by | Mar 26, 2025 | Business

The greatest sports action and icons now streaming on ESPN on Disney+ in Australia and New Zealand, plus all your favourite and beloved entertainment.

Disney+ today launched ESPN on Disney+ in Australia and New Zealand, bringing blockbuster matchups, unmissable moments and more than 10,000 hours of ESPN’s live sports action to the platform.

ESPN on Disney+ is now streaming and included for all Australia and New Zealand subscribers, both Disney+ Premium and Disney+ Standard.

Australian tennis star Nick Kyrgios – also a Boston Celtics and NBA mega fan – helms a full-scale marketing campaign across all platforms to launch ESPN on Disney+ and encourage subscribers to ‘Turn It On’.

The first seven days start with must-watch NBA action as the race to the NBA Playoffs heats up. Back-to-back Live NBA double headers tip off proceedings, headlined by superstars Stephen Curry and LeBron James. Jayson Tatum and the defending NBA champion Boston Celtics face off against the Phoenix Suns across March 26 and 27.

The Major League Baseball season opens stateside on March 28 with the New York Yankees meeting the Milwaukee Brewers in a special presentation, to be called by iconic ESPN voice Joe Buck, before Shohei Ohtani and the Los Angeles Dodgers return to Dodger Stadium to continue their World Series defence.

The NCAA Basketball Championship hits the ‘Sweet 16’ stage on March 28 as March Madness reaches the final stages; and Australian UFC championship contender Steven Erceg will battle former champion Brandon Moreno at UFC Fight Night live from Mexico City on March 30.

The new ESPN hub on Disney+ includes live ESPN and ESPN2 channels, fan-favourite studio shows such as SportsCenter, The Pat McAfee Show, NBA Today, and First Take, along with live events and on-demand replays, and iconic original programming including ESPN’s award-winning library of 30 for 30 films.

The Walt Disney Company Australia and New Zealand Senior Vice President and Managing Director, and Head of ESPN Asia-Pacific, Kylie Watson-Wheeler, said: “We’re thrilled ESPN on Disney+ is now streaming for all subscribers in Australia and New Zealand. It’s the new home ground for sports entertainment.

“ESPN is the seventh addition to our Disney, Pixar, Marvel, Star Wars, National Geographic and Star content hubs. Adrenaline-pumping sports are the perfect match up with our must-stream shows, like Daredevil: Born Again and High Potential, all on platform together like only Disney+ can do.

“ESPN expands our audience by bringing 10,000 hours of live sports action to Disney+, plus live events and on-demand replays, which represents additional value for subscribers and is a big win for sports fans, coming into what are sure to be nail-biting NBA Playoffs.”

ESPN on Disney+ adds to The Walt Disney Company’s more than 100 years of best-in-class content, including the latest and greatest from its iconic brands and franchises – Disney, Pixar, Marvel, Star Wars and National Geographic – as well as the Star tile’s expansive General Entertainment offering which includes content from FX, Searchlight, Hulu, and locally produced Originals, such as The Artful Dodger, Shipwreck Hunters Australia and The Clearing, among others.

Disney+ subscribers can also stream a stellar line up of acclaimed titles including Inside Out 2, Alien Romulus, A Real Pain, Shōgun, The Bear, and blockbuster hits, Moana 2 and Mufasa: The Lion King.

ESPN has extensive rights to major sporting events, featuring basketball action across the NBA, WNBA, FIBA as “Your Home for Hoops”, and more.

ESPN will celebrate its 30th Anniversary in Australia in September 2025 with its locally operated business spanning TV, digital, social and editorial platforms serving sports fans anytime, anywhere.

In addition to the ESPN offering on Disney+, ESPN is available via Foxtel, Kayo Sport, Fetch TV, and Sky NZ.

by | Mar 26, 2025 | Business

AgadPay has officially launched in the Philippines, offering employees safe, on-demand access to their earned wages before payday—without loans, interest, or debt traps. In a market where millions of Filipinos live paycheck to paycheck and often rely on high-interest payday lenders, AgadPay provides a healthier financial alternative that helps reduce stress and improve financial stability. The platform is free for employers to offer and has been shown to boost employee retention and productivity by giving workers greater control over their finances.

Manila, Philippines – March 26, 2025 – AgadPay, a new Earned Wage Access (EWA) platform, is now available nationwide, providing Filipino employees with safe, convenient access to the wages they have already earned—before payday. This solution involves no loans, no interest, and no debt traps. Instead, workers can withdraw a portion of their accrued salary for a small, transparent fee, eliminating the need for high-interest payday loans that can lead to spiraling debt.

What is Earned Wage Access (EWA)?

Earned Wage Access is an arrangement that lets employees tap into the income they have already accumulated prior to the official payday. It bridges the common financial gap that arises toward month’s end, cutting down on reliance on payday loans and informal lending. EWA is increasingly recognized as a sensible response to the urgent reality faced by Filipino workers, with 80% of Filipinos reportedly living paycheck to paycheck, 36 million still borrowing cash for daily needs, and 60% lacking any form of emergency fund. All these figures are underscoring the depth of financial stress many Filipinos experience.

Why the Philippines Needs EWA

The prevalence of high-cost lending is illustrated by the fact that 47.1% of Filipino adults regularly borrow money, often at interest rates that are difficult to repay. Many employees find themselves in a continuous cycle of debt, unable to break free from payday lenders. Studies have found that 66% of EWA users report reduced financial stress and that 79% of employees would consider changing jobs if EWA were offered elsewhere. This demonstrates strong demand for a more sustainable way to handle short-term cash shortages and underscores the value of EWA as a credible alternative to predatory lending sources.

A Better Option for Employees

By offering access to wages that have already been earned, AgadPay provides a dignified, debt-free way for workers to cover urgent expenses such as utility bills, tuition, or healthcare costs. There is no interest charged, only a minimal convenience fee, and employees remain in control of their own earnings rather than getting trapped in loan repayment cycles. This model relieves the anxiety that stems from living paycheck to paycheck and bolsters overall financial well-being.

A Win-Win for Employers

AgadPay is entirely free for companies to offer. Employers who adopt EWA report positive outcomes that include higher retention rates and a more engaged workforce, an important factor given that 1 in 5 employees admits to reduced productivity due to financial strain. Studies also indicate EWA can increase employee retention by up to 78%. AgadPay integrates easily with existing payroll systems, meaning organizations can support the financial health of their workforce without taking on additional administrative burdens.

AgadPay is now open to businesses across the Philippines. To explore how this new EWA platform can benefit both companies and their employees, visit www.agadpay.ph for details on scheduling a demo or requesting more information.

by | Mar 25, 2025 | Business

Paw enthusiasts unite! The much-loved Cat Lovers Festival and Dog Lovers Festival are making a highly anticipated return in 2025, bringing joy, education, and entertainment across Melbourne and Sydney, before heading to Brisbane in 2026.

Featuring an incredible line-up of attractions, the festivals are set to deliver an unforgettable experience for every pet lover, whether they are lifelong dog devotees or passionate cat enthusiasts.

The festivals will provide access to a wide selection of breeds, with experts and adoption groups, with the interactive facets complemented by exclusive shopping experiences, competitions and more.

“We are thrilled to bring these events back, offering pet lovers a unique opportunity to immerse themselves in a world of dogs and cats,” said Event Director, Paul Mathers.

“It’s incredibly exciting to see how the Cat and Dog Lovers Festivals continue to grow and evolve year after year. These festivals have become a highlight on the calendar for so many Australians, and we can’t wait to welcome everyone back for another unforgettable celebration of their furry companions.”

“From expert-led talks to action-packed arenas, visitors will find inspiration, entertainment, and valuable insights into pet ownership.”

Exciting festival highlights include the ADVANCE™ Stage, Breed Showcases, and dedicated Adoption Zones, designed to connect visitors with adoption groups and animal welfare organisations. The action-packed Vitapet Arena will feature live demonstrations, showcasing incredible dog skills and training techniques.

Star appearances will include Farmer Dave Graham, a festival favourite known for his engaging demonstrations, and Lara Shannon, renowned from TV’s Pooches at Play, offering expert dog training insights.

After a popular debut at the Melbourne event last year, social media sensation Jamie the Dog Trainer will be a must-see guest in both Melbourne and Sydney, while ABC TV’s Muster Dogs stars Marlene & Hudson and Jack & Pesto will be live on stage at select events, and Brodie Young will return as MC.

There will be high-flying antics with the Kurgo Dockdogs splashing into a 100,000 litre pool, the Pat-a-Pooch experience, with the Vitapet Door Prize giving guests the opportunity to win thousands of dollars’ worth of top gifts for their pooch.

A new addition to the Dog Lovers Festival is a dedicated hub for Dog-Friendly Travel, reflecting the growing popularity of dog-friendly vacations. Visitors will be able to explore the latest travel products, services, and destinations designed for adventures with their furry friend.

Cat lovers won’t be disappointed, with a packed program featuring the WHISKAS® Stage, Kitty Cosplay, Australia’s largest cat dress-up parade, the Championship Cat Show, the heart-warming Pat-a-Cat experience, and the fabulous Feline Natural Breed Showcase featuring rare and popular breeds.

Attendees can also experience the WHISKAS® Kitty Corner and put their cat knowledge to the test in CatKwiz. The Cat Lovers Festival will also boast a brand-new Marketplace, promoting boutique Australian business alongside the main Expo offering an extensive range of specialty cat products, festival-only specials, and exclusive items tailored to feline enthusiasts.

Cat Lovers Festival special guests, including Australia’s favourite veterinarian Dr. Katrina Warren, and local social media sensations Sonia Hankova & Kepler Copernicus will make appearances throughout the festivals.

The tour kicks off at the Sydney Showgrounds on August 23–24, followed by the Melbourne Showgrounds on October 25–26, and heads to Brisbane Showgrounds on May 16–17, 2026.

Attractions and speaker line-ups will vary by location, with further exciting announcements to be made in the lead-up to each festival.

Visitors are able to fetch Dog Lovers Festival tickets at dogloversfestival.com.au, or pounce on Cat Lovers Festival passes at catloversfestival.com.au, with limited opportunities for exhibitors still available at all three events.

And in Pawsome news – every cat lover who buys a ticket will also receive access to the Dog Lovers Festival and vice-versa, meaning you can access two great festivals for the price of one!

Please note: visitors are unable to bring their own dog or cat to the event for health and safety reasons, see websites for full details on this policy.

by | Mar 25, 2025 | Business

Discover the top 3 crypto airdrops to watch in late March 2025! Explore GOAT Network, Tari, and MegaETH—projects offering unique rewards through Bitcoin Layer-2, PoW mining, and NFT-based incentives. Don’t miss out on these lucrative opportunities!

As the crypto market enters the last week of March, Airdrop Hunters are on the lookout for lucrative opportunities to engage with promising projects at an early stage. Three noteworthy projects offer attractive airdrop opportunities: GOAT Network, Tari, and MegaETH.

These projects span Bitcoin Layer-2 (L2) solutions, unique Proof-of-Work (PoW) protocols, and Ethereum (ETH) scaling innovations.

GOAT Network: Get BTC and Turn into an Active Asset

GOAT Network is a Bitcoin Layer-2 solution designed to expand Bitcoin’s utility by integrating smart contracts and decentralized finance (DeFi).

Having officially launched its Alpha Mainnet on March 17, 2025, GOAT Network is moving away from conventional one-time airdrops. Instead, it has introduced an ongoing rewards system through the “One Piece Project.”

Participants in GOAT Network can engage by bridging assets such as BTC, BTCB, or Dogecoin (DOGE), minting soulbound NFTs, and interacting with dApps like GOATSwap and Oku.

These activities are rewarded with GEC (Proof of Activity) and GOAT Points, which can later be converted into GOATED tokens after the Token Generation Event (TGE) scheduled for late 2025.

GOAT Network encourages early adopters to interact actively, as airdrop rewards increase based on engagement levels. The project has allocated 6% of its total token supply for airdrops, with an additional 42% dedicated to sequencer and community mining and 1% reserved for influencer collaborations.

As the public mainnet launch and TGE approach, GOAT Network is positioning itself as a leader in Bitcoin-based DeFi.

Tari: Reward for Community Member

Tari is a Layer-1 blockchain focused on user-based proof-of-work (PoW) and digital asset management. With its mainnet launch scheduled for April 2025, early participants have an opportunity to accumulate Gems, which are likely to play a role in future token distribution.

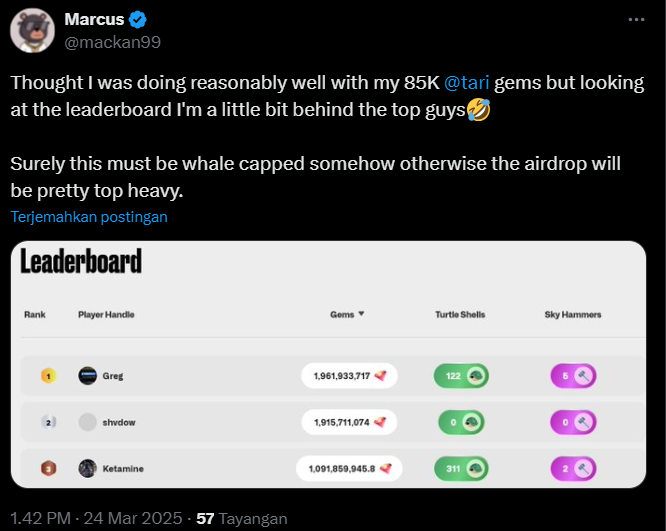

However, leaderboard data suggests that top participants have amassed a significant number of Gems, raising concerns about the fairness of the distribution. Some community members have suggested capping large allocations to prevent disproportionate rewards for “whales.”

Tari has allocated 5% of its total XTM token supply for its incentive program. Airdrop distribution is expected to occur approximately six months after the mainnet launch, with a 12-month vesting period for community tokens.

Users can earn Gems by mining tXTM (Tari’s testnet token) through the Tari Universe platform, completing quests, referring friends, and owning Yats domain names with high rhythm scores.

Additionally, rare collectibles such as “Turtle Shells” and “Sky Hammers” offer multipliers and boost airdrop eligibility, making them highly desirable.

Tari’s ASIC-resistant PoW algorithm ensures a fairer mining process, preventing domination by large-scale mining farms. Notably, U.S. residents are ineligible for the airdrop, but global participants can take advantage of the early-stage opportunity before testnet mining concludes.

MegaETH: An NFT-Based Airdrop Model

MegaETH takes a novel approach to airdrop distribution. As an Ethereum Layer-2 solution boasting transaction speeds of up to 100,000 TPS, MegaETH has secured backing from Vitalik Buterin and a $20 million seed funding round.

Instead of offering direct token airdrops, MegaETH has implemented an NFT-based reward system. While the public testnet is currently active, the project has stated that no immediate rewards will be granted for participation. However, many community members speculate that testnet interactions may impact future eligibility.

MegaETH has advised users to monitor related projects such as CAP Labs and Noise for potential clues on early access opportunities.

Although some users have expressed disappointment over the absence of a direct airdrop announcement, MegaETH’s alternative model may yield long-term benefits for engaged participants.

Conclusion

With airdrops remaining a significant attraction in the crypto space, GOAT Network, Tari, and MegaETH each provide unique opportunities for early adopters. Whether through DeFi-based incentives, PoW-based mining, or NFT-driven rewards, these projects offer distinct avenues for engagement.

Airdrop hunters should stay vigilant and actively participate to maximize their chances of securing valuable rewards in these emerging ecosystems.

by | Mar 25, 2025 | Business

Get ready for the Rats Kingdom (RK) token listing on March 28, 2025! Learn about claim issues, price predictions, investment potential, and how to secure your tokens before the deadline.

The highly anticipated listing date for Rats Kingdom (RK) is just around the corner, set for March 28, 2025. However, as the deadline approaches, many users are experiencing claim-related issues with their RK tokens.

From wallet connection problems to missing token visibility, both verified and non-verified community members are facing hurdles in accessing their coins.

Token Claim Issues and Solutions

The Rats Kingdom project had previously announced that eligible users must redeem their tokens before March 28. A snapshot was taken on January 10, 2025, to ensure a fair distribution. However, as the deadline nears, several users report technical issues.

Common Problems and Fixes

1. Trust Wallet Not Connecting: If you are not getting the approval popup, simply click “Try Again” when prompted.

2. Tokens Not Visible: Users need to manually add the RK token contract address to their wallet to view their holdings.

How to Claim Your RK Tokens in 4 Steps

- Ensure you have at least 15 POL (Polygon) in your wallet for gas fees.

- Add the official RK contract address to your wallet.

- Connect your wallet using the Telegram Mini App bot.

-

Tap “Claim Now,” approve the transaction, and wait for the tokens to appear in your wallet.

Important Points to Remember:

- Only verified users can claim instantly.

-

If unverified, you must complete the KYC process first.

-

Ensure you have enough Polygon (15 POL) to complete the transaction.

-

The claim window closes on March 28, 2025, the same day as the listing.

Rats Kingdom Listing and Price Predictions

The RK token will officially list on March 28, 2025. However, the exact platforms where it will debut remain unconfirmed. Speculations point to major global exchanges while others suggest it may only be available on its own exchange.

Rats Price Forecast and Investment Potential

With a total supply of 100 billion tokens, RK is being compared to the success of Hamster Kombat (HMSTR). Hamster Kombat launched at $0.0085, peaked at $0.01, and is currently trading at $0.002078.

Based on expert analysis, the RK listing price could range between $0.005 and $0.008. If listed on major exchanges, long-term projections suggest it could rise between $1 and $5.

According to current predictions, Rats is expected to increase by 227.30%, reaching $0.00009906 by April 24, 2025. However, the market sentiment remains bearish, with the Fear & Greed Index at 46 (Fear).

Investment Projection

If you invest $1,000 in Rats today and hold until May 2, 2025, the estimated potential profit is $3,583.20, representing a 358.32% ROI (excluding transaction fees).

Short-Term Price Targets

Why March 28, 2025?

The choice of March 28 for the listing and Token Generation Event (TGE) was strategic. The project team ensured that the launch date aligns with community engagement, technical readiness, and exchange partnerships.

This launch will not only mark the introduction of RK tokens into the broader crypto market but also serve as a significant milestone in the project’s roadmap.

Community Involvement and Future Prospects

The Rats Kingdom team has placed a strong emphasis on community engagement. From rewarding early adopters to fostering active discussions on Twitter, Telegram, and Discord, the project aims to build a loyal user base that supports its long-term vision.

Technical Aspects of the TGE

On March 28, 2025, the RK smart contract will be activated, minting and distributing tokens to eligible holders. Additional features include:

1. Exchange Listings: RK will debut on selected platforms, ensuring immediate trading liquidity.

2. Staking and Yield Farming: Plans to integrate staking opportunities for passive income generation.

3. Security Measures: Multi-layered security checks and audits to ensure safe transactions.

Conclusion

With only three days left before the official listing, now is the time for users to finalize their claims and verify transactions. Whether RK follows in the footsteps of Hamster Kombat or carves out its own niche, March 28 will be a defining moment for this emerging cryptocurrency.

As always, investors are reminded to conduct their own research and approach trading with caution. The future of Rats Kingdom remains promising, but market fluctuations should always be considered before making investment decisions.

You must be logged in to post a comment.