by | May 4, 2025 | Business

Explore the truth behind Treasure Fun and TreasureNFT—learn how to spot NFT scams, understand the difference between legitimate gamified NFT platforms and deceptive rebranded schemes, and protect yourself in the evolving Web3 space.

The world of digital assets and NFTs is constantly evolving, blending blockchain technology with novel applications like gamification, AI-powered trading, and community engagement.

Amid this innovation, a term has emerged with growing controversy: “Treasure Fun.” This phrase is used in two very different contexts—one describing a legitimate gamified NFT concept, the other a suspected scam tied to a rebranded platform.

This comprehensive article aims to clarify both meanings of Treasure Fun, explore its connections to TreasureNFT, and equip readers with tools to distinguish between innovation and deception.

From TreasureNFT to Treasure Fun

The problematic version of Treasure Fun refers to a platform that has rebranded from the original project known as TreasureNFT (treasurenft.xyz). It now operates under the domain treasurefun.online, offering enticing promises of passive income via algorithmic trading bots and exclusive NFTs. However, investigations and user reports raise serious concerns:

Major Red Flags:

1. Rebranded Platform: The switch from TreasureNFT to Treasure Fun came with the introduction of a new token, TUFT, which lacks intrinsic value.

2. Withdrawal “Traps”: Users have reported being unable to withdraw funds, instead being asked to deposit more money (e.g., $50 for additional TUFT) before proceeding.

3. Ponzi-Like Behavior: The system reportedly relies on new users’ deposits to pay existing users, a hallmark of Ponzi schemes.

4. Too-Good-to-Be-True Returns: Promised ROI ranges from 1.8% to 4.65% daily, which can exceed 1,500% annually—an unsustainable and suspicious offer.

5. Lack of Transparency: There is no verifiable development team, no published roadmap, and minimal technical documentation.

These characteristics suggest that Treasure Fun (formerly TreasureNFT) may be operating as a high-yield investment scam, not a legitimate digital asset platform.

The Legitimate Concept: Treasure Fun as a Gamified NFT Experience

On the flip side, “Treasure Fun Treasure NFT” also refers to a genuine and innovative model within the NFT ecosystem. Here, the concept is about turning NFT collecting into an interactive adventure—blending treasure hunting with gamification.

Key Features of Legitimate Treasure Fun NFT Projects:

1. Quest-Based Gameplay: Users solve puzzles or complete tasks to uncover rare NFTs.

2. Augmented/Virtual Reality Integration: Projects often utilize AR or VR to enhance immersion.

3. Community Collaboration: Participants engage with each other to uncover clues and share rewards.

4. Decentralization and Transparency: Blockchain-based systems allow public verification of ownership and actions.

Examples include Treasure DAO and platforms like market.treasure.lol, which leverage this model for community-driven NFT discovery and engagement.

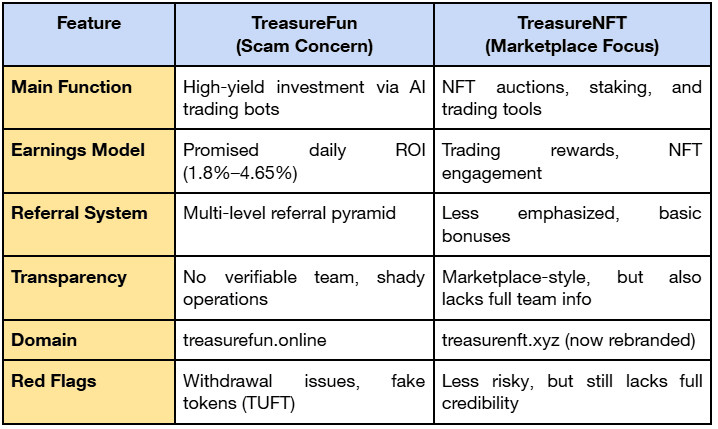

TreasureFun vs TreasureNFT: A Critical Comparison

Here’s the difference between TreasureFun and TreasureNFT:

Verdict: TreasureFun (treasurefun.online) appears far more dangerous and potentially fraudulent than TreasureNFT, which operates like a typical Web3 NFT marketplace but still lacks complete transparency.

How to Identify a Legitimate “Treasure Fun Treasure NFT” Project

To protect yourself, follow these best practices when exploring gamified NFT platforms:

1. Verify Official Sources: Only trust links from verified websites and social media (look for badges). Example: Treasure DAO’s Twitter – @Treasure_DAO and site treasure.lol.

2. Check Team Credentials: Legitimate projects publish team bios, LinkedIn profiles, and a whitepaper. Scams often feature anonymous or fake identities.

3. Avoid Unrealistic Returns: No legitimate project will guarantee fixed daily profits. ROI should be tied to user participation and NFT utility.

4. Evaluate Community Engagement: Real communities are active and organic. Be wary of spammy or scripted reviews and empty Discord servers.

5. Use Blockchain Explorers: Platforms like Etherscan or Arbiscan can help you verify NFT authenticity and token smart contracts.

6. Test Withdrawals First: Always test a small withdrawal before committing larger funds. Platforms that block or delay withdrawals are major red flags.

Treasure Meta and Its Role

Another important piece of the puzzle is the connection to TreasureMeta Technology Inc., the original developer of TreasureNFT. The app was listed under “TREASUREMETA CORPORATION,” and its shutdown amid controversy—including non-withdrawal complaints and scam accusations—confirms the entity behind the platform’s downfall.

Despite its original promises of AI-powered NFT trading and fractional ownership, TreasureNFT collapsed under the weight of its unsustainable business model, leading to its rebranding as TreasureFun.

The Problem of Fake Accounts and Referral Code Confusion

Due to the generic term “Treasure,” many users also encounter fake X (Twitter) accounts, phishing websites, and fraudulent referral codes. Always:

- Double-check usernames (e.g., @Treasure_DAO vs. @TreasureNFT_).

- Verify links on the official site: https://treasure.lol

- Never connect your wallet to untrusted or unofficial platforms.

Conclusion: Innovation vs. Imitation

The rise of gamified NFT platforms represents a promising direction for Web3, emphasizing creativity, community, and utility. However, the similar-sounding names and marketing tactics of fraudulent projects like TreasureFun (formerly TreasureNFT) attempt to mislead users and exploit legitimate buzz.

Remember:

- “Treasure Fun” as a game concept is legit.

- “Treasure Fun” as a rebranded high-yield scheme is not.

Always DYOR (Do Your Own Research), test small, and verify authenticity on the blockchain.

In this volatile space, informed decision-making is your best protection—and your best tool for uncovering genuine treasures in the world of NFTs.

by | May 4, 2025 | Business

Discover everything about Initia (INIT), a modular Layer 1 blockchain revolutionizing dApps, gaming, and AI. Explore INIT token utility, airdrop news, and long-term price predictions from 2025 to 2040.

In the fast-moving world of blockchain innovation, Initia (INIT) stands out as a forward-thinking, modular Layer 1 (L1) blockchain network purpose-built to support scalable, consumer-friendly decentralized applications (dApps).

With a special focus on gaming, social apps, and AI integration, Initia introduces a dynamic ecosystem that simplifies the developer experience while offering users seamless multi-chain interactions.

At its core, Initia combines Cosmos SDK and MoveVM, bringing together the interoperability of Cosmos with the security and performance of the Move programming language.

This architectural fusion empowers Initia to serve not just as a blockchain, but as an ecosystem enabler—fueling a vibrant world of Layer 2 rollups known as “initiums.”

What Is Initia?

Initia is a next-generation blockchain platform designed to streamline the creation and management of rollups—custom Layer 2 chains built for specific application needs.

Whether you’re a game developer, a DeFi protocol builder, or a social app founder, Initia offers the tools, scalability, and composability needed to launch your chain efficiently.

At a time when blockchain fragmentation hinders user adoption and developer momentum, Initia brings cohesion through its hybrid L1-L2 architecture, designed to provide shared security, liquidity, and interoperability across its rollup ecosystem.

Understanding Initia’s Modular Architecture

Initia’s architecture consists of three tightly integrated layers:

1. Initia Layer 1 (L1): The Central Coordination Hub

2. Interwoven Rollups: Scalable Layer 2 Chains

-

Known as initiums, these Layer 2s are fully customizable.

-

Developers can select different VMs, gas tokens, and on-chain governance models.

-

Enables high scalability for application-specific use cases such as games, social platforms, and DeFi protocols.

3. The Interwoven Stack: Simplified Blockchain Tooling

-

A plug-and-play development suite that accelerates rollup deployment.

-

Features built-in modules for AMMs, staking, oracles, and token standards.

-

Minimizes technical complexity, reducing time-to-market for projects.

INIT Token: Utility, Governance, and Ecosystem Growth

The INIT token plays a crucial role in maintaining the Initia ecosystem’s functionality and incentivizing its stakeholders:

1. Gas Fees: Used to pay for transactions on both Initia L1 and its rollups.

2. Staking: Delegators and validators stake INIT to secure the network and earn rewards.

3. Governance: Token holders vote on protocol changes, inflation rates, and network parameters.

As the number of initiums and applications grows, INIT’s utility is expected to expand into interchain DeFi, cross-rollup operations, and more complex governance mechanics.

Why Initia Is Different

1. Cosmos + MoveVM Integration

Initia is unique in blending the Inter-Blockchain Communication (IBC) protocol from Cosmos with the Move language’s safety-first, modular execution environment. This allows Initia to deliver secure, interoperable chains with greater flexibility than EVM-based competitors.

2. Rollups-as-a-Service

Initia reduces friction by enabling developers to deploy custom Layer 2 chains without starting from scratch. Preconfigured modules, customizable VMs, and built-in security drastically shorten the time to launch.

3. User-Centric Design

Initia prioritizes usability with wallet abstraction, fast finality, and multi-chain simplicity. End-users can interact across initiums and external chains without dealing with complex bridging mechanisms.

INIT Airdrop and Market Sentiment

As anticipation builds around the INIT airdrop, users and investors are closely watching Initia’s pre-launch market activity. The token currently trades in pre-markets such as Bitget and Aevo at a price range of $0.60–$0.70, giving the project an FDV of $600M–$700M.

Two key price scenarios are currently projected:

1. Without Binance Listing: INIT may trade steadily between $0.50 and $0.70, similar to how Dymension (DYM) performed post-launch.

2. With Binance Listing: INIT could launch at $1–$1.50, with its FDV reaching $1.5 billion, following a trajectory similar to Celestia (TIA) or Movement (MOVE).

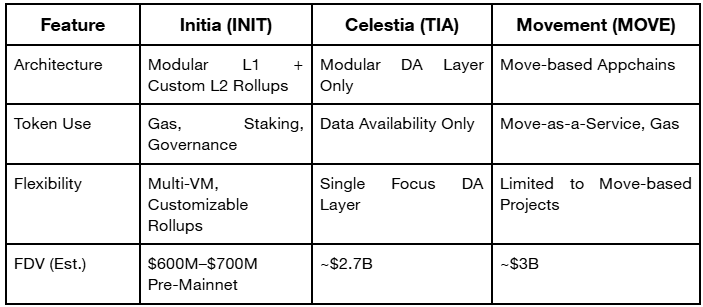

Comparative Analysis: Initia vs. Competitors

Initia’s more complete modular stack and multi-language support give it a technological edge over its peers in adaptability and composability.

INIT Token Price Forecast (2025–2040)

A combination of algorithmic models, historical performance, and investor sentiment suggests a promising long-term outlook for INIT. Below are the Initia (INIT) yearly projections:

Monthly Projections for 2025 also highlight strong potential returns:

1. May 2025: Avg. $1.52, Max. $2.56 (ROI: 239%)

2. June 2025: Avg. $3.00, Max. $3.56 (ROI: 372%)

3. July 2025: Avg. $ 1.57, Max. $1.63 (ROI: 115.78%)

4. August 2025: Avg. $2.72, Max. $3.03 (ROI: 302%)

5. September 2025: Avg. $1.16, Max. $1.35 (ROI: 71.91%)

6. October 2025: Avg. $1.139, Max. $1.24 (ROI: 64.17%)

7. November 2025: Avg. $1.063, Max. $1.73 (ROI: 78.40%)

8. December 2025: Avg. $1.43, Max. $1.59 (ROI: 110%)

Conclusion: Why Initia Could Redefine Web3 Infrastructure

Initia presents one of the most holistic blockchain ecosystems to date—offering not only a secure and scalable base layer but also a comprehensive development environment for launching high-performance, application-specific blockchains.

With its emphasis on modularity, user-centricity, and developer accessibility, Initia is poised to attract a wide range of projects across DeFi, gaming, AI, and social networking.

As the INIT token prepares for broader distribution through its airdrop and potential exchange listings, investors and builders alike should keep a close eye on this rising multi-chain ecosystem.

by | May 4, 2025 | Business

Discover XRPL SNAP, the MetaMask Snap that brings full XRP Ledger integration to MetaMask, enabling XRP transactions, token and NFT management, asset bridging, and direct XRP purchases, all in one secure multi-chain wallet interface.

The recent integration of XRP into MetaMask marks a significant milestone in the journey of XRP adoption. With the advent of XRPL SNAP, users can now interact directly with the XRP Ledger (XRPL) using MetaMask, a wallet that was traditionally reserved for Ethereum and EVM-compatible blockchains.

This innovation bridges a long-standing gap and empowers users to manage both XRP and Ethereum assets in a single, unified interface.

What is XRPL SNAP?

XRPL SNAP is a plugin developed using MetaMask’s Snaps framework—an extension system that allows MetaMask to support non-EVM blockchains. This tool enables native interaction with the XRP Ledger from within the MetaMask wallet.

With XRPL SNAP, users can:

- View XRP balances and addresses

- Send and receive XRP

- Sign all types of XRPL transactions

-

Manage XRPL tokens and NFTs

-

Interact with XRPL dApps

-

Buy XRP using credit cards

-

Bridge assets between XRPL and Ethereum

In short, XRPL SNAP turns MetaMask into a fully functional multi-chain wallet with XRP support, significantly enhancing both its utility and convenience.

How to Use XRPL SNAP in MetaMask

Using XRPL SNAP is a straightforward process. Follow these steps to get started:

1. Step 1 – Install MetaMask: Make sure you have the MetaMask browser extension installed and set up.

2. Step 2 – Visit the XRPL SNAP Page: Go to the official Snap listing: https://snaps.metamask.io/snap/npm/xrpl-snap/

3. Step 3 – Connect and Approve the Snap: Click “Connect” to link MetaMask with the XRPL Snap; MetaMask will prompt you to review permissions; Click “Approve & Install” to proceed. The Snap is developed by @leopoldjoy, a trusted contributor in the XRPL ecosystem.

4. Step 4 – Set Up XRPL Wallet: After installation, A new XRPL wallet address will be generated in your MetaMask; You’ll be able to view your XRPL address, request Test XRP, or fund your wallet using real XRP.

5. Step 5 – Activate Your XRPL Account: New XRPL accounts must be activated with a minimum deposit of 1 XRP, a unique anti-spam mechanism built into the XRP Ledger. For testing, request free XRP using the Testnet faucet; On mainnet, transfer XRP from an exchange or another wallet.

6. Step 6 – Send XRP: To send XRP: Click “Send XRP” inside the Snap interface; Enter the recipient’s XRPL address, amount, and (optionally) a destination tag; MetaMask will sign and submit the transaction; A confirmation will appear once it’s complete.

Why Use XRPL SNAP?

The integration brings several powerful benefits:

1. Seamless Multi-Chain Management: Manage XRP, XRPL tokens, NFTs, and Ethereum assets all from MetaMask—no need for separate wallets.

2. Low Fees and Fast Transactions: The XRP Ledger is known for its sub-second confirmation times and near-zero transaction fees, making it ideal for frequent or high-volume transfers.

3. Full XRPL Functionality: Users can sign any XRPL transaction (payments, trustlines, account settings); view real-time account dashboards; access full transaction history; & create and manage XRPL accounts

4. NFT and Token Support: Store and transfer XRPL NFTs and tokens natively inside MetaMask.

5. On-Ramp XRP Purchase: Thanks to the Transak integration, users can buy XRP directly within MetaMask using a credit card, bypassing centralized exchanges entirely.

6. Cross-Chain Bridging: Effortlessly bridge assets between EVM-compatible chains and the XRP Ledger, unlocking new DeFi possibilities across ecosystems.

Security Considerations

While XRPL SNAP offers exciting new functionality, users must remain vigilant:

- XRPL SNAP is not developed by Ripple, but by independent developers.

-

Only install from the official MetaMask Snap directory to ensure safety.

-

Never share your Secret Recovery Phrase or private keys—no Snap, dApp, or extension should ever request them.

-

MetaMask’s existing security features (including hardware wallet support) still apply to XRPL SNAP transactions.

XRPL SNAP vs Traditional XRP Wallets

Conclusion: Unlocking XRPL’s Potential Through MetaMask

XRPL SNAP is a major leap forward for XRP users and the broader crypto community. It simplifies asset management, supports a wide range of transactions, and enhances the MetaMask experience by bringing in a non-EVM giant like the XRP Ledger.

Whether you’re a seasoned MetaMask user or just getting started with XRP, XRPL SNAP is a practical, secure, and powerful way to unify your crypto interactions under one roof.

by | May 4, 2025 | Business

Discover what XFree Coin (XFREE) is, how it works, how to buy or earn it through staking, and how it compares to similarly named crypto and adult platforms. A full guide to its safety, utility, and future potential.

In the ever-evolving world of cryptocurrency, the spotlight often falls on major players like Bitcoin and Ethereum. But as blockchain technology matures, a wave of utility-driven, purpose-built tokens is rising, among them, XFree Coin (XFREE).

With a blend of staking rewards, real-world payment ambitions, and a unique identity in the digital finance ecosystem, XFREE is turning heads.

This article explores what XFree Coin is, how it works, how to obtain it, and how it compares to similarly named, but fundamentally different, platforms like xfree.com and other adult-themed crypto projects.

What Is XFree Coin?

XFree Coin (XFREE) was launched in 2022 as part of the FREEdom Coin ecosystem and is built on the BNB Smart Chain (BEP-20), a popular blockchain known for its fast and cost-efficient transactions.

It’s not just another token, it’s a reward-based asset designed for users who stake the foundational FREEdom Coin (FREE).

Key Highlights:

1. Total supply cap: 10 billion XFREE (scarcity-driven).

2. Earning mechanism: Up to 40% annual returns through staking FREE Coin.

3. Platform: Built on BEP-20 for fast and inexpensive transfers.

4. Long-term vision: Integration with crypto debit cards, enabling payments via Visa, Mastercard, Google Pay, or Apple Pay.

In essence, XFree Coin functions as a staking reward and a potential spending token—a dual purpose rarely seen with newer altcoins.

How to Buy XFree Coin

If you’re interested in owning XFREE, there are three main ways to do so:

1. Centralized Exchanges (CEXs)

2. Decentralized Exchanges (DEXs) like PancakeSwap

-

Use a wallet like Trust Wallet.

-

Buy BNB, transfer it to your wallet.

-

Connect the wallet to PancakeSwap.

-

Swap BNB for XFREE using the official smart contract.

3. Stake FREEdom Coin

Why Stake FREE to Earn XFREE?

The staking model behind XFREE is one of its standout features:

1. Attractive APY: Up to 40% returns annually.

2. Passive Income: No mining equipment needed.

3. Flexibility: Convert XFREE back to FREE using DEXs.

4. Potential Spending Utility: Future debit card integration.

For users looking to generate crypto income without the energy-intensive mining model, staking FREE to earn XFREE is a smart alternative.

Is XFree Coin Safe?

Like all emerging tokens, XFREE carries some inherent risks:

1. High volatility: As a newer asset, price swings are common.

2. Limited trading history: Less data means higher uncertainty.

3. Security awareness: Only use verified platforms and keep wallets secure.

4. Regulatory flux: Crypto laws may affect newer projects disproportionately.

Due diligence is key. Only invest what you can afford to lose.

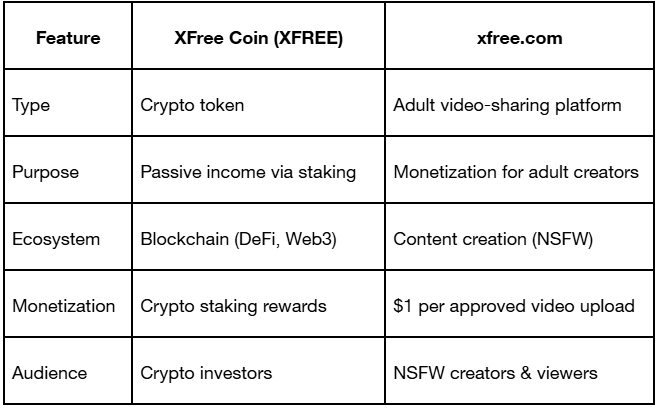

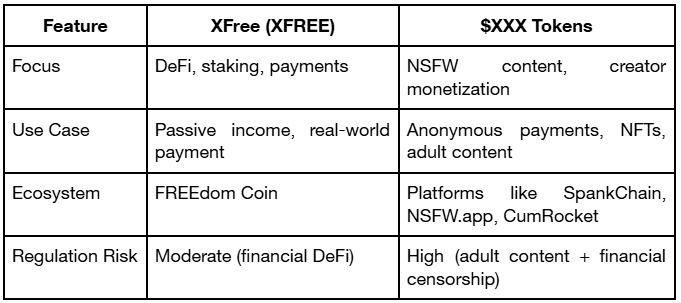

XFree Coin vs xfree.com: A Tale of Two Worlds

Don’t be fooled by the name. There’s a stark difference between XFree Coin (XFREE) and xfree.com, a mobile-first adult content platform that bills itself as the “TikTok of adult videos.”

Quick Comparison:

Despite the similar name, these platforms serve entirely different markets—one financial, the other entertainment. Their shared use of “X” signifies innovation and disruption, not affiliation.

XFree Coin vs $XXX: Crypto in the Adult Sector

Another layer of confusion arises from the comparison between XFree and $XXX tokens used in adult crypto projects. While XFree is not tied to any adult themes, $XXX tokens are explicitly designed for the adult entertainment industry.

Key Differences:

XFree appeals to mainstream crypto users seeking usability and long-term rewards, while $XXX tokens solve privacy and payment challenges within adult ecosystems.

What Makes XFree Unique?

1. Utility-focused: Built with usability in mind, not just speculation.

2. Community-oriented: Tied to the FREE Coin ecosystem with a clear roadmap.

3. Listed on Bitrue: More accessible than many speculative tokens.

4. Sustainable rewards: Encourages long-term holding through staking.

In a space flooded with meme tokens and hype coins, XFree stands out for offering something practical: a tool for passive income with a vision toward mass adoption.

Conclusion: XFree Coin in a Diversified Digital Future

The crypto space is expanding far beyond digital gold and hype-driven tokens. Projects like XFree Coin reflect a maturing industry, where utility, transparency, and community matter more than marketing.

Whether you’re looking to stake for rewards, diversify your crypto holdings, or explore real-world crypto spending, XFree offers a structured and grounded opportunity.

Meanwhile, names like xfree.com and $XXX remind us of crypto’s broader reach—from DeFi to decentralized adult content. But ultimately, XFree Coin carves out its own identity: clean, scalable, and purpose-built for financial empowerment in the age of Web3.

Important note: this article is not a solicitation to buy a particular token. This article is here to provide information so that readers can do research to find out about a project in the crypto ecosystem.

by | May 4, 2025 | Business

XRP price predictions for 2035 suggest a surge to $7.50 amid rising institutional adoption, legal clarity, and ETF optimism. Explore the latest XRP news, Ripple’s evolving strategy, and key market drivers shaping its future.

In a series of pivotal developments, Ripple’s native token, XRP, is making headlines again. From large-scale whale movements to institutional endorsements, legal breakthroughs, and long-term adoption forecasts, XRP appears to be positioning itself at the core of a global financial transformation.

With the cryptocurrency market forecasted to more than double in value over the next decade, XRP could emerge as a dominant force—if ongoing momentum persists.

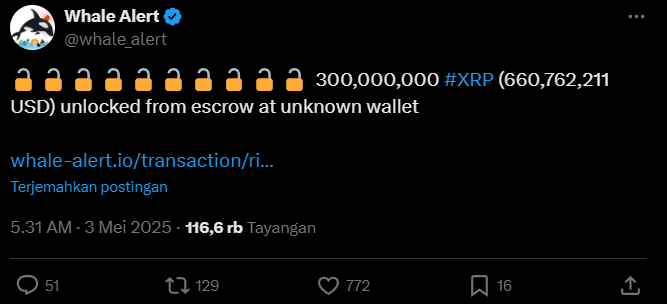

1 Billion XRP Unlocked as Ripple Adjusts Strategy

On May 3, blockchain analytics firm Whale Alert flagged three massive XRP transactions totaling 1 billion XRP.

The transfers included 200 million, 300 million, and a staggering 500 million XRP, with the latter confirmed to be initiated by Ripple itself. All transactions involved funds released from escrow to unidentified wallets.

Traditionally, Ripple has unlocked 1 billion XRP on the first of every month. However, this month’s release came on the third and followed a slightly altered structure: 700 million XRP was locked back into escrow before the new batch was released—a shift from previous protocol where escrow locking followed token distribution.

These changes reflect Ripple’s efforts to balance XRP liquidity with market discipline. A portion of the unlocked XRP is typically sold on exchanges to support operational costs, while another part is deployed within Ripple’s institutional payment network and distributed to strategic partners.

Rumors of Circle Acquisition Denied by Community

Earlier this week, reports emerged that Ripple offered to acquire Circle—the issuer of USDC—for $4 to $5 billion. After Circle declined, rumors circulated that Ripple had increased its bid to a massive $20 billion.

However, the XRP community swiftly denied these claims, with many users mocking media outlets like CoinTelegraph for perpetuating unfounded narratives.

MasterCard Backs XRP as Cross-Border Bridge

In a major vote of confidence, a leaked MasterCard report titled “Blockchain Technology Fuels New Remittances Business Cases” spotlighted XRP as a viable bridge currency for international remittances.

The report specifically praised Ripple’s partnerships with institutions like SBI Remit and acknowledged the XRP Ledger’s efficiency in eliminating the need for pre-funded accounts—reducing foreign exchange costs and improving global liquidity.

MasterCard’s recognition of XRP strengthens the token’s legitimacy and may signal growing institutional integration, especially in regions underserved by traditional banking systems.

Whale Activity Signals Institutional Repositioning

Despite a dip in on-chain volume—XRP transactions dropped from 800 million to 527 million in April—analysts interpret current whale movements as signs of repositioning. Nearly 300 million XRP changed hands within 48 hours, often a precursor to significant market shifts.

Technical analysts note that XRP is consolidating within a wedge pattern, trading around $2.13. Rising support and falling resistance suggest that the token may be gearing up for a breakout.

Ripple’s Expanding Global and DeFi Footprint

Ripple is rapidly expanding its ecosystem. It recently partnered with Revolut and Zero Hash to challenge stablecoin giants like USDT and USDC.

Other notable collaborations include Portugal’s Unicâmbio for real-time transfers between Portugal and Brazil and South Korea’s BDACS, which will use Ripple Custody for XRP and the Ripple USD stablecoin (RLUSD).

Within decentralized finance (DeFi), Ripple is working with Chainlink to bring RLUSD to Ethereum-based platforms, aiming to integrate seamlessly with both decentralized and institutional finance.

Ripple has also donated $100,000 worth of XRP to California wildfire relief, reinforcing its socially conscious brand.

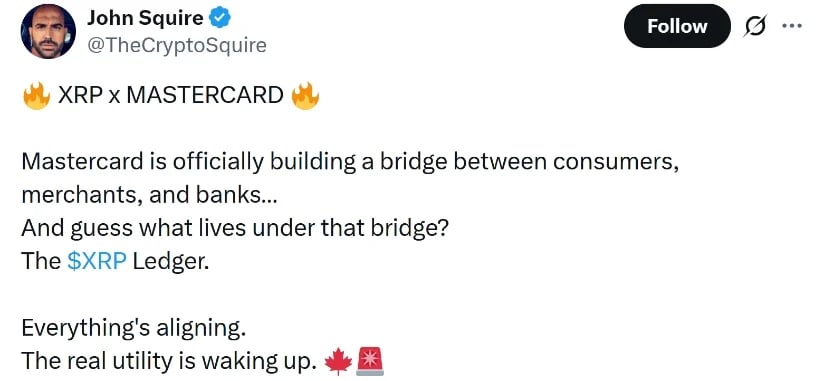

Media Analysts: XRP Is “Loading,” Not Lagging

Crypto analyst John Squire recently described XRP as “loading”—arguing that market players are underestimating its utility and institutional reach.

With Ripple Payments active in 55+ countries and partnerships with 350+ financial institutions—including Tranglo and Japan’s SBI—Squire believes XRP is uniquely positioned for a sustained bull run.

He also pointed to pending developments such as CME XRP futures and whispers of a BlackRock XRP trust. “XRP is battle-tested, institutionally aligned, legally resilient, and globally deployed,” said Squire.

Ripple’s Legal Battle Nears Resolution

Ripple’s legal dispute with the U.S. Securities and Exchange Commission (SEC) is approaching its conclusion. Following a partial victory in 2023, both parties recently filed a joint motion to pause the appeal, signaling the possibility of a final settlement by June 16.

If Judge Analisa Torres lifts the injunction preventing institutional XRP sales and reduces Ripple’s $125 million penalty, several critical developments could follow:

- The SEC could drop its appeal against XRP programmatic sales.

- Ripple might withdraw its cross-appeal.

- Pending spot XRP ETF applications could gain approval.

The new SEC Chair, Paul Atkins, is perceived as more crypto-friendly, further fueling optimism that XRP may soon receive ETF approval.

Price Outlook: Can XRP Hit $7.50 by 2035?

XRP’s performance remains a subject of bullish speculation. While XRP currently trading near $2.19, many analysts expect it to reach $5.75–$7.50 by 2035. This projection implies a return of 160%–240% over the next decade, or an average annual gain of 10%–13%.

Ripple’s integration into global financial infrastructure, rising institutional adoption, and potential ETF approvals could drive this growth.

Notably, XRP has historically outperformed the broader crypto market—gaining 270% over the past three years compared to the overall market’s 72% return. If this trend holds, XRP could continue to surpass expectations.

XRP’s Advantages and Risks

Why XRP Has an Edge:

- Speed & Cost: XRP settles cross-border payments in seconds at low fees, unlike SWIFT’s slow and expensive system.

-

Infrastructure: XRP Ledger is designed specifically for global payments.

-

Adoption: Ripple’s growing list of global partners indicates increasing acceptance.

-

ETF Potential: Spot ETFs could unlock demand from retail and institutional investors using traditional brokerages.

Risks to Consider:

- Volatility: Crypto markets are notoriously volatile; investors should prepare for sharp price swings.

-

Regulatory Hurdles: Despite positive momentum, the legal landscape can change quickly.

-

Adoption Lag: Ripple must accelerate institutional onboarding for long-term price growth.

Conclusion: XRP’s Next Decade May Define Its Legacy

With institutional support growing, legal clarity on the horizon, and technical upgrades in progress, XRP is more than just another digital token—it could be the backbone of a new financial era.

If Ripple continues to build bridges across banking systems, and if ETFs gain approval, XRP may not only reclaim past highs but exceed them—potentially reaching $7.50 or more by 2035.

Still, as with all crypto investments, risk management and long-term vision are key. For investors willing to weather short-term volatility, XRP remains one of the most promising contenders in the blockchain revolution.

by | May 2, 2025 | Business

7XM is a licensed online gaming platform designed for Filipino players, offering secure access to casino, slots, and sports betting. With its user-centric approach, the app is now one of the top-rated online gaming platforms in the Philippines.

MANILA, PHILIPPINES – In a rapidly growing digital entertainment landscape, 7XM Gaming App has firmly established itself as the #1 online gaming app in the Philippines, offering an unbeatable combination of top-tier games, secure mobile experience, and local-friendly features that resonate with millions of Filipino users.

CLAIM YOUR FREE 600 BONUS VIA GKASH

Launched with the vision of bringing premium gaming experiences to Filipino players, 7XM has quickly become a household name in the iGaming space. The app features a rich variety of casino games — from classic slots and fishing games to live dealer tables and sports betting — all accessible with a single tap.

“Our goal has always been to deliver an immersive, seamless, and trustworthy gaming experience tailored to the Filipino market,” said a spokesperson from 7XM. “We are proud to be recognized as the leading app in the country.”

CLAIM YOUR FREE 999 HERE

Key Reasons Why 7XM Leads the Pack:

Wide Game Selection – 7XM hosts an expansive library of top-rated games from global providers.

Mobile-Optimized Platform – Smooth, lag-free performance on Android and iOS.

Local Payment Options – Supports GCash, Maya, bank transfers, and other PH-preferred methods.

Legit and Secure – Operates under PAGCOR license and follows strict data protection protocols.

Generous Rewards – New users receive a ₱50 free bonus upon sign-up, with ongoing promos for loyal players.

With its commitment to innovation, user experience, and safety, 7XM continues to redefine online gaming in the Philippines. The app has received overwhelmingly positive reviews and maintains a strong presence across social media and affiliate platforms.

CLAIM YOUR FREE 600 BONUS VIA GKASH

Download and Join the 7XM Community Today

Players can download the app via the official website and start enjoying instant rewards, fast payouts, and nonstop gaming action.

For more information, visit: https://www.7xmph2.com/register?affiliateCode=cppvu

Media inquiries: pr***@*xm.com

by | May 2, 2025 | Business

Schneider Electric, a leader in the digital transformation of energy management and automation, today announced that its Schneider Sustainability Impact (SSI) program achieved a score of 7.95 out of 10 for the first quarter of 2025, toward a target of 8.80/10 by the end of the year. Recognised in January as the world’s most sustainable corporation by Corporate Knights, Schneider Electric remains committed to driving significant progress toward its sustainability goals as it embarks on the final year of its current SSI program.Throughout the first quarter, Schneider Electric has made substantial progress in various areas:

The company has helped its customers save and avoid nearly 700 million tonnes of CO2 emissions through its solutions. This concurs with the launch of the second Energise Power Purchase Agreement (PPA) cohort, enabling four global healthcare companies to buy 245 GWh of renewable electricity annually for the next 10 years. Efforts to reduce upstream carbon emissions have also been accelerated, achieving a 42% decrease from the company’s top 1,000 suppliers.

Already surpassing targets more than a year in advance, Schneider Electric’s commitment to fighting poverty and supporting communities remains strong. To date, 56 million people have gained access to energy through initiatives that develop clean energy solutions for education, healthcare, agriculture, and small businesses. Moreover, by signing the Rise Ahead Pledge recently, Schneider Electric is also working to expand access to essential services and promote socio-economic development, by focusing on energy poverty and impact investing in underserved markets.

Zone and country presidents continue to drive local impact initiatives, following the advancement of over 200 initiatives started in 2021. These programs aim to enhance the company’s sustainable impact by supporting and empowering local communities with training and mentoring, energy resiliency, environmental action, and more. For example, Schneider Electric UK and the Tottenham Hotspur Foundation have recently launched a STEM educational program to inspire local pupils with interactive workshops and digital resources, equipping them with essential skills for a sustainable future.

“At Schneider, we believe in strong partnerships with corporations, governments, local partners, and communities to uplift livelihoods, boost incomes, and expand access to education and reliable, clean energy,” said Chris Leong, Chief Sustainability Officer. “I’m especially proud of our people’s relentless pursuit to turn ambition into action, from innovating solutions for environmental impact to giving back to our communities. Together, we’re making progress and sustainability a reality for all.”

For more details, please refer to the Q1 2025 report of Schneider’s Sustainability Impact program, including the progress dashboard:

Recent recognition

Schneider Electric’s factory in Wuxi, China was recognised by the World Economic Forum as the company’s fourth Sustainability Lighthouse, due to its significant reductions in emissions while promoting a circular economy.

Schneider Electric has been ranked #1 in Europe and among the Top 10 globally in the 2025 Carbon Clean 200 list of publicly traded companies that are leading the transition to clean energy solutions.

Schneider Electric is included in Ethisphere’s Top 100 World’s Most Ethical Companies for 2025, demonstrating 14 years of unwavering commitment to business integrity.

Schneider Electric is recognised as a Top-Rated ESG performer out of more than 5,000 companies in Sustainalytics’ ratings universe.

Schneider Electric was honored with the Gold Seal of the Capital Goods industry for Gender Equality by Equileap in 2025.

by | Apr 30, 2025 | Business

Tech Neck Time Bomb: Spinal Health Week Exposes Hidden Cost to Australians’ Health & Productivity

“Get the heads up on tech neck!” – National Spinal Health Week is 26 May to 1 June 2025

With over 5.3 million Australians suffering from neck pain including, Tension Neck Syndrome, a musculoskeletal disorder (MSD) commonly known as ‘tech neck’ or‘text neck’, national Spinal Health Week (26 May to 1 June 2025) is dedicated to promoting spinal health and preventing the incidences of tech neck in Australians of all ages.

MSDs affect the joints, bones, muscles and multiple body areas (including the neck) and cost the Australian economy over $55 billion annually through direct health costs, lost productivity and reduced quality of life.

Dr Billy Chow, President of the Australian Chiropractors Association (ACA) said, “With tech neck emerging as a growing global public health concern, together with the projected increase in MSDs over the next two decades, the health burden on Australians and our economy is and will continue to be significant.”

“With over 34 million mobile phone connections and 95% of Australians accessing the internet via a smartphone, the focus of ACA’s annual national Spinal Health Week(26 May to 1 June 2025) is on encouraging Australians to adjust their thinking and take proactive steps to improve their spinal health and avoid debilitating tech neck,” said Dr Chow.

“Once primarily experienced by seniors, with the advent of smart devices and wide-spread use of tablets and computers by people of all ages including children; we’re seeing a growing number of younger patients in their 30s and 40s suffering from cervical spine disorders due to incorrect use of technology devices,” he said.

Studies have shown smartphone and computer use can have a significant impact on pain severity among tech neck sufferers with the most prevalent symptoms of neck and back pain linked to the length of time spent using a device and the degree of discomfort experienced.

Caused by poor posture and the prolonged or incorrect use of digital devices, tech neck can lead to headaches, neck, shoulder and upper back pain that over time, can lead to changes to the natural curve of the cervical spine.

A recent study ‘The Association Between Mobile Phone Usage Duration, Neck Muscle Endurance, and Neck Pain Among University Students’ published in Nature (29.8.2024), examined the correlation between phone use, duration, addiction, neck muscle endurance, and neck pain in university students.

“Although the study focused on mobile phone use by university students, with almost 87% of Australians now regular smartphone users and 75.5% being daily computer users, it’s fair to consider the findings may be broadly applied to the population generally, particularly young people who’ve grown up using smartphones and tablets,” said Dr Chow.

“While more studies are needed to better understand the implications of incorrect and overuse of technology on spinal health; to help prevent tech neck, we need to re-think how we use devices particularly young people who spend prolonged periods with their head bent forward viewing a smartphone,” he said.

“When it comes to smartphones, not only must we monitor the length of time we use our devices, but we must be cognisant that overuse and the way we use them can negatively impact our spinal health as well as our mental health,” Dr Chow said.

“The ACA recommends limiting recreational screentime to two hours per day, holding devices at eye level to prevent bending the neck forward, changing posture and taking regular breaks every ten minutes to look away from the device and move the neck from side-to-side.”

“Computer use is also a primary cause of tech neck. Although most common among office workers, with 75.5% of Australians aged 16 to 64 using computers daily, incorrect use and computer set up can lead to a range of MSDs.

“Whether using a laptop or a desktop at home, school, university or at work; it’s essential to take regular postural breaks every 30 minutes for movement and stretching and ensure workstations are set up ergonomically correct to help prevent tech neck, increase productivity and maintain overall spinal health and wellbeing,”

“During Spinal Health Week, we’re encouraging all Australians to adjust their thinking on how they use smartphones, tablets and computers to help prevent persistent, aggravated head, neck and upper back injuries which impact productivity at home, school and at work,” he said.

For sufferers of tech neck, while medications may offer temporary relief from neck and back pain, academic studies (including a Sydney University study) show opioids do not benefit people with acute neck or back pain (lasting up to 12 weeks) and have no positive role in treatment.

However, studies have shown that commencing treatment for tech neck promptly is crucial in preventing further functional decline and progression to a chronic condition. Effective treatment outcomes are achieved through a combination of strengthening and stretching exercises, manual therapy and postural correction.

“Every week over 400,000 chiropractic healthcare consultations help create well-adjusted Australians as ACA chiropractors play an important role in improving the spinal health of everyday Australians,” said Dr Chow.

“This Spinal Health Week, we’re inviting Australians to join the movement to learn and share practical strategies that can help prevent tech neck, promote overall spinal health ad wellbeing, and reduce the economic and personal burden of MSDs,” Dr Chow said.

As a leader in musculoskeletal health, ACA has invested over $2.3 million to advance research in building evidence-based practice for chiropractic healthcare and promotes the importance of maintaining spinal health through its annual flagship campaign, National Spinal Health Week – Australia’s longest running and award-winning health awareness campaign dedicated to improving the spinal health of Australians of all ages.

Get the heads up on tech neck and download ACA’s FREE Avoiding Tech Neck Factsheets and Electronic Device Checklistsfor Adults, Parents and Students, the Ergonomic Checklist, and the Stand Corrected Stretching Poster available to download from www.spinalhealthweek.org.au.

by | Apr 30, 2025 | Business

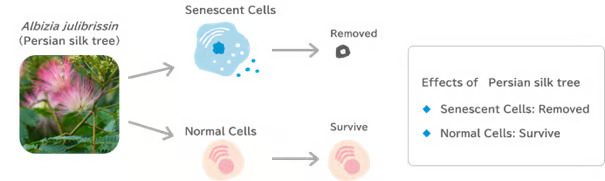

Ezaki Glico Co., Ltd. is a Silver Partner of the Expo’s Signature Pavilion “EARTH MART” and a Premium Partner of the “Osaka Healthcare Pavilion” at Expo 2025 Osaka, Kansai. As part of its participation in both pavilions, Glico held a press briefing on April 30 to share two key announcements: a newly obtained patent related to its “Cellular-care” research, and the development of “Rice soft candy” for the Expo 2025. At the “Osaka Healthcare Pavilion”, Glico is presenting an exhibition focused on “Cellular-care”. The company has been accelerating research on aging prevention and has announced that it has obtained a patent for demonstrating the senescent cell–removing effect of Persian silk tree. In addition to the details of the research that led to the patent, the briefing also covered the story behind “Rice soft candy”, which is being distributed exclusively at the Signature Pavilion “EARTH MART”. This newsletter provides a summary of the press releases announced today.

① Accelerating Research on Aging Prevention

Glico demonstrates senescent cell removal by Persian silk tree and obtains patent —Discovered from Glico’s Library of 6,000 Curated Ingredients —

Ezaki Glico Co., Ltd. conducted research to identify ingredients that act on the causes of aging, selecting approximately 6,000 candidates from its curated ingredient library, with a focus on those suitable for food applications. As a result, Glico demonstrated that Persian silk tree removes senescent cells (senolysis*1), and has now obtained a Patent (Patent No. 7659690). This marks the first patent in Japan for the removal of senescent cells using Persian silk tree. Moving forward, the Glico Group will continue its research, including validation in humans, to further explore its potential in aging-related applications.

For more information, please visit https://www.glico.com/global/news/46993/.

② Each Piece Encapsulates the Gentle Essence of Rice and a Vision for the Future of Our Planet

Glico develops “Rice soft candy” using rice-derived ingredients To be distributed exclusively inside “EARTH MART” at Expo 2025 Osaka, Kansai from the End of May

Ezaki Glico Co., Ltd. is a Silver Partner of the Expo’s Signature Pavilion “EARTH MART” at Expo 2025 Osaka, Kansai. Under the pavilion’s theme, “Thinking about the lives through eating”, Glico has developed “Rice soft candy” by applying the soft-candy-making technology it has cultivated since its founding—using rice, Japan’s staple food, as the key ingredient. “Rice soft candy” will be offered free of charge to pavilion visitors exclusively within “EARTH MART”, starting from the End of May. The Glico Group will continue to share the value of Japanese food culture with the world and offer new ideas that contribute to “Healthier days, Wellbeing for life”.

For more information, please visit https://www.glico.com/global/news/47011.

*1 Senolysis: Refers to the selective removal of senescent cells. The term is derived from seno (senescence) and lysis (destruction or breakdown).

[Notes of caution]

This document is an English translation of the Japanese original. In the event of any differences or inconsistencies between the Japanese and English versions, the Japanese language version shall take precedence.

by | Apr 30, 2025 | Business

The SEC has approved ProShares’ XRP futures ETFs, signaling a major shift in U.S. crypto regulation. Discover what this means for XRP, Ripple’s legal battle, and the future of spot ETFs.

In a major development for the cryptocurrency sector, the United States Securities and Exchange Commission (US SEC) has approved ProShares’ launch of XRP futures exchange-traded funds (ETFs), with trading set to begin on April 30, 2025.

This move is poised to reshape the landscape for XRP investors and highlights a broader shift in U.S. regulatory attitudes toward digital assets.

Understanding XRP and Ripple

XRP is a digital token created by Ripple Labs, a company focused on revolutionizing cross-border payments. Ripple’s network aims to connect international banks, enabling instant money transfers without the inefficiencies of traditional systems like SWIFT. XRP serves as a bridge currency within this network, offering rapid, low-cost transactions. A single cross-border transfer using XRP costs just a fraction of a cent, demonstrating its utility in real-world financial ecosystems.

Ripple’s ongoing legal battles with the SEC, which began in 2020, had cast a long shadow over XRP’s price. However, a more crypto-friendly political environment under President Donald Trump and recent developments hinting at a settlement have significantly improved sentiment around XRP.

What Are XRP Futures ETFs?

ProShares, already known for its Bitcoin Futures ETF (BITO), proposed three XRP-linked ETFs back in January 2025:

- Ultra XRP ETF (2x leveraged)

- Short XRP ETF (inverse -1x leveraged)

- UltraShort XRP ETF (inverse -2x leveraged)

These futures ETFs will track XRP prices based on the XRP Index, allowing investors to speculate on XRP’s price movements without owning the actual token. This differs from spot ETFs, which require the fund to hold the underlying asset itself.

The ETFs will invest in a combination of XRP futures contracts, swaps, and cash balances in money market instruments, including U.S. Treasuries. Importantly, this offers a regulated pathway for investors to engage with XRP price trends while reducing direct exposure risks.

Why This Approval Matters

The approval of ProShares’ XRP futures ETFs is a watershed moment for several reasons:

1. Regulatory Recognition: It marks increasing acceptance of XRP as a legitimate asset class within regulated U.S. financial markets.

2. Institutional Interest: The move could unlock substantial institutional capital, mirroring patterns observed after the introduction of Bitcoin and Ethereum ETFs.

3. Market Sentiment: XRP prices have already reacted positively, surging over 6% to $2.28 in early trading on April 28, with daily trading volume soaring by more than 53%.

In contrast, Bitcoin and other major cryptocurrencies saw price declines during the same period, highlighting XRP’s relative strength.

Ripple’s Legal Saga and Future Prospects

The backdrop of these developments is Ripple’s legal battle with the SEC. However, recent reports indicate that Ripple and the SEC have reached an agreement to settle the case. As part of the settlement:

- Ripple will pay $50 million of a previously escrowed $125 million penalty.

-

The SEC will withdraw its appeal regarding the “Programmatic Sales of XRP” ruling.

-

Judge Analisa Torres may lift the injunction on XRP sales to institutional investors.

If finalized, this settlement could remove a significant overhang on XRP and further boost its market credibility.

Broader Implications for XRP Spot ETFs

ProShares has also filed for a spot XRP ETF, which is currently pending SEC approval. A spot ETF would involve holding actual XRP tokens rather than futures contracts, offering a more direct exposure option to investors.

The precedent set by Brazil — where Hashdex recently launched the world’s first spot XRP ETF — suggests that once one major market opens the gates, others tend to follow. Betting platform Polymarket now places the odds of a U.S. XRP-spot ETF approval by December 2025 at 78%, up from 68% earlier this month.

Bloomberg Intelligence ETF analyst James Seyffart maintains high confidence in an eventual approval, predicting final decisions by October 2025.

XRP Price Outlook

Following the SEC’s announcement and broader market enthusiasm:

- Current Price: $2.2335

-

Market Cap: $136 billion

-

52-Week Range: $0.39 to $3.38

XRP is currently consolidating above key support levels near $2.10, with resistance around $2.22. A decisive breakout above $2.40 could set the stage for a retest of previous highs at $3.3999 and eventually its all-time high of $3.5505.

Still, downside risks remain, particularly if the Ripple-SEC settlement faces delays or if macroeconomic conditions worsen. A bearish scenario could see XRP retreat toward the $1.50 mark.

Conclusion: A Pivotal Moment for XRP and Crypto Markets

The launch of ProShares’ XRP futures ETFs is more than just a new investment product, it signals the maturing of the crypto industry and growing mainstream acceptance of alternative digital assets beyond Bitcoin and Ethereum.

With Ripple nearing a possible resolution with the SEC, rising institutional interest, and the growing likelihood of spot ETF approvals, XRP is well-positioned for a significant evolution in 2025 and beyond. However, investors should remain cautious and monitor legal and regulatory developments closely.

You must be logged in to post a comment.