by | Mar 25, 2025 | Business

KUALA LUMPUR, 25 March 2025 – In a major milestone for padel in the region, Asia Padel Events (APE) is set to bring the CUPRA FIP Tour 2025 to Kuala Lumpur, Malaysia, this April. Adding to the excitement, the Asia Pacific Padel Tour (APPT), the premier professional padel circuit focused on the Asia-Pacific region, will also host a highly anticipated tournament in the city. This dual offering solidifies Kuala Lumpur’s position as a leading padel destination in the region.

ASCARO Padel & Social Club, leader in exclusive clubs and racket sports, will be hosting both tournaments. Happening within weeks of each other, these two tournaments usher in a milestone for padel in Malaysia. Each one is poised to bring elite players from around the world and offer a display of world-class competition. Both local and international padel enthusiasts will have the chance to witness or participate in the action.

CUPRA FIP Tour: Malaysia’s First-Ever FIP Tournament

The CUPRA FIP Tour is the official international circuit of the International Padel Federation (FIP), hosting over 500 tournaments annually across 44 countries. Asia Padel Events (APE) is the official promoter of the CUPRA FIP Tour events across Asia. In 2025, APE is leading the expansion of the CUPRA FIP Tour into new host nations across the region, including Hong Kong, Malaysia, Vietnam, and more—creating more pathways for Asian athletes to compete internationally and grow the sport across the continent.

For the first time, Malaysia will join this prestigious list with the FIP Bronze Kuala Lumpur 2025, running from April 16 to 20, 2025, at ASCARO Padel & Social Club, 1 Utama.

Awarded a Bronze classification, the tournament will offer €7,000 in prize money and vital international ranking points, giving local and regional players the chance to compete against top global talents. The event represents a critical step forward in integrating Southeast Asia into the elite global padel circuit.

The tour will boost Malaysia’s reputation as a prominent destination for international padel events. Visit FIP Bronze Kuala Lumpur 2025 to find out more or sign up to join the competition. Registration is until April 2, 2025.

The Asia Pacific Padel Tour: Returning to KL for the Second Time

The week after the FIP tournament, ASCARO is also proud to bring the APPT to Kuala Lumpur from the 25th – 27th of April. As the first-ever Professional Padel Tour in the Asia-Pacific region, the APPT has rapidly become one of the largest and most popular tours worldwide.

With dedicated categories for both professional and amateur players, the APPT provides a competitive platform for players of all levels, giving everyone a chance to battle for glory on the courts.

The tournament will be held at the ASCARO Padel & Social Club in 1 Utama. Prizes will be awarded in all men’s and women’s categories, with cash prizes totalling $6,500 for professional players, and Joma Sport Padel equipment given to the winners of amateur categories.

Visit APPT Open Kuala Lumpur 2025 for more information. Registration is open until April 21, 2025.

ASCARO Champions Padel’s Growth in the Asia-Pacific Region

ASCARO serves as the leading force in the development of padel in the Asia-Pacific region. As the premier padel club of Kuala Lumpur, ASCARO Padel & Social Club has set a high standard for what padel is. It’s not just a game, but an experience that integrates a competitive sport with style. Since 2023, ASCARO has already been making waves in Malaysia. It established the country’s first-ever professional padel club, while attracting a new generation of players and fans alike. As part of its commitment to elevate the sport across the continent, ASCARO also has plans to open four new clubs in 2025.

Now, ASCARO is bringing two important tournaments to KL, both are big opportunities to celebrate padel in the region. Spearheading this effort is Daniel Liljekvist, Managing Director and Partner at ASCARO Padel and Social Club. Liljekvist expressed: “We are proud to host two major international padel tournaments this April— the first-ever FIP tournament in Malaysia, followed by the second Malaysian edition of the APPT. This marks a significant step in the growth of padel in the region, and ASCARO is honored to be at the forefront of this movement.”

Thanks to ASCARO’s strong regional presence, padel has attracted a diverse and enthusiastic audience. A growing community that Liljekvist and his team are determined to serve. “At ASCARO, we are committed to delivering a premium playing experience, and our distinctive high-quality courts set the stage for top-tier competition. Hosting these prestigious tournaments reflects our dedication to excellence, both in the facilities we provide and the level of play we support. We look forward to welcoming elite players, passionate fans, and the wider padel community for an unforgettable month of world-class padel”, Liljekvist added.

Presented together with Qliq Damansara Hotel, ASCARO’s official partner for the FIP Tour and the APPT.

by | Mar 25, 2025 | Business

Kuala Lumpur, Malaysia – Switch (Apple Premium Reseller) and Urban Republic, Malaysia’s leading smartphone and gadget retail store with over 200 locations nationwide, are proud to announce a groundbreaking advancement in customer service. In collaboration with CIMB Bank Berhad (“CIMB”) and Payments Network Malaysia Sdn Bhd (“PayNet”), Switch and Urban Republic are now the first smartphone and gadget retail stores in Malaysia to offer e-invoice submission directly through CIMB’s payment terminals, upon transaction completion.

(From left to right) Daniel Cheong, Head of Consumer Banking Malaysia, CIMB; Peggy Tan, Deputy Managing Director, CG Group (Switch / Urban Republic); Li Chau Ging, Managing Director, CG Group (Switch / Urban Republic); and Azrul Fakhzan Mainor, Senior Director of PayNet’s Commercial Division, have launched an instant e-invoice submission service. Urban Republic and Switch are the first smartphone and gadget retailers in Malaysia to offer this seamless feature through CIMB’s payment terminals.

This innovative service eliminates the need for customers to retain physical receipts as the receipts would be emailed to them immediately upon completing the transactions. By simply completing their purchase at any Switch or Urban Republic store using a CIMB terminal, customers can submit for their official e-invoice. This streamlined process enhances convenience, reduces paper waste, and provides a secure and efficient way to manage purchase records.

“We are thrilled to partner with CIMB and PayNet to bring this cutting-edge solution to our customers,” said Li Chau Ging Managing Director of Switch and Urban Republic.

“As the largest smartphone and gadget retail chain in Malaysia, we are committed to providing exceptional customer experiences. This instant e-invoice submission service underscores our dedication to innovation and sustainability, offering our customers a seamless and environmentally friendly transaction process.”

This collaboration leverages CIMB’s advanced payment terminal technology and PayNet’s robust payment infrastructure to deliver a seamless and secure e-invoice submission experience. Customers can easily access their e-invoice details directly on the terminal screen and opt to have it sent to their registered email address or mobile device.

Gurdip Singh Sidhu, Chief Executive Officer of CIMB Malaysia and CIMB Bank Berhad said, “At CIMB, we are committed to advancing our customers and society, and thereby continuously introducing enhanced services for their benefit. We are pleased to partner with PayNet to introduce an innovative solution through Switch and Urban Republic, so that our customers can have e-invoices directly and promptly shared with them. This we believe will help the merchant, the customer and by extension the government to make things simpler, better and faster for all.”

“As Malaysia’s national payments network, PayNet is committed to fostering seamless and secure digital payment transactions. This initiative exemplifies how strategic collaboration can accelerate digital adoption and enhance the retail experience for both businesses and consumers,” said Azrul Fakhzan Mainor, Senior Director of PayNet’s Commercial Division. “By enabling instant e-invoice submission through our payment infrastructure, we are making transactions more efficient, sustainable, and aligned with the needs of today’s digital-first economy.”

This new service is now available at six Switch locations (Wangsa Walk Mall, Plaza Low Yat, Plaza Shah Alam, Quayside Mall, The Mines and Sunway Pyramid), and will be rolled out at 83 more Switch and 117 Urban Republic outlets by 15 June.

by | Mar 25, 2025 | Business

Perseroan Terbatas (“PT”) is a limited liability company that is established under Indonesian law. The capital of a limited liability company is divided into shares and the responsibility of shareholders is based on the number of shares that he or she has.

Under Indonesian Company Law No. 40 of 2007 on Company Law as last amended by Law 11 of 2020 on Job Creation (“Company Law”), a company must be established by at least two shareholders. Its establishment takes place after a deed of establishment is issued by the notary which is followed by the approval of the Minister of Law and Human Rights; only then a PT obtain status as a “legal entity”.

To form a PT Indonesian company, here are 5 key points.

Name of the Indonesian Company

Under Government Regulation N. 43 of 2011 on the Procedures of Submission and Using Company Name, the company’s name should meet the following requirements:

1. Written in Latin letters;

2. Has not been used legally by another company or is not essentially the same as the name of another company;

3. Does not conflict with public order and/or decency;

4. Not the same or essentially the same as the name of a state institution, government institution, or international institution, unless it has obtained a permit from the institution concerned;

5. Does not consist of numbers or series of numbers, letters or series of letters which is not forming word;

6. Does not mean as the company/corporate, legal entity, or civil partnership, incorporation, limited liability company, or any other similar words;

7. The company which is wholly owned by an Indonesian citizen or an Indonesian entity has to use the Indonesian language as the company name. So that, the English or foreign words can only be used if it is a foreign-owned company.

In addition to the above, as required by the system of the Ministry of Law and Human Rights, the company name should be consisted of at least 3 (three) words. For example PT Anugerah Abadi Dunia, PT Nine World Champion.

Organs of the Indonesian Company

OrgansResponsibilitiesBoard of DirectorsLead the company’s daily business. A company can appoint a single director, but a public company, it must appoint at least two directors.Board of CommissionersSupervises and advises the Board of Directors of the Company. A company can appoint a single commissioner, but for a public company it must appoint at least two commissioners, one of whom must be an independent commissionerGeneral Meeting of Shareholders (GMS)It is the highest organ in the company. GMS has the authority to decide the matters that cannot be conducted by the Board of Directors or Board of Commissioners, among others, such as the approval of the transfer of shares, declaring a dividend, or the amendment of the articles of association.

Shareholders and Capital Structure

A company must be established by at least 2 (two) shareholders (it can be an individual or a business entity). The Capital structure of a company is divided into three categories:

Capital StructureExplanationAuthorized capitalthis capital is determined based upon mutual consent from the founders/shareholders Issued capitalthe Company Law mandates that a minimum of 25% of the authorized capital must be paid by the shareholders to the Company Paid-up capitalmust be paid in an amount equal to 100% of the issued capital. It is also important to note that a specific business sector may require a minimum amount of authorized capital and issued capital

Capital Structure on Foreign Ownership

Shares in an Indonesian company may be held by an Indonesian citizen/company and a foreign citizen/company. An Indonesian company whose shares are partly or entirely owned by a foreign citizen/company is known as a foreign investment company (“PT PMA”). Based on Investment Coordination Board Regulation No. 4 of 2021 on Guidelines and Procedures for Risk-Based Licensing and Investment Facilities, the minimum issued a capital requirement for PT PMA is Rp10,000,000,000 (ten billion Rupiah).Other than the minimum capital requirement as mentioned above, Indonesian law also governs the maximum foreign shareholding threshold is regulated under Presidential Regulation No. 10 of 2021 as last amended by President Regulation No. 49 of 2021 on the Investment Business Sectors (“Positive List Investment”). Under the Positive List, it divides the business activities that are (i) open for 100% foreign shareholding; (ii) partly owned by foreign shareholders, or; (iii) 100% closed for foreign shareholding.

Objectives and Purposes of the Company

A company must have objectives and purposes as well as business activities that are not contrary to provisions of laws and regulations, public order, and/or morality. The objectives and purposes of the company must be based on the Regulation of Central Bureau of Statistics (Badan Pusat Statistik) No. 2 of 2020 on the Indonesian Standard Industrial Classification (“KBLI”). The list of KBLI can be found in the link here https://oss.go.id/informasi/kbli-berbasis-risiko

by | Mar 24, 2025 | Business

The Coalition’s proposed nuclear sites in Queensland would not have access to enough water to operate or manage a nuclear incident, according to an explosive new report by the Queensland Conservation Council.

According to the Queensland Conservation Council, the proposed nuclear reactor in Callide would use more than double the water currently allocated to the existing Callide power station, while the proposed Tarong nuclear reactor would use 50 per cent more water than is allocated to the existing coal power station.

We’ve just hit 14 years since the Fukushima nuclear accident. This report shows that during the Fukushima emergency, the nuclear facility was flooded with 1.3 million cubic metres of sea water to prevent the plant from blowing up. There is no such water allocation for emergency response in Queensland dams, nor a storage solution for the potential millions of cubic metres of heavily radioactive water that such a disaster would create.

Queensland Conservation Council Director Dave Copeman says:

“The findings of this report are damning for the Coalition’s nuclear fantasy. There simply is not enough water available in the proposed locations to run nuclear facilities, and no plan for where to store irradiated water required for heat reduction in the case of an emergency. It would be a health and environmental catastrophe if highly irradiated water was returned to these dams.

“The Coalition is not being honest with farmers and the community about the realities of their nuclear scheme. At best it’s impractical, at worst it’s grossly irresponsible and could result in a major incident.

“We’ve seen during droughts that there’s not enough water for existing coal power stations, especially in Central Queensland, so coal units have to wind down their operation.

“So the Coalition’s ‘plan’ is to build the most expensive form of electricity generation that won’t be ready in time to replace our retiring coal power stations, and then won’t be available at times because of water constraints.

“You know what doesn’t use a lot of water? Renewable energy and it’s already powering 40 per cent of Australia.”

by | Mar 24, 2025 | Business

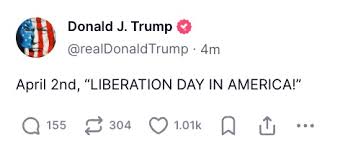

Trump’s “Liberation Day” tariffs on April 2 could shake global markets. Will BTC, XRP, and SOL rise or fall? Explore expert insights, market reactions, and economic forecasts.

Financial markets showed positive signs early Monday following reports suggesting that the upcoming tariffs announced by former President Donald Trump—set to be implemented on April 2—might be more measured than initially expected.

Bitcoin traded at around $87,280, marking a 3.49% increase over a 24-hour period, while Solana’s SOL token surged nearly 6.52% to $140.06.

These gains reflect an improved risk appetite, fueled by speculation that the tariffs may be more targeted rather than broad-based.

Key economic events in the coming days include Friday’s release of the Personal Consumption Expenditures (PCE) index, the Federal Reserve’s preferred inflation gauge, and the Senate Banking Committee’s hearing with SEC nominee Paul Atkins and Comptroller of the Currency nominee Jonathan Gould on March 27.

Market participants are closely watching these developments, as they could further influence sentiment leading up to Trump’s tariff announcement.

The “Liberation Day” Tariffs: A Pivotal Economic Event

Trump has positioned the April 2 tariff rollout as a significant milestone, dubbing it “Liberation Day”. The tariffs are expected to target nations that impose trade restrictions on the United States, aligning with Trump’s long-held stance on trade fairness.

According to economic analyst Alex Krüger, the significance of this event could surpass any Federal Open Market Committee (FOMC) meeting, with potential market reactions varying from a sharp rally to a steep decline, depending on the final details of the tariff policy.

While Trump’s previous tariff measures in February caused widespread market volatility—dragging down stocks and cryptocurrencies—there is cautious optimism that the upcoming tariffs will be more selective.

Officials close to the matter suggest that the new measures may not encompass all industries and could provide exemptions for key trading partners. This targeted approach may help mitigate some of the fears of an all-out trade war.

The Impact of Past Tariff Announcements on Markets

Historical trends suggest that markets react sharply to tariff policies. In February, Trump introduced a 25% tariff on Canadian and Mexican imports and a 10% tariff on Chinese goods, causing an immediate 8% drop in the total cryptocurrency market capitalization.

Bitcoin plummeted from around $105,000 to nearly $92,000. Similarly, U.S. equities suffered, with the S&P 500 declining by 7% and the NASDAQ falling 10% amid inflationary concerns and recession fears.

If the “Liberation Day” tariffs follow a similar trajectory, extreme volatility could ensue, particularly in risk-sensitive assets like cryptocurrencies and technology stocks.

Economists warn that a broad tariff implementation could lead to a 10-15% market correction, exacerbating financial instability.

The Global Response to Trump’s Trade Policies

The anticipation of the tariffs has already stirred reactions from major global economies. Chinese Premier Li Qiang has indicated that Beijing is preparing for “shocks that exceed expectations.”

Australian Treasurer Jim Chalmers described Trump’s approach as “seismic,” highlighting the potential for significant economic disruptions.

Meanwhile, Mexico’s President Claudia Sheinbaum has taken proactive steps to de-escalate tensions by collaborating with the U.S. on immigration and drug control measures.

However, analysts believe these efforts may only provide temporary relief, as Trump’s broader trade agenda remains aggressive.

The Federal Reserve’s Stance on Tariffs and Inflation

Despite Trump’s tariff strategy, the Federal Reserve has maintained a dovish stance, retaining its forecast for two interest rate cuts this year.

The Fed views the inflationary effects of tariffs as transitory and believes that rate cuts will help stabilize the economy.

However, the central bank has acknowledged an increase in economic uncertainty due to the impending tariff measures.

The Road Ahead: Market Speculation and Policy Uncertainty

As April 2 approaches, investors are grappling with the potential outcomes of the tariff announcement. Some experts suggest that Trump may include sector-specific tariffs targeting industries such as automobiles, semiconductor chips, pharmaceuticals, and lumber.

If auto tariffs are included, they could significantly impact global supply chains, particularly for European and Japanese manufacturers.

While Trump has hinted at possible exemptions for certain allies, the specifics remain unclear.

Kevin Hassett, Director of Trump’s National Economic Council, has downplayed fears of widespread tariffs, suggesting that the market is overestimating their impact. However, uncertainty continues to loom over global trade and financial markets.

Conclusion: A Defining Moment for Trade Policy

Trump’s “Liberation Day” tariffs mark a pivotal moment in U.S. trade policy, with far-reaching implications for global markets. Whether these tariffs will be narrowly focused or broadly applied remains to be seen.

If they are implemented aggressively, they could fuel economic turbulence, while a more measured approach might reassure investors and stabilize financial markets.

With cryptocurrencies and equity markets responding to every development, traders and policymakers alike are preparing for potential volatility.

As the world awaits Trump’s final decision on April 2, the balance between economic protectionism and market stability hangs in the balance.

You must be logged in to post a comment.