by | Jul 15, 2025 | Business

Discover how Pump.fun is revolutionizing meme coin creation and trading on the Solana blockchain, why its PUMP token is stirring both excitement and controversy, and what analysts are predicting for its future. Stay ahead of the crypto curve with Bitrue Blog.

Pump.fun is a groundbreaking meme coin launchpad built on the Solana blockchain, empowering anyone, even without coding skills, to instantly create and trade crypto tokens.

With its sleek, user-friendly interface and zero-cost token generation, the platform has become a magnet for creative individuals and communities seeking to engage with the fast-paced world of decentralized finance (DeFi).

Since its inception in January 2024, Pump.fun has facilitated over $700 million in revenue, driven largely by its automated bonding curve mechanics, fees on token launches, and the meteoric rise of meme culture in crypto.

But beyond the viral success lies a more complex story, one involving speculation, institutional funding, and controversy over tokenomics and decentralization.

Key Features of Pump.fun

1. Instant Token Creation: Tokens can be created in under a minute without coding or smart contract deployment.

2. Solana Integration: Offers fast, low-cost transactions, ideal for high-volume, low-value meme coins.

3. DEX Listing Automation: New tokens are instantly listed on decentralized exchanges like Raydium.

4. Bonding Curve Pricing: Token prices increase as demand rises, and fall as it drops, fostering speculative dynamics.

5. Community-First Approach: Empowers meme coin creators, influencers, and social groups to launch tokens for fun, branding, or profit.

How Pump.fun Works

1. Token Generation: Users fill out a short form (name, ticker, description, image) and launch instantly.

2. Liquidity Injection: A smart contract provides the initial liquidity.

3. Price Movement: A bonding curve adjusts the token’s price based on buy/sell pressure.

4. Trading Begins: Tokens become tradable immediately, often drawing interest from speculators and communities alike.

This frictionless system has attracted both retail creators and sophisticated bots. Coinbase’s Conor Grogan even noted that a single user created over 18,000 tokens, indicating the scale and automation at play.

The PUMP Token: ICO Breakdown and Price Action

The PUMP token, the platform’s native utility and revenue-sharing asset, has garnered massive attention.

1. Total Supply: 1 trillion tokens

2. ICO Allocation: 33% (18% to institutions, 15% to the public)

3. ICO Price: $0.004

4. Current Futures Price (Hyperliquid): $0.0056 (40% above ICO)

5. Market Forecast: Bullish short-term sentiment, but long-term volatility risk remains high

The ICO raised $500 million in just 12 minutes, making it one of the largest token offerings in crypto history.

However, the fact that only 15% of the supply is available to public traders has drawn criticism for fostering artificial scarcity and promoting pump-and-dump risks.

Volatility, Whales, and Speculative Mania

Pump.fun’s tokenomics have raised eyebrows:

- 85% of tokens are held internally (team, ecosystem, private investors)

- Whale activity on Hyperliquid includes $11 million in short positions ahead of the public launch, suggesting large players anticipate early sell-offs

- Despite this, daily trading volume for PUMP futures exceeded $30 million in its first 24 hours

This has led to conflicting predictions: some expect a “hated rally” as skeptics are caught off guard, while others warn of a short-lived pump followed by steep corrections.

Pump.fun as a Cultural and Economic Force

Pump.fun isn’t just a launchpad, it’s a movement reshaping internet culture and Web3 participation. The platform aims to evolve into a decentralized social network rivaling TikTok, Twitch, and Facebook, where users are financially rewarded for engagement.

Yet its revenue has dropped 92% from its peak, and competitors like LetsBonk and Raydium LaunchLabs are gaining traction.

Still, analysts like Ignas and Delphi Digital argue that Pump is undervalued. At a $4 billion fully diluted valuation (FDV), its FDV-to-earnings multiple is lower than most DeFi giants.

Some are forecasting a future $10 billion market cap, positioning PUMP among the top meme coins globally.

PUMP Token Price Predictions and ROI Scenarios

According to recent technical models:

1. Short-Term Range (July–Dec 2025): $0.0043—$0.0060

2. Potential Monthly ROI: Up to 25% gain (if bought at the current price of ~$0.0047)

3. Bearish Case: Price drops to $0.0042 by October

4. Bullish Case: Rally toward $0.006 by year-end

For short-sellers, platforms like Hyperliquid offer leverage, but this adds significant risk in a market driven by hype and low float.

Meme Coin Mania: What’s Next?

Pump.fun is riding the wave of a resurgent memecoin trend in 2025. New platforms like Snorter Bot, a Solana-based sniper bot for instant DEX buys, are gaining steam, raising over $1.5 million in presales.

With features like scam filters, portfolio tracking, and Telegram integration, it’s clear the meme economy is maturing.

Pump.fun sits at the epicenter of this boom, whether you see it as a revolutionary tool or a speculative bubble.

How to Buy $PUMP

You can buy $PUMP through:

- Pump.fun Official Site

-

Centralized Exchanges (CEXs): Bitrue

Conclusion

Pump.fun is redefining crypto participation, lowering barriers and making token creation both fun and accessible. Its ICO success, innovative mechanics, and meme-fueled energy mark it as a central player in this cycle’s DeFi landscape.

But make no mistake: this is a high-risk, high-reward ecosystem. With heavy whale involvement, volatile price action, and controversial tokenomics, new users must do their research and manage exposure carefully.

Whether you’re here to build, speculate, or just enjoy the ride, Pump.fun is a phenomenon worth watching.

The crypto landscape moves fast, don’t get left behind. For in-depth analysis, market updates, and expert insights on projects like Pump.fun and beyond, follow the Bitrue Blog and stay informed every step of the way.

by | Jul 15, 2025 | Business

Xpress Super App and hip-hop artist Tommie King teamed up on Palihim, a Manila-shot music video celebrating culture over KPIs. Reflecting Xpress’ Pinoy Pride. Every Ride. ethos, the bold collaboration showcases how tech can resonate beyond metrics through authentic, creative risks. Already disrupting mobility in Manila, Boracay, and soon Palawan, Xpress proves innovation is about meaning. Watch Palihim now.

In a landscape dominated by IPO valuations and quarterly KPIs, it’s refreshing—almost revolutionary—to see a tech company lean into something just for the joy of it.

That’s exactly what Xpress Super App, the Philippines’ rising star in ride-hailing, has done through its vibrant new collaboration with hip-hop artist Tommie King on his latest single and video, “Palihim”. Premiered July 11th worldwide, “Palihim” is already pulling in massive—and growing—viewership.

Xpress Super App, already making waves for its innovative approach to mobility with Moto-taxis, EV-Car-Taxis, and E-trikes operating in Greater Metro Manila, Boracay, and soon Palawan, surprised the market with this bold creative move. As a senior member of the Xpress leadership said: “We are a tech company. We wanted to do something fun for the sake of doing something fun. “And what better partner than Tommie King? The East Atlanta, Georgia native has built a reputation not only for his unique, authentic sound, but also for his respect and love for his adopted home in the Philippines. Known for tracks like “213” featuring Supafly and “Gwapingz” featuring Gat Putch, Tommie King brings professionalism, cultural fluency, and undeniable charisma—qualities that mirror Xpress Super App’s own ethos. “

Tommie King didn’t just bring his name to the table,” the Xpress representative continued. “He brought the same humility and genuine appreciation for Filipino culture that we’ve built our brand on. That’s why he was our first choice for this collaboration. His vibe aligns perfectly with our mantra: ‘Pinoy Pride. Every Ride.’ “For Tommie King, the collaboration was equally meaningful. “Xpress Super App didn’t come at me with some cookie-cutter brand agenda,” he said. “They just said, ‘We love your work and what you stand for. Let’s create something fun, something real.’ That resonated with me because it wasn’t forced—it was about celebrating where we are right now.

Shot against the neon-lit nights of Manila and the relentless rhythm of its street basketball courts, “Palihim” breaks free from the usual brand playbook to become something more: a vivid cultural experience. This collaboration proves that when a tech company dares to create—not just for the metrics, but for meaning—it sparks a resonance that lives far beyond the boundaries of its product. That’s the deeper message here: even in an industry obsessed with data and scale, there’s room to take risks, make art, and have fun.

The future? Bright. Both for Tommie King and for Xpress Super App. If “Palihim” is any indication, both are just getting started.

Watch Tommie King’s Palihim now—and stay tuned for what’s next.

by | Jul 15, 2025 | Business

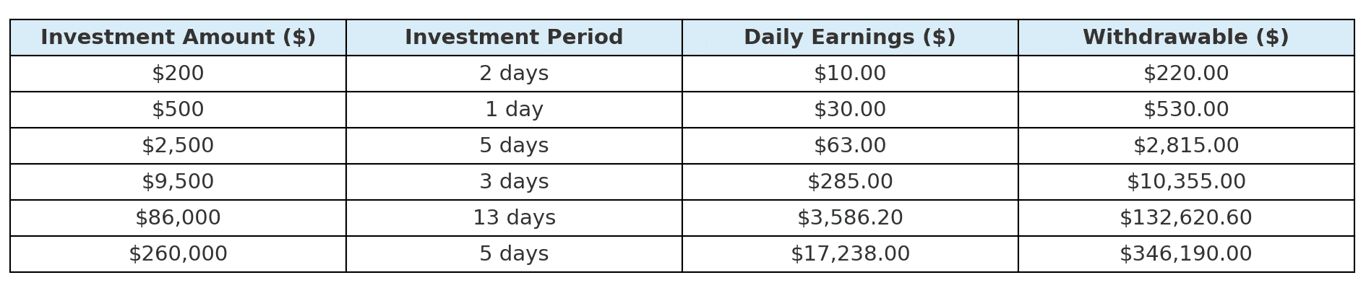

XRP’s price approaches $3, Bitcoin sets records above $120K, Ethereum climbs past $3,000. Amid the rally, professional capital is quietly flowing into BTC Miner — a cloud mining platform offering up to 6.63% (or more) stable daily USD returns, insulated from crypto volatility.

BTC Miner: the quiet passive wealth engine trusted by serious investors.

How BTC Miner Works

Register at https://btcminer.net

Deposit XRP, BTC, ETH, USDT, etc.

Balance converts to USD; contract activated

Choose 1/3/5/8-day flexible contracts

Daily returns paid in USD, withdraw anytime

Why BTC Miner?

Up to 6.63% (or higher) daily USD returns

AIG-insured, Tier-1 bank custody

USD-denominated income, no price risk

$500 trial bonus for new users

Referral rewards: 7% + 2% commissions

SSL encryption & risk control system

Referral Rewards

Level 1: Earn 7% from direct referrals

Level 2: Earn 2% from referrals’ referrals

Example:

Refer A investing $5,000 → You earn $350

A refers B investing $10,000 → You earn $200

Rewards paid instantly, unlimited scalability.

Client Testimonials (High Allocation)

“I began with $500,000 and scaled up to $3,500,000. Now generating over $620,000 in daily passive income. BTC Miner is our family fund’s primary revenue stream.” — Michael S., Family Office Manager, Germany

“I allocated $1,800,000 for structured returns. Daily payouts arrive automatically — no need to watch the market.” — Lisa M., Entrepreneur, Canada

“The $500 trial gave me confidence. After investing $150,000, I enjoy daily profits and fast withdrawals.” — Mr. Johnson, Private Investor, Florida, USA

Final Takeaway

In a volatile market, BTC Miner offers professionals stable, insured, automated daily crypto income — without trading.

Learn more: https://btcminer.net

by | Jul 14, 2025 | Business

Government rebates that boost the number of EVs feeding energy back into the grid would lower power prices for all Australians, according to new modelling by the Electric Vehicle Council.

Vehicle-to-grid (V2G) technology, known as bidirectional EV charging, allows energy stored in EVs, which are ‘giant batteries on wheels’, to be sent to the energy grid.

The modelling shows that over five years, a $3,000 government rebate towards a V2G charger would create more than $4,500 in downward pressure on electricity bills across Australia.

That means for every dollar spent supporting V2G, $1.50 comes back through lower wholesale prices and a reduced need for additional capital expenditure on power infrastructure.

Additionally, an EV owner who participates in V2G could earn around $1,000 per year for exporting power from their car to the grid when demand is high.

The EVC proposes the federal government include V2G chargers in its $2.3 billion home battery program to provide more value for money to the taxpayer.

The EVC estimates that 600,000 EVs doing V2G could match the output of NSW’s Eraring power station operating at full capacity. With the federal government’s initiative, more Australians can get onto V2G quicker and we can shut down coal fired power stations sooner.

Electric Vehicle Council CEO Julie Delvecchio said V2G has huge potential to make electricity cheaper for everyone and help stabilise the energy grid.

“Just as Australia became a rapid global leader in rooftop solar, we have the opportunity now to lead the charge in vehicle-to-grid uptake,” Ms Delvecchio said.

“EVs can store up to five times more energy than a typical home battery. That’s a huge untapped resource sitting in driveways and with the right technology, we can use it to save money and support the grid, and make the whole system more reliable for everyone. V2G enables EV owners to feed stored power back into the grid during periods of high demand, when electricity is most expensive and vulnerable to disruptions like blackouts.

“V2G allows EV owners to drive down power bills not just for themselves but for all Australians. EV owners could earn $1,000 annually by sending energy from their electric vehicle to the grid. Over five years, they can contribute more than $4,500 in broader community benefits that help reduce energy bills for everyone.

“Unlocking this energy from EVs brings huge financial benefits that are in the national interest. We need to encourage more people to use V2G chargers, which cost about the same as the average home battery at around $10,000.

“We’d like to see the Federal Government roll out a $3,000 rebate for V2G chargers so that more Australians can use this technology to generate lower power prices for themselves and others.

“Australia is home to more than 350,000 EVs, and a high proportion live in the middle and outer suburbs. With some EVs now around $30,000, the upfront cost is making it more affordable for more Australians to make the switch to cheaper-to-run cars. V2G unlocks the full benefit of EV uptake in a way that helps everyone – EV owner or not.

“A lesson we learnt from rooftop solar is that support from the government during the early years of adoption is essential to build momentum. Over time V2G chargers will become increasingly affordable and more Australians will embrace this technology. But to get the ball rolling a rebate would be enormously constructive.

“V2G offers more than lower energy bills, it can also improve the resilience of the energy system especially during severe weather events. While V2G is an emerging technology in Australia, a small group of early adopters have exported power to help stabilise the grid.”

EVC ask:

Allow the home battery program to include$3,000rebates for50,000V2G chargers in homes around the country by the end of 2028 at a cost of$150 millionThis policy would create a national benefit of more than$230 million by 2033.

by | Jul 14, 2025 | Business

The Company Makati opens August 1, 2025, offering flexible workspaces for teams in Legazpi Village.Now spanning 16 locations across five countries, The Company opens its Makati flagship, connecting over 400 companies and 1,800 members worldwide. The new site is a launchpad for business travel, local operations, and growth, complete with a Japanese Desk for bilingual support.

Makati City, Philippines – This August, the nation’s premier business district adds a fresh face to its landscape as The Company Makati opens in Legazpi Village. Managed by Zeroten Philippines Inc., the local arm of Japan’s Zero-Ten Park Co., Ltd., the launch signals another big step for a brand rooted in Cebu and now thriving across Japan, Singapore, Hawaii, and Vietnam.

A New Standard for Office Space in Makati

Set on the 11th floor of Frabelle Business Center, The Company Makati offers more than just office rentals—it’s a platform for growth, innovation, and collaboration. The 860-square-meter facility features private offices, coworking areas, meeting rooms, quiet work pods, event venues, and lounges, all backed by 24/7 access, business-grade security, business-grade fast Wi-Fi, and a full-service onsite concierge.

International Reach, Local Impact

With the addition of Makati, The Company now connects business communities across five countries and 16 locations, empowering over 400 companies and 1,800 members worldwide. For Japanese and other global companies looking to expand into Southeast Asia, the new Makati site is both a landing pad for business travel and a launchpad for local operations. The dedicated Japanese Desk provides bilingual support for everything from local hiring and compliance to business matchmaking.

But this hub isn’t just for international firms. The Company Makati’s partnership programs, ranging from startup incubation with Startup Island PH to an Artist-in-Residence initiative, are designed to help Philippine entrepreneurs, creatives, and fast-scaling SMEs grow and connect with both local and global markets.

A Prime Address for Hybrid Work and Growth

Located in Legazpi Village, one of Makati’s most walkable, livable, and connected districts, The Company Makati offers a work environment surrounded by parks, cafés, and cultural hotspots. Flexible layouts, build-to-suit solutions, and day office rentals mean businesses of all sizes and stages can find a home here, whether they need a one-desk starter office or a full floor for a regional team.

Executive Quotes:

Joy Garingo – Dela Serna, General Manager, The Company Philippines: “This new hub is more than just a coworking space. We aimed to create the best place where ideas and infrastructure merge, allowing founders, creatives, and remote teams to grow together.”

Masaki Suguro, CEO Zeroten Philippines Inc. / COO Zero-Ten Park Co., Ltd.: “We’re not just filling workspace seats. We’re focused on building long-term business value. Makati is a strategic step in that vision. We promise startups and global teams the support, tools, and community they need to grow.”

Book a Tour or Reserve Your Office Today

The Company Makati opens August 2025. Early tours, workspace inquiries, and partnership discussions are now welcome.

Facility at a Glance:

Address: 11F, Frabelle Business Center, Rada St., Legazpi Village, Makati City

Floor Area: 9,284.84 sq. ft. (approx. 860 sq. m.)

Features: Private offices, coworking spaces, fixed desks, meeting rooms, event venues, phone booths, pantry, shared lounge, virtual office,focus pods, offices for rent

Amenities: Secure high-speed Wi-Fi, 24/7 access and security, on-site concierge, Japanese Desk

About The Company:

Founded in Fukuoka, Japan, The Company is a workspace and community that champions work-sharing and multi-location collaboration, supporting startups, cross-border teams, multinational creators, and local communities across 16 locations in 5 countries, with 400 companies and 1,830 members as of January 2025.

Website: https://thecompany.jp

Operating Company:

Zero-Ten Park Co., Ltd. (Fukuoka, Japan), specialists in workspace operation, real estate, business matching, M&A, startup investment and support, and consulting. The new Manila location strengthens the ASEAN network and supports the overseas expansion of Japanese companies.

Website: https://zerotenpark.jp

Local Subsidiary:

Zeroten Philippines Inc. is the local subsidiary managing The Company brand in the Philippines, expanding from Cebu to Makati, and supporting startups, Japanese companies, and multinational teams with flexible working environments.

Website: https://thecompany.ph

by | Jul 14, 2025 | Business

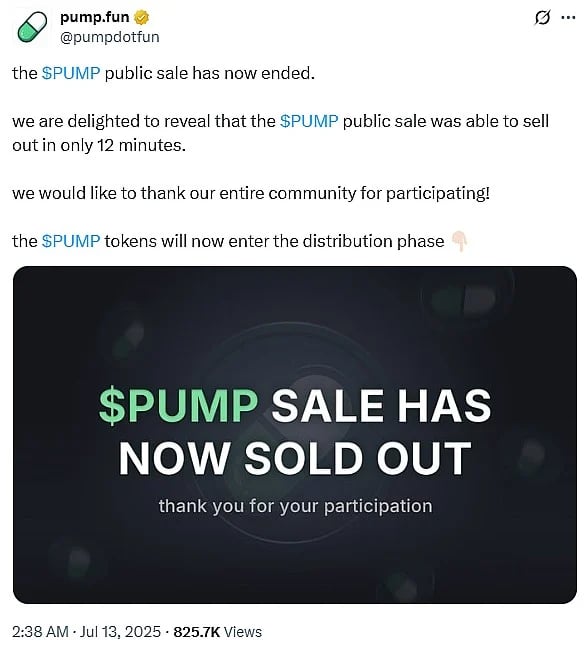

Pump.fun’s $600M ICO sold out in 12 minutes, pushing the PUMP token’s valuation to $4B. Discover key trading dates, tokenomics, controversies, and future plans in this comprehensive analysis and stay informed with the Bitrue Blog.

In a crypto landscape dominated by hype, speculation, and innovation, few stories have captivated investor attention like Pump.fun’s recent Initial Coin Offering (ICO).

The Solana-based meme coin launchpad sold out its $600 million public token sale in a record-breaking 12 minutes, setting a new benchmark for community-driven fundraising in 2025.

But as excitement mounts, so do questions about valuation, market behavior, and the project’s long-term impact.

A Record-Setting ICO in Just Minutes

On Saturday, Pump.fun offered 150 billion PUMP tokens, 15% of its total 1 trillion supply, at a sale price of $0.004 each.

The sale generated $600 million, with an overwhelming investor response that forced an early close far ahead of its planned 72-hour window.

Despite geographic restrictions that excluded participants from the U.S. and U.K. due to regulatory issues, platforms like Kraken, KuCoin, and Gate.io processed millions in token sales.

Kraken alone saw $30 million in investments, although technical issues led to unprocessed orders. The platform has since promised airdrops to affected users.

Distribution Phase and Trading Launch Timeline

Currently, PUMP tokens are in a 48-72 hour distribution phase, during which they are being transferred to buyers’ wallets but remain non-tradable.

The lock-up is designed to ensure fair distribution and infrastructure readiness on major exchanges.

PUMP spot trading is expected to begin between July 15–16, with Bitrue, Kraken, Bybit, KuCoin, MEXC, Gate.io, and Bitget among the confirmed exchanges listing the token.

This staging approach is meant to reduce early volatility and prevent token dumping.

Market Frenzy: Price Swings, Shorts, and Premarket Speculation

Despite the lockup, PUMP’s premarket activity has already caused ripples. On Hyperliquid, open interest in PUMP perpetual contracts exceeded $43 million, while Binance reported $12 billion in PUMP trading volume.

The token peaked at $0.0056, a 40% premium over its sale price, before pulling back to around $0.0048. This surge reflects strong speculative interest—but also the strategic behavior of seasoned traders.

Three major wallets were seen shorting PUMP on Hyperliquid, depositing over $11 million in USDC, likely planning to use their soon-to-be-unlocked tokens to cover positions and pocket low-risk profits of up to 40%.

Valuation and Allocation Breakdown

Pump.fun’s ICO places its fully diluted valuation at $4 billion, exceeding the initial $1 billion target. Polymarket odds suggest a 76% probability that this valuation will hold within 24 hours of the launch.

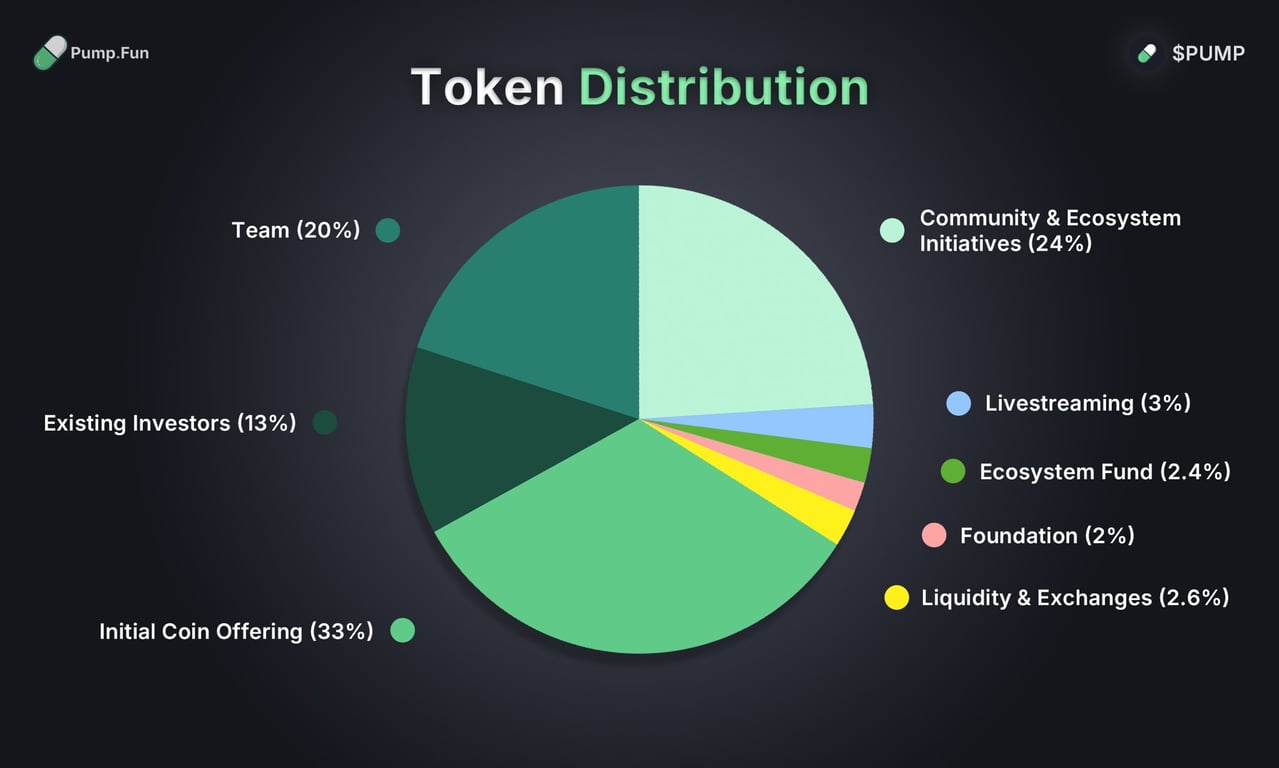

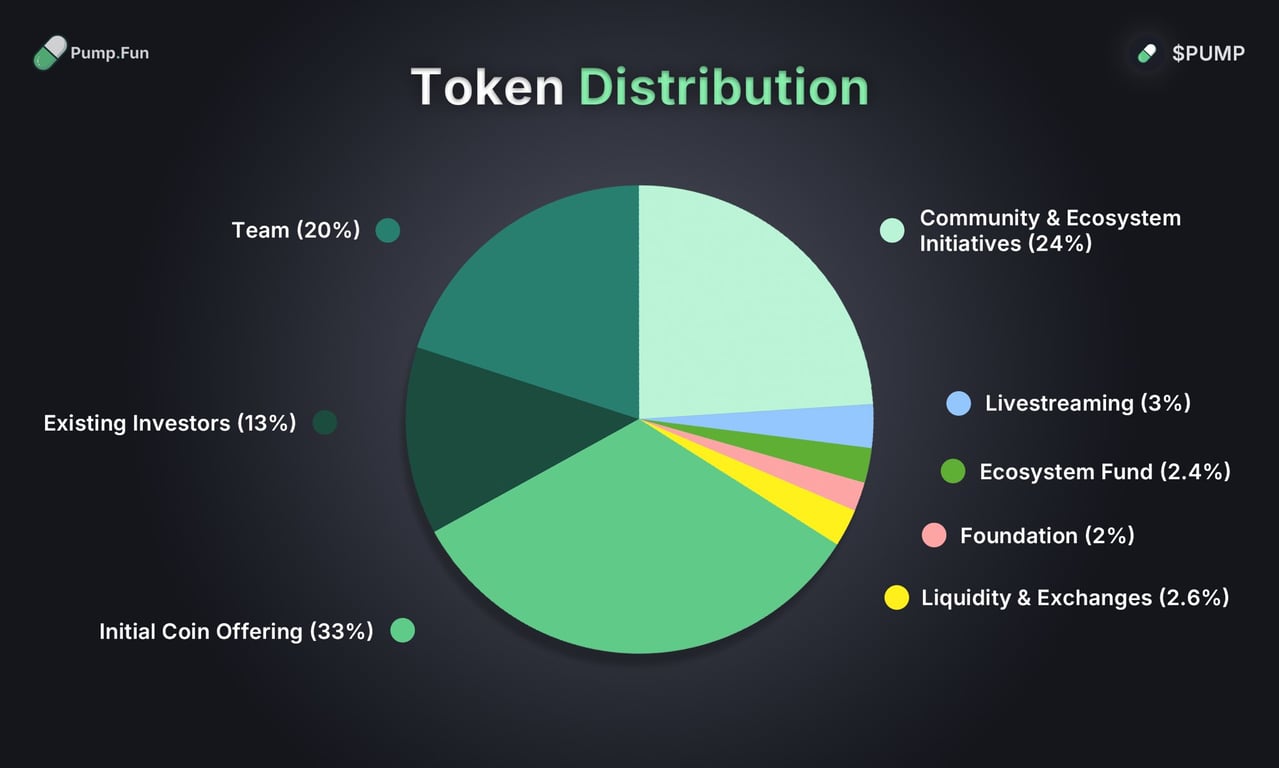

Token distribution:

- 33% for ICO and public sale

- 18% private sale to institutional investors

- 24% for community incentives

-

20% to the project team

-

13% for existing investors

-

2.6% liquidity provision

-

2.4% ecosystem development

While the breakdown supports ecosystem growth, critics argue the private sale disproportionately favors insiders, potentially undermining decentralization.

Beyond Meme Coins: Pump.fun’s Larger Vision

Far from being just another meme coin platform, Pump.fun plans to evolve into a decentralized Web3 social network to rival Facebook, TikTok, and Twitch.

Founders Noah Tweedale, Alon Cohen, and Dylan Kerler envision PUMP as the backbone of a platform rewarding genuine user engagement with real financial incentives.

This ambition has driven over $700 million in platform revenue since January 2024 and diversified earnings through its PumpSwap DEX, which alone generated $10 billion in June volume.

Security Warnings and Copycat Tokens

As with any hyped project, fraudsters have rushed in. Pump.fun has warned investors against fake tokens using the project’s name. The official PUMP contract address is: pumpCmXqMfrsAkQ5r49WcJnRayYRqmXz6ae8H7H9Dfn

Always verify token authenticity before transacting.

Criticism and Regulatory Hurdles

Despite the success, criticism persists. Some label Pump.fun as a speculative bubble, with Truth for the Commoner’s Mary Bent calling it “a Pied Piper leading Gen Z to ruin.”

Regulators remain watchful. The UK’s Financial Conduct Authority banned Pump.fun in December 2024, and a U.S. lawsuit is pending in the Southern District of New York, restricting access to two of the world’s largest crypto markets.

Platform Headwinds: LetsBONK Rising

Pump.fun faces rising competition from LetsBONK.fun, which has captured 55% market share and recently outpaced Pump.fun in daily revenue.

With a grassroots community and revenue reinvestment model, LetsBONK challenges Pump.fun’s dominance by aligning better with Web3 values.

Meanwhile, Pump.fun’s launchpad metrics have declined sharply:

1. Launchpad volume: from $11.6B in January to $3.65B in June

2. Revenue: from $133M in January to $34M in June

Still, its diversified ecosystem and DEX performance offer hope for a rebound.

The Road Ahead: Key Dates and Strategic Moves

1. Now—July 15: Token distribution phase (locked tokens)

2. July 15—16: Spot trading expected to go live

3. July 18: Final date for trading launch on major exchanges

With trading about to begin, all eyes are on whether Pump.fun can convert its fundraising triumph into lasting momentum—or become another cautionary tale in crypto history.

Conclusion: Opportunity Meets Uncertainty

Pump.fun’s $600M ICO signals a new chapter in meme coin history, marked by massive demand, strategic sophistication, and expanding ambitions.

Yet as the token enters open trading, investors must balance opportunity with caution, avoiding scams and keeping an eye on evolving regulatory and market dynamics.

Whether Pump.fun transforms into a full-fledged decentralized platform or fades under scrutiny will depend on its ability to deliver value beyond the hype.

Want to keep up with the latest insights, analysis, and crypto market movements? Follow the Bitrue Blog for real-time updates, trading strategies, token deep-dives, and everything crypto.

You must be logged in to post a comment.