by | Feb 24, 2025 | Business

Explore XRP price predictions for 2025, the impact of SEC regulations, market trends, and Ripple’s growth opportunities. Will XRP surge or struggle? Find out now.

Few digital assets spark as much debate as XRP. Some see it as the future backbone of cross-border payments due to its efficiency, while others question its long-term viability.

The uncertainty surrounding XRP’s regulatory status and its close association with Ripple only adds to the intrigue.

Yet, beyond the controversies, one undeniable reality remains: XRP is among the largest cryptocurrencies by market capitalization, and any potential shift in its utility can significantly impact its price.

This article explores XRP’s current state, its market dynamics, and the factors that will shape XRP’s trajectory through 2025.

SEC Appeal and Regulatory Uncertainty

On February 23, uncertainty loomed over the SEC’s decision on whether to pursue an appeal against the ruling on Programmatic Sales of XRP in the Ripple case.

This speculation grew after the SEC dismissed its case against Coinbase (COIN), hinting at a possible withdrawal from the Ripple appeal. However, the complexity of court rulings in the Ripple case adds an additional layer of uncertainty.

The situation is further complicated by an ongoing investigation by the Office of Inspector General (OIG) into potential conflicts of interest within the SEC. Reports suggest that former SEC Chair Gary Gensler withheld these findings before stepping down on January 15.

Acting Chair Mark Uyeda and Commissioner Hester Peirce have since remained silent, leading to speculation that the findings could impact the SEC’s legal strategy against Ripple.

A withdrawal of the SEC’s appeal could propel XRP beyond its all-time high of $3.5505, whereas continued litigation might suppress prices below $1.50.

The Role of XRP in Cross-Border Payments

Ripple, the fintech company behind XRP, provides blockchain-based solutions for cross-border transactions. Through RippleNet, financial institutions can facilitate faster and cheaper global transfers.

XRP serves as a bridge asset within this ecosystem, enabling liquidity on demand and reducing reliance on pre-funded accounts.

Despite these advantages, XRP’s adoption remains uncertain. Some of Ripple’s partners use its software without utilizing XRP, raising concerns about whether the token is essential for Ripple’s vision.

Additionally, competition from stablecoins and Central Bank Digital Currencies (CBDCs) threatens XRP’s long-term utility.

OIG Investigation and Its Potential Impact

A key development in the Ripple case is the investigation into former SEC Director Bill Hinman. In 2018, Hinman stated that Bitcoin (BTC) and Ethereum (ETH) were not securities while allegedly maintaining financial ties with law firm Simpson Thacher, a proponent of Ethereum.

Court documents indicate that Hinman continued meeting with Simpson Thacher despite SEC ethics warnings. The SEC’s failure to protect related documents under attorney-client privilege further fuels allegations of bias.

If the OIG findings confirm conflicts of interest, the SEC may face pressure to withdraw its appeal, further strengthening Ripple’s position and potentially boosting XRP’s price.

XRP Price Trends and Market Outlook

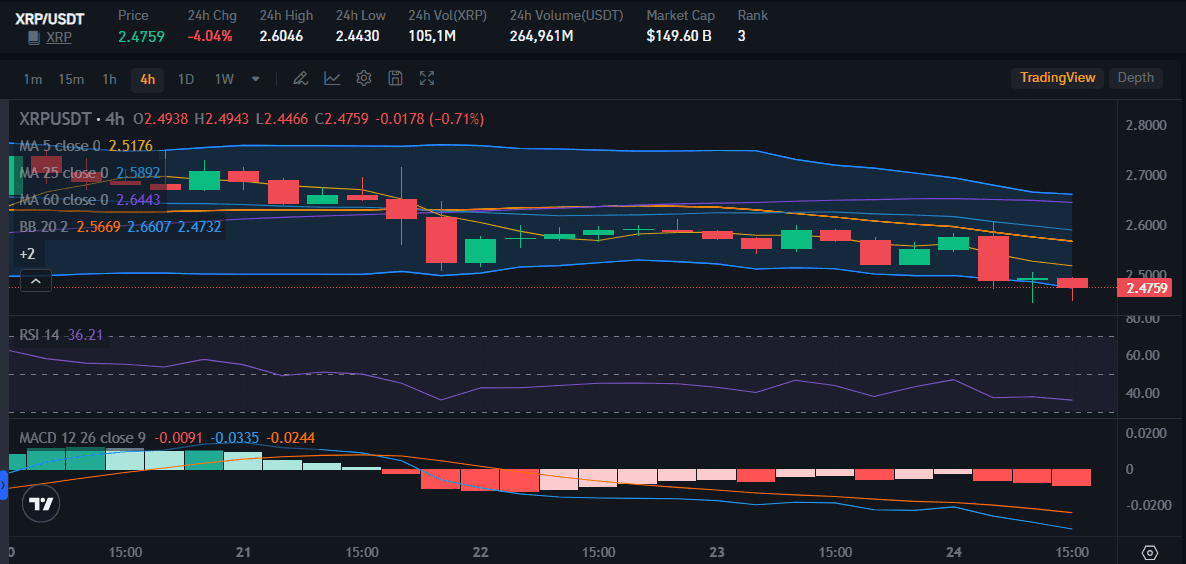

On February 24, XRP traded at $2.4759. While it remains below its January 16 high of $0.9399, key regulatory and market developments will determine its near-term trajectory.

1. SEC Appeal Outcome: A favorable outcome could drive XRP toward new highs, while continued legal battles may suppress investor confidence.

2. ETF Developments: Approval of an XRP-spot ETF could attract institutional inflows, potentially pushing prices toward $5.

3. Broader Market Trends: Economic indicators, Federal Reserve policies, and Bitcoin ETF trends will also influence XRP’s performance.

Institutional Adoption and Competitive Pressures

For XRP to sustain long-term growth, it must secure institutional adoption. Banks, fintech firms, and payment processors must integrate XRP into their liquidity solutions.

While Ripple has forged partnerships with financial institutions, the rising prominence of stablecoins and CBDCs presents a challenge.

Regulatory clarity will also play a crucial role. A decisive legal victory affirming that XRP is not a security could lead to its relisting on major U.S. exchanges, opening the door for new retail and institutional investors.

Technical Innovations and Market Trends

XRP’s competitive edge lies in its speed and low transaction costs. However, the blockchain landscape is evolving rapidly, with emerging Layer-2 solutions and new digital assets vying for market dominance.

Ripple must enhance its protocol, improve scalability, and build interoperability with other blockchain networks to maintain relevance.

Macroeconomic conditions also play a role. Interest rates, inflation, and investor sentiment influence capital inflows into cryptocurrencies. A bullish market environment could amplify positive developments for XRP, while economic downturns may limit its growth potential.

Analyst Predictions for 2025

Crypto analysts remain divided on XRP’s future, with bullish and bearish scenarios emerging.

1. Bullish Scenarios

- Increased institutional adoption by banks and remittance providers.

- Positive legal outcomes boosting investor confidence.

- Expansion into CBDCs, positioning XRP as a bridge currency.

2. Bearish Scenarios

-

Regulatory setbacks limiting XRP’s market accessibility.

-

Rising competition from stablecoins and next-generation blockchains.

-

Investor skepticism due to slow adoption of XRP-based solutions.

Opportunities for XRP Growth in 2025

Ripple’s ongoing engagement with central banks and its push into stablecoin initiatives could be a game-changer for XRP. If CBDCs and private-sector stablecoins integrate XRP for liquidity and cross-border settlements, the token’s utility could expand significantly.

However, regulatory uncertainty and competition from national digital currencies pose significant hurdles. Governments may opt for closed-loop systems, reducing the need for an external bridging asset like XRP.

Ripple must demonstrate that XRP’s speed, cost-efficiency, and interoperability offer a distinct advantage over fiat-backed alternatives.

Will XRP’s Price Rise or Fall in 2025?

XRP’s price trajectory will depend on regulatory clarity, institutional adoption, and macroeconomic trends. While its potential remains strong, skepticism is justified.

If Ripple secures major partnerships and regulatory victories, XRP could witness a sustained rally. However, continued legal uncertainties and competition from stablecoins and CBDCs may limit its upside.

Crypto analyst Dom recently noted that XRP’s 43% drop from its $0.9399 yearly peak might signal a major buying opportunity. Historically, XRP has rebounded sharply after deep corrections, as seen in the SEC lawsuit-induced plunge of 2020 and the COVID-driven crash.

Market expert Amonyx shares an optimistic outlook, predicting a major price surge based on historical trends. He highlights the Total 3 market cap metric (excluding BTC and ETH), which previously surged to $360 billion after a similar accumulation phase.

Conclusion

XRP’s journey remains uncertain, shaped by legal battles, market trends, and technological advancements. While regulatory clarity and institutional adoption could propel XRP to new heights, competition and skepticism persist.

Investors should closely monitor developments in the SEC case, ETF approvals, and Ripple’s partnerships to gauge XRP’s potential for 2025 and beyond.

by | Feb 21, 2025 | Business

PasaJob, a leading Philippine job platform with 2.3 million users on its GCash-integrated GJobs mini-program, has appointed seasoned HR tech entrepreneur Eddie Ybañez as CEO. This strategic move aims to capitalize on GJobs’ explosive growth and connect even more Filipino job seekers with employers in 2025. Learn how Ybañez plans to revolutionize the talent marketplace and tackle high unemployment. <img style="width: 100%;" src="https://slvrdlphn.com/wp-content/uploads/2025/02/public-187" alt="EDDIE YBANEZ Image source: Taipei Entrepreneurs Hub Facebook Page” />

Since its founding in 2020, PasaJob has been established under the leadership of Founder and CEO, Kristen Mariano, to become one of the leading job platforms in the Philippines. To strengthen PasaJob’s leadership team, the company has brought on serial entrepreneur Eddie Ybañez to serve as CEO. Mariano will remain as COO and Chairman of the board.

The transition to Ybañez could not have come at a more opportune time. In September 2023, PasaJob launched GJobs, a mini-program it developed in collaboration with GCash as part of the latter’s “finance for all” mandate. GJobs offers a diverse selection of legitimate job opportunities for all Filipinos with different qualifications, allowing users to conveniently apply right from their phones. GJobs is also the nation’s first job platform that connects employers and job seekers through referrals; users also have the opportunity to earn by referring jobs to peers on the platform.

In less than 17 months since its launch, GJobs has onboarded 2.3 million users, who have applied for 400,000 jobs and made 1 million job referrals. Ybanez now takes the lead in accelerating PasaJob’s next wave of growth in 2025, which aims to onboard more employers and post thousands of new jobs to lead to more hired Filipinos.

Ybañez is no stranger to HR technology: He co-founded Payruler, a human resource management system and payroll system, where he served as Chief Technology Officer. Ybañez understands how to leverage technology to help Filipino talent.

Reimagining the Filipino talent marketplace

To this end, Ybañez has already added several features to the product roadmap of GJobs that will simplify recruiting. At the top of the funnel, employers will have the ability to search for candidates that best meet their criteria from the database. When building a pipeline, the platform will also automatically find candidates who may be qualified that did not already apply. Finally, the platform will enable jobseekers to conduct asynchronous interviews.

All of these features will be powered by artificial intelligence.

“The talent marketplace is generally inefficient and fragmented. Jobseekers know how difficult it is to find a good job; employers share similar frustrations in finding the best talent. With AI, we can streamline the hiring process so that hiring companies and the right talent can connect with one another with the efficiency we’ve been accustomed to online and through the help of referral networks,” said Ybañez.

While there are many ways to source talent, PasaJob focuses heavily on referrals. The reason for this focus is that referrals shorten the hiring period from 42 days to 29 days on average, and referred employees have 70% longer tenures than other employees. Finally, recruiting in some industries is driven entirely by referrals: 55% of BPO hires are referrals, for example.

Because of these benefits, PasaJob will be able to help all companies, especially those with high-volume hiring needs, like BPO or manpower agencies. Ybañez elaborated more on their ideal enterprise partner.

“We are eager to work with companies in fast-growing industries that have significant hiring requirements. With our job platform built around smarter referrals, these enterprises can quickly find the talent they need and at scale. These hires will be a better culture-fit for the organization, so they can create impact while enhancing team dynamics,” said Ybañez.

Jobseekers looking for a role are encouraged to sign into GCash to use GJobs powered by PasaJob. Enterprises who want to hire via GJobs are encouraged to reach out to the PasaJob team through its website or email te**@*****ob.com. In addition to GJobs, PasaJob also operates Recruiters Circle, a recruitment service for highly specialized and technical roles, and Employee Referral Platform, a company-specific, white-labeled version of PasaJob.

by | Feb 20, 2025 | Business

The Executive Centre (TEC), Asia’s leading premium flexible workspace provider, is delighted to announce the launch of its new centre at Grosvenor Place, located on Level 15, 225 George Street, Sydney. This newest addition adds to TEC’s current portfolio of 4 centres in Sydney, reinforcing its dedication to delivering sophisticated workspace solutions in one of Australia’s most prestigious commercial addresses.

Grosvenor Place, a landmark 44-storey Premium Grade office building designed by the acclaimed architect Harry Seidler, is situated moments from Circular Quay. The TEC centre occupies a full floor, spanning close to 2,000 square meters and accommodating over 260 workstations, ensuring ample space for dynamic collaboration and productivity.

The centre boasts a welcoming concierge area, private offices, and a vibrant café serving expertly crafted barista coffee. Members will benefit from a range of premium amenities, including height-adjustable workstations, expansive collaborative spaces, advanced meeting facilities, private phone booths, digital pods and a podcasting studio, along with stunning views of Sydney Harbour.

Robert How, Country Director of Australia at The Executive Centre, expressed his enthusiasm for this significant milestone: “The opening of The Executive Centre at Grosvenor Place underscores our commitment to providing market-leading premium flexible workspace solutions in Australia’s most sought-after CBD locations. We are excited to foster a thriving community in this iconic setting.” This year also commemorates Robert’s 10th anniversary with TEC, during which he has played a pivotal role in shaping the company’s growth and innovation.

As the flexible workspace industry continues to gain traction, the outlook for Sydney’s office market remains optimistic. With increasing demand for adaptable work environments, The Executive Centre is poised to lead the charge in meeting the evolving needs of professionals and organisations.

The Executive Centre at Grosvenor Place is designed for discerning professionals and organisations seeking an inspiring and productive work environment, further solidifying TEC’s reputation for excellence in the flexible workspace sector.

by | Feb 20, 2025 | Business

Can XRP break through $5? XRP is surging amidst positive news, including the SEC acknowledging Grayscale’s XRP-spot ETF application and potential shifts in regulatory policy. Get the latest XRP news and price analysis here.

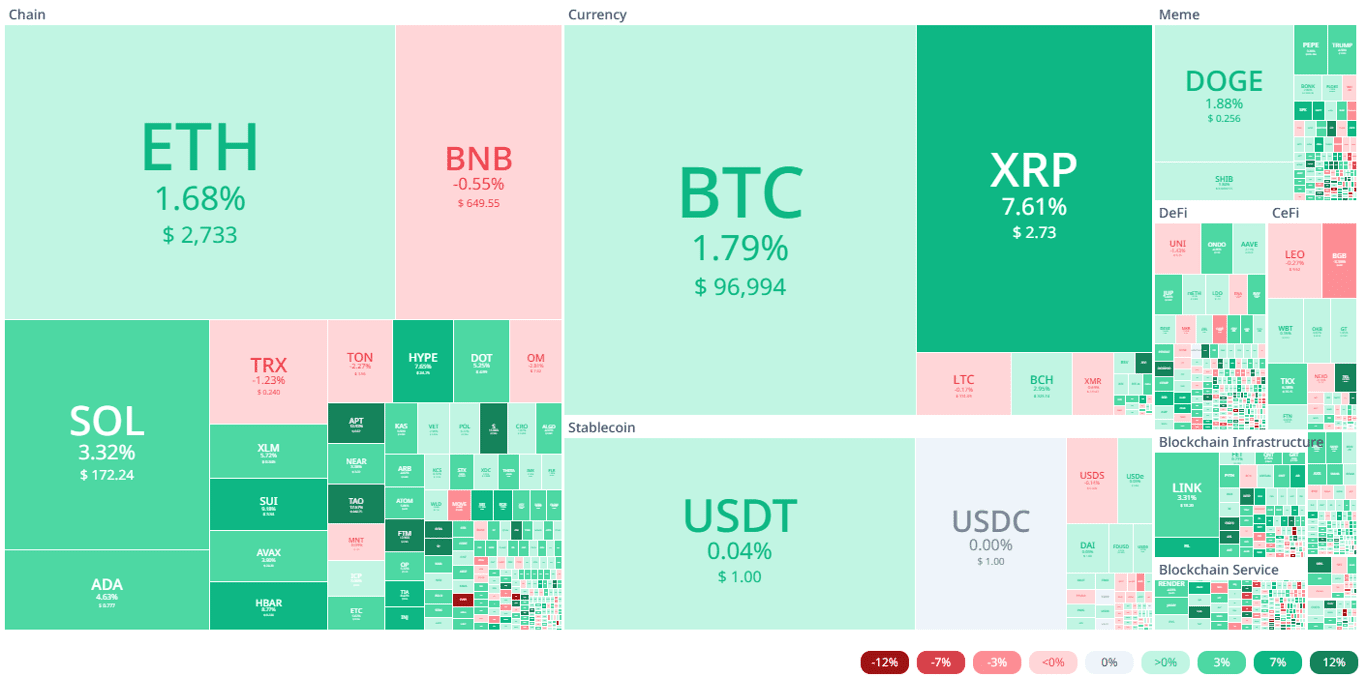

Today’s crypto market is green after being in the red zone for several days. Giant tokens, such as BTC, Solana, and Ethereum have experienced price increases, including XRP.

The increase in the price of XRP is higher than other major tokens? Is it because of the development of the XRP ETF project that Greyscale is currently working on?

Let’s discuss together the latest news about XRP today and its price prediction which is projected to touch $5 soon.

SEC Acknowledges Grayscale’s XRP-Spot ETF Application

On Thursday, February 13, the U.S. SEC officially acknowledged Grayscale’s application to convert its XRP trust into an exchange-traded fund (ETF).

While this acknowledgment does not guarantee approval, it marks a significant milestone for XRP. Leading ETF analyst Nate Geraci described the move as an “enormous message” in his X post.

Grayscale originally launched its XRP trust in September and applied to convert it into an ETF in January.

Although the SEC could reject the filing, the fact that it acknowledged the application instead of dismissing it outright suggests a possible shift in regulatory stance.

This development has fueled optimism in the cryptocurrency community, particularly among XRP investors.

SEC Litigation and Policy Adjustments

While the SEC remains engaged in litigation with Ripple, the company associated with XRP, the agency has also shown signs of shifting its approach to crypto enforcement.

On Wednesday, February 19, the newly revamped SEC and its Crypto Task Force continued addressing regulatory challenges and enforcement cases related to digital assets.

Fox Business journalist Eleanor Terrett reported a major court development regarding the SEC’s expansion of the Dealer Rule.

Under Acting Chair Mark Uyeda, the SEC voluntarily dismissed its appeal against a lawsuit brought by the Blockchain Association and the Crypto Freedom Alliance of Texas (CFAT).

This lawsuit challenged the SEC’s broad application of the Dealer Rule, which sought to classify high-frequency trading firms and certain crypto hedge funds as dealers.

The dismissal of the appeal is seen as a victory for innovators and entrepreneurs in the crypto space.

The Blockchain Association celebrated this move, stating: “Today, under new leadership at the agency, the SEC voluntarily dismissed its appeal, marking a total victory in the case not only for us, but for the innovators, entrepreneurs, and builders across America.”

The SEC’s appeal withdrawal follows recent court filings on enforcement actions against Binance, Coinbase, and Lejilex.

These filings requested stays, arguing that extensions would allow the SEC’s Crypto Task Force to develop a regulatory framework that could lead to better resolutions.

Ripple Case and Regulatory Priorities

Despite these positive developments, investors hoping for the SEC to withdraw its appeal of the Programmatic Sales of XRP ruling in the Ripple case may be disappointed.

The next deadline in the Ripple case is April 16, when Ripple must file its appeal-related reply brief. With no filings expected until then, it appears the SEC is prioritizing enforcement cases with tighter deadlines.

Eleanor Terrett noted: “I’m told by multiple legal sources that the SEC has been prioritizing cases with imminent court deadlines.”

Some experts speculate that the SEC may be waiting for Paul Atkins’ confirmation as SEC Chair before formally withdrawing from certain non-fraud crypto cases.

Current deadlines for major crypto lawsuits range from March 14 to April 16, allowing time for regulatory adjustments before the Crypto Task Force finalizes its approach.

XRP Price Trends: ETF Optimism and Market Response

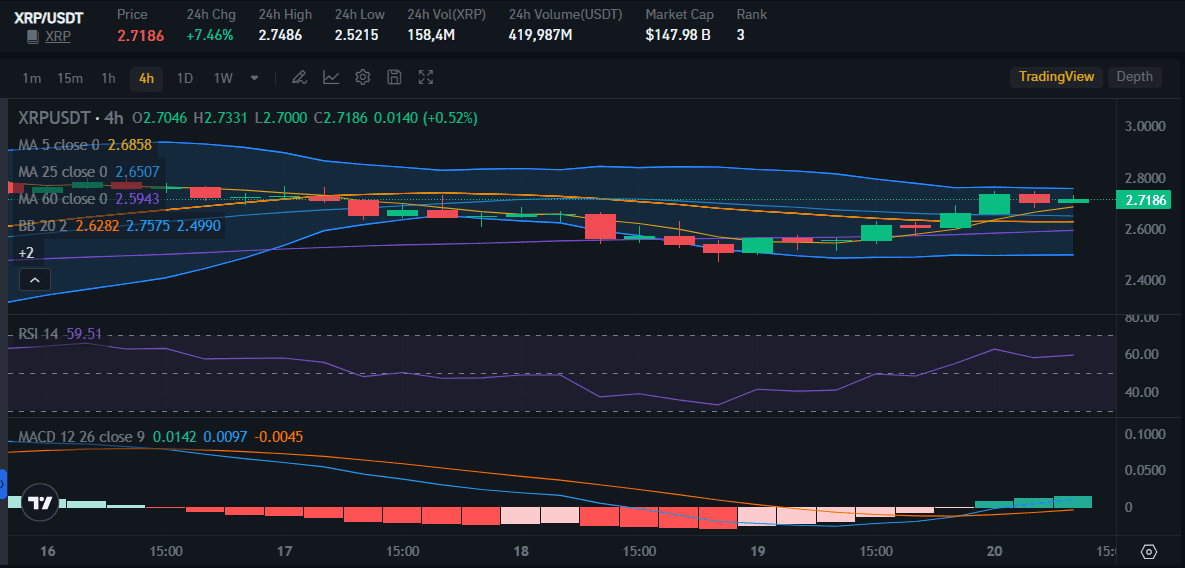

XRP has shown significant price movements in response to the latest regulatory developments. On February 20, XRP surged 7.46% and now trading at $2.7186.

This increase outperformed the broader crypto market, which gained 1.30% and reached a total market cap of $3.14 trillion.

Market analysts attribute XRP’s rally to speculation surrounding a potential SEC withdrawal from the Ripple case appeal and progress on the approval of XRP-spot ETFs. Key price scenarios include:

- Bullish Case: If the SEC withdraws its appeal, XRP could break past its all-time high of $3.5505.

- ETF Catalyst: An XRP-spot ETF approval could push prices toward $5, driven by institutional inflows.

- Bearish Case: A continued SEC appeal and an ETF rejection could send XRP below $1.50.

XRP analysts remain divided on the long-term price outlook. Some, like XRP Captain and Egrag Crypto, predict a massive rally to $250 or even four-digit price targets.

However, more conservative analysts suggest that XRP must first break key resistance levels, such as $3.40, to confirm a new all-time high.

Institutional Adoption and the Future of XRP

Ripple’s continued expansion and the potential approval of XRP-spot ETFs are expected to drive institutional adoption.

The company is actively securing new financial services partnerships, launching new financial products, and expanding its workforce in the U.S. These developments signal a broader acceptance of XRP in the global financial system.

Meanwhile, the U.S. government’s approach to crypto regulation remains a key factor. The Trump administration’s pro-crypto stance, combined with the SEC’s evolving enforcement strategy, suggests that regulatory clarity for XRP and other digital assets could be on the horizon.

With market optimism growing and regulatory shifts taking place, the next few months will be critical for XRP’s future.

Investors will closely watch the SEC’s next moves, as well as any updates on XRP-spot ETF approvals and Ripple’s legal battle, to determine the token’s trajectory in 2025 and beyond.

by | Feb 20, 2025 | Business

ASCARO invites investors to partake in the ASCARO Padel & Social Club expansion journey, with as little as RM4,550 on equity crowdfunding platform pitchIN.

KUALA LUMPUR, 20 February 2025 – ASCARO has officially launched an equity crowdfunding (ECF) campaign on pitchIN to raise RM20 million to execute ASCARO’s plans to open four state-of-the-art padel clubs across Kuala Lumpur and Jakarta by 2025.

Starting at RM4,550 – the lowest-tier of investment – investors will also be given an additional perk of free membership at ASCARO Padel & Social Club with higher investment amounts.

“Padel has grown fast in Southeast Asia and ASCARO is going beyond merely filling a market gap. We are crafting an entirely new paradigm for urban recreation and networking, creating a unique blend of athletic pursuit and luxury lifestyle,” said Daniel Liljekvist, Managing Director and Partner at ASCARO. “You can be part of this wave and leverage ASCARO’s unique platform in accelerating the growth of padel in the region.”

WHY PADEL? THE BASIC NUMBERS

While padel has been steadily building a reputation on the global sports scene with 25 million players across 110 countries, the potential for padel in Southeast Asia is immense yet largely unrealized for this fast-paced social sport that blends the best of tennis and squash. Globally, there are 20,000 padel clubs while there are only about 30 clubs so far in Kuala Lumpur, Bangkok and, Jakarta combined.

The promising emerging markets region boasts rapid economic growth, with the Asian Development Bank forecasting the region’s economy to grow by 4.5% and 4.7% in 2024 and 2025 respectively. This could signal rising disposable incomes leading to demand for premium experiences to continue to increase. Furthermore, the appetite for sports and social activities in these markets are voracious, with Malaysia at 48% for a weekly sports participation rate (International Journal of Human Movement & Sports Sciences, 2024) and Thailand with a 25% growth in mass participation sports events in 2024 (PR Newswire, March 2024).

ASCARO’s pioneer club at 1 Utama has set the stage with its impressive performance of turning a profit within its first year with average utilization rate of less than 50%, which increased to a steady state of over 90% by mid 2024. This is further highlighted with ASCARO’s revenue growth from RM1.8 million in 2023 to RM4 million in 2024.

What has propelled ASCARO’s success so far has been its diversified revenue model with robust streams such as memberships, court rentals, events, sponsorships, coaching and merchandise – ensuring financial resilience.

WHAT INVESTORS NEED TO KNOW

ASCARO’s expansion plan comes with solid financial foundations. With increased interest from corporate sponsors, coupled with cost reduction from spreading overheads over multiple clubs, each ASCARO Padel & Social Club is expected to comfortably generate an average of RM3 million in annual cashflow. This will enable ASCARO to continue launching new clubs at an expected cost of RM3-5 million per club. The projected number is 15 clubs by 2027, with an expected group-wide profit of over RM40 million. By this time, a clear exit strategy has also been charted, targeting a sale or an IPO (initial price offering) at a valuation of at least RM400 million, based on a relatively conservative multiple of 10x earnings.

With the pre-money valuation of RM91 million, this would make the RM20 million investment equivalent to a 18.02% stake, where investors can expect to make a 4x return on their money within 3 to 4 years.

For more risk-averse investors, however, a fixed investment is presented as an alternative offer: a preferred share option with 15% annual dividends for 4 years and a redemption at 150% of the investor’s initial investment at the end of 4 years. This is equivalent to approximately 2x return in 4 years.

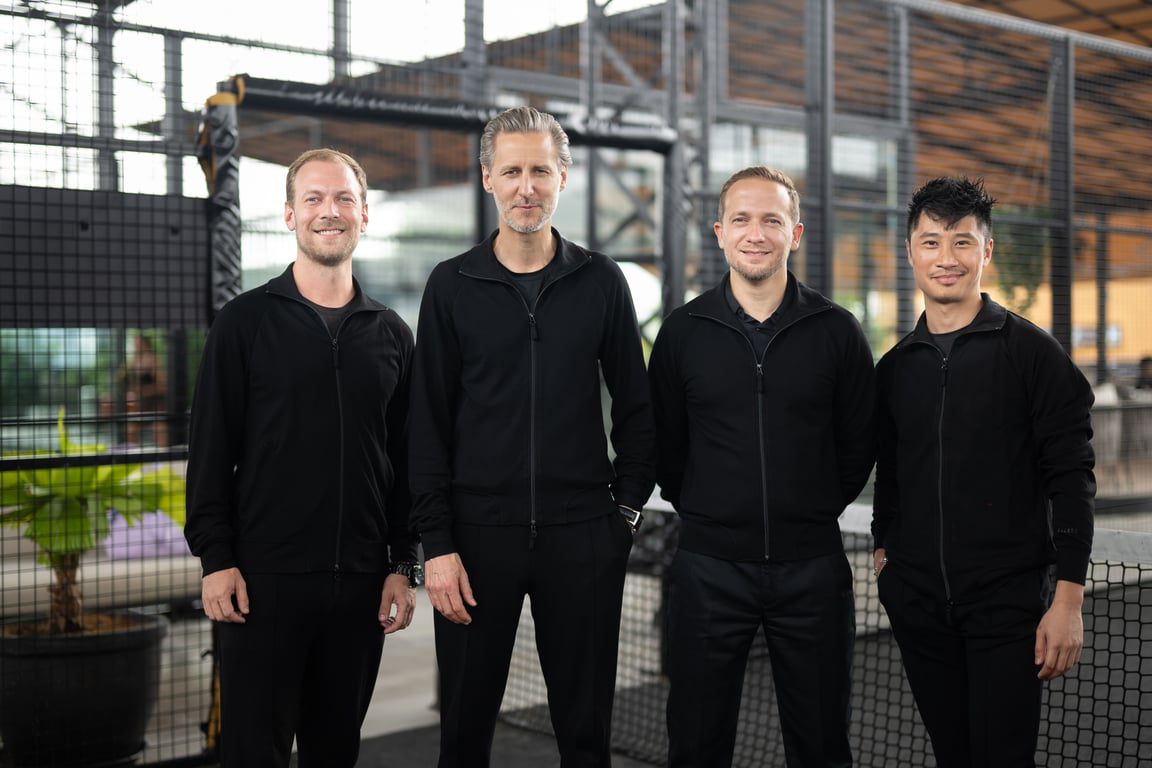

Finally, what this fundraising exercise will achieve will be the building blocks of the ASCARO experience – intersecting sport, luxury, and lifestyle. Helming this journey forward is a team of seasoned professionals with backgrounds in fashion, luxury hospitality, marketing and technology, supported by high-profile advisors and investors.

The Premium Padel Experience is equipped with Spanish black courts from Padel Galis, professional coaching and tournaments and an app. Luxury wellness facilities will be introduced with high-end gyms, yoga and meditation spaces and spa and recovery services. As for the social aspect of the space, gourmet restaurants and cocktail bars together with networking lounges and co-working areas would be created.

Stan Zabolotsky, Co-Founder added: “ASCARO stands for ‘And So Came A Revolution’. Not only has ASCARO pioneered padel in Malaysia, it has also meticulously crafted a unique approach that seamlessly blends the worlds of sports and socializing. Through this crowdfunding initiative, we are inviting our community to become co-owners of this exciting next step in our journey.”

To learn more about ASCARO’s Equity Crowdfunding campaign on pitchIN, and how investors can take secure their stake in this exciting venture, visit https://www.pitchin.my/equity/ascaro-sea

You must be logged in to post a comment.