by | Mar 28, 2025 | Business

Founder Dr. Cecilio K. Pedro established Lamoiyan in 1988, growing it from 20 employees to nearly 200 today, exporting over a dozen brands across APAC and MENA. A 100% Filipino family-run business, Joel Conrad Pedro steps into his father’s legacy of success in 2024.

Jovial, warm and direct, this 40-year-old Chief Executive is far from cut-and-paste. Joel went through the ranks paving his way to COO, then to CEO. An adventure glamper, car lover and concurrent CEO of Overland Kings, what can Joel bring to the table of a household and hygiene brand? Answer: A lot.

Says Joel, “You play with the cards that you’re dealing with. So Lamoiyan is a card I am dealt with because it’s a family business. Over the time we’ve been running this business, I’m blessed to have a good team with us without whom I cannot run my other business. That’s the nature of this work.”

The young CEO is stepping into leadership with solid business sense plus a reliable support system that allows freedom to explore other opportunities and interests. “Everybody needs passion here and there. I’m a businessman who likes the outdoors and cars, and I think everybody can agree that you need something to take your mind off things so you can do your main job excellently. My Overland Kings business is an outlet for me to be able to creatively give input on what else I do,” he adds.

Lamoiyan operates with core values of integrity, equality, and inclusion. Their brand is praised for prioritizing hearing-impaired individuals providing meaningful employment opportunities, and recognizing their community. Under its new CEO, the company reinforces these efforts through CSR initiatives like the creation of Silent Sanctuary, a self-sustaining school for the hearing-impaired that also serves as a glamping site.

As an outdoor enthusiast, Joel encourages clients to visit the site, with all proceeds supporting the school’s operations. “Silent Sanctuary is self-sustaining. It serves a clientele, and it’s easier to tell people to go camping than just always asking donation money for them. If they enjoy nature, if they enjoy the facility, maybe they give a bigger tip. It is win-win. That’s how we’re able to sustain it.”

Win-win mentality and spotting opportunity from crisis are Lamoiyan traits. During the lockdown, Lamoiyan produced isopropyl and ethyl alcohol brands that helped stabilize business and avoided layoffs.

“I think it’s a matter of being excellent in what you have. I always believe in being a good steward of what you’re given. At the end of the day, our mission and vision still goes back to helping the Filipinos, give them a product of quality, and affordable, that gives Filipinos products they can use. It’s also important to do it excellently. Have an excellent team.”

by | Mar 28, 2025 | Business

For years, the energy industry has mostly been a man’s world. But at Alsons Power, things are changing — and women are redefining the field.

At the heart of this transformation are three remarkable women from the Sarangani Energy Corporation (SEC) power plant in Maasim, Sarangani. Meet our power buddies Fritz Asuero, Kimberly Gaturian, and Charmaine Joyce Maningo — engineers, leaders, and role models. They’re not just breaking stereotypes; they’re helping to build a future where skill, heart, and determination matter more than gender.

For years, the energy industry has mostly been a man’s world. But at Alsons Power, things are changing — and women are redefining the field.

At the heart of this transformation are three remarkable women from the Sarangani Energy Corporation (SEC) power plant in Maasim, Sarangani. Meet our power buddies Fritz Asuero, Kimberly Gaturian, and Charmaine Joyce Maningo — engineers, leaders, and role models. They’re not just breaking stereotypes; they’re helping to build a future where skill, heart, and determination matter more than gender.

Breaking barriers, embracing innovation, and empowering future generations—Alsons Power’s female Power Buddies Fritz Asuero, Kimberly Gaturian, and Charmaine Joyce Maningo are reshaping the role of women in the energy sector.

Defying Stereotypes

Knowing how tough it can be for women in the energy sector, Kimberly Gaturian, a Distributed Control System (DCS) Engineer at SEC, shows that women can definitely make their mark and succeed in the power industry.

“I don’t have to compete with anyone in this male-dominated field; I just have to compete with myself and be the best version of me,” she affirms.

As an engineer, Kimberly helps ensure the smooth operation of the plant through advanced technology and smart systems. One of her proudest achievements is the wall seal blower changeover process, which has significantly improved plant safety and even influenced the design of SEC Unit 2.

Engineer Fritz Asuero, in charge of Quality Assurance and Quality Control (QAQC), knows what it’s like to be underestimated. People often assume women take longer to master engineering. But for Fritz, that only lights a fire within. “It’s not about being a man or a woman. It’s about passion and hard work.” Rather than letting this bias hold her back, she uses it as fuel to prove her skills, problem-solving abilities, and fresh perspectives in the workplace.

Currently, Fritz plays a key role in implementing Energy Management System, optimizing electricity use, and advancing sustainability efforts to further enhance the plant’s operational efficiency.

Then there’s Engineer Charmaine Joyce Maningo, a proud Maguindanaon who began her journey as a Project Control Engineer in 2014. Over the years, she took on bigger responsibilities — from managing warranties and saving the company significant costs, to overseeing the final acceptance of the plant’s Unit 1 and handling the warranty process for Unit 2 until 2021. She has since become a Juris Doctor and now serves as Regulatory Compliance Supervisor. Her combination of engineering and legal expertise is rare — and powerful.

“Alsons Power has a strong work culture that values expertise and fosters an inclusive space for women. Your success in the company is not defined by gender but by competence and determination,” Charmaine shared.

A Culture That Empowers, Not Just Employs

At Alsons Power, women are not just making their mark; they are empowered to lead, innovate, and excel. Through equal opportunities, mentorship, and a culture that values talent over gender, the company fosters a supportive workplace where women can thrive and contribute to shaping the future of energy.

“The plant may still be male-dominated, but the women here are among the best in their fields because we are valued, respected, and given equal opportunities to excel,” said Fritz.

Kimberly believes that Alsons Power enables women to leverage their unique strengths in engineering, particularly in driving innovation and advancing sustainability. “We may not be the ones physically hauling motors from the field to the workshop, but we have been trusted to develop an effective maintenance plan to prevent the need for removal in the first place. We can design automated controls to drive valves, reducing the need for manual labor,” she explains.

Women bring unique strengths to the industry — attention to detail, empathy, multi-tasking, and strategic thinking. And Alsons Power gives them space to shine.

Powering A More Inclusive Future

As the energy sector continues to evolve, the role of women becomes increasingly vital. Alsons Power celebrates their contributions through a culture rooted in care, inclusion, and equal opportunity—true to the Group’s brand promise: We Power with Care.

The Group is committed to building an environment where women can lead, thrive, and flourish—because at Alsons Power, the future isn’t just powered by energy, it’s powered by people.

by | Mar 27, 2025 | Business

URSEL Murillo-Laureno has been the co-founder and CEO of EdFolio and SkoolTek, taking solutions in education technology (EdTech) to the next level.

With a background in

educational leadership, she previously served as the principal of Bethany

Baptist Academy in Iligan City, Philippines, where she introduced a tablet-based

digital learning program in 2015, setting the stage for her passion for

innovation in education.

Driven by the

challenges schools faced during the Covid-19 pandemic, Ursel launched EdFolio,

a marketplace for e-books and educational supplementary materials.

She later developed

SkoolTek, a comprehensive school management system. The platform integrated

enrollment, billing, learning management, artificial intelligence facial

recognition, blockchain-based transcript management, a career-predictive-profiling

system, and other upcoming features, offering a seamless digital ecosystem for

schools.

Under her leadership,

EdFolio and SkoolTek have surpassed growth targets and are on track to double their

respective revenues.

This year, the two

companies continued to expand in the Association of Southeast Asian Nations

region.

Just recently, the

companies got into an investment-linked program run by an EdTech accelerator, based in Singapore.

Laureno also founded

the National Educational & Technology Conference or EdTek Con 2025, a

premiere event that brought together educators as well as industry and

government leaders to discuss the future of education in the Philippines.

A Christian

entrepreneur, Laureno credited her success to God’s

faithfulness.

Having witnessed

firsthand how God’s provision sustained her business through critical moments,

she has made it her mission to bridge technology and education to ensure that

institutions — regardless of size — could thrive in the digital era.

by | Mar 27, 2025 | Business

Explore Ethereum’s price prediction for April 2025. Will ETH sustain its recovery or face a downturn? Get expert insights on key resistance levels, market trends, volatility risks, and potential bullish or bearish scenarios. Stay ahead with the latest Ethereum analysis.

Ethereum (ETH) has recently demonstrated signs of recovery, breaking past the $2,000 level after a period of decline. This resurgence raises the question of whether Ethereum is entering a sustained bullish trend or if this is merely a temporary rebound.

After establishing strong support above $1,850, Ethereum mirrored Bitcoin’s (BTC) price action, reclaiming key resistance levels at $1,920 and $1,950 before pushing past $2,000. ETH reached a peak of $2,104 before encountering resistance and undergoing a minor correction.

Currently, Ethereum trades above $2,015 and remains above the 100-hour simple moving average. A bullish trendline has formed, with support at $2,000 on the hourly ETH/USD chart.

Despite short-term corrections, Ethereum faces strong resistance at $2,080 and $2,100, with further hurdles at $2,120 and $2,200. If ETH surpasses $2,200, a rally towards $2,250 or even $2,320 could materialize in the near term.

Support Levels and Potential Downtrend

Should Ethereum struggle to break resistance at $2,100, the price may retrace. Initial support is near $2,040, with stronger backing at $2,025, corresponding with the 61.8% Fibonacci retracement level from the $1,980 to $2,104 rally.

A drop below $2,025 could lead to a retest of the $2,000 support level, with further declines potentially targeting $1,950 or even $1,880.

Technical indicators present mixed signals. The hourly Moving Average Convergence Divergence (MACD) for ETH/USD suggests weakening bullish momentum, while the Relative Strength Index (RSI) has dipped below 50, indicating increased selling pressure.

Ethereum’s Volatility and Market Sentiment

Ethereum’s volatility remains subdued, with 7-day and 30-day implied volatility at 59% and 45%, respectively. Such low volatility levels are unusual and often precede sharp price movements. Analysts predict that April may increase volatility, driven by macroeconomic factors and shifting investor sentiment.

Despite the current market uncertainty, Ethereum’s circulating supply on centralized exchanges has dropped to a nine-year low, potentially amplifying price reactions if demand surges.

However, weak near-term confidence is reflected in the fact that Ethereum’s forward rate remains below the U.S. 5% Treasury bill rate.

Ethereum’s Price April Forecast

Market analysts predict Ethereum is at an inflection point, with price swings expected in April. Historical trends suggest that periods of low volatility often precede large price movements.

Due to rising interest rates and liquidity concerns, there is a 30% chance that ETH will drop below $1,800 by the end of May. Conversely, if demand surges, there is a 19% chance that Ethereum will rally above $2,500.

If institutional interest increases or favorable regulatory developments occur, Ethereum may experience a significant uptrend.

Investors are advised to prepare for heightened fluctuations in the coming weeks, as price action becomes more sensitive to macroeconomic changes and investor sentiment.

Future Price Trends and Market Outlook

Ethereum’s market outlook remains uncertain, with analysts warning of significant price swings in April. If bearish sentiment continues, Ethereum may test support at $2,037.10, while a potential reversal could target the $2,097.70 resistance level.

Investor mood and technical indicators will play crucial roles in shaping Ethereum’s price action.

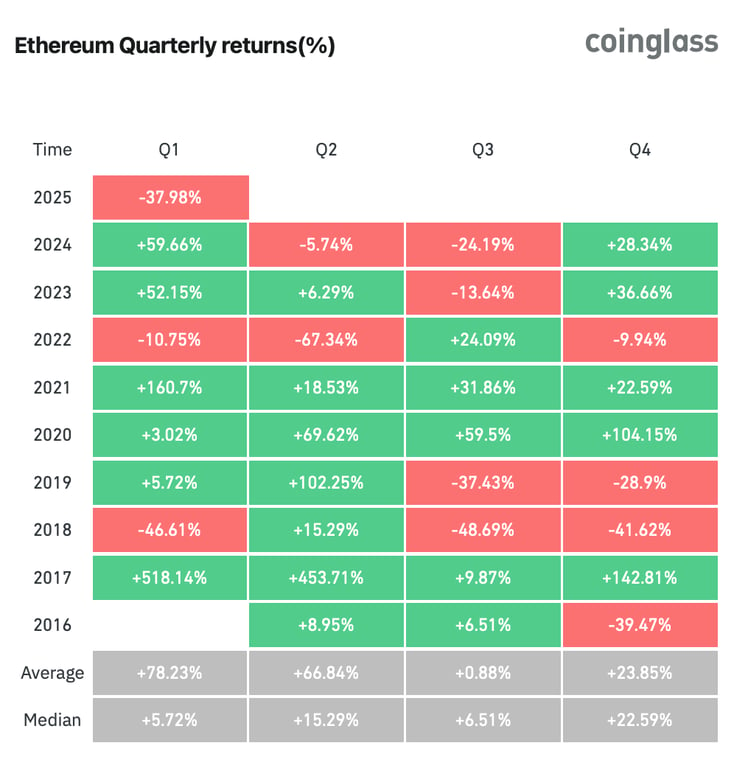

Bitcoin and Ethereum are both experiencing their worst first-quarter performances in years. ETH has declined 37.98% so far in Q1 2025, marking its worst Q1 since 2018, when it dropped 46.61%. Bitcoin, meanwhile, has fallen 6.49% this quarter, its worst Q1 since 2020.

Crypto market analysts predict that significant price rallies are unlikely before the end of Q1. Swyftx lead analyst Pav Hundal has stated that a “vertical swing up into the end of the quarter looks unlikely.”

Market clarity is expected to improve by mid-April, especially as U.S. economic policy developments unfold.

Conclusion

Ethereum has exhibited strong recovery signs but remains at a critical juncture. While it has reclaimed the $2,000 level, uncertainty persists regarding its future trajectory. If Ethereum can overcome key resistance levels, a bullish rally toward $2,250 or higher is possible.

Conversely, failure to maintain momentum may result in a downturn toward $1,950 or lower. With volatility expected to rise in April, traders and investors must remain vigilant and adapt their strategies to market developments.

by | Mar 26, 2025 | Business

Discover the latest XRP price predictions for April 2025. Will XRP break past $3 soon? Explore expert forecasts, technical analysis, market trends, and potential risks, including a possible flash crash before a major rally. Stay updated on XRP’s outlook, ETF speculation, and Ripple’s regulatory progress.

XRP, one of the leading cryptocurrencies, is generating significant market buzz, with many analysts predicting that it could soon surpass the $3 mark.

Recent forecasts indicate a potential return of nearly 75% by the end of March 2025, with some projections placing XRP’s high at around $4.30.

For April, estimates suggest a price range between $2.92 and $4.22, provided the bullish momentum continues.

Market Trends and Projections

Analysts anticipate that XRP could climb approximately 28.98% from its current price of $2.46 to reach an average of $3.17 by the end of March 2025.

This projection follows a recent decline of about 5.23% over the past 30 days. A potential high of $4.30 would yield a return on investment (ROI) of nearly 74.96%.

Several factors could influence this price surge, including Ripple’s ongoing business deals, positive sentiment around cryptocurrency regulation, and increased investor confidence.

If these elements align favorably, XRP crossing the $3 threshold in the next few weeks may not be unrealistic.

XRP April 2025 Outlook

Moving into April, XRP is expected to trade within a range of $2.92 to $4.22, with an average of around $3.57. Should the price push beyond $4, it would solidify XRP’s position as a premier cross-border asset and confirm the bullish trend.

However, these gains depend on market dynamics, investor confidence, and Ripple’s ability to expand its payment services. If major financial institutions or regulatory bodies adopt favorable policies, XRP could maintain an upward trajectory.

Technical Analysis and Potential Flash Crash

Despite the optimistic projections, some analysts caution against a potential flash crash in April. MetaShackle, a well-known crypto analyst on TradingView, has shared an Elliott Wave-based analysis of XRP’s price movements.

The analysis incorporates Fair Value Gaps (FVGs), liquidity zones, and trendlines to anticipate XRP’s next price action.

XRP’s False Breakout and Flash Crash

According to MetaShackle’s insights, XRP could experience a false breakout in the coming weeks, followed by a sharp flash crash that may liquidate overleveraged traders. This correction could initially drive the price down to the $1.40–$1.60 range before rebounding.

The price movements are expected to follow a 6-wave pattern, with a potential 7th wave breakout.

Currently, XRP is in Wave 4, which has triggered a major correction. If Wave 4 concludes, the price could move higher into Wave 5, reaching $2.80–$3.00 before a flash crash in Wave 6.

This temporary downturn could then set the stage for a significant rally in Wave 7, possibly pushing XRP past its 2018 all-time high of $3.84.

Current Market Performance and Resistance Levels

XRP is currently trading at $2.4031, marking a 1.49% increase for 24 hours. After hitting a high of $3.00 earlier this year, the cryptocurrency has demonstrated resilience despite short-term corrections.

Technical indicators suggest that the price is still above the key support level of $2.40 and the 100-hour simple moving average. However, resistance remains near the $2.48–$2.50 range.

A successful break above $2.50 could propel XRP towards $2.65 or even $2.80 in the short term.

If XRP fails to breach the $2.48 resistance, it could decline again, with initial support at $2.40 and a major support zone at $2.35. A further breakdown could see XRP testing support at $2.25.

XRP ETF Speculation and Institutional Interest

One of the most exciting developments for XRP is the growing interest in an XRP-based exchange-traded fund (ETF). Nate Geraci, a leading ETF analyst, predicts that major financial institutions like BlackRock and Fidelity may soon enter the XRP ETF market.

While BlackRock has previously dismissed new altcoin ETF offerings, industry experts believe that the firm will not remain on the sidelines for long. Franklin Templeton, managing over $1.5 billion in assets, has already shown interest in launching an XRP ETF.

Ripple’s Legal Victory and Regulatory Outlook

A significant boost for XRP came with Ripple’s recent legal victory against the U.S. Securities and Exchange Commission (SEC). The SEC initially sought a $2 billion fine from Ripple, but the company successfully reduced the penalty to just $50 million.

Additionally, the SEC’s injunction against Ripple is expected to be lifted, further solidifying its regulatory standing.

With these positive regulatory developments, investor sentiment has improved, increasing the likelihood of an XRP ETF approval in the near future.

Conclusion: Will XRP Reach New Heights?

The outlook for XRP remains bullish, with strong market interest, potential ETF developments, and positive regulatory momentum. While a flash crash could occur in April, it may serve as a setup for a larger breakout in May 2025.

If XRP successfully surpasses resistance levels and gains institutional backing, it could easily cross the $3 mark and push toward new all-time highs.

Investors should keep a close eye on market trends, regulatory updates, and Ripple’s ongoing developments to make informed decisions in this dynamic landscape.

You must be logged in to post a comment.