by | Jul 7, 2025 | Business

Multisys marks 15th anniversary with major milestones

Multisys renews ISO/IEC 27001:2022 certification, expands partnerships and AI capabilities<img style="width: 100%;" src="https://slvrdlphn.com/wp-content/uploads/2025/07/public-38" alt="From left to right: QRC Assurance and Solutions Corp. Country Business Lead – Philippines Lyn Aquino, Multisys CEO Vic Tria, and Multisys COO Atty. Kath Mila during the ISO 270001:2022 conferment ceremony for Multisys” />

Manila, Philippines—Multisys Technologies Corporation, a leader in software as a service (SaaS) and system integrations, and an affiliate of PLDT, the country’s largest telecommunications and digital services provider, is celebrating its 15th anniversary with more global certifications, expanded partnerships, and advanced innovations featuring artificial intelligence–cementing its position as one of the longstanding and trusted IT companies in the Philippines.

In its 15th year, Multisys successfully renewed its ISO/IEC 27001:2022 certification for its Information Security Management System (ISMS), following an extensive recertification audit by international certification body QRC Assurance and Solutions Corp. The audit confirmed that Multisys’ ISMS policies and procedures meet globally-recognized standards for securing data assets, with organizational, people, physical, and technological controls in place.

Multisys CEO & President Vic Tria shared that Multisys has also been beefing up its partnerships, having recognized as an official technology partner of Google and ServiceNow.

Multisys is officially part of the Google Cloud Partner program under the ‘Build’ category, allowing it to develop softwares that run on Google products. This is in line with Multisys’ strategic move to integrate Artifical Intellience in both its operations and product suite. Apart from Google, it has partnered with other AI pioneers to now offer geospatial intelligence, AI contact center and AI agents.

Meanwhile, ServiceNow listed Multisys under its ‘Consulting and Implementation’ Partner Program, equipping the latter to resell and integrate ServiceNow’s solutions and provide software development and integration services. ServiceNow is a leading Silicon Valley-based software company listed on the New York Stock Exchange.

“Our 15-year milestone reflects the trust our partners place in us. We intend to keep that commitment by making sure we use the best security measures and deliver the most advanced software innovations that truly add value,” Tria said.

Multisys saw a record-breaking banner year in 2024, posting a 105% increase in revenue–an all-time high for the company–as well as a 212% growth in its bottomline.

Among the biggest growth drivers is its strategic partnership with PLDT Enterprise, the corporate arm of PLDT, which empowers industries through next-generation digital solutions. Beyond reliable connectivity, PLDT Enterprise brings deep expertise in managing enterprise relationships and a robust ecosystem of solutions partners. Combined with Multisys’ strength in software innovation, the partnership is driving operational transformation, enhancing customer experiences, and enabling long-term business growth.

Together, Multisys and PLDT Enterprise have introduced telco-integrated platforms and services, powered by Multisys’ all-in-one digital solutions, including an enterprise portal, business support system, payment system, dealer management system, and order portal, designed to streamline operations and deliver greater value to businesses across industries.

Tria also shared that outside the country, Multisys is replicating its success story with Brunei’s largest telco, DST, who has tapped Multisys to co-develop Brunei’s first-ever Super App.

Multisys was named SME of the Year and a finalist for Technology Company of the Year alongside Accenture, IBM, Collabera, GENPACT and MDI Novare at the 2024 SOLAIA IT-BPM Awards, hosted by the IT & Business Process Association of the Philippines (IBPAP).

###

by | Jul 7, 2025 | Business

Asuene Inc. has signed a Memorandum of Understanding (MoU) with key ESG and decarbonization organizations in Taiwan to establish the Taiwan-Japan Carbon Alliance. This industry collaboration platform aims to advance international carbon management efforts. A total of eight organizations from Taiwan and Japan will participate in the alliance. Together, they will promote comprehensive initiatives such as the measurement of greenhouse gas (GHG) emissions across Scope 1–3, ESG disclosures, policy dialogues, and supply chain engagement—with the goal of building a practical foundation for ESG and decarbonization-driven management across Asia.

Background of the “Taiwan-Japan Carbon Alliance”

Amid accelerating global regulatory pressures around decarbonization, companies are now expected to measure GHG emissions across Scope 1, 2, and 3 with greater accuracy to meet evolving ESG disclosure requirements. Japan and Taiwan, in particular, share export-driven economic structures centered around manufacturing industries such as semiconductors, electronic components, precision machinery, and textiles. These industries are supported by deeply interconnected supply chains that extend across Southeast Asia.

Given this structure, companies in both countries urgently require a unified approach to measure GHG emissions across their entire supply chains and to align their ESG initiatives with international standards.

In response to these shared challenges, Asuene has formed a practical, implementation-focused alliance in partnership with key public and private sector players in Taiwan. The alliance will serve as a multi-functional platform for decarbonized management—supporting system implementation, cross-border data integration, policy engagement, and public awareness activities. By bringing together the decarbonization expertise of both Japan and Taiwan, the alliance also aims to accelerate the transition toward a low-carbon, sustainable economy across Asia.

Key Initiatives under the Taiwan-Japan Carbon Alliance

The Taiwan-Japan Carbon Alliance will undertake the following joint initiatives:

Support the implementation of carbon management platforms for Taiwanese companies to measure and manage GHG emissions

Provide guidance for aligning with international standards such as CSRD, CBAM, SBTi, and PCAF

Facilitate collaboration between Japanese and Taiwanese companies to share decarbonization and ESG expertise and expand cross-border business opportunities

Engage in policy and public dialogue through proactive communication and joint proposals

These initiatives will be rolled out in phases by the participating companies and organizations. Looking ahead, the alliance aims to grow beyond Japan and Taiwan to serve as a decarbonization platform across broader global markets, including Southeast Asia.

Asuene will continue leveraging the strengths of its cloud-based solution, ASUENE, which supports all-in-one GHG emissions measurement, reduction, and reporting across borders. Through this, we remain committed to advancing sustainability-driven business practices and contributing to the realization of a decarbonized global society.

Asuene Company Profile

Asuene Inc. is a leading Climate Tech company in Japan with the mission of ”Changing the world for the next generation”. We provide “ASUENE”, a carbon accounting platform to measure, report and reduce carbon emissions of companies and we contribute to the net zero society.

by | Jul 4, 2025 | Business

Office Chatani, Inc. (CEO: Masayuki Chatani) has announced the results of a survey they conducted on “intrapreneurs” in large companies, targeting those with over 1,000 employees. These results shed light on the actual state of business creation personnel in these companies.

Background

The world is currently in what has been called the VUCA age, where the business world is rapidly changing and uncertainty is growing. As the market and customers’ needs change by the second, companies are expected to respond to these needs with flexibility and innovation. Under these circumstances, business creation is an essential initiative to maintain and strengthen a company’s competitive position. On the other hand, due to the scale of resources and complexity of their decision-making process, managers cannot focus solely on the business environment, but must also face challenges such as rigid internal organization and a risk-averse culture while striving to generate new value. Among them, “intrapreneurs,” or one who creates new businesses while working within an organization, have been attracting attention. Large companies have a strong desire for individuals willing to go against the existing business structure and culture and generate new value within the company. To that end, Office Chatani, Inc. conducted a survey targeting managers within large companies regarding intrapreneurship in such companies.

Survey summary

– Among companies with over 1,000 employees, over half of them have personnel who are considered “intrapreneurs”

– The largest age group for “intrapreneurs” is 40-49

– The top three common skills among intrapreneurs are 1. Creativity and Imagination, 2. Business Strategy Acumen, and 3. Autonomy and Independent Action

– Many companies are working on “supporting internal and external personal networking” for the purpose of developing intrapreneurs

– The most important environmental factor for successful intrapreneurship is considered to be “a corporate culture that is tolerant of new challenges”

– Among companies indicating that they did not have any “intrapreneurs,” over 70% were not taking initiatives to cultivate intrapreneurship in their company

– Among companies without “intrapreneurs,” many named “providing training and educational opportunities for new business” as an initiative for cultivating intrapreneurship

– Among companies without “intrapreneurs,” the top three challenges or obstacles for cultivating intrapreneurship were said to be 1. “Lack of a role model in the company”, 2. “Lack of internal resources (time, budget, personnel)”, and 3. “Lack of a system or culture to evaluate challenges.”

Survey overview

Period: April 4-15, 2025

Method: Online survey

Target: Managers at companies with over 1,000 employees (men and women from 20s to 60s)

Total surveyed: 107 people

Monitored by: RC Research Data

Among companies with over 1,000 employees, over half of them have personnel who are considered “intrapreneurs”

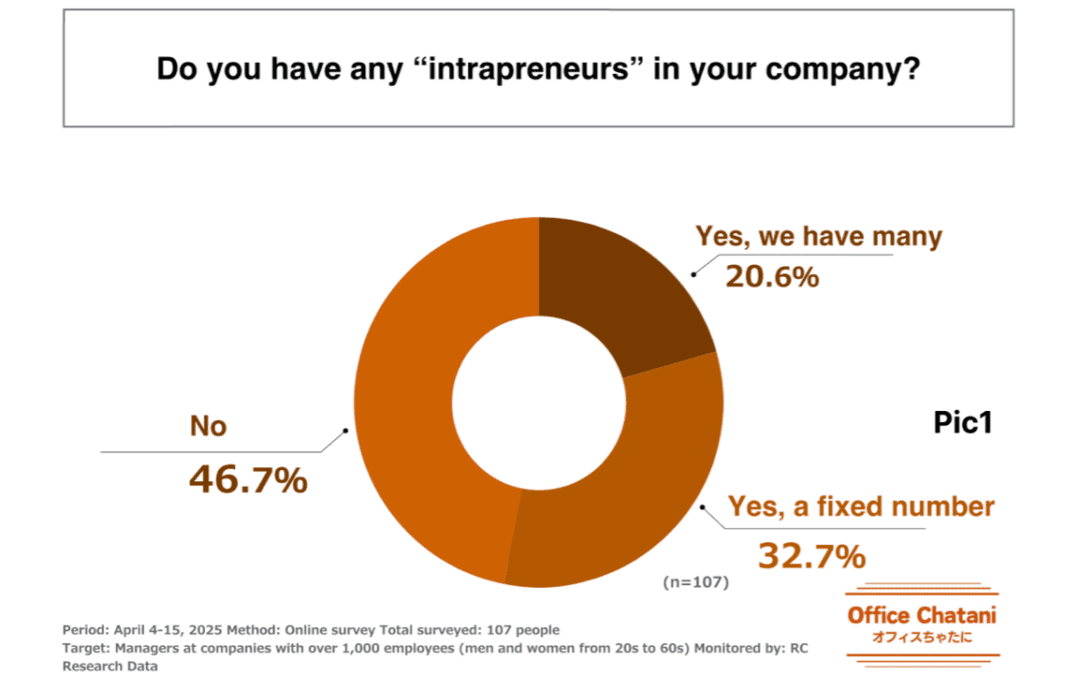

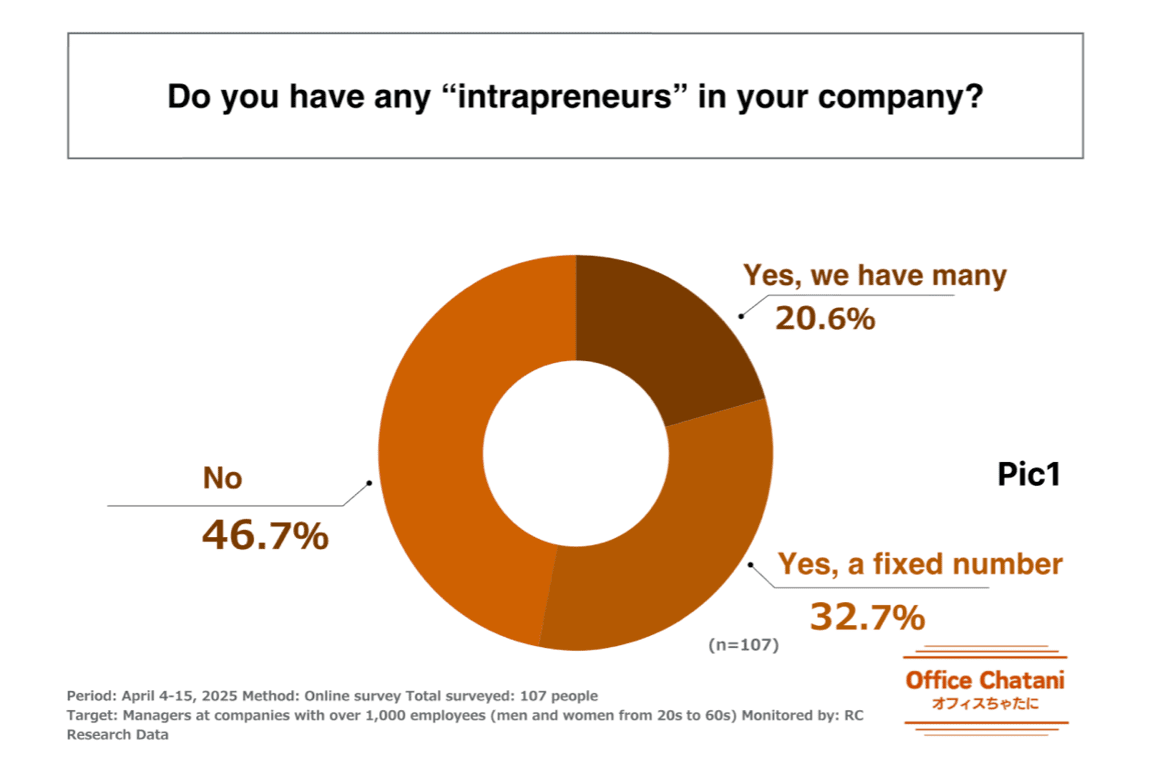

For the first question, “Do you have any “intrapreneurs” in your company?”, the top responses were “No.” with 46.7%, “Yes, a fixed number.” with 32.7%, and “Yes, we have many.” at 20.6%. Through these responses, it was found that more than half of companies with over 1,000 employees have intrapreneurs.

The largest age group for “intrapreneurs” is 40-49

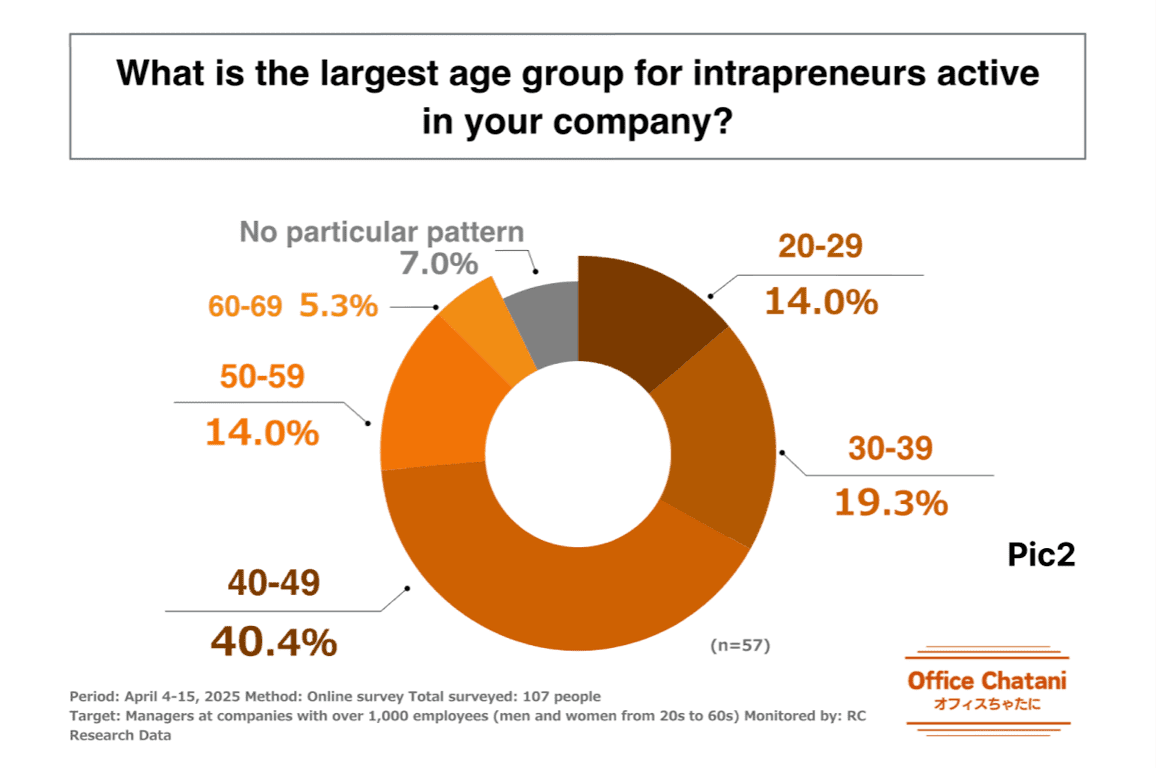

The next question was “What is the largest age group for intrapreneurs active in your company?” The top two responses were 40-49 (40.4%) and 30-39 (19.3%), so it was found that the most common age group for intrapreneurs was 40-49.

- The top three common skills among intrapreneurs are 1. Creativity and Imagination, 2. Business Strategy Acumen, and 3. Autonomy and Independent Action

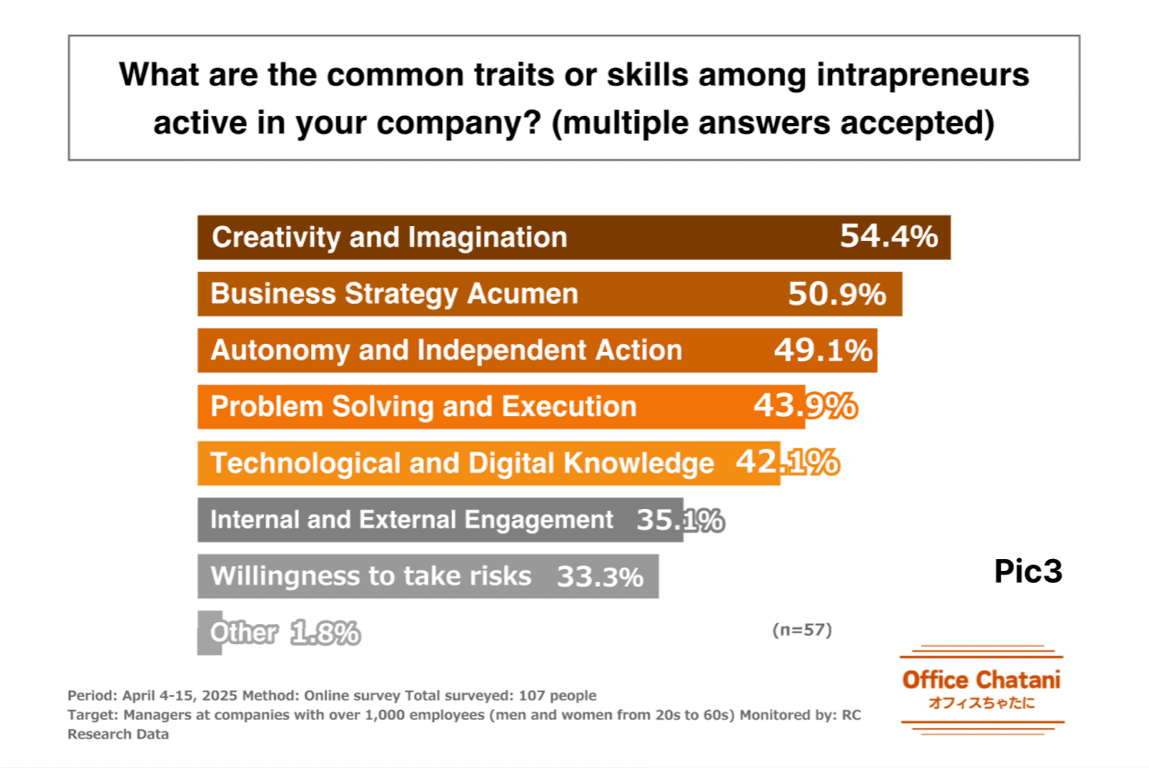

Following that, respondents were asked “What are the common traits or skills among intrapreneurs active in your company?” The top responses were “Creativity and Imagination” with 54.4%, “Business Strategy Acumen” with 50.9%, and “Autonomy and Independent Action” with 49.1%. In addition, a number of other options outside the top three exceeded 40%, meaning that a large number of traits and skills are common among intrapreneurs.

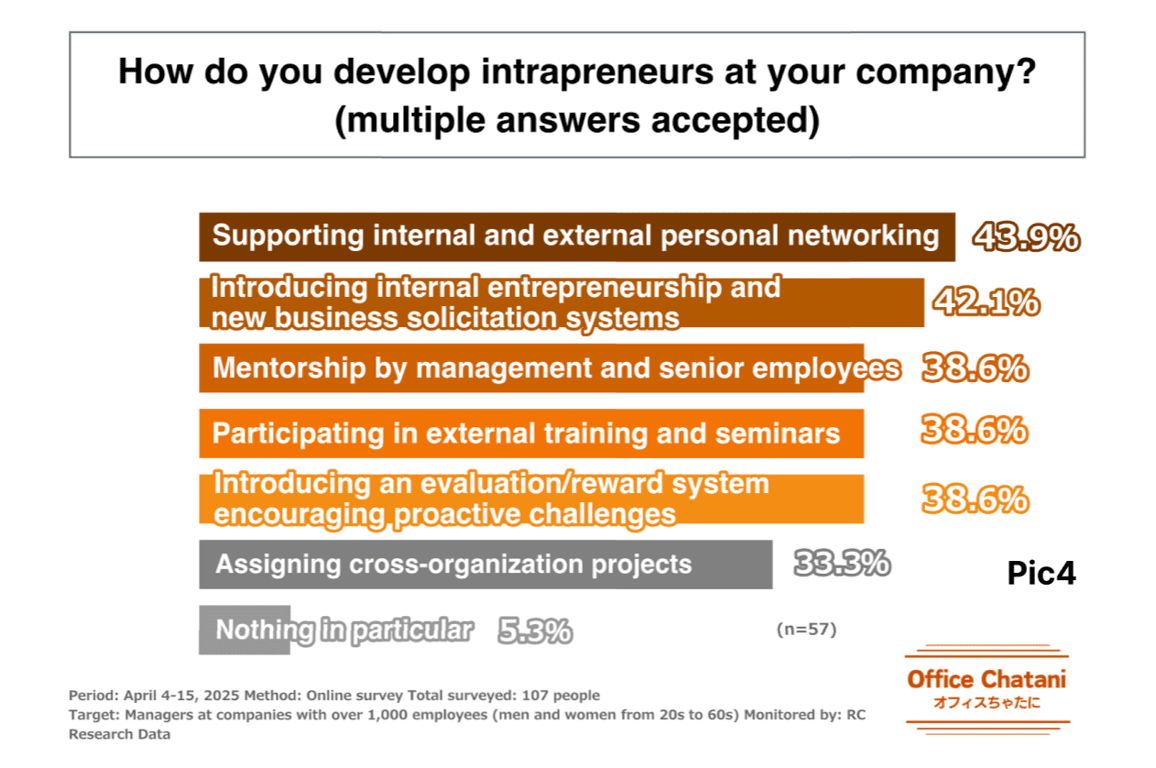

- Many companies are working on “supporting internal and external personal networking” for the purpose of developing intrapreneurs

Next, companies that indicated that they have intrapreneurs in their company were asked “How do you develop intrapreneurs at your company?”, with the top answers being “By supporting internal and external personal networking” with 43.9%, “By introducing an internal entrepreneurship system and new business solicitation system” with 42.1%, and “Through mentorship by management and senior employees,” “By participating in external training and seminars,” and “by introducing an evaluation and reward system that encourages proactive challenges” each tied at 38.6%. Based on these results, it was found that many companies are working on “supporting internal and external personal networking” for the purpose of developing intrapreneurs.

Continues in Part 2.

Survey conducted by:

Office Chatani, Inc.

Location: Tokyo

CEO: Masayuki Chatani

Description of business: Creative Management Support, Lectures, Writing, etc.

URL: https://www.office-chatani.com

Office Chatani, Inc. supports creative management.

CEO Masayuki Chatani, author of “Behind the Scenes at PlayStation: Former CTO Talks about 16 Years of Creation,” has previously served as CTO and EVP of a global video game business, an executive officer of an internet conglomerate, CEO of a professional firm’s digital group company, the Japan Head of the digital team at a strategic consulting firm, and other positions.

by | Jul 3, 2025 | Business

Bitcoin surged past $109,000 backed by institutional inflows, macroeconomic optimism, and renewed trade deals, yet traders remain cautious. Stay updated with the latest insights via the Bitrue blog.

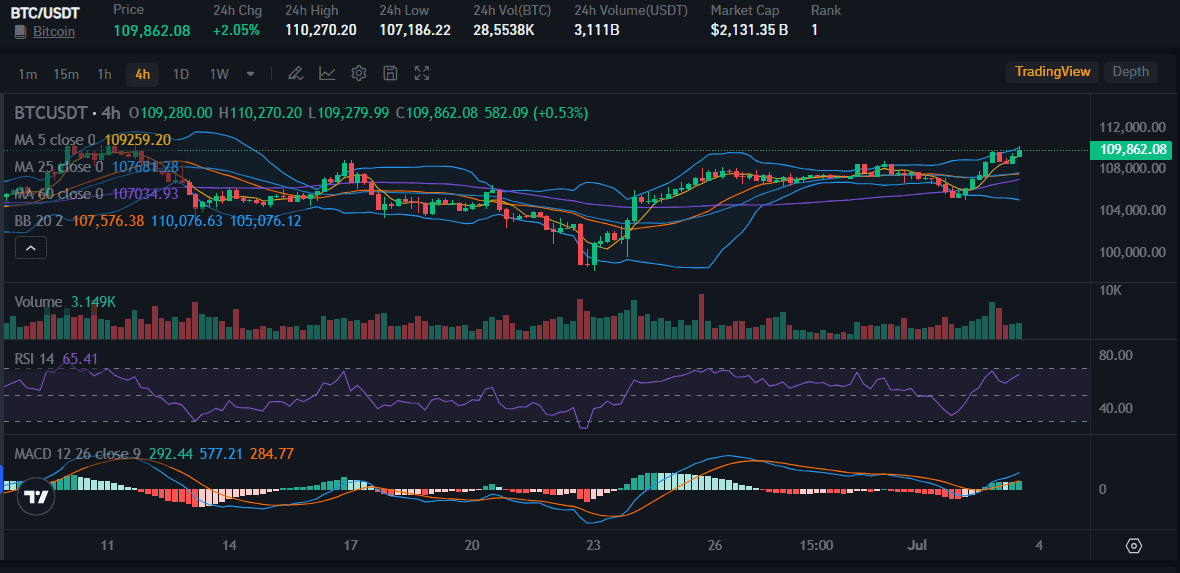

On July 3rd, Bitcoin (BTC) price soared by 2.05%, adding more than $2,900 to its value as it rallied from $106,300 to a peak of $109,862. The world’s largest cryptocurrency briefly pared gains to settle at $109,600, just under 3% shy of its all-time high of $111,970.

A surge in trading volume to $52.6 billion indicated that the move wasn’t speculative, it was driven by serious capital commitment, with Bitcoin accounting for nearly 45% of total crypto market activity.

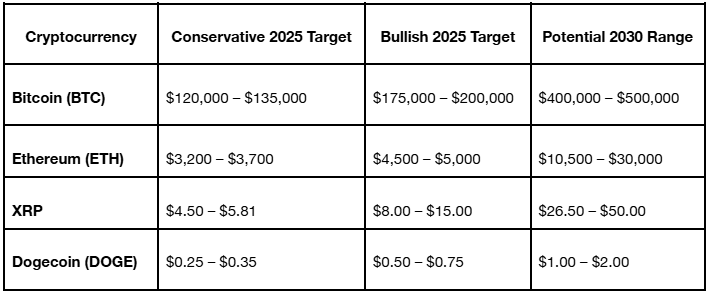

The rally reflects a rare convergence of macroeconomic shifts, improving liquidity, and bold investor behavior. Standard Chartered reaffirmed its bullish forecast, expecting Bitcoin to reach $135,000 by Q3 and $200,000 by the end of the year.

The bank attributes the momentum to a “new flow regime,” where spot ETFs, sovereign accumulation, and corporate treasury investments are displacing the post-halving slowdown narrative.

Institutional Demand Fuels Uptrend

In Q2 alone, institutional players added approximately 245,000 BTC to their holdings, with many new buyers emerging outside of known entities like MicroStrategy.

This trend is projected to accelerate, especially as passive ETF allocations gain traction and more public companies adopt Bitcoin as a treasury reserve asset.

This week’s successful launch of the REX-Osprey Solana + Staking ETF, which registered $20 million in day-one volume, further reinforced market appetite for crypto ETFs.

Bloomberg analyst Eric Balchunas labeled it a “top 1% debut,” and its success signaled growing confidence in altcoin-based products while bolstering Bitcoin’s standing as the sector’s foundation.

Macroeconomic Boost: Trade Deals and Policy Shifts

Bitcoin’s momentum also coincides with fresh macro tailwinds. U.S. President Donald Trump announced a trade agreement with Vietnam, Washington’s third such deal in recent weeks.

The new terms include a 20% tariff on Vietnamese exports and a 40% tariff on rerouted goods, but grant tariff-free access to U.S. exports.

This development, seen as part of Trump’s post-election economic pivot, lifted equities and risk assets across the board. The Nasdaq climbed 0.8%, and Bitcoin surged past the $109,000 mark.

Progress on U.S. trade fronts with India and China, as well as eased restrictions on chip exports, contributed to investor optimism. However, talks with Japan and South Korea have reportedly stalled.

A controversial tax bill is also under scrutiny in Congress, with some Republicans threatening to block its passage over fiscal concerns.

Amid all this, the market is closely watching U.S. labor data. A weaker-than-expected reading could prompt interest rate cuts from the Federal Reserve, adding further support for risk-on assets like Bitcoin.

Crypto Market Responds in Kind

The bullish sentiment rippled through the broader crypto market.

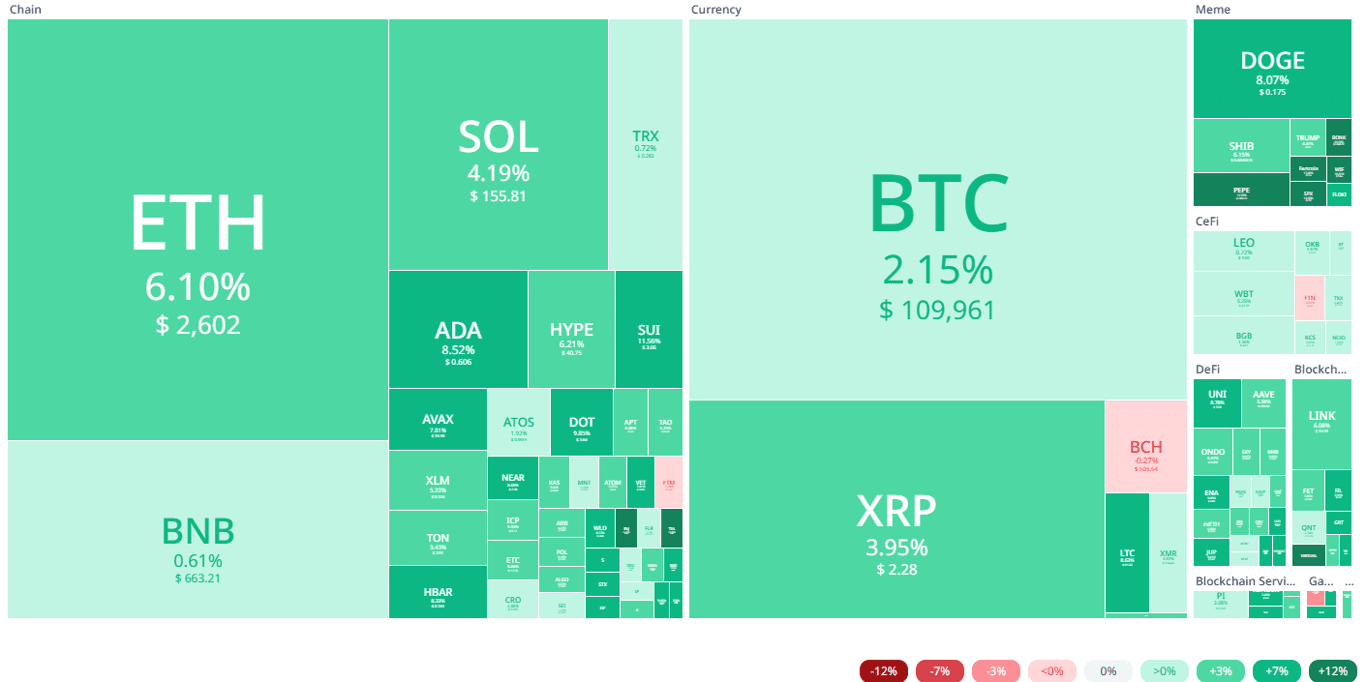

- Ethereum (ETH) rose 6.1% to $2,592.85

- XRP gained 3.7%

- Cardano (ADA) rebounded 7.8% after a sharp June decline

-

Solana (SOL) added 4.3%

-

Meme coins also saw action, with Dogecoin (DOGE) up 8.1% and $TRUMP climbing 4.4%

These gains suggest renewed investor confidence, particularly after a sluggish June.

Skepticism Lingers Despite Price Strength

Despite the bullish price action, derivatives data reveals a more cautious undertone. The BTC one-month futures premium remains below the 5% neutral mark, suggesting traders are not fully convinced of a sustained breakout.

This cautious sentiment began mid-June and continues even as Bitcoin retests levels near $110,000.

Additionally, the rally may have been partially driven by macro liquidity trends. Eurozone M2 money supply rose 2.7% year-over-year in April, echoing similar expansionary policies in the U.S.

Meanwhile, private payroll data from ADP revealed a drop of 33,000 jobs in June, adding to fears of an economic slowdown.

Options markets remain neutral as well. The 25% delta skew, which indicates risk perception in BTC options, stood flat at 0%, reflecting balanced sentiment on both upward and downward price moves.

While this is more optimistic than the bearish tone observed in late June, it still reflects market hesitancy.

China Market Signals Weak Confidence

Despite global bullishness, crypto sentiment in China tells a different story. A 1% discount on Tether (USDT) against the official CNY rate, its steepest since mid-May, suggests Chinese investors are exiting the market rather than buying in.

This divergence could indicate regional skepticism about the sustainability of Bitcoin’s rally.

Adding to the concern, spot Bitcoin ETFs saw $342 million in net outflows on Tuesday, further reinforcing market caution.

by | Jul 3, 2025 | Business

Bitcoin and Ethereum prices soar as the crypto market hits $3.31 trillion. Discover key drivers behind the July 2025 rally, expert predictions, and what comes next for BTC, ETH, XRP, and DOGE.

The cryptocurrency market is riding a powerful bullish wave as we enter July 2025, with Bitcoin reclaiming ground near its all-time high and Ethereum posting double-digit gains.

Fueled by favorable macroeconomic signals, institutional adoption, and rising liquidity, the total global crypto market cap reached $3.31 trillion, reflecting increasing investor confidence across digital assets.

Bitcoin, Ethereum Lead the Charge

As of July 3, Bitcoin (BTC) price climbed 2.15% to $109,961, with Ethereum (ETH) advancing 6.10% to $2,602.

This surge was accompanied by rising open interest in Bitcoin futures, now worth approximately $75 billion, marking a significant return of institutional capital to the market.

Wednesday’s spike followed President Trump’s announcement of a landmark U.S.-Vietnam trade deal, alongside expanding M2 money supply in both the U.S. and Eurozone.

These developments boosted global liquidity, a critical ingredient for fueling asset price rallies, and sent shockwaves through the crypto space.

“Bitcoin touched $109,700, its highest in three weeks, buoyed by macro optimism and ETF flows,” said Pi42 Co-Founder Avinash Shekhar. “A breakout above $110K could trigger the next bull run.”

Ethereum, on the other hand, is gaining steam with a clearer technical setup. After breaking out from $2,375, ETH surged past $2,550 with resistance at $2,665 and a breakout target of $2,800 in sight.

“ETH holds a stronger setup than BTC,” noted Riya Sehgal of Delta Exchange. “Whale accumulation and staking inflows continue despite flat retail activity.”

Altcoins Join the Rally

The crypto market rally isn’t limited to Bitcoin and Ethereum. Altcoins also showed strong upward momentum:

- Solana (SOL) gained 4%, buoyed by the $12 million inflow into the new REX-Osprey Solana Staking ETF.

- XRP rose 3%, driven by improving regulatory clarity and cross-border adoption.

- Dogecoin (DOGE) surged over 9% across two days, reflecting high-risk appetite among investors.

-

Chainlink, Avalanche, Sui, and Tron (TRX) also posted gains of up to 11%, indicating widespread bullish sentiment.

Why Is Crypto Going Up Today?

Four primary factors are driving this market rally:

1. Global Liquidity Expansion

2. U.S.-Vietnam Trade Agreement

The easing of tariffs and opening of trade channels improved investor sentiment, leading to a spike in Bitcoin futures and broad-based gains across altcoins.

3. Spot Bitcoin ETF Inflows

$407 million poured into spot BTC ETFs on July 2, reversing previous outflows and confirming institutional buy-in.

4. Technical Breakouts

Bitcoin and Ethereum both broke key resistance levels. BTC is eyeing $110,900 next, while ETH targets $2,800.

July 2025 Crypto Price Forecast

- Bitcoin remains within a consolidation channel but is now poised to break higher if it clears $110,000.

-

Ethereum is showing more technical strength with increased staking and DeFi activity.

-

XRP could rally to new highs if it breaks the $2.30 resistance and benefits from further regulatory wins.

-

Dogecoin rides the meme coin wave but still needs to overcome major resistance at $0.20.

Conclusion

This week’s rally underscores the dynamic interplay between macroeconomics, institutional inflows, and technical breakouts in shaping the crypto landscape.

Whether you’re a long-term holder or a short-term trader, the momentum suggests that the bull cycle may still have room to run, though caution remains essential in a volatile market.

The crypto market is on fire, and the next wave of innovation and profits is already unfolding. Whether you’re HODLing, staking, or trading the breakout, staying informed is your ultimate edge.

Power up your crypto IQ with real-time insights, expert analysis, and future-defining updates.

Dive into the next chapter of crypto with the Bitrue Blog, your go-to hub for everything from Bitcoin breakouts to altcoin alphas.

You must be logged in to post a comment.