by | Jul 16, 2025 | Business

KOLTIVA has appointed Joe Keen Poon as Executive Chairman, marking a strategic milestone in its global leadership in sustainable agriculture and supply chain traceability. Joe’s leadership reinforces KOLTIVA’s role as a key partner for companies seeking to meet global regulations like the EUDR, offering end-to-end solutions that combine geospatial digital traceability with on-the-ground support for smallholders to ensure sustainability from farm to final product.

In a major move underscoring its growing global presence in sustainable agriculture and supply chain traceability, the Indonesia-Swiss-based, venture-backed AgriTech firm KOLTIVA has named Joe Keen Poon as its new Executive Chairman. Announced earlier today, the appointment marks a strategic milestone in KOLTIVA’s continued international leadership trajectory.

This pivotal leadership marks a defining moment in KOLTIVA’s journey as the company accelerates its mission to build inclusive, deforestation-free, and fully traceable supply chains—aligning with emerging global regulations such as the European Union Deforestation Regulation (EUDR), CSDDD, CSRD, and other rising demands for environmental, social, and governance (ESG) compliance.

The appointment of Joe Keen Poon as Executive Chairman reinforces KOLTIVA’s unwavering commitment to sustainability, transparency, and innovation in agriculture. A seasoned global executive, Joe brings over 30 years of experience scaling purpose-driven technology and sustainability ventures. His leadership credentials span top-tier organizations, including Microsoft, Deloitte, Surbana Jurong, and, most recently, as Group CEO of the Singapore Institute of Management (SIM).

The Executive Chairman will play a central role in strengthening governance, unlocking investment pathways, and ensuring that KOLTIVA’s solutions remain scalable, secure, and rooted in impact. His appointment signals KOLTIVA’s next chapter: leveraging advanced analytics to deliver not just transparency — but foresight and resilience — in agricultural supply chains.

Founded in 2013, KOLTIVA has rapidly evolved into one of the most trusted technology partners in agriculture, working with over 1,9 million producers across 65 countries. Its integrated ecosystem—ranging from traceability platforms, capacity building as an extension services with in person field-training through its extensive agronomist network and digital payment tools to smallholder training programs—has become vital to agri businesses, enterprises and suppliers navigating today’s complex sustainability challenges.

As Executive Chairman, Joe will help KOLTIVA sharpen its long-term vision, deepen its impact across supply chains, and shape future partnerships that align with its triple-bottom-line: People, Planet, and Profit. “KOLTIVA is uniquely positioned at the intersection of agriculture, climate action, financial inclusion and digital transformation,” said Joe Keen Poon. “Joining this team is not only a professional honor—it’s an impact-commitment to reshaping how the world sources its food and raw materials, while supporting the rural smallholders who grow them.”

Joe Keen Poon will collaborate closely with the CEO and Co-Founder, Manfred Borer and the broader leadership team to strengthen KOLTIVA’s presence across key regions—including Indonesia, Asia-Pacific, the Americas, Europe and the Middle East, and Africa—strategic markets essential to the future of sustainable sourcing.

“We’ve built a strong foundation rooted in data integrity, human-centered technology intelligence, field operations, and client trust,” said Manfred Borer, CEO of KOLTIVA. “Now, we’re scaling. With Joe Keen Poon on board, we gain a partner with the global foresight and experience to guide us through this next chapter—one that will see us expand across continents while remaining deeply connected to rural farming communities.”

While the appointment brings fresh global perspectives, it also underscores continuity in KOLTIVA’s mission and values. The company remains deeply focused on enabling ethical sourcing, smallholders inclusion, and climate resilience through technology and on-the-ground presence. KOLTIVA’s approach remains unique in its integration of field expertise and digital traceability—a model that has won recognition from global enterprises, government institutions, public-private partnership, non-government organization to climate-impact driven investors.

“As regulatory landscapes shift, particularly with the introduction of the EU Deforestation Regulation (EUDR), companies across the globe are under pressure to verify the legality and sustainability of their raw material sources. KOLTIVA has been at the forefront of this movement, enabling full end-to-end traceability and polygon-based geospatial verification for commodities including palm oil, rubber, cocoa, and coffee.” Joe Keen Poon. “What drew me to this role was not just the technology, but the company’s relentless focus on empowering producers and building trust between stakeholders. That’s where true sustainability begins.”

by | Jul 16, 2025 | Business

Kuala Lumpur, 16 July 2025 – Ensure your storage tanks meet industry standards. PetroSync’s API 653 Training helps you lead inspection and compliance with confidence.

Have You Ever Wondered If Your Storage Tanks Are Truly Safe?

Imagine walking through your facility one quiet morning, hearing the subtle hum of operations and seeing your storage tanks standing firm — as they always have. But beneath that calm surface, undetected corrosion, settlement, or weld defects could be silently growing. You’re not alone in this concern. Many engineers and plant managers ask themselves: “How do I really know if my storage tanks are still reliable?”

Aboveground storage tanks (ASTs) are often out of sight and, unfortunately, out of mind — until it’s too late. A single failure could lead to catastrophic spills, environmental damage, and millions in losses. That’s why regular, qualified inspections are not just important — they’re essential.

And this is where the API 653 standard comes into play.

API 653: The Inspection Code That Could Save Millions

API 653 is more than a set of guidelines. It’s a powerful inspection standard developed by the American Petroleum Institute specifically for aboveground storage tanks. It covers critical areas such as tank inspection, repair, alteration, and reconstruction — ensuring structural integrity and compliance with best practices.

Here are a few eye-opening facts:

According to NACE International, corrosion-related failures in storage tanks cost the industry over $7 billion annually.

Improper or missed inspections have been cited in over 80% of major tank-related incidents.

Tanks older than 20 years without API 653-compliant inspections are at significantly higher risk of failure.

Following API 653 ensures your tanks meet safety and environmental standards — but more importantly, it gives you peace of mind.

From Confusion to Confidence: Your API 653 Learning Journey

Reading the API 653 codebook might feel overwhelming. It’s technical, dense, and filled with detailed engineering requirements. But don’t worry — you don’t need to navigate it alone.

Through the API 653 training course, you’ll learn how to:

Evaluate tank shell integrity, roof structures, and bottom plates

Calculate corrosion rates and remaining life

Interpret inspection intervals and repair criteria

Prepare for the API 653 certification exam with real-world case studies

At PetroSync, we understand that every professional learns differently. That’s why our courses are designed with a hands-on approach, combining theory with actual inspection scenarios, so you’re not just memorizing codes — you’re applying them.

Whether you’re a fresh inspector, a reliability engineer, or a seasoned plant manager, this training helps transform confusion into clarity.

Why Professionals Choose PetroSync for Their API 653 Training

There are dozens of training providers out there — so why do industry professionals consistently choose PetroSync?

Here’s what sets us apart:

Expert Instructors: Our trainers are certified professionals with decades of inspection experience.

Interactive Format: Engage with practical case studies, mock exams, and live discussions.

Globally Recognized Certification Prep: Boost your chances of passing the API 653 exam on your first try.

Career Advantage: Many of our alumni have gone on to secure key roles in top energy companies after completing our course.

Joining PetroSync is not just about attending a class — it’s about investing in your professional growth, earning industry respect, and making a real impact in your organization.

by | Jul 16, 2025 | Business

Asuene Inc. has officially completed the business transfer and M&A of “Sustana,” the greenhouse gas (GHG) accounting cloud service formerly provided by Sumitomo Mitsui Banking Corporation (SMBC), following all necessary regulatory approvals. The transaction was finalized on July 15, 2025.

Effective July 16, 2025, SMBC has also begun referral based sales of Asuene’s flagship carbon accounting platform “ASUENE” to its corporate clients in Japan. “ASUENE” supports businesses in measuring, reducing, and reporting GHG emissions.

Through this partnership, Asuene and SMBC aim to help meet the growing demand for advanced decarbonization and ESG management solutions in Japan and globally—driving both corporate value and a more sustainable society.

Sustana Business Integration and Future Plans

Asuene announced in May 2025 its intention to acquire SMBC’s “Sustana” and integrate the platform with its own carbon accounting platform “ASUENE.” The acquisition, part of a broader capital and business alliance with the SMBC Group, was completed on July 15, 2025.

Starting July 16, SMBC will be able to start introducing “ASUENE” to their clients and partners and will be able to handle “ASUENE” as an intermediary. Decarbonization and sustainability related needs of domestic and overseas customers are shifting from the company level to the supply chain level and are growing increasingly sophisticated and complex.

To meet these needs, both companies will combine ASUENE’s advanced system development and customer support capabilities with the comprehensive financial capabilities and domestic and overseas networks of the SMBC Group to strengthen support for corporate decarbonization management and help maximize corporate value.

Following the transfer, “Sustana” will continue to operate as part of Asuene’s service offerings for the time being. Full integration into “ASUENE” is scheduled within the next year, allowing Asuene to deliver even more advanced solutions for the evolving decarbonization and ESG needs of companies worldwide.

by | Jul 15, 2025 | Business

SharpLink Gaming just became the largest corporate Ethereum holder with 198,300 ETH. As ETH surpasses $3,000, experts predict a surge to $7,500 and beyond. Learn more about Ethereum’s price forecast, staking ETF potential, and top altcoin opportunities.

In a move that sent shockwaves through the crypto community, NASDAQ-listed sportsbook marketing firm SharpLink Gaming has aggressively expanded its Ethereum (ETH) holdings, purchasing 16,370 ETH worth $48.7 million on Sunday, July 13.

This acquisition pushes its total Ether reserves to a staggering 198,300 ETH, now valued at nearly $608 million, making SharpLink the largest corporate ETH holder, even surpassing the Ethereum Foundation.

This latest purchase follows a 10,000 ETH buy from the Ethereum Foundation just days earlier, highlighting the company’s all-in pivot to Ethereum as its primary reserve asset.

The shift began in late May, alongside the announcement of Ethereum co-founder Joseph Lubin joining SharpLink as chairman of the board.

Why SharpLink’s Ethereum Strategy Matters

SharpLink’s strategic embrace of Ethereum comes at a pivotal moment. As ETH reclaims the $3,000+ level, the company’s aggressive accumulation underscores a broader institutional belief in Ether as a future-proof asset.

Lubin explained that such moves are essential for supporting Ethereum’s ecosystem growth: “It’s going to be critical to enable the supply-demand dynamics of Ether to right-size as we build more and more applications.”

With over 1.34 million ETH now held in corporate treasuries, worth nearly $4.1 billion, SharpLink’s position may influence other institutional players to follow suit, especially as Ethereum spot ETFs gain traction globally.

Ethereum Price Prediction: Is $7,500 in Sight?

Currently trading around $3,100, Ethereum has seen weekly gains of 6–7%. According to market experts and analytics from Arkham Intelligence and CoinGecko, ETH is gaining momentum thanks to a perfect storm of catalysts:

1. Record ETF inflows: U.S.-listed spot Ethereum ETFs saw net inflows of $468.63 million in one week.

2. Deflationary supply: Since Ethereum’s Merge and EIP-1559, ETH’s net issuance has dropped by over 99%.

3. Institutional interest: Firms like BlackRock, Coinbase, and Circle are deepening their involvement in Ethereum’s ecosystem.

Many analysts now forecast Ethereum hitting $5,000 in the short-to-medium term, with bullish scenarios suggesting $7,500 by year-end, driven by ETF-related buying pressure and whale accumulation.

PEPE and Remittix (RTX): Altcoins Fueling the Ethereum Ecosystem

Alongside Ethereum’s rise, meme coin Pepe (PEPE) is once again seeing whale interest. On-chain data shows major Ethereum wallets accumulating PEPE, betting on a second-wave rally.

The revived attention marks a shift as retail traders rotate into low-cap coins with utility, a growing trend in July.

Meanwhile, Remittix (RTX) is emerging as a serious DeFi contender. With over $16 million raised and 550 million RTX tokens sold, RTX is preparing for a Q3 launch of its crypto-to-fiat wallet, enabling cross-chain transfers directly to bank accounts.

Early investors are taking advantage of a 50% presale bonus, betting on RTX as the next breakout altcoin of 2025.

The $1.5 Million Ethereum Prediction: Vision or Delusion?

In the most audacious prediction yet, EMJ Capital founder Eric Jackson says Ethereum could one day reach $1.5 million per token. While this isn’t a short-term call, Jackson’s case is built on several long-term drivers:

- Ethereum staking ETFs, expected by October 2025, could transform ETH into a yield-generating institutional product.

- Deflationary supply mechanics, with ETH burn outpacing issuance.

- Mass adoption, with giants like Shopify, Coinbase, Circle, and Robinhood using Ethereum’s blockchain for payments and settlement.

Jackson argues that Ethereum is evolving into a “rail system” for global crypto commerce. Once staking ETFs go live, ETH becomes more than just “digital oil”—it becomes a productive asset that appeals to traditional finance.

Ethereum’s Road to $10K–$15K in This Cycle

While $1.5 million ETH remains a distant vision, experts believe $10,000–$15,000 is within reach by 2026. Factors supporting this view include:

- Layer 2 adoption (e.g., Coinbase’s Base)

-

Enterprise use of Ethereum rails

-

Continued ETF approval momentum

-

Increased staking activity

Market analysts note that whale holdings have increased by over 18%, while exchange reserves are down, indicating long-term accumulation.

Conclusion: Is Ethereum Still Undervalued?

The convergence of corporate adoption, regulatory advancements in ETFs, and growing real-world use cases makes Ethereum one of the most compelling investment stories in the crypto market today.

Whether ETH hits $5,000 this year, or $1.5 million in the future, the fundamentals are aligning for a transformative moment.

With the crypto market entering a new phase of institutionalization and innovation, Ethereum appears to be leading the charge.

Stay ahead of the curve with expert crypto insights, market forecasts, and emerging trends, follow the Bitrue Blog for daily updates on Ethereum, altcoins, DeFi, and more.

by | Jul 15, 2025 | Business

Discover USD1 by World Liberty Financial, a politically-backed stablecoin blending blockchain speed with fiat trust. Learn how to buy, use, and evaluate USD1’s role in today’s digital economy.

In the rapidly evolving world of cryptocurrency, stablecoins have emerged as a critical pillar, bridging traditional finance with the decentralized future.

In 2025, a bold new contender entered the arena: USD1, a fiat-backed stablecoin developed by World Liberty Financial (WLFI).

Branded as a “sovereign digital dollar” and supported by high-profile political and institutional ties, USD1 is positioning itself as a revolutionary tool for payments, trading, and global finance.

But how does USD1 differentiate itself in a landscape dominated by giants like USDT and USDC? What risks and opportunities does it offer? And most importantly, should you be paying attention? Here’s everything you need to know.

What Is USD1?

USD1 is a fiat-backed stablecoin pegged 1:1 to the U.S. Dollar. Launched in March 2025 by World Liberty Financial (WLFI), it operates on Ethereum and Binance Smart Chain, with expansion plans for the TRON network.

Its reserves are held in short-term U.S. treasuries and cash equivalents, managed by BitGo Trust Company, a leading regulated digital asset custodian.

What sets USD1 apart is its institutional focus. From day one, it was designed not just for traders and DeFi users, but for governments, banks, and global investors seeking fast, transparent, and secure digital settlements.

Key Features of USD1

1. 1:1 USD Backing: Every USD1 token is fully collateralized by U.S. dollar reserves and short-term treasuries, making it a trustworthy digital representation of fiat.

2. Monthly Reserve Reports: WLFI publishes monthly attestations, ensuring transparency and accountability for all token holders.

3. Real-Time Global Transactions: USD1 enables instant 24/7 transfers worldwide, making it ideal for remittances, B2B settlements, and on-chain finance.

4. Multi-Chain Compatibility: Deployed on Ethereum and BSC, USD1 supports cross-chain token bridging, enhancing usability across DeFi, CEXs, and payment rails.

5. BitGo Custodianship: Trusted by institutional clients, BitGo guarantees the safekeeping of USD1’s reserves through its regulated entities.

Use Cases: More Than Just a Stable Dollar

1. Cross-Border Payments: Avoid costly banking fees and delays with near-instant settlements between businesses and individuals across the globe.

2. DeFi Lending & Borrowing: Use USD1 as collateral or liquidity on lending protocols for predictable yields and reduced volatility risk.

3. Crypto Trading & Arbitrage: Leverage USD1’s stable value to trade volatile assets, hedge positions, or engage in arbitrage across decentralized and centralized exchanges.

4. Token Swapping and Bridging: Seamlessly move USD1 between blockchains using bridges, ideal for multi-chain DeFi applications.

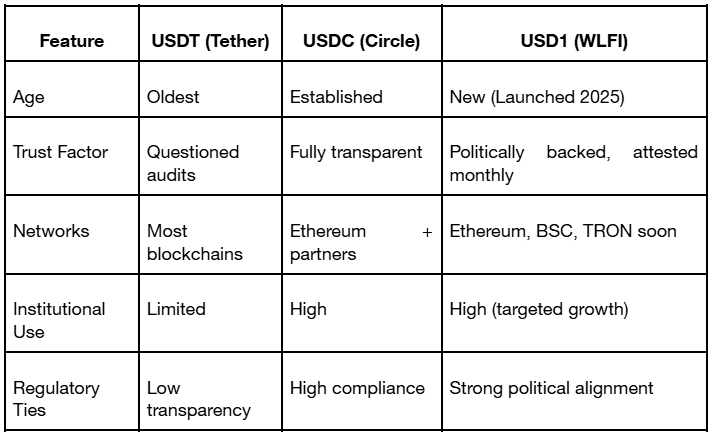

USD1 vs USDT vs USDC: A New Challenger Enters

USD1’s blend of political support, institutional partnerships, and rapid growth makes it a serious contender in the stablecoin race, especially for those seeking alternatives outside traditional stablecoins.

Recent Developments and Milestones

1. Listed on Bitrue (July 9, 2025): USD1 became available on its first centralized exchange, Bitrue, with zero trading fees until July 16 and pairs with USDT and BTC.

2. $2 Billion Investment Deal: Announced during Token2049 in Dubai, USD1 was used in a major $2B deal involving Binance and MGX, a UAE-based investment firm.

3. WLFI Airdrop Launch: WLFI began distributing USD1 tokens to governance token holders, fostering community participation and testing its airdrop infrastructure.

Risks to Watch

Despite its strong debut, USD1 carries several risks:

1. Limited Liquidity: While Bitrue adds legitimacy, USD1 still relies on few centralized and decentralized exchanges.

2. Lack of Third-Party Attestations: USD1 has not yet released independently verified attestations from major accounting firms, unlike USDC.

3. Political Controversy: Its direct ties to former U.S. President Donald Trump raise concerns over regulatory neutrality and long-term adoption across global markets.

How to Buy USD1 on Bitrue

- Create a Bitrue account and complete verification.

- Deposit USDT or BTC.

- Navigate to the USD1/USDT trading pair.

-

Place your buy order and confirm the trade.

The Future of USD1

As WLFI continues developing its own wallet app, integrating with retail merchants, and building DeFi lending pools, USD1 is laying the foundation for mass adoption.

Its momentum has already made it one of 2025’s fastest-growing stablecoins, with a market cap exceeding $2.1 billion shortly after launch.

If these growth strategies succeed, USD1 may not just challenge USDT and USDC, it could reshape how stablecoins are issued, governed, and adopted at the institutional level.

Conclusion

USD1 is not just another dollar-pegged token. It’s a politically-backed, institutionally-focused, and fast-evolving stablecoin project that merges blockchain efficiency with fiat stability.

It’s still early, with some risks left to address, but for those seeking a fresh alternative to the status quo, USD1 offers a compelling mix of innovation, access, and opportunity.

Follow the latest updates about crypto like Pump.fun update, market insights, and stablecoin developments on the Bitrue Blog, your trusted source for everything in the digital asset space.

You must be logged in to post a comment.