by | Jul 17, 2025 | Business

In celebration of its 33rd year in the power industry, Alsons Power Group, the power generation arm of the Mindanao-based Alcantara Group, launched its first-ever “We Power with Care Day,” on July 11, marked by simultaneous environmental and community development activities across the country, reinforcing the Group’s commitment to sustainability and inclusive growth.

In celebration of its 33rd year in the power industry, Alsons Power Group, the power generation arm of the Mindanao-based Alcantara Group, launched its first-ever “We Power with Care Day,” on July 11, marked by simultaneous environmental and community development activities across the country, reinforcing the Group’s commitment to sustainability and inclusive growth.

The We Power with Care Day mobilized more than 600 individuals, including Alsons Power employees, community members, and local government partners across key sites in Bohol, Iligan, Makati, Negros Occidental, Sarangani, and Zamboanga. The participants took part in tree planting, river and coastal cleanups, and school support programs, bringing to life Group’s brand promise, “We Power with Care.”

“This isn’t just an anniversary event. It is a reflection of who we are and what we stand for. It’s our way of giving back to the communities we serve and bringing to life our brand promise, We Power with Care,” said Antonio Miguel B. Alcantara, Chief Executive Officer of Alsons Power, during the Kick-off program of the We Power with Care Day.

From Luzon to Mindanao, various activities took place across the Alsons Power’s project and business units:

· In Zamboanga City, Western Mindanao Power Corporation (WMPC) led a coastal cleanup in Sitio Bukana Mala, Bolong, collecting 25 sacks of non-biodegradable wastes, weighing around 125 kilos, with the help of over 75 employees and community volunteers.

· In Murcia, Negros Occidental, Bago Hydropower Resources Corporation (BHRC) organized a river cleanup in Sitio Balasyang, removing 900 kilos of waste and engaging around 50 local stakeholders.

· Mapalad Power Corporation (MPC) in Ubay, Bohol planted 150 tree seedlings within the plant premises with the help of 100 employees and volunteers from the community and government, supporting reforestation and biodiversity conservation in the area.

· In Iligan, Alsons Power Supply Corporation (APSC) and MPC Iligan spearheaded a coastal cleanup at Centennial Park in Dalipuga, collecting 110 kilos of recycleable and non-biodegradable waste and mobilizing over 75 volunteers.

· Siayan-Zambo River Power Corporation (SZPC) conducted a tree planting activity in Barangay Poblacion, Siayan, Zamboanga del Norte, planting 120 narra trees with the support of 100 volunteers.

· The Group’s Makati team helped green La Mesa Eco Park through a tree planting activity involving over 32 employees and 150 seedlings.

· In Sarangani, Sarangani Energy Corporation (SEC) and Siguil Hydro Corporation brought the spirit of “We Power with Care” to schools by turning over Smart TVs, school bags, and supplies to more than 500 students from nearby schools. A special book reading session was also held. Earlier that day, employees from both plants also participated in a tree planting activity within the SEC premises as part of the celebration.

Aside from education and environmental activities, Alsons Power also turned over the community share of the Municipality of Maasim and Barangay Kamanga from the SEC, reinforcing the Group’s commitment to inclusive growth and sustainable development. The community share forms part of the Department of Energy’s Energy Regulation ER 1-94 program, which requires energy companies to allocate funds to support local communities. These funds can be used for infrastructure, livelihood, and other local development initiatives.

Under the Energy Regulations (ER) 1-94 program of the Department of Energy, host communities of power generation facilities are entitled to financial benefits to fund electrification, livelihood, health, and environmental projects.

These efforts reinforced Alsons Power’s commitment to its brand promise, “We Power with Care,” highlighting the Group’s broader push to integrate sustainability into its operations and uplift the communities it serves.

Founded in 1992, Alsons Power was one of the pioneers in addressing power shortages in Mindanao through its partnership with the National Power Corporation under the Northern Mindanao Power Corporation. Today, the company operates over 460 megawatts of capacity from a mix of renewable and conventional energy sources.

With a growing pipeline of hydro and solar projects, Alsons Power is actively expanding its renewable energy portfolio, aligned with national goals for cleaner, more sustainable power generation.

by | Jul 17, 2025 | Business

Kuala Lumpur, 17 July 2025 – Enhance your expertise in refractory inspection and quality control. Join PetroSync’s API 936 Training and ensure thermal system reliability.

Why Refractory Standards Matter in High-Temperature Industries

Imagine standing near a furnace that reaches temperatures over 1,000°C. In industries like petrochemical, cement, and power generation, this is a daily reality. To withstand such extreme heat, refractory materials are installed—serving as the silent protectors of critical assets.

But here’s the catch: even a minor error in refractory design or installation can lead to equipment damage, production loss, and even serious safety incidents. That’s why global standards like API 936 exist—to ensure the quality, reliability, and safety of refractory applications.

If you’re involved in any part of refractory planning, inspection, or project execution, understanding these standards isn’t just “nice to have”—it’s essential.

Understanding the Core of API 936

The API 936 standard, developed by the American Petroleum Institute, provides critical guidelines for refractory material selection, installation, and inspection for equipment operating under high temperatures. This includes fired heaters, reformers, and other critical infrastructure used in refineries and process plants.

API 936 doesn’t just list material specifications. It also defines clear procedures for:

Evaluating refractory performance

Installation quality control

Pre-qualification testing and documentation

Inspector responsibilities and qualifications

In short, API 936 brings structure, accountability, and predictability to a field that historically relied heavily on experience and “tribal knowledge.”

Common Pitfalls Without Proper Knowledge

Many professionals find themselves thrust into refractory projects with little guidance beyond past practices. Maybe you’ve been in that situation—where you’re unsure whether the castable was mixed correctly, whether the dry-out schedule was too aggressive, or if the inspector was even qualified to sign off on the job.

Some of the most common mistakes in refractory work include:

Improper material selection

Non-compliance with curing/drying procedures

Inadequate anchoring systems

Poor inspection documentation

Unfortunately, these mistakes can lead to massive rework costs and downtime.

That’s why formal knowledge of API 936 is so valuable—it gives you a structured way to anticipate, prevent, and solve problems before they escalate.

How PetroSync’s API 936 Training Course Empowers Professionals

At PetroSync, we understand the gap between theoretical standards and real-world application. That’s why our API 936 training course is designed not just to teach the standard—but to make it practical, applicable, and relevant to your daily work.

Here’s what you’ll gain from the course:

A deep understanding of API 936 clauses and their implications

Real-life case studies of refractory failure and best practices

Insight from seasoned instructors with decades of field experience

Confidence to oversee refractory installations and inspections in compliance with global standards

Whether you’re an inspector, engineer, or project manager, this training gives you the tools to ensure your projects are compliant, efficient, and safe.

Plus, joining PetroSync means you’re part of a global network of professionals who take technical excellence seriously.

Start mastering refractory quality with confidence. Discover more about PetroSync and take the first step toward becoming a trusted expert in the field.

by | Jul 17, 2025 | Business

Doctor Anywhere Philippines makes it easier for Filipinos to see doctors online, with fully covered video consultations for members of partner HMOs and insurance companies.

MANILA, PHILIPPINES — Even after the pandemic, telemedicine remains a convenient option for Filipinos to see a doctor without leaving home.

Doctor Anywhere Philippines, launched in 2021, is part of a broader regional network led by Doctor Anywhere, a tech-led healthcare company headquartered in Singapore. The company operates across six Southeast Asian countries—Singapore, Malaysia, Thailand, Indonesia, Vietnam and the Philippines—bringing innovative health services to millions of users in the region.

In the Philippines, the Doctor Anywhere app has grown rapidly in the last four years. These online doctor consultations cover a wide range of health services—from 24/7 general practitioners, to specialist care, mental wellness support, and even prescription medication ordering and delivery, all managed through a single mobile app. Users of the Doctor Anywhere app can also access online medical documents, such as medical certificates, prescriptions, and referral letters, when deemed necessary by the doctor after their online consultation.

Many common medical concerns can be addressed through video consultations, including fever, coughs and colds, allergies, skin conditions, and other non-emergency cases. Even chronic conditions like diabetes or hypertension can be effectively managed remotely through regular check-ins and digital prescriptions. This makes the Doctor Anywhere app a practical option for common health concerns that don’t require a hospital or clinic visit.

By connecting patients directly to licensed doctors through their smartphones, Doctor Anywhere Philippines removes inconvenient barriers to healthcare such as long travel and wait times, clinic queues, and the need for paperwork. The app offers a fast, secure, and reliable way to consult with doctors anytime, anywhere, and for many users, these services are already fully covered by their HMO or insurance account.

At its core, Doctor Anywhere’s mission is to bring quality, accessible healthcare to Filipinos, whether they live in busy urban centers or underserved rural communities.

Online Doctor Consultations Covered by HMOs and Insurances

One of the most practical features of Doctor Anywhere Philippines is its integration with leading health maintenance organizations (HMOs) and insurance companies. All members of Doctor Anywhere Philippines’ partner HMOs and insurances can simply link their membership account in the app, and online consultations are fully covered—no letter of authorization (LOA) or reimbursement process required.

Here’s a list of HMOs and insurances whose members can access fully covered video consultations with 24/7 general practitioners and a wide range of specialists through the Doctor Anywhere Philippines app:

-AMAPHIL

-COCOLIFE Healthcare*

-Eastwest Healthcare

-Etiqa Life & General Assurance Philippines, Inc.

-Flexicare

-Forticare Health Systems International, Inc.

-Fortune Life

-Generali

-Health Maintenance, Inc. (HMI)*

-Lacson and Lacson Insurance Brokers

-Manulife Medical Secure**

-Manulife HealthFlex***

-Manulife Chinabank Life Assurance Medical Secure**

-Manulife Chinabank Life Assurance HealthFlex***

-Maxicare

-MedAsia Philippines

-Medicare Plus

-MI Healthcare Inc.

-Sun Life Grepa

-WellCare Health Maintenance

*With fully covered video consultations with 24/7 general practitioners only through the Doctor Anywhere app. Consultations with mental health experts are available at discounted rates.

**With fully covered video consultations with 24/7 general practitioners only through the Doctor Anywhere app. Consultations with specialists and mental health experts are available at discounted rates.

***With four fully covered video consultations with 24/7 general practitioners only through the Doctor Anywhere app. Consultations with specialists, mental health experts and additional general practitioners are available at discounted rates.

Convenient Online Consultations

Doctor Anywhere Philippines simplifies what has traditionally been a time-consuming and often frustrating process. Instead of waiting hours or days for an appointment, users can connect with a licensed doctor in five minutes or less through the app. General practitioners are available 24/7, including holidays, for on-demand video consultations.

The Doctor Anywhere app also allows users to schedule consultations with a wide range of specialists based on their preferred date and time, including dermatologists, endocrinologists, Ears, Nose, and Throat (ENT) specialists, gastroenterologists, general surgeons, hematologists, infectious disease doctors, oncologists, ophthalmologists (eye doctor), orthopedic surgeons, rehabilitation medicine specialists, rheumatologists, and urologists. This is especially helpful for patients who require more focused care or ongoing treatment, but may find it difficult to visit a clinic due to busy schedules or distant locations.

In addition to physical health concerns, Doctor Anywhere Philippines is seeing a rise in demand for its online mental health services. Many Filipinos are now more open to seeking professional help for issues such as stress, anxiety, depression, and work-related burnout. The app connects users to licensed psychologists in a secure, virtual session, making it easier for individuals to access the support they need without stigma or hassle.

To support treatment and continuity of care, Doctor Anywhere also offers in-app medication delivery. After a doctor consultation, users can conveniently purchase prescribed medicines directly through the app, ensuring timely access to necessary medications without needing to go out and visit a pharmacy.

Every consultation is conducted via secure video call, and users receive their online medical documents right after the session, when medically necessary, at the discretion of doctors. These include:

-Medical certificates

-Prescriptions

-Referral letters for further medical care or lab procedures

All online medical documents are securely stored within the Doctor Anywhere app. Each file is password-protected and accessible only through the user’s account, ensuring confidentiality and data privacy at all times.

Having these medical documents readily available in one place is especially helpful for users who may need to revisit prescriptions, track their medical history, or submit health-related documents for work, school, or travel.

Getting Started: How to Use Doctor Anywhere Philippines

Getting started with Doctor Anywhere Philippines is quick and easy. All you need is a smartphone and a stable internet connection. Whether you’re at home, in the office, or on the go, you can access healthcare services through the app in just a few minutes. For the best experience, find a quiet, well-lit space where you and your doctor can see and hear each other clearly. This helps ensure smooth communication and allows your doctor to assess your symptoms and explain medical concerns more accurately.

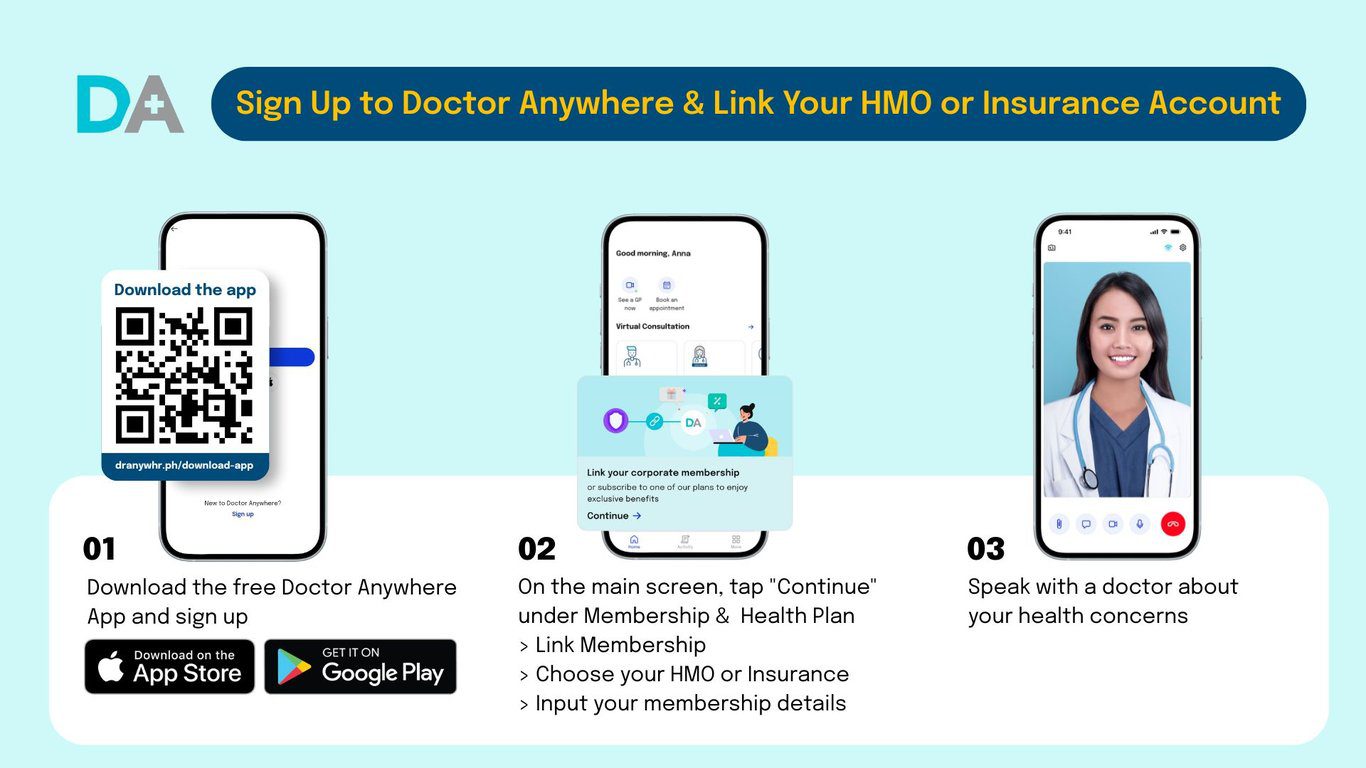

Here’s how to begin:

- Download the free Doctor Anywhere app on the App Store (iOS) or Google Play Store (Android), or scan the QR code in the image.

- On the Home screen, tap “Continue” under “Membership & Health Plan”. Choose “Link Membership”, search for your HMO or insurance, and enter your membership details.

- Once linked, you can access fully covered 24/7 video consultations with accredited doctors.

Coverage for specialist and mental health consultations may vary depending on your plan, so it’s best to confirm with your HMO or insurance company before booking an appointment.

What If You Don’t Have an HMO or Insurance?

For Filipinos without health coverage, Doctor Anywhere Philippines offers DA Healthwise, an annual health plan for only ₱99 per year. It gives users access to discounted, unlimited online consultations with general practitioners, specialists, and mental health experts for 12 months. Users only pay the discounted rate when they book an online consultation, unlike traditional health insurance, which charges fixed monthly premiums whether or not services are used.

This flexible plan is an ideal option for freelancers, small business owners, students, and anyone looking for affordable healthcare coverage. It’s a simple way to stay on top of your health without worrying about high costs or complicated insurance processes.

Enhanced Healthcare In The Philippines

Whether you have health insurance or not, and whether you’re in the city or the province, Doctor Anywhere Philippines makes it easier to see a doctor online when you need one. You don’t have to deal with traffic, long waiting times, or extra paperwork. With 24/7 online consultations including holidays, no LOA needed, and a growing list of HMO partners, the app offers a more convenient and user-friendly way to access healthcare.

Download the free Doctor Anywhere app today and link your HMO or insurance account to access your health benefits, or explore affordable options with DA Healthwise.

by | Jul 17, 2025 | Business

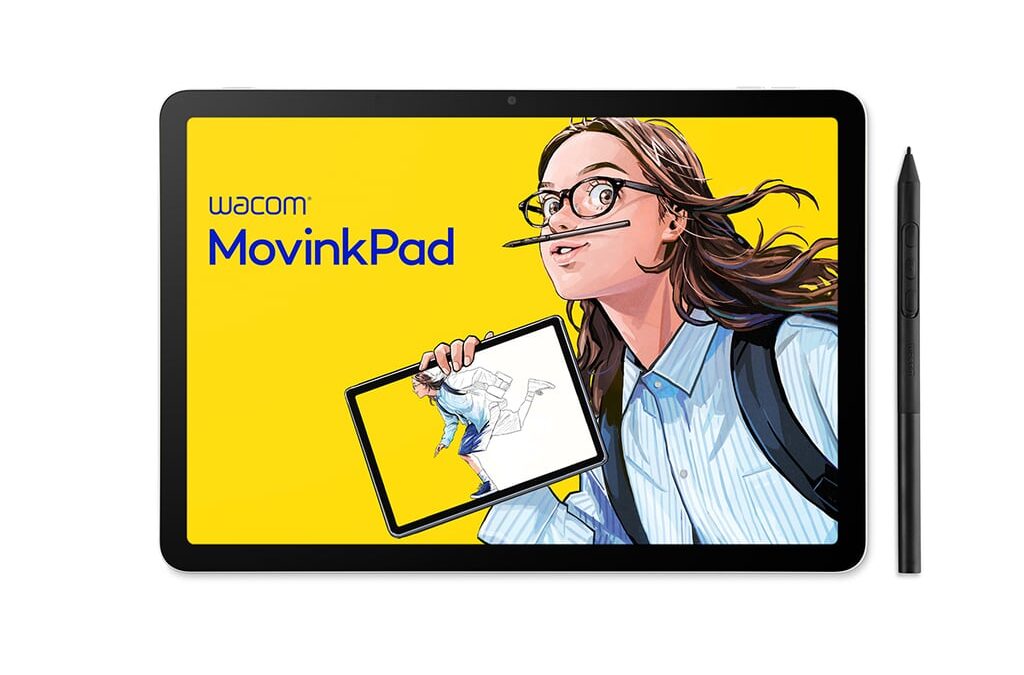

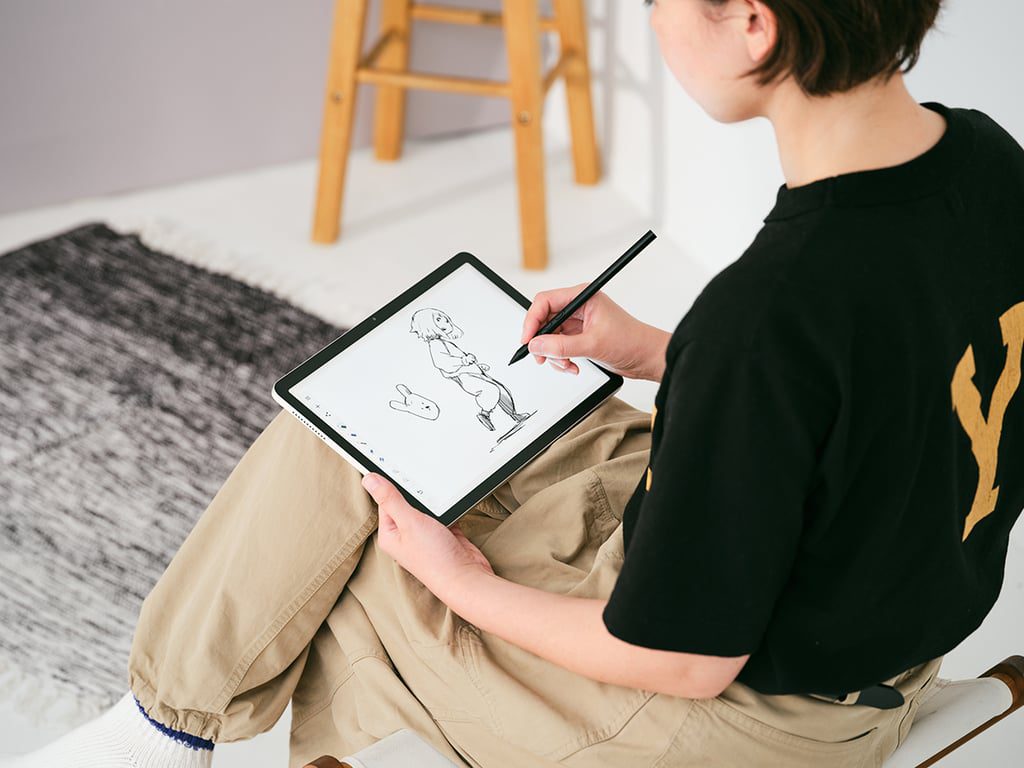

Wacom MovinkPad 11 is a breakthrough portable creative pad that redefines what a digital drawing device can be. Unlike entertainment-focused tablets, it’s built to capture inspiration the moment it strikes and help users dive into drawing—anytime, anywhere. Its Quick drawing function and seamless workflow keep creativity flowing from the start.

TOKYO

– July 17, 2025 – Today Wacom unveils Wacom MovinkPad 11, an all-in-one

creative pad that brings drawing into daily life with ease. Whether sketching

for fun or capturing inspiration, this device makes it easy to start drawing

right away. Designed for instant creativity, it’s ready the moment you pick up

the pen, running Android 14 for a familiar, intuitive experience.

No Limits. Just Draw.

Not

just another tablet, the Wacom MovinkPad 11 is designed to make digital drawing

simple and fun from day one. It includes everything needed to start drawing—no

PC, no setup, just a digital pen and canvas. Its lightweight body features an

11.45-inch multi-touch display with anti-glare etched glass that reduces

reflections and keeps you focused. It comes with the battery-free Wacom Pro Pen

3, widely used and trusted by professionals across creative industries, for its

precision and a natural drawing feel. With a tap and brief hold of the pen, the

device wakes up and is ready when inspiration strikes.

Whether

at home, at school, in a café, or on the road, the Wacom MovinkPad 11 fits

easily into everyday creative moments.

“The

Wacom MovinkPad 11 is for people who just can’t stop drawing,” said Koji Yano,

Senior Vice President, Wacom Branded Business. “Whether you love to doodle

between classes or are moving up from drawing on a smartphone screen, this

portable creative pad makes it easier and more fun to just draw. And this is

just the beginning—stay tuned for what’s to come in the portable creative pad

series.”

Creative Apps to Get Started

The

included Wacom Canvas app supports freehand sketching and light illustration. A

two-year license of Clip Studio Paint DEBUT—an entry version of the app used by

creative professionals—offers an easy start with 40,000+ brushes, and features

for comics, 3D, and animation.

The Quick drawing function

makes starting easy. Just tap and hold the pen on the screen to launch Wacom

Canvas and start sketching right away. A tap takes you into Clip Studio Paint

to refine your work, which is saved automatically to Wacom Shelf.

“The

Wacom MovinkPad 11 is poised to be a comfortable digital canvas for everyone,

from those exploring digital art to those engaged in creative work,” said

Tetsuya Kobayashi, Executive Officer at Celsys. “Paired with Clip Studio Paint,

it offers a refined, intuitive creative experience wherever creativity takes

you.”

Customize Your Setup

with Pens and Accessories

In

addition to Wacom Pro Pen 3, it also supports digital pens from familiar stationery

brands like Dr. Grip, LAMY, and STAEDTLER, offering options to match your

personal style. The Wacom MovinkPad 11 Case with Stand is also available,

designed to protect your device and double as a stand for comfortable drawing

angles.

The Wacom MovinkPad 11 is

coming this summer. To learn more about the product, visit: https://www.wacom.com/products/portable-pad/wacom-movinkpad-11

by | Jul 17, 2025 | Business

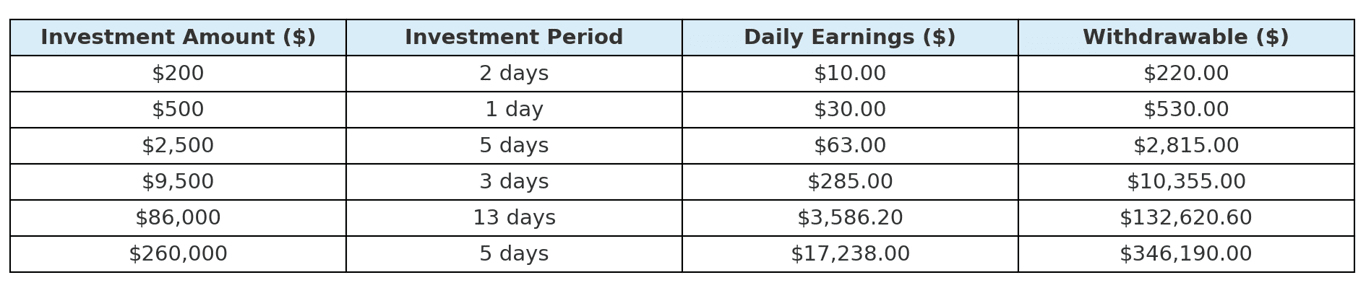

As XRP climbs towards $3 and Bitcoin surpasses $120,000, global investors are seeking reliable ways to profit from crypto’s growth without price exposure risks. UK-based BTC Miner, a leading cloud mining platform, now offers a powerful alternative: guaranteed daily USD returns, fully protected by Tier-1 bank custody and SSL-encrypted data security, with no need for mining equipment or technical expertise.

BTC Miner allows investors to easily convert XRP, BTC, ETH, or USDT deposits into daily passive income, all tracked in USD. This model eliminates crypto volatility risks while delivering stable, predictable returns from real-world, green-energy-powered mining farms.

BTC Miner Platform Highlights:

$500 Free Mining Bonus – Risk-free start for all new users

Daily USD Payouts, fully stable and consistent

Client Funds Held in Tier-1 Banks for maximum security

SSL Encryption Protecting All Personal Data and Transactions

Supports XRP, BTC, ETH, USDT, DOGE deposits

Flexible 1 to 30-day contracts, withdraw anytime

No hardware or maintenance required

Green energy mining farms across Europe and North America

Multi-level referral commissions for additional passive earnings

“A Safer Second Chance for XRP and Crypto Investors”

“XRP’s rally is impressive, but volatility concerns remain,” said Thomas Reynolds, BTC Miner’s marketing lead. “BTC Miner offers investors guaranteed passive income, secured in USD, without worrying about token price swings. It’s simple, secure, and accessible to everyone.”

Why BTC Miner Stands Out:

No exposure to crypto price risks

Daily USD returns up to 6.63%+

Funds safely stored in Tier-1 global banks

All personal and financial data secured via SSL encryption

Withdraw anytime in your preferred cryptocurrency

100% cloud-based, no hardware required

Start in Minutes:

Register at https://btcminer.net

Claim your $500 free trial mining bonus

Choose a contract (1-30 days)

Earn daily USD payouts

Withdraw in XRP, BTC, ETH, or USDT anytime

About BTC Miner

BTC Miner is a global cloud mining platform providing secure, transparent, and eco-friendly mining services. Client funds are protected in Tier-1 banks, and user data is fully SSL-encrypted. BTC Miner enables investors worldwide to enjoy passive Bitcoin mining income—without equipment or technical complexity.

For More Information:https://btcminer.net

by | Jul 16, 2025 | Business

Primary producers across Australia have the opportunity to expand their knowledge, free of charge, at Rabo Client Council online workshops designed to help provide the financial skills essential to managing an agricultural enterprise.

The practical Financial Skills Workshops will be held online in August and September.

The initiative – which provides farmers with an opportunity to upskill – has been led and funded by food and agribusiness banking specialist Rabobank’s Rabo Client Councils, a group of innovative, forward-thinking farming clients who are passionate about making a difference in their communities and support a range of activities designed to make a meaningful impact on the vibrancy and resilience of rural Australia.

Offered at no cost to participants, the interactive workshops provide practical, hands-on information on understanding financial statements and banking requirements and explore topics such as taxation versus management accounting, essential business management ratios and understanding key components of a business’s financial profile.

Rabobank head of community and client engagement Glenn Wealands said the workshops, which are specifically designed for farm owners and managers, aim to enhance participants’ financial knowledge and expertise.

Mr Wealands said the workshops were being offered online to provide an alternative to the ongoing face-to-face program of Financial Skills Workshops that continue to be rolled out nationwide. “This recognises the challenges that some farmers may face in taking time away from their operations, or being in remote locations where they are unable to attend any of the workshops in person,” he said.

The online workshops will be delivered in two half day sessions, with Module One – which focuses on understanding how to read, interpret and use financial reports – held across Thursday August 14 and Friday August 15, 2025.

Module Two workshops – which focus on gross margin analysis, a critical step in farm planning and decision making – will be held on Thursday September 11 and Friday September 12, 2025.

Mr Wealands said the Module Two workshops would take an enterprise-focused approach, with content tailored to suit the operations of participants. “We will consider cash flow implications for these enterprise choices and explore preparing annual cash flow budgets,” he said.

Mr Wealands said past attendees had found the Financial Skills Workshop information valuable and immediately applicable to their businesses.

“Since launching in 2018, the Rabo Client Councils have so far extended this valuable learning opportunity to over 5,000 farmers across Australia and New Zealand,” he said.

The virtual workshops will be presented by director of Hudson Facilitation, Tony Hudson.

Online workshop dates:

Measuring Financial Performance workshop

Thursday 14 and Friday 15 August 2025

East Coast: 8.50am to 12.00pm AESTCentral: 8.20am to 11.30am ACSTWest Coast: 6.50am to 10.00am AWST

Gross Margin Analysis and Cash Flow Budgeting workshop

Thursday 11 and Friday 12 September 2025

East Coast: 8.50am to 12.00pm AESTCentral: 8.20am to 11.30am ACSTWest Coast: 6.50am to 10.00am AWST

To register to participate, please visit the Rabobank website or click here.

You must be logged in to post a comment.