by | Mar 20, 2025 | Business

XRP surges nearly 10% as the SEC drops its lawsuit against Ripple, marking a major win for crypto. Discover how regulatory shifts and political changes are shaping XRP’s future, potential ETF approvals, and market growth. Stay updated on the latest XRP news!

The cryptocurrency world witnessed a significant development on Wednesday as the U.S. Securities and Exchange Commission (SEC) decided to drop its long-running lawsuit against Ripple, the company closely associated with the digital asset XRP.

The announcement, made by Ripple CEO Brad Garlinghouse, sent XRP’s price soaring by 10%, reaching a high of $2.55 before settling slightly lower at $2.49.

A Long-Awaited Victory for Ripple and the Crypto Industry

In a video posted on X, Garlinghouse expressed relief and triumph over the conclusion of the legal battle. “It’s over,” he declared, emphasizing that the nearly four-year legal dispute had been a painful but necessary journey to establish legal clarity for the crypto industry.

The SEC initially sued Ripple in December 2020, accusing the company of selling XRP as an unregistered security.

This legal battle became one of the most consequential cases for the crypto industry, as it had far-reaching implications on how cryptocurrencies would be classified and regulated in the U.S.

In a partial victory for Ripple, U.S. District Judge Analisa Torres ruled in 2023 that while Ripple had violated securities laws in its institutional sales, its programmatic sales to retail investors did not constitute an unregistered security offering.

The SEC appealed this ruling in 2024, but its decision to drop the appeal marks the final chapter of the case.

Political Shifts and SEC’s Changing Stance on Crypto

The SEC’s decision to abandon its appeal is part of a broader shift in regulatory oversight following President Donald Trump’s return to office in 2025.

Under former SEC Chair Gary Gensler, appointed by President Joe Biden, the agency aggressively pursued lawsuits against major crypto firms such as Coinbase, Kraken, and Gemini.

Gensler asserted that most cryptocurrencies were unregistered securities and required strict regulatory compliance.

However, following Trump’s victory, the SEC has taken a markedly different approach. Mark Uyeda, a conservative SEC commissioner, took over as acting chair and initiated a restructuring of the agency’s crypto enforcement division.

Pro-crypto Commissioner Hester Peirce has since led efforts to establish a more industry-friendly regulatory framework. As part of this shift, the SEC has dropped lawsuits and investigations into major crypto entities, including Binance, Kraken, Yuga Labs, and Ripple.

The Impact on XRP and the Crypto Market

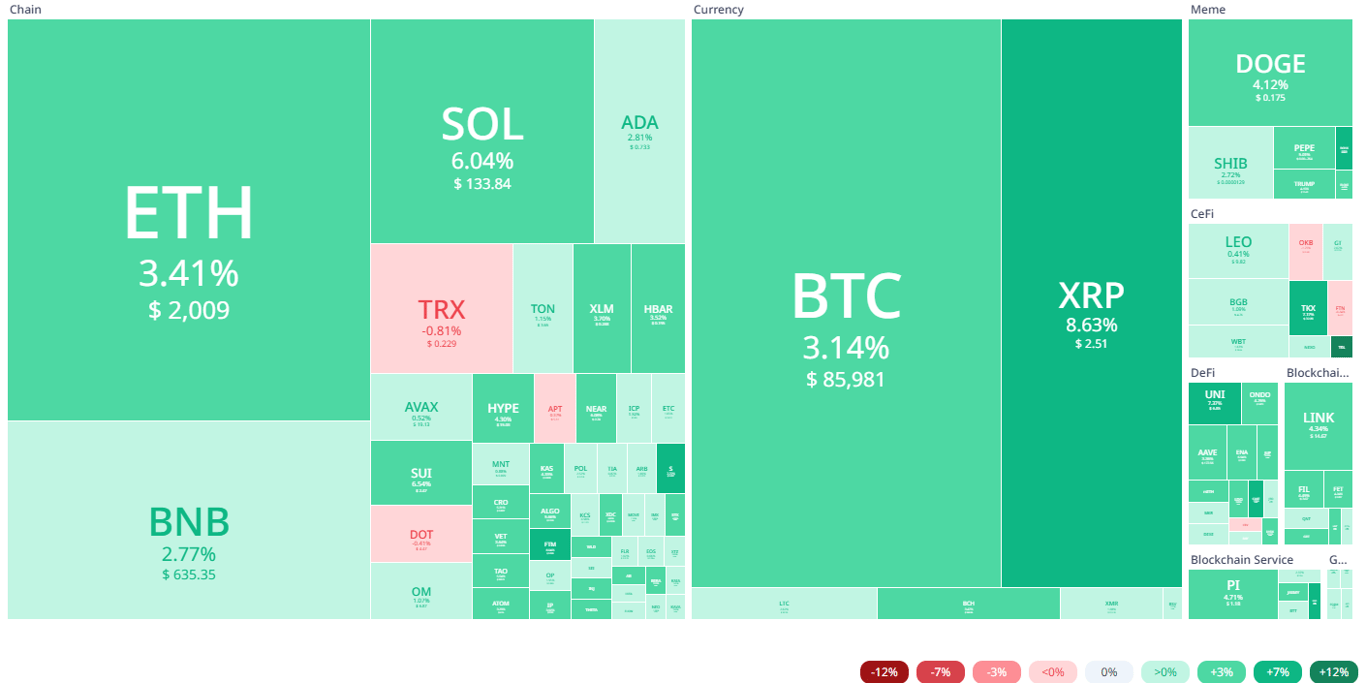

The SEC’s withdrawal of the Ripple case has significantly impacted XRP, which surged 8.63% on Thursday afternoon.

This price spike is part of a broader trend, with CNBC recently naming XRP “the biggest winner” in the post-election economy. Since Trump’s victory, the coin’s value has skyrocketed by 400%.

Despite this rally, the overall crypto market has faced downward pressure in recent months.

Bitcoin briefly rose above $85,000 following the announcement before experiencing a slight dip. Nonetheless, XRP remains a standout performer, reflecting growing investor confidence in Ripple’s future.

Ripple’s Political Contributions and Future Prospects

Ripple and its executives have actively engaged in political lobbying, contributing over $70 million to the pro-crypto Fairshake super PAC and over $5 million to Trump’s inaugural fund.

These strategic donations underscore the increasing intersection of cryptocurrency and politics, with industry leaders pushing for favorable regulations.

With the SEC lawsuit now behind it, Ripple’s future appears promising. Speculation is mounting about the approval of an XRP exchange-traded fund (ETF), which could further legitimize the asset and drive adoption.

Major investment firms like Grayscale, Bitwise, and Franklin Templeton have already filed for such an ETF, with Bloomberg analysts estimating a 65-75% chance of approval by year-end.

A New Era for Crypto Regulation

The SEC’s recent policy shift signals a new era for crypto regulation in the U.S. The agency has abandoned its 2022 proposal requiring certain crypto firms to register as alternative trading systems, a move that would have imposed stricter oversight.

Additionally, it has initiated a crypto task force to work on defining digital asset classifications and establishing clear regulatory guidelines.

“The system just feels broken,” Garlinghouse said at the Digital Assets Summit in New York. “We had to fight this fight for the industry while the SEC attacked us. There were no victims, no investor losses. They were just not acting in good faith.”

As the SEC takes a more collaborative approach under the new administration, crypto firms are optimistic about regulatory clarity and market growth.

The industry now looks ahead to further developments, including potential ETF approvals and expanded use cases for blockchain technology.

Conclusion

Ripple’s legal victory marks a significant turning point for both the company and the broader crypto industry. As regulatory winds shift in favor of digital assets, XRP’s resurgence highlights investor optimism and the potential for increased adoption.

While uncertainties remain, one thing is clear—Ripple has emerged stronger from this battle, setting a precedent for the future of cryptocurrency regulation in the United States.

by | Mar 20, 2025 | Business

Ripple secures a major legal victory as the SEC drops its appeal, reinforcing XRP’s legitimacy and fueling market optimism. Could this lead to an XRP spot ETF and further price gains? Stay updated on Ripple’s next moves and the evolving crypto landscape.

The long-standing legal battle between Ripple vs the U.S. Securities and Exchange Commission (SEC) took a dramatic turn on March 19, 2025, when the SEC announced it was withdrawing its appeal against Ripple.

This development marks a significant victory not only for Ripple but for the broader cryptocurrency industry, signaling a shift in regulatory oversight under the new U.S. administration.

SEC Drops Appeal, Ripple Gains Upper Hand

Ripple CEO Brad Garlinghouse shared the news on X, calling it “the moment we’ve been waiting for,” while Ripple’s Chief Legal Officer, Stuart Alderoty, emphasized that the company is now in the driver’s seat.

This decision confirms that XRP is not a security and that programmatic sales of XRP do not qualify as investment contracts.

The SEC had initially filed its appeal in January 2025, just before the departure of SEC Chair Gary Gensler.

Many drew parallels between this move and the agency’s 2020 lawsuit against Ripple, which was filed days before former SEC Chair Jay Clayton stepped down.

However, the regulatory landscape has since changed, with President Donald Trump’s pro-crypto stance reshaping the SEC’s approach to digital assets.

XRP Market Reaction and Price Movement

Following the SEC’s reversal, XRP surged to a session high of $2.5073 before stabilizing. Despite the gains, XRP has yet to reclaim its January 2025 peak of $3.3999 or its all-time high of $3.5505.

Nevertheless, the ruling has bolstered market confidence in Ripple and XRP’s long-term potential.

Ripple’s Next Move: Cross-Appeal or Settlement?

While Ripple celebrates the SEC’s withdrawal, the company still faces a decision on whether to proceed with its cross-appeal. In August 2024, Judge Analisa Torres ordered Ripple to pay a $125 million fine for violating U.S. securities laws.

Ripple had responded with a cross-appeal in October 2024, seeking to overturn certain aspects of the judgment.

Legal experts outline four possible scenarios for Ripple:

1. Continue the cross-appeal – This could result in a ruling from an appellate court on whether investment contracts require contracts.

2. Drop the cross-appeal and attempt to amend the judgment – This could potentially reduce the $125 million penalty.

3. Drop the cross-appeal and settle with the SEC privately – This would provide certainty but might not overturn previous rulings.

4. Pay the fine and move forward – This would allow Ripple to focus on business expansion.

While some speculate that a settlement might be the cleanest resolution, others believe that Ripple will push for a complete reversal of the penalties imposed.

Potential for an XRP Spot ETF

The SEC’s decision to drop its appeal also strengthens the case for an XRP spot Exchange-Traded Fund (ETF).

The approval of such an ETF could significantly boost institutional demand for XRP, similar to how Bitcoin’s spot ETF approval in January 2024 contributed to BTC’s surge past $109,000. Analysts predict that an XRP ETF could drive prices toward $5 if approved.

Crypto Regulation Under the Trump Administration

Since Donald Trump’s return to office, the SEC has taken a more lenient approach toward crypto. In addition to ending its case against Ripple, the agency has dismissed or paused legal actions against major exchanges like Coinbase and Kraken.

Trump has also nominated Paul Atkins, a pro-crypto legal expert, to replace Gary Gensler as SEC Chair.

Ripple was a key donor in the last congressional election cycle, and its leadership has maintained close ties with the Trump administration. The company’s strategic positioning could further influence regulatory decisions in favor of crypto adoption.

Conclusion: What’s Next for XRP?

Despite the SEC’s retreat, several factors will continue to shape XRP’s price and market position:

1. Ripple’s Cross-Appeal: A successful appeal could propel XRP beyond its all-time high of $3.55.

2. ETF Approval: Institutional inflows from an XRP spot ETF could push prices toward $5.

3. Global Economic Conditions: Market uncertainties, including trade tensions and recession risks, could impact short-term price action.

The coming months will be crucial for Ripple as it decides its next legal and business moves. While the battle with the SEC may be ending, the future of XRP and its role in the broader financial ecosystem remains an evolving story.

by | Mar 20, 2025 | Business

Global online fashion and lifestyle retailer SHEIN is excited to announce the official launch of its Affiliate Program in Australia, offering content creators, influencers, and digital entrepreneurs an opportunity to collaborate with one of the world’s fastest-growing fashion brands.

“We are thrilled to introduce the SHEIN Affiliate Program in Australia, providing content creators and online entrepreneurs with a seamless way to monetize their influence,” said a SHEIN spokesperson.

“This program is designed to empower affiliates with the tools and incentives needed to drive engagement and revenue while connecting their audiences with affordable, trend-forward fashion.”

The SHEIN Affiliate Program has been successfully implemented in various international markets, including the United States, United Kingdom, Canada, Germany, Italy, Spain, and Mexico. The launch of this program in Australia signifies SHEIN’s dedication to fostering digital entrepreneurship and supporting the local creator economy.

By offering Australian content creators and digital entrepreneurs the opportunity to collaborate through the affiliate program, SHEIN reinforces its commitment to the Australian market, fostering mutually beneficial relationships and enhancing brand engagement within the region.

The program is now open to Australian fashion influencers, bloggers, content creators, and digital marketers, aged 18 and above.

Upon signing up, new affiliates receive a $3 reward. If they successfully refer an order within the first 90 days, they will earn an additional $5, bringing the total reward to $8.

Key Benefits of the SHEIN Affiliate Program:

Competitive Commission Structure – Commissions earned on sales generated through unique affiliate links.Exclusive Promotions – Firsthand access to new collections, seasonal campaigns, and special discount codes.Advanced Tracking & Insights – Utilize robust analytics to track performance and optimize earnings.Global Brand Association – Partner with a leading e-commerce fashion platform with millions of customers worldwide.

How to Join:Australian creators interested in partnering with SHEIN can sign up via the SHEIN Affiliate Program portal: https://onelink.shein.com/4/4316m01tv2pm and start earning commissions by promoting their favourite SHEIN style.

by | Mar 20, 2025 | Business

Interior Diary announces its focus on Japandi design, blending Japanese minimalism with Scandinavian coziness for timeless, balanced interiors.

This fusion style is perfect for Singapore’s compact homes, emphasizing clean lines, natural materials, and muted palettes to create airy, clutter-free spaces.

The firm tailors Japandi to local living environments, ensuring both style and functionality. Directors highlight how the design philosophy promotes calm and well-being, transforming homes into restorative sanctuaries.

With a commitment to craftsmanship and sustainable practices, Interior Diary is positioning itself as a leading voice in the Japandi movement, inspiring homeowners to embrace intentional living.

Singapore, March 19, 2025 — Interior Diary, a leading interior design firm in Singapore, proudly announces its focus on Japandi design as part of its evolution towards premium renovations. By fusing the elegance of Japanese minimalism with the warmth of Scandinavian functionality, Interior Diary is redefining contemporary living spaces, offering homeowners a sanctuary of style, serenity, and purpose.

The Rise of Japandi: A Perfect Fusion of East and West

Japandi design, a harmonious blend of Japanese Wabi-Sabi principles and Scandinavian hygge, has become increasingly popular for its ability to create calm, clutter-free spaces that are both aesthetically beautiful and highly livable. This hybrid style marries clean lines, natural textures, and muted color palettes, resulting in interiors that feel timeless, cozy, and effortlessly chic — perfect for Singapore’s modern homeowners seeking balance in their living environments.

“Japandi perfectly encapsulates what many homeowners are looking for today — a space that feels tranquil yet inviting, minimal yet full of character. It’s not just a design style; it’s a lifestyle,” says Gary Ng, Director of Interior Diary.

Tailoring Japandi for Singaporean Homes

Singapore’s compact living spaces make Japandi an ideal design choice. The style’s emphasis on thoughtful curation, multifunctional furniture, and maximizing natural light aligns perfectly with the needs of HDB flats (like this 4 room HDB in the North West of Singapore) and condominiums. Interior Diary expertly adapts these principles, crafting homes that feel spacious, breathable, and connected to nature — even in the heart of the city.

Key design elements include:

Natural Materials: Soft woods, stone, rattan, and linen to create an organic, grounded feel.

Neutral Palettes: Earthy tones like beige, taupe, and soft greys, accented by muted greens and blues.

Clean Lines & Minimalist Layouts: Uncluttered spaces with sleek, functional furniture to promote flow and openness.

Handcrafted Touches: Artisan ceramics, paper lanterns, and simple decor that add personality without overwhelming the space.

“We love how Japandi allows us to create homes that are not only visually stunning but also deeply restorative. It’s about stripping away excess and focusing on what truly enhances your daily life,” shares Steven Loh, Co-Director of Interior Diary.

Premium Craftsmanship & Thoughtful Design

Interior Diary’s commitment to quality craftsmanship and attention to detail make it the perfect partner for homeowners seeking to bring Japandi into their living spaces. From selecting sustainable materials to working with skilled artisans, the firm ensures every project reflects the authenticity and artistry that define Japandi design.

The team takes a holistic approach, considering everything from lighting and spatial flow to texture and sensory balance. The result is a cohesive living environment that feels effortlessly polished yet invitingly personal — a place where every element serves a purpose and contributes to a greater sense of harmony.

Sustainable Living Through Design

Japandi’s focus on natural materials and longevity aligns with Interior Diary’s commitment to sustainable design practices. The firm carefully sources eco-conscious materials and advocates for quality, timeless pieces over mass-produced trends. This ensures that the spaces they create are not only beautiful but also environmentally responsible and built to last.

A Leading Voice in Japandi Design

As Japandi continues to captivate design enthusiasts globally, Interior Diary aims to be a leading voice for this movement in Singapore. The firm plans to host open houses, collaborate with local artisans, and share educational content on social media to inspire more homeowners to embrace the beauty of simplicity and intentional living.

By championing Japandi in Singaporean homes, Interior Diary hopes to shift the conversation around interior design — encouraging people to see their homes not just as places to live, but as sanctuaries that nurture well-being, creativity, and meaningful connections.

by | Mar 20, 2025 | Business

Indonesia, with its stunning landscapes and rich cultural heritage, has become an attractive destination for foreign property investors. Whether you’re a tourist enchanted by the country’s beauty, an investor looking for lucrative opportunities, or a retiree seeking a serene abode, Indonesia offers a range of property options to suit your needs. This guide aims to provide an in-depth look at foreign property ownership in Indonesia, highlighting recent regulatory changes, investment requirements, and the advantages of using professional services to navigate the process.

In recent years, Indonesia has made significant strides in simplifying the process for foreigners to own property. In this article, you will be informed about the property ownership in Indonesia as well as how you can purchase the property in Indonesia.

Types of Property Ownership in Indonesia

1. Hak Pakai (Right to Use)

Hak Pakai is a legal framework that allows foreigners to own property in Indonesia under the “right to use” title. This type of ownership is typically granted for an initial period of up to 30 years and can be extended. It is particularly popular among expatriates and retirees who wish to live in Indonesia long-term as this can be owned by foreign individuals.

The ownership of the Right to Use can be granted to the individual foreigners with certain requirements and limitations such as the minimum amount of transaction, the maximum size of the land, and the possession of the Temporary Stay Permit (KITAS) and Permanent Stay Permit (KITAP). These amounts vary depending on the location and type of property. Generally, urban areas and prime locations require higher investment amounts compared to rural or less developed regions.

Under Right to Use, the foreigner can own a house or residence in the form of a landed house or commercial apartment. The subsidized apartments are prohibited to be owned by foreigners so that you can only buy a commercial apartment. Meanwhile for the landed house, there are minimum requirements as below:

A house with a luxury house category in accordance with the provisions of the legislation; you may anticipate a regulation in each region/province/city to set out the minimum price of a luxury house category.1 (one) plot of land per person/family. In terms of having a positive impact on the economy and social, the landed house can be granted for more 1 (one) plot of the land or more than 2.000m2with permission from the Minister; and/orThe maximum land area is 2,000 m2 (two thousand square meters).

If the land title of the landed house is freehold title or right to build, the foreigner must change the land title to right to use by making an agreement with the owner of freehold title regarding the granting of the right from the owner of freehold title to the foreigner before Land Deed Official (Pejabat Pembuat Akta Tanah / PPAT). Such agreement shall be registered to the Indonesian Land Agency (BPN) so that BPN will issue the Right to Use Certificate in the name of the foreigner.

2. Hak Guna Bangunan (Right to Build)

Hak Guna Bangunan grants foreigners the right to build and develop on state-owned land. This title is usually valid for 30 years and can be renewed. This type of property ownership can only be owned by an Indonesian legal entity (PT PMA) and cannot be held by foreign individual. Although it cannot be owned by foreign individual, owning property through a PT PMA is the most preferred choice by foreigners as there is no restriction/requirement as mentioned in the section 1 above. The structure of ownership through a PT PMA might be different from one another. Therefore, it is best to discuss how to set up the property ownership with the expert to avoid any legal issue in the future.

Benefits of Using Our Company for Property Purchase

1. Expertise in Company Formation

For those looking to purchase property through a company, we offer expert services in company formation. This can be a strategic approach to property ownership, providing additional flexibility and potential tax benefits.

2. Navigating Legalities and Paperwork

The legal landscape of property ownership in Indonesia can be daunting for foreigners. Our company specializes in handling all legal aspects, ensuring that the process is smooth and compliant with local regulations. From obtaining necessary permits to finalizing transactions, we manage every detail.

CPT Corporate handle property purchases from simple to complex transactions. We assist with house residency, villas and hotels throughout Indonesia.

Addressing Common Concerns for Foreign Property Buyers

Language Barriers:Language can be a significant barrier for foreigners in Indonesia. Our team bridges this gap, ensuring clear communication and understanding throughout the property buying process.Legal Complexities:The legal complexities of foreign property ownership can be overwhelming. Our experienced legal team simplifies these complexities, providing clear guidance and handling all necessary legalities.Cultural Differences:Cultural differences can pose challenges in any international transaction. We offer cultural consultancy services to help you navigate and respect local customs, ensuring a smooth and respectful process.Call to Action: Ready to explore property ownership in Indonesia? Contact us today for a consultation, and let us help you find your dream property. Visit our website to browse our listings and learn more about our comprehensive services.

Frequently Asked Questions

- What is Hak Pakai and how does it work?

Answer: Hak Pakai, or “right to use,” allows foreigners to own property in Indonesia for an initial period of up to 30 years, with the possibility of extensions.

- Can foreigners buy land in Indonesia?

Answer: Foreigners cannot directly buy freehold land in Indonesia, but they can obtain property rights such as Hak Pakai or Hak Guna Bangunan (through PT PMA).

- What are the minimum investment requirements for foreign property ownership?

Answer: Minimum investment amounts vary by location and property type, generally higher in urban and prime areas.

- Is it necessary to form a company to buy property in Indonesia?

Answer: While not always necessary, forming a company can provide additional flexibility and benefits for property ownership.

- How can your company assist with property purchase?

Answer: We offer comprehensive services, including land due diligence, legal assistance, company formation, and connections with trusted real estate agents and developers.

Conclusion

Navigating foreign property ownership in Indonesia is made easier with the right guidance and professional assistance. With recent regulatory changes, a variety of property rights options, and our comprehensive support services, owning property in Indonesia is now more accessible and secure. Whether you’re looking to invest, retire, or simply enjoy a slice of paradise, Indonesia offers unparalleled opportunities. Contact us today to start your journey towards owning property in this beautiful and dynamic country.

Discover the seamless process of foreign property ownership in Indonesia with our expert services. From navigating legalities to connecting with trusted real estate agents, we ensure your investment is secure and stress-free. Learn more about how we can assist you by visiting our website

You must be logged in to post a comment.