by Penny Angeles-Tan | Oct 22, 2024 | Business

Vitalik Buterin, co-founder of Ethereum, has identified centralization as one of the biggest risks for Ethereum. Buterin has proposed a potential solution known as “The Scourge.” Check out the full explanation in this article.

Becoming one of the largest blockchain platforms, Ethereum continues to grow and attract investor interest. However, like every technology, Ethereum also faces challenges and risks. One of the biggest risks facing Ethereum is the centralization of proof-of-stake (PoS).

Centralized Proof-of-Stake

Proof-of-stake is a consensus mechanism that Ethereum uses to validate transactions and secure the network. In PoS, validators must lock a certain amount of ETH to participate in the validation process.

One of the risks in PoS is centralization, where a small number of validators control most of the network. This can increase the risk of 51% attacks, transaction censorship, and value extraction.

Vitalik Buterin and The Scourge

Vitalik Buterin, co-founder of Ethereum, has identified centralization as one of the biggest risks for Ethereum. Buterin has proposed a potential solution known as “The Scourge.”

The Scourge aims to reduce the risk of centralization by using techniques such as encrypted and a two-tier staking approach. This can help prevent large validators from controlling large portions of the network and reduce the risk of transaction censorship.

Centralization Risk Analysis

Some things that need to be considered so that we can carry out risk analysis are:

1. 51% attack risk: Centralization can increase the risk of 51% attacks, where a small group of validators can control the network and invalidate transactions.

2. Transaction censorship: Centralized validators may choose not to process certain transactions, which could disrupt Ethereum’s functionality.

3. Value extraction: Centralized validators can earn larger profits than small validators, which can reduce value for Ethereum users.

Potential Solutions

Apart from The Scourge, some other potential solutions to overcome PoS centralization on Ethereum include:

1. Increased validator set size: Expanding the number of validators can reduce the risk of centralization.

2. Anti-centralization mechanisms: Development of mechanisms that can prevent large validators from controlling the network.

3. Increased user participation: Encouraging more users to become validators can help reduce centralization.

Conclusion: Current Ethereum Price

Centralization of proof-of-stake is one of the biggest risks facing Ethereum. While potential solutions exist, addressing this issue will require continued efforts from the Ethereum community.

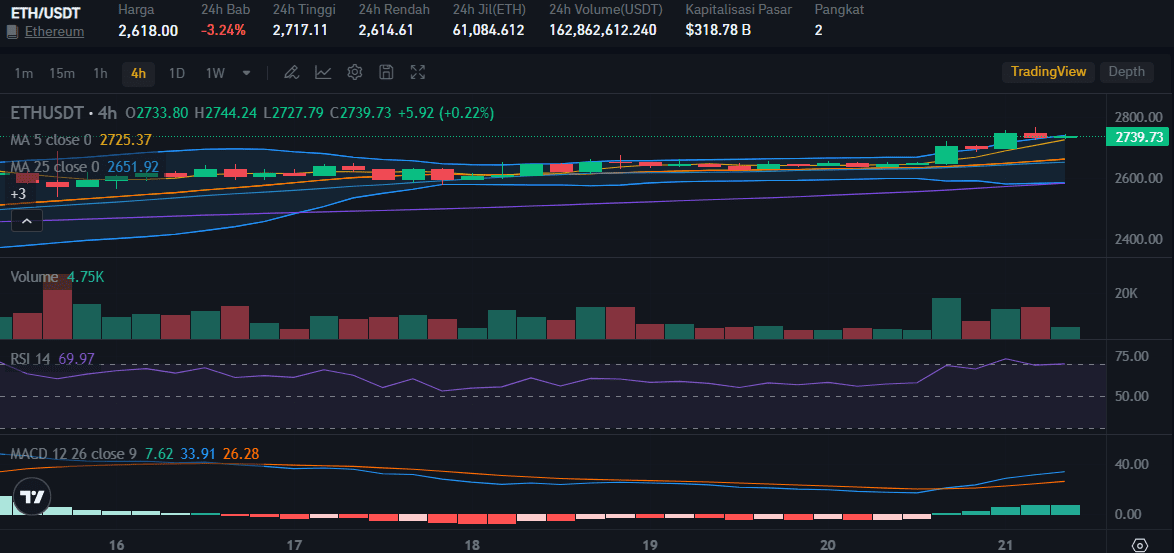

As additional information for those of you who are interested in Ethereum, currently the price of the ETH token is minus 3.24% so it is trading at $2,618.

Although Ethereum price experienced a decline, the RSI indicator has a value of more than 69, so it is indicated that there will be a bullish trend in the near future. The MACD line also explains that the trend will come soon because the buying trend is dominating compared to the selling trend.

Apart from checking token prices in real time, you can also check price conversions ETH to USD easily on the Bitrue website. So, you can know how to allocate funds beforehand buy Ethereum.

by Penny Angeles-Tan | Oct 21, 2024 | Business

Ethereum founder says Ethereum is changing fundamentals. Learn more about how Ethereum will change the world with blockchain technology, from DeFi to the metaverse. Discover the potential and challenges facing Ethereum in the future.

Ethereum wasn’t built just overnight. Its development went through several phases, starting with Frontier in 2015, which laid the foundation for miners and developers. Later phases such as Homestead and Metropolis focused on improving security, functionality, and developer experience.

If you are interested in Ethereum and its network, this article will help you understand this token well. This article will explore the exciting future of Ethereum, a leading blockchain network.

Starting from Ethereum’s latest upgrade, Ethereum’s roadmap to scalability and sustainability, and the implications for users and developers.

Check ETH Futures Market

Potential and Challenges of Ethereum in the Future

Ethereum has great potential to become the backbone of the digital economy. With its ability to facilitate secure and transparent transactions, Ethereum can drive business growth and innovation across various sectors.

Ethereum could become the ultimate platform for building a metaverse, a connected virtual world where people can work, play, and socialize. Ethereum can also integrate artificial intelligence technology to create smarter and more efficient applications.

With the various potentials above, Ethereum has several challenges to face in the future, such as:

1. Scalability: Despite significant progress, Ethereum still faces challenges in increasing scalability to accommodate rapid growth in users and transactions.

2. Regulation: Unclear regulations in various countries can hinder Ethereum’s growth and adoption.

3. Competition: Ethereum faces competition from various other blockchain platforms that offer different features and advantages.

Green Revolution: Ethereum 2.0 and Proof-of-Stake

Significant changes occurred in 2020 with the launch of Ethereum 2.0 and the transition from Proof-of-Work (PoW) to Proof-of-Stake (PoS). This change dramatically reduces Ethereum’s energy consumption, making it a more environmentally friendly platform.

PoS also lowers the barrier to entry for participating in the network, as users no longer need expensive mining equipment.

Roadmap Ethereum Towards Scalability

While PoS is a big step forward, Ethereum’s roadmap doesn’t stop there. The network is actively working on scalability solutions to overcome transaction speed limitations. Here are some key aspects of this roadmap:

1. Sharding: Ethereum plans to implement sharding, a technique that divides the blockchain into smaller pieces, enabling parallel processing of transactions and significantly increasing network throughput.

2. Layer-2 Scalability Solution: Layer-2 solutions such as rollups have helped reduce transaction bottlenecks on the Ethereum mainnet. This solution aggregates off-chain transactions and then efficiently executes them on-chain, resulting in faster and cheaper transactions.

3. EIP-7762: This proposed enhancement aims to simplify cost distribution and scalability by focusing on roll-up integration and introducing a new cost-sharing model.

A Brighter Future for Ethereum Developers and Users

Ethereum’s roadmap holds great potential for developers and users. Here’s what you can expect:

1. Lower Transaction Fees: With increased scalability, transaction fees on Ethereum are expected to decrease significantly, making the network more accessible to everyone.

2. Faster Transactions: Faster transaction confirmation times will result from faster block times and improved processing capabilities.

3. Enhanced Security: Ethereum’s focus on security remains primary, and the PoS mechanism along with ongoing development efforts will continue to strengthen the network’s resilience.

4. A More Vibrant Ecosystem: Increased scalability will pave the way for a variety of decentralized applications (dApps) built on Ethereum, driving further innovation and user adoption.

Conclusion

Ethereum’s roadmap is ambitious and constantly evolving. With a focus on scalability, sustainability, and security, Ethereum is poised to maintain its role as a leader in the blockchain space.

This future holds exciting possibilities for developers and users, with a more efficient, secure, and accessible Ethereum ecosystem on the horizon.

With the increasingly comprehensive Ethereum network, it cannot be denied that this will also have a positive impact on Ethereum price. Converting the price of ETH to USD will also strengthen investors’ increasing confidence in the development of Ethereum network technology.

Ethereum may be experiencing a price decline recently which is a bit worrying. However, as Ethereum continues to develop smart contracts for other parts of its network, more and more users will buy ETH in the future.

by Penny Angeles-Tan | Oct 20, 2024 | Business

Ripple Swell 2024 has begun. This annual event will discuss various things about crypto, blockchain, and existing crypto regulations. How will Ripple Swell affect the price of XRP?

Ripple Swell 2024 has started on October 15. For two days, Ripple will hold a conference to discuss crypto, blockchain, and investment regulations.

Then, how will the Ripple Swell 2024 affect XRP price? Will it provide a positive trigger so that the price of the token rises? Check out the detailed explanation below.

Ripple Swell 2024’s Highlights

Ripple Swell 2024 is Ripple’s annual event. This year was the eighth year of the Ripple Swell event which was held in Miami on October 15-16 2024. There were more than 600 participants from more than 40 countries attending.

At Ripple’s annual conference this year, several great speakers will appear, from Andrienne Harris who is Head of Financial Services in New York to Tim McCourt as senior managing director of Chicago-based CME Group.

Ripple Swell 2024 opened with a chat about regulations and the crypto landscape in America. In this session, discussions about court cases that are often carried out by the SEC are of course also carried out. Discussions about stablecoins have not gone unnoticed, especially since Ripple also has plans to issue its stablecoin.

For the second day, discussions will revolve around leadership influencing the crypto market. The leadership in question is of course the arrangement of a state leader who also discusses the current general elections in America.

America as a country that is often a center for investment, including crypto, its leadership is certainly in the spotlight. Because, of this leader, new regulations will be created which could later have a positive or negative impact on the crypto market.

Effect of Ripple Swell on XRP Price

XRP token holders are eagerly awaiting this Ripple Swell event. Because, at this event, Ripple will also make announcements that often have a good impact on XRP token holders. So, don’t be surprised if the price of XRP can increase when this event takes place.

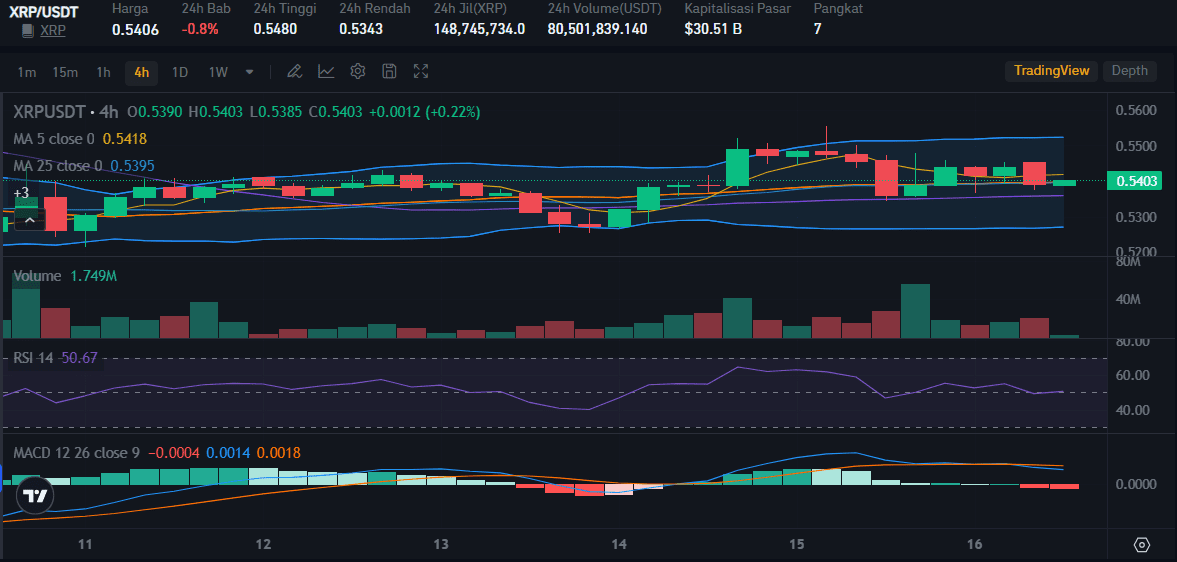

However, unfortunately, when this article was written on the first day of Ripple Swell 2024, the price of XRP decreased by -0.08%. Currently, XRP is trading at $0.5406.

Even though it has experienced a decline, the RSI value of XRP is still above 50, which means the buying trend is still slightly more dominant than the selling trend. The MACD line for this token is still above the existing limit line.

It is believed that the percentage decrease in the price of XRP that is less than 1% will not last long and could cause the price to bounce up.

When Will the RLUSD Stablecoin Launch?

Ripple Swell 2024 is also an event where the Ripple community collects the latest information regarding the launch of the RLUSD stablecoin. RLUSD is predicted to be a strong stablecoin because it focuses on regulations under the New York Trust Company Charter with its very strict supervision.

RLUSD has been testing on the XRP ledger and Ethereum mainnet since August 9.

Ripple claims that there will be a third-party audit of cash assets in every monthly report published so that there will be strong transparency and accountability.

Until the time this article was written, Ripple had not made an official announcement when RLUSD would be launched.

Conclusion

In general, the opening of the Ripple Swell 2024 event has not had a significant influence on the price of XRP the price has decreased. However, optimism for an increase in XRP prices remains, especially since October always provides a positive signal for the crypto market.

For those of you who are currently doing research before buying XRP, you can make maximum use of Bitrue’s features. You can check XRP price in real-time, knowing the price conversion XRP to USD easily, to follow the development of information on the Ripple project as a whole from time to time on the Bitrue blog.

by Penny Angeles-Tan | Oct 19, 2024 | Business

Ripple partners with leading exchanges to launch RLUSD! Learn how this stablecoin will change the global payments landscape and attract institutional investors.

Ripple USD (RLUSD), the new stablecoin from Ripple, has been anticipated since its first announcement. This stablecoin is designed to have an equivalent value to the US dollar and aims to facilitate cross-border transactions and provide stability in the digital asset ecosystem.

Understand fully about RLUSD, how it differs from other stablecoins, and when the RLUSD launch will be officially carried out by reading this article to the end.

What is RLUSD?

RLUSD is a type of cryptocurrency whose value is pegged to the US dollar. In contrast to cryptocurrencies such as Bitcoin whose value is very volatile, RLUSD is designed to have a stable value. This makes it a more reliable means of payment, especially for cross-border transactions.

How does RLUSD work? So, each RLUSD token is backed by US dollar reserves held in a separate account. This reserve will be regularly audited by a third party to ensure that the number of RLUSD tokens in circulation always corresponds to the value of US dollars held.

Some of the reasons why RLUSD was launched are:

1. Meet market needs: There is a high demand for stable and reliable stablecoins for various purposes, such as payments, asset tokenization, and DeFi.

2. Increasing adoption of blockchain technology: RLUSD is expected to accelerate the adoption of blockchain technology in the financial industry.

3. Connecting traditional and digital worlds: RLUSD can be a bridge between the traditional financial system and the world of digital assets.

RLUSD advantages

Capped by the US dollar, the value of RLUSD tends to be more stable than other cryptocurrencies. RLUSD is also backed by US dollar reserves guaranteed by the government.

Not only that, RLUSD can be used in various countries and regions through Ripple’s partner network. This stablecoin is designed to meet strict regulatory standards, providing more confidence to users. RLUSD can operate on multiple blockchains, including XRP Ledger and Ethereum.

Who Supports RLUSD?

Several major crypto exchanges have expressed support for RLUSD, including:

1. Uphold: Popular multi-asset trading platform.

2. Bitstamp: One of the oldest and most trusted cryptocurrency exchanges.

3. Bitso: Latin America’s leading cryptocurrency exchange.

4. MoonPay: Crypto payment infrastructure provider.

5. Independent Reserve: Australia-based cryptocurrency trading platform.

6. CoinMENA: A cryptocurrency exchange focused on the Middle East and North Africa.

7. Bullish: A cryptocurrency exchange backed by Peter Thiel.

The Future and Comparison of RLUSD with Other Stablecoins

With support from strategic partners and a focus on regulatory compliance, RLUSD has great potential to become one of the world’s leading stablecoins. RLUSD can accelerate the adoption of blockchain technology in a variety of sectors, including finance, commerce, and real estate.

To provide a clearer picture of RLUSD’s position in the market, we can make a comparison with other popular stablecoins such as USDT and USDC. Some aspects that can be compared include:

1. Guarantee Mechanism

RLUSD: Reportedly backed by US dollar reserves, short-term government bonds, and other cash assets. Ripple is committed to conducting monthly audits of these reserves.

USDT: Originally claimed to be fully backed by US dollars, however, there has been some controversy regarding the transparency of its reserves.

USDC: Reported to be fully backed by US dollars and equivalent assets, with monthly audits performed by major accounting firms.

2. Transparency

RLUSD: Ripple has expressed its commitment to transparency by conducting monthly audits of RLUSD reserves.

USDT: USDT’s transparency has been a subject of debate, especially after several reports cast doubt on their claims of full reserves.

USDC: USDC is considered to have a higher level of transparency than USDT, with monthly audits conducted by large accounting firms.

3. Market Adoption

RLUSD: Still relatively new and has not yet reached the same level of adoption as USDT or USDC. However, with the support of major exchanges and Ripple’s reputation, the adoption potential of RLUSD is huge.

USDT: USDT is the most widely used stablecoin in the world, with a huge market capitalization.

USDC: USDC is USDT’s closest competitor and has gained widespread adoption across DeFi platforms and exchanges.

4. Regulation

RLUSD: Ripple has stated that RLUSD is designed to meet strict regulatory standards, including oversight from the New York Department of Financial Services (NYDFS).

USDT: USDT has faced several regulatory challenges, especially regarding its reserve claims.

USDC: USDC is generally considered more regulatory compliant than USDT and has received approval from various regulators.

5. RLUSD Competitive Advantages

Ripple Support: Ripple has an extensive network and experience in the blockchain industry.

Focus on institutions: RLUSD is designed to appeal to institutions with an emphasis on security, transparency, and regulatory compliance.

Integration with Ripple ecosystem: RLUSD can be integrated with Ripple’s cross-border payment solutions and other products.

Potential Uses of RLUSD

Apart from cross-border payments, RLUSD has great potential for use in various other applications, such as:

1. DeFi (Decentralized Finance): RLUSD can be used as an underlying asset in various DeFi protocols, such as lending, borrowing, and yield farming.

2. Asset tokenization: RLUSD can be used to tokenize real-world assets, such as real estate, stocks, and commodities.

3. In-game payment: RLUSD can be used as currency in blockchain-based games.

Conclusion

The launch of RLUSD is an important step for Ripple and the cryptocurrency industry as a whole. With support from strategic partners and a focus on regulatory compliance, RLUSD has the potential to become one of the world’s leading stablecoins.

However, the success of RLUSD will also depend on several factors, such as market developments, regulatory changes, and Ripple’s ability to continue to innovate.

The creation of RLUSD will also have a positive impact on XRP price, especially when it is launched. If you are one of the XRP token holders, you can feel happy about this innovation from Ripple. However, don’t be careless buy XRP coins.

You still have to do research before deciding to invest completely in a token. Find out what the current condition is, and whether the value of XRP to USD is strengthening or not. Carry out a tactical strategy so you can invest according to your current financial condition.

by Penny Angeles-Tan | Oct 18, 2024 | Business

Explore the potential rewards and risks of investing in the Bitcoin futures market. A complete guide to understanding market dynamics and making better investment decisions.

Bitcoin, as the largest cryptocurrency, continues to attract the interest of investors from various circles. One of the interesting aspects of Bitcoin is the futures market which allows traders to speculate on the price of Bitcoin without needing to buy or sell physical coins.

This article will discuss the increase in Bitcoin open interest along with an analysis of the Bitcoin futures market. Read to the end to understand the entire explanation.

Bitcoin Futures Market Analysis

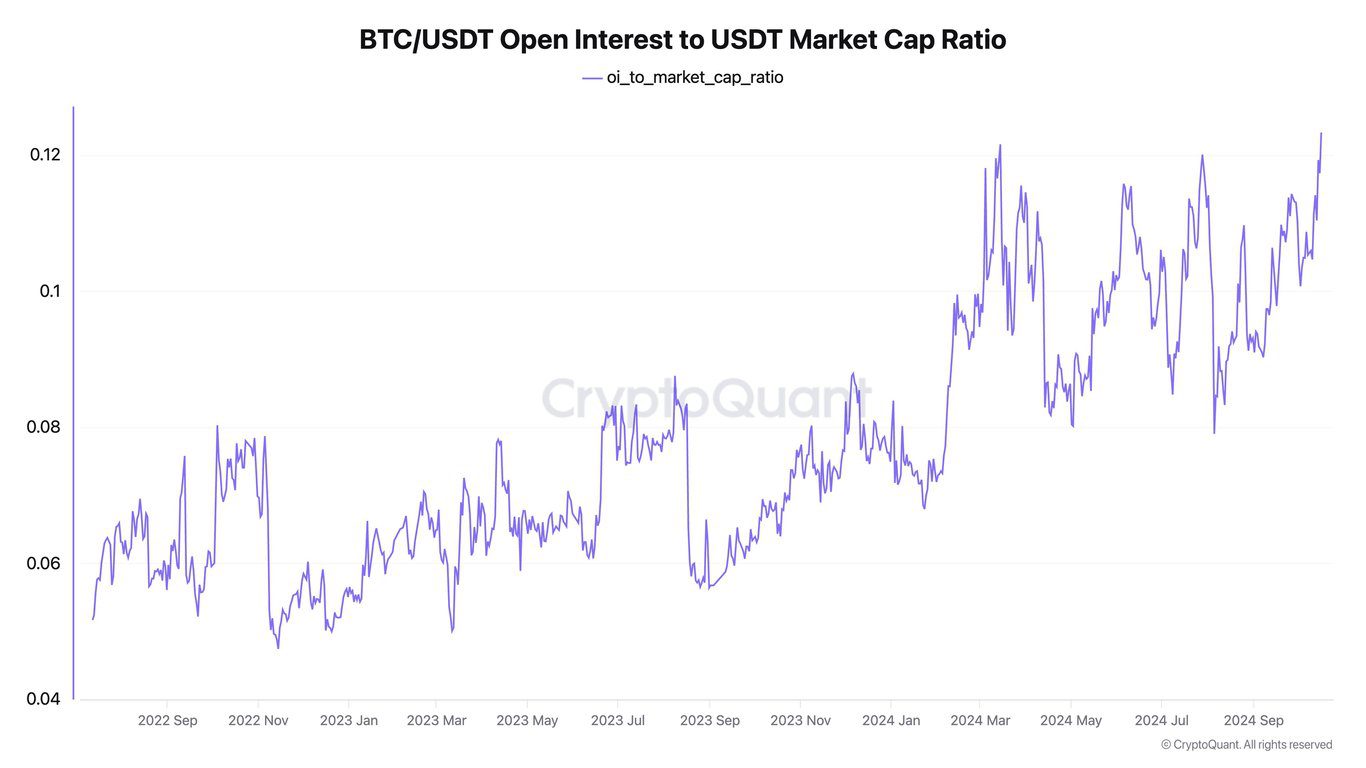

Recent analysis suggests that the Bitcoin futures market may be heading into its second bullish phase. Data from CryptoQuant shows increased leverage in the BTC USDT futures market, which could be an indication of potential significant price movements.

Ki Young Ju, CEO of CryptoQuant, analyzed two important metrics: the ratio of BTC-USDT open interest to reserves and the ratio of BTC-USDT open interest to USDT market capitalization. These two metrics indicate a significant increase in leverage in the Bitcoin futures market.

Increased Open Interest

Bitcoin (BTC) open interest reached a staggering $19.8 billion at 574,680 BTC on October 15. Data from CryptoQuant reflects a significant increase in demand for the largest cryptocurrencies, indicating how much new money has entered the digital asset market in recent months.

The funding rate has surged to the highest level since August, indicating that most of those open positions are long positions expecting further appreciation.

While an increase in open interest is usually a positive indication for Bitcoin price action, some market observers have expressed concerns that increased volatility could be threatened.

The highly leveraged nature of the futures market will eventually pave the way for large-scale liquidations if and when sudden price swings occur.

According to data from Glassnode, a large number of Bitcoin futures contracts are cash-margined and not crypto-margined, meaning they are collateralized by US dollars or dollar-pegged stablecoins and not the cryptocurrency itself.

Bitcoin Price Increase Potential

At the moment, Bitcoin price in the Bitrue futures market it was at $67,764 with an increase of 0.78%. Previously, within 24 hours, Bitcoin reached its highest price in the futures market at $68,353.

It can be seen from the BTC price chart excerpt above that the RSI value is 63, which means a trend to buy Bitcoins is much more dominant than the selling trend. However, this dominance is still within reasonable limits, not overbought.

The MACD line appears to have a downward trend, but the position of the line which is still above the threshold indicates that the BTC position is currently strong in its bullish possibility.

An increase in open interest can be a positive indication of Bitcoin’s potential price increase. However, keep in mind that the crypto market is highly volatile, and factors such as changes in regulatory policies and technological developments can affect the price of Bitcoin.

Risks to be Aware of

The crypto market is known for its high volatility, so the price of Bitcoin can experience sharp fluctuations. Changes in regulatory policies can also affect Bitcoin prices.

Using leverage can increase potential profits, but also increases the risk of loss. Apart from that, Bitcoin also faces competition from other cryptocurrencies.

Conclusion

The increase in Bitcoin open interest shows the high interest of investors in the futures market. However, keep in mind that high open interest can also increase the risk of volatility. If the market moves against a trader’s position, massive liquidations can occur.

For those of you who are interested in investing in Bitcoin in the futures market, do not immediately invest without studying current market conditions. Do your own research (DYOR) by knowing price statistics, price conversions from BTC to USD, and how the project is progressing. Knowing the fundamentals of a token is also very good for knowing where you stand as an investor.

You must be logged in to post a comment.