by Penny Angeles-Tan | Oct 23, 2024 | Business

Crypto futures trading provides benefit opportunities for users. Understand the mechanism, how it works, and its benefits. This article will also be explained about crypto futures event that Bitrue will hold next month.

The crypto ecosystem offers interesting instruments: cryptocurrency futures trading. These contracts allow investors to bet on the future price of digital assets, without having to actually buy them.

What is the mechanism, how does it work, and the benefits? You can see the detailed explanation in this article. This article will also explain the crypto futures event which will be held next November on Bitrue. So, if you want to maximize profits in the futures crypto with Bitrue, read this article till the end.

Working Mechanism of Cryptocurrency Futures Trading

Futures Crypto resembles futures contracts in general. Both parties, namely the buyer and seller of the contract, agree to transact at a certain price in the future. The asset at stake in these contracts is the fiat value of a particular digital asset. The transaction completion date is also determined when the contract is made.

Crypto futures contracts are traded on various exchanges, including Bitrue which offers Bitcoin and Ether futures contracts on margin.

History of Crypto Futures Contracts

Bitcoin futures contracts were first listed on the CBOE in early December 2017 but were later discontinued. However, in January 2024 the CBOE announced again trading Bitcoin futures contracts and Ethereum with margin. This makes CBOE “the first registered crypto exchange and clearing house in the US to offer both leveraged and spot derivatives trading on a single platform.”

CME also launched Bitcoin futures contracts in December 2017. This contract is traded electronically on the Globex platform and is cash-settled. Bitcoin and Etherium futures contracts are based on the CME CF Bitcoin Reference Rate and the CME CF Ether Reference Rate.

CME also has reference rates for various other crypto assets, although futures contracts for these cryptos are not yet available for trading on their exchange. These reference rates are published for use by traders on other exchanges. Currently, there are 17 crypto asset reference rates, including Bitcoin and Ethereum, 4 DeFi token reference rates, and 3 Metaverse token reference rates.

Benefits of Trading Crypto Futures Contracts

The main advantage of trading Bitcoin futures contracts is that it offers regulated exposure to the cryptocurrency. This is an important point in a volatile ecosystem with wild price swings. In the US, Bitcoin futures contracts on the CME are regulated by the Commodity Futures Trading Commission (CFTC).

This offers a level of trust and protection for institutional investors, who make up the majority of traders in such contracts.

- Simplicity: Bitcoin futures contracts also simplify the process of investing in Bitcoin. You don’t need to create a Bitcoin wallet or place money in a storage and security solution when trading because there are no Bitcoin exchanges. An additional advantage of cash settlement contracts is that they eliminate the risk of physical ownership of volatile assets.

- Safer than Crypto Holdings: Bitcoin futures contracts are relatively safer for dabbling in Bitcoin without getting burned because futures contracts have position and price limits that allow you to reduce your risk exposure to the asset class.

- Position Limits: Position limits differ between exchanges. For example, CME allows a maximum of 8,000 front-month futures contracts for Bitcoin and micro Bitcoin, and 8,000 for Ether and micro Ether.

Considerations When Trading Crypto Futures Contracts

The number of crypto exchanges offering crypto futures contract trading continues to grow, as does the number of participants and trading volume compared to other commodities. Trading crypto futures contracts has its peculiarities, such as:

- Trading volume in crypto futures contracts can mimic the volume of their spot market counterparts. Price fluctuations can also be high, especially during periods of price volatility. During these times, crypto futures contracts may appear to follow spot market prices or trade at a significant premium or discount to spot prices.

-

Most exchanges are irregular. However, Some trading venues, such as CME, trade crypto futures contracts mostly on unregulated exchanges. Among the world’s largest platforms for Bitcoin futures contracts, only CME is regulated by the CFTC.

-

Crypto futures contract options is a relatively new development. It functions like a standard options contract in that it represents the right, not the obligation, to buy cryptocurrency at a certain price at a future date.

Maximizing Profits in Cryptocurrency Futures Trading with Bitrue

Bitrue will hold a special event for crypto futures in the next month. There are two categories that you can choose, namely:

1. Liquidation Security for New Futures Users

This category is specifically for new Bitrue users at the time the event takes place. To participate in this category, you must open futures positions worth 100 USDT or more in any currency pair during the event period with a leverage of less than 20x.

Later, you will get additional prizes by inviting friends to take part in this event. The rewards you can get are more than 40% rebate commission and 10 USDT in futures trial funds.

2. Trade Futures And Claim 25 USDT Futures Trial Funds

This second category can be participated by new users and existing Bitrue users. New users are required to trade with amounts more than 100 USDT in their first futures transaction to receive 10 USDT futures trial funds.

For old Bitrue users, you can complete the first stage of Novice and Experienced Trader tasks to claim an additional 15 USDT in futures trial funds.

Conclusion

Before joining crypto futures, you must do in-depth research first. The Bitrue website provides various complete features that can help you do research, starting from checking the price of a token, knowing the price conversion for example from BTC to USD, to find out about various projects that a token or network is working on by reading articles on the Bitrue blog.

By understanding the mechanics, benefits, and risks of trading crypto futures contracts, you can make wiser investment decisions.

by Penny Angeles-Tan | Oct 23, 2024 | Business

Learn about liquidation in crypto futures trading, from what the contract is to how it works. This article discusses the factors that cause liquidation, the process, and the importance of risk management for traders to avoid financial losses. Discover strategies for success in the world of crypto futures!

A futures contract is an agreement to buy or sell an underlying asset at a specified price at a specified date in the future. This is a type of derivative contract. These contracts are important in financial markets as they provide traders with opportunities to hedge or speculate.

In this article, we will discuss this type of trading about crypto liquidations and try to understand why crypto liquidations are a valuable tool.

Understanding Crypto Liquidation in Futures Trading

Crypto liquidation in futures trading is about closing positions to balance the initial trade. If a trader has a long position, meaning they want to buy the asset, they must sell the contract to liquidate it. Conversely, if they have a short position, meaning they want to sell the asset, they must buy back the contract to complete the liquidation.

Crypto liquidations are common in futures trading, but traders should think carefully about the effects. This includes looking at how leverage can affect trading results.

Not knowing how crypto liquidation works can lead to major financial losses, especially for new traders who may not fully understand futures trading. In other words, traders who do not know when and how to manage their positions risk liquidation.

Basics of Crypto Liquidation in the Market

Crypto liquidation in futures trading depends on margin requirements. When you trade futures, you must deposit a percentage of the contract value as a margin. It serves as collateral to cover possible losses.

When the price of the underlying asset changes, margin requirements also change. If a trade goes against you and your margin account falls below a certain level, known as maintenance margin, you will receive a margin call.

How Crypto Liquidation Works in Futures Trading?

Liquidation in futures trading occurs for two main reasons:

1. The first reason is voluntary crypto liquidation. Here, a trader decides to close a position before the expiration date of the futures contract. They may do this to take profits, limit losses, or change their trading strategy based on market analysis or risk appetite.

2. The second reason is forced liquidation. This occurs when a trader’s margin account falls below the required maintenance margin level. This usually happens because the price of the underlying asset has fallen. In this case, the brokerage firm can sell the trader’s position, no matter what their investment plans or outlook.

Crypto Liquidation Process for Traders

The liquidation process for people trading in the futures market has several steps. When a trader wants to close their position or if they get a margin call, the first step is to place an order against their current position. For example, if a trader is long on a futures contract, they would need to enter a sell order for the same type and number of contracts.

Profits go to the trader’s trading account, while losses reduce the margin account. Traders need to keep an eye on their margin levels, especially during difficult market conditions. This helps them avoid forced liquidation and major financial losses.

Factors Leading to Liquidation in Futures

Several things can cause the liquidation of a futures contract. This affects both long and short positions. One major factor is that large changes in the price of the underlying asset can lead to large losses and margin calls.

High liquidity in the futures market can exacerbate this. Even small price changes can cause large fluctuations.

Changes in interest rates can affect the costs associated with futures positions. This can affect how profitable the position is and may lead to liquidation. It is important to know that futures trading uses leverage. This means that profits and losses can be magnified.

Traders should think about market risk, interest rate changes, and their risk tolerance. This will help reduce possible liquidation risks.

Conclusion

MKnowing about crypto liquidation in futures trading is the key to success. When you understand the basics, you can move through the markets better. You can use risk management techniques is important.

Understanding trading strategies will also help you to avoid unwanted liquidations. By focusing on timing, predicting trends, and taking advantage of market changes, traders can make better choices.

Bitrue can help you do research before trading crypto futures. You can study before buying futures Bitcoin, Ethereum, Solana, XRP, and other crypto tokens. Also, find out how to convert prices from Ethereum to USD and other tokens easily on the Bitrue website.

by Penny Angeles-Tan | Oct 22, 2024 | Business

Vitalik Buterin, co-founder of Ethereum, has identified centralization as one of the biggest risks for Ethereum. Buterin has proposed a potential solution known as “The Scourge.” Check out the full explanation in this article.

Becoming one of the largest blockchain platforms, Ethereum continues to grow and attract investor interest. However, like every technology, Ethereum also faces challenges and risks. One of the biggest risks facing Ethereum is the centralization of proof-of-stake (PoS).

Centralized Proof-of-Stake

Proof-of-stake is a consensus mechanism that Ethereum uses to validate transactions and secure the network. In PoS, validators must lock a certain amount of ETH to participate in the validation process.

One of the risks in PoS is centralization, where a small number of validators control most of the network. This can increase the risk of 51% attacks, transaction censorship, and value extraction.

Vitalik Buterin and The Scourge

Vitalik Buterin, co-founder of Ethereum, has identified centralization as one of the biggest risks for Ethereum. Buterin has proposed a potential solution known as “The Scourge.”

The Scourge aims to reduce the risk of centralization by using techniques such as encrypted and a two-tier staking approach. This can help prevent large validators from controlling large portions of the network and reduce the risk of transaction censorship.

Centralization Risk Analysis

Some things that need to be considered so that we can carry out risk analysis are:

1. 51% attack risk: Centralization can increase the risk of 51% attacks, where a small group of validators can control the network and invalidate transactions.

2. Transaction censorship: Centralized validators may choose not to process certain transactions, which could disrupt Ethereum’s functionality.

3. Value extraction: Centralized validators can earn larger profits than small validators, which can reduce value for Ethereum users.

Potential Solutions

Apart from The Scourge, some other potential solutions to overcome PoS centralization on Ethereum include:

1. Increased validator set size: Expanding the number of validators can reduce the risk of centralization.

2. Anti-centralization mechanisms: Development of mechanisms that can prevent large validators from controlling the network.

3. Increased user participation: Encouraging more users to become validators can help reduce centralization.

Conclusion: Current Ethereum Price

Centralization of proof-of-stake is one of the biggest risks facing Ethereum. While potential solutions exist, addressing this issue will require continued efforts from the Ethereum community.

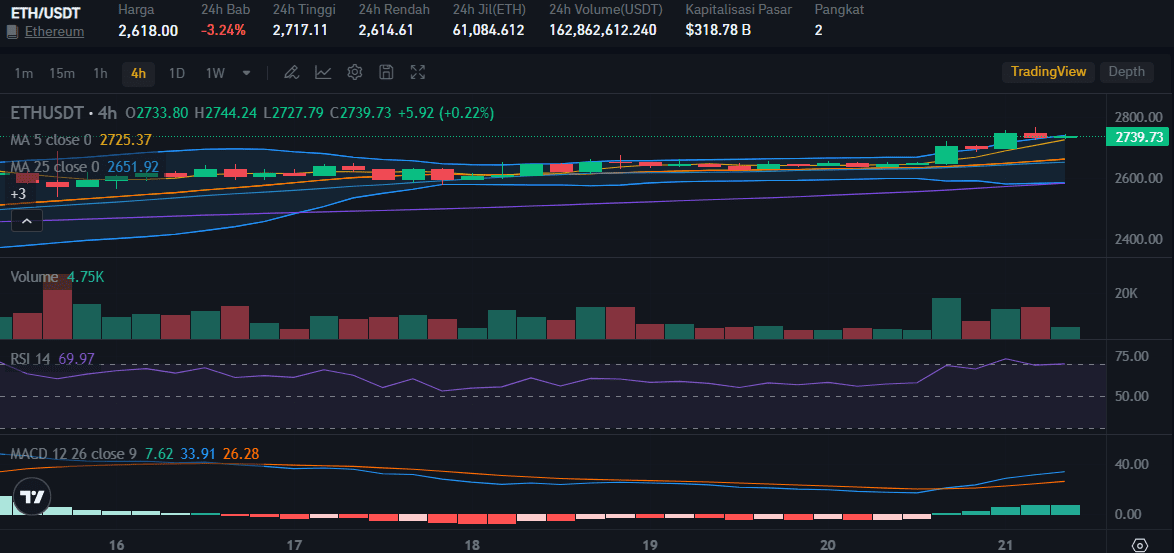

As additional information for those of you who are interested in Ethereum, currently the price of the ETH token is minus 3.24% so it is trading at $2,618.

Although Ethereum price experienced a decline, the RSI indicator has a value of more than 69, so it is indicated that there will be a bullish trend in the near future. The MACD line also explains that the trend will come soon because the buying trend is dominating compared to the selling trend.

Apart from checking token prices in real time, you can also check price conversions ETH to USD easily on the Bitrue website. So, you can know how to allocate funds beforehand buy Ethereum.

by Penny Angeles-Tan | Oct 21, 2024 | Business

Ethereum founder says Ethereum is changing fundamentals. Learn more about how Ethereum will change the world with blockchain technology, from DeFi to the metaverse. Discover the potential and challenges facing Ethereum in the future.

Ethereum wasn’t built just overnight. Its development went through several phases, starting with Frontier in 2015, which laid the foundation for miners and developers. Later phases such as Homestead and Metropolis focused on improving security, functionality, and developer experience.

If you are interested in Ethereum and its network, this article will help you understand this token well. This article will explore the exciting future of Ethereum, a leading blockchain network.

Starting from Ethereum’s latest upgrade, Ethereum’s roadmap to scalability and sustainability, and the implications for users and developers.

Check ETH Futures Market

Potential and Challenges of Ethereum in the Future

Ethereum has great potential to become the backbone of the digital economy. With its ability to facilitate secure and transparent transactions, Ethereum can drive business growth and innovation across various sectors.

Ethereum could become the ultimate platform for building a metaverse, a connected virtual world where people can work, play, and socialize. Ethereum can also integrate artificial intelligence technology to create smarter and more efficient applications.

With the various potentials above, Ethereum has several challenges to face in the future, such as:

1. Scalability: Despite significant progress, Ethereum still faces challenges in increasing scalability to accommodate rapid growth in users and transactions.

2. Regulation: Unclear regulations in various countries can hinder Ethereum’s growth and adoption.

3. Competition: Ethereum faces competition from various other blockchain platforms that offer different features and advantages.

Green Revolution: Ethereum 2.0 and Proof-of-Stake

Significant changes occurred in 2020 with the launch of Ethereum 2.0 and the transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). This change dramatically reduces Ethereum’s energy consumption, making it a more environmentally friendly platform.

PoS also lowers the barrier to entry for participating in the network, as users no longer need expensive mining equipment.

Roadmap Ethereum Towards Scalability

While PoS is a big step forward, Ethereum’s roadmap doesn’t stop there. The network is actively working on scalability solutions to overcome transaction speed limitations. Here are some key aspects of this roadmap:

1. Sharding: Ethereum plans to implement sharding, a technique that divides the blockchain into smaller pieces, enabling parallel processing of transactions and significantly increasing network throughput.

2. Layer-2 Scalability Solution: Layer-2 solutions such as rollups have helped reduce transaction bottlenecks on the Ethereum mainnet. This solution aggregates off-chain transactions and then efficiently executes them on-chain, resulting in faster and cheaper transactions.

3. EIP-7762: This proposed enhancement aims to simplify cost distribution and scalability by focusing on roll-up integration and introducing a new cost-sharing model.

A Brighter Future for Ethereum Developers and Users

Ethereum’s roadmap holds great potential for developers and users. Here’s what you can expect:

1. Lower Transaction Fees: With increased scalability, transaction fees on Ethereum are expected to decrease significantly, making the network more accessible to everyone.

2. Faster Transactions: Faster transaction confirmation times will result from faster block times and improved processing capabilities.

3. Enhanced Security: Ethereum’s focus on security remains primary, and the PoS mechanism along with ongoing development efforts will continue to strengthen the network’s resilience.

4. A More Vibrant Ecosystem: Increased scalability will pave the way for a variety of decentralized applications (dApps) built on Ethereum, driving further innovation and user adoption.

Conclusion

Ethereum’s roadmap is ambitious and constantly evolving. With a focus on scalability, sustainability, and security, Ethereum is poised to maintain its role as a leader in the blockchain space.

This future holds exciting possibilities for developers and users, with a more efficient, secure, and accessible Ethereum ecosystem on the horizon.

With the increasingly comprehensive Ethereum network, it cannot be denied that this will also have a positive impact on Ethereum price. Converting the price of ETH to USD will also strengthen investors’ increasing confidence in the development of Ethereum network technology.

Ethereum may be experiencing a price decline recently which is a bit worrying. However, as Ethereum continues to develop smart contracts for other parts of its network, more and more users will buy ETH in the future.

by Penny Angeles-Tan | Oct 20, 2024 | Business

Ripple Swell 2024 has begun. This annual event will discuss various things about crypto, blockchain, and existing crypto regulations. How will Ripple Swell affect the price of XRP?

Ripple Swell 2024 has started on October 15. For two days, Ripple will hold a conference to discuss crypto, blockchain, and investment regulations.

Then, how will the Ripple Swell 2024 affect XRP price? Will it provide a positive trigger so that the price of the token rises? Check out the detailed explanation below.

Ripple Swell 2024’s Highlights

Ripple Swell 2024 is Ripple’s annual event. This year was the eighth year of the Ripple Swell event which was held in Miami on October 15-16 2024. There were more than 600 participants from more than 40 countries attending.

At Ripple’s annual conference this year, several great speakers will appear, from Andrienne Harris who is Head of Financial Services in New York to Tim McCourt as senior managing director of Chicago-based CME Group.

Ripple Swell 2024 opened with a chat about regulations and the crypto landscape in America. In this session, discussions about court cases that are often carried out by the SEC are of course also carried out. Discussions about stablecoins have not gone unnoticed, especially since Ripple also has plans to issue its stablecoin.

For the second day, discussions will revolve around leadership influencing the crypto market. The leadership in question is of course the arrangement of a state leader who also discusses the current general elections in America.

America as a country that is often a center for investment, including crypto, its leadership is certainly in the spotlight. Because, of this leader, new regulations will be created which could later have a positive or negative impact on the crypto market.

Effect of Ripple Swell on XRP Price

XRP token holders are eagerly awaiting this Ripple Swell event. Because, at this event, Ripple will also make announcements that often have a good impact on XRP token holders. So, don’t be surprised if the price of XRP can increase when this event takes place.

However, unfortunately, when this article was written on the first day of Ripple Swell 2024, the price of XRP decreased by -0.08%. Currently, XRP is trading at $0.5406.

Even though it has experienced a decline, the RSI value of XRP is still above 50, which means the buying trend is still slightly more dominant than the selling trend. The MACD line for this token is still above the existing limit line.

It is believed that the percentage decrease in the price of XRP that is less than 1% will not last long and could cause the price to bounce up.

When Will the RLUSD Stablecoin Launch?

Ripple Swell 2024 is also an event where the Ripple community collects the latest information regarding the launch of the RLUSD stablecoin. RLUSD is predicted to be a strong stablecoin because it focuses on regulations under the New York Trust Company Charter with its very strict supervision.

RLUSD has been testing on the XRP ledger and Ethereum mainnet since August 9.

Ripple claims that there will be a third-party audit of cash assets in every monthly report published so that there will be strong transparency and accountability.

Until the time this article was written, Ripple had not made an official announcement when RLUSD would be launched.

Conclusion

In general, the opening of the Ripple Swell 2024 event has not had a significant influence on the price of XRP the price has decreased. However, optimism for an increase in XRP prices remains, especially since October always provides a positive signal for the crypto market.

For those of you who are currently doing research before buying XRP, you can make maximum use of Bitrue’s features. You can check XRP price in real-time, knowing the price conversion XRP to USD easily, to follow the development of information on the Ripple project as a whole from time to time on the Bitrue blog.

You must be logged in to post a comment.