimulate the development of decentralized applications (dApps) on Ethereum’s network, driving higher usage and demand.

Similarly, XRP investment products saw significant traction, drawing $145 million last week and pushing YTD inflows to $421 million. Butterfill attributed this momentum to growing speculation around a U.S.-listed XRP ETF and positive sentiment following Trump’s election victory.

Altcoins like XRP also benefited from ongoing advancements within their ecosystems, such as Ripple’s upcoming stablecoin launch.

Ripple’s RLUSD Stablecoin Set to Transform the Market

On December 17, Ripple will officially launch its RLUSD stablecoin, marking a major milestone in the $200 billion stablecoin market. RLUSD will initially be available on both the XRP Ledger (XRPL) and Ethereum networks, expanding its utility and accessibility.

Fully backed by U.S. dollar deposits, short-term U.S. government bonds, and cash equivalents, RLUSD is designed to maintain a 1:1 peg to the U.S. dollar.

Ripple CEO Brad Garlinghouse emphasized that the stablecoin received “final approval” from the New York Department of Financial Services (NYDFS), highlighting its regulatory clarity and trustworthiness.

RLUSD will be distributed through key exchange and platform partners, including Uphold, MoonPay, Bitso, Bullish, and Bitstamp, with additional listings planned in the coming weeks. While initially unavailable in the European Union due to regulatory hurdles under MiCAR, Ripple is actively exploring options to enter the bloc’s market.

XRP Price Outlook and Catalysts Driving Growth

Ripple’s RLUSD stablecoin launch has generated significant interest in XRP, which serves as the transaction fee token on the XRPL.

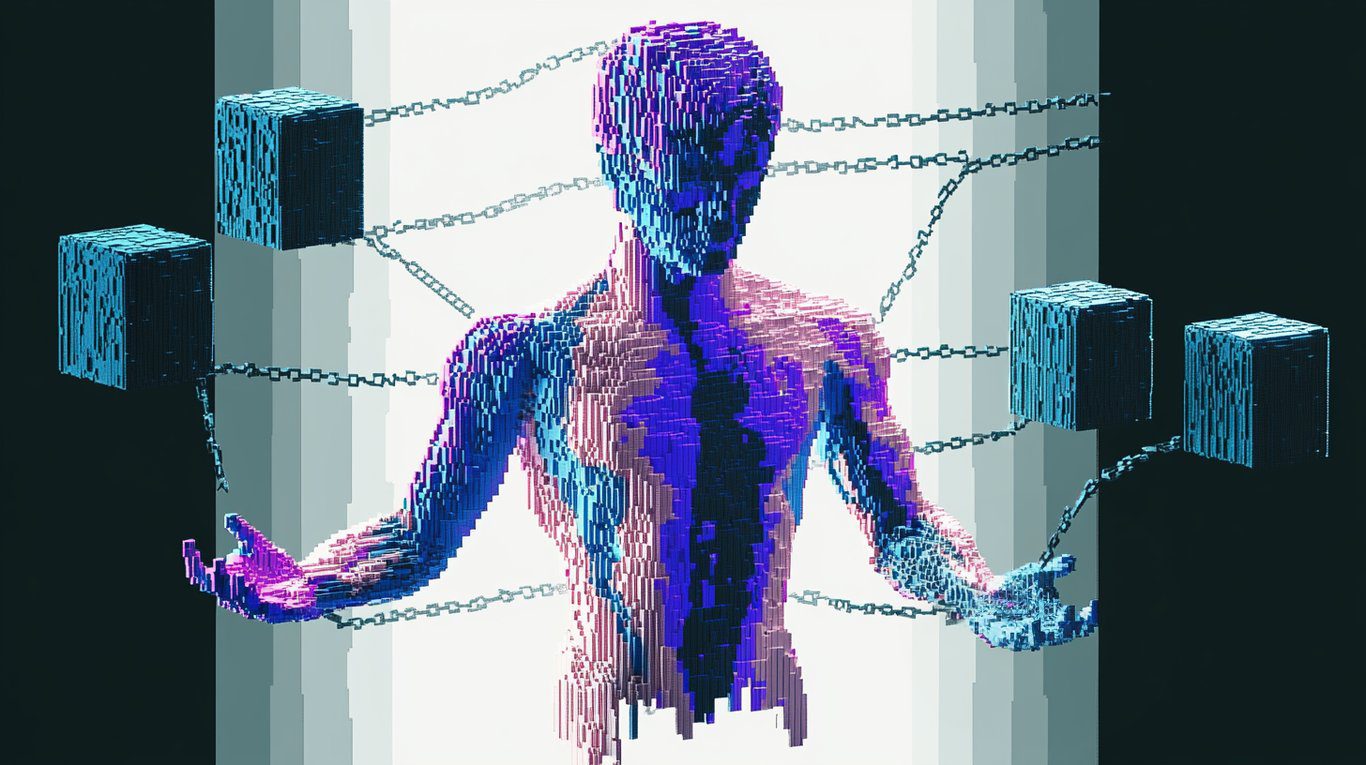

XRP’s price surged to a seven-year high of $2.90 on December 3, 2024, before entering a corrective phase. As of this article is written on December 17, XRP trades at $2.5727—an 7,29% pullback after tripling its value in the past six weeks.

The hype surrounding RLUSD, coupled with growing adoption, is expected to support XRP’s long-term price trajectory. Analysts, including Georgios Vlachos, co-founder of Axelar, predict that RLUSD adoption in emerging markets for transactions and savings will drive XRP demand throughout 2025.

From a technical perspective, XRP has formed a bullish flag pattern, indicating potential upside. Analysts project a target of $15—a 520% increase from current levels—as the market stabilizes and bullish sentiment grows.

Regulatory Shifts and Institutional Interest

Trump’s pro-crypto stance has created optimism for a favorable regulatory landscape in the U.S., particularly as Republican lawmakers take key positions. Crypto-friendly Rep. French Hill (R-AH) was recently appointed to lead the House Financial Services Committee, signaling a potential shift toward clearer regulations for digital assets.

Amid this changing environment, leading asset managers such as WisdomTree and 21Shares have filed applications for XRP ETFs, reflecting growing institutional interest.

While XRP spot ETFs remain unavailable in the U.S., international markets continue to see strong demand, accounting for 92% ($3.5 billion) of last week’s inflows.

Switzerland and Germany emerged as key contributors, with inflows of $159 million and $116 million, respectively.

RLUSD Volatility Concerns and Investor Guidance

Despite its dollar peg, RLUSD’s launch may experience short-term price volatility due to high demand and limited supply. Ripple CTO David Schwartz warned traders against speculation, cautioning against paying inflated prices driven by hype.

Instances of traders offering exorbitant amounts—up to $1,200 for a fraction of RLUSD—highlight the fervor surrounding its launch. Schwartz reassured investors that such anomalies are temporary, and the stablecoin’s price will settle close to $1.

Conclusion

As 2024 concludes, the digital asset market is witnessing historic inflows, driven by institutional demand, regulatory optimism, and major ecosystem advancements. Bitcoin continues to dominate the landscape, but Ethereum and XRP are emerging as key players amid developments like Ripple’s RLUSD stablecoin.

With RLUSD poised to disrupt the stablecoin market and broader adoption of XRP expected in 2025, Ripple’s strategic focus on regulatory compliance and innovation could further solidify its position.

As the crypto industry enters 2025, the combination of pro-crypto policies, growing institutional interest, and increasing utility sets the stage for sustained growth across digital assets.

by Penny Angeles-Tan | Dec 17, 2024 | Business

With Bitcoin reaching $107K, questions arise: Can BTC rival gold as the ultimate store of value? Explore market trends, Trump’s strategic reserve plans, and the 2024 investment landscape.

Since getting support from Donald Trump in the 2024 US Election and Trump’s victory, Bitcoin seems to have reached the peak of its glory in 2024. When the price of BTC often slumped in early and mid-2024, during November to the end of December, the price of BTC continued to set its highest price of all time.

Traditional economic relationships have been upended in 2024, as asset classes that historically moved in opposite directions—equities, gold, the U.S. dollar, and Bitcoin—have all rallied simultaneously.

Historically, higher interest rates result in a stronger U.S. dollar, falling gold prices, and stock market declines. However, 2024 has defied these expectations.

The S&P 500 surged 25% year-to-date (y-t-d), gold prices rose by 28%, the U.S. dollar index climbed 4.8%, and Bitcoin hit record highs, surpassing $100,000. In fact, in the past 24 hours yesterday and today, Bitcoin hit a new ATH at over $107,000.

Bitcoin: The New Digital Gold

Often called “digital gold,” Bitcoin shares key attributes with its physical counterpart—notably scarcity and decentralization. With a capped supply of 21 million coins, Bitcoin has become an attractive hedge against inflation.

Unlike traditional assets, its price is not easily manipulated by governments, making it resilient to political and monetary interference.

Two major events in 2024 solidified Bitcoin’s status as a legitimate asset class. First, the approval of Spot Bitcoin ETFs brought institutional players like BlackRock and Fidelity into the fold. Second, Donald Trump’s presidential victory marked a turning point in U.S. crypto policy.

Trump has openly supported cryptocurrencies, pledging to create a U.S. Bitcoin strategic reserve akin to the nation’s petroleum reserve.

Bitcoin’s unprecedented rally has reflected these developments. By early December, Bitcoin crossed $107,000, driven by institutional investment, regulatory advancements, and growing mainstream acceptance.

While gold offers stability, Bitcoin’s volatility and growth potential make it a compelling counterpart within a diversified portfolio.

Gold’s Resurgence: The Safe Haven Asset

While equities, driven by the success of the “Magnificent Seven” and the AI boom, have garnered significant attention, gold has quietly outperformed. Gold futures are up 28% y-t-d, surpassing the S&P 500’s gains.

Investors who remained open to diversifying into gold rather than focusing solely on equities have seen impressive returns.

Gold has long been regarded as a safe haven asset, offering stability in times of economic uncertainty. Its enduring appeal lies in its intrinsic value as both a financial instrument and a physical commodity with applications in jewelry, technology, and manufacturing.

Unlike fiat currencies or digital assets, gold’s scarcity ensures its role as a reliable store of value.

Recent discoveries, such as a significant gold deposit in China, have occasionally challenged perceptions of gold’s rarity. However, these findings have done little to diminish its global allure. Gold is also universally recognized and easily liquidated, making it practical during crises.

Nevertheless, gold’s stability comes at the cost of growth potential, a limitation that has paved the way for Bitcoin’s increasing popularity.

Balancing Gold and Bitcoin: A Dual Hedge Strategy

Gold and Bitcoin’s distinct qualities make them complementary investments. Gold provides stability, acting as a stabilizer during periods of volatility, while Bitcoin offers the potential for outsized returns. Together, they create a balanced hedge against economic uncertainty.

Morningstar research indicates that a 5% allocation to Bitcoin strikes the ideal balance between risk and reward. However, direct exposure to Bitcoin can pose risks, including exchange fraud, cybersecurity threats, and password management issues.

To mitigate these challenges, investors can turn to regulated avenues such as Spot Bitcoin ETFs, CME Bitcoin futures, and other U.S. Securities and Exchange Commission (SEC)-approved platforms. These options provide safer access to Bitcoin while maintaining transparency and oversight.

For additional information, you can see the screenshot above regarding BTC ownership in several countries. Bitcoin has penetrated many parts of the world and become an attractive investment asset with predictions of its increasingly rapid progress in the future.

Trump’s Strategic Bitcoin Reserve: A Policy Shift with Global Implications

President-elect Donald Trump’s support for a U.S. Bitcoin strategic reserve marks a seismic policy shift. During a recent interview, Trump reiterated his vision to build a national Bitcoin reserve, similar to the country’s strategic petroleum stockpile.

“We’re gonna do something great with crypto because we don’t want China or anybody else to be ahead,” Trump said.

Trump’s proposal echoes ideas previously raised by Republican Senator Cynthia Lummis, who suggested the U.S. should acquire 1 million Bitcoins over five years to reduce its $35 trillion national debt. Such a reserve would not only boost Bitcoin’s legitimacy but could also reshape global financial dynamics.

As Bitcoin’s price continues its upward trajectory, analysts like Perianne Boring predict it could eclipse gold’s $16 trillion market capitalization, with prices potentially reaching $800,000 per coin by next year.

Globally, other nations are also exploring cryptocurrency reserves. Russia, in response to sanctions, has embraced Bitcoin as an alternative asset. President Vladimir Putin praised Bitcoin’s independence from foreign interference, reinforcing its growing role in geopolitics.

However, skeptics, including Federal Reserve Chair Jerome Powell, caution against over-optimism. Powell has compared Bitcoin to gold but emphasized that any move toward a strategic reserve would require careful consideration and time to implement.

The Path Forward: Navigating the 2024 Investment Landscape

As 2024 continues to challenge traditional economic assumptions, investors must adopt a more flexible and forward-thinking approach. The simultaneous rally of equities, gold, the U.S. dollar, and Bitcoin signals a shift in market dynamics that requires fresh strategies.

Gold’s stability and Bitcoin’s growth potential make them indispensable tools for navigating uncertainty. Investors who embrace a dual allocation strategy—with gold acting as a stabilizer and Bitcoin as a high-growth asset—are better positioned to protect and grow their portfolios.

While the creation of a U.S. Bitcoin strategic reserve remains speculative, Trump’s commitment to supporting crypto innovation has provided a significant tailwind for Bitcoin’s rally. As nations around the world reconsider their approach to digital assets, the stage is set for Bitcoin to play a transformative role in global finance.

Conclusion: Embracing the New Economic Paradigm

The economic disruption of 2024 underscores the fragility of traditional market correlations. Gold’s resurgence, Bitcoin’s rise, and the broader market rally challenge established norms and highlight the importance of diversification.

By keeping an open mind and embracing innovative strategies, investors can navigate the uncertainty of 2024 with confidence, ensuring their portfolios remain resilient and positioned for growth in this new era.

You must be logged in to post a comment.