by Penny Angeles-Tan | Nov 14, 2024 | Business

Discover the rise of Peanut the Squirrel (PNUT), a meme coin fueled by social media buzz and celebrity endorsements. Explore its price surge, market impact, and the factors driving the popularity of meme coins in the cryptocurrency space.

In the ever-evolving world of cryptocurrencies, meme coins have consistently defied expectations, capturing the hearts and wallets of investors worldwide. Peanut the Squirrel (PNUT), a token inspired by a viral internet pet, is the latest sensation to take the crypto market by storm.

PNUT: The Rise of a Furry Phenomenon

Peanut, a beloved squirrel, gained immense popularity on social media platforms. However, a tragic event involving the animal sparked widespread outrage and sympathy. This outpouring of emotion and the involvement of high-profile figures like Elon Musk propelled Peanut into the public consciousness.

Capitalizing on this newfound fame, the PNUT token was launched, quickly gaining traction among crypto enthusiasts. The token’s surge in popularity was further fueled by its listing on prominent cryptocurrency exchanges, including Binance. This increased accessibility and liquidity contributed to significant price gains.

PNUT Price Today

At the time of writing this article on November 14, PNUT experienced a fantastic price surge of up to 284.24% to trade at $1.7089. Its highest price in 24 hours was $1.8413 from its lowest price of $0.4152.

PNUT’s MACD line shows high seriousness for bullish. PNUT’s RSI value reached 80.54 which shows that PNUT is currently experiencing the risk of being overbought by crypto investors.

The Impact of Social Media and Celebrity Endorsements

Social media has become a powerful tool for driving cryptocurrency trends. The viral nature of Peanut’s story and the support of influential figures like Elon Musk played a crucial role in attracting investors to the PNUT token.

However, it’s important to note that the cryptocurrency market is highly volatile, and the value of meme coins can fluctuate rapidly. While social media can ignite interest, conducting thorough research and considering the underlying fundamentals before investing in any cryptocurrency is essential.

The Enduring Appeal of Meme Coins: A Deeper Dive

While the initial surge in popularity of meme coins like Dogecoin and Shiba Inu may have surprised many, the underlying reasons for their enduring appeal are multifaceted.

1. Community and Sentiment

A strong and passionate community is a cornerstone of many successful meme coins. These communities often engage in social media campaigns, memes, and other online activities to promote their favorite tokens. This collective enthusiasm can significantly impact price volatility.

2. Psychological Factors

FOMO (Fear of Missing Out) is a powerful psychological driver that can lead to impulsive investment decisions. When a meme coin starts trending, it can create a sense of urgency among investors, driving demand and pushing prices higher.

3. Speculation and Gambling

The speculative nature of cryptocurrency markets, particularly meme coins, attracts a significant number of traders who are willing to take risks in the hope of high returns. This speculative behavior can amplify price swings and create opportunities for both significant gains and losses.

4. The Role of Influencers

Social media influencers, celebrities, and even prominent figures like Elon Musk can significantly impact the price of meme coins. A single tweet or endorsement can trigger a buying frenzy, leading to rapid price increases.

Conclusion: The Future of Meme Coins

While meme coins have undoubtedly captured the public’s imagination, it’s important to approach them with a level of skepticism. Their long-term viability remains uncertain, and their value is often tied to speculative sentiment and market trends.

As the cryptocurrency market matures, more traditional assets and projects with solid fundamentals will likely gain prominence. However, meme coins may continue to play a role in the ecosystem, particularly as a tool for community building and experimentation.

In conclusion, meme coins like Peanut the Squirrel are a fascinating phenomenon that highlights the unpredictable nature of the cryptocurrency market. While they can offer significant rewards, they also come with substantial risks. Investors should carefully weigh the potential benefits and drawbacks before deciding to invest in these volatile assets.

If you want to invest in a meme coin or other token in the crypto ecosystem, you should do in-depth research and not just because of FOMO. Check the strength and risk of investing in the token by checking the price conditions, technical analysis, fundamental analysis, and others.

If you are confused, you can visit the Bitrue website and use the existing features to strengthen your research before investing in crypto. Bitrue has a token price conversion check to USD, a token price chart that is updated in real-time, and a Bitrue blog that you can read articles on so that you stay updated on the latest crypto ecosystem.

by Penny Angeles-Tan | Nov 12, 2024 | Business

The seven tokens that will be discussed in this article are AIOZ, AMC, PIXFI, GME, EQ9, DEGEN, and ACT. Here is the analysis and discussion.

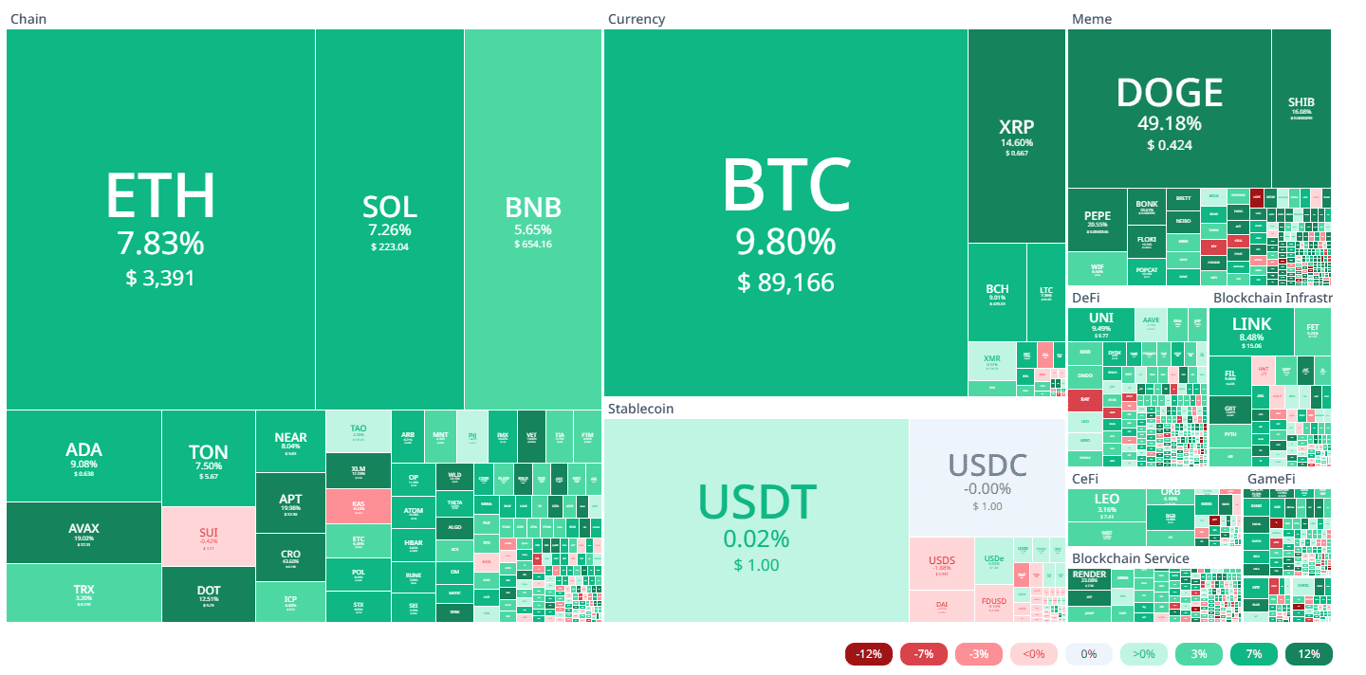

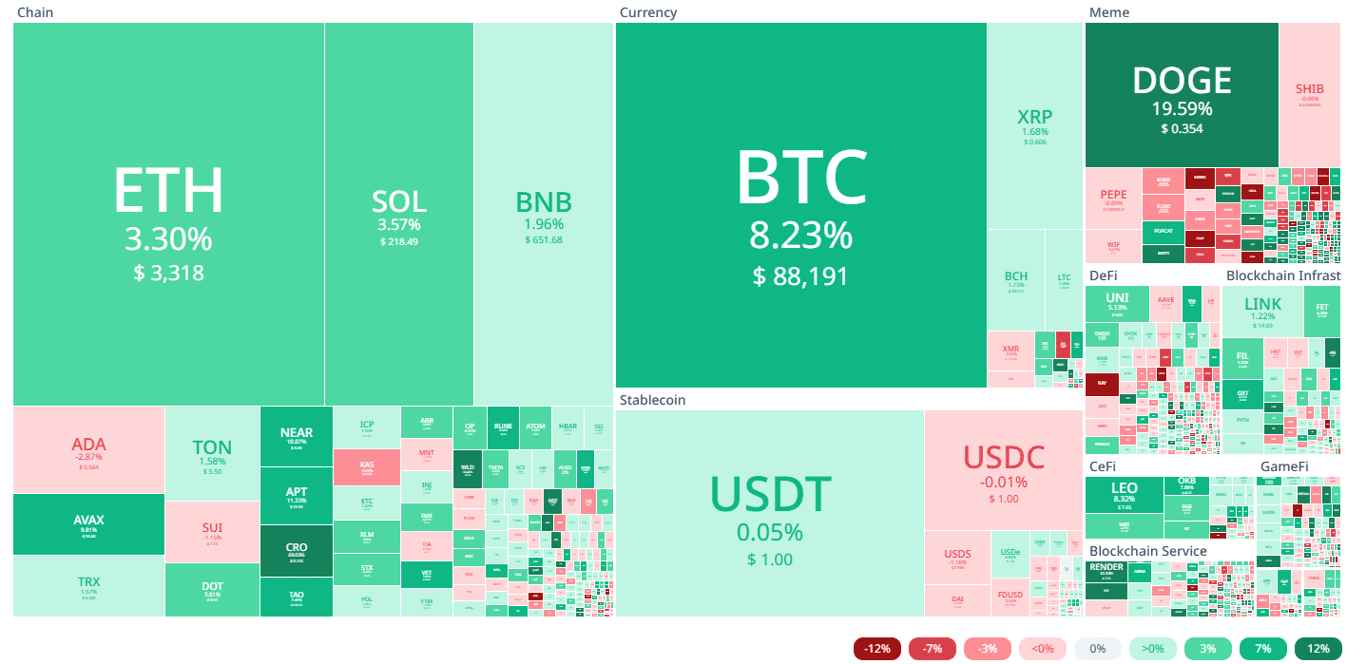

In today’s crypto heatmap on Cryptorank, the crypto ecosystem is greening up. In the joy of crypto investors who see major tokens such as BTC, ETH, SOL, XRP, to USDT experiencing significant increases, other alternative tokens are no less positive.

In this article, you will find out what are the 7 crypto tokens that have increased by more than 50%. It will be presented specifically for you how the price charts of the seven crypto tokens so that you can do their technical analysis.

7 Crypto Tokens with More Than 50% Increase

Today, BTC has again set a record with its new ATH. With a 9.80% increase, Bitcoin is currently trading at $89,166, up more than $8,000 from yesterday’s price of only $81,000.

Other major tokens such as Ethereum, Solana, XRP, and USDT have also experienced significant increases. The price of Ethereum today has even reached almost $4,000 with an increase of 7.83%. Solana is even at $223.04 with an increase of 7.26%.

In addition to the major tokens, other altcoins have also experienced a very significant increase of more than 430%. The token is Act I: The AI Prophecy which is currently on the rise.

The seven tokens that will be discussed in this article are AIOZ, AMC, PIXFI, GME, EQ9, DEGEN, and ACT. Here is the analysis and discussion.

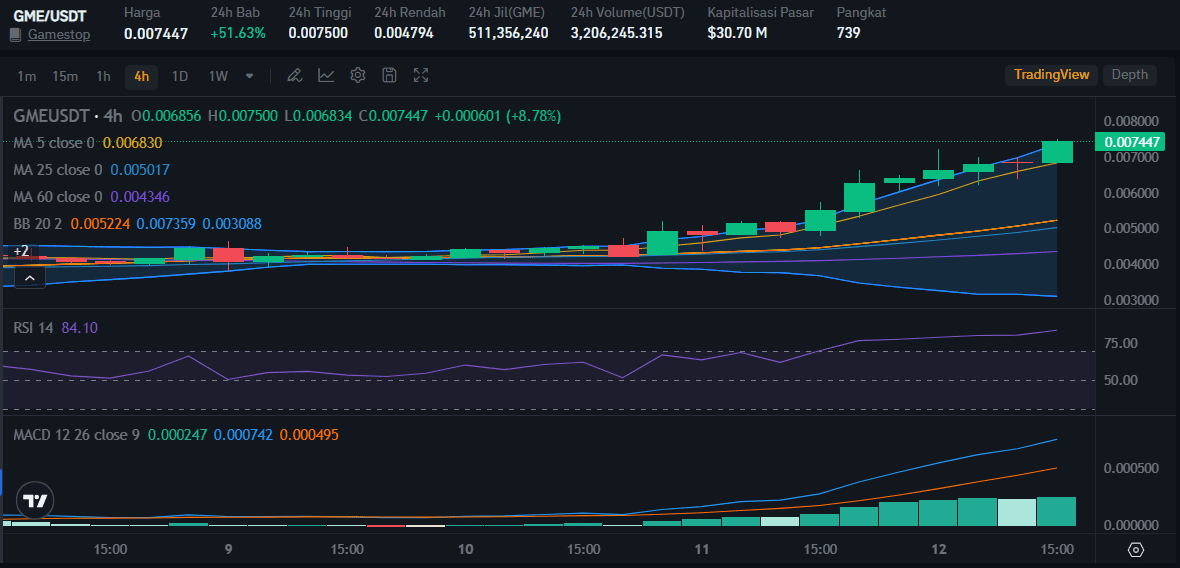

1. Gamestop (GME)

Percentage increase: 51,63%

Sector: Gaming, Memes, Solana Ecosystem

Market Capitalization: $52.12M

Total supply: 6.89B GME

The crypto token with the ticker GME went viral in 2021 due to its unexpected price spike. Roaring Kitty, an online broadcaster, was the cause of GameStop’s rally at that time.

Now, GME is experiencing an increase that cannot be underestimated. With an increase of more than 51%, GME is currently trading at $0.007447 with its highest price in 24 hours being $0.007500. GME’s market capitalization has also increased by 65.86% currently.

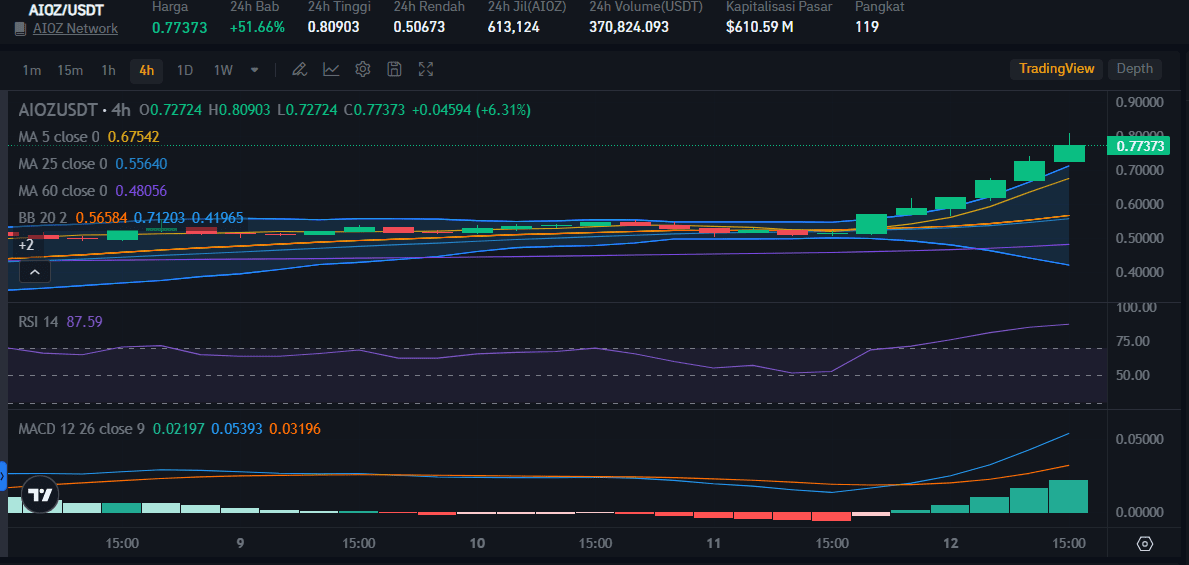

2. AIOZ Network (AIOZ)

Percentage increase: 51,66%

Sector: Media, Platform, AI & Big Data

Market Capitalization: $847.21M

Total supply: 1.14B AIOZ

AIOZ Network is currently focusing on building its AIOZ W3AI V3 with a focus on AI training with Decentralized Federated Learning to Spaces for building AI dApps.

AIOZ has more than 7 years of experience in its active development and will continue to update to broader development in the blockchain ecosystem, nodes, to infra.

Today, the AIOZ token has increased by 51.66% so that the current AIOZ price is $0.77373. The AIOZ RSI value is already in the overbought stage because it is at 87.59.

3. Dogecoin (DOGE)

Percentage increase: 53,15%

Sector: Mineable, PoW, Scrypt

Market Capitalization: $62.45B

Total supply: 146.76B DOGE

Dogecoin today is experiencing an increase of up to 53.15% so it is now for $ 0.42597. Previously, in 24 hours, DOGE was at its highest price of $ 0.43744.

This Shiba Inu-inspired memecoin has Dogecoin Core which is open-source and community-driven software. The development process is very open to the public so that everyone can see, discuss, and even develop the software.

4. Pixelverse (PIXFI)

Percentage increase: 64,02%

Sector: Gaming, Toncoin Ecosystem, Tap To Earn (T2E)

Market Capitalization: $7.98M

Total supply: 5B PIXFI

Pixelverse, which started from a successful Telegram game, has indeed received high support since its launch. With its PIXFI token, Pixelverse has succeeded in strengthening its presence in the crypto ecosystem.

In its mini-game on Telegram, Pixelverse has many interesting features, ranging from PvP Battles, Referral programs, Daily Combo, to Daily Rewards.

Now, the price of PIXFI has reached $0.007378 and is one of the crypto tokens from the Telegram game with a very high increase in this exciting week of crypto. With an increase of more than 64%, PIXFI is increasingly showing its ability to be bullish.

5. Degen (DEGEN)

Percentage increase: 77,55%

Sector: Memes, Base Ecosystem

Market Capitalization: $245.10M

Total supply: 36.97B DEGEN

DEGEN is currently trading at $0.01891 after experiencing a 77.55% increase. DEGEN’s RSI figure is very high at 86.56 which means there is already a red code because it is overbought. The MACD line is undoubtedly increasing by a fairly large distance which means that there is currently a bullish trend.

DEGEN was created in the realm of strong meme culture. Degen also has Degen Chain which is a pioneer of L3s in the Base network. There, users can build and use Degen apps.

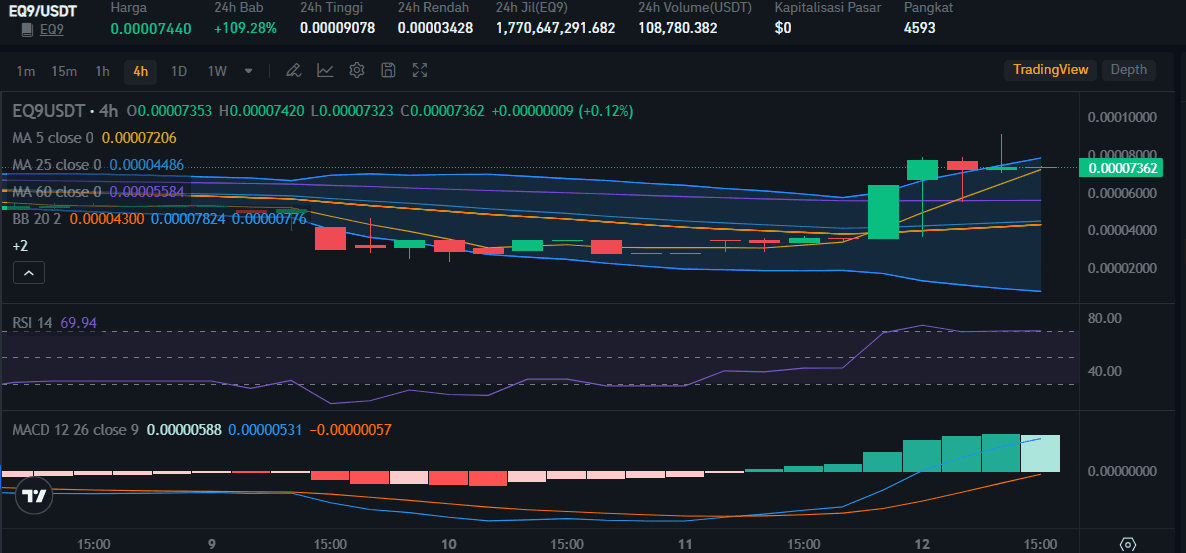

6. EQ9 (EQ9)

Percentage increase: 109,28%

Sector: dApps

Market Capitalization: $30.65K

Total supply: 1.80B EQ9

EQ9 created by a company called EQUALS9 ENTERPRISES & PARTNERSHIPS is a corporation from Brazil. This company focuses on controlling its various subsidiaries in various sectors. This company then created the EQ9 token as a bridge in the integration of their business ecosystem with blockchain.

When this article was written on November 12, EQ9 experienced a surprising increase because the percentage increase was more than 109%. Now, EQ9 is trading at $0.0007440 in 24 hours.

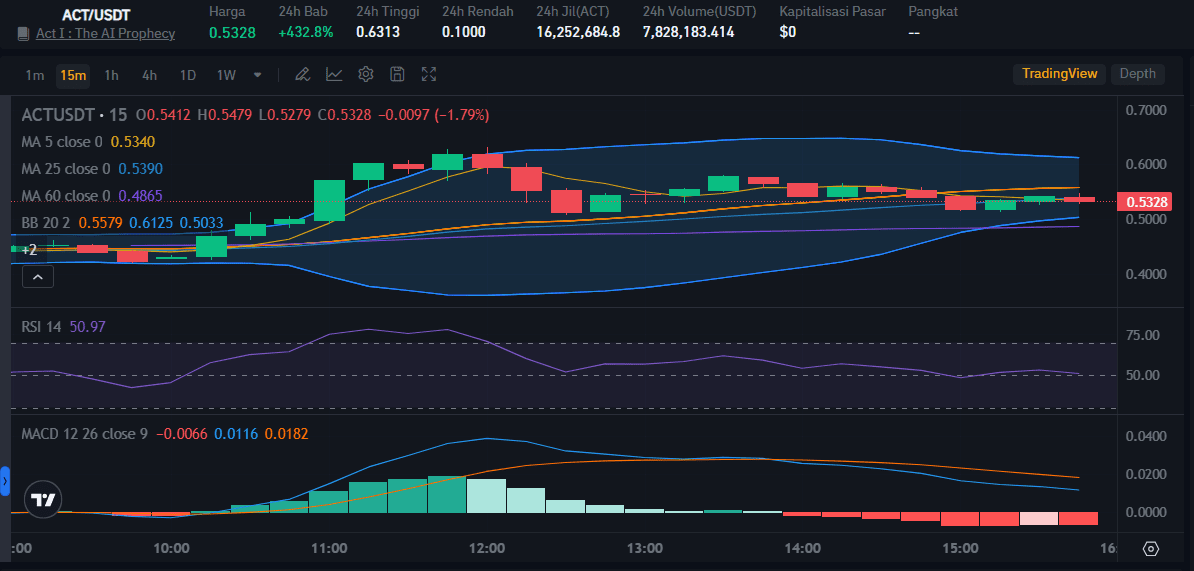

7. Act I: The AI Prophecy (ACT)

Percentage increase: 432,8%

Sector: Memes, Solana Ecosystem, AI Memes

Market Capitalization: $507.58M

Total supply: 948.25M ACT

Act I: The AI Prophecy (ACT) is currently experiencing hype due to its launch on various global crypto exchanges. ACT is a decentralized open-source project. Its goal is to create an interactive AI ecosystem. Users can freely interact with AI.

Because of this promising system, the ACT token has received high support. Currently, ACT has even experienced a very fantastic price increase of 432.8% so it is currently traded for $ 0.5328.

The ACT RSI value even tends to be normal with a more dominant buying trend than the selling trend. The MACD line looks down, but it does not eliminate the possibility that ACT will experience a greater bullish shortly.

Conclusion: DYOR

That’s an explanation of the 7 crypto tokens that have increased by more than 50% today. Always remember to do in-depth research before trading crypto. That way, you will know the risks of each token. Crypto prices are volatile, so strategize so you can get maximum profit in crypto investment.

Bitrue can help you in doing research. You can check prices, convert prices from token prices to USD, and check the latest information on every project in the crypto ecosystem.

by Penny Angeles-Tan | Nov 11, 2024 | Business

Bitcoin has shattered its previous all-time high, reaching over $87,000. With its bullish trend continuing, many are wondering if BTC will hit $100,000 this November. Read on to explore the factors driving Bitcoin’s price surge, its dominance in the crypto market, and what could push it past $100K in the coming months.

Bitcoin breaks its new ATH! Today, Bitcoin price hits over $87,000 with its highest price at $81,844. Will Bitcoin reach $100,000 faster than predicted in Q1 2025? Let’s read the explanation in this article until the end.

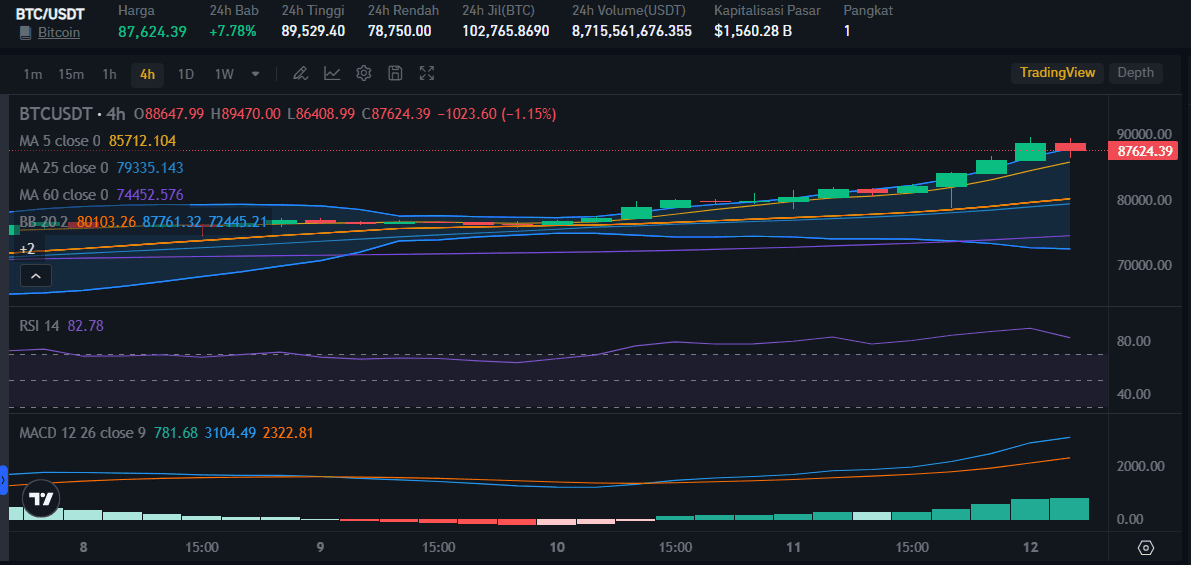

Bitcoin Price Today

On November 12, Bitcoin’s price was $87,624. This increase is fantastic because it has increased by approximately $3,000 from its lowest price of $78,750 in a matter of hours.

The Bitcoin price chart above shows that the BTC RSI value is very high, at 82,78, which could indicate overbought conditions.

The Bitcoin MACD line is far above the limit line which means that a bullish trend is occurring. If this line remains in this condition, Bitcoin will continue its bullish trend not only today and could break through its new ATH again.

Bitcoin and Its Dominance in the Crypto Ecosystem

Today, the crypto ecosystem has varying price conditions for each token. It can be seen that the price of Bitcoin which rose by breaking a new record did not affect other tokens to also rise. BTC’s increase of almost 3% was indeed less than the increase in the price of DOGE which was almost 24%.

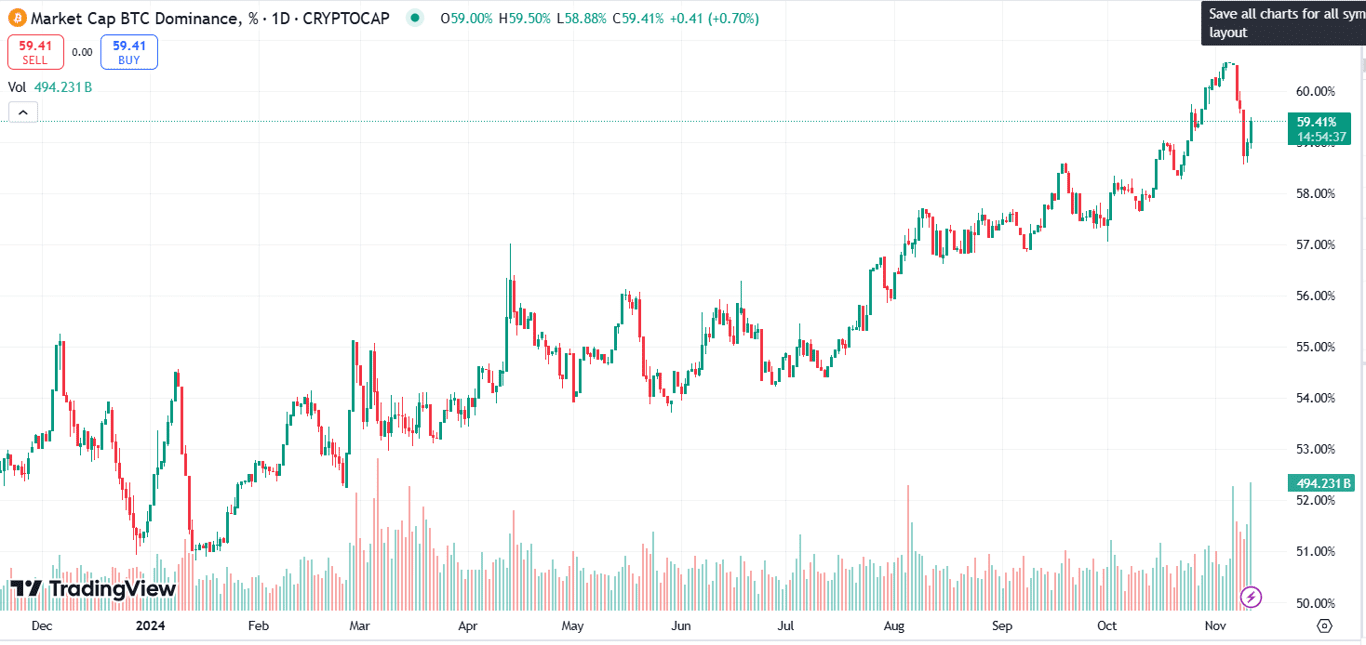

Bitcoin’s dominance in the crypto ecosystem today is 59.42%. A fairly high number because it is more than 50%. However, when compared to the conditions on November 7, BTC dominates at 60.55% which means there is a decrease today.

Conclusion: Reasons for Bitcoin Price Increase

The reason for this drastic increase in Bitcoin prices is predicted to be the reason for Donald Trump’s victory in the US Election this week. Right when Trump dominated voters in various regions of America, the crypto ecosystem even turned green with a price increase that cannot be underestimated in the majority of crypto tokens.

Bitcoin has been recorded to have increased by 35% in the past month and 94% in this year. When Donald Trump is officially inaugurated as the new president of America, the price of Bitcoin and other tokens could experience another promising spike. Especially when Donald Trump really carries out his promise to protect a more stable crypto ecosystem in America.

For those of you who want to buy Bitcoin tokens because you are interested in the price increase, don’t forget to do in-depth research. Bitrue can help you in researching BTC and other crypto tokens. Just visit the Bitrue website and you can check the Bitcoin price to easily do a BTC to USD price convert.

Bitrue also regularly presents articles about crypto that you can read at any time. That way, you will always be up to date on the crypto ecosystem.

by Penny Angeles-Tan | Nov 10, 2024 | Business

Manila, Philippines – NIVEA, your trusted skin care partner, recently marked a significant milestone in its commitment to skin health and well-being by hosting a nationwide raffle. This initiative went beyond simply offering prizes; it was a celebration of care, connection, and the expert solutions NIVEA provides to help you feel your best.

Manila, Philippines – NIVEA, your trusted skin care partner, recently marked a significant milestone in its commitment to skin health and well-being by hosting a nationwide raffle. This initiative went beyond simply offering prizes; it was a celebration of care, connection, and the expert solutions NIVEA provides to help you feel your best.

As a global leader in skincare, NIVEA is dedicated to delivering advanced skin solutions that empower individuals to embrace their own glow. With a focus on fostering community and well-being, NIVEA encourages you to connect with others and enjoy life to the fullest.

The much-anticipated nationwide raffle is still ongoing, providing you with the opportunity to win exciting prizes! As NIVEA continues its mission to reward and celebrate loyal customers, each winner exemplifies the confidence that comes from caring for one’s skin.

Join for a chance to be one of the lucky winners! From October 10 to December 10, 2024, spend ₱500 on NIVEA products for your chance to win a dream trip to South Korea for two (2)!

Unlock More Opportunities to Win with NIVEA

NIVEA has even more thrilling opportunities for you to showcase your skincare passion and potentially score exclusive goodies — share your NIVEA love on social media, and you could be the next lucky winner.

NIVEA has even more thrilling opportunities for you to showcase your skincare passion and potentially score exclusive goodies — share your NIVEA love on social media, and you could be the next lucky winner.

To enter, visit NIVEA’s official Instagram @nivea_ph and find the “Add Yours” template in the 10/10 IG story highlight. Click the “Add Yours” button to create a 30-second video showcasing your favorite NIVEA product and why it deserves a 10 out of 10. Tag NIVEA in your post and include the hashtag #10outof10fromNIVEA.

By participating, you’ll have a chance to win exclusive NIVEA goodies like the NIVEA Intensive Moisture Body Milk, NIVEA Body Extra Bright Radiant & Smooth Lotion, NIVEA Extra Bright Super 10 Body Serum, and more.

The NIVEA Pop-up Booth

NIVEA recently brought its expert skincare advice with its exciting pop-up booths! Visitors enjoyed personalized skin consultations, product demonstrations, and exclusive offers. If you missed the event at SM Mall of Asia and SM North Edsa, you can still experience NIVEA’s 10 out of 10 care through exclusive online offers. A perfect chance to pamper your skin and discover your new favorite products!

Join the NIVEA Squad

Whether you’re a longtime fan or new to the NIVEA family, this is your chance to experience 10 out of 10 care and win amazing prizes. Follow NIVEA on social media and visit their website to learn more about upcoming promos and the latest in skincare innovations. Let NIVEA’s expert care continue to be a part of your daily routine and your special moments.

Whether you’re a longtime fan or new to the NIVEA family, this is your chance to experience 10 out of 10 care and win amazing prizes. Follow NIVEA on social media and visit their website to learn more about upcoming promos and the latest in skincare innovations. Let NIVEA’s expert care continue to be a part of your daily routine and your special moments.

Together, let’s celebrate the power of feeling cared for!

by Penny Angeles-Tan | Nov 9, 2024 | Business

Discover everything you need to know about MemeFi’s upcoming token launch on November 12. Learn about its transition to the Sui Network, the airdrop, and where to buy MEMEFI tokens on global crypto exchanges like Bitrue. Stay updated on the latest developments in the MemeFi ecosystem!

MemeFi is one of Telegram’s tap-to-earn games that will soon launch tokens and circulate on various global crypto exchanges, including Bitrue. This popular mini-game has officially announced its token release date on November 12.

If you are one of the MemeFi players and plan to buy this token when it is listed on a crypto exchange later, you should read this article until the end.

In this article, you will learn everything about MemeFi, from the MemeFi network to estimates of whether MemeFi will reap praise or vice versa like previous Telegram games that launched tokens.

MemeFi’s transition to Sui Network

At the end of October, MemeFi developers made an official announcement that the mini-game was moving to Sui Network from Linea, Ethereum’s layer-2. This announcement was quite surprising because, from the start, MemeFi was built on Linea.

However, the collaboration between MemeFi developers and Mysten Labs, the creator of Sui Network, made the game decide to move networks when its token was launched in the second week of November. Telegram games have been very popular lately.

Many mini-games have launched tokens, such as Notcoin, Hamster Kombat, and Catizen. The majority of token launches from these games are on TON as Telegram’s official network.

The mapping of MemeFi’s plan to launch tokens on the Sui network has indeed stolen attention. However, Telegram supports it. MemeFi’s collaboration on the Sui Network is expected to help the integration between Sui and Telegram even closer so that later various cool collaborations can be created that can be useful for users.

MemeFi Token Launch and Airdrop

This game, launched on Telegram in April 2024, has gained a lot of popularity. There are currently 23,048,161 monthly active users playing MemeFi.

This popularity may be below Hamster Kombat players in terms of numbers, but each unique character in MemeFi makes users feel at home playing it. The large number of users has enlivened the enthusiasm for the launch of the MemeFi token and airdrop on November 12.

As MemeFi’s gratitude to the community that has accompanied it since the beginning, MemeFi will allocate 90% of the total MemeFi tokens to the community in the form of an airdrop.

MemeFi has taken a snapshot for the airdrop on November 6. Later, the final allocation will be distributed by the developer on November 8.

Until now, MemeFi has not officially announced which other crypto exchanges will list the MEMEFI token on November 12. It is planned that Bitrue will enliven the launch of the MEMEFI token later with other global crypto exchanges.

Conclusion

For those of you who can’t wait for the launch of the MEMEFI token, you can visit the Bitrue website to find out the latest developments in the launch of the MemeFi token. When it is officially launched later, you can also directly check the MEMEFI price on the Bitrue website and even find out the price conversion from MEMEFI to USD.

Don’t miss the latest news in the crypto ecosystem. Check out the latest crypto news for free and easily by simply visiting the Bitrue blog.

Manila, Philippines – NIVEA, your trusted skin care partner, recently marked a significant milestone in its commitment to skin health and well-being by hosting a nationwide raffle. This initiative went beyond simply offering prizes; it was a celebration of care, connection, and the expert solutions NIVEA provides to help you feel your best.

Manila, Philippines – NIVEA, your trusted skin care partner, recently marked a significant milestone in its commitment to skin health and well-being by hosting a nationwide raffle. This initiative went beyond simply offering prizes; it was a celebration of care, connection, and the expert solutions NIVEA provides to help you feel your best. NIVEA has even more thrilling opportunities for you to showcase your skincare passion and potentially score exclusive goodies — share your NIVEA love on social media, and you could be the next lucky winner.

NIVEA has even more thrilling opportunities for you to showcase your skincare passion and potentially score exclusive goodies — share your NIVEA love on social media, and you could be the next lucky winner. Whether you’re a longtime fan or new to the NIVEA family, this is your chance to experience 10 out of 10 care and win amazing prizes. Follow NIVEA on social media and visit their website to learn more about upcoming promos and the latest in skincare innovations. Let NIVEA’s expert care continue to be a part of your daily routine and your special moments.

Whether you’re a longtime fan or new to the NIVEA family, this is your chance to experience 10 out of 10 care and win amazing prizes. Follow NIVEA on social media and visit their website to learn more about upcoming promos and the latest in skincare innovations. Let NIVEA’s expert care continue to be a part of your daily routine and your special moments.

You must be logged in to post a comment.