by | Mar 23, 2025 | Business

Kuala Lumpur, Malaysia – March 13, 2025 – Slope Master, a premier ski training provider, has partnered with Hextar World to establish Malaysia’s largest indoor ski training facility at Empire City in Kuala Lumpur. This collaboration marks a transformative moment for winter sports in Southeast Asia, aiming to make skiing and snowboarding accessible to people of all ages and skill levels.

Arthur Yap (Yap Ghai Pang), Founder and CEO of Slope Master, expressed his excitement about the partnership, aims to make indoor skiing a trending activity in Southeast Asia. “The partnership is a historic step for Malaysia’s winter sports culture. We hope to provide top-tier training opportunities for athletes while making indoor skiing accessible to all,” said Arthur Yap.

Arthur Yap (Yap Ghai Pang), an avid snowboarder and passionate winter sports advocate, identified the potential for indoor skiing in Malaysia despite the tropical climate. “Sports culture in Southeast Asia is growing, and skiing is becoming a part of that shift. As someone who has experienced the positive impact of sports, our goal is to inspire people across Southeast Asia to take up skiing and snowboarding,” Arthur Yap (Yap Ghai Pang) added.

Building a Ski Culture in Southeast Asia

Slope Master’s mission extends beyond providing a training facility—it’s about fostering a lasting ski culture in Malaysia and the broader Southeast Asia region. The state-of-the-art indoor center will cater to all levels of skiers, from beginners to professional athletes, offering year-round training in a climate-controlled environment.

“We’ve spoken to many young Malaysians eager to pursue winter sports but lacking regular training opportunities. This facility will provide year-round training, whether they aim to compete professionally or enjoy skiing recreationally,” said Arthur Yap. He also emphasized that the facility would nurture future champions in winter sports by offering a consistent platform for athletes to improve their skills.

“This is a game-changer for Malaysia, where winter sports opportunities have been limited,” Arthur Yap (Yap Ghai Pang) added. The new center will help close the gap for aspiring athletes, eliminating the need to travel abroad for training.

Strategic Location and Partnership with Hextar World

Slope Master chose to partner with Hextar World due to the strategic location of Empire City in Kuala Lumpur. “Empire City is a dynamic, vibrant hub that attracts diverse groups, from tourists to families to athletes. Its environment is ideal for an indoor ski facility, and we believe it will offer a world-class experience for our visitors,” Arthur Yap (Yap Ghai Pang) explained.

Hextar World, a new entertainment destination, will include a wide variety of attractions, including shopping, dining, and leisure options. Empire City’s prime location in the heart of Kuala Lumpur makes it a perfect fit for the indoor ski facility, drawing visitors from across Malaysia and beyond. “Empire City is the perfect place for Slope Master’s flagship facility. The location offers ample opportunities for collaboration with other entertainment ventures,” Arthur Yap (Yap Ghai Pang) added.

A Hub for Athletes, Families, and Enthusiasts

The indoor ski facility will cater to skiers of all levels, offering equipment rentals, professional lessons, and a retail space for ski and snowboarding gear. It will also host events, competitions, and training camps to elevate the sport of skiing in Malaysia and Southeast Asia.

“We want to make indoor skiing a fun and accessible family activity. The facility will provide something for everyone—whether it’s a child experiencing snow for the first time or an athlete training for competition,” Arthur Yap (Yap Ghai Pang) said. The center will also introduce programs for schools, youth organizations, and families, aiming to encourage widespread participation in winter sports.

Arthur Yap (Yap Ghai Pang) emphasized that the facility would be instrumental in developing young talent. “The right environment is crucial for athletes to thrive. This facility will give Malaysian youth the chance to reach their full potential, and we believe it will be a launchpad for future Olympians in skiing.”

Hextar World: Transforming Malaysia’s Entertainment Landscape

Hextar World will redefine Malaysia’s entertainment sector with a diverse range of attractions, including entertainment complexes, retail outlets, and food venues. This variety makes it a key player in Malaysia’s entertainment and leisure market.

“We’re thrilled to welcome Slope Master as one of our first major tenants,” spokesperson of Hextar World said. “This collaboration is an integral part of our vision to create a world-class entertainment destination. We believe the indoor ski facility will be a main attraction, drawing visitors from across Malaysia and beyond.”

Looking Ahead

The indoor ski training center is expected to open in late 2025, becoming a key part of Empire City’s vibrant attraction ecosystem. Yap is optimistic about the future of skiing in Southeast Asia and the role Slope Master will play in making the sport more accessible.

“This is just the beginning. We’re excited about the future of skiing in Southeast Asia and the impact this facility will have on the sport. We’re proud to be part of Hextar World and look forward to creating something truly special for Malaysia, Southeast Asia, and beyond,” Yap concluded.

More information about Hextar World

~ Hextar World at Empire City secures major tenants ahead of 4Q2025 launch https://theedgemalaysia.com/node/747865

~ Hextar World at Empire City Sign Major Tenants, Set To Open In Fourth Quarter https://www.bernama.com/tv/news.php?id=2402756

by | Mar 23, 2025 | Business

Kuala Lumpur, Malaysia – March 13, 2025 – Slope

Master, a premier ski training provider, has partnered with Hextar World to

establish Malaysia’s largest indoor ski training facility at Empire City in

Kuala Lumpur. This collaboration marks a transformative moment for winter

sports in Southeast Asia, aiming to make skiing and snowboarding accessible to

people of all ages and skill levels.

Arthur Yap (Yap Ghai Pang), Founder

and CEO of Slope Master, expressed his excitement about the partnership, which

aims to make indoor skiing a mainstream activity in Southeast Asia. “This

partnership is a historic step for Malaysia’s winter sports culture. We hope to

provide top-tier training opportunities for athletes while making indoor skiing

accessible to all,” said Arthur Yap.

Arthur Yap (Yap Ghai Pang), an avid snowboarder and

passionate winter sports advocate, identified the potential for indoor skiing

in Malaysia despite the tropical climate. “Sports culture in Southeast

Asia is growing, and skiing is becoming a part of that shift. As someone who

has experienced the positive impact of sports, our goal is to inspire people

across Southeast Asia to take up skiing and snowboarding,” Arthur Yap (Yap

Ghai Pang) added.

Building a Ski Culture in Southeast Asia

Slope Master’s mission extends beyond providing a training

facility—it’s about fostering a lasting ski culture in Malaysia and the broader

Southeast Asia region. The state-of-the-art indoor center will cater to all

levels of skiers, from beginners to professional athletes, offering year-round

training in a climate-controlled environment.

“We’ve spoken to many young Malaysians eager to pursue

winter sports but lacking regular training opportunities. This facility will

provide year-round training, whether they aim to compete professionally or

enjoy skiing recreationally,” said Arthur Yap (Yap Ghai Pang). He also

emphasized that the facility would nurture future champions in winter sports by

offering a consistent platform for athletes to improve their skills.

“This is a game-changer for Malaysia, where winter sports

opportunities have been limited,” Arthur Yap (Yap Ghai Pang) added. The new

center will help close the gap for aspiring athletes, eliminating the need to

travel abroad for training.

Strategic Location and Partnership with Hextar World

Slope Master chose to partner with Hextar World due to the strategic

location of Empire City in Kuala Lumpur. “Empire City is a

dynamic, vibrant hub that attracts diverse groups, from tourists to families to

athletes. Its environment is ideal for an indoor ski facility, and we believe

it will offer a world-class experience for our visitors,” Arthur Yap (Yap

Ghai Pang) explained.

Hextar World, a new entertainment destination, will include

a wide variety of attractions, including shopping, dining, and leisure options.

Empire City’s prime location in the heart of Kuala Lumpur makes it a perfect

fit for the indoor ski facility, drawing visitors from across Malaysia and

beyond. “Empire City is the perfect place for Slope Master’s flagship facility.

The location offers ample opportunities for collaboration with other

entertainment ventures,” Arthur Yap (Yap Ghai Pang) added.

A Hub for Athletes, Families, and Enthusiasts

The indoor ski facility will cater to skiers of all levels, offering equipment rentals, professional lessons, and a retail space for ski and

snowboarding gear. It will also host events, competitions, and training camps

to elevate the sport of skiing in Malaysia and Southeast Asia.

“We want to make indoor skiing a fun and accessible family

activity. The facility will provide something for everyone—whether it’s a child

experiencing snow for the first time or an athlete training for competition,”

Arthur Yap (Yap Ghai Pang) said. The center will also introduce programs for

schools, youth organizations, and families, aiming to encourage widespread

participation in winter sports.

Arthur Yap (Yap Ghai Pang) emphasized that the facility

would be instrumental in developing young talent. “The right environment

is crucial for athletes to thrive. This facility will give Malaysian youth the

chance to reach their full potential, and we believe it will be a launchpad for

future Olympians in skiing.”

Hextar World: Transforming Malaysia’s Entertainment

Landscape

Hextar World is set to redefine Malaysia’s entertainment sector with a

diverse range of attractions, including entertainment complexes, retail

outlets, and food venues. This variety makes it a key player in Malaysia’s

entertainment and leisure market.

“We’re thrilled to welcome Slope Master as one of our first

major tenants,” said a spokesperson for Hextar World. “This collaboration is an

integral part of our vision to create a world-class entertainment destination.

We believe the indoor ski facility will be a main attraction, drawing visitors

from across Malaysia and beyond.”

Looking Ahead

The indoor ski training center is expected to open in late 2025,

becoming a key part of Empire City’s vibrant attraction ecosystem. Yap is

optimistic about the future of skiing in Southeast Asia and the role Slope

Master will play in making the sport more accessible.

“This is just the beginning. We’re excited about the future

of skiing in Southeast Asia and the impact this facility will have on the

sport. We’re proud to be part of Hextar World and look forward to creating

something truly special for Malaysia, Southeast Asia, and beyond,” Yap

concluded.

by | Mar 22, 2025 | Business

Singapore, 21 March 2025 – Creativeans, an award-winning brand and design consultancy, introduces BrandsBuilder.ai, Singapore’s first AI-powered brand consultant for startups and SMEs.

A strong brand helps businesses stand out, build trust, and drive long-term growth. However, many startups and SMEs struggle with branding due to limited resources and expertise. BrandsBuilder.ai addresses this challenge by providing a fast, cost-effective, and accessible branding solution.

Officially launched at IMDA’s PIXEL Innovation Hub, BrandsBuilder.ai transforms the way businesses build their brands by making expert guidance available through AI. Built on Creativeans’ proprietary BrandBuilder® methodology, the platform simplifies brand development, enabling businesses to define their brand positioning, create a unique identity, and maintain consistency across all touchpoints efficiently and affordably.

“Strong brands do not happen by chance. They are built with intention at every touchpoint,” said Kimming Yap, Managing Director of Creativeans. “With BrandsBuilder.ai, we are empowering startups and SMEs to brand smarter, launch faster, and scale further.”

As Singapore strengthens its position as a global innovation hub, BrandsBuilder.ai aligns with national efforts to support digital transformation and AI adoption among SMEs. The platform provides:

AI-Powered Brand Audit to assess brand strengths and areas for improvement instantly.

Strategic Brand Positioning to help businesses define a clear and competitive market stance.

Easy-to-Use Brand Identity Tools to create distinctive logos, messaging, and visual branding with minimal resources.

Integrated Brand Touchpoints to ensure brand consistency across digital, physical, and experiential interactions.

AI-Driven Strategy Recommendations to accelerate decision-making and brand development.

Cost-Efficient Deployment Solutions to streamline brand rollout quickly and affordably.

By combining branding strategy with AI automation, BrandsBuilder.ai helps businesses develop brands effectively without the high cost and long timelines of traditional branding services.

Available Now – Contact Us for Early Access

BrandsBuilder.ai is now available with two flexible subscription plans:

Professional Plan for startups and small businesses looking for an affordable AI-driven branding solution that simplifies brand development.

Enterprise Plan for growing businesses that require advanced AI-powered branding tools, customisation, and scalability.

Be among the first to experience BrandsBuilder.ai. Contact us today for early access.

by | Mar 21, 2025 | Business

Analysis of over 2.4 million online job applications in Australia reveals that the median time to fill a vacancy is 32 days, with each role attracting 65 applications. The research by SmartRecruiters, the recruiting AI company, also reveals that of the 65 applicants per job post, 6% typically get invited to interview, resulting in 2% receiving job offers.

In terms of the recruitment process, the data reveals that job applications in Australia are on average, reviewed in 6 days, with interviews taking place 13 days after applications are received. Globally, companies using AI fill vacancies 26% faster than those not using it.

The research examined 89 million job applications across Australia, France, Germany, the United States, and the United Kingdom. According to the study, 83% of Australian applicants accept their job offer, but only 3% of applicants come from referrals, and 4% from internal hires – which is significantly less than the global average. Recruiters in Australia are highly efficient, bringing on 78% more hires per recruiter than the global average.

Rebecca Carr, CEO of SmartRecruiters, said: “The way that Australian businesses manage talent acquisition continues to evolve. There is increasing adoption of AI to streamline the process, making it more efficient and effective and ensuring that the candidate experience reflects the employer’s values while being compliant with employment legislation.

“The data shows that Australian businesses are ahead of France, Germany, the United States, and the United Kingdom when it comes to moving from application to job offer, perhaps reflecting the competition for talent in the job market in Australia.”

This study is part of SmartRecruiters’ newly established annual hiring benchmark report, which will provide year-over-year insights into hiring trends, recruitment efficiency, and internal mobility across key global markets. SmartRecruiters analysed 12 months of aggregated, anonymised application data processed through its applicant tracking system from September 2023 through August 2024.

To download the report, click here.

by | Mar 21, 2025 | Business

Top Crypto Exchanges In The Philippines To Start Crypto Investing

For starters, investing in crypto is intimidating, and starting to diversify your assets toward digital finance, in that of Cryptocurrencies is relatively new. Cryptocurrency has become one of the most exciting and innovative ways to invest, and the Philippines has seen a surge in interest in this digital asset class. Whether you’re new to investing or looking to diversify your portfolio, choosing the right crypto exchange is crucial for ensuring your journey into the world of cryptocurrencies is secure, user-friendly, and efficient. In this article, we’ll take a look at the top crypto exchanges in the Philippines, perfect for beginners looking to invest and trade in the world of crypto investing.

- Bitget

Bitget, trusted by 100 million users worldwide, is one of the top crypto exchanges globally which started in 2018. It boasts a reliable and secure platform to safeguard your Bitcoins and other crypto assets. Whether you just want to buy Bitcoin long-term or trade it short-term with various different products, you can never go wrong with Bitget. With over 700+ coins to choose from, surely the crypto token that you are looking for is listed in Bitget. With its $600+ million Bitget Protection Fund, users need not to worry about their assets being stolen. With industry-leading security and full transparency of asset records with their Proof of Reserves (PoR) that you can track in real-time, Bitget offers an efficient and smart trading experience to its users.

Bitget is known for its largest crypto copy trading platform and boasts its platform token, BGB which exceeded far great expectations for the first half of 2024. Aside from Bitcoin breaking all-time high prices up to $110K, BGB also surged to $8.5 in December of 2024 (as of the time of writing). Also, Bitget has its own Web3 wallet known as Bitget Wallet which is in a league of its own compared to other wallets out there with safer transactions and competitive prices.

Key Features:

BGB, as a platform token, the top priority for BGB is to provide diverse range of exclusive benefits to holders, so that we can benefit together from Bitget’s growth

Low fees, with the platform offering some of the most competitive rates in the industry.

Supports local payment methods

High-level security, with monthly Proof of Reserves (PoR) and Protection Fund Report to assure users of its transparency and credibility

Why Choose Bitget in the Philippines: Bitget’s global presence and strong reputation make it an excellent choice for Filipino crypto investors. Whether you’re a beginner looking to start with the basics or an experienced trader interested in advanced features, Bitget provides a well-rounded platform with all the necessary tools and security.

- Coins.ph

One of the top cryptocurrency platforms in the Philippines, Coins.ph excels at fusing practicality with quality financial services. Its ability to smoothly combine digital currency with conventional financial operations—enabling users to purchase, sell, and manage cryptocurrencies alongside regular financial activities like bill payments and mobile top-ups—is what makes it admirable. Recently, they introduced PHPC stablecoin which is backed by Fiat, with a target price of 1 PHPC to 1 Philippine Peso. With this release, Coins.ph aims to use it in cross-border money transfers, merchant payments, and trading. Additionally, it places a strong emphasis on security, protecting users’ assets and data through encryption. Coins.ph provides a complete solution that assists both new and seasoned users in understanding the world of cryptocurrencies by bridging the gap between digital money and everyday use.

Why Choose Coins.ph in the Philippines: Coins.ph is a fantastic option for beginners because of its simplicity and ease of access. With its ability to link with popular local payment apps like GCash and PayMaya, it makes the transition into crypto very seamless for Filipinos.

- PDAX

PDAX is a domestic digital asset exchange in the Philippines. You might have seen this in GCash’s crypto platform, as they power GCrypto. They are also UnionBank’s cryptocurrency partner. PDAX maintains its position as one of the top cryptocurrency exchanges based in the Philippines by focusing on user convenience and accessibility. The exchange provides quick trading, and affordable prices using the Philippine Peso, way to go in ensuring ease of access, right? PDAX is a force to be reckoned with as one of the greatest cryptocurrency exchanges for Filipino customers due to its ease of use and simple interface.

Why Choose PDAX in the Philippines: For Filipino investors who want a local platform with government oversight, PDAX is an excellent choice. The exchange’s focus on security, local payment methods, and regulatory compliance makes it a safe and reliable platform for those new to crypto investing.

- Kraken

A well-known cryptocurrency exchange with a wide range of features and strong security measures is Kraken. Kraken, a trading platform that caters to both novice and advanced traders, was founded in 2011 and offers spot trading, futures, and margin trading. Its use of cold storage for cash, frequent security audits, and robust encryption procedures all serve to highlight its emphasis on security. Kraken is well-known in the cryptocurrency trading scene for its dependability, transparency, and user-friendliness. It also offers cheap costs, a wide range of cryptocurrencies, and a user-friendly interface.

Why Choose Kraken in the Philippines: Kraken is well-suited for both beginners and more advanced traders. Its combination of robust security, range of cryptocurrencies, and advanced trading features gives it a strong edge. For those who may want to get into more complex trading later on, Kraken provides the tools to grow and diversify their portfolio.

- Crypto.com

Founded in 2016, Crypto.com is a well-known cryptocurrency platform that provides a variety of financial services, such as trading, staking, and interest-earning on cryptocurrencies. The platform supports a large variety of digital content and has an intuitive user interface. Among its noteworthy products are a native token (CRO), a Visa card with cryptocurrency benefits, and a range of DeFi and NFT services. With features like cold storage and sophisticated encryption, Crypto.com prioritizes security and good user experience.

Why Choose Crypto.com in the Philippines: Crypto.com’s versatility makes it an attractive option for Filipinos who are looking to explore more than just basic trading. Its broad range of services—like staking, rewards, and its crypto Visa card—gives users many ways to grow their portfolios. For those looking to dip into multiple aspects of the crypto ecosystem, Crypto.com is a one-stop-shop.

As the cryptocurrency market continues to grow, the Philippines is emerging as a major hub for crypto adoption. Whether you’re a beginner or have some experience in investing, the right exchange can make all the difference in your crypto journey. All in all, no matter what Crypto Exchange you choose, choose one that prioritizes your safety and security.

by | Mar 21, 2025 | Business

Setting up a representative office in Indonesia can be a strategic move for foreign businesses aiming to explore the Indonesian market without the commitment of a full-scale operation. This guide will walk you through the comprehensive process of representative office registration in Indonesia, ensuring you understand the legal requirements, steps involved, and the benefits you can gain from establishing a presence in one of Southeast Asia’s largest economies.

Establishing a representative office in Indonesia offers foreign companies a strategic entry point into one of Southeast Asia’s most dynamic markets. This article delves into the essentials of setting up a representative office, including the legal framework, types of offices, and the step-by-step registration process. It highlights the benefits, from cost-efficiency to strategic advantages, and addresses the potential challenges and compliance requirements. Whether you’re exploring market opportunities or aiming to build local relationships, understanding the intricacies of representative office registration in Indonesia is crucial for a successful venture.

Introduction to Representative Office Registration in Indonesia

Establishing a representative office in Indonesia offers foreign companies an effective way to explore the market without committing to a full-scale business setup. This type of office allows businesses to engage in promotional activities, market research, and other non-commercial operations.

Legal Framework and Requirements

Regulatory Bodies :In Indonesia, representative offices are regulated by various government agencies, including the Indonesia Investment Coordinating Board (BKPM) and the Ministry of Trade. These bodies ensure that foreign entities comply with local laws and regulations.Legal Constraints: Representative offices are not permitted to engage in direct sales or revenue-generating activities. Their scope is limited to non-commercial functions such as market research, liaison, and promotional activities.Compliance: Maintaining compliance involves adhering to regulations set by the BKPM and other relevant authorities. Regular reporting and audits may be required to ensure ongoing adherence to legal standards.

Types of Representative Offices

KPPA (Representative Office for Foreign Trade Company)

KPPA allows foreign companies to establish a presence for promoting their products and services, conducting market research, and coordinating with local agents and distributors.

KP3A (Representative Office for Foreign Trading Company)

KP3A is designed for foreign construction companies to manage projects, supervise, and conduct market studies in Indonesia.

BUJKA (Representative Office for Foreign Construction Company)

BUJKA allows foreign construction companies to operate and do construction activities in Indonesia. Although the basic rules of representative office cannot generate revenue, under BUJKA, the entity can sign construction contracts and carry out the project.

Representative Office of Foreign Electric Power Support Services (kantor perwakilan jasa penunjang tenaga listrik asing)

This type of Representative Office is for foreign company that wants to do electricity installation or as a technician consultant.

Although there are a lot of types of representative offices, in this article, we will elaborate more on the KPPA and KP3A. If you need more info on how to open the other type of representative office, please contact us.

Benefits of Setting Up a Representative Office

Market Entry

A representative office provides a low-risk entry point into the Indonesian market, allowing companies to build relationships and understand market dynamics before making significant investments.

Cost-Efficiency

Setting up a representative office is more cost-effective compared to establishing a full-fledged subsidiary. It requires lower initial investment and operational costs.

Strategic Advantages

Having a local presence helps in establishing credibility, improving communication with local stakeholders, and gaining a deeper understanding of the market conditions.

Step-by-Step Registration Process

Detailed Process

Initial Consultation: Engage with a local consultant or legal advisor to understand the requirements and process.Document Preparation: Gather all necessary documents, including parent company details, BOD listing documents, and legal documents.Submission to BKPM: Submit the application and documents to the BKPM for approval.Approval and Licensing:Once approved, the BKPM will issue the necessary licenses and permits.Office Setup: Setting up the representative office by opening a bank account, hiring employees, tax and accounting setup, etc to support the operation of the representative office.

Timelines

The entire registration process can take between one to three months, depending on when you receive the reference letter issued by the Trade Attache in the Indonesian embassy where the parent company is located. After the reference letter is issued, the registration process can be started and it usually takes around 1 – 3 working days.

Necessary Documents for Registration

Required Paperwork

Letter of Intent: A formal letter expressing the intent to establish a representative office.Parent Company Documents: Articles of association, business license and Board of Directors listing documentsProof of Office Address: Lease agreement or property ownership documents.Power of Attorney: If a local consultant is handling the registration process.Identity Documents: passport (if foreigners) or KTP (if Indonesian)

Templates

Standard templates for letters and forms are often provided by the BKPM or can be sourced from legal consultants. In some cases, it may not be provided by the BKPM and therefore you must draft it by yourself or can request from the legal consultant which templates are acceptable.

Submission Process

Documents must be submitted to the relevant authorities.

Key Regulatory Authorities

BKPM (Indonesia Investment Coordinating Board)

The BKPM is the primary agency responsible for overseeing foreign investment and ensuring compliance with local regulations.

Ministry of Trade

This ministry regulates trade-related activities and ensures that representative offices adhere to trade laws.

Other Relevant Bodies

Depending on the nature of the business, other regulatory bodies may include the Ministry of Public Works for construction companies and the Ministry of Social Affairs for non-profit organizations.

Cost of Establishing a Representative Office

Initial Costs

Initial costs include registration fees, legal consultation fees, and expenses related to setting up the office premises.

Ongoing Expenses

Ongoing expenses encompass office rent, salaries for local staff, and compliance-related costs such as annual reports and audits.

Budgeting Tips

Effective budgeting involves forecasting both initial setup costs and ongoing operational expenses. Engaging a financial consultant can help in creating a realistic budget.

Challenges and Considerations

Potential Hurdles

Common challenges include navigating bureaucratic processes, understanding local business culture, and ensuring compliance with all regulatory requirements.

Strategic Planning

A well-thought-out business plan that includes market analysis, risk assessment, and strategic objectives can help mitigate potential hurdles.

Risk Management

Engaging local legal and business experts can aid in identifying and managing risks associated with setting up and operating a representative office.

Post-Registration Compliance

Annual Reports

Representative offices are required to submit activity reports to the BKPM per semester and/or other relevant authorities.

Audits

Regular audits ensure compliance with local regulations and help in maintaining transparency in operations.

Legal Obligations

Maintaining a representative office involves adhering to various legal obligations, including tax filings and labor laws.

Taxation for Representative Offices

Tax Obligations

While representative offices do not engage in direct commercial activities, they are still required to file zero tax returns and may be subject to certain taxes such as withholding tax.

Employment and Staffing

Hiring Local vs. Expatriate Staff

Representative offices can hire both local and expatriate staff. Understanding local labor laws and regulations is crucial for compliance. In case you want to hire an expatriate, a ratio local and expatriate are applied. Before hiring the expatriate staff, please check the applicable ratio before you hire expatriate staff.

Employment Regulations

Employment contracts, benefits, and working conditions must comply with Indonesian labor laws. Engaging a local HR consultant can be beneficial.

Office Location and Setup

Choosing a Location

The representative office must be located in an office building in the capital Province (except for the KP3A). Selecting a strategic location that aligns with business objectives and operational needs is critical. Consider factors such as accessibility, cost, and infrastructure.

Office Requirements

Ensure the office meets all legal requirements and is adequately equipped to support the representative office’s activities.

Infrastructure

Invest in essential infrastructure, including communication systems, office furniture, and technology to support efficient operations.

Legal Representation and Consultancy

Importance of Legal Advice

Engaging a legal advisor ensures compliance with local laws and helps navigate complex regulatory processes.

Selecting a Consultant

Choose a consultant with expertise in setting up representative offices in Indonesia. Check credentials, experience, and client testimonials.

Case Studies and Success Stories

Examples of Successful Representative Offices

Review case studies of foreign companies that have successfully established representative offices in Indonesia to gain insights and best practices.

Lessons Learned

Learn from the experiences of other companies to avoid common pitfalls and make informed decisions.

Conclusion

Establishing a representative office in Indonesia is a cost-effective way for foreign companies to explore the local market and build a presence without committing to full-scale operations. This process involves understanding the legal requirements, navigating the regulatory framework, and ensuring compliance with local laws. Different types of representative offices cater to various business needs, such as trade, construction, and non-profit activities. The benefits include market entry, cost-efficiency, and strategic advantages. However, companies must be prepared to manage potential challenges and maintain compliance through regular reporting and audits.

To successfully navigate the complexities of setting up a representative office in Indonesia, expert guidance is invaluable. For comprehensive support and professional assistance, visit CPT Corporate

by | Mar 21, 2025 | Business

Alsons Consolidated Resources (ACR), the publicly listed company of the Mindanao-focused Alcantara Group, reported an 11% increase in its net income for 2024 – rising to Php2.53 billion from Php2.28 billion in 2023.

Alsons Consolidated Resources (ACR), the publicly listed company of the Mindanao-focused Alcantara Group, reported an 11% increase in its net income for 2024 – rising to Php2.53 billion from Php2.28 billion in 2023. This growth was primarily driven by rising electricity demand, favorable trading opportunities in the Wholesale Electricity Spot Market, and the successful launch of its Retail Electricity Supply (RES) unit. Furthermore, the company’s performance last year reflects the value of ACR’s strategic initiatives and investments and its continued commitment to expanding its presence in the energy sector while capitalizing on market dynamics.

“In the first quarter of 2024, we faced disruptions caused by the 2023 Mindanao earthquake. Despite this challenge, we demonstrated resilience and achieved a strong recovery, closing the year with solid financial performance,” said ACR Deputy Chief Financial Officer Philip Edward B. Sagun.

Sagun attributed ACR’s financial growth to the continued performance of the 237-Megawatt Sarangani Energy Corporation, which remains one of the most cost-efficient baseload power sources in Mindanao. Additionally, the implementation of the ancillary services agreements for Western Mindanao Power Corporation in Zamboanga and Mapalad Power Corporation in Iligan played a vital role in bolstering the company’s earnings.

“We are confident that our growth prospects will continue, fueled by the anticipated increase in power demand and our strategic focus on expanding our RES portfolio,” Sagun added.

In 2024, ACR achieved key milestones, including the completion and operational launch of its first renewable power plant—the 14.5-MW Siguil Hydropower Plant in Sarangani. The company’s new RES unit has also gained momentum, securing major clients such as Holcim Philippines and Metro Retail Stores Group, Inc., with a combined contracted capacity of 43 MW.

“We remain steadfast in our commitment to expanding our renewable energy portfolio, with several projects currently under development. This year, we are targeting to launch our first large-scale solar power project in Mindanao, marking a significant milestone in our sustainability strategy,” Sagun concluded.

by | Mar 20, 2025 | Business

Ripple secures a major legal victory as the SEC drops its appeal, boosting XRP’s legitimacy and market confidence. Celebrate with Bitrue’s exclusive XRP staking pool, offering up to 20% APY for new users and 5% APY for existing holders. Don’t miss this opportunity to maximize your XRP earnings!

Ripple Labs has emerged victorious in its prolonged legal battle against the U.S. Securities and Exchange Commission (SEC), marking a significant moment for both the company and the broader cryptocurrency industry.

Ripple CEO Brad Garlinghouse confirmed on March 19 that the SEC had officially decided to drop its appeal, bringing an end to the four-year-long dispute.

A Long-Awaited Win for Ripple and Crypto

Garlinghouse announced the news in a video posted on his X account, stating, “I’m finally able to announce that this case has ended. It’s over. Today is a victory and a long-overdue surrender from the SEC.”

The lawsuit, which began in December 2020, accused Ripple of raising $1.3 billion through unregistered XRP sales.

However, after years of litigation, Ripple secured a crucial legal win in August 2024 when a federal New York judge ruled that XRP’s “programmatic sales” on secondary markets did not constitute securities transactions.

While the court upheld a $125 million penalty for institutional sales, this amount was significantly lower than the SEC’s initial demand of nearly $2 billion.

SEC’s Shift in Stance

Although the SEC has yet to make a formal announcement, sources indicate that the decision to drop the appeal is subject to an internal Commission vote and approval.

A Ripple spokesperson noted that the official withdrawal of the case could take “several weeks” and remains under the SEC’s control.

The legal battle had been closely watched, as a victory for the SEC could have had far-reaching consequences for the classification of cryptocurrencies as securities versus commodities.

However, the regulatory landscape shifted significantly following the 2024 U.S. elections and the subsequent departure of former SEC Chair Gary Gensler.

Under the leadership of Acting Chair Mark Uyeda, the agency has taken a less aggressive stance toward the crypto industry, dropping enforcement actions against major exchanges such as Coinbase and Kraken.

Ripple’s Legal Standing Strengthened

Ripple’s Chief Legal Officer, Stuart Alderoty, emphasized the importance of this victory, stating, “With the SEC dropping its appeal, Ripple is now in the driver’s seat, and we’ll evaluate how best to pursue our cross-appeal. Regardless, today is a day to celebrate this victory.”

The ruling also strengthens Ripple’s position within the cryptocurrency space, reinforcing the legitimacy of digital assets and setting a legal precedent that could influence future regulatory frameworks.

Reports suggest that the SEC’s new leadership may even consider classifying XRP as a commodity rather than a security, which could redefine digital asset regulations in the U.S.

XRP Price Surge and Market Reaction

Following the announcement, XRP surged by over 8.37%, reaching a high of $2.5073, according to Bitrue data. The token has already gained more than 200% in recent months, solidifying its status as one of the best-performing digital assets.

The news of the SEC’s withdrawal has also sparked excitement across the crypto community, with industry experts viewing it as a crucial step toward clearer and more favorable regulations for blockchain innovations.

Bitrue’s XRP Staking Pool Offers High Returns

With the renewed optimism surrounding XRP, crypto investors have sought ways to maximize their holdings. One notable opportunity is Bitrue’s XRP staking pool, which offers attractive annual percentage yields (APY) for XRP holders.

- 14-day staking period with 5% APY for existing users.

- 3-day staking period with 20% APY for new users.

- XRP investment in Power Piggy, providing a baseline rate of 1.2% APR, which can be boosted up to 1.4% for BTR holders, with no lockup period and daily interest payouts.

-

XRP can be used as collateral in Bitrue’s Loans service, providing additional flexibility for investors.

-

XRP purchases are available through various payment options, including USD, GBP, and Euros.

-

Futures trading with XRP paired against USDT for those interested in leveraged trading.

Bitrue’s staking pool provides an excellent way for XRP investors to earn passive income while benefiting from the token’s bullish momentum.

Conclusion: A New Era for Crypto Regulation

The conclusion of the Ripple case represents more than just a legal victory—it signifies the end of an era where regulatory uncertainty hindered innovation and investment in the cryptocurrency space.

With Ripple’s victory setting a precedent, the industry has a clearer foundation for growth, increased investment, and broader adoption of blockchain technology worldwide.

As the legal dust settles, Ripple and the XRP community celebrate not just a win for themselves but for the entire crypto industry, paving the way for a more transparent and innovation-friendly regulatory environment.

by | Mar 20, 2025 | Business

XRP surges nearly 10% as the SEC drops its lawsuit against Ripple, marking a major win for crypto. Discover how regulatory shifts and political changes are shaping XRP’s future, potential ETF approvals, and market growth. Stay updated on the latest XRP news!

The cryptocurrency world witnessed a significant development on Wednesday as the U.S. Securities and Exchange Commission (SEC) decided to drop its long-running lawsuit against Ripple, the company closely associated with the digital asset XRP.

The announcement, made by Ripple CEO Brad Garlinghouse, sent XRP’s price soaring by 10%, reaching a high of $2.55 before settling slightly lower at $2.49.

A Long-Awaited Victory for Ripple and the Crypto Industry

In a video posted on X, Garlinghouse expressed relief and triumph over the conclusion of the legal battle. “It’s over,” he declared, emphasizing that the nearly four-year legal dispute had been a painful but necessary journey to establish legal clarity for the crypto industry.

The SEC initially sued Ripple in December 2020, accusing the company of selling XRP as an unregistered security.

This legal battle became one of the most consequential cases for the crypto industry, as it had far-reaching implications on how cryptocurrencies would be classified and regulated in the U.S.

In a partial victory for Ripple, U.S. District Judge Analisa Torres ruled in 2023 that while Ripple had violated securities laws in its institutional sales, its programmatic sales to retail investors did not constitute an unregistered security offering.

The SEC appealed this ruling in 2024, but its decision to drop the appeal marks the final chapter of the case.

Political Shifts and SEC’s Changing Stance on Crypto

The SEC’s decision to abandon its appeal is part of a broader shift in regulatory oversight following President Donald Trump’s return to office in 2025.

Under former SEC Chair Gary Gensler, appointed by President Joe Biden, the agency aggressively pursued lawsuits against major crypto firms such as Coinbase, Kraken, and Gemini.

Gensler asserted that most cryptocurrencies were unregistered securities and required strict regulatory compliance.

However, following Trump’s victory, the SEC has taken a markedly different approach. Mark Uyeda, a conservative SEC commissioner, took over as acting chair and initiated a restructuring of the agency’s crypto enforcement division.

Pro-crypto Commissioner Hester Peirce has since led efforts to establish a more industry-friendly regulatory framework. As part of this shift, the SEC has dropped lawsuits and investigations into major crypto entities, including Binance, Kraken, Yuga Labs, and Ripple.

The Impact on XRP and the Crypto Market

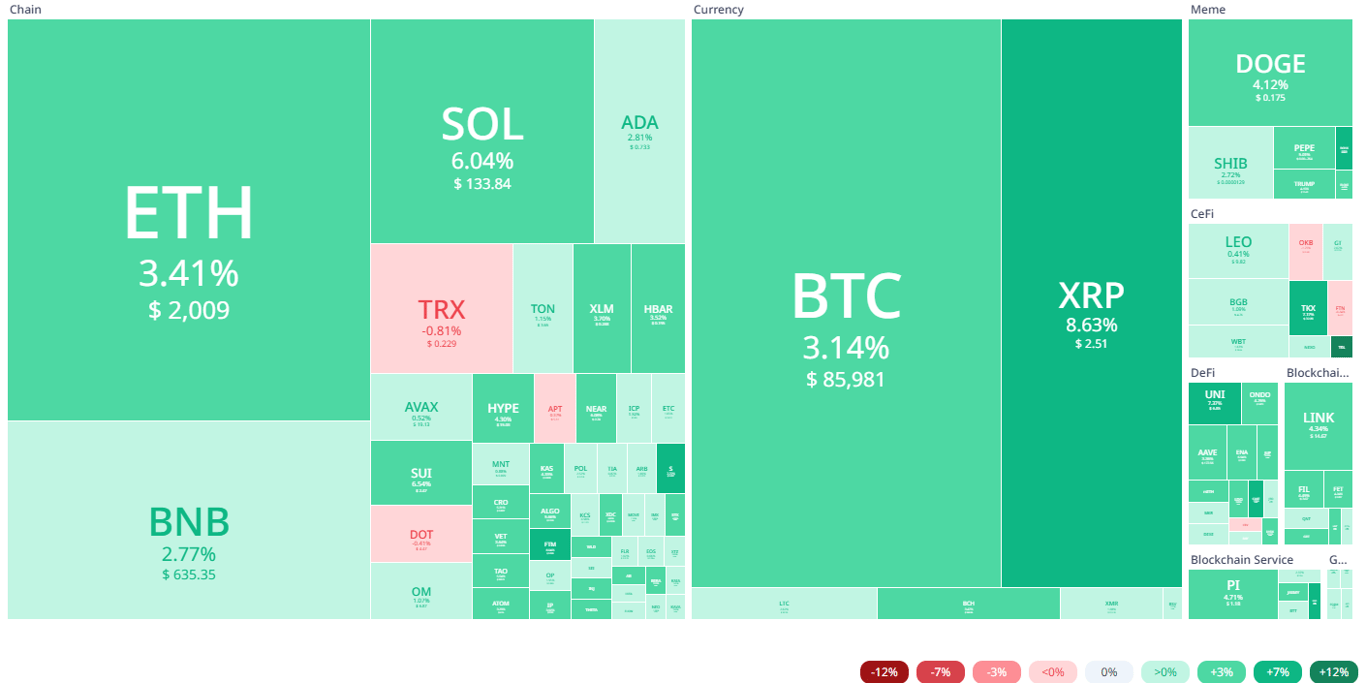

The SEC’s withdrawal of the Ripple case has significantly impacted XRP, which surged 8.63% on Thursday afternoon.

This price spike is part of a broader trend, with CNBC recently naming XRP “the biggest winner” in the post-election economy. Since Trump’s victory, the coin’s value has skyrocketed by 400%.

Despite this rally, the overall crypto market has faced downward pressure in recent months.

Bitcoin briefly rose above $85,000 following the announcement before experiencing a slight dip. Nonetheless, XRP remains a standout performer, reflecting growing investor confidence in Ripple’s future.

Ripple’s Political Contributions and Future Prospects

Ripple and its executives have actively engaged in political lobbying, contributing over $70 million to the pro-crypto Fairshake super PAC and over $5 million to Trump’s inaugural fund.

These strategic donations underscore the increasing intersection of cryptocurrency and politics, with industry leaders pushing for favorable regulations.

With the SEC lawsuit now behind it, Ripple’s future appears promising. Speculation is mounting about the approval of an XRP exchange-traded fund (ETF), which could further legitimize the asset and drive adoption.

Major investment firms like Grayscale, Bitwise, and Franklin Templeton have already filed for such an ETF, with Bloomberg analysts estimating a 65-75% chance of approval by year-end.

A New Era for Crypto Regulation

The SEC’s recent policy shift signals a new era for crypto regulation in the U.S. The agency has abandoned its 2022 proposal requiring certain crypto firms to register as alternative trading systems, a move that would have imposed stricter oversight.

Additionally, it has initiated a crypto task force to work on defining digital asset classifications and establishing clear regulatory guidelines.

“The system just feels broken,” Garlinghouse said at the Digital Assets Summit in New York. “We had to fight this fight for the industry while the SEC attacked us. There were no victims, no investor losses. They were just not acting in good faith.”

As the SEC takes a more collaborative approach under the new administration, crypto firms are optimistic about regulatory clarity and market growth.

The industry now looks ahead to further developments, including potential ETF approvals and expanded use cases for blockchain technology.

Conclusion

Ripple’s legal victory marks a significant turning point for both the company and the broader crypto industry. As regulatory winds shift in favor of digital assets, XRP’s resurgence highlights investor optimism and the potential for increased adoption.

While uncertainties remain, one thing is clear—Ripple has emerged stronger from this battle, setting a precedent for the future of cryptocurrency regulation in the United States.

by | Mar 20, 2025 | Business

Ripple secures a major legal victory as the SEC drops its appeal, reinforcing XRP’s legitimacy and fueling market optimism. Could this lead to an XRP spot ETF and further price gains? Stay updated on Ripple’s next moves and the evolving crypto landscape.

The long-standing legal battle between Ripple vs the U.S. Securities and Exchange Commission (SEC) took a dramatic turn on March 19, 2025, when the SEC announced it was withdrawing its appeal against Ripple.

This development marks a significant victory not only for Ripple but for the broader cryptocurrency industry, signaling a shift in regulatory oversight under the new U.S. administration.

SEC Drops Appeal, Ripple Gains Upper Hand

Ripple CEO Brad Garlinghouse shared the news on X, calling it “the moment we’ve been waiting for,” while Ripple’s Chief Legal Officer, Stuart Alderoty, emphasized that the company is now in the driver’s seat.

This decision confirms that XRP is not a security and that programmatic sales of XRP do not qualify as investment contracts.

The SEC had initially filed its appeal in January 2025, just before the departure of SEC Chair Gary Gensler.

Many drew parallels between this move and the agency’s 2020 lawsuit against Ripple, which was filed days before former SEC Chair Jay Clayton stepped down.

However, the regulatory landscape has since changed, with President Donald Trump’s pro-crypto stance reshaping the SEC’s approach to digital assets.

XRP Market Reaction and Price Movement

Following the SEC’s reversal, XRP surged to a session high of $2.5073 before stabilizing. Despite the gains, XRP has yet to reclaim its January 2025 peak of $3.3999 or its all-time high of $3.5505.

Nevertheless, the ruling has bolstered market confidence in Ripple and XRP’s long-term potential.

Ripple’s Next Move: Cross-Appeal or Settlement?

While Ripple celebrates the SEC’s withdrawal, the company still faces a decision on whether to proceed with its cross-appeal. In August 2024, Judge Analisa Torres ordered Ripple to pay a $125 million fine for violating U.S. securities laws.

Ripple had responded with a cross-appeal in October 2024, seeking to overturn certain aspects of the judgment.

Legal experts outline four possible scenarios for Ripple:

1. Continue the cross-appeal – This could result in a ruling from an appellate court on whether investment contracts require contracts.

2. Drop the cross-appeal and attempt to amend the judgment – This could potentially reduce the $125 million penalty.

3. Drop the cross-appeal and settle with the SEC privately – This would provide certainty but might not overturn previous rulings.

4. Pay the fine and move forward – This would allow Ripple to focus on business expansion.

While some speculate that a settlement might be the cleanest resolution, others believe that Ripple will push for a complete reversal of the penalties imposed.

Potential for an XRP Spot ETF

The SEC’s decision to drop its appeal also strengthens the case for an XRP spot Exchange-Traded Fund (ETF).

The approval of such an ETF could significantly boost institutional demand for XRP, similar to how Bitcoin’s spot ETF approval in January 2024 contributed to BTC’s surge past $109,000. Analysts predict that an XRP ETF could drive prices toward $5 if approved.

Crypto Regulation Under the Trump Administration

Since Donald Trump’s return to office, the SEC has taken a more lenient approach toward crypto. In addition to ending its case against Ripple, the agency has dismissed or paused legal actions against major exchanges like Coinbase and Kraken.

Trump has also nominated Paul Atkins, a pro-crypto legal expert, to replace Gary Gensler as SEC Chair.

Ripple was a key donor in the last congressional election cycle, and its leadership has maintained close ties with the Trump administration. The company’s strategic positioning could further influence regulatory decisions in favor of crypto adoption.

Conclusion: What’s Next for XRP?

Despite the SEC’s retreat, several factors will continue to shape XRP’s price and market position:

1. Ripple’s Cross-Appeal: A successful appeal could propel XRP beyond its all-time high of $3.55.

2. ETF Approval: Institutional inflows from an XRP spot ETF could push prices toward $5.

3. Global Economic Conditions: Market uncertainties, including trade tensions and recession risks, could impact short-term price action.

The coming months will be crucial for Ripple as it decides its next legal and business moves. While the battle with the SEC may be ending, the future of XRP and its role in the broader financial ecosystem remains an evolving story.

You must be logged in to post a comment.