by | Mar 26, 2025 | Business

AgadPay has officially launched in the Philippines, offering employees safe, on-demand access to their earned wages before payday—without loans, interest, or debt traps. In a market where millions of Filipinos live paycheck to paycheck and often rely on high-interest payday lenders, AgadPay provides a healthier financial alternative that helps reduce stress and improve financial stability. The platform is free for employers to offer and has been shown to boost employee retention and productivity by giving workers greater control over their finances.

Manila, Philippines – March 26, 2025 – AgadPay, a new Earned Wage Access (EWA) platform, is now available nationwide, providing Filipino employees with safe, convenient access to the wages they have already earned—before payday. This solution involves no loans, no interest, and no debt traps. Instead, workers can withdraw a portion of their accrued salary for a small, transparent fee, eliminating the need for high-interest payday loans that can lead to spiraling debt.

What is Earned Wage Access (EWA)?

Earned Wage Access is an arrangement that lets employees tap into the income they have already accumulated prior to the official payday. It bridges the common financial gap that arises toward month’s end, cutting down on reliance on payday loans and informal lending. EWA is increasingly recognized as a sensible response to the urgent reality faced by Filipino workers, with 80% of Filipinos reportedly living paycheck to paycheck, 36 million still borrowing cash for daily needs, and 60% lacking any form of emergency fund. All these figures are underscoring the depth of financial stress many Filipinos experience.

Why the Philippines Needs EWA

The prevalence of high-cost lending is illustrated by the fact that 47.1% of Filipino adults regularly borrow money, often at interest rates that are difficult to repay. Many employees find themselves in a continuous cycle of debt, unable to break free from payday lenders. Studies have found that 66% of EWA users report reduced financial stress and that 79% of employees would consider changing jobs if EWA were offered elsewhere. This demonstrates strong demand for a more sustainable way to handle short-term cash shortages and underscores the value of EWA as a credible alternative to predatory lending sources.

A Better Option for Employees

By offering access to wages that have already been earned, AgadPay provides a dignified, debt-free way for workers to cover urgent expenses such as utility bills, tuition, or healthcare costs. There is no interest charged, only a minimal convenience fee, and employees remain in control of their own earnings rather than getting trapped in loan repayment cycles. This model relieves the anxiety that stems from living paycheck to paycheck and bolsters overall financial well-being.

A Win-Win for Employers

AgadPay is entirely free for companies to offer. Employers who adopt EWA report positive outcomes that include higher retention rates and a more engaged workforce, an important factor given that 1 in 5 employees admits to reduced productivity due to financial strain. Studies also indicate EWA can increase employee retention by up to 78%. AgadPay integrates easily with existing payroll systems, meaning organizations can support the financial health of their workforce without taking on additional administrative burdens.

AgadPay is now open to businesses across the Philippines. To explore how this new EWA platform can benefit both companies and their employees, visit www.agadpay.ph for details on scheduling a demo or requesting more information.

by | Mar 25, 2025 | Business

Paw enthusiasts unite! The much-loved Cat Lovers Festival and Dog Lovers Festival are making a highly anticipated return in 2025, bringing joy, education, and entertainment across Melbourne and Sydney, before heading to Brisbane in 2026.

Featuring an incredible line-up of attractions, the festivals are set to deliver an unforgettable experience for every pet lover, whether they are lifelong dog devotees or passionate cat enthusiasts.

The festivals will provide access to a wide selection of breeds, with experts and adoption groups, with the interactive facets complemented by exclusive shopping experiences, competitions and more.

“We are thrilled to bring these events back, offering pet lovers a unique opportunity to immerse themselves in a world of dogs and cats,” said Event Director, Paul Mathers.

“It’s incredibly exciting to see how the Cat and Dog Lovers Festivals continue to grow and evolve year after year. These festivals have become a highlight on the calendar for so many Australians, and we can’t wait to welcome everyone back for another unforgettable celebration of their furry companions.”

“From expert-led talks to action-packed arenas, visitors will find inspiration, entertainment, and valuable insights into pet ownership.”

Exciting festival highlights include the ADVANCE™ Stage, Breed Showcases, and dedicated Adoption Zones, designed to connect visitors with adoption groups and animal welfare organisations. The action-packed Vitapet Arena will feature live demonstrations, showcasing incredible dog skills and training techniques.

Star appearances will include Farmer Dave Graham, a festival favourite known for his engaging demonstrations, and Lara Shannon, renowned from TV’s Pooches at Play, offering expert dog training insights.

After a popular debut at the Melbourne event last year, social media sensation Jamie the Dog Trainer will be a must-see guest in both Melbourne and Sydney, while ABC TV’s Muster Dogs stars Marlene & Hudson and Jack & Pesto will be live on stage at select events, and Brodie Young will return as MC.

There will be high-flying antics with the Kurgo Dockdogs splashing into a 100,000 litre pool, the Pat-a-Pooch experience, with the Vitapet Door Prize giving guests the opportunity to win thousands of dollars’ worth of top gifts for their pooch.

A new addition to the Dog Lovers Festival is a dedicated hub for Dog-Friendly Travel, reflecting the growing popularity of dog-friendly vacations. Visitors will be able to explore the latest travel products, services, and destinations designed for adventures with their furry friend.

Cat lovers won’t be disappointed, with a packed program featuring the WHISKAS® Stage, Kitty Cosplay, Australia’s largest cat dress-up parade, the Championship Cat Show, the heart-warming Pat-a-Cat experience, and the fabulous Feline Natural Breed Showcase featuring rare and popular breeds.

Attendees can also experience the WHISKAS® Kitty Corner and put their cat knowledge to the test in CatKwiz. The Cat Lovers Festival will also boast a brand-new Marketplace, promoting boutique Australian business alongside the main Expo offering an extensive range of specialty cat products, festival-only specials, and exclusive items tailored to feline enthusiasts.

Cat Lovers Festival special guests, including Australia’s favourite veterinarian Dr. Katrina Warren, and local social media sensations Sonia Hankova & Kepler Copernicus will make appearances throughout the festivals.

The tour kicks off at the Sydney Showgrounds on August 23–24, followed by the Melbourne Showgrounds on October 25–26, and heads to Brisbane Showgrounds on May 16–17, 2026.

Attractions and speaker line-ups will vary by location, with further exciting announcements to be made in the lead-up to each festival.

Visitors are able to fetch Dog Lovers Festival tickets at dogloversfestival.com.au, or pounce on Cat Lovers Festival passes at catloversfestival.com.au, with limited opportunities for exhibitors still available at all three events.

And in Pawsome news – every cat lover who buys a ticket will also receive access to the Dog Lovers Festival and vice-versa, meaning you can access two great festivals for the price of one!

Please note: visitors are unable to bring their own dog or cat to the event for health and safety reasons, see websites for full details on this policy.

by | Mar 25, 2025 | Business

Discover the top 3 crypto airdrops to watch in late March 2025! Explore GOAT Network, Tari, and MegaETH—projects offering unique rewards through Bitcoin Layer-2, PoW mining, and NFT-based incentives. Don’t miss out on these lucrative opportunities!

As the crypto market enters the last week of March, Airdrop Hunters are on the lookout for lucrative opportunities to engage with promising projects at an early stage. Three noteworthy projects offer attractive airdrop opportunities: GOAT Network, Tari, and MegaETH.

These projects span Bitcoin Layer-2 (L2) solutions, unique Proof-of-Work (PoW) protocols, and Ethereum (ETH) scaling innovations.

GOAT Network: Get BTC and Turn into an Active Asset

GOAT Network is a Bitcoin Layer-2 solution designed to expand Bitcoin’s utility by integrating smart contracts and decentralized finance (DeFi).

Having officially launched its Alpha Mainnet on March 17, 2025, GOAT Network is moving away from conventional one-time airdrops. Instead, it has introduced an ongoing rewards system through the “One Piece Project.”

Participants in GOAT Network can engage by bridging assets such as BTC, BTCB, or Dogecoin (DOGE), minting soulbound NFTs, and interacting with dApps like GOATSwap and Oku.

These activities are rewarded with GEC (Proof of Activity) and GOAT Points, which can later be converted into GOATED tokens after the Token Generation Event (TGE) scheduled for late 2025.

GOAT Network encourages early adopters to interact actively, as airdrop rewards increase based on engagement levels. The project has allocated 6% of its total token supply for airdrops, with an additional 42% dedicated to sequencer and community mining and 1% reserved for influencer collaborations.

As the public mainnet launch and TGE approach, GOAT Network is positioning itself as a leader in Bitcoin-based DeFi.

Tari: Reward for Community Member

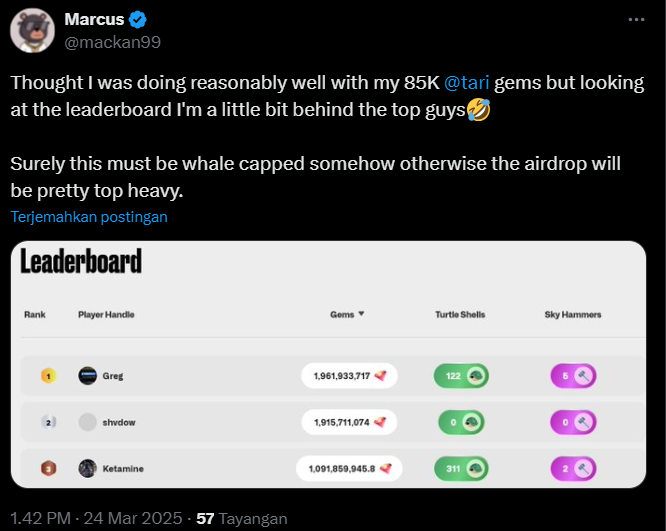

Tari is a Layer-1 blockchain focused on user-based proof-of-work (PoW) and digital asset management. With its mainnet launch scheduled for April 2025, early participants have an opportunity to accumulate Gems, which are likely to play a role in future token distribution.

However, leaderboard data suggests that top participants have amassed a significant number of Gems, raising concerns about the fairness of the distribution. Some community members have suggested capping large allocations to prevent disproportionate rewards for “whales.”

Tari has allocated 5% of its total XTM token supply for its incentive program. Airdrop distribution is expected to occur approximately six months after the mainnet launch, with a 12-month vesting period for community tokens.

Users can earn Gems by mining tXTM (Tari’s testnet token) through the Tari Universe platform, completing quests, referring friends, and owning Yats domain names with high rhythm scores.

Additionally, rare collectibles such as “Turtle Shells” and “Sky Hammers” offer multipliers and boost airdrop eligibility, making them highly desirable.

Tari’s ASIC-resistant PoW algorithm ensures a fairer mining process, preventing domination by large-scale mining farms. Notably, U.S. residents are ineligible for the airdrop, but global participants can take advantage of the early-stage opportunity before testnet mining concludes.

MegaETH: An NFT-Based Airdrop Model

MegaETH takes a novel approach to airdrop distribution. As an Ethereum Layer-2 solution boasting transaction speeds of up to 100,000 TPS, MegaETH has secured backing from Vitalik Buterin and a $20 million seed funding round.

Instead of offering direct token airdrops, MegaETH has implemented an NFT-based reward system. While the public testnet is currently active, the project has stated that no immediate rewards will be granted for participation. However, many community members speculate that testnet interactions may impact future eligibility.

MegaETH has advised users to monitor related projects such as CAP Labs and Noise for potential clues on early access opportunities.

Although some users have expressed disappointment over the absence of a direct airdrop announcement, MegaETH’s alternative model may yield long-term benefits for engaged participants.

Conclusion

With airdrops remaining a significant attraction in the crypto space, GOAT Network, Tari, and MegaETH each provide unique opportunities for early adopters. Whether through DeFi-based incentives, PoW-based mining, or NFT-driven rewards, these projects offer distinct avenues for engagement.

Airdrop hunters should stay vigilant and actively participate to maximize their chances of securing valuable rewards in these emerging ecosystems.

by | Mar 25, 2025 | Business

Get ready for the Rats Kingdom (RK) token listing on March 28, 2025! Learn about claim issues, price predictions, investment potential, and how to secure your tokens before the deadline.

The highly anticipated listing date for Rats Kingdom (RK) is just around the corner, set for March 28, 2025. However, as the deadline approaches, many users are experiencing claim-related issues with their RK tokens.

From wallet connection problems to missing token visibility, both verified and non-verified community members are facing hurdles in accessing their coins.

Token Claim Issues and Solutions

The Rats Kingdom project had previously announced that eligible users must redeem their tokens before March 28. A snapshot was taken on January 10, 2025, to ensure a fair distribution. However, as the deadline nears, several users report technical issues.

Common Problems and Fixes

1. Trust Wallet Not Connecting: If you are not getting the approval popup, simply click “Try Again” when prompted.

2. Tokens Not Visible: Users need to manually add the RK token contract address to their wallet to view their holdings.

How to Claim Your RK Tokens in 4 Steps

- Ensure you have at least 15 POL (Polygon) in your wallet for gas fees.

- Add the official RK contract address to your wallet.

- Connect your wallet using the Telegram Mini App bot.

-

Tap “Claim Now,” approve the transaction, and wait for the tokens to appear in your wallet.

Important Points to Remember:

- Only verified users can claim instantly.

-

If unverified, you must complete the KYC process first.

-

Ensure you have enough Polygon (15 POL) to complete the transaction.

-

The claim window closes on March 28, 2025, the same day as the listing.

Rats Kingdom Listing and Price Predictions

The RK token will officially list on March 28, 2025. However, the exact platforms where it will debut remain unconfirmed. Speculations point to major global exchanges while others suggest it may only be available on its own exchange.

Rats Price Forecast and Investment Potential

With a total supply of 100 billion tokens, RK is being compared to the success of Hamster Kombat (HMSTR). Hamster Kombat launched at $0.0085, peaked at $0.01, and is currently trading at $0.002078.

Based on expert analysis, the RK listing price could range between $0.005 and $0.008. If listed on major exchanges, long-term projections suggest it could rise between $1 and $5.

According to current predictions, Rats is expected to increase by 227.30%, reaching $0.00009906 by April 24, 2025. However, the market sentiment remains bearish, with the Fear & Greed Index at 46 (Fear).

Investment Projection

If you invest $1,000 in Rats today and hold until May 2, 2025, the estimated potential profit is $3,583.20, representing a 358.32% ROI (excluding transaction fees).

Short-Term Price Targets

Why March 28, 2025?

The choice of March 28 for the listing and Token Generation Event (TGE) was strategic. The project team ensured that the launch date aligns with community engagement, technical readiness, and exchange partnerships.

This launch will not only mark the introduction of RK tokens into the broader crypto market but also serve as a significant milestone in the project’s roadmap.

Community Involvement and Future Prospects

The Rats Kingdom team has placed a strong emphasis on community engagement. From rewarding early adopters to fostering active discussions on Twitter, Telegram, and Discord, the project aims to build a loyal user base that supports its long-term vision.

Technical Aspects of the TGE

On March 28, 2025, the RK smart contract will be activated, minting and distributing tokens to eligible holders. Additional features include:

1. Exchange Listings: RK will debut on selected platforms, ensuring immediate trading liquidity.

2. Staking and Yield Farming: Plans to integrate staking opportunities for passive income generation.

3. Security Measures: Multi-layered security checks and audits to ensure safe transactions.

Conclusion

With only three days left before the official listing, now is the time for users to finalize their claims and verify transactions. Whether RK follows in the footsteps of Hamster Kombat or carves out its own niche, March 28 will be a defining moment for this emerging cryptocurrency.

As always, investors are reminded to conduct their own research and approach trading with caution. The future of Rats Kingdom remains promising, but market fluctuations should always be considered before making investment decisions.

by | Mar 25, 2025 | Business

KUALA LUMPUR, 25 March 2025 – In a major milestone for padel in the region, Asia Padel Events (APE) is set to bring the CUPRA FIP Tour 2025 to Kuala Lumpur, Malaysia, this April. Adding to the excitement, the Asia Pacific Padel Tour (APPT), the premier professional padel circuit focused on the Asia-Pacific region, will also host a highly anticipated tournament in the city. This dual offering solidifies Kuala Lumpur’s position as a leading padel destination in the region.

ASCARO Padel & Social Club, leader in exclusive clubs and racket sports, will be hosting both tournaments. Happening within weeks of each other, these two tournaments usher in a milestone for padel in Malaysia. Each one is poised to bring elite players from around the world and offer a display of world-class competition. Both local and international padel enthusiasts will have the chance to witness or participate in the action.

CUPRA FIP Tour: Malaysia’s First-Ever FIP Tournament

The CUPRA FIP Tour is the official international circuit of the International Padel Federation (FIP), hosting over 500 tournaments annually across 44 countries. Asia Padel Events (APE) is the official promoter of the CUPRA FIP Tour events across Asia. In 2025, APE is leading the expansion of the CUPRA FIP Tour into new host nations across the region, including Hong Kong, Malaysia, Vietnam, and more—creating more pathways for Asian athletes to compete internationally and grow the sport across the continent.

For the first time, Malaysia will join this prestigious list with the FIP Bronze Kuala Lumpur 2025, running from April 16 to 20, 2025, at ASCARO Padel & Social Club, 1 Utama.

Awarded a Bronze classification, the tournament will offer €7,000 in prize money and vital international ranking points, giving local and regional players the chance to compete against top global talents. The event represents a critical step forward in integrating Southeast Asia into the elite global padel circuit.

The tour will boost Malaysia’s reputation as a prominent destination for international padel events. Visit FIP Bronze Kuala Lumpur 2025 to find out more or sign up to join the competition. Registration is until April 2, 2025.

The Asia Pacific Padel Tour: Returning to KL for the Second Time

The week after the FIP tournament, ASCARO is also proud to bring the APPT to Kuala Lumpur from the 25th – 27th of April. As the first-ever Professional Padel Tour in the Asia-Pacific region, the APPT has rapidly become one of the largest and most popular tours worldwide.

With dedicated categories for both professional and amateur players, the APPT provides a competitive platform for players of all levels, giving everyone a chance to battle for glory on the courts.

The tournament will be held at the ASCARO Padel & Social Club in 1 Utama. Prizes will be awarded in all men’s and women’s categories, with cash prizes totalling $6,500 for professional players, and Joma Sport Padel equipment given to the winners of amateur categories.

Visit APPT Open Kuala Lumpur 2025 for more information. Registration is open until April 21, 2025.

ASCARO Champions Padel’s Growth in the Asia-Pacific Region

ASCARO serves as the leading force in the development of padel in the Asia-Pacific region. As the premier padel club of Kuala Lumpur, ASCARO Padel & Social Club has set a high standard for what padel is. It’s not just a game, but an experience that integrates a competitive sport with style. Since 2023, ASCARO has already been making waves in Malaysia. It established the country’s first-ever professional padel club, while attracting a new generation of players and fans alike. As part of its commitment to elevate the sport across the continent, ASCARO also has plans to open four new clubs in 2025.

Now, ASCARO is bringing two important tournaments to KL, both are big opportunities to celebrate padel in the region. Spearheading this effort is Daniel Liljekvist, Managing Director and Partner at ASCARO Padel and Social Club. Liljekvist expressed: “We are proud to host two major international padel tournaments this April— the first-ever FIP tournament in Malaysia, followed by the second Malaysian edition of the APPT. This marks a significant step in the growth of padel in the region, and ASCARO is honored to be at the forefront of this movement.”

Thanks to ASCARO’s strong regional presence, padel has attracted a diverse and enthusiastic audience. A growing community that Liljekvist and his team are determined to serve. “At ASCARO, we are committed to delivering a premium playing experience, and our distinctive high-quality courts set the stage for top-tier competition. Hosting these prestigious tournaments reflects our dedication to excellence, both in the facilities we provide and the level of play we support. We look forward to welcoming elite players, passionate fans, and the wider padel community for an unforgettable month of world-class padel”, Liljekvist added.

Presented together with Qliq Damansara Hotel, ASCARO’s official partner for the FIP Tour and the APPT.

by | Mar 25, 2025 | Business

Kuala Lumpur, Malaysia – Switch (Apple Premium Reseller) and Urban Republic, Malaysia’s leading smartphone and gadget retail store with over 200 locations nationwide, are proud to announce a groundbreaking advancement in customer service. In collaboration with CIMB Bank Berhad (“CIMB”) and Payments Network Malaysia Sdn Bhd (“PayNet”), Switch and Urban Republic are now the first smartphone and gadget retail stores in Malaysia to offer e-invoice submission directly through CIMB’s payment terminals, upon transaction completion.

(From left to right) Daniel Cheong, Head of Consumer Banking Malaysia, CIMB; Peggy Tan, Deputy Managing Director, CG Group (Switch / Urban Republic); Li Chau Ging, Managing Director, CG Group (Switch / Urban Republic); and Azrul Fakhzan Mainor, Senior Director of PayNet’s Commercial Division, have launched an instant e-invoice submission service. Urban Republic and Switch are the first smartphone and gadget retailers in Malaysia to offer this seamless feature through CIMB’s payment terminals.

This innovative service eliminates the need for customers to retain physical receipts as the receipts would be emailed to them immediately upon completing the transactions. By simply completing their purchase at any Switch or Urban Republic store using a CIMB terminal, customers can submit for their official e-invoice. This streamlined process enhances convenience, reduces paper waste, and provides a secure and efficient way to manage purchase records.

“We are thrilled to partner with CIMB and PayNet to bring this cutting-edge solution to our customers,” said Li Chau Ging Managing Director of Switch and Urban Republic.

“As the largest smartphone and gadget retail chain in Malaysia, we are committed to providing exceptional customer experiences. This instant e-invoice submission service underscores our dedication to innovation and sustainability, offering our customers a seamless and environmentally friendly transaction process.”

This collaboration leverages CIMB’s advanced payment terminal technology and PayNet’s robust payment infrastructure to deliver a seamless and secure e-invoice submission experience. Customers can easily access their e-invoice details directly on the terminal screen and opt to have it sent to their registered email address or mobile device.

Gurdip Singh Sidhu, Chief Executive Officer of CIMB Malaysia and CIMB Bank Berhad said, “At CIMB, we are committed to advancing our customers and society, and thereby continuously introducing enhanced services for their benefit. We are pleased to partner with PayNet to introduce an innovative solution through Switch and Urban Republic, so that our customers can have e-invoices directly and promptly shared with them. This we believe will help the merchant, the customer and by extension the government to make things simpler, better and faster for all.”

“As Malaysia’s national payments network, PayNet is committed to fostering seamless and secure digital payment transactions. This initiative exemplifies how strategic collaboration can accelerate digital adoption and enhance the retail experience for both businesses and consumers,” said Azrul Fakhzan Mainor, Senior Director of PayNet’s Commercial Division. “By enabling instant e-invoice submission through our payment infrastructure, we are making transactions more efficient, sustainable, and aligned with the needs of today’s digital-first economy.”

This new service is now available at six Switch locations (Wangsa Walk Mall, Plaza Low Yat, Plaza Shah Alam, Quayside Mall, The Mines and Sunway Pyramid), and will be rolled out at 83 more Switch and 117 Urban Republic outlets by 15 June.

by | Mar 25, 2025 | Business

Perseroan Terbatas (“PT”) is a limited liability company that is established under Indonesian law. The capital of a limited liability company is divided into shares and the responsibility of shareholders is based on the number of shares that he or she has.

Under Indonesian Company Law No. 40 of 2007 on Company Law as last amended by Law 11 of 2020 on Job Creation (“Company Law”), a company must be established by at least two shareholders. Its establishment takes place after a deed of establishment is issued by the notary which is followed by the approval of the Minister of Law and Human Rights; only then a PT obtain status as a “legal entity”.

To form a PT Indonesian company, here are 5 key points.

Name of the Indonesian Company

Under Government Regulation N. 43 of 2011 on the Procedures of Submission and Using Company Name, the company’s name should meet the following requirements:

1. Written in Latin letters;

2. Has not been used legally by another company or is not essentially the same as the name of another company;

3. Does not conflict with public order and/or decency;

4. Not the same or essentially the same as the name of a state institution, government institution, or international institution, unless it has obtained a permit from the institution concerned;

5. Does not consist of numbers or series of numbers, letters or series of letters which is not forming word;

6. Does not mean as the company/corporate, legal entity, or civil partnership, incorporation, limited liability company, or any other similar words;

7. The company which is wholly owned by an Indonesian citizen or an Indonesian entity has to use the Indonesian language as the company name. So that, the English or foreign words can only be used if it is a foreign-owned company.

In addition to the above, as required by the system of the Ministry of Law and Human Rights, the company name should be consisted of at least 3 (three) words. For example PT Anugerah Abadi Dunia, PT Nine World Champion.

Organs of the Indonesian Company

OrgansResponsibilitiesBoard of DirectorsLead the company’s daily business. A company can appoint a single director, but a public company, it must appoint at least two directors.Board of CommissionersSupervises and advises the Board of Directors of the Company. A company can appoint a single commissioner, but for a public company it must appoint at least two commissioners, one of whom must be an independent commissionerGeneral Meeting of Shareholders (GMS)It is the highest organ in the company. GMS has the authority to decide the matters that cannot be conducted by the Board of Directors or Board of Commissioners, among others, such as the approval of the transfer of shares, declaring a dividend, or the amendment of the articles of association.

Shareholders and Capital Structure

A company must be established by at least 2 (two) shareholders (it can be an individual or a business entity). The Capital structure of a company is divided into three categories:

Capital StructureExplanationAuthorized capitalthis capital is determined based upon mutual consent from the founders/shareholders Issued capitalthe Company Law mandates that a minimum of 25% of the authorized capital must be paid by the shareholders to the Company Paid-up capitalmust be paid in an amount equal to 100% of the issued capital. It is also important to note that a specific business sector may require a minimum amount of authorized capital and issued capital

Capital Structure on Foreign Ownership

Shares in an Indonesian company may be held by an Indonesian citizen/company and a foreign citizen/company. An Indonesian company whose shares are partly or entirely owned by a foreign citizen/company is known as a foreign investment company (“PT PMA”). Based on Investment Coordination Board Regulation No. 4 of 2021 on Guidelines and Procedures for Risk-Based Licensing and Investment Facilities, the minimum issued a capital requirement for PT PMA is Rp10,000,000,000 (ten billion Rupiah).Other than the minimum capital requirement as mentioned above, Indonesian law also governs the maximum foreign shareholding threshold is regulated under Presidential Regulation No. 10 of 2021 as last amended by President Regulation No. 49 of 2021 on the Investment Business Sectors (“Positive List Investment”). Under the Positive List, it divides the business activities that are (i) open for 100% foreign shareholding; (ii) partly owned by foreign shareholders, or; (iii) 100% closed for foreign shareholding.

Objectives and Purposes of the Company

A company must have objectives and purposes as well as business activities that are not contrary to provisions of laws and regulations, public order, and/or morality. The objectives and purposes of the company must be based on the Regulation of Central Bureau of Statistics (Badan Pusat Statistik) No. 2 of 2020 on the Indonesian Standard Industrial Classification (“KBLI”). The list of KBLI can be found in the link here https://oss.go.id/informasi/kbli-berbasis-risiko

by | Mar 24, 2025 | Business

The Coalition’s proposed nuclear sites in Queensland would not have access to enough water to operate or manage a nuclear incident, according to an explosive new report by the Queensland Conservation Council.

According to the Queensland Conservation Council, the proposed nuclear reactor in Callide would use more than double the water currently allocated to the existing Callide power station, while the proposed Tarong nuclear reactor would use 50 per cent more water than is allocated to the existing coal power station.

We’ve just hit 14 years since the Fukushima nuclear accident. This report shows that during the Fukushima emergency, the nuclear facility was flooded with 1.3 million cubic metres of sea water to prevent the plant from blowing up. There is no such water allocation for emergency response in Queensland dams, nor a storage solution for the potential millions of cubic metres of heavily radioactive water that such a disaster would create.

Queensland Conservation Council Director Dave Copeman says:

“The findings of this report are damning for the Coalition’s nuclear fantasy. There simply is not enough water available in the proposed locations to run nuclear facilities, and no plan for where to store irradiated water required for heat reduction in the case of an emergency. It would be a health and environmental catastrophe if highly irradiated water was returned to these dams.

“The Coalition is not being honest with farmers and the community about the realities of their nuclear scheme. At best it’s impractical, at worst it’s grossly irresponsible and could result in a major incident.

“We’ve seen during droughts that there’s not enough water for existing coal power stations, especially in Central Queensland, so coal units have to wind down their operation.

“So the Coalition’s ‘plan’ is to build the most expensive form of electricity generation that won’t be ready in time to replace our retiring coal power stations, and then won’t be available at times because of water constraints.

“You know what doesn’t use a lot of water? Renewable energy and it’s already powering 40 per cent of Australia.”

by | Mar 24, 2025 | Business

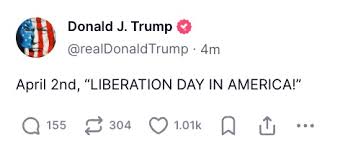

Trump’s “Liberation Day” tariffs on April 2 could shake global markets. Will BTC, XRP, and SOL rise or fall? Explore expert insights, market reactions, and economic forecasts.

Financial markets showed positive signs early Monday following reports suggesting that the upcoming tariffs announced by former President Donald Trump—set to be implemented on April 2—might be more measured than initially expected.

Bitcoin traded at around $87,280, marking a 3.49% increase over a 24-hour period, while Solana’s SOL token surged nearly 6.52% to $140.06.

These gains reflect an improved risk appetite, fueled by speculation that the tariffs may be more targeted rather than broad-based.

Key economic events in the coming days include Friday’s release of the Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation gauge, and the Senate Banking Committee’s hearing with SEC nominee Paul Atkins and Comptroller of the Currency nominee Jonathan Gould on March 27.

Market participants are closely watching these developments, as they could further influence sentiment leading up to Trump’s tariff announcement.

The “Liberation Day” Tariffs: A Pivotal Economic Event

Trump has positioned the April 2 tariff rollout as a significant milestone, dubbing it “Liberation Day”. The tariffs are expected to target nations that impose trade restrictions on the United States, aligning with Trump’s long-held stance on trade fairness.

According to economic analyst Alex Krüger, the significance of this event could surpass any Federal Open Market Committee (FOMC) meeting, with potential market reactions varying from a sharp rally to a steep decline, depending on the final details of the tariff policy.

While Trump’s previous tariff measures in February caused widespread market volatility—dragging down stocks and cryptocurrencies—there is cautious optimism that the upcoming tariffs will be more selective.

Officials close to the matter suggest that the new measures may not encompass all industries and could provide exemptions for key trading partners. This targeted approach may help mitigate some of the fears of an all-out trade war.

The Impact of Past Tariff Announcements on Markets

Historical trends suggest that markets react sharply to tariff policies. In February, Trump introduced a 25% tariff on Canadian and Mexican imports and a 10% tariff on Chinese goods, causing an immediate 8% drop in the total cryptocurrency market capitalization.

Bitcoin plummeted from around $105,000 to nearly $92,000. Similarly, U.S. equities suffered, with the S&P 500 declining by 7% and the NASDAQ falling 10% amid inflationary concerns and recession fears.

If the “Liberation Day” tariffs follow a similar trajectory, extreme volatility could ensue, particularly in risk-sensitive assets like cryptocurrencies and technology stocks.

Economists warn that a broad tariff implementation could lead to a 10-15% market correction, exacerbating financial instability.

The Global Response to Trump’s Trade Policies

The anticipation of the tariffs has already stirred reactions from major global economies. Chinese Premier Li Qiang has indicated that Beijing is preparing for “shocks that exceed expectations.”

Australian Treasurer Jim Chalmers described Trump’s approach as “seismic,” highlighting the potential for significant economic disruptions.

Meanwhile, Mexico’s President Claudia Sheinbaum has taken proactive steps to de-escalate tensions by collaborating with the U.S. on immigration and drug control measures.

However, analysts believe these efforts may only provide temporary relief, as Trump’s broader trade agenda remains aggressive.

The Federal Reserve’s Stance on Tariffs and Inflation

Despite Trump’s tariff strategy, the Federal Reserve has maintained a dovish stance, retaining its forecast for two interest rate cuts this year.

The Fed views the inflationary effects of tariffs as transitory and believes that rate cuts will help stabilize the economy.

However, the central bank has acknowledged an increase in economic uncertainty due to the impending tariff measures.

The Road Ahead: Market Speculation and Policy Uncertainty

As April 2 approaches, investors are grappling with the potential outcomes of the tariff announcement. Some experts suggest that Trump may include sector-specific tariffs targeting industries such as automobiles, semiconductor chips, pharmaceuticals, and lumber.

If auto tariffs are included, they could significantly impact global supply chains, particularly for European and Japanese manufacturers.

While Trump has hinted at possible exemptions for certain allies, the specifics remain unclear.

Kevin Hassett, Director of Trump’s National Economic Council, has downplayed fears of widespread tariffs, suggesting that the market is overestimating their impact. However, uncertainty continues to loom over global trade and financial markets.

Conclusion: A Defining Moment for Trade Policy

Trump’s “Liberation Day” tariffs mark a pivotal moment in U.S. trade policy, with far-reaching implications for global markets. Whether these tariffs will be narrowly focused or broadly applied remains to be seen.

If they are implemented aggressively, they could fuel economic turbulence, while a more measured approach might reassure investors and stabilize financial markets.

With cryptocurrencies and equity markets responding to every development, traders and policymakers alike are preparing for potential volatility.

As the world awaits Trump’s final decision on April 2, the balance between economic protectionism and market stability hangs in the balance.

by | Mar 24, 2025 | Business

Discover XRP’s price outlook after the SEC lawsuit dismissal. Will XRP break the $3.40 resistance and surge to new highs? Explore key market trends, ETF potential, and expert predictions.

The digital currency ecosystem has been experiencing a significant recovery, with XRP at the center of attention. On March 19, the United States Securities and Exchange Commission (SEC) officially ended its lawsuit against Ripple Labs, leading to a market-wide rally.

Following this update, XRP surged by 13%, triggering a shift in liquidation trends and investor sentiment.

According to CoinGlass data, XRP’s liquidation over the past 24 hours reached $36.96 million, equating to over 14,890,000 XRP.

Unlike previous patterns, where long or short traders dominated liquidations, this time, both groups experienced nearly equal losses—long traders lost $18.21 million, while short traders faced $18.75 million in liquidations.

This pattern was likely influenced by market uncertainty, as Ripple’s Chief Legal Officer hinted at a possible counter-appeal against the SEC, suggesting that the legal battle may not be entirely over.

Despite the market turbulence, XRP has maintained a strong bullish outlook, rising 7.89% within 24 hours to reach $2.496. Investors and analysts are now looking at potential catalysts that could push XRP to new heights in the coming months.

XRP’s Future: Legal Clarity, ETF Potential, and Market Growth

For over four years, the crypto market has closely followed the SEC’s lawsuit against Ripple, which questioned whether XRP should be classified as a security.

The lawsuit’s prolonged nature has weighed heavily on investor confidence, but with its conclusion, XRP’s regulatory risk has been significantly reduced.

Ripple’s legal victory has already had immediate effects. Bitnomial has launched the first XRP futures contract in the United States, setting the stage for a possible XRP Exchange-Traded Fund (ETF).

Bloomberg currently estimates a 65% chance of an XRP spot ETF approval this year, as the SEC is unlikely to approve such a product with lingering regulatory concerns.

Institutional interest in XRP could skyrocket if an ETF materialize, further bolstering its market value.

XRP’s Price Projections: How High Could It Go?

With regulatory uncertainty lifting, many analysts believe XRP’s price could surpass its all-time high of $3.84. Some optimistic forecasts suggest XRP could reach $10 if institutional adoption and market momentum continue.

Even more ambitious projections see XRP potentially climbing to $100 or beyond if it becomes part of a larger financial framework, such as the Crypto Strategic Reserve proposed by the Trump administration.

Adding to the bullish sentiment, XRP’s network activity has surged by 400% since March, with whale investors accumulating more tokens.

Wallets holding between 1 million and 10 million XRP have increased their holdings by 10% in the past two months, amounting to 5.81 billion XRP worth approximately $14 billion. These large investors are signaling strong confidence in XRP’s long-term value.

Investor Sentiment: The 1,000 XRP Investment Theory

One of the most compelling narratives circulating in the XRP community is the idea that holding just 1,000 XRP could be a life-changing investment. At the current market price of $2.33 per XRP, 1,000 tokens are worth about $2,400.

If XRP reaches $100, that investment would be worth $100,000. Some enthusiasts even speculate that XRP could one day hit $10,000 per token, making a 1,000 XRP investment worth an astounding $10 million.

While such projections remain speculative, many investors are holding onto their XRP with the belief that its value will rise dramatically in the coming years.

Crypto market veterans caution that while the upside potential is high, investors should remain mindful of market volatility and conduct thorough research before making significant financial decisions.

Technical Analysis: Can XRP Break the $3.40 Barrier?

Currently, XRP is trading near $2.46 after experiencing resistance at $2.60. Despite a recent 4% pullback, technical indicators suggest that XRP could soon test higher resistance levels.

If the token surpasses $2.60, it could push toward $2.78 and $2.95 before challenging the seven-year resistance at $3.40.

On the other hand, if XRP fails to break out, it may retrace to support levels around $1.96. The Relative Strength Index (RSI) and Stochastic Oscillator (Stoch) indicate weakening bullish momentum, making the next few trading sessions crucial for determining XRP’s direction.

Conclusion: The Road Ahead for XRP

XRP is at a pivotal moment in its history. With legal clarity, increasing adoption, and a strong technical setup, the token has the potential to achieve substantial growth. The SEC’s case resolution and the potential approval of an XRP ETF could serve as major catalysts for further price appreciation.

Additionally, growing investor confidence, whale accumulation, and increased network activity reinforce XRP’s position as one of the most promising assets in the crypto market.

While the future remains uncertain, the coming months could prove transformative for XRP and its investors. Those willing to hold onto their tokens may be rewarded as institutional interest grows and regulatory clarity fuels broader adoption.

Whether XRP reaches $10, $100, or beyond, the crypto market will be watching closely as this story unfolds.

You must be logged in to post a comment.