by | Jun 23, 2025 | Business

Manila, Philippines — June 23, 2025 — Taxumo, the trusted online tax filing platform, has partnered with Cebuana Lhuillier, one of the Philippines’ largest and leading microfinancial services provider, to empower Filipino entrepreneurs through accessible business loans and empower MSMEs with simplified tax compliance.

A Partnership Rooted in Empowerment

“Filipino entrepreneurs face unique challenges, from complex tax regulations to limited access to financing. This partnership brings together the strengths of Taxumo’s seamless tax filing system and Cebuana Lhuillier’s trusted loan offerings to provide a holistic support system,” said Geraldine Arboleda, CEO at Taxumo.

For Cebuana Lhuillier, the partnership is an extension of its long-standing mission to uplift underserved sectors. “For over 35 years, we’ve helped Filipinos access financial tools once out of their reach. This collaboration with Taxumo is a powerful next step—connecting the dots between financial access and responsible business growth. It’s about fueling ambition, and backing that ambition with real, timely support,” said Jean Henri Lhuillier, President & CEO of Cebuana Lhuillier.

Taxumo subscribers can now apply for Cebuana Lhuillier’s Microbusiness Loan directly through the Taxumo platform, allowing for a streamlined process that integrates income verification and loan application in one place.

Loan Offerings Tailored to Entrepreneurs’ Needs

Cebuana Lhuillier’s Microbusiness Loan caters to diverse business needs, including working capital, inventory financing, equipment purchases, and short-term cash flow support. Key features include:

Exclusive benefits for Taxumo users include priority loan processing and reduced documentation requirements, recognizing their commitment to responsible business management.

Driving Real Growth for Filipino Entrepreneurs

This partnership is already making an impact for many, from sari-sari store owners to ride-hailing drivers, providing timely access to capital that helps businesses restock, upgrade equipment, and manage cash flow gaps.

Cebuana Lhuillier guarantees strict data privacy, transparency in lending terms, and ethical collection practices, with ongoing financial education through their Kanegosyo Center —a dedicated hub that offers free training, resources, and mentorship to help micro and small business owners grow and sustain their enterprises. Taxumo subscribers are encouraged to explore this opportunity to unlock the financing they need to elevate their businesses.

For more information, visit www.taxumo.com or Taxumo’s Instagram, Facebook, and Tiktok Pages.

by | Jun 22, 2025 | Business

Ethereum teeters near $2,500 amid rising sell pressure, DeFi outflows, and geopolitical chaos. With options expiry looming and ETH/BTC at a critical level, is a breakout, or breakdown, inevitable?

Ethereum (ETH) has returned to a pivotal support level around $2,500, following a convergence of bearish catalysts, ranging from declining investor activity and rising technical resistance to geopolitical instability and market-wide liquidations.

As the market braces for continued volatility, analysts are watching both the ETH/BTC ratio and global risk factors for signs of what’s next.

Options Expiry Spurs Volatility Ahead of Key Price Decisions

One of the most immediate sources of price tension is Ethereum’s upcoming options expiry. With more than 56,000 ETH contracts set to expire on June 21, split between approximately 33,000 call options and 23,500 puts, traders are positioned for significant price action.

According to data from Laevitas, much of the open interest is concentrated near current price levels. This alignment raises the likelihood of ETH gravitating toward the “max pain” point, where the highest number of options expire worthless, amplifying short-term volatility.

Investor Confidence Wanes as DeFi Outflows Accelerate

Ethereum’s Total Value Locked (TVL) in decentralized finance (DeFi) has dropped from 28 million ETH in early May to just over 25 million, representing a 10% contraction in six weeks.

The rapid outflow, highlighted by DefiLlama, signals either profit-taking behavior or a shift in capital to other chains or assets.

This cooling enthusiasm across DeFi platforms suggests speculative capital is retreating, with investor sentiment shifting from growth to caution.

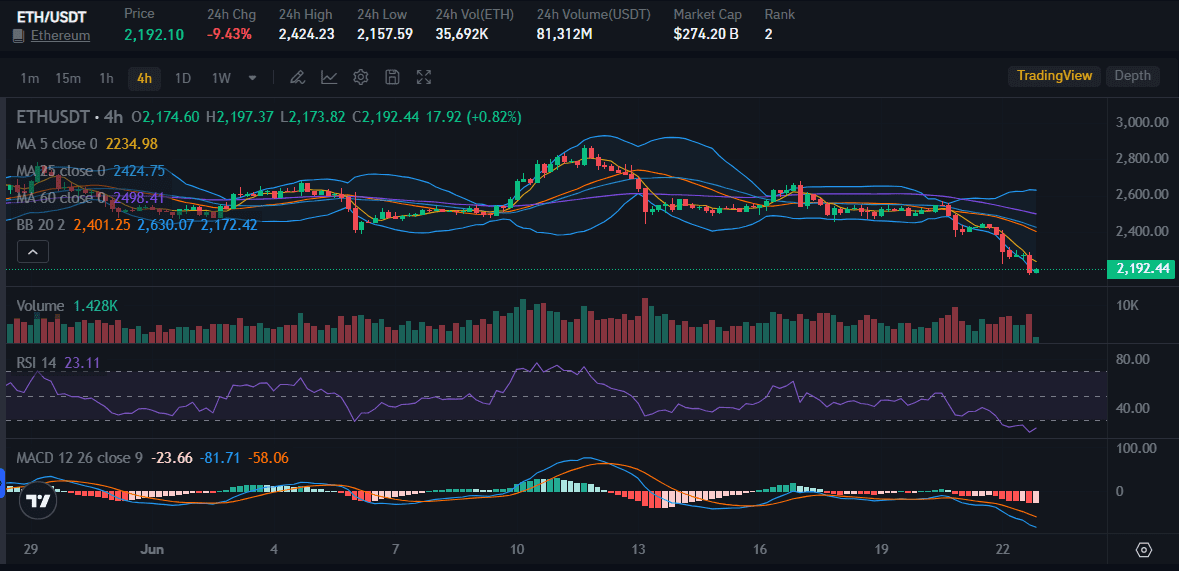

Technical Headwinds Limit Recovery Attempts

ETH’s price has struggled to breach the $2,565 resistance, which coincides with the intersection of the 100-day and 200-day Simple Moving Averages (SMA). After a brief attempt to rally, ETH was rejected and fell back below $2,500, prompting fears of a deeper correction.

Heightened trading volume during the recent decline further supports a sell-off narrative. Analysts are now watching key levels:

- Support: $2,475 and $2,385

- Resistance: $2,525 and $2,700

A confirmed break below support could trigger a slide toward $2,385, while a push above $2,525 might renew bullish momentum.

ETH/BTC Ratio at Crucial Turning Point

The ETH/BTC ratio is another crucial metric. Analyst M-log1 noted the ratio has approached a long-tested support line, with bulls defending it eight times in recent weeks. With seller momentum fading, there’s an 80% probability of a breakout to the upside, M-log1 estimates.

If ETH begins outperforming BTC, this could usher in a broader altcoin rally, a sentiment echoed by analyst Daan, who pinpoints 0.026 BTC as a breakout threshold for Ethereum dominance.

Macro Risks: Middle East Tensions and U.S. Policy Add Fuel to the Fire

Ethereum’s price weakness is also unfolding against a backdrop of mounting geopolitical tension and restrictive monetary policy. Bitcoin has already plunged below $100,000 (a psychological and technical threshold) after the U.S. and Israel bombed Iran, with fears the conflict could expand regionally.

Compounding this, Iran’s parliament has reportedly approved closing the Strait of Hormuz, which handles 20% of global oil traffic. A complete shutdown would not only spike oil prices but also dent global risk appetite, historically bad news for crypto assets.

ETH Exchange Activity Suggests Bearish Tilt — But Long-Term Accumulation Grows

Ethereum has seen four straight days of net inflows to centralized exchanges, totaling 285,000 ETH, according to CryptoQuant.

This trend indicates sustained sell-side pressure. Meanwhile, futures open interest surged by 720,000 ETH, likely driven by short positions, contributing to over $163 million in ETH liquidations in just 24 hours.

Still, structural signs remain encouraging:

- Accumulation addresses (wallets with no history of selling) have grown by 5 million ETH in June.

-

Staked ETH has reached a record high of 35.1 million, with 500,000 ETH added in just two weeks.

-

New Ethereum addresses are rising, hitting 800K–1M weekly.

These trends suggest long-term confidence remains intact, even as short-term traders adjust to volatile conditions.

Chart Watch: ETH Poised at Triangle Apex

ETH is approaching the apex of a symmetrical triangle, bounded above by the 200-day SMA and below by the 50-day EMA. A decisive breakout could define Ethereum’s next leg:

- Bullish breakout: Targets $2,850 and possibly $3,000.

-

Bearish breakdown: Risks retesting support near the 100-day SMA.

Technical indicators like the RSI and Stochastic Oscillator lean bearish, but neither is deeply oversold, suggesting room for further downside before a rebound.

Conclusion: Ethereum at a Crossroads

Ethereum stands at a defining moment. Despite clear signs of short-term bearish momentum, critical support at $2,400 has not yet broken. Meanwhile, ETH’s correlation to Bitcoin and global risk sentiment remains high, with the ETH/BTC ratio potentially triggering a larger altcoin recovery, or collapse.

In the days ahead, traders and investors should closely monitor:

- Options expiry outcomes

- $2,400 support and $2,700 resistance

- ETH/BTC ratio movement

-

Geopolitical developments and oil prices

If Ethereum can hold its ground and break above $2,700, the path toward $3,000 remains viable. But failure to do so, especially in a risk-off environment, could spark a deeper retracement.

by | Jun 22, 2025 | Business

Europe takes the lead in the global crypto market with MiCA regulation, as U.S. retail activity declines and Trump’s high-stakes crypto deals raise questions. Discover how EU clarity is beating American uncertainty.

Europe is quietly winning the global crypto war. With the implementation of the Markets in Crypto-Assets (MiCA) regulation at the start of 2025, the European Union has taken a commanding lead over the United States, despite President Donald Trump’s public endorsement of crypto.

As American retail activity slows and legal uncertainty drags on, Europe’s unified framework is unleashing a new wave of institutional and retail investment.

MiCA Triggers a Surge in EU Trading Volumes

According to Paybis co-founder Konstantins Vasilenko, trading volumes from European Union customers jumped an astonishing 70% quarter-over-quarter in Q1 2025, right after MiCA officially took effect on January 1.

This spike wasn’t about frequency, it was about volume. “The number of trades hardly moved,” Vasilenko said, suggesting larger and more deliberate investments from newly confident investors.

Meanwhile, crypto activity in the U.S. moved in the opposite direction. Platforms like Robinhood reported a 35% drop in crypto trading, and Coinbase saw retail participation shrink to just 18% of total spot trading volume, down from 40% in 2021.

“The timing is hard to ignore,” Vasilenko added.

What MiCA Gets Right: Clarity, Consistency, and Confidence

The MiCA framework introduces a single licensing regime across all 27 EU member states. Once licensed in one country, crypto firms can operate across the entire bloc, giving companies scalability and investors peace of mind.

Several major platforms have already secured MiCA licenses.

Beyond licensing, MiCA implements a series of investor protections modeled on Europe’s financial instruments directive (MiFID), including:

- Clear disclosures

- Cooling-off periods

- Transparent fee structures

-

Full-reserve requirements for stablecoins

-

Independent audits and asset segregation

These policies have significantly reduced regulatory ambiguity and restored investor confidence in the EU crypto market.

France Leads, Germany Builds, Netherlands Connects

France has emerged as a clear standout within Europe, thanks to its early 2019 PACTE law, which laid the groundwork for MiCA. Paybis reported a 175% increase in crypto activity in France in Q1 2025.

Fintech hubs like Station F and the proactive approach by France’s financial regulator AMF are helping crypto adoption soar, with national crypto usage expected to reach 24% penetration this year.

Elsewhere:

- Germany is building institutional infrastructure, with Deutsche Boerse’s Clearstream preparing to offer crypto settlement.

-

The Netherlands stands out for its robust payment systems and strong connectivity in the digital asset space.

As Vasilenko notes, “Liquidity pools in Frankfurt or Paris, customer support in Dublin, and compliance ops in Vilnius — all under the single MiCA umbrella.” The idea of a single “crypto hub” is becoming obsolete.

U.S. Falls Behind Despite Trump’s Rhetoric and High-Profile Crypto Ventures

While Europe builds, the U.S. dithers. Despite vocal support from Donald Trump and select members of Congress, the country still lacks cohesive federal crypto legislation. Regulatory uncertainty has paralyzed both investors and institutions.

As Vasilenko puts it: “State-by-state money-service licenses, unresolved SEC lawsuits, and sudden delistings mean ordinary users still can’t tell which coins, or even which staking products, will be available next month.”

Even Trump’s own crypto dealings appear mired in opacity.

Trump’s Crypto Empire: Bold Moves, Quiet Sales

Trump launched World Liberty Financial in September 2024, promising a “financial revolution.” The venture sold tokens with controversial terms, tokens couldn’t be resold, and 75% of proceeds after the first $30 million reportedly went to Trump and his family.

By early 2025, the Trumps and their partners had sold over $750 million worth of tokens. A new stablecoin, pegged to the U.S. dollar, attracted a $2 billion investment from a UAE firm. Yet behind the scenes, the Trumps began quietly divesting:

Their stake in World Liberty fell from 75% to 60% in January, then down to 40% by mid-June, according to subtle changes on the company’s website.

If World Liberty is valued similarly to Circle, whose stock tripled after going public, Trump’s divestments could have netted $135 million personally.

This aligns with Trump’s renewed focus on monetary policy. He recently attacked Fed Chair Jerome Powell, calling him a “moron” and a “numbskull,” and hinted he may fire him if interest rates don’t come down. His criticism comes amid a record $37 trillion U.S. debt load and rising interest payments.

Glimmers of Hope: The GENIUS Act and Stablecoin Reform

There may still be hope for the U.S. crypto scene. The GENIUS Act, now moving through Congress, could create a federal licensing regime and clear definitions for stablecoins, potentially echoing Europe’s MiCA.

If passed before the end of 2025, Vasilenko believes the law “would do for U.S. retail what MiCA just did for Europeans.”

Meanwhile, Circle’s successful public debut has reignited interest in crypto’s mainstream potential. The Senate recently passed a stablecoin regulatory bill, and markets are now eyeing Federal Reserve action in July, which could trigger a fresh Bitcoin rally.

Bitcoin Holds Strong Above $100K Amid Macro Uncertainty

Bitcoin has remained resilient, trading above $100,000, despite geopolitical risks and volatility. Analysts say its performance underscores its growing status as a safe-haven asset, similar to gold.

As Elliot Johnson of Bitcoin Treasury Corporation puts it, “Bitcoin’s recent strength… is a testament to its growing appeal as a long-term treasury asset.”

David Hernandez of 21Shares agrees: “Bitcoin’s fundamental properties—its scarcity, decentralization, and neutrality, make it an increasingly relevant asset for navigating an uncertain future.”

Conclusion: The Regulatory Divide Is Reshaping the Global Crypto Map

As Europe pushes forward with MiCA, and the U.S. grapples with internal divisions and politically charged ventures, the crypto balance of power is shifting.

While Trump’s brand may still move markets, it is Europe’s clarity, coordination, and consumer protections that are winning investor trust.

For now, Europe has the edge. But if Washington can unify around a framework like GENIUS, the race may soon become competitive again.

by | Jun 22, 2025 | Business

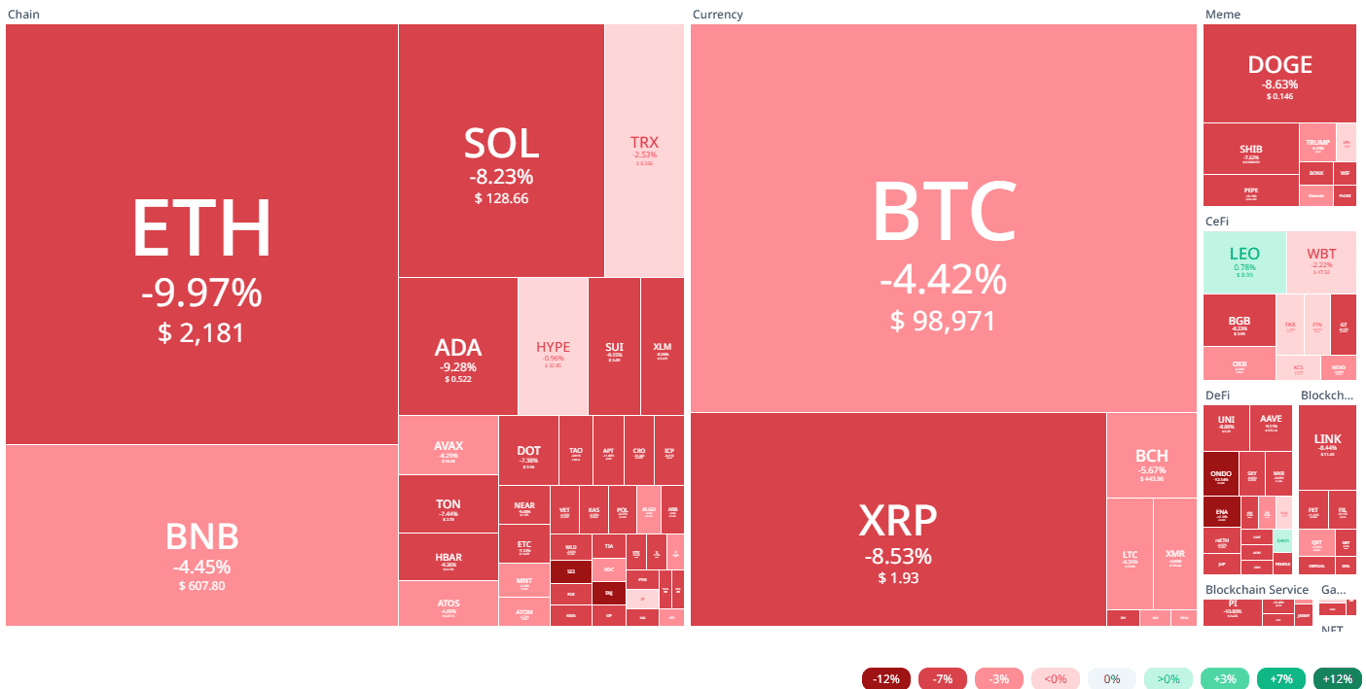

The crypto market plunged as the U.S. and Israel launched airstrikes on Iran’s nuclear sites, sending Bitcoin below $100K and triggering over $1B in liquidations. Rising geopolitical tensions and inflation fears spark panic selling across digital assets.

The cryptocurrency market experienced a dramatic downturn over the weekend as geopolitical tensions erupted following the U.S. and Israel’s coordinated airstrikes on Iran’s nuclear facilities.

Bitcoin plummeted below the critical $100,000 threshold, and major altcoins followed suit, triggering mass liquidations and sparking fear across risk markets.

Tensions Ignite: U.S. Bombs Iranian Nuclear Sites

On Sunday, June 22, the global geopolitical landscape was rocked after the United States, under orders from former President Donald Trump, joined Israel in launching targeted airstrikes on three Iranian nuclear sites, Fordow, Natanz, and Isfahan.

Trump declared the mission a “complete and total success,” aiming to dismantle Iran’s nuclear enrichment infrastructure. Iran, meanwhile, vowed swift retaliation, deepening fears of a broader Middle East conflict.

According to the New York Times, this military action dramatically escalates tensions in a region already teetering on the brink, prompting immediate shockwaves across financial markets, especially crypto.

Crypto Market Turns Red: Bitcoin Breaks Below $100K

The crypto market reacted instantly to the news. Within hours of the airstrikes, Bitcoin’s price crashed by over 4%, falling from a stable $103,000 to as low as $98,971. This marks the first time in over 40 days that BTC traded below the $100K psychological support level.

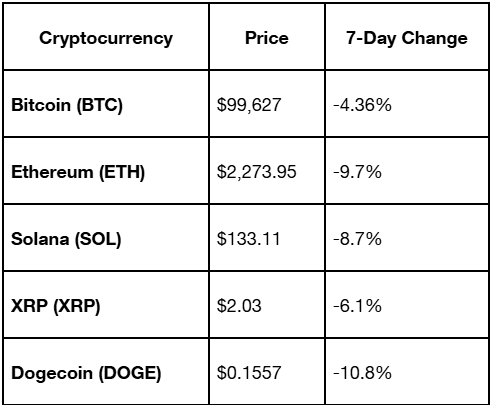

Key Crypto Price Drops:

Virtuals Protocol, Celestia (TIA), Aptos (APT), and AB were among the hardest-hit altcoins, all losing over 9% in the past 24 hours.

Massive Liquidations and Market Fear

CoinGlass data revealed that total liquidations surged by 38% to over $682 million in a 24-hour span, with $1 billion in total crypto value wiped out across exchanges. Most of the liquidations targeted high-leverage positions in Bitcoin, Ethereum, and Solana.

The fear was palpable. Trading volume in Bitcoin spiked over 33%, indicating that panic selling—not normal trading, was driving the market activity. Altcoin segments such as AI tokens, including FET and VIRTUAL, lost nearly 10%, while Cardano (ADA) approached a three-month low.

Why Did Crypto Crash? Two Core Reasons

1. Risk-Off Sentiment Amid Geopolitical Uncertainty

Historically, major geopolitical events trigger a “risk-off” sentiment in financial markets. Investors flee from volatile, riskier assets—like crypto and equities—and pile into safe-haven assets such as gold, the U.S. dollar, and government bonds.

Hanain Malik of Tellimer told Bloomberg:

“Short-term, markets such as crude oil, stocks, and crypto will pivot on whether Iran retaliates and widens the war in a way that impacts oil supply versus backing down and offering concessions on its nuclear program.”

2. Inflation and Fed Policy Concerns

Oil prices surged following the strikes, with Brent crude and WTI up over 32% from yearly lows. Shipping costs are also climbing, signaling that U.S. consumer inflation could spike again. This would pressure the Federal Reserve to maintain higher interest rates longer than previously expected.

Last week, the Fed kept rates steady at 4.25%–4.50% and hinted at two rate cuts in 2025. But surging oil and inflation fears could derail those plans, which is bearish for crypto, as digital assets tend to perform better in low-rate environments.

Market Outlook: What’s Next?

With Bitcoin hovering just above $99,000 and Ethereum sliding below $2,300, traders are bracing for more volatility in the coming days. Analysts warn that if Iran retaliates, Bitcoin could dip to $95K or even lower.

The next 48 hours are critical. Any signal of an Iranian counterstrike or prolonged conflict could intensify the sell-off. On the flip side, a diplomatic de-escalation could provide temporary relief and possibly trigger a market rebound.

Conclusion

The U.S.-Iran conflict has once again highlighted the vulnerability of crypto markets to macro and geopolitical shocks. As tensions escalate, traders and investors are adopting a cautious stance.

With more than $1 billion wiped out in a day and sentiment turning defensive, the crypto market enters a critical phase.

All eyes are now on Tehran and Washington. The outcome of this standoff may determine whether Bitcoin finds a new floor—or continues its descent below five-digit territory.

by | Jun 22, 2025 | Business

Bitcoin’s current rally is drawing eerie comparisons to 2017, but Real Vision CEO Raoul Pal believes this crypto cycle could stretch into 2026. Meanwhile, rising geopolitical tensions in the Middle East and fears over oil disruptions are sending shockwaves through global markets and triggering high volatility across BTC, ETH, and XRP.

The crypto market is undergoing a storm of macroeconomic momentum and geopolitical shockwaves, prompting analysts to draw parallels with previous bull cycles, most notably the landmark rally of 2017.

Raoul Pal, CEO of Real Vision and former Goldman Sachs executive, believes that the current environment shares “spooky” similarities to 2017, yet is also setting the stage for an even longer and more volatile crypto cycle, potentially stretching into 2026.

Simultaneously, escalating Middle East tensions, fueled by a sudden U.S.-Israel-led strike on Iranian nuclear facilities, have sent shockwaves through global markets.

The aftermath has triggered dramatic price swings in Bitcoin, Ethereum, XRP, and broader risk assets, while threatening global oil supply and further inflaming inflation fears.

Bitcoin’s Trajectory Echoes 2017, But the Cycle May Be Extended

According to Pal, Bitcoin’s current market behavior eerily mimics the trend seen in 2017, when BTC climbed steadily throughout the year before its historic December breakout. In 2017, Bitcoin soared from $1,044 in January to $14,156 by December, a staggering 1,255% gain.

However, this time may be different. Pal emphasizes that macroeconomic indicators, especially his “business cycle score”, signal we’re still early in the broader economic upcycle, and that could extend the crypto bull run for years.

“It’s spookily similar to 2017,” Pal said. “But this cycle could go longer, possibly into Q2 2026, especially with the weakening U.S. dollar acting as a tailwind.”

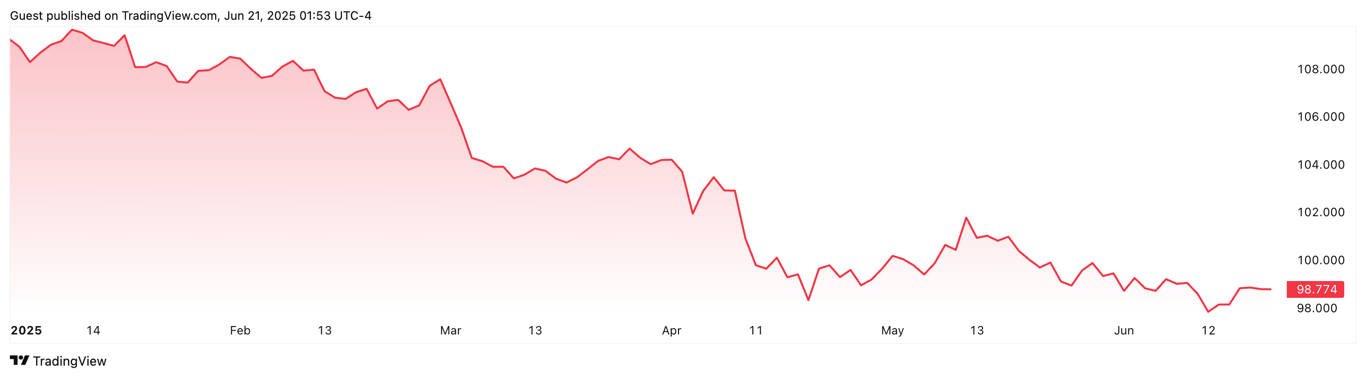

Indeed, since the start of 2025, the U.S. Dollar Index (DXY) has dropped nearly 9%, sitting at 98.77, making Bitcoin more attractive as both a speculative asset and a potential hedge against fiat debasement.

Macro Tailwinds and Institutional Adoption Fuel Market Optimism

Pal pointed out that macro forces, especially delayed interest rate adjustments and a stagnating dollar throughout much of 2024, have caused the crypto cycle to shift and potentially expand.

“The whole cycle got shifted because rates didn’t get adjusted,” he noted. “This looks more like 2020 than 2021, it feels like the earlier stages of a bull market.”

Meanwhile, the Middle East is rapidly emerging as a crypto hub. On a recent trip to the region, Pal met with several Sovereign Wealth Funds across Saudi Arabia, UAE, Bahrain, and Qatar. Their verdict?

“The mandate across the region is clear: AI and blockchain. Governments aren’t just investing in Bitcoin, they’re building entire infrastructures on the blockchain,” Pal reported.

This growing institutional interest suggests that long-term capital is entering the space, potentially cushioning crypto against the typical boom-bust patterns.

Chaos in the Middle East: War and Oil Choke Points Shake Crypto

However, just as macro tailwinds offered optimism, geopolitical tensions have rattled investor confidence.

On Saturday, the U.S., alongside Israeli forces, launched coordinated strikes on Iranian nuclear facilities in Fordow, Natanz, and Isfahan. In retaliation, Iran fired 27 missiles into Israeli territory, hitting targets in Tel Aviv, Haifa, and the Golan Heights.

The chaos reverberated across markets:

- Bitcoin crashed to $100,945 within minutes of the announcement, shedding over $40 billion in market cap.

- It later rebounded slightly to $102,350, but warning signs remain.

- Ethereum (ETH) and XRP also suffered, falling to their lowest levels in weeks.

Technical indicators aren’t reassuring either. Bitcoin is testing the $102K level repeatedly. A fresh “death cross” (when the 50-day SMA falls below the 200-day SMA) and tightening Bollinger Bands point to potential further volatility.

Strait of Hormuz in Focus: A Looming Economic Catastrophe?

Further compounding the market turmoil is Iran’s potential move to block the Strait of Hormuz, a strategic waterway handling around 20% of global oil supply. According to reports, over 50 large oil tankers scrambled to flee the region following the U.S. strikes.

Market analysts, including JPMorgan, have warned that oil prices could surge to $130 per barrel, pushing U.S. inflation to 5%—levels not seen since early 2023. Such a spike could force the Federal Reserve to reconsider future rate cuts, tightening financial conditions and possibly triggering broader risk-off sentiment.

Crypto as a Safe Haven—or Risk Asset?

These events reinforce a growing debate: Is Bitcoin a safe haven, or merely another speculative asset?

In times of economic uncertainty, Bitcoin has historically attracted capital as a non-sovereign store of value. However, during acute crises, especially those with global military implications, it often reacts like a high-risk tech stock.

Still, some analysts believe these conditions set the stage for another breakout. Historically, long periods of consolidation, like the one Bitcoin is currently experiencing—have preceded parabolic moves.

Conclusion: A Battle Between Macro Optimism and Geopolitical Fear

The crypto market is currently walking a tightrope. On one side are powerful macro tailwinds, institutional adoption, and weakening fiat currencies, elements that mirror the bullish backdrop of 2017 and 2020.

On the other side lies geopolitical instability that threatens to short-circuit global markets.

With sovereign funds betting big on blockchain, and the global economy just beginning to recover, the longer-term outlook for crypto remains bullish.

But in the short term, expect turbulence as markets digest war headlines, oil price shocks, and uncertainty in the Strait of Hormuz.

As Raoul Pal put it, “The cycle’s not over—it might just be getting started.”

You must be logged in to post a comment.