by | Jun 29, 2025 | Business

Explore the top meme coins and altcoins dominating 2025, including LILPEPE, SHIB, DOGE, PEPE, and rising stars like SYRUP, HYPE, and FARTCOIN. Discover their unique features, bullish momentum, and how to invest ahead of July’s market shifts. Stay updated with Bitrue Blog.

As we approach July 2025, the cryptocurrency market is buzzing with investor activity, driven by strong price momentum, vibrant communities, and growing institutional interest.

Among the most talked-about tokens this year are four meme coins and several promising altcoins, all vying for dominance in a highly speculative but opportunity-rich sector.

Meme Coins Stealing the Spotlight in 2025

1. Little Pepe (LILPEPE): A Meme Coin with Real Utility

LILPEPE is rapidly rising through the meme coin ranks thanks to its blend of cultural relevance and technical innovation.

Built on a Layer-2 blockchain, it boasts tax-free transactions, anti-sniper bot protection, and ultra-fast payments. The project has already raised over $1 million in presale and is trending across social media platforms.

Key Feature:

Pepe Pump Pad, LILPEPE’s launchpad, enhances project safety by letting meme coin creators lock liquidity and avoid rug pulls—adding a layer of trust to a historically volatile niche.

Price Prediction:

Some bulls predict a 25,000% rally by 2026, driven by increasing adoption and growing community strength.

2. Shiba Inu (SHIB): The Veteran Meme Coin with Shibarium Edge

Despite a saturated meme coin market, Shiba Inu (SHIB) remains a leader. Backed by a loyal community, SHIB’s Layer-2 solution, Shibarium, boosts its scalability and usability.

At $0.00001151 in June 2025, SHIB’s integration with NFTs and DeFi platforms positions it for a potential resurgence in the coming quarters.

3. Dogecoin (DOGE): The OG Meme Coin Still Going Strong

Created in 2013, DOGE continues to thrive on brand recognition and endorsements, particularly from Elon Musk.

Priced around $0.16340, its use for tipping and real-world transactions gives it a stability and legitimacy many meme coins lack.

4. Pepecoin (PEPE): Viral Energy Meets Transactional Efficiency

PEPE, inspired by the Pepe the Frog meme, is one of 2025’s most hyped tokens. Priced at $0.00009, it combines low transaction fees with social virality.

Its cult-like following and presence on platforms like Twitter and Reddit fuel speculation of a massive upside potential, possibly reaching 50,000% growth in the coming year.

Emerging Altcoins to Watch in July 2025

Beyond meme coins, several altcoins are showing strong technical patterns and increased investor interest:

1. Pudgy Penguins (PENGU): Surging Volume and Momentum

PENGU has surged over 16.59% recently, supported by a 245% spike in trading volume, signaling robust bullish interest.

With a market cap of $707 million and optimism from 71% of its holders, this token is proving to be more than just cute branding.

2. F (F): A Speculative Gem with High Volatility

Trading at $0.0004217, F saw a 15.5% price rise in a single day. However, its low market cap and profile score (48%) mark it as a high-risk asset.

Despite this, 76% of users express bullish sentiment, suggesting that risk-tolerant investors are keeping it on their radar.

3. deBridge (DBR): Breakout Performer

With a 58.83% surge in one day, DBR has a market cap of $52.1 million and a strong bullish community (88%). Its TVL ratio of 5.43 indicates high investor confidence, though a post-surge correction remains a possibility.

Cryptos to Watch in July: All-Time Highs & Bullish Indicators

1. Maple Finance (SYRUP): From Breakout to $1?

SYRUP broke its all-time high in June, thanks to bullish pressure reflected in the Chaikin Money Flow (CMF).

If momentum holds, SYRUP could hit $1 in July, but a decline in demand could drag it back to $0.30.

2. SPX6900 (SPX): Triangle Breakout Pending

After a 32% drop from its ATH, SPX trades in a symmetrical triangle with indicators like the Awesome Oscillator and CMF showing bullish bias.

A breakout could push it beyond $2, but buyer fatigue could reverse gains.

3. Hyperliquid (HYPE): Liquidity Driven Growth

HYPE has rallied nearly 900% in 7 months, now trading above $45. A rising Money Flow Index (MFI) suggests continued capital inflow, potentially pushing prices to $60 if the Fed cuts interest rates in July.

4. FARTCOIN: The Unpredictable Meme Contender

While not setting new highs yet, FARTCOIN has rebounded from its recent dip below $1. If bullish RSI trends persist, the token could target $1.65 in the coming weeks.

Conclusion

The crypto landscape in mid-2025 reflects a blending of meme culture and financial innovation.

From technically robust meme coins like LILPEPE and SHIB, to breakout altcoins like SYRUP and HYPE, investors are presented with exciting, albeit volatile, opportunities.

With increased institutional participation, evolving blockchain infrastructure, and a possible interest rate cut on the horizon, the second half of 2025 could unlock new heights for both meme coins and altcoins.

Stay Informed, Stay Ahead! To keep up with the latest trends, project updates, and expert insights in the fast-paced world of cryptocurrency, follow the Bitrue Blog. Stay informed, make smarter investment choices, and never miss a bullish breakout again.

by | Jun 29, 2025 | Business

Solana (SOL) shows signs of a bullish reversal with strong technical patterns, resistance breakout potential, and investor interest. Discover whether now is the right time to buy SOL and what traders should watch next.

Solana (SOL), the sixth-largest cryptocurrency by market cap, is making waves in the crypto market again. After weeks of weakness, technical signals now suggest that SOL may be poised for a significant breakout.

Solana currently trading around $151.01, Solana has gained 3.52% in the past 24 hours and nearly 12% over the last week, sparking renewed interest among traders and investors.

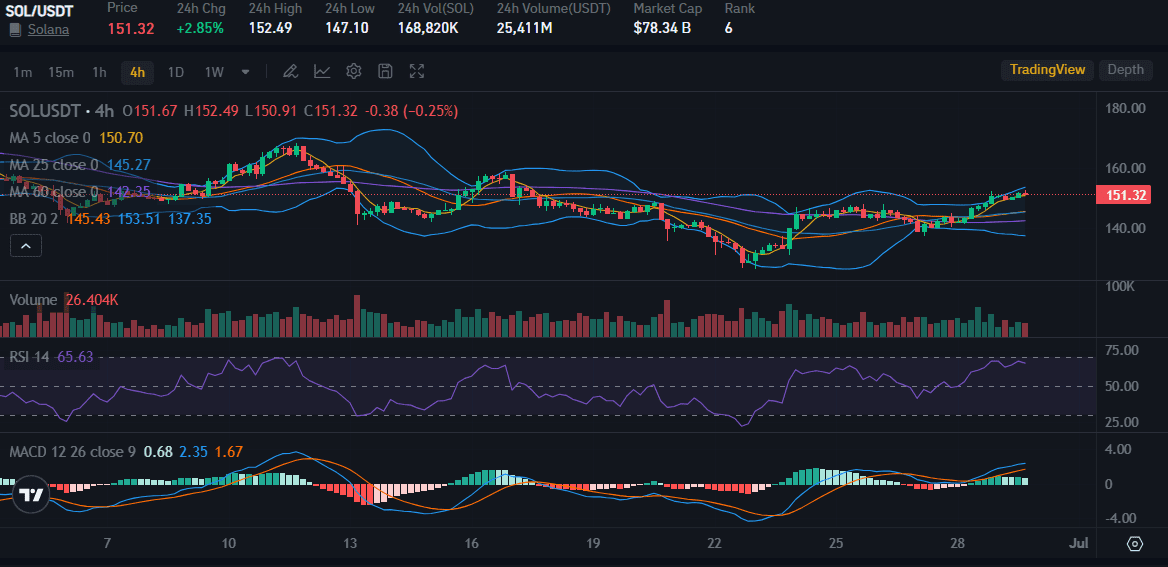

SOL/USD Daily Chart Shows Momentum Building

Solana’s price action on the daily chart indicates a steady climb from its recent pivot near $120, a zone that aligns with the 0.618 Fibonacci retracement. This level has historically attracted buyers, and this time is no different.

The presence of consecutive green Heikin Ashi candles signals that downward momentum is fading, and buyers may be regaining control.

Currently, SOL is testing the 0.236 Fibonacci level near $152.50. A confirmed daily close above this resistance could open the path to the psychologically significant $160 mark, representing a potential 5.7% upside from its current price of $151.32.

Calculation:

($160 – $151.33) / $151.33 ≈ 5.7%

Should this breakout materialize, the next logical target would be the $180 level, which matches a previous swing high.

RSI and Technical Indicators Signal Bullish Trend

The Relative Strength Index (RSI) is currently at 52.68, above the neutral 50 mark for the first time in weeks. This uptick indicates growing bullish sentiment. If the RSI continues to climb toward 55 or higher, it would further support the bullish outlook.

Additionally, the Bollinger Bands are hinting at a price target of $164, adding another layer of technical validation for upward movement.

Double Bottom Pattern Indicates Reversal

Technical analysts are closely watching a developing double bottom pattern on Solana’s chart, a classic bullish reversal indicator.

This “W”-shaped formation shows two price troughs near $135, separated by a peak around $155. A breakout above the $155 resistance level would confirm this formation, potentially pushing SOL toward the $170–$195 range.

The depth of the double bottom pattern supports a price target in this range, especially if accompanied by a volume surge, which often validates bullish breakouts.

Golden Cross Formation Could Drive Prices to $172+

Solana’s chart also shows signs of an impending golden cross, a bullish signal where the 9-day moving average crosses above the 21-day moving average. Currently trading above a critical inflection point around $147.66, SOL appears to be preparing for another leg up.

If confirmed, this formation could push Solana’s price to $172.51 in the midterm, suggesting a potential 17.2% gain from the recent lows. However, a spike in trading volume will be key to sustaining such a rally.

Current Price Metrics

1. Price: $151.32

2. Market Cap: $80.72 billion

3. 24-hour Volume: $2.44 billion (with volume recently declining by 9.11%)

4. 7-Day Performance: +12%

5. Resistance Levels to Watch: $152.50, $155, $160, $180

6. Support Levels: $140, $130 (0.5 Fibonacci retracement)

Bullish Sentiment Among Binance Traders

Supporting the technical indicators is on-chain sentiment data: Binance traders are increasingly placing long bets on Solana. This behavior suggests broader optimism and belief in SOL’s near-term upside potential.

However, traders must be cautious. While the chart is constructive, a confirmed daily close above $155 is essential to avoid potential fake-outs or sharp pullbacks.

Conclusion: Is Now the Time to Buy Solana?

Solana’s current market setup is encouraging. With technical indicators turning bullish, a developing double bottom pattern, and a potential golden cross, SOL is well-positioned for a breakout, provided it clears resistance at $155.

Whether you’re a short-term trader or long-term investor, Solana is worth watching closely in the coming days.

Stay ahead of the curve! For more in-depth analysis, latest updates, and trading tips on the crypto market, follow the Bitrue Blog today.

by | Jun 29, 2025 | Business

Bitcoin (BTC) rebounded strongly to over $107,000 amid Middle East ceasefire news, rising institutional demand, and improving macroeconomic signals. Discover what’s fueling this crypto surge and why a new all-time high could be near.

Bitcoin (BTC) has staged a powerful recovery, climbing nearly 7% this week to trade above $107,000 by Friday, just shy of its previous all-time high of $111,980.

The surge comes amid a confluence of bullish signals: easing geopolitical tensions, increasing institutional accumulation, a supportive regulatory environment, and strengthening macroeconomic fundamentals.

A Sharp Reversal From Weekend Lows

Bitcoin had tumbled to $98,200 on Sunday June 22, marking a 45-day low. But by Monday, it soared above $105,000 and maintained its momentum through midweek, closing at $107,000 on Wednesday and stabilizing around that level.

This rebound aligned with several market-moving headlines, most notably:

1. Middle East Ceasefire: Former US President Donald Trump announced a “complete and total” ceasefire between Israel and Iran, which helped defuse global market anxiety.

2. Macro Optimism: Investors are pricing in greater odds of a US Federal Reserve interest rate cut later this year. CME Group’s FedWatch Tool shows the probability of rates dropping to 3.75% or lower has surged to 53%, up from 38% last week.

3. US GDP Weakness: A Q1 GDP contraction of 0.5%, coupled with subdued jobless claims and a weak USD, supported risk-on assets like crypto.

Technical Signals Confirm the Bullish Shift

Three key indicators are reinforcing the bullish case for Bitcoin:

1. Exchange BTC Reserves Hit 10-Year Low

Data from CryptoQuant shows only 40,000 BTC are being transferred to exchanges daily, the lowest since 2014. Low exchange reserves historically precede major bull runs, as seen in 2016, 2019, and late 2023.

2. Bullish Engulfing Pattern on Weekly Chart

Bitcoin’s weekly chart displays a bullish engulfing candlestick pattern. The price bounced from the Fair Value Gap (FVG) zone between $97,900 and $100,700, signaling strong buyer support.

3. Strengthening Institutional Demand

Several public companies have accumulated BTC this week. Highlights include:

1. Metaplanet: Added a total of 2,665 BTC this week, bringing its holdings to 12,345 BTC.

2. ProCap BTC, LLC: Acquired 4,932 BTC following a $1B merger and $750M funding round.

3. Blockchain Group: Participated in BTC buying alongside corporate peers.

ETF Inflows Accelerate

Spot Bitcoin ETFs are seeing robust inflows, with over $1.71 billion added in the past week, the highest since May.

This 13-day streak of net inflows highlights the growing appetite for Bitcoin exposure among institutional and retail investors alike.

Regulatory Winds Shifting in Favor of Crypto

Two major regulatory developments have further bolstered confidence:

1. Fed Softens Stance: The US Federal Reserve dropped “reputational risk” from its bank oversight rules, a move that lifts restrictions on crypto banking access and custody services.

2. Crypto-Friendly Legislation: A bipartisan Senate bill would clarify when crypto is classified as a commodity vs. a security and give exchanges a clearer path to compliance under the Commodity Futures Trading Commission (CFTC).

Additionally, William Pulte of the FHFA announced that Fannie Mae and Freddie Mac are preparing to count crypto assets for mortgage qualification, potentially revolutionizing crypto’s use in traditional finance.

Mining Disruptions and Hashrate Dip

Despite bullish sentiment, Bitcoin’s hashrate dropped 8% over the past week, from 943.6 million TH/s to 865.1 million TH/s.

While some suspect geopolitical disruptions in Iran (a major hub for unregulated mining), others point to power outages in the U.S., such as the April storm in Texas and Oklahoma, which caused a temporary 27% drop in global hashpower.

Will Bitcoin Hit a New All-Time High?

From a technical perspective, BTC is primed for more gains. The Relative Strength Index (RSI) stands at 56, indicating moderate bullish momentum. The MACD also flashed a bullish crossover on Thursday, a classic buy signal.

To retest its all-time high of $111,980, BTC would need just a 5.13% push from current levels.

If this barrier is broken, analysts see the potential for a breakout to $120,000 in the coming weeks, especially if ETF inflows remain strong and macro conditions continue to favor risk assets.

Conclusion: A Bullish Storm Brewing

Bitcoin’s recovery from sub-$100K levels has been swift and well-supported by technical, institutional, and macroeconomic factors.

While volatility remains a constant, the building momentum suggests BTC could be on the cusp of another historic breakout.

As the crypto market continues to evolve rapidly, staying informed is crucial.

Stay ahead of every major trend, follow the latest updates, insights, and expert analysis on the Bitrue Blog.

by | Jun 29, 2025 | Business

Bitcoin’s price action shows strong bullish signals as technical indicators align, while financial experts like Ric Edelman call for higher crypto allocations in modern portfolios. Learn what this means for BTC’s future and how it compares to Gold. Stay updated via the Bitrue Blog.

Bitcoin (BTC) continues to defy expectations with a strong recovery and shifting sentiment from financial experts, setting the stage for what could be a monumental year in crypto.

With its price showing resilient strength across multiple timeframes and prominent financial voices like Ric Edelman urging larger crypto allocations, BTC is positioning itself not just as a digital asset, but a global macro contender alongside gold, real estate, and fiat.

Daily Chart: V-Shaped Reversal Signals Recovery

Bitcoin’s recent price correction from a high of $110,789 to a low of $98,240 has been met with a powerful V-shaped rebound.

Daily candles now show smaller-bodied green bars and rising volume, reflecting healthy, but moderated, bullish momentum. The price currently consolidates just below the $108,000 resistance mark.

A confirmed breakout above the $110,000 level, especially on significant volume, could trigger the next leg in Bitcoin’s long-term uptrend. On the downside, support at $103,000 and $98,000 offers a safety net based on historical buying activity.

4-Hour Chart: Bullish Flag Forms

Zooming into the 4-hour timeframe, BTC to USD is printing a textbook bullish flag, a continuation pattern often preceding upward movement. A breakout near $108,358 on strong volume suggests buyers are increasingly confident.

If the price retests the $107,000–$107,500 region and holds, it may offer a strategic entry point for traders. However, a breakdown below $106,800 could invalidate this short-term bullish structure.

1-Hour Chart: Consolidation and Breakout

The 1-hour chart reflects short-term accumulation and breakout behavior. Recent upward moves supported by increasing volume signal renewed momentum.

Entries in the $107,700–$108,000 range may be favorable for bulls, with stops placed below $107,200 to manage risk if sell-side pressure increases.

Technical Indicators: Bullish Momentum Emerges

1. RSI (Relative Strength Index): At 59, indicating a healthy neutral zone—neither overbought nor oversold.

2. Stochastic & CCI (Commodity Channel Index): Neutral, but showing early bullish leanings.

3. MACD & Momentum (10): In buy territory, supporting an emerging upward bias.

4. ADX (Average Directional Index): At 14, reflecting weak trend strength—but not contradicting other bullish signs.

Moving Averages: Strong Bullish Alignment

All major EMAs and SMAs—from 10-day to 200-day—are currently sitting below BTC’s market price, sending clear buy signals. Notably:

1. 10-day EMA: $106,462

2. 10-day SMA: $105,524

3. 200-day EMA: $94,475

4. 200-day SMA: $96,224

These levels confirm both short-term and long-term support for a sustained bullish run, contingent on volume spikes and breakout confirmations.

Ric Edelman’s Bold Call: Crypto Allocation Should Be 10–40%

Renowned financial advisor Ric Edelman, founder of the Digital Assets Council of Financial Advisors, has significantly shifted his view on crypto in investment portfolios. In 2021, Edelman recommended just a 1% allocation.

Today, he’s calling for 10% to as high as 40%, stating, “That’s astonishing. No one has ever said such a thing.”

Why the Sudden Shift?

1. Crypto’s Maturity: In Edelman’s view, the past four years have brought the industry from uncertainty to mainstream adoption.

2. Government Clarity: Questions around regulatory bans and obsolescence have mostly been resolved.

3. Institutional Adoption: Bitcoin ETFs and institutional inflows validate crypto’s role as a serious asset class.

Additionally, Edelman believes the traditional 60/40 portfolio model is obsolete, especially given increased life expectancy and the need for higher-return assets.

“Today’s 60-year-old is kind of like yesterday’s 30-year-old,” Edelman noted, emphasizing the need for risk-adjusted, high-growth investments like crypto.

He adds that Bitcoin is uncorrelated to traditional assets like stocks, bonds, or commodities, making it a powerful diversification tool.

Bitcoin vs. Gold: A New ATH on the Horizon?

According to pseudonymous analyst Checkmate, Bitcoin is on the verge of breaking its all-time high (ATH) against Gold (XAU), a level that’s remained untouched since 2021.

As of now, 1 BTC equals 32.72 ounces of gold, a figure that has grown over 50% in under a year.

Despite geopolitical instability boosting Gold’s appeal, Bitcoin has joined the elite ranks of global macro assets in record time, just 16 years after its inception.

Crypto analyst Willy Woo highlights this as unprecedented, noting BTC is the only asset added to that list in the last 150 years.

Gold-Pegged Stablecoins on the Rise

Digital interest in gold is also spiking. Tether Gold (XAUT) recently reached an $850 million market cap, signaling investor demand for both digital and traditional safe havens.

Bull vs. Bear Outlook

Bullish Case:

- Strong technical alignment across all timeframes

- All moving averages and key indicators signaling buy

- Institutional adoption and long-term asset recognition

-

Analysts predicting BTC could reach $150K–$250K this year, $500K by decade’s end

Bearish Case:

- Oscillators like RSI and Stochastic remain neutral

-

ADX shows low trend strength

-

Breakdowns below $106,800 (4H) or $107,200 (1H) could invalidate the current bullish setup

Conclusion

With bullish momentum building across timeframes, institutional sentiment strengthening, and experts like Ric Edelman calling for major crypto exposure, Bitcoin appears poised for continued growth, not just in USD value, but as a global macro asset rivaling gold.

As Bitcoin approaches a potential breakout above $110,000, investors and traders alike would be wise to keep a close eye on volume and key support levels. Whether you’re a long-term holder or a tactical trader, the coming weeks may prove pivotal.

Stay Ahead of the Curve: To keep up with the latest Bitcoin analysis, market trends, and expert crypto insights, follow the Bitrue Blog for regular updates and actionable intelligence!

by | Jun 29, 2025 | Business

Ripple CEO Brad Garlinghouse’s unwavering support for XRP, paired with Ripple’s legal victories and growing ETF optimism, renews investor confidence. Explore XRP’s price outlook, tokenization potential, and what it could mean for XRP’s bold $20,000 forecast.

Ripple CEO Brad Garlinghouse has once again made headlines, not just for Ripple’s legal victories, but for his symbolic and deeply personal show of support for XRP.

In a recent post on X, Garlinghouse reaffirmed he is “1,000% committed” to XRP’s future, a sentiment he literally wears on his sleeve.

A Tattoo with a Message

Garlinghouse, a Harvard MBA and former Yahoo executive, proudly sports a tattoo that references the landmark summary judgment date, July 13, 2023, when Judge Analisa Torres ruled that Ripple’s programmatic sales of XRP did not constitute securities.

The tattoo also features planetary motifs, signifying his belief in XRP’s future on a cosmic scale.

Digital Asset Buy, a known XRP influencer, praised Garlinghouse’s decision to get tattooed past age 50, stating it symbolizes deep conviction: “When someone with a Harvard MBA gets a tattoo after 50, they have thought it through.”

However, crypto tattoos haven’t always aged well. Mike Novogratz of Galaxy Digital showcased a Luna tattoo shortly before the token’s catastrophic collapse.

His firm later paid $200 million in penalties related to that very debacle, a stark reminder that market sentiment can turn quickly.

Ripple’s Legal Momentum: The Cross-Appeal Withdrawal

Adding to bullish sentiment, Ripple has officially dropped its cross-appeal in the case against the U.S. SEC.

Investors interpreted the move as strategic, especially as the SEC is now expected to withdraw its own appeal, potentially closing the book on a legal battle that began in December 2020.

Ripple’s decision came shortly after Judge Torres rejected the joint request for an indicative ruling on settlement terms.

Despite this, analysts like Fred Rispoli and Bill Morgan suggest Ripple is well-prepared and that institutional XRP sales through On-Demand Liquidity (ODL) may still be compliant with regulatory expectations.

Pro-crypto lawyer James Murphy noted that the SEC and Ripple do not require court approval to dismiss their appeals. If both parties proceed quickly, the resolution could pave the way for the long-awaited XRP-spot ETF, with October as the final approval deadline.

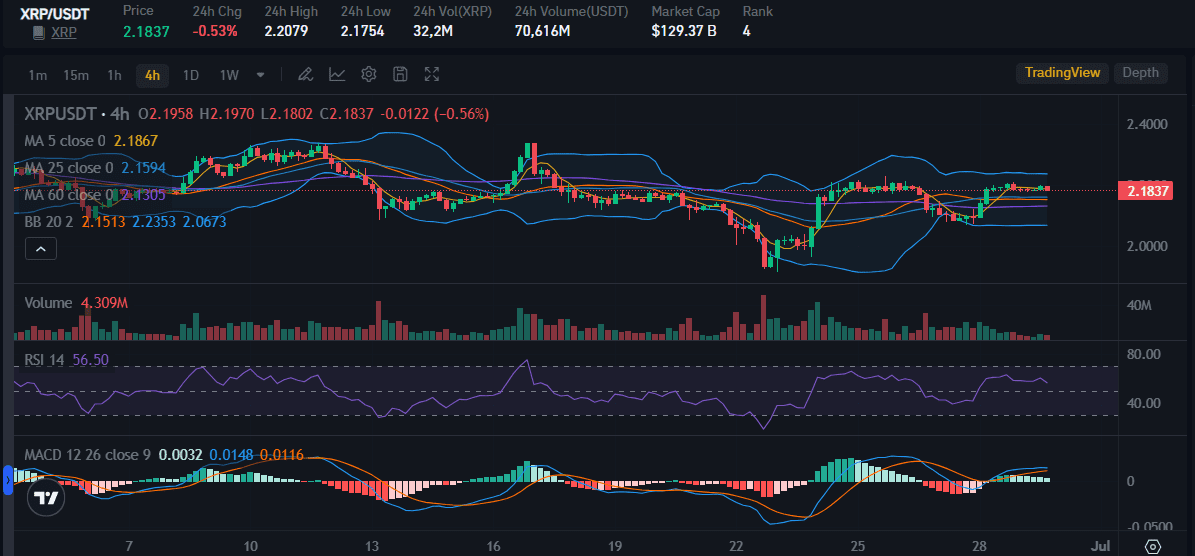

XRP Price Outlook: Key Technicals and Catalysts

XRP price trade at $2.1837 on June 29, outperforming the broader market. Though still below its 50-day EMA, it remains above the 200-day EMA, signaling a bullish long-term bias despite short-term uncertainty.

Key resistance lies at $2.6553 (May 12 high). A breakthrough could see XRP climb toward $3, and possibly its 2025 peak of $3.3999. Failure to maintain momentum, however, may trigger a dip below $2 and test support at $1.9299.

Technical Indicators:

- 14-day RSI: 50.26 (neutral, room to rise)

- 200-day EMA: Acts as key support

- 50-day EMA: Short-term resistance threshold

XRP’s Future: Could It Really Hit $20,000?

Among the more explosive narratives floating around is a renewed forecast that XRP could someday hit $20,000. First introduced in 2022 by game developer Chad Steingraber, the theory hinges on the rise of tokenized assets, bank adoption, and a supply squeeze.

1. Rise of Tokenized Assets

Steingraber envisions widespread issuance of stablecoins and CBDCs on the XRP Ledger. If hundreds of new tokens adopt XRP for settlement, daily demand could skyrocket.

2. Banks Using XRP as a Reserve Asset

According to the theory, major financial institutions could stockpile XRP as a backing asset in private ledgers, removing significant supply from circulation and triggering a demand shock.

3. Institutional Supply Absorption

Only ~20 billion XRP are in public hands after accounting for locked, burned, or lost tokens. If institutions absorb most of that, circulation could shrink to under 100 million, laying the groundwork for exponential price gains.

Yet, there are hurdles. The SEC’s case, though seemingly winding down, still casts a shadow. Ethereum and Solana remain dominant players in the tokenization space. XRP must prove superior in scalability, cost-efficiency, or regulatory clarity to gain traction.

A High-Risk, High-Reward Scenario

The $20,000 target hinges on multiple “ifs”:

- Explosive tokenization on XRPL

-

Major banks holding XRP as reserves

-

Real-world supply constraint

Failing any of these would dramatically scale back expectations. Still, the conversation itself underscores growing institutional interest in XRP and how regulatory clarity could be a game changer.

Conclusion

Ripple’s dropping of its cross-appeal, Garlinghouse’s personal branding, and the buzz around XRP’s role in tokenized finance reflect a maturing narrative.

While forecasts of XRP hitting five-figure territory are speculative, they represent growing confidence in its underlying infrastructure and legal positioning.

As Ripple edges closer to regulatory closure and eyes ETF approval, XRP remains one of the most closely watched digital assets in the market.

Stay ahead of the curve. Follow the latest updates on XRP, Ripple’s legal journey, and ETF progress by visiting the Bitrue Blog. The crypto landscape evolves quickly, don’t miss your next big opportunity.

You must be logged in to post a comment.