by | Mar 6, 2025 | Business

Trump’s Strategic Crypto Reserve prioritizes XRP, SOL, and ADA over Bitcoin and Ethereum. Discover the reasons behind this bold move, its economic and political implications, and how it impacts the crypto market.

Since his return to the White House, President Donald Trump has taken a new approach to the cryptocurrency industry, focusing on clearer regulations and the establishment of a Strategic Crypto Reserve.

However, what has sparked widespread interest is his preference for certain digital assets—XRP, Solana (SOL), and Cardano (ADA)—over more established cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH).

Why Trump Supports XRP, SOL, and ADA

Ki Young Ju, CEO of CryptoQuant, explains that the Trump administration backs only digital assets that align with U.S. national interests. This strategic selection aims to bolster America’s financial dominance on the global stage.

According to a Zycrypto report, Young Ju noted on the platform X that the crypto industry has become a powerful tool for the U.S. to strengthen its financial influence worldwide.

By supporting these particular assets, the administration seeks to attract foreign capital into the U.S. crypto market, giving the country a competitive advantage.

Trump has instructed the Presidential Working Group to continue developing the Strategic Crypto Reserve with XRP, SOL, and ADA as key assets. Initially, Bitcoin and Ethereum were excluded, but they were later added.

However, Young Ju argues that this inclusion does not necessarily benefit BTC and ETH, as both are considered more neutral on a global scale.

Cryptocurrency as America’s Economic Weapon

Trump’s policy suggests that digital assets aligned with U.S. interests will receive regulatory protection and support. In contrast, neutral or unfavorable assets could face stricter regulations.

This shift is evident in more lenient policies toward projects that align with the administration’s agenda, such as meme coins themed around Trump.

Young Ju remarked, “Now, if something benefits Trump and supports U.S. national interests, it is no longer considered illegal.” This statement underscores the administration’s willingness to back crypto projects that follow government policies.

Community Reactions to Trump’s Crypto Policies

Despite debates about the selection of assets for the Strategic Crypto Reserve, many crypto investors welcome this policy shift. It signifies greater acceptance of the industry in the U.S. and presents opportunities to attract new capital into the market.

Since taking office again, Trump has implemented strategic crypto policies, including establishing a specialized task force to develop clearer regulations.

Some U.S. states are also drafting legislation to create Strategic Bitcoin Reserves, marking a significant shift from previous administrations’ restrictive stance on cryptocurrencies.

Understanding Trump’s Crypto Picks

In a Truth Social post, Trump confirmed that his executive order on digital assets would create a national stockpile of XRP, SOL, and ADA. This announcement surprised many traders, causing a price surge for these tokens.

Later, Trump added Bitcoin and Ethereum to the reserve. Below is a breakdown of the selected cryptocurrencies:

1. XRP

Created by U.S.-based Ripple, XRP is the world’s third-largest cryptocurrency, with $140 billion in circulation and a price of approximately $2.40 per token. Ripple promotes XRP as a faster and cheaper alternative for global fund transfers compared to Bitcoin.

Despite its volatility, XRP has gained regulatory support, with Ripple’s President Monica Long stating that the company’s political action committee (PAC) supports candidates advocating pro-crypto regulations.

2. Solana (SOL)

SOL is the token powering the Solana blockchain, often used for launching meme coins—including Trump’s own cryptocurrency, introduced in January 2025. With $73 billion worth of tokens in circulation, SOL ranks as the sixth-largest cryptocurrency.

However, it has experienced significant volatility, particularly due to its past association with former FTX CEO Sam Bankman-Fried. Despite this, Solana remains a strong Ethereum competitor, especially in the NFT market.

3. Cardano (ADA)

Founded in 2015 by Ethereum co-founder Charles Hoskinson, Cardano (ADA) has $31.4 billion in circulation, making it the eighth-largest cryptocurrency.

ADA experienced a substantial price increase of over 70% following Trump’s announcement. Cardano’s decentralized structure includes five key entities, including the Switzerland-based Cardano Foundation and the for-profit company Emurgo.

4. Bitcoin (BTC)

As the world’s first and most valuable cryptocurrency, Bitcoin has a market cap exceeding $1.7 trillion, accounting for over half of the $3 trillion digital asset market. The SEC’s approval of Bitcoin ETFs in January 2024 and Trump’s pro-crypto stance have contributed to its price surge.

However, Bitcoin’s decentralized nature means it lacks direct political alignment, making its initial omission from the Strategic Crypto Reserve surprising.

5. Ethereum (ETH)

Ethereum powers decentralized finance (DeFi) applications and smart contracts. Founded by Vitalik Buterin, it remains the second-largest cryptocurrency.

Trump-affiliated company World Liberty Financial has issued digital tokens on Ethereum, raising over $500 million. The Ethereum blockchain continues to play a major role in reshaping global finance.

The Political and Economic Implications

Trump’s crypto reserve announcement has generated discussions about his administration’s broader economic strategy. The initial exclusion of Bitcoin raised concerns among BTC proponents who view it as the cornerstone of decentralized finance.

Some analysts argue that prioritizing XRP, SOL, and ADA over Bitcoin and Ethereum could introduce volatility and political risk.

David Sacks, Trump’s Crypto Czar, and Bo Hines, Executive Director of the initiative, have faced criticism for their handling of crypto policy.

Critics point to Trump’s controversial meme coin launches ($TRUMP and $MELANIA) and argue that the administration lacks deep expertise in digital asset regulation.

Potential Risks and Future Developments

The inclusion of relatively illiquid assets like XRP, SOL, and ADA in the Strategic Crypto Reserve could pose financial risks. Bitcoin’s daily trading volume far exceeds that of these tokens, making it the most stable choice for a national reserve.

Solana has experienced periodic network outages, and XRP’s centralized governance has drawn scrutiny.

If any of these tokens collapse, the administration may face political fallout, damaging trust in government-backed crypto policies. The Terra (LUNA) crash in 2022 and the FTX scandal serve as reminders of the volatility and regulatory risks in the digital asset market.

The Road Ahead: Bitcoin’s Rising Influence

Despite the focus on XRP, SOL, and ADA, Bitcoin remains the most dominant digital asset. Trump’s policies, while seemingly favoring certain tokens, have indirectly boosted Bitcoin’s appeal as the most liquid and decentralized cryptocurrency.

Following Trump’s announcement, Bitcoin’s price surged by approximately 7%, adding nearly $100 billion to its market cap.

The upcoming White House Crypto Summit, led by Sacks and Hines, will provide further clarity on the administration’s long-term digital asset strategy. If Trump pivots toward prioritizing Bitcoin’s security and liquidity, the U.S. could emerge as a leader in the digital financial revolution.

Conclusion

Trump’s approach to cryptocurrency represents a paradigm shift in U.S. digital asset policy. While the Strategic Crypto Reserve prioritizes XRP, SOL, and ADA, Bitcoin remains the most significant player in the market.

The administration’s regulatory stance will shape the future of crypto adoption in the U.S., influencing global financial markets. Whether this initiative succeeds or encounters regulatory hurdles remains to be seen, but one thing is clear—cryptocurrency is now firmly on the national agenda.

by | Mar 6, 2025 | Business

Discover the latest XRP price prediction for 2025-2027. Can XRP still deliver big returns? Explore key factors like legal developments, banking partnerships, whale activity, and market trends to determine its future potential. Read more now!

Have you checked the XRP price prediction recently and wondered if it still has the potential for big gains? You’re not alone. XRP gained popularity due to its promise of instant, low-cost international money transfers, attracting banks and financial institutions worldwide.

However, with regulatory challenges and increasing competition, investors now question whether XRP can reclaim its former glory or if its time has passed.

So, what does the future hold for XRP? Let’s take a deep dive into its price history, predictions for 2025 and beyond, and the key factors influencing its trajectory.

XRP Price History: A Quick Look Back

Understanding XRP’s past performance is crucial for predicting its future. XRP hit an all-time high (ATH) of $3.84 in January 2018 during the crypto boom. However, its price dropped significantly to around $0.20 following the SEC lawsuit against Ripple in December 2020.

Ripple later secured legal victories, which restored investor confidence. By July 2023, XRP had rebounded to around $0.80. As of March 6th 2025, XRP is trading around $2.6, reflecting investor caution amid ongoing regulatory uncertainty.

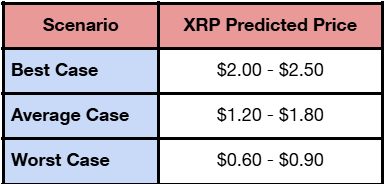

XRP Price Prediction for 2025: A Detailed Outlook

Predicting XRP’s future price is challenging, but we can make educated guesses based on legal developments, partnerships, adoption rates, and competition.

Positive Factors for XRP in 2025

1. Legal Clarity: A favorable settlement in Ripple’s SEC lawsuit could trigger a significant price surge. If Ripple gains full regulatory approval, XRP could surpass $1.50 by late 2025.

2. Banking Partnerships: Ripple’s existing partnerships with major banks like Santander and Bank of America may expand, pushing XRP’s price towards $2.00.

3. Increasing Adoption: XRP’s efficient cross-border payment technology is well-suited for international transactions, particularly in Asia. Wider adoption could drive prices higher.

Potential Risks and Challenges

- Regulatory Uncertainty: Unfavorable legal developments could stall XRP’s growth, keeping it under $1.00.

- Competition: Cryptos like Stellar (XLM) offer similar services. Strong competition could limit XRP’s upside potential, capping its price below $1.50.

XRP Price Range in 2025

Considering Ripple’s resilience and growing adoption, XRP is likely to trade around $1.50 by late 2025—potentially offering a 200% gain from today’s price.

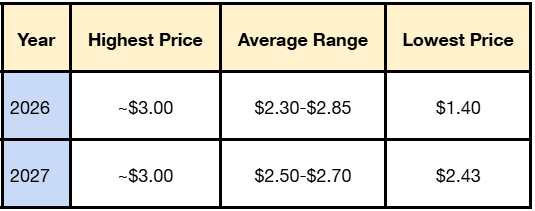

Short-Term XRP Crypto Price Predictions: 2026 and 2027

1. XRP in 2026

– Early 2026: Strong start, with XRP reaching $2.83 in January and peaking at $3.04 in March.

– Mid-2026: Consolidation phase between $2.30 and $2.85 as investors secure profits.

– Late 2026: Prices stabilize around $2.35 to $2.56, indicating steady investor confidence.

2. Investor Tips for 2026

- Consider taking profits when XRP peaks at around $3.00.

-

Monitor regulatory developments closely.

-

Be prepared for volatility, offering multiple entry and exit points.

3. XRP in 2027

– Early 2027 (Jan-Apr): XRP hovers around $2.50, indicating cautious investor sentiment.

– Mid-2027 (May-Aug): A bullish rally could push XRP to $2.95.

– Late 2027 (Sep-Dec): Stability returns, with XRP trading between $2.53 and $2.71.

Whale Activity and Market Sentiment

Recent whale activity suggests strong confidence in XRP’s long-term potential. Over the past week, whale addresses holding between 100 million and 1 billion XRP added 1.34 billion tokens, worth over $3.26 billion.

Despite an 18% price crash, whales continued accumulating rather than selling, signaling bullish sentiment.

Additionally, XRP’s Price DAA Divergence, a market indicator, has issued a buy signal, suggesting potential price increases. XRP also remains above its $2.33 support level, having posted a 37% price increase after a weekend of high volatility.

The Impact of Ripple’s Strategy and Market Developments

Ripple’s ongoing legal battle with the SEC remains a critical factor for XRP’s future. A favorable ruling could trigger institutional adoption, while further regulatory challenges may hinder growth.

The Trump Factor and Market Volatility

U.S. President Donald Trump’s proposal to create a national crypto reserve—including XRP—boosted its price to $2.99. However, the rally was short-lived, with XRP falling back to $2.50 due to market sell-offs.

Meanwhile, South Korean traders have been aggressively accumulating XRP, with Upbit now holding “twice as much” XRP as Binance. Upbit accounts for over 14% of global XRP trading volume, reinforcing South Korea’s growing influence in the market.

Ripple’s Controversial XRP Sales and Market Manipulation Concerns

Ripple’s Chief Technology Officer, David Schwartz, defended the company’s right to sell XRP tokens, sparking debate over market manipulation concerns.

Meanwhile, a dormant wallet containing over $7 billion in XRP—linked to Ripple co-founder Chris Larsen—has raised further questions.

Recent transactions indicate at least $109 million in XRP was moved to exchanges in early 2025, fueling speculation over Ripple’s financial strategy.

Technical Analysis: XRP Price Levels to Watch

1. Support Level: $2.33

2. Key Resistance Levels: $2.70 and $2.95

3. Breakout Potential: If XRP surpasses $2.70, it could target $3.50 in the coming weeks.

In the BTC trading pair, XRP is recovering towards the 3400 SAT resistance level. If it breaks through, a further rally could follow.

Conclusion: Is XRP Still a Good Investment?

Despite past setbacks, XRP remains one of the most actively traded cryptocurrencies. Its legal battles, adoption by financial institutions, and whale accumulation indicate strong long-term potential. However, risks such as regulatory uncertainty and market competition remain significant.

For investors, XRP offers potential upside, particularly if Ripple secures a favorable SEC ruling and expands partnerships. A 200% gain by late 2025 is possible, making XRP attractive for those seeking steady, long-term returns.

However, volatility will remain high, so investors should stay informed and adjust their strategies accordingly.

by | Mar 6, 2025 | Business

PAWS is set for its highly anticipated exchange listing on March 18, 2025! Learn about its origins, Solana migration, tokenomics, airdrop details, and price predictions. Will PAWS be the next big Web3 success story? Read now!

The cryptocurrency market is excited as PAWS, a promising new token born from a Telegram mini-app, officially announces its Token Generation Event (TGE) and exchange listing.

Scheduled for March 18, 2025, the event is expected to mark a major milestone for the project and its rapidly growing community.

The Rise of PAWS: From Telegram Mini-App to Web3 Powerhouse

Initially developed as a mini-app within Telegram, PAWS quickly gained traction among users, amassing over 85 million onboarded users and 50 million monthly active users (MAU). However, regulatory shifts within Telegram, specifically the centralization of its ecosystem under The Open Network (TON), prompted PAWS to take a new direction.

To maintain its decentralized ethos, PAWS transitioned to Solana, leveraging its robust blockchain infrastructure to expand accessibility, scalability, and security.

This strategic migration has already yielded impressive results. Within just 48 hours of integrating with Phantom Wallet, PAWS witnessed over nine million downloads, showcasing its immense popularity and potential in the decentralized finance (DeFi) landscape.

PAWS Tokenomics and Airdrop Strategy

In preparation for its TGE, PAWS has released crucial details regarding its tokenomics and distribution strategy:

– Total Supply: 100 billion PAWS tokens

– Airdrop Allocation:

- 62.5% distributed to PAWS app users for current and future incentives

- 7.5% reserved for Solana OG communities

– Exchange Listings: The token will be available on both decentralized exchanges (DEX) and centralized exchanges (CEX) from day one

– Token Claim: Eligible users can claim their PAWS tokens via the official website

The emphasis on community-driven tokenomics underscores PAWS’ commitment to fostering organic growth, a stark contrast to projects that rely heavily on venture capital funding and traditional marketing strategies.

Speculation on Exchange Listings and Price Predictions

With the official listing date confirmed, speculation is mounting over which major exchanges will support PAWS trading.

While the PAWS team has yet to release an official statement regarding its listing venues, cryptic hints—including recurring mentions of “BBB”—have led many to believe that Binance, Bybit, and Bitget could be among the first to list the token.

Other prominent exchanges such as KuCoin, MEXC, Gate.io, and OKX are also being closely monitored.

Price predictions for PAWS are equally intriguing. Analysts estimate an initial trading range between $0.009 and $0.010, drawing comparisons to similar meme-based tokens such as Hamster Kombat ($HMSTR), which debuted with a comparable total supply.

If PAWS sustains its current momentum and successfully executes its roadmap, its valuation could rise to $0.030–$0.050 in the mid-term. A potential Binance listing could catalyze further price appreciation, with some experts speculating that PAWS could eventually reach the $1 mark.

The PAWS Airdrop: How to Participate

The PAWS airdrop program is one of the most anticipated in the crypto space. Eligible users who actively engaged with the PAWS mini-app before December 30, 2024, will receive PAWS tokens. To qualify, participants must have:

- Frequently used the PAWS mini-app on Telegram

-

Complete in-app tasks to earn PAWS points

-

Linked their TON wallet before the snapshot date

While the exact distribution timeline has yet to be finalized, the PAWS team continues to provide regular updates to ensure a seamless token claim process.

Conclusion: Is PAWS Truly a New Web3 Success Story?

With its bold move to Solana and its commitment to community-driven growth, PAWS is positioning itself as a formidable force in the cryptocurrency landscape.

Drawing inspiration from successful Web3 projects such as Pudgy Penguins, Berachain, and Doodles, PAWS aims to transcend its origins as a meme coin and become a major player in the decentralized ecosystem.

As the March 18, 2025, listing date approaches, all eyes are on PAWS and its potential to disrupt the market. Whether it can live up to its high expectations remains to be seen, but one thing is certain—PAWS is a project that cannot be ignored.

by | Mar 6, 2025 | Business

Metro Finance, one of Australia’s leading independent non-bank lenders for asset finance, has followed on from its recent consumer survey findings, sharing responses from Australian businesses and revealing a range of impacts as cost of living pressures continue to bite consumer spending.

The business survey, responded to by 1,000 Australian employed and self-employed workers, indicates a spread of both economic optimism and belt-tightening.

When it came to business spending, respondents earmarked two primary costs for their own business or their employer’s in 2025: 39.9 per cent cited human resources, which includes training and benefits programs, as a key cost for the year ahead, while 42.3 identified supplier costs of producing goods and services being the main consideration.

Despite the expectation that goods and services will cost more in 2025 (a sentiment shared with recent respondents of Metro’s consumer survey), 66.4 per cent of respondents did not think their business would seek financing in 2025. This figure, however, contrasts with the overwhelming majority of those surveyed who remain confident of securing business finance if needed, at 72.1 per cent.

42.3 per cent of respondents also suspected the need to improve business cashflow would be the main motivator to seek financing in 2025.

Metro Finance CEO, David Albest, commented on the latest trends in the business survey.

“As we saw recently with the results of Metro’s 2025 consumer survey, there is a general sense of the market cautiousness, as businesses and their customers both take a hard look at their budgets, and make prudent decisions based on some uncertain market conditions,” David said.

From an operational point-of-view, increasing revenue (32.1 per cent), improving cashflow (29.7 per cent) and reducing debt (27 per cent) were the primary business goals for FY25, with respondents’ businesses reacting to inflation, higher interest rates and slower consumer spending. 38.7 per cent of all respondents also acknowledged that their business was cutting costs in a bid to improve net profit.

Interestingly, while saving costs and conserving budgets were recurrent themes with those surveyed, sustainability and initiatives to tackle waste and energy consumption are appearing to be adopted by businesses around the country.

39.6 per cent identified recycling as a way businesses were including sustainability in their operations, while 27.6 per cent flagged solar energy technology.

19.6 per cent of survey respondents also acknowledged low or zero emission vehicles as a feature of businesses’ sustainability efforts.

David Hall, National Novated Manager at Metro, commented on the proliferation of low and zero emission vehicles being provided to employees through salary packaging.

“Metro’s novated leasing offering is contuinuing to experience growth, with over 18,000 cars, of which 11,000 were low or zero-emission vehicles, being leased by employees through their employers in 2024,” David explained.

“What we’re seeing from a market perspective is novated leasing is an increasingly popular way for businesses to retain staff and incentivise high-performers, while at the same time helping employees’ household budgets save money by reducing their tax liability and providing consistency and predictability in their repayments. At a time of market volatility, this can been extremely beneficial for both sides of the fence,” David continued.

Investing in sustainability, either by adopting new processes and initiatives, or updating business assets, is also generating positive residual benefits for businesses in 2025: 35.7 per cent of respondents believed their business was well-respected in the community because of its sustainability efforts.

26.4 per cent cited customers seeing sustainable business as industry leaders, with 19.9 per cent also attributing greater B2B engagement because of their respective company’s sustainability initiatives. 16.4 per cent, however, believed that customers saw sustainable businesses as being more expensive than competitors.

Recently, Metro’s MetroEco green lending program received an additional $50 million funding commitment from the Clean Energy Finance Corporation (CEFC) – this new investment doubles the CEFC’s total commitment to $100 million, highlighting the strong demand from businesses ready to embrace sustainability in a number of different ways.

Since launching MetroEco in July 2024, Metro has supported over 4,000 electric vehicles hit the road across 26 different brands, along with funding energy-efficient equipment and battery technology — all made possible with competitive interest discounts for eligible green assets.

As a partner of Greenfleet, the Metro business offset 2,134 tonnes of carbon in 2024, and contributed $49,968 to sustainability efforts such as revegetating 547 hectares of land which included 460 hectares of protected koala habitat. Since joining Greenfleet in 2023, Metro has offset 4,015 tonnes of carbon, and contributed $80,815.

Following the trends: consumers watch their pennies

As businesses take a conservative approach to FY25, consumers are no-doubt influencing the current trend of belt-tightening; also identified in Metro’s Australia-wide consumer survey, which also saw 1,000 respondents take part.

Key findings of the Metro consumer survey (Jan 2025):

-

44 per cent of all respondents shop around for the best price on fuel, and will only buy on days where it is historically lower at the bowser

-

48.9 per cent of households surveyed said that saving money on energy utilities would be their main interest in upgrading their home’s technology

-

41.3 per cent said they would not currently purchase an electric vehicle (EV), with 41.5 per cent claiming that they do not consider EVs mobility to be durable, regardless of brand

-

29 per cent, however, indicated they would opt for an EV made by an established mainstream brand already selling internal combustion engine (ICE) vehicles in the market

-

66.2 per cent said they would consider either a plug-in or mild hybrid for their next vehicle

-

33.4 per cent, would like to save as much as possible and would consider a loan on an electric vehicle if the rate was cheaper

-

52.9 per cent cited concerns over petrol prices as being a key motivator for a hybrid vehicle purchase

-

33.7 per cent have recently established a new household budget

-

43.7 per cent said they would, or have already switched brands to more affordable options

by | Mar 6, 2025 | Business

On March 14, 2025, the PROTECT International Conference Series on “Doing Business Amidst New Threats” will take place at the New World Makati Hotel.

The international community is facing an evolving different threat to global peace and security. While the global security risk and threat in 2024 may be described as “unprecedented”, 2025 may be described as “unconventional”. We see this in geopolitical tensions, gray zone warfare actions, AI arms race, rising insider threats, fragmented extremism and other developments. PROTECT 2025 conference on Doing Business Amidst New Threats will deep dive into these security challenges.

On March 14, 2025, the PROTECT International Conference Series on “Doing Business Amidst New Threats” will take place at the New World Makati Hotel.

The event will feature prominent speakers, distinguished panelists, and thought leaders from various sectors as they discuss key issues affecting businesses today. From cyber threats and health security to climate change and cross-border crimes, the conference will address how these complex issues intersect and how businesses can navigate these volatile landscapes.

For more information on the forum, contact the Secretariat: le******@*******************al.com

The Opening Address will be delivered by Secretary Eduardo Año, National Security Adviser to the National Security Council. Gen. Romeo S. Brawner, Jr. PA, Chief of Staff of the Armed Forces of the Philippines will deliver the Keynote Address.

Digitalization And Cyber Threats will be featured in three panel discussions on Digital Identity, Cyber Threats, and The Legal Aspects of Cybercrime.

Digital technology has been changing the ways businesses are done and will continue to do so each year. Meantime, cyber threat actors are applying more advanced and sophisticated technologies to challenge cybersecurity. Understanding what is happening in the world now is therefore no longer an option but is an absolute necessity. The future is rapidly developing whether we like it or not. Adapting to change, if not done strategically can be disastrous.

A Session on Human and Health Issues aims to provide an awareness of human health security and the interactions of key issues and events. Moderated by Dr. Kenneth Hartigan-Go, discussions will cross cut through health, education, and security.

Environmental/Climate Issues will be the subject of one session. The changing environment affects the business world. They impact on business practices from resources, to supply chain, to logistics, to energy sources, to customer behavior and demographics.

Cross-border phenomena concern both international and domestic security. Heightened concerns about transnational crimes are a consequence of advances in transportation and telecommunication. Many times, businesses become instruments or victims of such crimes.

A session on Transnational Issues will start with a presentation on Crime- Terror Nexus by Global Security Expert Prof. Rohan Gunaratna of the S. Rajaratnam School of International Studies, Nanyang Technological University, Singapore. This will be followed by a Panel Discussion on cross-border phenomena.

The National Issues session will discuss two major security challenges confronting the Philippines today: state-sponsored cyber challenges and the country’s relations with the US and China.

You must be logged in to post a comment.