by | Jun 13, 2025 | Business

Despite employment reaching a record high in 2024, half of Australian workers (50%) are living paycheck to paycheck, according to ADP Research’s People at Work 2025 report. The study, which surveyed nearly 38,000 workers across 34 markets, uncovers stark regional disparities and generational divides in the global workforce’s financial resilience.

The findings reveal a complex financial picture, both locally and internationally: taking on extra work doesn’t necessarily close the pay gap, as nearly six in 10 (57%) workers surveyed globally are still struggling to make ends meet, even working multiple jobs.

In Australia, over half (52%) of workers with two jobs and nearly six in 10 (58%) of those with three or more jobs report holding multiple roles to cover necessary expenses.

Key Findings:

Global strain: Globally, more than half (54%) of single-job holders, 59% of workers with two jobs, and 61% of workers with three or more jobs are struggling to make ends meet.

Working multiple jobs to make ends meet: A significant portion of Australians are turning to multiple jobs to cope with financial demands.

Two jobs: 58% say they do it to afford extra costs, and 35% to build life savings and prepare for retirement.

Three or more jobs: 58% do it to build savings and prepare for retirement, and 46% to cover extra costs.

Regional Comparison: The country with the highest percentage of workers living paycheck to paycheck is Egypt (84%), followed by Saudi Arabia (79%) and the Philippines (78%). In contrast, South Korea reports the lowest proportion globally, at just 18%. Within the Asia-Pacific region, Australia ranks as the fourth lowest in terms of the share of employees living paycheck to paycheck, with 50% of workers facing this financial pressure. Only Japan (29%), Taiwan (30%), and China (31%) report lower proportions.

Why workers take multiple jobs

The survey reveals that most workers holding multiple jobs are doing it to cover their necessary expenses, to save for future spending, and to build savings for retirement. The number of workers working more than one job is the highest in the Middle East Africa (34%), Latin America (24%), and Asia Pacific (24%).

While people have different reasons for taking on extra work, holding two or more jobs can be a necessity in parts of the world where average wages are low relative to a country’s cost of living. Informal economies in Africa, Latin America and parts of Asia exacerbate challenges, with workers who piece together gig or part-time roles lacking stability or protection.

Navigating the high cost of living

“Pay is the foundation of financial wellbeing for most workers, yet our data shows that even record employment isn’t translating into financial security. Nearly two-thirds of people who hold three jobs still struggle to make ends meet. This presents an opportunity for employers to take a more holistic approach to compensation to help workers navigate the higher living costs of today’s global economy,” ADP chief economist Nela Richardson said.

“With the rising cost of living putting pressure on Australian households, many workers are finding it increasingly difficult to stretch their paychecks, even when holding down multiple jobs. For small and medium-sized businesses, offering across-the-board pay rises may not be realistic — but there are other meaningful ways to support employees,” Judy Barnett, Operations Director at ADP Australia said.

“Flexible work arrangements, subsidised transport, wellness programs, or financial planning support can go a long way in easing day-to-day pressures. These practical benefits help build trust, reduce turnover, and create more resilient workplaces at a time when employee wellbeing has never been more critical,” added Barnett.

by | Jun 13, 2025 | Business

XRP ETF approval is closer than ever as Ripple nears a $50M SEC settlement. With June 17 looming and markets on edge, is XRP about to skyrocket—or crash? Here’s what you need to know.

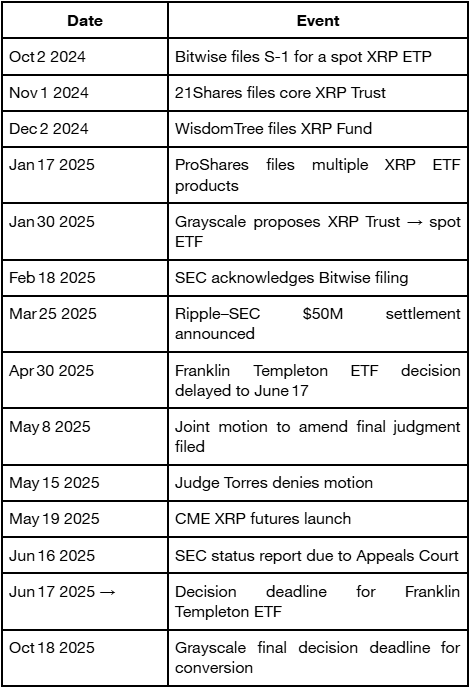

As the SEC’s decision deadline for Franklin Templeton’s spot XRP ETF on June 17 rapidly approaches, speculation is escalating over the potential approval of XRP spot ETFs from major firms, including Grayscale, Franklin Templeton, and Bitwise.

Market participants are taking note of Ripple’s ongoing push to settle its long-running lawsuit with the SEC, a development that could remove a major obstacle to ETF approval, pending final judicial sign-off.

XRP ETF Odds: From Euphoria to Slight Pullback

On prediction platform Polymarket, the probability of an XRP ETF being greenlit by end-2025 soared to 98% in early June, before easing to around 88% in recent days. These numbers underscore both strong confidence and market sensitivity to regulatory cues.

SEC vs. Ripple: The Settlement Stalemate

Ripple’s legal battle with the SEC hinged on whether XRP constituted an unregistered security. Although the two parties reached a tentative $50 million settlement in March, Judge Torres rejected their joint motion in May due to procedural issues under Rule 60.

They have refiled and paused appeals, aiming for limited remand through the Second Circuit. A procedural status report is due to be submitted by the SEC by June 16, yet the settlement is still awaiting final judicial approval, meaning the case remains formally open.

Looking ahead, the June 17 deadline looms large for the Franklin Templeton ETF decision, and Grayscale’s chance of converting its XRP Trust to a spot ETF finalizes by October 18, 2025.

Price Dynamics & “Buy the Rumor” Effects

XRP has been highly reactive to both XRP ETF speculation and legal headlines:

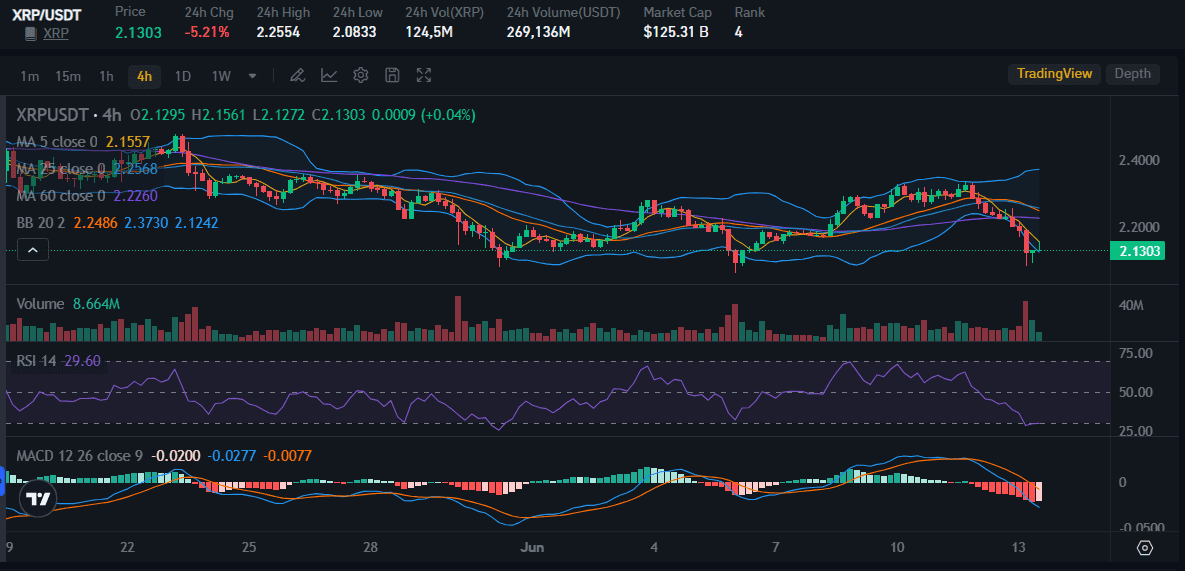

- On June 12, XRP price declined roughly 5,21%, closing near $2.13, as the broader crypto market weakened.

- Technical indicators: a break above the 50-day EMA may lead to retesting $2.50 and eventually $3.55, while sliding below the 200-day EMA risks a drop to $1.93 .

Traders are treating the ETF buildup like the classic “buy the rumor, sell the news” scenario long seen with Bitcoin and Ethereum.

Projections range from bullish (up to $27) to cautious, with expectations of swift 20–40% corrections post-approval.

Market Volatility & Liquidation Shock

In the past 24 hours, XRP faced $7.95 million in liquidations, predominantly on long positions, triggered by a 182% futures imbalance and price dipping to around $2.11.

Though sharp, analysts view this as a short-duration turbulence within a broader upward trend, especially given ongoing institutional tailwinds.

Institutional Momentum: Futures, Stablecoins & Corporate Treasury Adoption

1. CME XRP Futures

On May 19, CME Group launched cash-settled XRP futures, standard (50,000 XRP) and micro (2,500 XRP) contracts, linked to the CME CF XRP‑Dollar Reference Rate.

These futures add institutional legitimacy, fulfilling a key SEC requirement for mature market structure.

2. Corporate & Real-World Adoption

Ripple’s network is seeing growing real-world use:

- Corporate allocations: Webus, VivoPower, and Wellgistics are committing over $450 million in XRP for treasury and payment purposes.

-

Tokenized assets: Guggenheim Treasury Services issued digital commercial paper on the XRP Ledger.

-

Stablecoin integration: On June 12, USDC came to XRPL, enabling auto-bridging through XRP, a move to bolster liquidity and stablecoin utility on Ripple’s network.

XRP Key Timeline at a Glance

What Comes Next?

1. June 16–17

2. Market and Technical Signals

Traders are watching the 50- and 200-day EMAs; momentum may surge or falter based on price action and ETF headlines.

3. Ongoing Institutional Growth

Futures activity, stablecoin integrations, and institutional treasury adoption all support XRP’s positioning—independent of a spot ETF outcome.

Conclusion

XRP stands at a pivotal juncture. With the SEC’s legal battle nearing resolution and regulated futures trading already in motion, the environment is primed for an ETF decision by late 2025. While odds on Polymarket exceed 80–90%, the outcome hinges on:

- Court confirmation of the $50 million settlement,

- SEC’s interpretation of ETF applications in this new legal context,

- And whether XRP’s market infrastructure satisfies regulatory demands for transparency and investor protection.

XRP’s future could point toward institutional mainstreaming, or a roller-coaster bear trap. All eyes now are on the June 16–17 window.

by | Jun 13, 2025 | Business

The crypto market plunged over 7% amid escalating Israel-Iran conflict, renewed Trump tariff threats, and over $1.2B in liquidations. Bitcoin, Ethereum, and XRP led the selloff, while investors brace for further volatility driven by geopolitical risks, macro uncertainty, and massive options expiry.

The global cryptocurrency market suffered a severe blow on Friday, 13 June, with major digital assets plunging in response to a storm of negative catalysts, including geopolitical conflict, renewed U.S. trade tensions, macroeconomic concerns, and widespread liquidations.

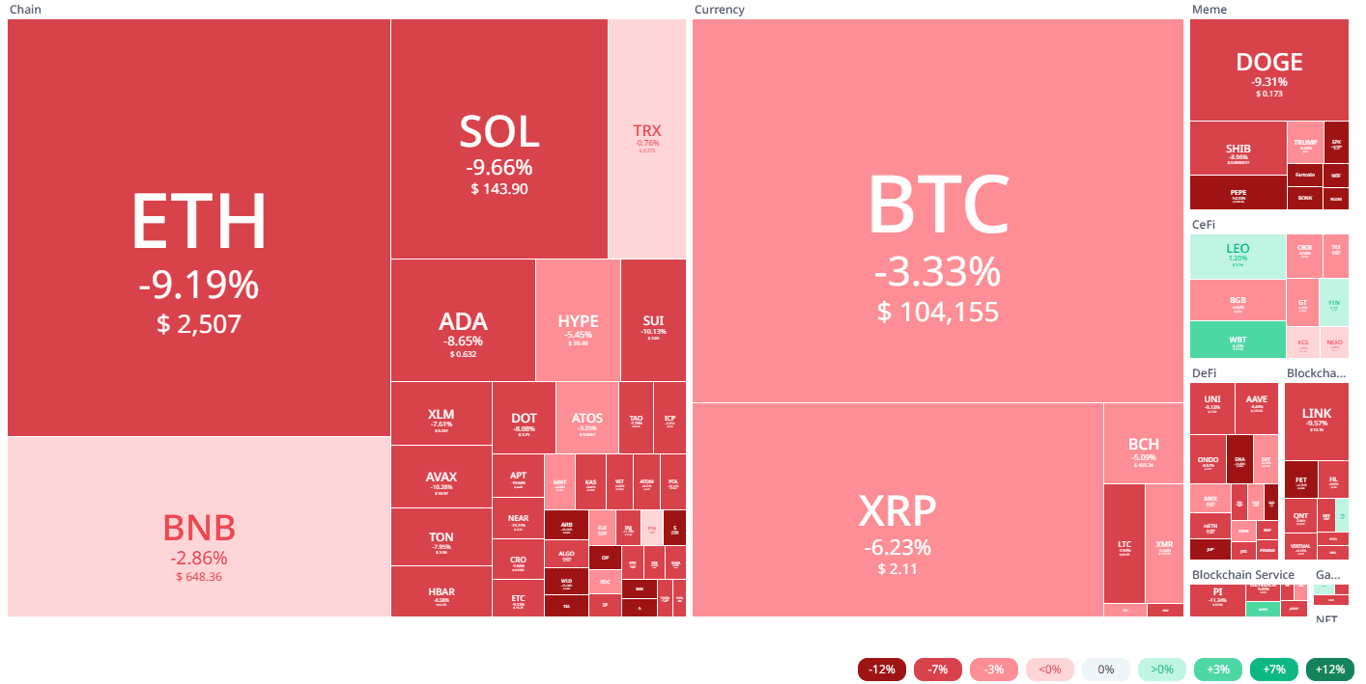

Bitcoin, Ethereum, and XRP Lead the Drop

The price of Bitcoin (BTC) tumbled to an intraday low of $102,000, marking a 7% drop over the past 48 hours. Ethereum (ETH) and XRP followed suit, plummeting 10% and 7% respectively within the last 24 hours.

As of press time, Bitcoin had recovered slightly to trade around $104,155, while Ethereum was at $2,507 and XRP price at $2.11.

Overall, the global cryptocurrency market capitalization fell by over 7% in 24 hours to $3.3 trillion, according to CoinGlass data.

Israel-Iran Conflict Ignites Investor Fear

Markets were roiled early Friday by news that Israel launched a preemptive military strike on Iran, targeting strategic nuclear and military sites.

The attack reportedly resulted in significant casualties, including Iranian military leaders and civilians. Iranian officials have vowed a “harsh response,” raising fears of a broader regional war.

Israeli Prime Minister Benjamin Netanyahu declared the beginning of Operation Rising Lion, aiming to dismantle Iran’s nuclear capabilities. In response, Israel closed its main airport and raised national defenses to the highest level.

The White House swiftly issued a statement distancing the U.S. from the attack. Secretary of State Marco Rubio reiterated that the United States was not involved and that protecting American personnel in the region remains the top priority.

The geopolitical fallout immediately triggered a flight to safety: gold rose 0.75% to $3,428/oz, while crude oil spiked nearly 10% to $74 per barrel.

JPMorgan warned that oil could reach $120 if the conflict escalates, potentially pushing U.S. inflation back up to 5% from its recent 2.4% level.

Trump’s Tariff Threats Add to Market Volatility

Uncertainty deepened as former President Donald Trump signaled a return to protectionist trade policy. Trump announced plans to reintroduce sweeping tariffs aimed at pressuring U.S. trading partners, adding fuel to investor concerns.

While Treasury Secretary Scott Bessent hinted at a possible extension to the current 90-day tariff pause, markets reacted cautiously.

The fading optimism over a potential trade deal between the U.S. and China, combined with Trump’s demand for a 100 basis point Fed rate cut, compounded fears of macroeconomic instability, sending both traditional and digital markets into a tailspin.

$3.7 Billion in Options Expiry Sparks Liquidation Avalanche

One of the key technical drivers of Friday’s market crash was the expiry of over $3.7 billion in crypto options on Deribit. This includes 28,000 BTC options (worth over $3 billion) and 242,000 ETH options (worth $700 million).

The high volatility surrounding these expiries led to sharp position unwinding. BTC’s put-call ratio of 0.95 and Ethereum’s more bearish 1.20 reading reflected a shift in trader sentiment. The “max pain” points, $107,000 for BTC and $2,700 for ETH, indicated likely retracement levels.

CoinGlass data confirmed that crypto liquidations surged over 125% in one day, crossing $1.2 billion. An astonishing $930 million of long positions were wiped out in just 12 hours. The largest liquidation was a $201 million BTCUSDT order on Binance.

Over 247,000 traders were liquidated, with BTC and ETH accounting for the lion’s share of losses. Whales also contributed to the selloff, as seen with one notable wallet depositing 1,000 BTC (worth $106 million) to Binance after accumulating it at an average price of $18,665.

Support Levels Breached Across the Board

Bitcoin broke below its key support level at $106,000 and the June open, setting off a cascade of forced selling.

Ethereum mirrored this weakness, dropping below its $2,650 support. XRP also failed to hold above $2.20, despite positive sentiment stemming from Ripple’s ongoing legal resolution efforts with the U.S. SEC.

Solana (SOL) plunged 11% to $141, Dogecoin (DOGE) fell 2.5% to $0.19, and Binance Coin (BNB) slipped 4% to $597. Altcoins across the board suffered as the crypto market entered oversold territory, with the Relative Strength Index (RSI) dropping to 28.

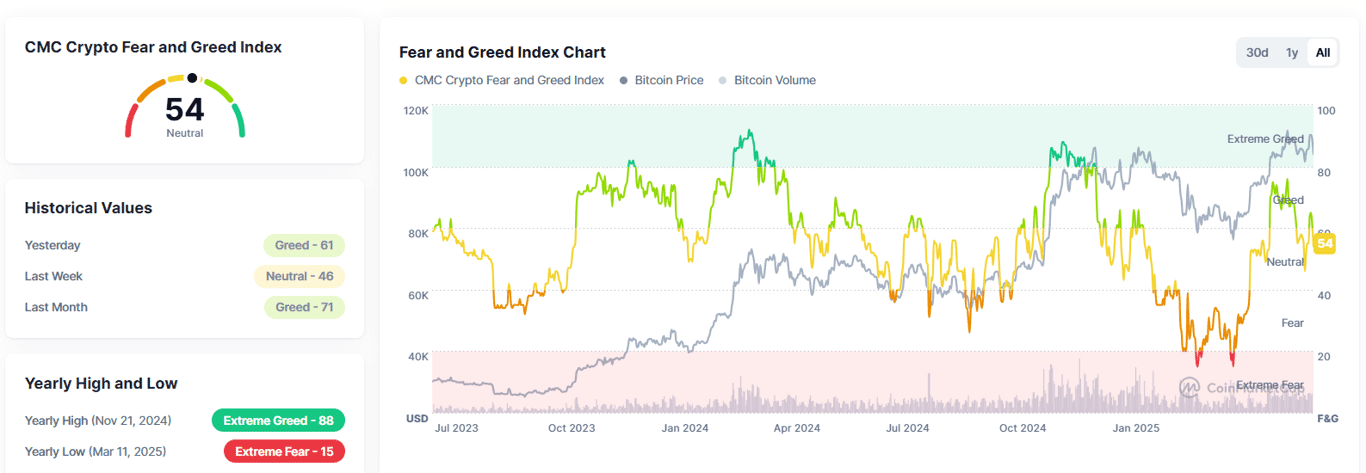

Interestingly, despite the carnage, the Crypto Fear & Greed Index remained in the “Greed” zone at 54.

A “Bull Trap” or Start of a Deeper Correction?

Thursday’s market behavior now looks like a classic “bull trap.” Initially, crypto assets rallied following a surprisingly low U.S. CPI reading of 2.4%, but this optimism was swiftly replaced by fear amid cascading liquidations, geopolitical risk, and technical breakdowns.

Analysts say the market had already shown signs of weakening demand, especially for Bitcoin. According to CoinPanel’s Dr. Kirill Kretov, “Macroeconomic uncertainty is still high, and with thin liquidity, even moderate players can move prices significantly.”

What Comes Next? Analyst Outlooks

Despite current volatility, many experts maintain a bullish long-term view:

1. Bitcoin (BTC): Analysts forecast consolidation between $100,000–$120,000. Bitfinex projects $115,000 by early July, while Fundstrat’s Tom Lee suggests a year-end target between $150,000 and $250,000.

2. Ethereum (ETH): A summer rally could see ETH revisit $2,800–$3,000 levels, supported by rising institutional interest.

3. XRP: The June 16 SEC lawsuit outcome remains a key catalyst. A favorable verdict could ignite a rally above $2.50, while a negative ruling may push it toward $1.80 or lower.

4. Dogecoin (DOGE): Technical resistance at $0.25 remains a barrier. Without fresh momentum, a dip toward $0.15 is possible.

Conclusion: A Cautionary Turning Point

Friday’s meltdown was a sobering reminder of the fragility of risk assets in a high-volatility, high-uncertainty environment. Whether this marks the start of a broader downtrend or a temporary correction remains unclear.

What is certain, however, is that traders and investors alike are in for a turbulent ride ahead, as global tensions, U.S. politics, and market mechanics continue to collide.

As the world watches developments in the Middle East and the financial markets react, one thing is clear: the age of crypto is no stranger to chaos, and opportunity.

by | Jun 13, 2025 | Business

Kuala Lumpur, Malaysia – [29 Mei 2025, Khamis] – Untuk Siaran Segera

Sebagai pihak utama dalam mempromosikan inisiatif baharu yang bertujuan meningkatkan penghargaan global mengenai produk pertanian terbaik dari Eropah, Kesatuan Koperasi Pertanian Kebangsaan Greece (ETHEAS) dan Jawatankuasa Tenusu Latvia (LDC) kini memberi tumpuan kepada penawaran tenusu luar biasa dari Latvia yang disesuaikan khas untuk pengguna di Malaysia.

Kempen “Produk Eropah Premium” di bawah program inisiatif “Langkah-Langkah Penyediaan Maklumat dan Promosi Produk Pertanian di Kanada, Malaysia dan Korea Selatan” bertujuan untuk meningkatkan pengiktirafan global terhadap keunggulan pertanian Eropah. Objektif utamanya adalah untuk meningkatkan kesedaran, memperkukuh pengiktirafan pengguna, merangsang penggunaan, dan akhirnya menggalakkan eksport produk premium Eropah ke Malaysia, Kanada dan Korea Selatan.

Kempen ini menampilkan pelbagai jenis produk bertaraf tinggi dari Greece dan Latvia. Kategori pertama mempamerkan 11 produk yang diperakui PDO daripada Greece, termasuk minyak zaitun, buah zaitun meja, anggur kering, kuma-kuma, keju keras, serta gam mastik dan minyak gam mastik. Latvia pula dengan bangganya memperkenalkan pelbagai produk tenusu tulen – khususnya keju – yang amat serasi dengan cita rasa rakyat Malaysia.

Keju Latvia: Kualiti Artisanal untuk Pengguna Moden

Sektor tenusu Latvia terkenal dengan komitmennya terhadap kualiti dan tradisi, menghasilkan keju yang menggabungkan teknik turun-temurun dengan inovasi moden. Antara eksport paling bernilai dari Latvia ialah produk tenusu unggulnya, terutamanya pelbagai jenis keju yang diraikan kerana rasa yang kaya, kaedah pengeluaran yang bersih, serta kemahiran pembuatan tradisional. Keju Latvia dihasilkan menggunakan susu segar berkualiti tinggi yang diperoleh daripada ladang tenusu tempatan yang mematuhi piawaian ketat Kesatuan Eropah dari segi keselamatan, kebajikan haiwan, dan kawalan kualiti.

Industri pembuatan keju di Latvia menawarkan pelbagai jenis produk, termasuk:

- Keju separa keras dan keras dengan profil perisa dari lembut hingga ke mantap

- Keju salai dengan aroma yang tersendiri, sesuai untuk hidangan berpinggan atau dilelehkan

- Keju lembut segar yang sesuai untuk sapuan, salad, atau resipi gabungan (fusion)

Bebas daripada bahan tambahan dan pengawet tiruan, keju-keju dari Latvia memenuhi permintaan yang semakin meningkat di Malaysia terhadap produk semula jadi, berkhasiat dan berlabel bersih.

Selera Multikultural Malaysia Menerima Keju dalam Masakan Fusion

Pasaran tenusu Malaysia sedang mengalami pertumbuhan pesat disebabkan oleh peningkatan kesedaran kesihatan, pendapatan yang semakin meningkat, pembandaran, dan pengaruh budaya Barat. Pasaran makanan tenusu di Malaysia telah berkembang secara konsisten, didorong oleh kefahaman pengguna yang semakin mendalam tentang manfaat pemakanan produk tenusu.

Sebagai sebuah negara yang berbilang kaum dan berbudaya penuh warna-warni, Malaysia terkenal dengan kepelbagaian kulinari yang menggabungkan rasa tradisional dengan pengaruh global. Dalam beberapa tahun kebelakangan ini, keju telah muncul sebagai ramuan kegemaran rakyat Malaysia, dan kini digunakan dalam pelbagai hidangan — daripada makanan jalanan tempatan hingga ciptaan fusion moden. Sama ada nasi lemak bertabur keju, roti dengan mozzarella, atau pasta sambal pedas bersama parmesan, rakyat Malaysia kini semakin kerap memasukkan produk tenusu ke dalam hidangan harian mereka. Selera yang semakin meningkat ini mencerminkan trend yang lebih luas, di mana ramuan Barat — terutamanya keju — dimasukkan secara kreatif ke dalam masakan tradisional, menjadikannya lebih unik dan menarik kepada generasi muda yang lebih berani mencuba.

Melihat kepada kegemaran rakyat Malaysia terhadap segala jenis keju, pasaran Malaysia yang berkembang kini semakin menerima produk tenusu premium yang seimbang antara kenikmatan dan kesihatan. Empat kategori produk Latvia (produk tenusu, gula-gula buah-buahan, coklat dan konfeksi, serta snek masin), terutamanya keju Latvia, sangat serasi dengan landskap ini kerana rasa asli dan nilai pemakanannya.

Produk tenusu Latvia yang serba boleh membolehkan ia diguna dalam pelbagai aplikasi masakan, daripada hidangan Barat tradisional hingga kepada masakan fusion Asia yang inovatif. Selain itu, pengeluar tenusu Latvia juga mengamalkan amalan pengeluaran yang telus dan bersih, menjadikannya sesuai untuk pengguna sensitif terhadap halal yang mencari produk tenusu Eropah yang selamat dan dihasilkan secara beretika.

Mengukuhkan Hubungan Melalui Cita Rasa Bersama

Malaysia merupakan salah satu negara utama untuk memulakan penerokaan ke pasaran Asia Tenggara, di mana kualiti premium dan keselamatan makanan produk tenusu Latvia menjadi keutamaan kepada pengguna. Berdasarkan kecenderungan rakyat Malaysia terhadap produk tenusu seperti susu, keju, mentega, sapuan, dan dadih, Jawatankuasa Tenusu Latvia yakin bahawa produk tenusu berkualiti dapat membawa keunggulan Latvia terus ke komuniti dan peruncit di Malaysia, sambil menawarkan piawaian baharu dalam rasa dan kepercayaan pengguna. Ini merupakan peluang terbaik bagi rakyat Malaysia untuk menerokai produk tenusu dan keju berkualiti tinggi sambil berinovasi dalam budaya pemakanan yang pelbagai di negara ini.

Memupuk Keselamatan, Kualiti dan Kebajikan Haiwan

Kempen ini menekankan tiga tema utama: keselamatan produk, kualiti unggul dan kebajikan haiwan — yang amat berkaitan dalam sektor tenusu. Semua produk Latvia yang terlibat dalam kempen ini dihasilkan di bawah peraturan ketat Kesatuan Eropah, memastikan produk tersebut mematuhi piawaian global tertinggi.

Untuk maklumat lanjut mengenai kempen “Produk Eropah Premium”, sila layari laman sesawang https://premiumeuropeanproducts.eu/ atau hubungi kami melalui emel di in**@*********************ts.eu.

Laman media sosial khas untuk program ini boleh didapati di Instagram, Facebook dan YouTube: @premiumeuropeanproducts.

Nota kepada Editor

Mengenai Kesatuan Koperasi Pertanian Kebangsaan Greece (ETHEAS)

Ditubuhkan oleh koperasi terkemuka di Greece dan berdasarkan undang-undang Greece, ETHEAS merupakan badan penyelaras kebangsaan bagi Koperasi Pertanian di Greece. Dengan lebih daripada 300 koperasi ahli yang mewakili kira-kira 80% daripada jumlah perolehan koperasi pertanian Greece, ETHEAS bertujuan untuk memajukan pembangunan luar bandar dan koperasi, menyokong serta mempromosikan aktiviti ahlinya di peringkat domestik dan antarabangsa, memberikan pandangan pakar mengenai pergerakan koperasi, pengeluaran pertanian dan pembangunan sektor, menyelia penyebaran serta promosi idea koperasi, serta memberikan khidmat dan pendidikan kepada ahlinya melalui kajian, projek penyelidikan dan tugasan.

Mengenai Jawatankuasa Tenusu Latvia (LDC)

Jawatankuasa Tenusu Latvia (LDC), yang ditubuhkan pada tahun 1995, mewakili sektor pemprosesan tenusu di Latvia dan bertujuan untuk melindungi kepentingannya. LDC terdiri daripada 17 ahli yang memproses kira-kira 80% daripada jumlah pengeluaran susu industri di Latvia.

by | Jun 13, 2025 | Business

In anticipation of Malaysia’s upcoming nationwide E-Invoicing mandate in August 2024, Koshidaka Malaysia organised an internal training session to enhance staff readiness and understanding of the new system. The session featured insights from certified professionals in accounting and tax compliance.

On 12 June 2025, Koshidaka Malaysia (Karaoke Manekineko) held an in-house

training session focused on the upcoming implementation of Malaysia’s national

E-Invoicing system. The session, held at the company’s headquarters, featured a

team of HRDF-certified trainers from YYC—one of Malaysia’s leading professional

accounting and tax advisory firms.

The

training aimed to provide employees with a clear and practical understanding of

E-Invoicing, which will become mandatory nationwide beginning August 2024. It

covered a wide range of essential topics, including the rationale behind the government’s

transition to a digital invoicing system, an overview of E-Invoicing concepts,

technical and procedural implementation steps, and the compliance requirements

businesses must follow.

The trainers used real-life case studies and interactive discussions to

highlight how E-Invoicing will affect daily operations for businesses of

various sizes. Employees engaged actively, gaining insight into not only the

formal structure of E-Invoicing but also its wider implications on operational

transparency and financial reporting.

In addition to corporate relevance, the session also touched on how

E-Invoicing applies to individuals—such as freelancers and self-employed

professionals—underscoring its role in promoting personal financial discipline

and tax compliance.

Koshidaka Malaysia emphasised the importance of early preparation,

stating that staying informed and upskilling employees are essential strategies

for navigating regulatory changes. The company plans to continue hosting

similar knowledge-sharing initiatives as part of its commitment to responsible

business practices and continuous improvement.

by | Jun 13, 2025 | Business

Melbourne-based Galcon Contractors was commissioned by the Department of Education to deliver concrete paths and compliant access ramps across multiple schools during holiday periods, improving safety, accessibility, and movement while minimising disruption.

Across Melbourne, schools are quietly improving how students and staff move through their grounds — with new access paths and ramps helping bring facilities in line with evolving safety and accessibility standards. Galcon Contractors, a Melbourne-based concreting firm, was recently engaged by the Department of Education to deliver a series of upgrades across multiple schools. These included the construction of concrete pathways and compliant access ramps, designed to support ease of movement and improve everyday usability.

The upgrades were delivered across multiple sites during school holiday periods, ensuring no disruption to school operations. Galcon’s civil-scale project experience and detailed scheduling capabilities made them a natural choice for coordinating the rollout.

With a growing reputation for delivering high-quality concreting solutions in the education, government, and commercial sectors, Galcon Contractors continues to support infrastructure that’s built to last — and built to serve.

![[KnoWaterleak: Case Study] A Local Government with a population of 100k-200k in Japan](https://slvrdlphn.com/wp-content/uploads/2025/06/public-137-1080x627.)

by | Jun 12, 2025 | Business

- Achieving 6× More Effective Leak Detection and 79% Cost Reduction –

Tokyo, Japan – June 12, 2025 – Tenchijin Inc., a space-tech innovator, announces the implementation of its “KnoWaterleak” solution in a Japanese local government. This digital transformation (DX) solution for water utilities leverages satellite dataleverages satellite data to support sustainable water infrastructure management and has significantly improved both leak detection efficiency and cost-effectiveness. In municipalities with populations between 100,000 and 200,000, the solution achieved 6 times higher efficiency in leak detection and a 79% reduction in leakage survey costs.

Addressing Underground Infrastructure Challenges

Water infrastructure faces critical challenges due to aging underground pipelines that are difficult to assess from the surface. In Malaysia, water leakage is expected to cause RM4 billion in losses by 2030, with non-revenue water rates reaching critical levels in many states. The situation is worsening primarily due to aging infrastructure and insufficient maintenance. (Source: Malaysian Water Association) Both in Japan and globally, local governments face a critical challenge. In Japan, over 176,000 kilometers of water pipes installed during the 1960s economic boom are now past their 40-year service life. Meanwhile, globally, aging infrastructure and constrained budgets are placing immense pressure on municipal resources. With replacement costs averaging 200 million yen per kilometer, this creates an unprecedented financial burden for local governments worldwide.

Breakthrough Results in Leak Detection and Cost Efficiency

1. Six-fold Increase in Leak Detection Efficiency

Traditional acoustic surveys detected an average of 0.7 leaks per 10 km of pipeline.

With KnoWaterleak’s technology integration, this increased to 4.2 leaks per 10km

– a six-fold improvement in detection efficiency.

2. Significant Cost Reduction in Leak Detection and Risk Assessment Surveys

Traditional survey costs averaged 25,000 MYR (860,000 JPY) per leak detection. The implementation of

KnoWaterleak reduced this to approximately 5,200 MYR (180,000 JPY) per leak. Including both

technology costs and acoustic surveys, this represents a 79% reduction in total survey expenses,

enabling more effective utilization of limited budgets.

3. Precise Risk Assessment and Targeted Detection

– The system’s risk assessment proved highly accurate, with 40% (50 locations) of all leaks identified in high-risk areas:

– E-rated areas (highest risk, shown in red) comprise only 3% of total area but contained 10% (12 locations) of discovered leaks

– D-rated areas (second highest risk, shown in orange) represent 17% of total area and contained 30% (38 locations) of leaks

– Combined, these high-risk areas (E and D ratings) representing just 20% of the total area yielded 40% (50 locations) of all leak

detections. These results demonstrate the effectiveness of the system’s risk assessment and validate the prioritization strategy

for high-risk zones.

The implementation of KnoWaterleak represents a significant advancement in water infrastructure management, demonstrating that satellite technology can revolutionize traditional utility operations. The remarkable improvements in leak detection efficiency and cost reduction showcase the potential of space technology in solving earthbound challenges.With aging water infrastructure becoming a global concern, solutions like KnoWaterleak offer a scalable, data-driven approach to infrastructure maintenance. The system’s proven ability to accurately identify high-risk areas while significantly reducing operational costs makes it a valuable tool for municipalities worldwide facing similar challenges.As water infrastructure continues to age globally, the need for innovative, cost-effective solutions becomes increasingly critical. Tenchijin’s success in Japanese municipalities serves as a model for how space technology can be effectively applied to enhance infrastructure management and ensure sustainable water supply systems for future generations.

by | Jun 12, 2025 | Business

Asuene Inc. is pleased to announce a strategic capital and business alliance with Daikin Industries, Ltd., the world’s leading HVAC company. This partnership was formalized through a third-party allocation of new shares as part of Asuene’s Series C2 round second close, bringing the company’s total funding to US $73.7 million.

Through this alliance, the two companies will offer integrated decarbonization services by combining Asuene’s carbon accounting platform “ASUENE” and consultation with Daikin’s energy-saving solutions in HVAC and building management. The partnership will primarily target the North American and Japanese markets, where both companies will jointly accelerate initiatives to support corporate climate action with greater precision and scale.

Background: Addressing Global Needs for Decarbonization and Energy Optimization

As the global push toward decarbonization intensifies, CO2 emissions from buildings account for about 20 to 30 percent of the total worldwide. Optimizing energy use—particularly in air conditioning and lighting—has become a key priority. In Japan, the introduction of GX-ETS (Green Transformation Emissions Trading Scheme) and expanded disclosure requirements under the new SSBJ (Sustainability Standards Board of Japan) are driving companies to act swiftly.

Meanwhile, in the US, states, municipalities, and private companies are advancing climate initiatives from planning to execution. With growing demand for measurable, actionable solutions, there is a particular emphasis on improving energy efficiency in buildings and facilities.

“ASUENE”, carbon accounting platform, is the No.1* market share service in Asia. We had also established its US subsidiary, ASUENE USA, to deliver localized solutions and support companies in meeting regional compliance and ESG goals.

Daikin operates in over 170 countries and is the global leader in HVAC. In the US alone, its HVAC business exceeds US $10 billion in annual revenue and continues to see rapid growth.

*Based on a July 2024 study by Tokyo Shoko Research

Details of the Strategic Partnership: Building Seamless Decarbonization Solutions in Japan and North America

Asuene and Daikin share a common vision: to become globally leading decarbonization solution providers originating from Japan. This capital and business alliance, formalized through Asuene’s Series C2 funding, marks a major step toward that goal.

By integrating Asuene’s platform with Daikin’s HVAC equipment and building management systems, the partnership will provide companies with a seamless, one-stop solution to measure, reduce, and report emissions. This end-to-end approach—from carbon accounting to practical implementation—will help companies reduce energy costs and accelerate their sustainability efforts.

Together, Asuene and Daikin will strengthen their competitiveness and drive innovation across Japan and North America, working toward a more sustainable global society.

Comments from Key Executives

Masaaki Miyatake, Executive Officer, Applied Solutions Business, Daikin Industries, Ltd.

Against the backdrop of global climate action and ESG initiatives, carbon measurement and reduction have become essential. By combining Asuene’s advanced GHG accounting capabilities with Daikin’s energy-efficient HVAC systems and operational expertise, we aim to deliver actionable, one-stop decarbonization solutions. Through this collaboration, we will contribute to building a more sustainable society, both in Japan and worldwide.

Kohei Nishiwada, Founder, CEO & COO, Asuene Inc.

We are deeply honored to enter a strategic capital partnership with Daikin, a global HVAC leader. This is more than an investment—it’s a bold commitment to our shared mission of decarbonization. By combining our strengths, we are fully committed to leading the market not only in Japan but in North America as well. This collaboration marks the beginning of our next chapter, and we are driving it forward with purpose and momentum.

About Daikin Industries, Ltd.

・Company Name: Daikin Industries, Ltd.

・Representative : Naofumi Takenaka, Representative Director, President and COO

・Headquarters: Osaka Umeda Twin Towers South, 1-13-1 Umeda, Kita-ku, Osaka

・Website: https://www.daikin.com

by | Jun 11, 2025 | Business

Ripple’s legal battle with the SEC, soaring ETF approval odds, and bullish chart signals are putting XRP in the spotlight. Will 2025 mark a historic breakout or a brutal crash? Here’s what investors need to know.

As the legal standoff between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) continues, XRP investors closely monitor key court developments, potential ETF approvals, and bullish technical signals that could define the token’s 2025 trajectory.

With a pivotal deadline looming and speculation intensifying, XRP’s future remains tightly interwoven with regulatory actions and institutional interest.

Legal Crossroads: Ripple vs. SEC Reignites Uncertainty

On June 10, investor focus pivoted back to the SEC v. Ripple case, following fresh court filings and the approach of a critical June 16 deadline.

The SEC must submit a status report to the U.S. Court of Appeals, following the expiration of a 60-day abeyance granted in April.

The legal landscape was further complicated when Judge Analisa Torres denied the SEC’s request for an indicative ruling on the proposed settlement terms.

These terms, jointly filed by Ripple and the SEC, aimed to lift the injunction against XRP institutional sales and reduce the imposed $125 million penalty.

The denial has reintroduced legal ambiguity, prompting concerns that both parties may soon advance with their respective appeals.

Investors had anticipated another SEC request before the deadline, but the agency’s silence has cast doubt on a summer resolution.

Since Judge Torres’ decision, XRP has shown notable volatility, dropping from $2.6553 on May 12 to $2.0607 by June 5, before rebounding to around $2.30.

ETF Momentum: XRP’s Position in the Altcoin ETF Race

The prospect of spot XRP exchange-traded funds (ETFs) has become a focal point for the market. On June 10, Bloomberg Intelligence’s Eric Balchunas predicted a busy summer for altcoin ETFs, with Solana leading the way.

Although XRP is in contention, ongoing litigation has tempered its chances, placing its ETF approval odds behind Litecoin and Solana.

Nevertheless, market sentiment shifted sharply after Polymarket data on June 10 revealed a surge in approval odds for an XRP spot ETF, jumping to 98%, up from 68% in April.

This spike follows a wave of applications from leading firms like Bitwise, Grayscale, Franklin Templeton, and 21Shares, along with the successful May 19 launch of XRP futures ETFs by CME Group, which saw $19 million in first-day volume.

Further bolstering XRP’s institutional appeal, three companies announced plans to allocate over $471 million into XRP treasuries. Notably, Webus International filed a $300 million XRP strategic reserve with the SEC, highlighting growing corporate trust and adoption.

Traditional Finance Meets Crypto: Ripple-Guggenheim Collaboration

Ripple’s expanding influence in traditional finance was also underscored by a new partnership with Guggenheim Treasury Services. Under the deal, Guggenheim will offer its U.S. Treasury-backed commercial paper on the XRP Ledger.

Ripple will invest $10 million into the offering, which features customized maturities of up to 397 days.

This marks a significant move toward the tokenization of real-world assets (RWAs), a growing trend on Wall Street. With over $7 billion in tokenized U.S. Treasurys already issued, spearheaded by BlackRock, Franklin Templeton, and Fidelity, the partnership strengthens XRP’s position in the burgeoning RWA market.

Technical Signals: Bullish Setups Hint at Explosive Upside

While regulatory developments weigh heavily on XRP, chart analysts are growing increasingly bullish. Crypto analyst JD (@jaydee_757) identified a hidden bullish divergence on the two-week Stochastic RSI, drawing parallels with XRP’s 2017-2018 market cycle. Back then, a similar setup led to a 20x rally.

JD noted that XRP has broken out from a multi-year symmetrical triangle originating in 2018, signaling a potential parabolic move.

He projects a price surge toward $17, followed by a dramatic correction, possibly crashing below $1, echoing the 94% drop seen post-2017 rally.

Market analyst Egrag Crypto shares a similar view, forecasting XRP to hit between $20 and $27 in 2025 before potentially retracing to around $3 during a bearish phase.

His “Guardian Arch” analysis leverages the 21-week EMA and 33-week SMA, along with the presence of a bullish flag on the monthly chart.

Price Outlook: Resistance, Support, and What’s Next

On June 10, XRP closed at $2.3064, down 0.66% on the day, slightly underperforming the broader crypto market. Currently, XRP trades at $2.2894, recovering from recent lows around $2.06 and up 9.7% over the past few days.

A move above $2.35 could spark a climb toward resistance at $2.6553 and eventually the $3.00 mark.

Surpassing this barrier may confirm the start of a parabolic uptrend with potential targets beyond $25. Conversely, failure to hold support could expose XRP to downside risk near $1.93, the 200-day EMA level.

Final Thoughts: Hope and Caution in Equal Measure

With legal clarity still pending and ETF hopes surging, XRP stands at a critical juncture. The growing integration of Ripple with institutional finance, combined with bullish chart patterns, presents a compelling narrative for XRP bulls. Yet, historical precedent and unresolved litigation caution against overexuberance.

Whether XRP fulfills its projected rise to double digits or falls victim to another dramatic correction, one thing is clear, 2025 will be a defining year for the cryptocurrency, both in court and on the charts.

by | Jun 11, 2025 | Business

As a leading enterprise in the field of heavy-lift unmanned helicopters in China, China Flightwin-Innovation Technology Co., Ltd. (hereinafter referred to as “Flightwin”) is making its debut at the Indo Defence Expo & Forum held from June 11 to 14 at the Jakarta Convention Center in Indonesia, highlighting three star UAV products that represent its technological prowess: FWH-3000 tandem rotor unmanned helicopter, FWH-1500 ton-class unmanned helicopter, and FWH-300 unmanned helicopter. These three UAVs, with their outstanding performance parameters and mature industry solutions, have drawn wide attention from overseas users.

A Three-Model Matrix Showcasing Benchmark Technologies in Heavy-Lift UAVs

The three unmanned helicopters exhibited by Flightwin cover a payload range from 50 kg to 1000 kg, fully demonstrating the company’s full-scenario logistics transport capabilities with heavy-lift UAVs:

· FWH-3000 Tandem Rotor Unmanned Helicopter: As the largest payload unmanned helicopter platform worldwide, it adopts a tandem dual-rotor design, with a maximum take-off weight of 2300 kg and a maximum mission payload of 1000 kg. Its internal cabin space reaches 4.2 cubic meters, capable of simultaneously carrying two 500 kg standard pallets or six injured personnel. With a flight endurance of up to 5 hours and wind resistance up to scale 7, it can perform cargo delivery and medical rescue missions in extreme environments such as plateaus, deserts, and remote islands.

· FWH-1500 Ton-Class Unmanned Helicopter: A flagship product of Flightwin, it has a maximum take-off weight of 1000 kg, a maximum payload of 300 kg and the service ceiling of 6500 m. The model has proven its reliability in numerous real-world operations at home and abroad, including nighttime cross-mountain material delivery during the July 2023 flood rescue in Beijing, high-altitude delivery at 5200 meters, and multi-island cross-sea transportation tasks.

· FWH-300 Unmanned Helicopter: With a take-off weight of 220 kg and maximum payload of 50 kg, it can be equipped with electro-optical pods, firefighting bombs, and other payloads, making it suitable for tactical reconnaissance, disaster area broadcasting, and emergency material airdrop.

Full-Scope Applications, Deepening Presence in the Southeast Asian Market

Founded in 2008 and headquartered in Beijing, Flightwin is one of the few companies in China with full-industry-chain R&D and manufacturing capabilities for unmanned helicopters. Its products are widely used in emergency rescue, forest firefighting, and cargo delivery, and have achieved commercial deployment in multiple countries in the Middle East, Africa, and Southeast Asia.

At this Indo Defence Expo & Forum, Flightwin is focusing on showcasing solutions tailored to the region’s multi-island terrain and tropical rainforest climate, such as:

· The take-off and landing capability of the FWH-1500 meets the cargo delivery needs of offshore oil platforms;

· The large payload of the FWH-3000 allows rapid response for inter-island and remote area cargo transportation and medical rescue;

· Inspection and rapid suppression of forest fires with UAV extinguishing bombs dropping;

· The entire product line has passed rigorous high-temperature and high-humidity adaptation testing, ensuring stable operation in tropical climates.

Repeated International Recognition, Global Attention to Its Technological Strength

Flightwin has long been advancing its internationalization. At the 2024 UMEX exhibition in Abu Dhabi, its full product range attracted hundreds of international clients for discussions.

“This exhibition is an important opportunity for us to expand into the Southeast Asian market,” said Chen Chong, VP of Flightwin. “We look forward to using this platform to match China’s independently developed heavy-lift UAV technologies with the real needs of Indonesia and surrounding countries, promoting deeper UAV application in fields such as cargo delivery, forest fire prevention, and emergency rescue.”

You must be logged in to post a comment.