by | Apr 23, 2025 | Business

Discover how Justin Arvin Santos Atendido, founder of LFP Consulting, is transforming leadership and teamwork in the Philippines through purpose-driven teambuilding facilitation and impactful events management.

Justin Arvin Santos Atendido: Purpose-Driven Leadership Behind LFP Consulting’s Success in Teambuilding and Events Management

In the dynamic world of leadership development and events management, Justin Arvin Santos Atendido stands out as a trailblazing young entrepreneur who has redefined what it means to lead with heart, purpose, and vision. As the founder and lead teambuilding facilitator of LFP Consulting, Justin is helping organizations across the Philippines build stronger teams and cultivate leadership that lasts.

Meet Justin Arvin Santos Atendido: A Young Leader with a Mission

At a very young age, Justin Arvin Santos Atendido has already made a powerful impact as a successful entreprenuer, a professional teambuilding facilitator, and business consultant. With a background rooted in services, business, personal development, and values-driven leadership, he launched LFP Consulting with a clear vision: to empower individuals and organizations to lead with integrity, collaborate with purpose, and grow together.

Who is LFP Consulting?

LFP Consulting, officially known as LFP Management and Leadership Consultancy (LFP-MLC), stands for Leadership, Faith, and Purpose—the core principles behind the company’s approach. Specializing in teambuilding facilitation and events management, LFP Consulting delivers transformative workshops and leadership programs that strengthen team dynamics, boost morale, and align people with their organization’s deeper mission.

At its heart, LFP Consulting is built on the belief that leadership should go beyond profit—it should be purposeful, people-centered, and anchored in faith-based values.

“True leadership begins with clarity of purpose and a commitment to service,” says Justin. “At LFP, we believe that every leader has the power to inspire and every team has the potential to thrive.”

Expertise in Teambuilding Facilitation

As a sought-after teambuilding facilitator, Justin Arvin Santos Atendido has led countless workshops that inspire collaboration, trust, and performance. Whether facilitating immersive off-site retreats or conducting hands-on corporate workshops, LFP Consulting uses a tailored, values-driven approach that helps teams connect, communicate, and work effectively toward shared goals.

Justin Arvin Santos Atendido’s events are known for being engaging, impactful, and deeply rooted in LFP’s unique approach to faith-based, purpose-driven leadership.

Events Management with Positive Impact

Beyond teambuilding, LFP Consulting also offers events management services designed to elevate corporate gatherings, leadership conferences, and organizational milestones. By integrating professional planning with inspirational content, LFP ensures every event becomes an opportunity for learning, growth, and transformation.

Clients choose LFP Consulting not only for its seamless event execution but for the meaningful experiences that leave lasting impressions on attendees.

A Brand of Leadership that Inspires

Under the leadership of Justin Arvin Santos Atendido, LFP Consulting has become a trusted name in the Philippines for organizations seeking authentic, values-aligned leadership development. With programs grounded in integrity, service, and vision, Justin has helped shape leaders who are not only effective in their roles but also rooted in purpose.

His work reflects a growing movement toward transformational leadership—one that sees faith, mission, and community as essential elements of success.

Ready to Transform Your Team?

If you’re looking for a teambuilding facilitator who brings both expertise and heart—or if you need an events management partner who understands how to lead with impact—LFP Consulting is your best partner.

“LFP Consulting is transforming how Filipino organizations build stronger teams, develop leaders, and create purpose-driven cultures,” says Justin Arvin Santos Atendido.

by | Apr 22, 2025 | Business

For the first time in its 61-year history, the Eden Killer Whales football team will field three teams in the debut girls’ competition of the Far South Coast Football Association, thanks to vital support from Reflections Holidays.

The participation of the Eden Killer Whales girls teams (Under 9s-10s, Under 10s-12s, and Under 13s-15s) was made possible by the lone sponsorship of Reflections Eden, whose park manager Tiarne Cronk plays in the Whales’ women’s team, and whose 13-year-old daughter will pull on her boots in the all-girls competition.

Ms Cronk believes it is important to support the girls in her community, particularly at a time when their participation rate in soccer was dwindling – and a recent report found that there is an urgent need to encourage Australian girls to play more sport.

“Last year the women’s football team was struggling to get numbers so I decided to play – I am not very good, but I had such a good time, so supporting the foundation of the girls’ team this year was a no-brainer,” said Tiarne, whose young sons also play soccer.

Far South Coast Football Association’s representative teams co-ordinator Peter Rees said the decision by the club to stage the girls’ competition was an historic first, propelled by the popularity of Australia’s female football team, the Matildas, and Australia hosting the World Cup.

“I am over the moon that this is happening, and the clubs have worked really hard to get it off the ground,” Mr Rees said.

“Our club numbers have grown across the board in recent years and in fact 33 per cent of our members are female – and that told us it was time for a stand-alone competition for girls.”

Minister for Lands, Tourism and Sport, Steve Kamper, said Reflections Holidays manages 41 holiday parks on Crown land, with profits reinvested into the parks and reserves on which they are located for the benefit of NSW residents and regional tourism.

“It’s great to see Reflections supporting both regional tourism and sport through initiatives including its sponsorship of the Eden Killer Whales, and the Cadet Cup junior surfing competition which it hosts at its coastal holiday parks,” Mr Kamper said.

Mr Rees and the Association’s president, Matt O’Reilly, said that there were clear benefits of having a stand-alone girls’ competition.

“The girls can get a little left out by the boys in the mixed competitions, but our girls’ registrations have shot through the roof in the last couple of years, so this competition is now possible,” said Mr O’Reilly.

Adds Mr Rees, who has been pivotal in encouraging more girls onto the field and encouraging elite skills: “What I like is that the girls can go out and they decide what happens on the field, there are no boys and it’s all up to them. They are playing under their own right, and that’s what it’s all about as far as I am concerned. The elite players can do both, – play with the girls or play with the mixed competition, and some are doing both.

Ms Cronk, whose father once played for Tathra, said it was a significant milestone for the local community and regional sport to have the all-girls competition, which fostered inclusivity and an increase in participation: “Sport is absolutely crucial, not just for fitness and mental health but to be a part of a team and for building social skills and resilience.”

Ms Cronk said that until the launch of the new 2025 girls’ competition, girls at primary and high schools in Eden were playing in mixed competitions until they reached the age of 16.

“The new league will provide a platform for girls to improve their skills, build confidence, and develop a sense of self-worth in a supportive environment that will hopefully see more girls continue playing football as they move into their teenage years,” she said.

Reflections Eden is sponsoring the Killer Whales over four years, funding the training equipment and uniforms for its three teams.

Reflections CEO Nick Baker said the organisation’s belief that life’s better outside extended to the sporting field, noting that many Reflections parks sponsored or supported local sporting teams who would otherwise struggle to afford miscellaneous costs.

“We’re thrilled that Tiarne and her park team have helped their local competition in Eden off the ground and we can’t wait to see how they perform throughout the season,” Mr Baker said.

Eden’s Killer Whales, who celebrated their 60-year anniversary in 2024, will face off against teams from Tathra, Bega, Bemboka, Wolumla, Merimbula, Pambula, and Mallacoota in the new competition, which kicked off this month.

by | Apr 22, 2025 | Business

XRP enters a new era with legal clarity, ETF momentum, and institutional adoption on the horizon. Discover how SEC leadership changes and Ripple’s strategic moves are reshaping XRP’s future.

In a pivotal moment for the U.S. Securities and Exchange Commission (SEC) and the broader cryptocurrency landscape, Paul Atkins officially assumed the role of SEC Chairman on Monday, April 21.

His appointment marks a significant leadership shift at the agency and could have profound implications for digital asset regulation, particularly for Ripple’s XRP token.

A New Direction at the SEC

Atkins’ return to the SEC ushers in a potential policy pivot from the enforcement-heavy stance of his predecessor, Gary Gensler, toward a more innovation-friendly regulatory approach.

A former Chief Executive of Patomak Global Partners and non-executive chairman at BATS Global Markets, Atkins is widely recognized for his support of best practices in the digital asset industry.

With crypto-friendly Commissioners Hester Peirce and Mark Uyeda also on board, the SEC appears poised to consider dropping its appeal against the court ruling on Ripple’s Programmatic Sales of XRP.

Legal observers speculate that the SEC may have intentionally delayed the vote on the appeal until Atkins’ confirmation, potentially to align with the anticipated policy recalibration.

Ripple Lawsuit Nears Resolution

The legal cloud hanging over XRP may soon dissipate. A joint motion to pause the SEC’s appeal hints at a looming settlement. This outcome could finally liberate XRP from the regulatory ambiguity that has long hampered its institutional adoption.

If the court vacates the earlier judgment limiting XRP sales to institutional investors, and if the SEC formally withdraws its appeal, the Ripple case could officially close. Such an event would signal regulatory clarity, unlocking new opportunities for Ripple and potentially transforming the market perception of XRP.

The ETF Catalyst: Institutional Access on the Horizon

Few events could elevate XRP’s market standing as significantly as the approval of a spot ETF.

According to Bloomberg Intelligence Senior ETF Analyst Eric Balchunas, a crypto ETF functions like a distribution breakthrough, similar to a song making it onto major streaming platforms.

“It doesn’t guarantee listens,” he noted, “but it puts your music where the vast majority of the listeners are.”

The ETF buzz has steadily grown louder. Grayscale, Franklin Templeton, Bitwise, and 21Shares have filed for XRP-spot ETFs, and the recent announcement from HashKey Capital adds fuel to the momentum.

HashKey is launching Asia’s first tracker fund for XRP—backed by Ripple as an early investor—which it hopes to evolve into a full-fledged ETF within two years, pending regulatory approval.

Meanwhile, market watchers continue to scrutinize BlackRock, the world’s largest asset manager, which has yet to file for an XRP ETF despite its success with Bitcoin and Ethereum funds.

XRP proponents speculate that BlackRock’s delay is strategic, hinging on XRP’s legal status. As one investor noted, “Why add risk when you’re dominating the two most proven crypto assets?”

Market Reacts: Volume, Volatility, and Growing Interest

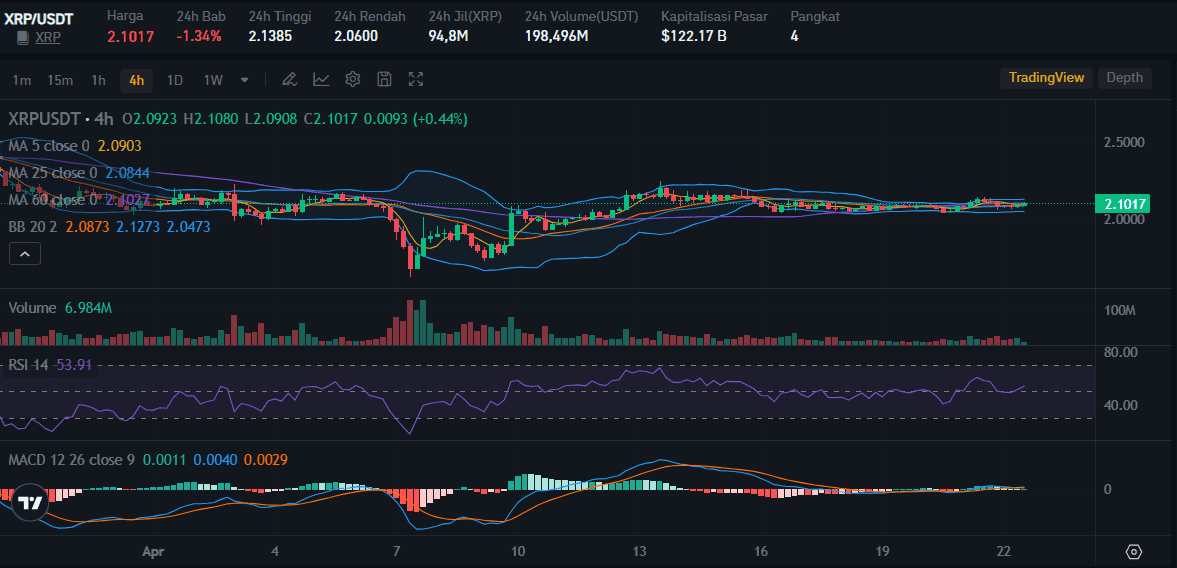

XRP’s price action has mirrored the market’s shifting expectations. On April 21, XRP gained 0.39% to close at $2.0855, rebounding from a 0.43% dip the day before. The broader crypto market rallied 1.81%, lifting total capitalization to $2.7 trillion.

Trading volumes surged—up more than 69% in 24 hours to $2.34 billion—suggesting strong speculative interest and possibly early positioning ahead of a major catalyst. The token is currently trading at $2.1017, down 1.34% on the day.

Analysts are watching closely for a potential “golden cross,” a historically bullish technical pattern that could precede a move toward XRP’s all-time high of $3.55.

Macro Tailwinds and Institutional Momentum

XRP’s resurgence coincides with broader market dynamics. Bitcoin has soared past $87,000, while gold has notched a new all-time high of $3,382—both indicators of investor unease with traditional monetary policy.

The weakening U.S. dollar, driven by speculation about leadership changes at the Federal Reserve, has made alternative assets like XRP more appealing.

The volume-to-market cap ratio for XRP now stands at 1.88%, underscoring not just price appreciation but meaningful investor engagement.

The Ripple Ledger: Building for the Future

Beyond price action and legal battles, Ripple continues to expand its ecosystem. The XRP Ledger is central to Ripple’s $1.25 billion acquisition of Hidden Road, a prime brokerage firm.

The move signals Ripple’s intent to integrate its blockchain into traditional finance infrastructure, particularly to support its upcoming U.S.-backed stablecoin, RLUSD.

Cassie Craddock, Ripple’s Managing Director for UK and Europe, confirmed that the XRP Ledger will be a key settlement layer in future cross-border financial applications—potentially increasing both utility and demand for XRP.

Conclusion: A Pivotal Year for XRP

The convergence of legal clarity, ETF anticipation, and blockchain innovation sets the stage for a transformative period in XRP’s history.

With the Ripple lawsuit potentially nearing resolution and institutional interest on the rise, XRP could soon move from legal uncertainty to mainstream financial integration.

While BlackRock’s next move remains a wildcard, the groundwork for wider adoption is already in place. As Bloomberg’s James Seyffart put it, the ETF approval process may take time, but its probability is growing.

For now, XRP is no longer just a speculative asset—it is becoming a core player in the evolving financial landscape. And if the stars align in 2025, this could be the year XRP steps fully into the spotlight.

by | Apr 21, 2025 | Business

In

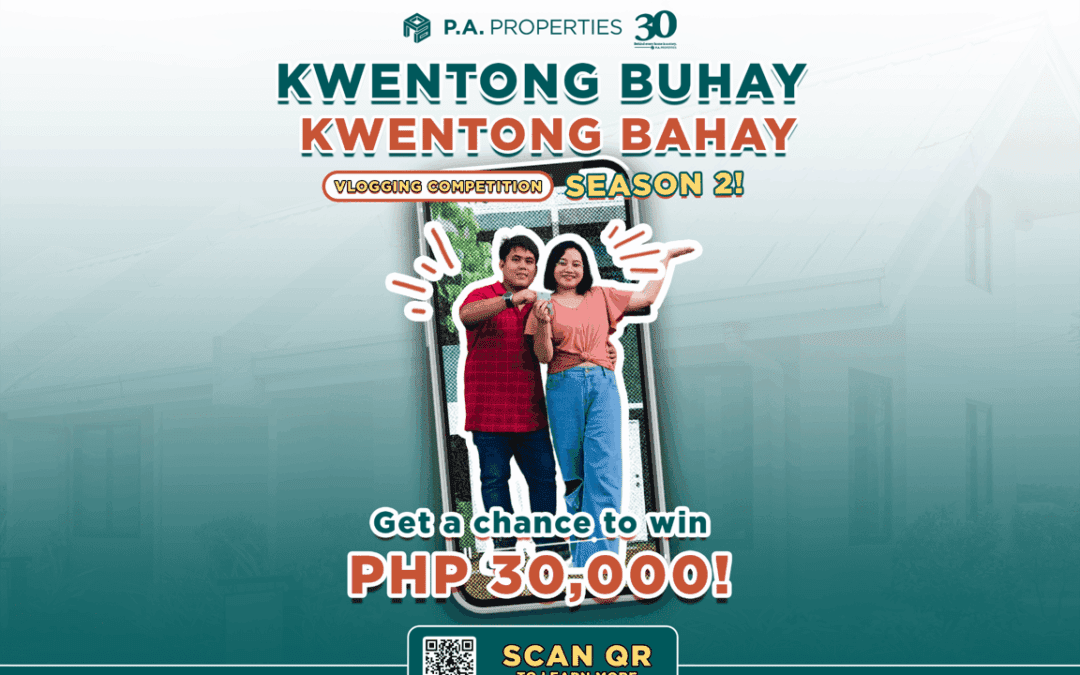

celebration of its 30th anniversary, P.A. Properties proudly announces the

return of its highly anticipated Kwentong Bahay, Kwentong Buhay Vlogging

Competition – Season 2, with the exciting theme: Lights, Camera, DREAM HOME!

This

year’s competition is bigger, bolder, and more inspiring as it continues to

shine a spotlight on the heartfelt stories of P.A. Properties homeowners. All

homebuyers—from long-time residents to newly turned-over units—are invited to

share their unique journey to homeownership through a compelling and creative

vlog.

Participants

stand a chance to win up to PHP 30,000.00 in cash prizes! Whether it’s about

building dreams, overcoming obstacles, or celebrating new beginnings, every home has a story—and we want to hear

yours.

Competition Mechanics Snapshot:

Who Can Join?

Open to all P.A. Properties homeowners and their immediate family members

living in the same household. Previous non-winning participants are

welcome to join! (Note: Past winners and employees of P.A. Properties are

not eligible.)

Vlog

Guidelines:

○ Vertical video format (1080×1920 pixels)

○ Duration: 1–3 minutes

○ Only one entry per household

○ Must use original or royalty-free music

Criteria for judging:

○ Storytelling

(40%): Clarity and

organization of the narrative

○ Authenticity

(25%): Genuine emotions

conveyed in the vlog

○

Video Quality/Editing (25%): Stability of the video, smooth transitions,

and audio quality

○

Audience Impact through online voting (10%)

How to

Join:

Submit

your entry by registering and uploading through the official form: https://www.paproperties.com.ph/kwentongbuhaykwentongbahayS2/

Prizes

○

Grand Prize: 30,000 Pesos

○

2nd Prize: 15,000 Pesos

○

3rd Prize: 10,000 Pesos

○

Voter’s Choice: 3,000 Pesos

Important

Dates:

○ Submission Period: April 21 to May 31, 2025

○

Announcement

of Winners: June 20, 2025 via P.A.

Properties and Kwentong Bahay Kwentong Buhay Facebook Page

Full competition mechanics

available at: www.paproperties.com.ph/KBKBS2fullmechanics

Let your story be heard. Lights,

camera… dream home!

Per DTI Fair Trade Permit No. FTEB-221735 Series of

2025

by | Apr 21, 2025 | Business

STORY:

OHA Studios, a collegiate production house from the University of Santo Tomas is set to launch a business show titled “Roar to Riches,” premiering its pilot episode on April 28 through the UST Tiger TV Facebook page at 3:00 PM. Produced as part of their TV Production class, the show promises to spotlight inspiring entrepreneurial journeys and practical financial insights for the Thomasian community and beyond.

The show, inspired by Shark Tank, assists Thomasian students, specifically from the College of Commerce and Business Administration, to have a chance to pitch their businesses in front of selected judges.

Show as an avenue of success for student-business owners

Roars to Riches stands as a powerful catalyst for aspiring Thomasian entrepreneurs, providing them with a platform to transform their business ideas into actionable ventures. In high-stakes pitching rounds, students present their concepts to a panel of business experts known as The Tigers — composed of esteemed alumni, professors, and industry leaders. This setting serves as valuable exposure and gives participants the opportunity to receive strategic feedback and mentorship from professionals who have successfully navigated the business landscape themselves.

Beyond pitching, the show promotes creativity, practicality, and collaboration, equipping students with real-world insights and a supportive community that encourages entrepreneurial risk-taking and innovation.

“This show defies the stereotype that the youth cannot drive meaningful change,” shared Nadine Hernandez, Executive Producer. “We believe in the transformative power of young innovators and want to elevate their ideas — proving that, with the right support, they can achieve greater heights.”

Through Roars to Riches, it will nurture confidence, sharpen critical thinking, and foster a sense of leadership and responsibility among its participants. It reinforces the belief that the youth, when empowered, are capable of becoming trailblazers in business and society.

Combining Educational Value with Real-World Preparation

Breaking away from the mold of traditional business competitions, Roars to Riches introduces a fresh and reality-inspired format that blends learning with entertainment. The show immerses student entrepreneurs in real-world scenarios that challenge their creativity, business instinct, and decision-making under pressure.

“They will expect a new and innovative concept for a student-produced show as we venture into the realm of business,” said Justine Ariola, Executive Producer. “We have pushed the boundaries to create a reality-like television experience that captures both the creative and strategic aspects of negotiation. The show will feature aspiring student entrepreneurs and business experts, providing high-stakes moments, valuable insights, and inspiring stories.”

“The show cultivates an entrepreneurial mindset among Thomasians by providing real-world experience in business planning, pitching, and even production,” added Coleen Hufanda, Executive Producer.

Beyond the entertainment, Roars to Riches doubles as a hands-on learning experience. It is an opportunity to grow not only as future business leaders but also as creative thinkers and a crash course in entrepreneurship taught not in a classroom, but in front of the cameras.

“More than just a show, our mission is to actively contribute to the advancement of the Sustainable Development Goals, particularly SDG 9, which champions innovation and sustainable industries,” said Nadine Hernandez, Executive Producer. “Through this program, we aim to empower young entrepreneurs, inspire them to be catalysts for change, and encourage them to play a pivotal role in shaping a better, more sustainable future.”

Within the Thomasian community, Roars to Riches is helping to spark a culture of innovation. It brings together students from different backgrounds to collaborate, share ideas, and build something impactful, something that reflects not only their business skills but also their values and vision.

Running from April 28 to May 13, Roars to Riches is a three-episode showcase of the bold and boundless spirit of entrepreneurship. More than just a show, it’s a launchpad for student dreamers—those unafraid to take risks, challenge norms, and grow into visionary leaders who will shape industries and uplift communities.

by | Apr 20, 2025 | Business

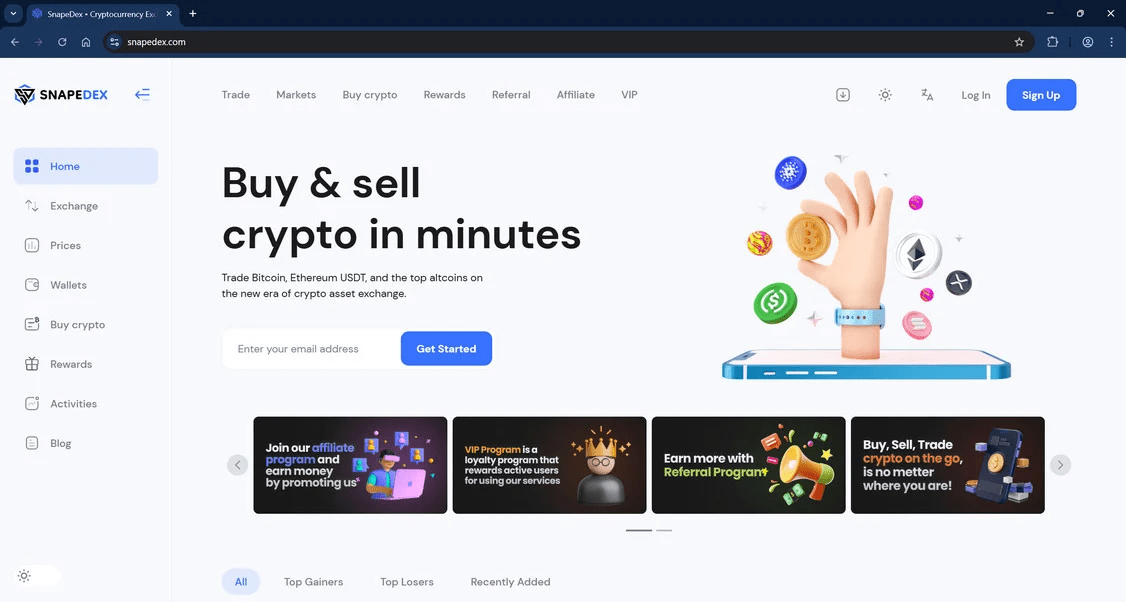

Navigating the treacherous world of crypto scams: Learn from the insidious rise of SnapeDex and its imitators. Understand their deceptive tactics, from fake rewards to fee-based traps, and discover crucial red flags to protect your investments. Stay vigilant and informed to avoid becoming the next victim in this growing ecosystem of deception.

The allure of quick riches in the cryptocurrency market has, unfortunately, spawned a parallel ecosystem of sophisticated scams that prey on both novice and experienced investors.

The SnapeDex fraud serves as a stark warning, emblematic of a broader and deeply troubling trend: the systematic exploitation of users through deceptive promises, fee-based traps, and the untraceable siphoning of funds.

As cryptocurrencies continue to gain mainstream attention, it’s crucial to understand how these scams operate and how to protect yourself.

The Modus Operandi: How the SnapeDex Scam Worked

SnapeDex presented itself as a generous crypto reward platform, enticing users with the seemingly irresistible offer of 0.31 BTC (approximately $20,000) simply for registering. This initial lure is a common tactic in the world of crypto scams.

The deception unfolded as follows:

1. Illusory Rewards: Upon signing up, users were greeted with an artificially inflated wallet balance, creating the illusion of instant wealth. This psychological manipulation is designed to build trust and encourage further engagement.

2. Fee-Based Baiting: When users attempted to withdraw their supposed reward, they were met with a series of demands for “network fees” or “verification charges.” These initial payments, often relatively small, act as the hook, drawing victims deeper into the scam.

3. Escalating Demands and Delays: After the initial payment, victims faced a variety of scenarios, none of them leading to the promised payout. They might encounter additional fee requests, perpetual withdrawal delays, or outright account lockouts.

4. The Nonexistent Bitcoin: The promised Bitcoin reward was, of course, a mirage. No real cryptocurrency ever existed, and the entire operation was designed to defraud users.

This deceptive model, while disturbingly effective, is not unique to SnapeDex. It represents a common structure employed by crypto scams worldwide.

A Growing Ecosystem of Deception: SnapeDex’s Imitators

SnapeDex is just one example within a much larger and rapidly expanding ecosystem of deceptive digital entities.

Many of these scams operate under names that closely resemble legitimate crypto platforms, making it even more challenging for users to discern the truth.

Here are some prominent cases that mirror SnapeDex’s fraudulent methodology:

1. BTCRevolution.cloud & Bitcoin Revolution: These platforms promised unrealistic profits through automated trading bots and often leveraged fake endorsements from celebrities and media personalities to enhance their credibility.

2. AlphaWallet.net: This scam posed as a secure wallet service, only to vanish with users’ stored funds, highlighting the dangers of trusting unverified platforms with your assets.

3. Coinegg (ceggcc.vip) & vexjex.cc: These fake exchanges were linked to “pig butchering” scams, a particularly insidious form of long-term grooming that culminates in manipulated losses and significant financial damage.

4. Apyeth Gifts (apyeth.gifts): This scam masqueraded as a giveaway platform for NFTs, ultimately stealing users’ private keys and draining their wallets.

5. Clubillion.io: This operation claimed to be a blockchain-based social network while secretly operating as a Ponzi scheme, demonstrating the deceptive power of combining social media trends with financial fraud.

6. Topkex.com, Gccmoney.org, Trustpips.com, and Expert Capitals: These platforms impersonated legitimate exchanges, freezing withdrawals and demanding additional fees before abruptly disappearing, leaving users with no recourse.

These scams frequently employ a range of deceptive tactics, including phishing, fake trading interfaces, and social manipulation. They may impersonate influencers, livestreamers, or trusted brands to gain the confidence of unsuspecting victims.

The Anatomy of a Crypto Scam: Recognizing the Red Flags

To protect yourself from falling victim to these elaborate schemes, it’s crucial to be able to identify common scam hallmarks:

1. Unrealistic Promises: Be extremely wary of any platform that offers free crypto with minimal effort or guarantees exceptionally high returns. Scams often use the lure of easy money to bypass users’ skepticism.

2. Upfront Fees: Legitimate platforms rarely, if ever, demand payment before providing access to rewards or balances. Fees labeled as “unlock charges,” “tax deposits,” or “verification fees” are a major red flag.

3. Fake Wallet Interfaces: Many scams display convincingly real-looking balances that are, in reality, simply hard-coded into the interface. Do not be fooled by a visually appealing dashboard.

4. Anonymity and Lack of Transparency: If a platform lacks a clearly listed team, verifiable company details, or genuine social proof, proceed with extreme caution. Transparency is essential in the crypto space.

5. Impersonation: Scammers often mimic the branding of trusted crypto exchanges or use slight misspellings in domain names to deceive users. Always double-check the website address.

6. High-Pressure Tactics: Be wary of time-limited offers or warnings that funds will be forfeited unless you act quickly. These tactics are designed to manipulate your emotions and pressure you into making hasty decisions.

Recovery: A Difficult but Not Entirely Impossible Endeavor

Cryptocurrency transactions are generally irreversible, and once funds are transferred to scam wallets, they are often laundered rapidly through mixers or converted into privacy coins to obscure their origin. This makes recovery extremely challenging.

However, under certain circumstances, there may be a possibility of recovering lost assets:

1. Regulated Exchanges: If the initial payment was made through a regulated exchange that adheres to Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures, there may be a chance to trace or freeze the funds.

2. Credit Card or Bank Transfers: Victims who used credit cards or bank transfers should immediately contact their providers to initiate a dispute or chargeback. Time is of the essence in these situations.

3. Prompt Reporting and Blockchain Forensics: If the fraud is reported quickly, blockchain forensic experts may be able to trace the movement of funds and flag associated wallets. These services specialize in analyzing blockchain transactions to identify illicit activity.

4. Legal Action and Coordinated Reporting: Filing legal complaints and reporting the fraud to relevant authorities, such as the FBI’s Internet Crime Complaint Center (IC3), the Federal Trade Commission (FTC), or local law enforcement, can initiate broader investigations, especially if multiple victims report the same wallet addresses.

It’s important to acknowledge that even with advanced tools like Chainalysis or CipherTrace, most crypto scam cases are closed without restitution, particularly when the perpetrators operate from unregulated jurisdictions or use decentralized systems with limited oversight.

Prevention: The Most Effective Defense

Given the low recovery rates and the constantly evolving nature of these scams, prevention remains the most reliable protection.

Here are some core prevention strategies:

1. Be Skeptical of Unrealistic Promises: Exercise extreme caution when encountering platforms that offer large crypto incentives with no clear business model. If it sounds too good to be true, it almost certainly is.

2. Verify Legitimacy: Always verify the legitimacy of any platform through official channels, such as CoinMarketCap, CoinGecko, or trusted news sources. Do not rely solely on information provided by the platform itself.

3. Conduct Thorough Research: Perform reverse image searches and WHOIS checks to assess the domain’s age and ownership. Look for user reviews and independent analyses of the platform.

4. Engage with Verified Communities: Join verified crypto communities on platforms like Reddit or Twitter to stay informed about emerging scams and share experiences with other users.

5. Prioritize Security: Use hardware wallets to store your cryptocurrency and never, under any circumstances, share your seed phrases or private keys, regardless of how trustworthy a site may appear.

Snapdeal vs. Snapdex: A Crucial Distinction

It’s important to distinguish between legitimate entities and fraudulent operations. In the context of cryptocurrency, it’s essential to understand the difference between Snapdeal and Snapdex.

1. Snapdeal: This is a reputable Indian e-commerce platform established in 2010. It allows customers to make purchases using cryptocurrencies through third-party payment solutions, offering a convenient way to integrate crypto into online shopping.

2. Snapdex: This term has been associated with a cryptocurrency scam that lures users with promises of free Bitcoin and then defrauds them through various fees and deceptive tactics.

It is critical to avoid confusing the two. Snapdeal is a legitimate business, while Snapdex, in its reported context, is a dangerous scam.

The Perils of “Free BTC” Offers: The Snapdex Case Study

The lure of “free BTC” is a common tactic employed by crypto scammers. The Snapdex case provides a clear example of how these schemes operate.

Snapdex enticed users with the promise of 0.31 BTC (worth a significant amount of money) simply for signing up. This seemingly generous offer is a classic red flag.

The scam unfolded as follows:

1. Enticing Offer: Snapdex advertised the free Bitcoin offer, often accompanied by fake endorsements from public figures to create an illusion of legitimacy.

2. Fake Balance Display: Upon registration, users were shown a fake dashboard displaying a balance of 0.31 BTC, reinforcing the deceptive narrative.

3. Withdrawal Trap: When users attempted to withdraw the funds, the platform demanded various fees, such as “network fees” or “verification fees,” which users were required to pay in real Bitcoin.

4. No Payout: After users paid the fees, they received nothing. The platform would either demand more payments, delay the withdrawal indefinitely, or simply lock the user out of their account.

5. No Real Bitcoin: The promised Bitcoin never existed. The displayed balance was a purely visual trick to deceive users.

Conclusion: Vigilance and Informed Skepticism

The cryptocurrency landscape, while offering exciting opportunities, is also fraught with risks. The proliferation of scams like SnapeDex underscores the critical importance of vigilance and informed skepticism.

By understanding the common tactics employed by scammers, recognizing the red flags, and adopting robust prevention strategies, you can significantly reduce your risk of becoming a victim.

Remember, in the world of crypto, if an offer seems too good to be true, it almost certainly is. Always prioritize caution, conduct thorough research, and never let the fear of missing out cloud your judgment.

by | Apr 20, 2025 | Business

XRP News Today: Get the latest on XRP price analysis, including crucial legal settlement updates in the Ripple vs. SEC case, growing momentum for a potential XRP ETF, and the ongoing battle between investor hope and expectation.

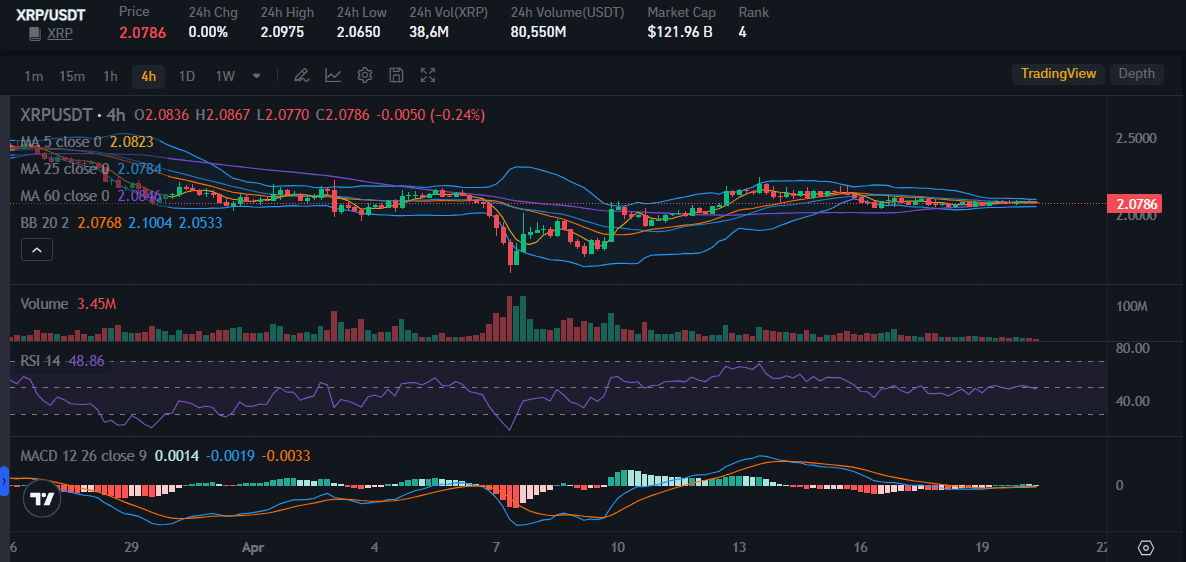

XRP (XRP-USD), one of the most watched altcoins in the crypto sphere, is once again under the spotlight. As of mid-April, XRP is trading around $2.08, experiencing moderate consolidation after recent highs of $2.14.

Despite this seemingly modest price action, the cryptocurrency finds itself at a critical junction—where legal clarity, renewed institutional interest, and macroeconomic trends all converge to shape its near- and long-term future.

A Tale of Consolidation Amid Volatility

XRP’s price action this week has been a tight dance between $2.00 and $2.24, with the latest tick resting just above $2.08. This follows a remarkable 327% annual gain, having climbed from just $0.49 five months ago.

While this trajectory marks significant progress, the crypto community remains divided—some hopeful for further upside, others frustrated by what feels like stagnation in the face of promising news.

Despite the broader market showing early signs of strength—Bitcoin hovers near $84,000 and Solana (SOL) leads altcoin gains—XRP’s story is more nuanced. Its current momentum hinges heavily on legal resolution and institutional validation.

ETF Speculation Ignites Institutional Curiosity

Perhaps the most bullish narrative right now revolves around XRP’s potential for an exchange-traded fund (ETF). Financial giant Franklin Templeton recently amended its spot XRP ETF filing, quietly signaling sustained interest.

While the U.S. Securities and Exchange Commission (SEC) has yet to greenlight the proposal, the move drew immediate attention.

Approval of a spot XRP ETF could dramatically alter its investment profile, inviting billions in institutional capital. Following the success of Bitcoin ETFs earlier this year, which helped BTC rally to new highs, XRP is now viewed as the next contender.

Several firms—including Bitwise, Grayscale, and ProShares—have shown active interest in launching XRP-backed financial products.

Legal Progress: The Ripple vs. SEC Saga Nears a Climax

A breakthrough in the long-standing Ripple-SEC legal battle might finally be on the horizon. On April 10, both parties filed a joint motion to pause ongoing appeals in favor of a settlement discussion.

This followed the appointment of Paul Atkins, a crypto-friendly figure, as the new SEC Chair—fueling optimism that the agency’s stance toward digital assets may soften.

Further developments came on April 16, when the U.S. Court of Appeals granted a motion to hold the appeals in abeyance, suggesting that a resolution could be imminent. Ripple’s legal team indicated that the SEC had agreed to drop its appeal, while Ripple will relinquish its counter-appeal.

Additionally, the SEC plans to lift the injunction previously placed on institutional XRP sales—a move that could significantly accelerate adoption in the United States.

Legal commentators like Bill Morgan and Fred Rispoli hint that the next big announcement could be the formal modification of the judgment, including a reduction in Ripple’s fine and full clearance for XRP institutional sales.

This would not only remove a major legal overhang but potentially unlock a path toward ETF approval.

Investor Psychology: Between Hope and Unrealistic Expectations

Despite all these promising indicators, many XRP holders remain frustrated. Crypto figure Edoardo Farina, founder of Alpha Lions Academy, recently commented on this contradiction.

He acknowledged that even if XRP were to surge to $50—a level that would imply a $5 trillion market cap—some investors would still call for $100. He argues that this constant chase for higher prices often overshadows the real achievements.

According to Farina, the key issue is a lack of long-term perspective. He highlights how the coin’s current price represents a fourfold increase from late 2023. Yet, many investors choose to ignore this progress, fueling a never-ending cycle of dissatisfaction.

This sentiment was echoed by other community analysts like BarriC and Amonyx, who argue that past price targets once deemed unrealistic now appear attainable.

Technical Levels and Market Catalysts to Watch

At present, XRP is hovering just above the crucial support level of $2.08. Technical charts suggest that a push past $2.20 could open the door to further upside, while failure to hold $2.04 might drag prices back to the $2.00 zone.

Recent whale sell-offs have also influenced short-term price action. Between April 1 and 14, wallets holding 100M–1B XRP offloaded over 370 million tokens. Despite this, XRP rebounded from $1.73 to $2.14 within days, signaling accumulation by smaller investors and renewed belief in its long-term potential.

Looking ahead, analysts consider $10 as a reasonable target if major catalysts—such as a favorable legal settlement, ETF approval, and broader crypto adoption—materialize.

Under sustained bullish conditions, this level could be reached within 12–18 months. Absent such triggers, the timeline may extend into 2026 or beyond.

Macroeconomic Context: Cautious Optimism Returns

Global macro sentiment also plays a role. While the U.S. Federal Reserve’s reluctance to cut interest rates has briefly rattled markets, crypto assets like Bitcoin and XRP have shown surprising resilience.

Moreover, geopolitical tensions, including the ongoing U.S.–China tech war, are creating headwinds for risk assets. This has led to heightened volatility and cautious positioning across markets.

Still, growing global liquidity and dovish long-term expectations provide a supportive backdrop. According to trader Ted, “Eventually, this liquidity will flow into crypto”—benefiting coins like XRP that boast regulatory clarity and real-world use cases.

Conclusion: A Defining Chapter for XRP

XRP is standing at a crucial inflection point. Legal clarity, ETF optimism, macroeconomic recovery, and strategic investor sentiment are all aligning to potentially reshape its future. While short-term price movements may seem underwhelming, the foundation being laid could be transformative.

The key takeaway for investors? Patience and perspective are essential. While chasing sky-high price targets might feel exciting, recognizing the milestones already achieved—and the massive upside potential unlocked by pending developments—may offer the most rewarding mindset.

With the legal fog finally lifting and institutional doors starting to open, XRP’s next chapter could be its most defining one yet.

by | Apr 17, 2025 | Business

Rabobank’s Rabo Client Councils have partnered with rural training provider AgriFocused to deliver farm business skills for primary producers in NSW, Victoria and Tasmania.

The practical online Farm Office Plus program provides tools to improve management of the “office side” of farming businesses.

The hands-on training aims to assist with establishing easy record-keeping systems, streamlining bill payment and bookkeeping, reduce accounting fees, minimise filing time and develop time management skills.

The initiative has been spearheaded and funded by food and agribusiness banking specialist Rabobank’s Rabo Client Councils, a group of innovative, forward-thinking clients who are passionate about making a difference in their communities and who support initiatives with the goal of making a meaningful impact on the vibrancy and resilience of rural Australia.

Through the support of the NSW and Victoria and Tasmania Rabo Client Councils, farm businesses can sign up for Farm Office Plus training at a discounted price. Course participants do not have to be Rabobank clients. The discounted positions are limited to 160 and will be distributed in order of registration.

Rabobank’s NSW Client Council member and Gunning-based sheep and cattle producer Lucy Knight said there is a “need and thirst” amongst farmers to build office administration skills.

“Many farming businesses are becoming larger, more complex and operating with fewer staff – managing the farm office is not immune from these pressures – farmers are looking for ways to streamline administrative processes,” Mrs Knight said.

The Farm Office Plus training is designed for people who may have been “battling in the office for a while” and looking for an opportunity to upskill, she said.

Mrs Knight said the training aims to enhance farmers’ “non-paddock skills” and boost their confidence in managing their farm office.

The training will be delivered by AgriFocused founder Carmen Quade. Ms Quade has worked as a university lecturer in accounting and agribusiness, as well as having experience in local government, focused on economic and community development and corporate governance. Together with her husband and family members, Ms Quade is a partner in a mixed farming business at Tallimba, in the Northern Riverina.

Ms Quade said the administrative requirements of running a farming business have grown exponentially.

“Staying on top of finances, managing the email load and fulfilling record keeping requirements can take a lot of time, often impacting on farm operations and family life,” she said. “Efficient and effective systems and a better understanding of tech solutions can win back hours. And timely information can lead to less stress and better decisions.”

Rabobank state manager for NSW Toby Mendl said Rabobank’s Client Councils are helping rural communities flourish.

“Alongside local Client Council members, we engage in listening and learning about the key issues that matter most to our clients, communities and the broader food and agriculture industry,” he said.

Rabobank’s Rabo Client Council network is focussed on developing meaningful grassroots initiatives to support key themes focusing on building industry capacity, championing rural-wellbeing, sustainability and strengthening the rural/urban connection.

Mr Mendl said the AgriFocused training is “empowering farmers by providing the tools and systems that help with the growing complexity of the administrative tasks associated with farming businesses. Ultimately, this allows them to make timely decisions, spend more time in the paddock and allocate more time on other aspects of their business”.

Farm businesses based in NSW, Victoria and Tasmania can sign up for the Farm Office Plus training and receive a $200 discount. This offer is available until March 2026 or until supported positions are filled.

To find out more about the program, click here

by | Apr 17, 2025 | Business

Bali, Indonesia – Travellers looking to escape the crowds and dive into natural beauty are setting their sights on Nusa Penida — a rugged island gem just off the southeast coast of Bali. With dramatic coastal cliffs, hidden coves, and crystal-clear waters, Nusa Penida offers a refreshing mix of adventure and serenity.

Whether it’s exploring iconic spots like Kelingking Beach or enjoying a slow sunset cruise, reaching Nusa Penida from Bali is easier than ever — with travel options to suit every type of visitor.

About the Nusa Islands

The Nusa Islands are a trio of islands located just a short boat ride from Bali’s mainland. Each has its own charm:

Nusa Penida

Nusa Penida is known for its raw beauty and dramatic landscapes

1. Kelingking Beach: A scenic cliff resembling a T-Rex, offering sweeping ocean views.

2. Broken Beach: A natural rock arch over turquoise waters.

3. Angel’s Billabong: A crystal-clear natural infinity pool set into the rocks.

4. Crystal Bay: A tranquil beach ideal for snorkelling and relaxing.

Nusa Ceningan

Nusa Ceningan, the smallest of the three, sits between Nusa Penida and Nusa Lembongan. With cliffside views and the famed Blue Lagoon, it’s a favourite for laid-back travellers and cliff jumpers.

Nusa Lembongan

Nusa Lembongan boasts mellow beach vibes, charming villages, and fantastic diving — perfect for those seeking both relaxation and ocean exploration.

How to Get There

Travellers can choose from two main transport options from Bali to Nusa Penida:

1. Private Boat Rental

For a seamless and personalised experience, boat rental is a premium option. Private boats offer comfort, privacy, and flexibility — ideal for families, groups, or couples wanting to island-hop at their own pace.

“Many of our guests prefer private charters for their freedom and convenience,” says Ketut Arya, a travel consultant at Bali Luxury Travel. “They can choose their departure time, avoid the crowds, and stop wherever they like — it’s truly a custom journey.”

When considering boat rentals, you can check this list reputable providers of boat rental bali that highly recommended for their reliability and stellar service.

2. Public Ferry

A budget-friendly alternative, scheduled ferries operate daily from Sanur, Padang Bai, and Kusamba. While they can be crowded and less flexible, ferries remain a reliable choice for solo travellers or those on a tighter schedule.

Tips Before Booking a Boat

1. Know Your Purpose: Choose your vessel based on your plan — whether it’s a day of island hopping, snorkelling, or a romantic sunset cruise.

2. Book Early: Secure your spot in advance, especially during holidays and high season, to avoid limited availability and price hikes.

3. Book Early: Secure your spot in advance, especially during holidays and high season, to avoid limited availability and price hikes.

4. Check Weather Conditions: Monitor the marine forecast and be prepared to reschedule if conditions are rough. Calm seas make all the difference.

5. Use Reputable Operators: Select licensed providers with strong reviews, transparent pricing, and appropriate insurance.

A Must-Do While in Bali

Planning a visit to Nusa Penida is increasingly seen as a must-do experience for anyone holidaying in Bali. With stunning natural backdrops and easy travel options, the Nusa Islands are a perfect escape from the hustle — just an hour away by boat.

“There’s something magical about sailing out from Bali and arriving in a place that still feels untouched,” adds Arya. “It’s the side of Bali most travellers don’t expect — and never forget.”

by | Apr 17, 2025 | Business

Kuala Lumpur, Malaysia – 26th March 2025 — Crewstone International Sdn Bhd, a PEMC-licensed private equity firm, and Vince Group, one of Malaysia’s leading integrated real estate developers, are proud to announce the launch of a strategic partnership to establish a RM150 million Real Estate Investment Fund — marking a major milestone in the country’s investment and property landscape.

This newly established fund will pioneer Malaysia’s first fully integrated real estate investment ecosystem, enabling investors to participate in a seamless, end-to-end property investment platform — from acquisition and development to value enhancement and exit realization.

“This partnership sets a new benchmark for real estate investment in Malaysia. By combining our investment structuring capabilities with Vince Group’s robust property ecosystem, we are unlocking a future where real estate investing is smarter, scalable, and more accessible,” said Ahmad Izmir, CEO of Crewstone International.

The fund will focus on high-yield, risk-mitigated real estate opportunities throughout Malaysia, with an emphasis on capital preservation and attractive upside potential for both institutional and qualified investors.

“We’re proud to collaborate with Crewstone to bring a bold vision to life — a one-stop, future-ready real estate platform designed to generate long-term value,” said Dato’ Vincent Nee, Group Managing Director of Vince Group. “This RM150 million fund is more than a financial vehicle — it’s a revolution in how real estate investment is approached in Southeast Asia.”

The signing ceremony, held in Kuala Lumpur, was attended by key stakeholders, and investors — marking the formal launch of this ambitious initiative. The partnership is expected to catalyze innovation within Malaysia’s real estate and alternative investment sectors, while offering robust returns to aligned partners.

About Crewstone International

Crewstone International is a private equity and investment management firm licensed under the Securities Commission Malaysia (License No. VCPE/0099/2023). With over MYR 500 million in assets under management, Crewstone specializes in cross-border private equity, credit, and fund strategies with a focus on delivering value for institutional and government partners.

About Vince Group

Vince Group is a diversified property group with an end-to-end ecosystem across development, marketing, leasing, and hospitality. With a track record of transformative real estate projects across Malaysia, the Group is known for innovation, execution excellence, and a strong commitment to shaping the built environment.

You must be logged in to post a comment.