by Penny Angeles-Tan | Dec 26, 2024 | Business

Explore Solana’s price outlook and potential for reaching $500 in 2025. This analysis delves into current market trends, on-chain fundamentals, macroeconomic factors, and technical analysis to assess SOL’s future trajectory.

The cryptocurrency market has seen significant activity around Solana (SOL), particularly as it attempts to stage a recovery during the holiday season. SOL’s performance, coupled with macroeconomic and on-chain fundamentals, paints a nuanced picture of its short-term and long-term potential.

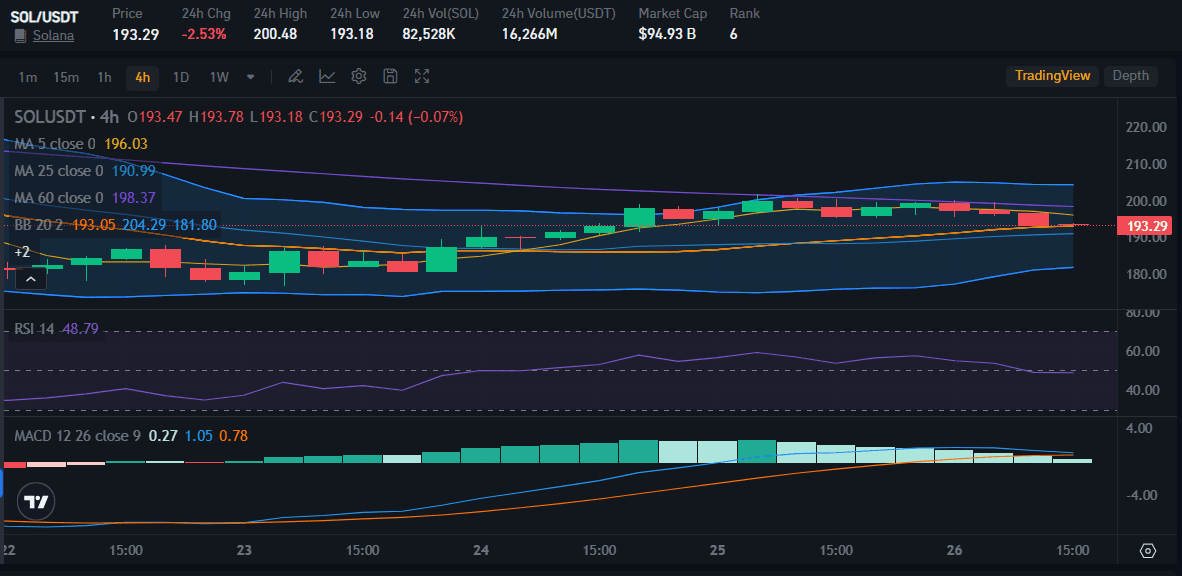

Current Market Trends: Solana’s Modest Rebound

As of Christmas Day 2024, Solana’s price is making a modest recovery, trading just below the critical $200 mark. The asset has rebounded by 13% from its multi-week lows around $175, yet it remains significantly lower than its recent peak in the $260s.

However, despite the recent uptick, SOL is still trapped in a broader downtrend. Both the 21-day and 50-day moving averages (DMAs) suggest persistent bearish momentum, with analysts emphasizing that a meaningful break above $220 is necessary to confirm a trend reversal.

At the time of writing this article on December 26, 2024, Solana is trading at $193.29 with a decrease of -2.51%. The RSI value is below 50 which means the selling trend is higher than the buying trend.

Impact of Macroeconomic Factors

The Federal Reserve’s hawkish policy stance, signaling only two interest rate cuts in 2025, has dampened confidence in risk assets, including cryptocurrencies.

However, bullish indicators, such as the continued strength of the U.S. economy and the incoming pro-crypto Trump administration, provide a counterbalance.

This favorable regulatory and macroeconomic environment could usher in a “golden age” for the U.S. crypto industry, potentially driving renewed investor interest in assets like Solana.

Why Solana Could Retest $260 and Beyond

Solana, despite recent market volatility, exhibits strong on-chain fundamentals and presents a compelling case for a potential retest of $260 and beyond.

Robust network activity, indicated by rising trading volumes and transaction counts, coupled with a relatively low market capitalization compared to Ethereum, suggests significant room for growth.

While a direct comparison to Ethereum is unlikely, analysts predict a substantial price appreciation driven by Solana’s scalability advantages and increasing adoption within the DeFi and NFT sectors.

1. Strengthening On-Chain Fundamentals

Solana’s blockchain metrics remain robust, with trading volumes, transaction counts, and Total Value Locked (TVL) showing strong upward trends, according to DeFi Llama.

These indicators highlight increasing network usage, which could support future price gains.

Solana’s market cap of $94 billion, about 25% of Ethereum’s, suggests ample room for growth. While it is unlikely to surpass Ethereum this cycle, analysts predict a potential 4-5x increase from current levels, driven by Solana’s exceptional scalability and growing adoption in decentralized finance (DeFi) and non-fungible tokens (NFTs).

2. Short-Term Technical Analysis

Key Levels to Watch

– Support: $173.42 (61.8% Fibonacci level) has emerged as a critical base for SOL. If this level holds, it could signal the end of a corrective phase and the start of a bullish reversal.

– Immediate Resistance: $193.20 (50% Fibonacci level) serves as the first hurdle for upward momentum.

– Higher Resistance: $209.93 (38.2% Fibonacci) and $230.64 (23.6%) are subsequent levels to watch for a sustained breakout.

- Downside Target: Failure to hold the $173 support could push SOL toward the $152.65 level (78.6% Fibonacci).

3. Elliott Wave Analysis

Solana appears to be in the final stages of a corrective W-X-Y wave structure. A bullish reversal is plausible if the “C” wave concludes near the $173 support zone. A successful rebound could target $230 and potentially set the stage for higher highs.

Long-Term Price Outlook: Could Solana Reach $500?

Despite current struggles, many analysts remain optimistic about Solana’s future. As the crypto market transitions to a new cycle in 2025, several factors could propel SOL toward the ambitious $500 mark:

1. Pro-Crypto Regulatory Shift: The incoming U.S. administration is expected to create a favorable environment for blockchain innovation, benefitting major projects like Solana.

2. Ecosystem Expansion: Solana continues to attract new projects, enriching its ecosystem with advanced decentralized applications, tokenization initiatives, and cutting-edge solutions.

3. Bull Market Potential: Historical patterns suggest that Solana, like other major cryptocurrencies, has yet to enter the most explosive phase of its bull market, with significant upside remaining.

Risks and Challenges

1. Low Trading Volume: Recent declines in trading activity signal reduced investor confidence, potentially hindering price recovery.

2. Macroeconomic Uncertainty: Continued Fed hawkishness and other global economic factors could limit risk appetite for speculative assets.

Conclusion

Solana’s price action reflects a market in flux, caught between bearish trends and bullish fundamentals. While the short-term outlook suggests consolidation, the long-term narrative remains promising, driven by strong on-chain activity, ecosystem growth, and favorable macroeconomic shifts.

If Solana can break key resistance levels and sustain momentum, a retest of $260 appears likely, with the $500 target in 2025 firmly within reach.

by | Dec 26, 2024 | Business

Reputation House, the UAE’s most titled reputation management agency, predicts online reputation to emerge as the key digital asset in upcoming year

Dubai’s Reputation House, recognized globally for its expertise in online reputation management, has forecasted an important shift in the corporate world: online reputation will become the most critical digital asset for businesses in 2025. With the digital landscape expanding and consumer trust increasingly tied to online perceptions, maintaining a strong reputation is no longer optional—it is imperative.

Market trends validate this prediction. The global online reputation management market is projected to grow from $319.12 million in 2023 to $876.77 million by 2030, with a compound annual growth rate (CAGR) of 15.53%. Highlighting this trend, Dima Raketa, CEO of Reputation House, notes:

“This exponential growth shows the real thing — businesses are waking up to the fact that a strong digital reputation drives measurable outcomes, from higher customer acquisition rates to increased investor confidence. As more industries compete in the digital space, companies that actively manage their reputation will gain a decisive advantage over those that treat it as an afterthought. And our mission at Reputation House is to help brands unlock the full potential of their digital presence by staying ahead of image-related challenges.”

Reputation House helps businesses stay ahead by offering a wide range of services to manage and improve their online presence. These include thorough reputation audits, real-time tracking of media mentions, and advanced AI tools to keep tabs on what’s being said about them online. The company works closely with clients to create personalized strategies, helping them handle challenges quickly and stay competitive.

The services provided by the agency are set to help startups and companies in different sectors. With actionable insights and real-time data, these services allow companies to make informed decisions, cultivate trust with their audience, and maintain a positive brand image.

In 2024, Reputation House became the most titled reputation agency in the United Arab Emirates with 5 international business awards in eight categories.

To learn more about Reputation House and its services, visit the website.

by | Dec 26, 2024 | Business

December 26, 2024 – VRITIMES, a leading platform in press release distribution, is excited to announce its partnership with Yeyemenin and Filgizmo, two vibrant online platforms dedicated to sharing news, updates, and insights from around the world. This strategic collaboration aims to empower businesses, organizations, and local influencers with an effective channel to distribute press releases to Yeyemenin and Filgizmo’s broad and engaged audience.

With VRITIMES’ advanced press release distribution technology, content will now seamlessly reach Yeyemenin and Filgizmo’s growing readership, ensuring that stories about business developments, cultural events, and community-driven initiatives in the Philippines connect with the right audience at the right time.

“We are thrilled to partner with Yeyemenin and Filgizmo, platforms that has become a trusted source of news and information for Filipinos,” said Ferry Bayu, CEO of VRITIMES. “This collaboration allows us to enhance the visibility of businesses and organizations in the Philippines, ensuring their stories resonate with readers who care deeply about local growth, innovation, and community impact.”

Yeyemenin and Filgizmo are widely recognized for its commitment to delivering fresh, relevant, and impactful news from all over the world. This partnership with VRITIMES provides local businesses, influencers, and changemakers with a powerful tool to share their messages effectively, leveraging cutting-edge distribution technology to reach audiences that matter most.

Through this collaboration, VRITIMES, Yeyemenin, and Filgizmo are working to uplift the voices of Filipinos, support local initiatives, and bring more visibility to the stories that shape communities across the nation.

by Penny Angeles-Tan | Dec 26, 2024 | Business

Discover Bitcoin’s remarkable 2024 journey, with a 131.5% YtD surge and key events like ETF approvals, halving, Trump’s pro-crypto win, and Fed rate cuts. Explore market trends, challenges, and future forecasts, including Tom Lee’s bold $250K prediction for 2025.

Bitcoin (BTC) experienced a rollercoaster year in 2024, marked by significant price fluctuations, groundbreaking events, and renewed optimism among investors. By December 25, Bitcoin closed at $98,429, representing a 131.5% year-to-date (YtD) increase compared to its closing price of $42,505 at the end of 2023.

Let’s delve into the factors driving Bitcoin’s performance and its potential trajectory.

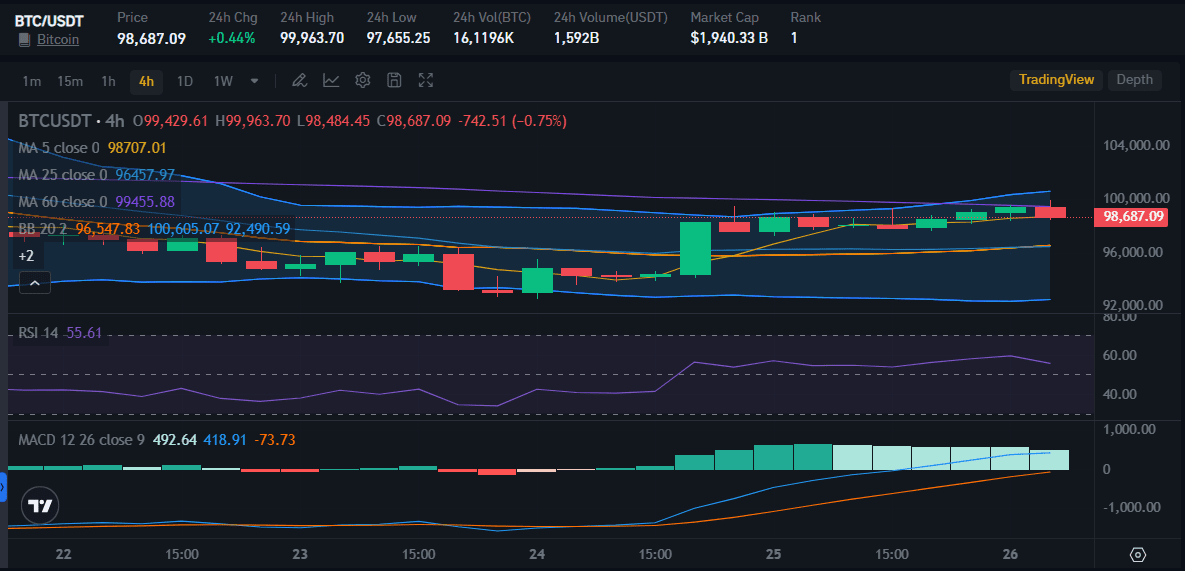

Price Highlights and Market Capitalization

Bitcoin began 2024 on a challenging note, hitting its lowest price of $39,179 in mid-January. From this low, it soared 171.6% to reach its all-time high of $106,415 on December 17.

On December 18, Bitcoin’s market capitalization surged to $2.1 trillion, elevating it to the seventh-largest asset globally, surpassing major companies like Saudi Aramco, Meta Platforms, and Tesla.

At the time of writing this article on December 26, BTC is at $98,687 with a gain of 0.44%. A price that is not too encouraging because BTC’s price is predicted to touch $100,000 again on Christmas Eve.

Four Key Events Driving Bitcoin’s Performance

Bitcoin has 4 major events happening during 2024 that will cause the token to surge in price today.

1. Approval of Bitcoin Spot ETFs in January

The U.S. Securities and Exchange Commission (SEC) approved 11 Bitcoin Spot Exchange-Traded Funds (ETFs), including offerings from BlackRock, Fidelity, and ARK Invest.

These ETFs allow traditional investors to gain exposure to Bitcoin without directly holding the asset. The approval attracted an inflow of $35.47 billion into Bitcoin Spot ETFs by December 24, pushing Bitcoin to $73,000 shortly after the announcement.

2. Bitcoin Halving in April

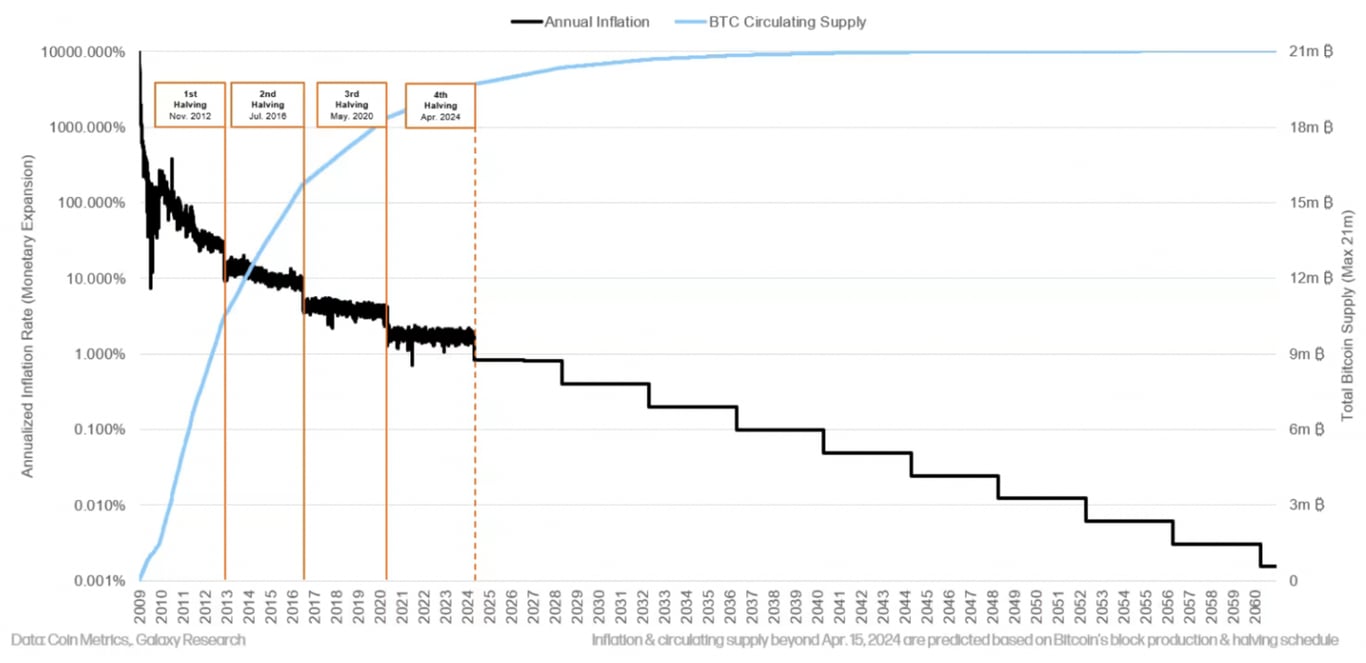

On April 20, Bitcoin underwent its fourth halving, reducing the mining reward from 6.25 BTC to 3.125 BTC. Historically, halvings have triggered long-term price increases due to reduced supply.

While Bitcoin’s price consolidated between $63,000 and $64,000 immediately post-halving, it aligned with historical patterns, which often see significant price growth within six months to a year after such events.

3. Trump’s Pro-Crypto Presidential Victory in November

Donald Trump’s re-election as U.S. President on November 6 was celebrated by the crypto community.

His pro-crypto stance, including promises to make the U.S. the “crypto capital of the world,” boosted Bitcoin’s price by 10%, reaching $75,984. Trump’s policies are expected to foster a more favorable regulatory environment for cryptocurrencies.

4. Federal Reserve’s Interest Rate Cuts

Throughout 2024, the Federal Reserve cut interest rates by 100 basis points, including reductions of 50 bps in September and 25 bps each in November and December.

Lower interest rates typically benefit risk assets like Bitcoin by encouraging capital flow away from bonds and into alternative investments.

Market Dynamics and Challenges

Just like other crypto tokens, BTC also experiences price movements that go up and down. Here’s how BTC’s price dynamics will be throughout 2024.

1. Derivatives and Margin Markets

Despite significant price volatility, Bitcoin’s derivatives market maintained a neutral-to-bullish stance. Futures contracts traded at a robust 12% premium, reflecting strong demand for leveraged long positions.

Meanwhile, Bitcoin’s margin markets showed a 25x long-to-short ratio, indicating sustained bullish sentiment.

2. Whale Activity and Sell-Side Pressure

On-chain data revealed increased sell-side pressure from large investors during market downturns. The average Bitcoin transaction size peaked at $306,100 in December, the highest in two years, often signaling intensified sell-offs.

This behavior, combined with market uncertainty, poses short-term risks to Bitcoin’s price stability.

Bitcoin’s Future Prospects

So, what is the future of BTC? Here is an explanation that you can read.

1. Support and Resistance Levels

As of December 25, Bitcoin’s key support level stands at $90,500. Breaching this level could lead to further declines, with $88,000 as the next major support.

Conversely, breaking above the $99,426 resistance could signal a bullish recovery, potentially paving the way for a retest of the $108,353 high.

2. Tom Lee’s Prediction

Prominent analyst Tom Lee predicts Bitcoin could reach $250,000 by 2025, citing a friendlier regulatory landscape and increased adoption. He also highlights Bitcoin’s potential role as a Treasury reserve asset, which could significantly bolster its value.

Conclusion

Bitcoin’s performance in 2024 underscores its resilience and adaptability amid macroeconomic and geopolitical shifts. While challenges remain, such as heightened whale activity and economic uncertainty, the asset’s growing institutional adoption and favorable regulatory developments paint an optimistic picture for 2025 and beyond.

Investors and enthusiasts alike should keep a close watch on market trends, support levels, and policy shifts as Bitcoin continues its journey as a transformative global asset.

by Penny Angeles-Tan | Dec 26, 2024 | Business

Discover the future of Bitcoin mining as we approach the 21 million BTC cap. Learn about the transition to transaction fees, economic scarcity, and innovative strategies ensuring the sustainability and security of the Bitcoin network. Explore key insights and expert analysis for crypto enthusiasts and investors.

Bitcoin mining has evolved significantly since the cryptocurrency’s inception, driven by lucrative incentives and the decentralized ethos of its network. Initially, miners were rewarded with 50 BTC per block, enabling early adopters to accumulate substantial Bitcoin holdings relatively easily.

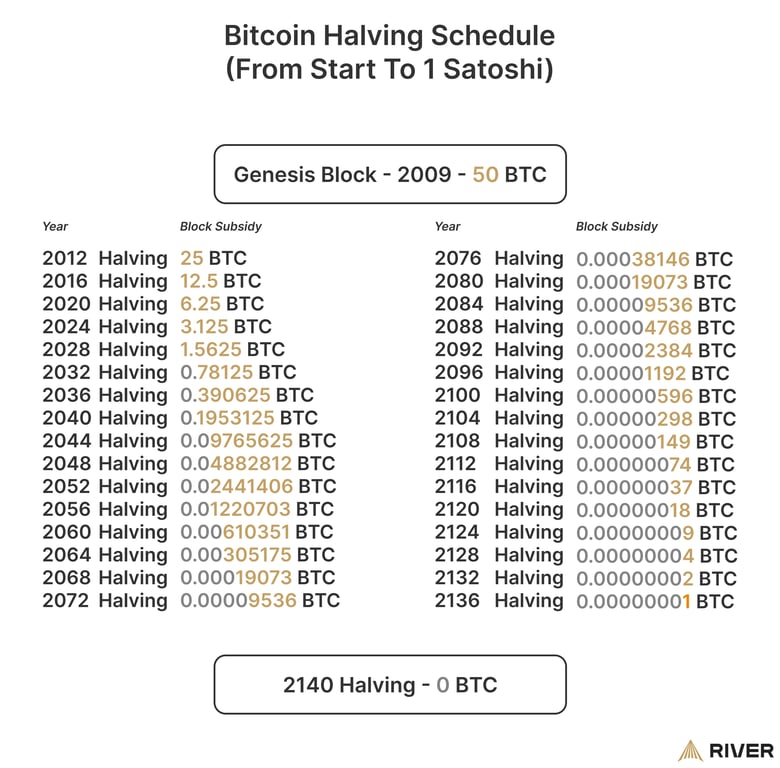

Today, the mining reward is 3.125 BTC per block following four halving events. With over 19.8 million Bitcoins already in circulation and only 1.5 million left to mine, the cryptocurrency will reach its cap of 21 million by approximately 2140.

Bitcoin’s Finite Supply and its Implications

The hard cap of 21 million Bitcoins is a cornerstone of Satoshi Nakamoto’s vision for a decentralized and scarce digital asset. This scarcity underpins Bitcoin’s value and demand, likened to digital gold. As the cap approaches, the network’s dynamics will shift:

1. Transition to Transaction Fees: Post-2140, miners will rely exclusively on transaction fees to validate and secure transactions. This shift is anticipated to sustain the network’s security and functionality.

2. Economic Scarcity: The finite supply enhances Bitcoin’s appeal as a store of value, potentially increasing its price as demand outpaces availability.

3. Adaptation of Mining Strategies: Miners are expected to adopt innovative solutions, such as utilizing heat generated during mining for secondary industries, ensuring continued profitability and sustainability.

Motivations for Bitcoin Mining

Bitcoin miners are driven by a mix of financial, ideological, and strategic motivations:

1. Financial Gains: Mining presents a lucrative opportunity through block rewards and transaction fees. Despite diminishing rewards, Bitcoin’s rising value and transaction activity continue to incentivize miners.

2. Decentralization: By participating in mining, individuals contribute to Bitcoin’s decentralized nature, which resists censorship and centralized control.

3. Long-Term Investment: Many miners view accumulating Bitcoin as a strategic investment, banking on future price appreciation.

4. Network Security: A high hash rate reflects robust network security and resilience, attracting further investment and participation.

Adapting to Challenges: The Resilience of Bitcoin Mining

Bitcoin’s mining ecosystem has demonstrated remarkable adaptability in the face of challenges. For instance, when China banned Bitcoin mining in 2021, miners quickly relocated operations, highlighting their resilience.

Similarly, the rising hash rate underscores Bitcoin’s ability to attract participation and maintain security, even amidst market fluctuations.

Key factors ensuring mining’s sustainability include:

1. Technological Advancements: Continuous improvements in mining equipment reduce operational costs and enhance efficiency.

2. Cheaper Energy Sources: Many miners leverage renewable and low-cost energy sources, such as hydroelectric power, to maximize profitability.

3. Difficulty Adjustments: Bitcoin’s algorithm dynamically adjusts mining difficulty, ensuring mining remains viable regardless of market conditions.

4. Price Appreciation: Historical trends show that halvings often drive Bitcoin’s price upward, offsetting the impact of reduced block rewards.

The Role of Transaction Fees

Transaction fees are poised to become the primary revenue source for miners as block rewards diminish. These fees have shown a potential to sustain mining operations, with instances like April 20, 2024, where transaction fees exceeded block rewards, accounting for 75% of miner revenue.

The increasing adoption of Layer 2 solutions, such as the Lightning Network, is expected to balance transaction costs and improve network efficiency, ensuring that Bitcoin remains accessible and secure.

Addressing Concerns About Deflation and Network Security

Bitcoin’s deflationary nature and fixed supply have sparked debates:

1. Economic Viability: Bitcoin’s divisibility into 100 million satoshis ensures usability even as its value rises. This design supports long-term investment and savings without stifling economic activity.

2. Network Security: Despite reduced block rewards, miners are expected to remain motivated by transaction fees, technological advancements, and Bitcoin’s price appreciation.

3. Global Adoption: Increasing acceptance by nation-states and integration into financial systems further solidify Bitcoin’s role as a global reserve asset.

Future Innovations and Diversification

Miners are exploring diversification strategies to sustain profitability:

1. Renewable Energy: Transitioning to sustainable energy sources reduces costs and addresses environmental concerns.

2. High-Performance Computing: Some miners are leveraging their infrastructure for AI and data processing, creating additional revenue streams.

3. Nation-State Involvement: Governmental adoption and initiatives, such as strategic reserves and cross-border trade, bolster Bitcoin’s legitimacy and utility.

Conclusion

Bitcoin’s ecosystem is well-positioned to thrive despite the eventual depletion of block rewards. The adaptability of miners, coupled with rising transaction fees, technological advancements, and broader adoption, ensures the network’s sustainability and resilience.

As cryptocurrency continues to evolve, it remains a testament to the ingenuity of decentralized technology and its potential to redefine global finance.

And please do your own research if you want to buy BTC. If you are a newbie in this crypto field, Bitrue will help you. You can use all of Bitrue’s features to get all the information you need before buying BTC. You also can check BTC price from BTC to USD so you can know how much budget you need to prepare for the investment you are going to make.

You must be logged in to post a comment.