by Penny Angeles-Tan | Dec 10, 2024 | Business

Unlock Bitcoin’s potential with Babylon and Bitrue! Stake BTC to earn rewards, strengthen Proof-of-Stake networks, and enjoy flexible interest rates up to 2.3% APR. Discover secure, innovative staking today.

Bitcoin (BTC), known as a store of value and the most prominent cryptocurrency, is evolving into a more dynamic financial asset. With the advent of Babylon, BTC holders now have an opportunity to stake their assets to earn rewards while bolstering the security of Proof-of-Stake (PoS) blockchain networks.

In collaboration with Bitrue, Babylon offers an innovative platform for BTC staking, allowing users to unlock the potential of their digital assets. Let’s dive into the key aspects of this partnership, how it works, and why it’s generating buzz in the crypto world.

Staking BTC on Babylon via Bitrue

Bitrue and Babylon enable users to stake Bitcoin seamlessly through a recently announced partnership. This collaboration enhances Babylon’s adoption and provides Bitrue users with easy access to Bitcoin staking and its associated benefits.

Benefits of Staking BTC on Bitrue

There are many benefits of staking BTC on Bitrue, such as:

1. Maximum Yield Results: Earn competitive returns by participating in BTC staking.

2. Safe and Measurable Restaking: A transparent and secure process for reaping rewards.

3. Fast Unbonding: Quick withdrawal of your staked BTC when needed.

4. Daily Rewards: Earn Babylon points and staking rewards directly through Bitrue.

These features make Babylon’s platform user-friendly while providing tangible incentives for staking participation.

Key Advantages of BTC Staking

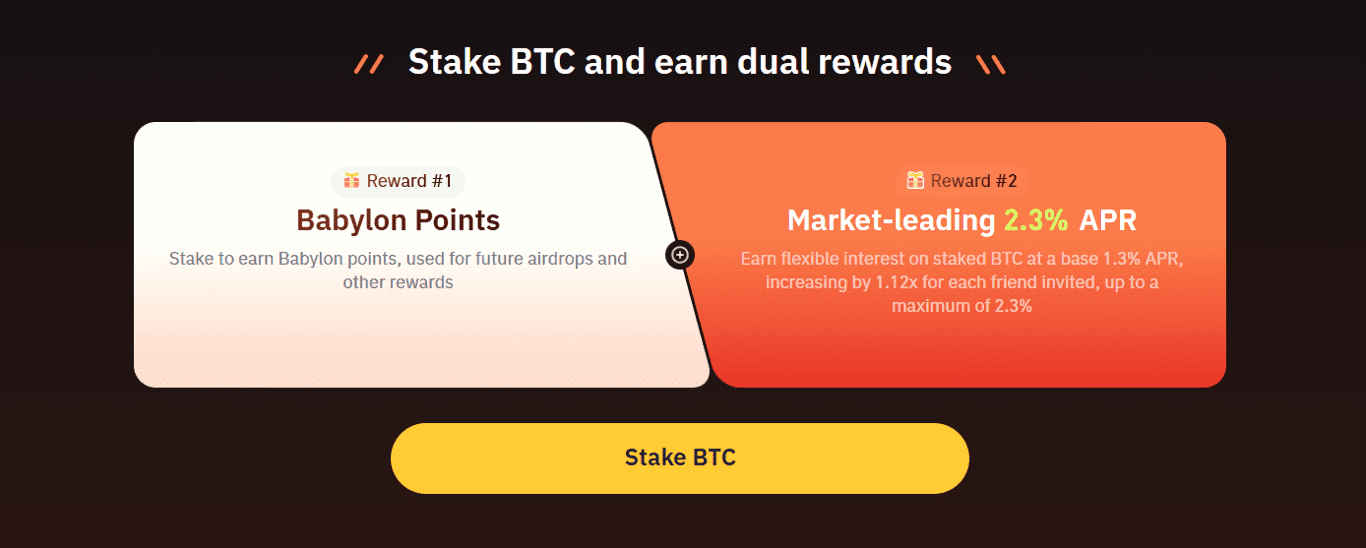

Staking BTC on Bitrue via Babylon brings two notable rewards:

1. Babylon Points

Babylon points are distributed daily based on the amount of BTC staked by users about the total staking pool. The calculation accounts for factors such as:

– On-chain staking successes or failures.

– Quota returns.

– Commission payments to finality providers.

To track their earnings and optimize staking strategies, participants can monitor their Babylon points through Bitrue’s “My Holdings” section.

2. Flexible Interest Rates

Users can enjoy an Annual Percentage Rate (APR) that starts at 1.3% and increases up to 2.3% through Bitrue’s Flexible Income feature. This flexible interest model incentivizes user participation, with APR increments based on successful referrals:

1 Invite: APR increases to 1.46%.

2 Invites: APR grows to 1.63%.

3 Invites: APR reaches 1.83%.

4 Invites: APR climbs to 2.05%.

5 Invites: Unlocks the maximum APR of 2.3%.

By inviting friends and expanding the Bitrue user base, participants can maximize their earning potential during the promotional period.

What is Babylon?

Babylon is a cutting-edge protocol designed to convert Bitcoin into a productive asset by integrating it into the PoS ecosystem. This transformation supports the security of PoS networks while allowing BTC holders to earn staking rewards.

By leveraging advanced cryptographic techniques and self-custody mechanisms, Babylon ensures users retain full control of their funds during staking.

Core Features of Babylon

Some of the key features of Babylon are:

1. Unmediated Operations: Completely permissionless and decentralized, Babylon removes intermediaries from the staking process.

2. Bitcoin Script Compatibility: Utilizes Bitcoin scripts to enable staking and slashing mechanisms.

3. Economic Stability: Strengthens PoS networks while providing financial incentives to users.

Babylon’s innovative approach is reshaping how Bitcoin operates within the broader blockchain landscape.

Meet the Babylon Team

Babylon’s team includes experts from academia, engineering, and business sectors, such as:

1. David Tse (Co-Founder): Stanford University professor leading algorithm development.

2. Mingchao Yu (CTO): Oversees technical aspects and protocol efficiency.

3. Xinshu Dong (Chief Strategy Officer): Focuses on partnerships and market opportunities.

4. Adam Ettinger (Chief Legal Officer): Ensures compliance with crypto regulations.

The team’s diverse expertise ensures the protocol’s reliability, security, and growth in the blockchain ecosystem.

Babylon Ecosystem and Strategic Partners

Babylon collaborates with over 87 strategic partners, including DeFi platforms, digital wallets, custodians, and the Cosmos ecosystem. These partnerships enable seamless integration between Bitcoin and PoS networks, expanding Babylon’s reach and utility.

For instance:

1. Integration with Cosmos enhances interoperability for Bitcoin staking across multiple blockchains.

2. Support from digital wallets ensures security and accessibility for users.

Babylon’s network is pivotal in bridging Bitcoin’s potential with the DeFi world.

Security and Future Potential

Babylon employs robust security measures, including a decentralized sequencing system and advanced time-stamping protocols, to create a secure staking environment. As adoption grows, its security features inspire confidence among users.

The $1.5 Trillion Opportunity

Babylon has already achieved significant milestones, with 24,000 BTC (~$1.5 billion) staked in its second round. This reflects the untapped potential of Bitcoin staking in DeFi. With a secure protocol, Babylon aims to activate dormant Bitcoin reserves, increasing market liquidity and furthering Bitcoin’s integration into decentralized finance.

How to Get Started

Starting December 10, 2024, at 11 AM UTC, you can begin staking BTC via Bitrue. Follow these steps:

1. Ensure you have Bitcoin in your Bitrue account.

2. Visit the staking section on the Bitrue platform for a detailed guide.

3. Study the risks involved and proceed confidently.

Conclusion

Babylon’s partnership with Bitrue marks a turning point in Bitcoin’s journey from a passive store of value to a dynamic, profit-generating asset. By offering secure and efficient staking solutions, Babylon empowers BTC holders to participate in the evolving DeFi ecosystem.

Whether you’re an experienced crypto enthusiast or new to staking, this innovative platform provides an accessible way to grow your assets while contributing to blockchain security.

by Penny Angeles-Tan | Dec 9, 2024 | Business

Discover Babylon, Transforming Bitcoin (BTC) into a dynamic asset that secures Proof-of-Stake blockchains while earning rewards. Explore staking benefits, seamless integrations, and enhanced DeFi utility for BTC holders.

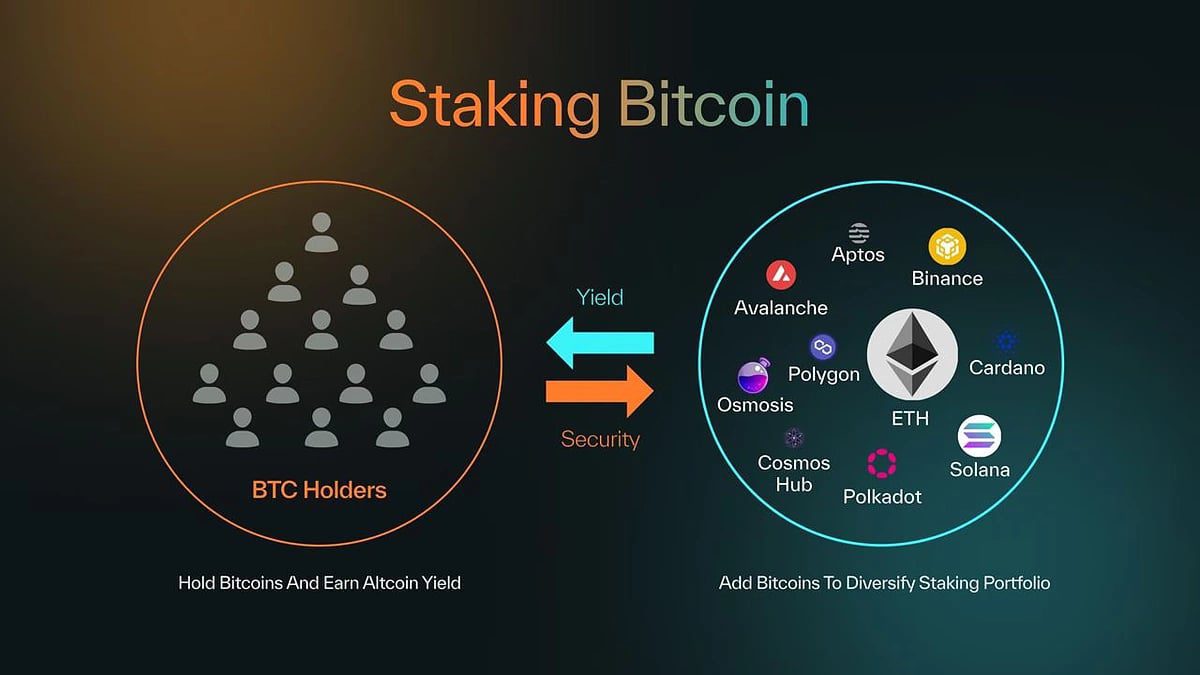

Babylon is a groundbreaking project aimed at reshaping the utility of Bitcoin (BTC) by enabling its holders to enhance the security of Proof-of-Stake (PoS) blockchains while earning yield.

This innovative approach allows Bitcoin to transcend its traditional role as a store of value or medium of exchange and become an active participant in the decentralized economy.

What is Babylon?

Babylon introduces a staking protocol that allows Bitcoin holders to secure PoS blockchains without needing to bridge, wrap, or hold their BTC in custody.

By leveraging Bitcoin’s inherent strengths—its timestamping service, blockspace, and asset value—Babylon unlocks new possibilities for integrating Bitcoin into decentralized finance (DeFi).

This protocol is particularly impactful for PoS ecosystems like Cosmos, Polygon, and Bitcoin Layer 2s, offering enhanced economic security and scalability. By doing so, Babylon positions Bitcoin as a critical asset for securing the broader blockchain ecosystem.

How Does Babylon Work?

Babylon has several main components, here is a detailed explanation that you can study in more depth.

1. Bitcoin Staking Protocol

Babylon’s staking protocol allows Bitcoin holders to stake their BTC directly to secure PoS chains, app chains, and dApps. Unlike traditional staking, Babylon’s approach does not require Bitcoin to be bridged or held by third parties, significantly reducing risks.

– Security: Staked BTC remains safe and withdrawable, provided participants act in good faith. The protocol also ensures prompt unbonding of staked assets using the Bitcoin timestamping protocol, eliminating delays and social consensus dependencies.

– Compatibility: Designed as a modular plug-in, the protocol integrates seamlessly with various PoS chains, making it a versatile solution for enhancing blockchain security.

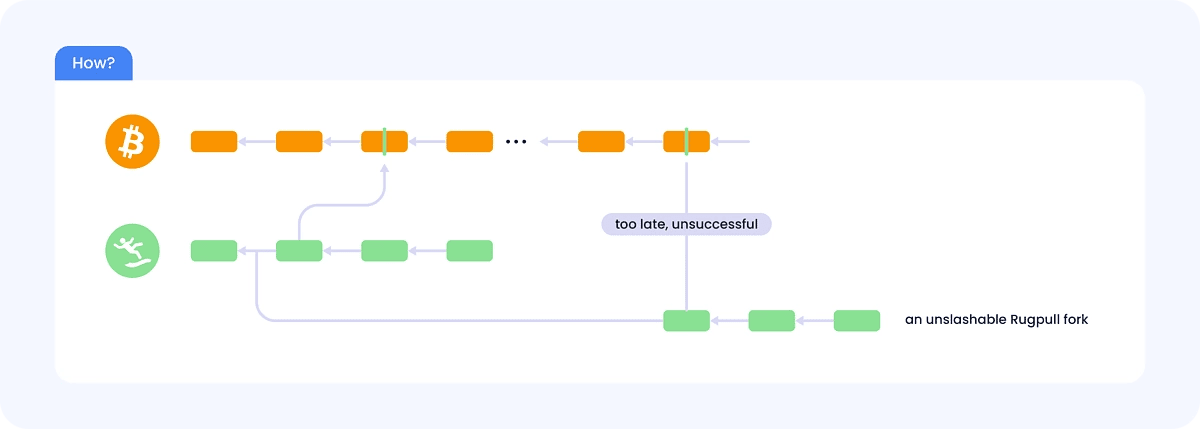

2. Bitcoin Timestamping Protocol

This protocol timestamps blockchain events onto the Bitcoin network, borrowing Bitcoin’s robust security features to enhance PoS network integrity.

– Long-range Attack Prevention: By tying PoS blockchain data to immutable Bitcoin timestamps, Babylon protects against malicious forks and chain manipulation.

– Efficiency: It supports fast stake unbonding, reduces security costs, and facilitates cross-chain synchronization without social consensus.

3. Bitcoin Data Availability Protocol

This protocol uses Bitcoin’s blockspace to provide a censorship-resistant layer for PoS chains, ensuring critical data remains accessible and secure. It enhances blockchain reliability, making Babylon an invaluable tool for decentralized applications.

Key Benefits of Babylon

1. Expanding Bitcoin’s Utility

Babylon transforms Bitcoin from a passive store of value into an active financial tool. BTC holders can now earn rewards while contributing to the security of PoS networks.

2. Strengthening PoS Blockchain Security

Babylon leverages Bitcoin’s Proof-of-Work (PoW) security to enhance the resilience of PoS chains against attacks, particularly in their early stages of development.

3. Increasing Capital Efficiency

The protocol enables BTC holders to stake their assets without compromising liquidity, thereby increasing the capital efficiency of Bitcoin within the DeFi ecosystem.

4. Fast and Flexible Unbonding

Unlike traditional staking systems, Babylon offers a swift unbonding process, ensuring users can access their funds promptly while maintaining flexibility.

Funding and Partnerships

Babylon’s vision is supported by a robust team, including co-founders David Tse and Fisher Yu, alongside expert advisors. The project has garnered significant funding, raising over $18 million in December 2023 from leading investors such as Polychain Capital, OKX Ventures, and Polygon Ventures.

Babylon’s growing ecosystem boasts partnerships with Lombard, Akash Network, Binance Web3 Wallet, Injective (INJ), and others, further solidifying its market position and expanding its integration potential.

Implications for the Blockchain Ecosystem

1. For Bitcoin Holders

Babylon offers a secure, self-directed custodian mechanism for staking BTC, providing a passive income stream while maintaining control over their assets. This setup eliminates the risks associated with third-party custody, making staking accessible and safe.

2. For PoS Networks

Babylon’s protocols address critical challenges like long-range attacks and data availability, ensuring PoS networks remain secure and efficient. This is particularly beneficial for new chains, which often face security vulnerabilities during their early stages.

3. For Decentralized Finance

By integrating Bitcoin into PoS networks, Babylon enhances cross-chain interoperability and opens new avenues for Bitcoin’s role in the decentralized economy.

Conclusion

Babylon represents a paradigm shift in blockchain security and Bitcoin utility. Its innovative protocols enable Bitcoin holders to actively participate in securing PoS ecosystems while earning rewards.

By bridging Bitcoin’s PoW strengths with PoS flexibility, Babylon is poised to redefine the decentralized economy, fostering greater security, efficiency, and interconnectedness across blockchains.

As the blockchain space continues to evolve, Babylon stands out as a pioneer, unlocking Bitcoin’s potential to safeguard the decentralized future.

For additional information, if you want to stake Babylon, you can join the campaign that is being held by Bitrue. You can get dual rewards by earning Babylon points while getting 2.3% APR on your BTC.

by Penny Angeles-Tan | Dec 8, 2024 | Business

Bitcoin surpasses $100,000 for the first time, marking a historic milestone in cryptocurrency’s evolution. Explore its institutional adoption, political support under President-elect Trump, and future prospects in the financial mainstream.

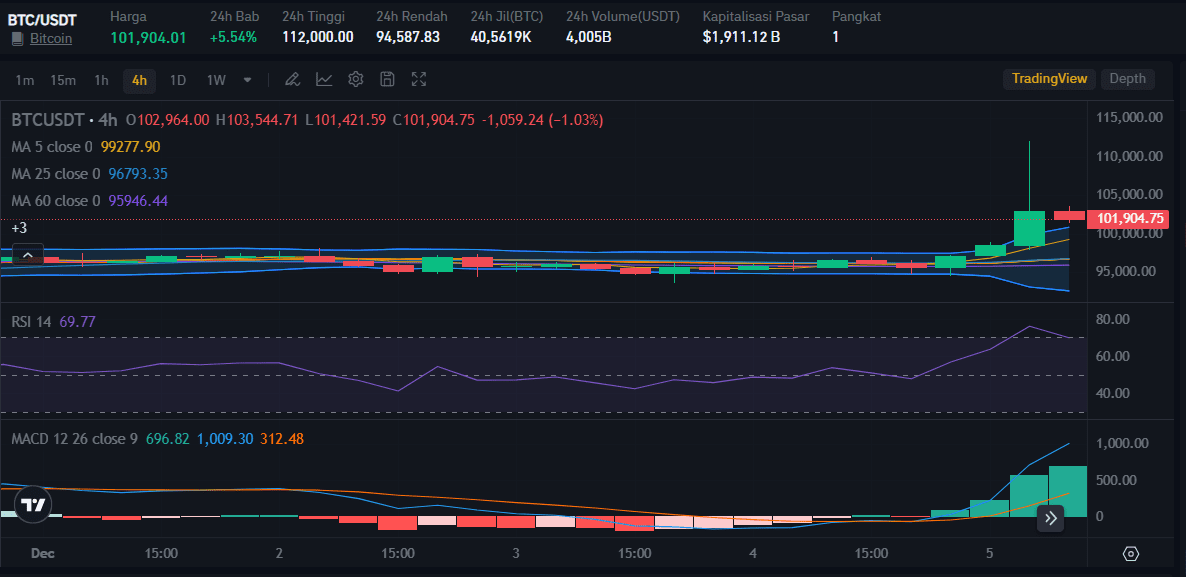

In a historic moment for the financial world, the price of Bitcoin surged past $100,000 for the first time on Wednesday, peaking at $103,844.05. This milestone reflects a dramatic increase of over 45% since November 5 and more than 140% year-to-date in 2024.

The rise comes amid an increasingly crypto-friendly political environment, fueled by President-elect Donald Trump’s promises to support the industry.

As you can see from the price chart above, at the time of writing this article on December 5, Bitcoin was at $101,904 with a 5.54% increase. In fact, in the last 24 hours, the price of BTC reached $112,000.

A New Chapter for Bitcoin

Bitcoin, launched 15 years ago by an unknown entity under the pseudonym Satoshi Nakamoto, has transcended its origins as an experimental digital currency. Initially envisioned as a peer-to-peer payment system, many now view Bitcoin as a store of value and a hedge against geopolitical instability and inflation.

Institutional interest in cryptocurrency has skyrocketed, with exchange-traded funds (ETFs) playing a pivotal role.

BlackRock’s iShares Bitcoin Trust ETF, the largest of its kind, has seen significant growth since its launch in January, now valued at over $45 billion.

“There’s growing interest across institutional and wealth-management spaces,” said Jay Jacobs, BlackRock’s U.S. head of thematic and active ETFs. ETFs have simplified Bitcoin investment, allowing mainstream and institutional investors to capitalize on its volatile yet lucrative price movements.

Political Winds Favoring Crypto

President-elect Donald Trump’s surprising pivot from crypto skepticism to advocacy has invigorated the industry. During his campaign, Trump pledged to establish a U.S. Bitcoin “strategic reserve,” eliminate taxes on crypto transactions, and create policies to encourage domestic Bitcoin mining.

His pick of Paul Atkins, a known crypto advocate, as the next SEC Chair signals a likely shift toward lighter regulation, contrasting with the strict enforcement under outgoing Chair Gary Gensler.

Trump’s engagement with the crypto community extends beyond policy. From headlining the Bitcoin Conference in Nashville to using Bitcoin for a high-profile purchase in Manhattan, he has actively courted the crypto demographic.

His administration also plans to establish a dedicated crypto policy role in the White House, marking an unprecedented move in U.S. financial governance.

Market Reactions and Future Prospects

Bitcoin’s rally has sparked renewed interest in the broader cryptocurrency market. Altcoins like Ethereum Classic (ETC) and Bitcoin SV (BSV) have seen double-digit percentage gains, reflecting broader market enthusiasm.

Experts suggest the bull market is far from over, with eToro’s Josh Gilbert noting, “This feels like the early stages of a sustained rally.”

However, Bitcoin’s notorious volatility remains a cautionary tale. Market analysts warn against overexuberance, emphasizing the potential for price corrections. Pav Hundal of Swyftx remarked on the momentum but advised caution, noting that “assets rarely rise in a straight line forever.”

A Paradigm Shift in Financial Markets

Bitcoin’s ascent has drawn comparisons to gold, with Federal Reserve Chair Jerome Powell describing it as a “digital competitor to gold” rather than a rival to traditional currencies. Institutional players like Fidelity, Invesco, and Charles Schwab are preparing to enter the crypto market, underscoring Bitcoin’s growing legitimacy.

Mike Novogratz, CEO of Galaxy Digital, summed up the sentiment: “We’re witnessing a paradigm shift. Bitcoin and the entire digital asset ecosystem are on the brink of entering the financial mainstream.”

Looking Ahead

As Trump prepares to take office in January, the cryptocurrency community is optimistic about a regulatory environment that fosters innovation and mainstream adoption. While challenges remain—from security concerns to potential regulatory hurdles—Bitcoin’s milestone signals a transformative moment for the financial landscape.

The road ahead may not be smooth, but with institutional adoption rising and political support strengthening, Bitcoin’s journey from a niche asset to a global financial staple appears inevitable. Whether this surge heralds a new era or is merely another peak in its volatile history, one thing is clear: Bitcoin has cemented its place in the financial world.

Conclusion

The strengthening of support for Bitcoin has made cryptocurrency more trusted and investors with traditional investment instruments are slowly looking at crypto. If you are one of those people, make sure to always do in-depth research, from technical to fundamental crypto tokens must be checked carefully.

You don’t need to be confused about how and where to do this reliable research. Because, Bitrue can help you. There are many features that you can use to do independent research, from checking BTC prices in real time, converting BTC prices to USD easily, to reading the latest information on the crypto ecosystem for free on the Bitrue blog.

Bitrue will be your reliable crypto investment buddy. In fact, Bitrue often holds airdrop events and deposit contests so you can get maximum benefits in investing.

by Penny Angeles-Tan | Dec 7, 2024 | Business

Explore Ethereum’s (ETH) journey to $3,900 and beyond with bullish predictions for 2025 and 2030. Discover key drivers like institutional inflows, whale activity, DeFi growth, and network upgrades, alongside critical resistance levels and long-term outlooks.

As the second-largest cryptocurrency by market capitalization, Ethereum (ETH) continues to captivate the market’s attention. Amid broader volatility, ETH’s performance suggests strong bullish momentum, supported by institutional interest, increasing on-chain activity, and favorable market sentiment.

Recent Performance and Price Movement

At the time of writing, ETH is trading at $3,895 after experiencing a 5.06% increase with its highest price in 24 hours being $3,901. The current ETH RSI value is even at 72 which means the buying trend is more dominant than the selling trend, even tending to be overbought.

The daily trading volume surged by 4% to over $42 billion, reflecting heightened investor activity. ETH has rebounded above the critical $3,500 resistance level, with technical indicators like the 50-day EMA crossing above the 200-day EMA signaling potential for further gains.

The uptrend aligns with a broader market shift. Bitcoin (BTC) recently reached $100,000, boosting investor confidence across the altcoin market, including Ethereum. However, ETH’s price remains 21% below its all-time high (ATH) of $4,891, set in November 2021.

Institutional Activity and ETFs Driving Growth

Institutional interest in Ethereum has intensified, particularly through exchange-traded funds (ETFs). U.S.—based spot Ethereum ETFs reported eight consecutive days of net inflows, totaling $901.3 million as of early December.

Key contributors include BlackRock’s ETHA fund, with $65.3 million in inflows, and Fidelity’s FETH fund, with $73.7 million.

Despite outflows from Grayscale’s Ethereum Trust (ETHE), the overall inflow trend indicates growing confidence among institutional investors, further supporting Ethereum’s price trajectory.

Whale and Retail Activity Boost On-Chain Metrics

Ethereum whales have played a pivotal role in recent price movements. Whales holding 10K to 100K ETH increased their holdings by 460K ETH in the past week, while those with larger stakes (100K to 1 million ETH) reduced theirs by 490K ETH. This redistribution suggests a shift of ETH from institutions to retail whales.

On-chain activity has also intensified, with Ethereum registering a net outflow of $820 million from exchanges over seven days, indicating accumulation by long-term holders. The total number of Ethereum holders rose to 133.21 million on December 4, emphasizing rising retail interest.

DeFi and Network Growth

Ethereum’s decentralized finance (DeFi) sector continues to thrive, with total value locked (TVL) reaching $72.9 billion. This robust ecosystem supports broader adoption and reinforces Ethereum’s position as a foundational blockchain for DeFi, NFTs, and decentralized applications.

Furthermore, staking flows have seen consistent inflows, reflecting long-term investor confidence. A growing amount of ETH is being locked in staking protocols, reducing available supply and supporting price appreciation.

ETH Price Predictions in 2025 & 2030 and Market Sentiment

Industry experts and financial institutions are optimistic about Ethereum’s long-term potential:

- Deltec Bank predicts ETH could reach $10,000 by 2025 and $22,500 by 2030.

- Standard Chartered projects a 2025 target of $14,000, citing Ethereum’s network upgrades and potential scalability improvements.

- Gigantic-Cassocked-Rebirth (GCR) anticipates a $10,000 price point, driven by DeFi growth and adoption of Ethereum 2.0.

-

Finder analysts forecast an average price of $6,105 by 2025, underpinned by institutional investment and technological advancements.

Goldman Sachs has even suggested that Ethereum could surpass Bitcoin as a store of value, thanks to its extensive use in DeFi and its foundational role in blockchain innovation.

Challenges and Key Levels to Watch

While optimism abounds, Ethereum faces significant resistance at $4,000 and its ATH near $4,891. A clear break above these levels, supported by sustained volume and on-chain activity, could validate bullish patterns like the cup-and-handle formation, potentially driving ETH toward new highs of $7,000 or beyond.

However, a daily close below $3,400 could invalidate the current bullish thesis, sending ETH toward support levels around $2,817.

Conclusion

Ethereum’s recent rally is a confluence of institutional interest, strong on-chain metrics, and technological advancements. As it edges closer to the psychologically significant $4,000 mark, ETH appears poised for a defining move. While risks remain, the long-term outlook for the leading altcoin remains promising, with the potential to reclaim its ATH and embark on a new bullish cycle.

Investors should monitor critical resistance levels, market sentiment, and macroeconomic conditions to navigate the evolving landscape effectively.

by Penny Angeles-Tan | Dec 6, 2024 | Business

Bitcoin surpasses $100,000, marking a historic milestone in cryptocurrency evolution. Explore key factors, challenges, and future trends shaping Bitcoin’s role in modern finance.

The world’s leading cryptocurrency, Bitcoin, has achieved an unprecedented milestone, surging past $100,000 for the first time during late trading on Wednesday. This marks a watershed moment in the evolution of digital assets, a sector increasingly intertwined with technological innovation, financial strategies, and global geopolitics.

Key Factors Behind Bitcoin’s Ascent

There are many factors about the increase in Bitcoin price today, some of them are:

1. Regulatory Optimism

Bitcoin’s recent rally has been powered by investor anticipation of clearer, more supportive regulations under the incoming administration. The creation of a cryptocurrency advisory council and the potential mainstreaming of crypto assets as part of government reserves have amplified confidence in the sector.

2. Institutional Adoption and Market Dynamics

The approval of spot Bitcoin exchange-traded funds (ETFs) earlier this year opened doors for institutional investors, further legitimizing Bitcoin as an asset class. With ETF holdings exceeding $100 billion, the demand for Bitcoin has surged.

Additionally, the recent “halving” event, which reduced the rate at which new Bitcoins are mined, has exacerbated supply-demand imbalances, pushing prices higher.

3. Market Sentiment and Strategic Buying

Sudden price corrections, historically a source of panic in the market, now represent buying opportunities for a growing pool of investors who view Bitcoin as a legitimate, long-term investment vehicle.

High-profile corporate acquisitions, such as MicroStrategy’s massive Bitcoin holdings worth over $40 billion, continue to anchor confidence in the digital currency.

4. Trump’s Role in Crypto Fever

Donald Trump’s presidency has become a turning point for the cryptocurrency industry. Initially a skeptic, Trump’s pivot to crypto-friendly policies has catalyzed the sector. His administration’s rhetoric and appointments signal a commitment to fostering innovation while reducing regulatory friction.

Critics, however, have raised concerns about the potential risks of deregulation, drawing parallels to past financial crises.

Proponents, like Galaxy Digital CEO Mike Novogratz, argue that Bitcoin’s surge reflects a paradigm shift. Novogratz highlights the convergence of institutional adoption, advances in blockchain technology, and a clearer regulatory roadmap as transformative forces propelling Bitcoin into the financial mainstream.

Challenges on the Horizon

While Bitcoin’s record-breaking rally has been a cause for celebration, its ascent is not without challenges. The cryptocurrency’s inherent volatility, regulatory uncertainties, and environmental concerns remain significant hurdles.

1. Volatility: A Double-Edged Sword

Bitcoin’s price history is a testament to its volatility. Despite its current upward trajectory, past boom-and-bust cycles remind investors of the risks involved. Market corrections are a natural part of any financial asset’s journey, and Bitcoin is no exception.

Analysts like Josh Gilbert and Mike Novogratz caution investors to practice disciplined profit-taking, ensuring they are not overly exposed to potential downturns.

2. Regulatory Uncertainty

Regulation remains a contentious issue in the cryptocurrency space. While Trump’s administration promises a lighter regulatory touch, critics argue that unchecked growth in the crypto sector could exacerbate existing issues such as fraud, tax evasion, and market manipulation.

The nomination of Paul Atkins as SEC Chair suggests a pivot toward more industry-friendly policies, but this shift may face resistance from lawmakers and traditional financial institutions wary of Bitcoin’s disruptive potential.

Additionally, global regulatory coordination is lacking, with some countries embracing cryptocurrencies while others impose outright bans. This fragmented approach could create hurdles for Bitcoin’s seamless integration into the global financial system.

3. Environmental Concerns

Bitcoin mining, the process by which new coins are created, has long been criticized for its energy-intensive nature. With many mining operations relying on non-renewable energy sources, Bitcoin’s carbon footprint has become a growing concern.

Advocacy for cleaner energy solutions within the industry has gained momentum, and some companies are exploring renewable energy options to address these criticisms. However, whether these efforts can scale to meet Bitcoin’s increasing energy demands remains to be seen.

The Institutional Shift

Despite these challenges, Bitcoin’s growing acceptance among institutional investors marks a pivotal shift. Financial giants like BlackRock, Fidelity, and Invesco have not only legitimized Bitcoin but also opened the floodgates for broader participation.

The launch of Bitcoin ETFs has been a game-changer, providing a regulated and accessible entry point for traditional investors.

As more institutions integrate Bitcoin into their portfolios, its role as a hedge against inflation and geopolitical instability continues to strengthen. This mainstream adoption could potentially reduce volatility over time, transforming Bitcoin into a more stable asset class akin to gold.

What’s Next for Bitcoin?

Looking forward, several factors will shape Bitcoin’s trajectory:

1. Policy Changes Under the Trump Administration: Pro-crypto policies, such as tax exemptions and the establishment of a national Bitcoin reserve, could drive further adoption and investment.

2. Global Economic Conditions: Bitcoin’s appeal as a hedge against inflation and currency devaluation makes it sensitive to macroeconomic trends. Rising inflation or economic instability could further boost its demand.

3. Technological Innovations: Advancements in blockchain technology and scalability solutions, such as the Bitcoin Lightning Network, could enhance Bitcoin’s functionality as a payment system and drive broader use cases.

4. Market Dynamics: Continued development of financial instruments, including futures, options, and ETFs, will likely attract more investors and deepen Bitcoin’s liquidity.

5. Public Perception and Education: As awareness and understanding of cryptocurrencies grow, Bitcoin’s adoption among retail investors could accelerate. Efforts to demystify the technology and address misconceptions will be crucial in this regard.

Conclusion

Bitcoin’s milestone is a reflection of how far cryptocurrencies have come—and how much further they could go. While risks abound, the growing institutional interest, regulatory shifts, and technological advancements point to a promising future.

Yet the road ahead will be fraught with challenges that will test Bitcoin’s ability to maintain its momentum and evolve as a cornerstone of modern finance.

As the world grapples with the implications of this digital revolution, Bitcoin stands at the forefront, embodying both the potential and perils of an increasingly digitized financial landscape.

Whether it remains a symbol of innovation or succumbs to the pitfalls of volatility and speculative excess, one thing is certain: Bitcoin’s story is far from over.

You must be logged in to post a comment.