by Penny Angeles-Tan | Dec 1, 2024 | Business

Explore Bitcoin’s recent volatility, key levels, and market dynamics as it approaches $100,000. Learn why the crypto market is down, the role of liquidations, and opportunities in altcoins like CatSlap. Stay informed and navigate the trends confidently!

The cryptocurrency market has once again found itself in the spotlight as Bitcoin experiences significant volatility on its path toward the elusive $100,000 mark. Amid media speculation of a “crypto crash” and panicked retail investors, many are asking: Why is the crypto market down today?

Let’s break down the current trends, market dynamics, and the factors driving these fluctuations, along with a spotlight on emerging opportunities.

Bitcoin’s Recent Performance: A Rollercoaster Ride

Bitcoin (BTC) has been on an unprecedented run, fueled by increasing market confidence and institutional interest. However, over the weekend, the flagship cryptocurrency saw sharp price swings, oscillating between $95,700 and $98,600, before retreating to around $94,000—a drop of nearly 5% in just 24 hours.

The pullback has wiped nearly $200 billion from the total market cap, leaving investors questioning its next move.

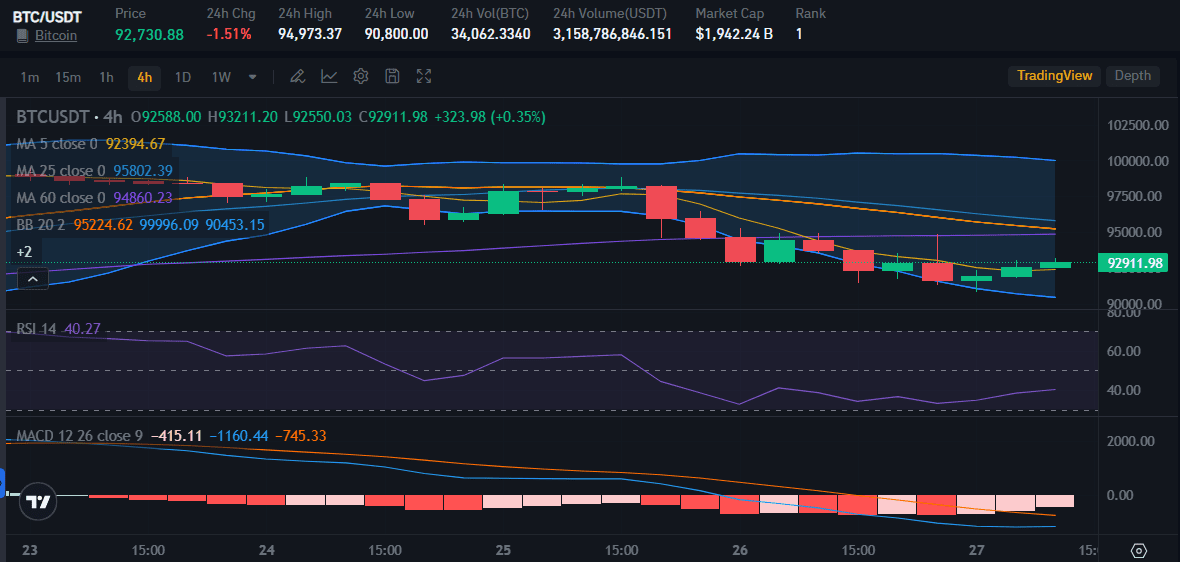

At the time of writing on November 27, Bitcoin price dropped by 1.51% to $92,730 with its highest price in 24 hours being $94,973. BTC RSI value is also below 50 so the selling trend is more dominant than the buying trend.

Key Levels to Watch

1. Resistance: $95,750 – Breaking above this level could pave the way for a return to $98,880 and potentially $100,000.

2. Support: $93,000 and $90,000 – Falling below these levels might signal deeper corrections toward $88,000.

Why Is the Crypto Market Down Today?

Several factors contribute to the current market downturn:

1. Liquidations Fuel the Downtrend

Data from Coinglass shows that over $489 million in long positions were liquidated in the last 24 hours. Bitcoin alone accounted for $56 million of these losses. When leveraged positions are forcibly closed, it increases selling pressure, exacerbating price declines.

2. Profit-Taking Activity

The weekend saw over 74,000 BTC moved to exchanges, with many traders likely taking profits following Bitcoin’s near-$100,000 rally. Such activity, especially during low-volume periods, can amplify price fluctuations.

3. Market Sentiment and Volatility

Despite the downturn, market sentiment remains bullish, with the Fear & Greed Index still indicating “extreme greed” at 82. However, such optimism can sometimes precede corrections as traders reassess their positions.

4. Options Expiry

The upcoming $9.4 billion Bitcoin options expiry has added pressure, with traders repositioning portfolios in anticipation of potential volatility.

The Bigger Picture: Is This a Crash or a Correction?

Contrary to alarmist headlines, this appears to be a natural correction within a larger bull market. Flash crashes and high volatility are common during price discovery phases, particularly at critical psychological levels like $100,000.

1. Whales and Institutional Players Remain Bullish: Large-scale investors, including MicroStrategy, have continued accumulating Bitcoin, signaling long-term confidence.

2. Historical Patterns: Such pullbacks often serve to flush out over-leveraged positions, creating a healthier base for future growth.

Altcoins and Meme Coins in Focus

When Bitcoin experiences a downturn, altcoins often suffer more pronounced losses. However, this environment can also create opportunities in niche markets like meme coins.

Whale Moves in Meme Coins

One standout is CatSlap (SLAP), a new meme coin that has surged by 6,000% since its stealth launch. Key highlights include:

1. Viral Momentum: CatSlap’s clicker game, Slapometer, has driven widespread engagement.

2. Whale Activity: Significant investments from large holders suggest confidence in its potential, with projections for a $100M market cap.

Meme coins like CatSlap often thrive during Bitcoin’s consolidations, as smart money looks for quick gains before the next BTC rally.

What’s Next for Bitcoin and the Crypto Market?

1. Short-Term Outlook

Bitcoin faces immediate resistance at $95,750 and support around $93,000. Breaking these levels could dictate its next move:

- Upside Potential: A breakout above $95,750 could renew bullish momentum, with $100,000 in sight.

- Downside Risk: Failure to hold $93,000 might trigger deeper corrections, with $88,000 as the next key level.

2. Long-Term Outlook

Analysts agree that Bitcoin remains in a long-term bullish trend. Institutional adoption, limited supply, and favorable macroeconomic conditions suggest the $100,000 milestone is a matter of when—not if.

Conclusion: Key Takeaways for Investors

Bitcoin’s journey to $100,000 is a testament to its resilience and growing adoption. While corrections and volatility may test investor nerves, they are also part of the process that paves the way for future growth.

Whether you’re holding Bitcoin or exploring altcoins and meme coins, staying informed and strategic will help you navigate these exciting yet unpredictable markets.

For investors, pay attention to the following three things to stay safe in all crypto market conditions.

1. Don’t Panic Over Corrections: Volatility is inherent to the crypto market. Instead of reacting emotionally, focus on the broader trend.

2. Diversify and Explore Opportunities: While Bitcoin consolidates, altcoins and meme coins like CatSlap may present lucrative short-term opportunities.

3. Stay Updated on Market Events: Keep an eye on developments such as options expiries, whale movements, and institutional investments to make informed decisions.

by Penny Angeles-Tan | Nov 29, 2024 | Business

Justin Sun invests $30M in Donald Trump’s crypto project, World Liberty Financial (WLFI), becoming its largest backer. Explore how this partnership shapes innovation, blockchain, and Trump’s crypto ambitions.

Justin Sun, the founder of the Tron blockchain and a controversial figure in the cryptocurrency space, has become the largest investor in World Liberty Financial (WLFI), a crypto project launched by President-elect Donald Trump.

Sun’s investment of $30 million was confirmed via a post on X, where he expressed his enthusiasm for contributing to innovation and “making America great again.” The investment came through Sun’s crypto exchange HTX, which acquired 2 billion WLFI tokens priced at $0.015 each.

Sun’s investment has brought the project’s total token sales to $52 million, still significantly short of its ambitious $300 million goal.

World Liberty Financial: A Glimpse into Trump’s Crypto Initiative

World Liberty Financial aims to be a decentralized financial platform offering services such as borrowing, lending, and investing in digital assets.

Trump has partnered with the venture through his LLC, DT Marks DEFI, which is entitled to 75% of net revenues once the project surpasses $30 million in sales—a threshold now reached thanks to Sun’s involvement.

Trump is listed as the project’s Chief Crypto Advocate, with his sons Eric, Barron, and Donald Trump Jr. serving as Web3 Ambassadors.

Despite its high-profile backing, the WLFI token’s launch in mid-October faced challenges, including limited sales to non-U.S. persons, U.S.-accredited investors, and nontransferable tokens.

These restrictions have likely hindered broader adoption, with blockchain data showing only about 20,400 unique wallet holders out of over 100,000 whitelisted potential investors.

Early Success and Future Prospects

World Liberty Financial co-founder Zak Folkman expressed optimism following Sun’s purchase, describing it as a testament to the project’s early success.

While the project still has a long way to go to meet its $300 million fundraising target, the recent influx of funds could help drive momentum. Folkman hinted at more significant developments in the coming weeks, suggesting the project is poised for future growth.

The Implications of Trump’s Crypto Involvement

This venture underscores the evolving nature of Trump’s business dealings. Unlike his real estate ventures, World Liberty Financial allows for direct financial contributions, such as Sun’s $30 million purchase, with minimal costs or liabilities for Trump’s LLC.

During Trump’s first presidency, concerns over the “emoluments clause” and foreign governments’ spending at his Washington, D.C. hotel were frequently raised. This new crypto initiative sidesteps those debates by creating a digital financial ecosystem where investments like Sun’s directly benefit Trump’s enterprises.

Justin Sun’s Controversies and Regulatory Landscape

While Sun’s investment aligns with Trump’s campaign promises to make the U.S. a global crypto hub, it also brings scrutiny. Sun and his Tron network have faced regulatory challenges, including a March 2023 lawsuit by the SEC alleging fraud and unregistered securities sales. The SEC also accused Sun of manipulating trading activity to artificially inflate Tron’s price.

Sun denies these allegations, and the broader crypto industry is closely watching how Trump’s administration might reshape regulatory policies. Notably, SEC Chair Gary Gensler has announced his retirement on Inauguration Day, potentially opening the door for a more crypto-friendly approach.

The Future of WLFI and Its Role in the Crypto Landscape

World Liberty Financial aspires to become a major player in the decentralized finance (DeFi) space. However, its path forward depends on addressing the challenges that have limited early adoption, including token transferability and restrictions on U.S. retail investors.

With Trump’s advocacy and Sun’s high-profile investment, WLFI has the potential to attract more significant investments and partnerships. As the project evolves, its ability to meet its lofty goals will hinge on its capacity to deliver a compelling and inclusive financial platform.

Conclusion: A High-Stakes Partnership

Justin Sun’s $30 million investment marks a significant milestone for World Liberty Financial, providing the platform with both credibility and resources. For Trump, it highlights how his foray into crypto could reshape his business model while aligning with his broader vision of deregulation and innovation.

As World Liberty Financial moves forward, its success—or failure—will offer insights into the broader convergence of politics, cryptocurrency, and global finance. The project has set its sights high, and the coming months will determine whether it can achieve its ambitious goals.

If you want to find more news about Donald Trump and his relationship with the crypto ecosystem, the Bitrue blog provides many articles for you to read. You can read articles on the Bitrue blog anytime and anywhere for free.

by Penny Angeles-Tan | Nov 29, 2024 | Business

Ethereum (ETH) surges past $3,545, breaking an 8-month downtrend. Explore bullish predictions, DeFi dominance, NFT trends, and key resistance levels driving its growth. Learn more now!

Ethereum (ETH), the world’s second-largest cryptocurrency, is experiencing a significant surge in price. After breaking out of an eight-month downtrend, ETH has climbed over 6% today, reaching $3,545. This rally follows a strong week with an 11.1% rise and a staggering 41% gain in the last 30 days.

Analysts Are Bullish on Ethereum’s Future

Analysts are optimistic about Ethereum’s future, predicting it could reach over $4,800 during this cycle. Several factors contribute to this bullish sentiment:

1. Technical Breakouts: ETH has broken free from a descending channel and descending triangle pattern, indicating potential for further price increases. Analysts have set targets as high as $4,700, bringing it close to its all-time high of $4,878.

2. Strong Momentum Indicators: Technical indicators like the Relative Strength Index (RSI) reaching 70 and Ethereum outperforming its moving averages suggest a robust upward trend.

3. Potential Golden Cross: A Golden Cross, where the short-term moving average crosses above the long-term one, is another bullish signal on the horizon.

Ethereum’s Dominance in DeFi

Ethereum remains a dominant force in the cryptocurrency space. It accounts for over half of the total value locked (TVL) in DeFi, solidifying its critical role in the ecosystem. Additionally, the success of ETH-based layer-two solutions further strengthens its position.

Possible Boost from Favorable Regulations

The possibility of pro-crypto legislation under the incoming Trump administration could also benefit Ethereum. If implemented, such policies could accelerate its growth and align its market price with its perceived intrinsic value.

Recent Price Action and Upcoming Resistance Levels

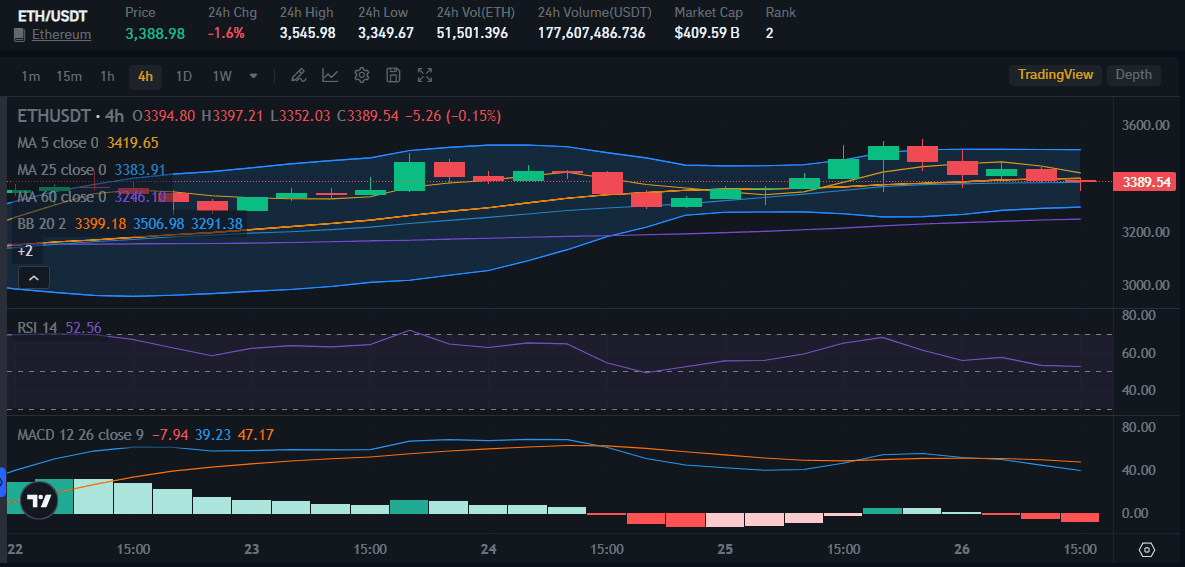

At the time of writing this article on November 26, Ethereum is priced at $3,388, which means it has decreased by 1.6% with its highest price being $3,545 in the last 24 hours.

Despite the price decrease, Ethereum’s RSI value is above 50, which means there is still hope for a price increase in the near future because the ETH buying trend is still dominant compared to the selling trend.

Increased weekend buying pressure and potential rotation away from Bitcoin have pushed Ethereum prices up. Analysts suggest a 30% rally is possible if ETH maintains bullish pressure above the key $3,400 level.

A successful break above $3,400 could see prices surge towards $4,189 and potentially reach $4,862.

NFT Market Update

While NFT sales have dipped slightly from the previous week, the overall trend remains positive, with a total volume of $158 million.

Ethereum remains the top network for NFT sales, followed by Solana. Interestingly, Solana is witnessing a surge in the number of NFT buyers.

Analyst Predictions on Altcoins

Popular analyst Altcoin Sherpa believes Ethereum might be nearing a cycle bottom relative to Bitcoin (ETH/BTC). He expects altcoins, including XRP, to perform well after Bitcoin completes its current rally.

Overall, Ethereum’s outlook is positive. With strong technical indicators, a dominant position in DeFi, and potential tailwinds from regulations, ETH seems poised for further growth.

Key Factors Driving Ethereum’s Growth

As Ethereum continues its bullish momentum, its dominance in the crypto market remains undeniable. Its robust network, extensive developer community, and innovative applications have solidified its position as a leading blockchain platform.

1. Layer-2 Solutions: The emergence of layer-2 solutions like Arbitrum and Optimism has significantly improved Ethereum’s scalability and transaction speed, addressing one of its major limitations.

2. DeFi Ecosystem: Ethereum remains the backbone of the decentralized finance (DeFi) ecosystem, offering a wide range of financial services, from lending and borrowing to derivatives trading.

3. NFT Market: Ethereum has a significant presence in the NFT market, with many popular NFT collections being minted and traded on the platform.

4. Institutional Adoption: Increasing institutional interest in Ethereum, with major financial institutions and corporations exploring blockchain technology, has further bolstered its credibility.

Potential Challenges and Risks

While Ethereum’s future looks promising, it’s important to acknowledge potential challenges and risks:

1. Network Congestion: Despite layer-2 solutions, Ethereum’s network can still experience congestion during peak times, leading to increased transaction fees.

2. Competition from Other Blockchains: Emerging blockchains like Solana and Cardano are vying for market share, offering faster transaction speeds and lower fees.

3. Regulatory Uncertainty: Regulatory uncertainty surrounding cryptocurrencies can impact the overall market sentiment and investment flows.

Conclusion

Ethereum’s strong fundamentals, coupled with its active developer community and growing ecosystem, make it a compelling investment opportunity. However, as with any investment, it’s essential to conduct thorough research and consider the potential risks involved.

You should always do thorough research before investing in the crypto ecosystem even if you are buying a leading token like Bitcoin, Ethereum, or Solana. Do your research using the features of the Bitrue website that you can access for free.

by Penny Angeles-Tan | Nov 27, 2024 | Business

Learn 7 essential strategies to navigate cryptocurrency market crashes. Stay calm, assess market factors, embrace volatility, and protect your investments in this unpredictable yet promising digital asset space.

Cryptocurrency markets are notorious for their volatility. Prices can surge to new highs only to plummet shortly after, leaving investors and traders grappling with uncertainty.

Recent developments, including the approval of a spot Bitcoin ETF and the approaching Bitcoin halving in 2024, have boosted market sentiment, with Bitcoin reaching a record high on March 5, 2024. Yet, the history of crypto tells us that dramatic crashes can follow significant rallies.

To successfully navigate this unpredictable market, investors must understand the factors driving volatility, assess their investment strategies, and prepare for potential downturns.

What Drives Cryptocurrency Volatility?

There are many factors why the crypto market has fluctuating prices. Some of them are as explained below.

1. Market Sentiment and Speculation

Cryptocurrency prices are heavily influenced by trader sentiment. With no intrinsic cash flow to support valuations, cryptos rely on market perception and speculation. This makes them vulnerable to swings between optimism and despair.

For instance, Bitcoin fell nearly 23% in four days in June 2023, while Ethereum plunged 31%. Such movements attract professional traders using advanced algorithms but can be nerve-wracking for individual investors.

2. Macroeconomic Factors

Rising inflation, higher interest rates, and liquidity tightening by central banks can impact riskier assets like crypto. For example, the Federal Reserve’s decision to reduce monetary stimulus in 2021 triggered a prolonged downturn in the crypto market.

3. Regulatory Actions

Governments and regulatory agencies, such as the SEC, play a significant role in shaping the crypto landscape. Decisions to ban crypto-related services or enforce stricter controls, as seen in China’s crackdowns in 2017 and 2021, have caused significant price drops.

4. Institutional Moves and Market Events

Large-scale institutional activities and derivatives expiries can introduce volatility. Recent outflows from Bitcoin ETFs, contrasting with inflows into others, reveal divided market sentiment.

Additionally, catastrophic events like the collapse of FTX in 2022 ripple through the market, affecting not only exchanges but also coins and companies connected to them.

Has Crypto Crashed Before?

Yes, the crypto market has seen multiple crashes:

1. December 2017: Bitcoin peaked near $20,000 before falling below $3,500 by the end of 2018.

2. November 2021: Bitcoin’s record high of $69,000 was followed by a 75% drop within a year.

Each crash underscores the importance of cautious investing and diversification.

What Should Investors Do During a Market Crash?

To keep your financial condition safe when investing in the crypto ecosystem, you can do these 7 things when the crypto market is experiencing a decline.

1. Stay Calm and Avoid Emotional Decisions

When prices plummet, panic selling can lead to substantial losses. Instead, revisit your reasons for investing. Are you in for the long-term opportunity, or are you looking for short-term gains? This clarity will help you make rational decisions.

2. Assess the Situation

Analyze the root causes of the crash. Is it a regulatory development, macroeconomic factor, or market rumor? Understanding the context allows you to respond strategically rather than react impulsively.

3. Embrace Volatility

Volatility is inherent to the crypto market and attracts traders seeking profit opportunities. While nerve-wracking, it can also be lucrative if approached with a clear strategy.

4. Reevaluate Your Portfolio

Decide whether to buy more during dips, hold, or exit the market. Ensure these choices align with your financial goals and risk tolerance.

5. Use Secure Storage

With exchange collapses being a recurring risk, consider transferring assets to a secure crypto wallet. Both online and offline options exist, offering varying degrees of security.

6. Invest What You Can Afford to Lose

Crypto is a high-risk asset class. A general rule is to limit crypto investments to no more than 10% of your overall portfolio.

7. Maintain an Emergency Fund

An emergency fund ensures that you’re not forced to liquidate investments during unfavorable market conditions.

Conclusion: Preparing for the Future

With events like the Bitcoin halving and continued institutional interest, the crypto market holds potential for long-term growth. However, its unpredictable nature calls for a balanced approach:

- Diversify your portfolio across traditional and alternative assets.

- Keep updated with market developments and regulatory changes.

- Stick to a disciplined investment strategy, focusing on long-term goals.

Cryptocurrency investment is not for the faint of heart, but with the right strategies, it can be a rewarding part of a diversified portfolio. By understanding the market’s dynamics and preparing for its inherent risks, investors can navigate the turbulence and seize opportunities in this evolving space.

by Penny Angeles-Tan | Nov 25, 2024 | Beauty

Montesa Medical Group (MMG) has officially launched its highly anticipated Aesthetic Center at The Manila Hotel, solidifying the group’s commitment to providing advanced dermatology and age management services. The blessing and grand opening event, held on November 11, 2024, drew an esteemed gathering of MMG’s partners, industry leaders, and loyal clients, reflecting the strong support for MMG’s vision of beauty and wellness innovation.

The event commenced with a ribbon-cutting ceremony at the center’s serene location with The Manila Hotel’s Spa area, inviting guests to experience the center’s luxurious ambiance and state-of-the-art facilities. Designated to deliver an immersive and transformative aesthetic experience, the new center is poised to redefine beauty care for clients seeking sophisticated and natural-looking results.

Dr. Anna Marie Montesa

Dr. Anna Marie Montesa, President, CEO, and Medical Director of MMG, captivated attendees with a keynote address that highlighted the center’s extensive range of offerings—from advanced, non-invasive treatments to personalized skincare regimens.

The new MMG Aesthetic Center at The Manila Hotel offers a wide range of cutting-edge treatments and procedures tailored to address diverse aesthetic concerns. As Dr. Anna Marie Montesa, the visionary founder of MMG, explains, “We are excited to bring our expertise and state-of-the-art technologies to the Manila Hotel. Our goal is to empower individuals to look and feel their solutions that cater to their unique needs.”

Featured treatments include: the Cuter Titan, which promotes collagen production for firmer, younger-looking skin, and the Cutera Laser Genesis, renowned for improving skin texture and reducing redness.

The center also offers Ultratherapy, the gold standard in skin lifting and the only FDA-approved non-invasive treatment in its category, alongside Exilis Ultra for precise skin tightening and EMS Body Sculpting, which builds muscle and burns fat for a toned physique.

MMG specializes in skin rejuvenation with treatments like MMG Exosomes, Angel Lift, and liquid facelifts to achieve plump, youthful skin. The MMG Whitening Peel effectively fades spots and regulates pigmentation as its source, preventing recurrence and ensuring long-term results.

Dr. Montesa reaffirmed MMG’s dedication to client-centered care, underscoring the center’s role as a leader in delivering effective, innovative solutions for every unique beauty and wellness need.

Joey Lina, Manila Hotel President

Atty. LJose D. Lina, Jr., President of The Manila Hotel, also shared his excitement about the collaboration, emphasizing the mutual commitment to unparalleled service and excellence that both institutions uphold.

Nestled within the iconic surroundings of The Manila Hotel, Montesa Medical Group Aesthetic Center is set to become a premier beauty destination, blending elegance, expertise, and a commitment to achieving naturally radiant results.

The new center marks a milestone for MMG as it expands its footprint alongside its established branches at Tomas Morato Quezon City and Ayala Mall Circuit Makati, continuing its pursuit of excellence in natural-looking aesthetic and wellness solutions. Embrace timeless beauty at Montesa.

You must be logged in to post a comment.