by Ferry Bayu | Apr 7, 2025 | Banking and Finance

Exciting crypto news: Babylon’s $BABY token is launching on Bitrue, featuring staking rewards and airdrop events! Discover its utilities and token distribution, and learn how to benefit from the Babylon Protocol.

The crypto ecosystem is constantly evolving, bringing new opportunities for users. This week, one of the major stories comes from Bitrue, which is set to launch the Babylon $BABY token and hold a deposit contest.

What are the details, and what benefits will users receive? Read this article to find out!

Get to Know about Babylon $BABY

Before we discuss the launch of the $BABY token on Bitrue, let’s get to know Babylon first. The $BABY token is the native cryptocurrency of Babylon Genesis, which is the inaugural token of the Bitcoin Secured Network (BSN). This network is specifically designed to protect and manage various blockchain systems. The $BABY token has four main utilities: Governance, Network Security, Transaction Utility, and Rewards and Incentives.

Later, Babylon token holders can be involved in forming the direction of the protocol, which means users have a voice in the network.

Babylon token holders also support validator operations and maintain consensus.

Babylon tokens will later be used to pay network transaction fees.

$BABY tokens will later be distributed as staking rewards to $BABY and $BTC token stakers while promoting active participants in the network.

These four utilities demonstrate that networks built from this segment of Bitcoin will also incorporate smart contracts and staking, features that were previously absent in Bitcoin. As a result, users can feel assured that staking on the Babylon network is both safe and trustworthy.

In a post from the official Babylon Foundation account (@bbn_foundation), Babylon will conduct a $BABY token airdrop event as part of the Phase 1 transition. This airdrop program will be available to stakers during Phase 1.

A total of 6% of the Babylon supply, which amounts to 600 million BABY tokens, will be allocated for the Babylon airdrop program. The airdrop will be distributed alongside the launch of the Babylon Genesis blockchain. There are five categories for the Babylon airdrop program, which are as follows:

Stake Participation Airdrop

In this category, 30 million BABY tokens will be allocated for stakers who meet the requirements. There are three types of prize recipients in this category:

- Cap 1 participants with a total of 550 $BABY tokens received. In this first type, a total of 16.5 million BABY tokens were distributed.

- Cap 2 participants with a total of 150 BABY tokens with a total of 2.25 million BABY tokens

- Cap 3 participants with a total of 100 BABY tokens for each participant and a total of 11.2 BABY tokens distributed.

Base Staking Reward Airdrop

There are a total of 335 million $BABY tokens distributed in this category. Every eligible staker will receive a fixed allocation of BABY tokens for each BTC block. For more details, please refer to the following table.

Bonus Staking Reward Airdrop for Phase 2 Transition

The third category consists of 200 million BABY tokens that will be distributed to eligible recipients. Active stakers on March 31, 2025 will receive an airdrop bonus in addition to the second category if they successfully transition to Phase 2.

To receive this bonus, users must continue staking, register to stake on Babylon Genesis within 4 weeks of Network Launch, and continue staking for at least 100 consecutive days after registration.

The fourth category is aimed at NFT Pioneer Pass holders with a BABY token count of 30 million. Each holder will receive 300 BABY tokens per NFT. The block that will be taken as a requirement is Polygon 68305555.

GitHub Developer Recognition Program

A total of 5 million $BABY tokens will be distributed to users in this fifth category. A snapshot was taken at 8 AM UTC on February 23rd. If there are not enough eligible users, the tokens will be returned to the community allocation.

Babylon $BABY Launch on Bitrue: Coming Soon

Babylon will be launched on Bitrue on April 10, 2025. Many programs, such as launchpoo, staking, and power piggy, will provide benefits for Bitrue users.

In order not to miss the events that Bitrue will hold before or during the Babylon listing, you can immediately register as a Bitrue user. Later, you will join the community and become a targeting Bitrue core user who will receive the latest information.

by | Apr 6, 2025 | Business

XRP surges past $2.14 amid SEC regulatory shifts, Ripple lawsuit updates, and growing XRP ETF momentum. Explore price analysis, bullish vs bearish scenarios, and what’s next for investors.

XRP continues to gain ground amid a changing regulatory landscape, a positive market outlook for exchange-traded funds (ETFs), and technical indicators pointing toward a possible breakout.

Following a strong performance in early April, the cryptocurrency has caught the attention of investors once again, driven by speculation over U.S. Securities and Exchange Commission (SEC) decisions, ongoing Ripple litigation, and the potential entry of institutional giant BlackRock into the XRP-spot ETF space.

XRP Extends Gains Amid Broader Market Weakness

On Saturday, April 5, XRP posted a 0.73% gain, closing at $2.1443 after surging 3.21% the previous day.

This marked the third consecutive daily increase for the token, outperforming the broader crypto market, which declined by 0.44%. This brought the total cryptocurrency market capitalization to $2.64 trillion.

However, when this article was written on April 6, 2025, the price of XRP had actually fallen by 2.83% and is currently trading at $2.0913.

Despite near-term bearish signals from the charts, XRP continues to show resilience—driven by regulatory optimism and ETF speculation.

SEC Developments Spark Investor Optimism

A key driver behind XRP’s upward momentum lies in recent statements from SEC Acting Chair Mark Uyeda, who cited Executive Order 14192, focused on deregulation to spur prosperity.

Uyeda urged the Commission’s staff to review guidance related to digital assets, including the 2019 framework on Investment Contract Analysis—a document heavily relied upon in past enforcement actions such as SEC v. Ripple.

This review could lead to modifications or even a rescindment of the framework, a development that journalist and CryptoAmerica host Eleanor Terrett says might signal the SEC’s evolving stance.

Such a shift would likely ease regulatory pressure on XRP and similar assets, potentially paving the way for broader institutional acceptance.

Ripple Lawsuit Update: Settlement Discussions Progress

The Ripple vs. SEC legal battle remains central to XRP’s price trajectory. While Ripple CEO Brad Garlinghouse stated in March that the SEC planned to withdraw its appeal over the Programmatic Sales of XRP ruling, the agency has yet to confirm this move.

In response to this uncertainty, XRP retreated by 28% from its March 19 high of $2.5925.

However, Ripple has initiated a cross-appeal withdrawal and announced a potential settlement that includes:

- A reduced penalty of $50 million (down from $150 million),

- Removal of the injunction on institutional XRP sales in the U.S.

- The finalization of this settlement hinges on whether the SEC formally drops its appeal, leaving investors in suspense.

XRP-Spot ETFs: A Key Catalyst for Future Gains

One of the most significant drivers for XRP’s long-term value lies in the pending approval of XRP-spot ETFs. Currently, 18 applications are under SEC review.

While BlackRock has yet to file, analysts at AP Abacus suggest the firm is preparing to enter the space—potentially mirroring its successful Bitcoin ETF launch in January.

BlackRock’s entry could be transformative. The firm’s iShares Bitcoin Trust (IBIT) has already garnered $39.9 billion in net inflows, underscoring its influence in attracting institutional capital.

Should BlackRock file for an XRP ETF, institutional demand could surge, accelerating XRP’s path toward mainstream adoption.

XRP Technical Outlook: Bullish Indicators Take Shape

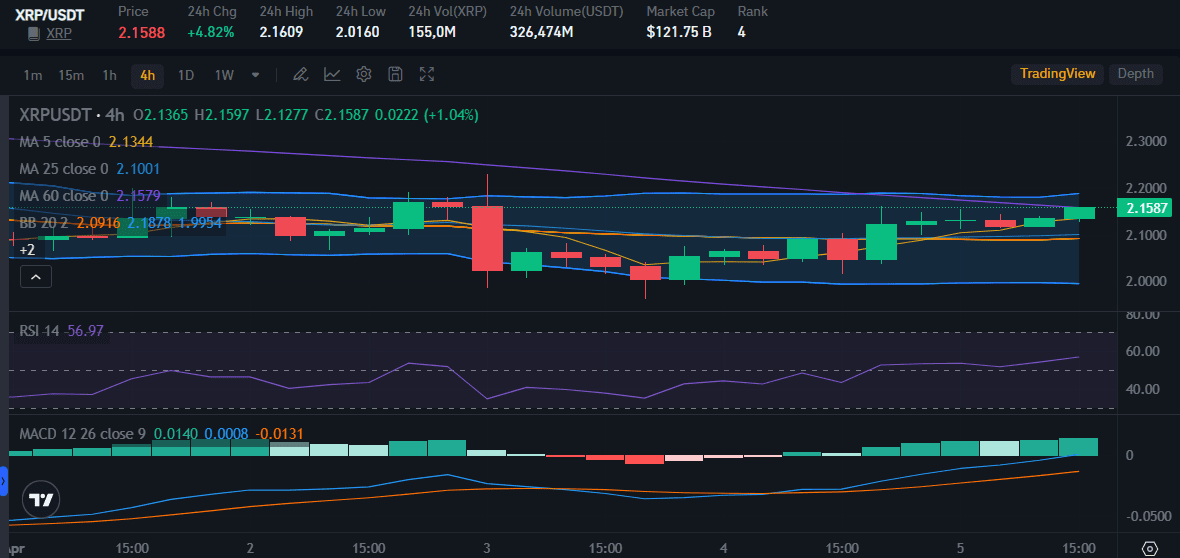

From a technical standpoint, XRP is approaching a breakout. According to analyst Triparna Baishnab (via TradingView), XRP’s current price action shows bullish momentum:

- XRP trades at $2.1375, nearing key resistance at $2.14–2.15.

-

The MACD indicator has formed a golden cross, while the RSI stands at 60.36, reflecting growing but sustainable bullish pressure.

Should XRP break through the $2.15 resistance, it could climb toward the $2.17–2.18 range. However, failure to break out may lead to a temporary pullback toward the $2.10–2.11 support zone. Volume confirmation during a breakout will be critical to validating the next leg up.

XRP Price Scenarios: What Could Happen Next?

1. Bullish Case

- SEC formally withdraws its appeal in the Ripple case.

-

A final settlement is reached, lifting legal uncertainty.

-

Approval of XRP-spot ETFs triggers institutional buying.

-

XRP could test $2.5925, the March high, followed by $3.3999 (January high), and potentially reach its record high of $3.5505. With ETF momentum, XRP may even aim for $5.00.

2. Bearish Case

- Delays or lack of SEC action on appeals and ETF approvals.

-

Renewed legal wrangling or cross-appeals dampen sentiment.

-

A rejection from resistance and declining macro sentiment (e.g., Fed hawkishness or worsening trade tensions) could drag XRP below $2.00, with $1.9299 and $1.50 as potential support levels.

Macroeconomic and Market Conditions

XRP’s price action is also influenced by global macroeconomic factors. As tariff tensions between the U.S. and China escalate, markets have become increasingly volatile.

While equity markets tumbled, Bitcoin (BTC) and other cryptocurrencies have shown relative resilience, bolstering investor confidence in digital assets as alternative stores of value.

BTC, for instance, held near $83,828 after a week of volatility, while XRP outpaced BTC in recent gains. However, both assets are susceptible to changes in US inflation data, Federal Reserve policy, and crypto-related legislation.

Conclusion: XRP Poised at a Pivotal Moment

XRP’s current performance reflects a confluence of legal developments, technical indicators, and institutional momentum. With regulatory guidance under review, settlement talks advancing, and the prospect of ETFs on the horizon, XRP stands at a decisive crossroad.

- Investors should monitor:

- Any official SEC withdrawal of its appeal.

- Progress on Ripple’s settlement terms.

-

Announcements regarding XRP ETF applications, especially by BlackRock.

-

Broader economic indicators and legislative developments in the U.S.

If these catalysts align, XRP could embark on a significant rally. For now, cautious optimism prevails as the crypto market waits for clarity.

by Penny Angeles-Tan | Apr 5, 2025 | Advocacy

The time, effort, and dedication required to train for a race or marathon make crossing the finish line incredibly rewarding for many runners. Similarly, creating a greener, more sustainable future demands a collective commitment of the same magnitude.

The first-ever GCash Eco Run transformed the streets of Ayala Avenue in Makati into a platform for this eco-movement. Over 12,000 eco-runners laced up their shoes—not just to achieve personal records but to make a lasting impact on the environment. Thanks to the support of event sponsors and sustainability partners, this milestone initiative has already resulted in the planting of 76,000 trees across 11 hectares in the Negros region, showcasing the powerful effects of our collective actions.

A race that goes beyond the finish line

In support of the South Negros Reforestation Initiative, which is a long-standing partnership between Silliman University and GCash, each sign-up for the GCash Eco Run contributed to the planting of a grey stilted mangrove tree in Negros Occidental. GCash doubled its commitment by pledging an additional tree for every participant. As a result, the runners contributed to the planting of a total of 24,000 new trees.

Grey stilted mangroves play a vital role in environmental conservation. They help mitigate the impacts of extreme weather, sequester carbon, and provide habitats for marine life. Consequently, mangrove forests are among the most effective natural ecosystems for carbon storage today, making them a crucial asset in the fight against climate change.

In line with its commitment to using technology for good, the GCash Eco Run served as a platform to raise awareness about sustainable living. The event brought together partner organizations and eco-conscious brands to share their initiatives and inspire collective action.

Various organizations championing different sustainability causes participated in the event. For example, Berdeng Kalaw collects paper and metal for recycling, while Caritas Manila converts clothing donations into funds for scholarships. Zolo specializes in reselling and recycling e-waste, and Aling Tindera focuses on gathering plastic waste for recycling.

Attendees had the opportunity to explore products from partner eco-merchants including Cut the Craft, Bukid ni Bogs, Wonderhome Naturals, Eco Shift, and Commune. They also received GCash VISA cards made from 100% recycled plastic.

GCash facilitates positive change by connecting partners with Silliman University, turning commitments into tangible action. With the support of eight collaborating companies for a greener future, a total of 52,000 trees will be planted in Negros, in addition to the 24,000 trees planted by the eco runners.

Nuvali Run Club members joined the 10KM race of the GCash Eco Run

Runners gather at the starting line of the first-ever GCash Eco Run, taking strides for sustainability and mangrove restoration–planting over 76,000 trees in the Negros region.

Continue taking steps for the environment with GForest

GCash is committed to making sustainable living easier and more accessible for every Filipino. Through its GForest initiative, users earn green energy points with every transaction on the GCash app, whether it’s cashing in, sending money, paying bills, buying load, or even taking 20,000 steps a day. These points can be redeemed to plant virtual trees and contribute to a greener future.

In collaboration with various partner organizations, GCash transforms these virtual trees into real ones planted in key areas across the country. This demonstrates how GForest serves as a platform for technology that promotes positive change.

“Much like how GForest turns virtual trees into actual ones, the GCash Eco Run brings together our community of Green Heroes, driven by a shared purpose to create real-world impact—one step, one tree, and one action at a time,” said CJ Alegre, GCash Head of Sustainability.

The largest digital eco-movement is growing even bigger. Every step we take, every action we make, and every tree we plant brings us closer to a greener future. Become a green hero today by signing up on the GForest feature in your GCash app dashboard.

The GCash Eco Run is proudly supported by corporate partners who have also committed to planting trees, including IKEA Philippines, Globe At Home, Pay & Go, and eTap Solutions. This initiative enhances Silliman University’s efforts in mangrove reforestation.

About GCash

GCash is the leading finance super app in the Philippines. Through the GCash app, users can easily perform various financial transactions, such as purchasing prepaid airtime, paying bills through a network of partner billers nationwide, and sending or receiving money anywhere in the Philippines, even to other bank accounts. Users can also shop from over 6 million partner merchants and social sellers. Additionally, GCash provides access to savings, credit, loans, insurance, and investment opportunities, all from the convenience of their smartphones.

The mobile wallet operations of GCash are managed by G-Xchange, Inc. (GXI), which is a wholly-owned subsidiary of Mynt— the first and only “duacorn” in the Philippines.

GCash is a strong advocate for the United Nations Sustainable Development Goals (SDGs), especially focusing on SDGs 5, 8, 10, and 13. These goals promote safety and security, financial inclusion, diversity, equity, and inclusion, as well as urgent action to combat climate change and its effects.

by | Apr 5, 2025 | Business

Stay updated on the latest XRP news, including Ripple’s legal battle with the SEC, market performance, and future price predictions. Explore expert insights on ETF prospects, regulatory developments, and key technical levels impacting XRP’s trajectory. Don’t miss out on what’s next for XRP!

On March 19, Ripple CEO Brad Garlinghouse revealed that the U.S. Securities and Exchange Commission (SEC) intends to withdraw its appeal against Judge Torres’ ruling on Programmatic Sales of XRP. However, the SEC has yet to formally comment on the matter, leaving uncertainty in the market.

In response, Ripple’s Chief Legal Officer, Stuart Alderoty, outlined proposed settlement terms that include:

- A reduction in the penalty from $150 million to $50 million. Initially, the SEC had sought $2 billion.

- The removal of an injunction restricting XRP sales to institutional investors.

The SEC’s next closed meeting, scheduled for April 3, could be pivotal in finalizing the appeal withdrawal. In the meantime, XRP has faced heavy selling pressure, plummeting 19% to $2.1088. If the SEC delays its vote, XRP could slip below $2.

Legal Experts Weigh In on the SEC Withdrawal Process

While optimism is high, legal analysts caution that a formal withdrawal may take time. Pro-crypto attorney Fred Rispoli suggested that the SEC Commission might vote on the matter within 30 days, with Judge Torres potentially vacating the injunction within the same timeframe.

“At most, we are 60 days out from this being 100%, formally, legally, and spectacularly over,” Rispoli stated.

XRP Market Performance and Outlook

On April 1, XRP rose by 2.35%, reversing its 2.24% loss from the previous day to close at $2.1389. However, it underperformed the broader crypto market, which saw a 2.81% gain, raising the total market capitalization to $2.7 trillion.

XRP’s future trajectory depends on several key factors:

1. SEC vs. Ripple Filings: Any motions related to the withdrawal of injunctions or case resolution could significantly influence market sentiment.

2. XRP Spot ETF Prospects: The potential approval of an XRP spot ETF in the U.S. could propel prices toward $3.5505. Conversely, delays in approval could limit gains.

3. Macro Risks: Economic factors such as trade tensions and recession concerns could push XRP down to $1.7938, while easing risks could support a rebound above $3.

Despite these considerations, technical indicators suggest bearish trends for XRP in the near term.

XRP Price Struggles Below Key Levels

XRP dropped over 5% on March 31 to a low of $2.06, increasing the risk of breaking below the crucial $2 threshold. The 200-day EMA at $1.94 is the last line of defense, and historically, falling below this level has led to accelerated declines.

XRP’s current technical structure is concerning, with a descending triangle pattern signaling an imminent breakdown. If support at $2 fails, the next major levels lie between $1.85 and $1.80. To reverse this trend, XRP must reclaim the $2.30–$2.40 range with strong volume.

Ripple Escrow Strategy and Supply Control

Ripple continues its strategic management of XRP supply, recently locking 700 million tokens in escrow. The firm releases 1 billion XRP monthly for institutional sales, operational costs, and liquidity but often returns a significant portion to escrow to stabilize the market.

In March, Ripple Labs opted not to release the scheduled 1 billion XRP, instead sending 700 million back into escrow. Analysts believe this move aims to control selling pressure and maintain price stability.

Ripple’s ongoing control over more than 40% of the total XRP supply remains a topic of debate. While some investors see this as strategic supply management, critics argue it centralizes influence over the token’s value.

SEC Case Resolution and Regulatory Impact

Ripple’s legal battle with the SEC has shaped its market performance. A U.S. court previously ruled that XRP sales on public exchanges were not securities, but institutional sales required compliance.

In January 2025, the SEC appealed, arguing that Ripple’s promotional efforts led to profit expectations, classifying XRP as an unregistered security under the Howey Test. However, with President Donald Trump’s pro-crypto stance, the SEC dismissed its appeal, and Ripple agreed to pay a reduced $50 million fine.

Broader Crypto Market Trends

The crypto market remains volatile, with macroeconomic factors adding uncertainty. On April 1, Bitcoin surged 3.20% to $85,150 but remains at risk due to ongoing U.S.-China trade tensions.

Key Market Themes to Watch:

- SEC vs. Ripple case resolution.

-

U.S. tariff developments and potential retaliatory actions.

-

Progress on the Bitcoin Act and broader crypto regulations.

-

U.S. labor market and inflation reports.

-

Institutional ETF inflows and outflows.

Conclusion: What’s Next for XRP?

At the time of writing this article on April 5, 2025, XRP was trading at $2.1588 with a gain of 4.82%. XRP’s near-term outlook remains uncertain, with potential downside risks if the SEC delays its case withdrawal. The $2 mark remains a crucial psychological and technical level.

If XRP fails to maintain support, further declines to $1.80 are possible. Conversely, positive regulatory developments and ETF progress could help push XRP toward $3.

Investors should remain cautious and monitor key legal and macroeconomic developments that could shape XRP’s future price action.

by | Apr 5, 2025 | Business

Discover how FintechZoom Crypto is revolutionizing financial technology through blockchain, digital currencies, and fintech innovations. Stay informed with expert insights, market trends, regulatory updates, and the latest in DeFi and cybersecurity. Explore the future of digital finance with FintechZoom today!

In today’s rapidly evolving financial landscape, one name stands out as a beacon of innovation and transformation—FintechZoom Crypto.

As blockchain technology, digital currencies, and financial technology converge, platforms like FintechZoom are redefining how we perceive and interact with the financial world.

But what exactly is FintechZoom Crypto, and how is it influencing and reshaping the financial industry?

Understanding FintechZoom

FintechZoom is an online platform operating at the intersection of finance and technology—fintech. With a specialized focus on the crypto industry, it provides valuable insights, news, and resources for those keen on understanding the complex and dynamic world of cryptocurrencies and blockchain technology.

More than just a news outlet, FintechZoom serves as a comprehensive hub that connects users with the latest trends, technological advancements, and strategic developments in the financial tech realm.

The Significance of Crypto in FintechZoom

Cryptocurrencies have evolved beyond a mere trend to become a crucial component of global financial systems. The rise of Bitcoin, Ethereum, and other altcoins has opened new investment opportunities while challenging traditional banking systems. In this context, FintechZoom serves as an essential resource by offering:

1. Insights and Analysis: Understanding market trends, regulatory developments, and emerging financial products.

2. Education and Learning: Providing clarity on complex concepts such as blockchain, decentralized finance (DeFi), non-fungible tokens (NFTs), and smart contracts.

3. News and Updates: Offering real-time news on crypto markets, investment strategies, and fintech innovations.

How FintechZoom is Transforming Financial Narratives

1. Building Knowledge Repositories

FintechZoom empowers its audience with well-researched articles, white papers, and in-depth studies, making it a go-to resource for financial enthusiasts and professionals.

2. Bridging the Gap Between Fintech and Cryptocurrency

While fintech encompasses a broad spectrum of technologies enhancing financial services, cryptocurrencies play a significant role within this space. FintechZoom highlights how blockchain and decentralized applications (DApps) are shaping the broader fintech ecosystem.

3. Fostering Professional Networks

Through virtual forums, webinars, and community discussions, FintechZoom connects fintech professionals, blockchain developers, and crypto enthusiasts, fostering collaboration and innovation.

Key Areas Covered by FintechZoom Crypto

1. Market Trends and Analytics

Understanding market movements is essential for strategic decision-making. FintechZoom offers deep dives into market trends, enabling investors to make informed choices based on analytical models and data-driven insights.

2. Regulatory Developments

With governments worldwide adapting to digital currencies, staying informed about new regulations is vital. FintechZoom tracks policy changes, compliance requirements, and their implications for the crypto industry.

3. Latest Technological Innovations

FintechZoom explores advancements in blockchain technology, decentralized finance (DeFi), and the rise of innovative crypto projects reshaping the industry.

4. Safety and Security Insights

Security remains a major concern in the crypto world. FintechZoom offers expert advice on protecting digital assets, understanding cybersecurity threats, and avoiding scams and fraudulent activities.

Why FintechZoom Crypto Matters More Than Ever

The intersection of fintech and cryptocurrency is growing at an exponential rate. As more individuals and institutions invest in digital currencies, platforms like FintechZoom provide valuable insights, helping users navigate this rapidly changing landscape.

By staying ahead of financial innovations and elaborating on their impact, FintechZoom is instrumental in driving mass adoption and understanding of cryptocurrency and blockchain applications.

Alternative Platforms for Crypto Insights

While FintechZoom offers a broad financial perspective, there are other dedicated platforms like Bitrue.com/blog that provide in-depth cryptocurrency-specific insights.

Bitrue.com/blog, for instance, focuses more on live trading activity, token utility, and blockchain developments.

Combining FintechZoom’s general finance approach with specialized platforms allows users to gain a more comprehensive understanding of the crypto world.

Future Prospects of FintechZoom Crypto

1. Expansion of DeFi Platforms: As decentralized finance continues to grow, FintechZoom will cover emerging DeFi projects and their impact on the financial industry.

2. Blockchain Integration Across Industries: Beyond crypto, FintechZoom will highlight how blockchain is revolutionizing industries such as supply chain management, healthcare, and real estate.

3. Advancements in Regulatory Frameworks: With regulations evolving, FintechZoom will keep its audience informed on compliance measures that shape the future of digital assets.

4. Growth of Institutional Investment: FintechZoom will analyze the increasing role of institutional investors in cryptocurrency markets and their influence on price movements and market stability.

5. Security Innovations: As threats in the crypto space rise, FintechZoom will report on the latest advancements in cybersecurity and digital asset protection.

6. Adoption of Central Bank Digital Currencies (CBDCs): Governments are exploring digital currencies issued by central banks, and FintechZoom will track these developments and their impact on traditional finance.

7. Rise of Crypto-Based Financial Services: Lending, borrowing, and investing in crypto are becoming mainstream, and FintechZoom will continue to cover the evolution of these services.

8. User Education and Awareness: FintechZoom will persist in providing guides, analysis, and expert opinions to simplify crypto adoption for the general public.

Conclusion

FintechZoom Crypto is a crucial platform for understanding the intersection of finance and blockchain technology.

By delivering timely insights, comprehensive educational content, and expert analysis, it serves as a trusted resource for both beginners and experienced investors.

As the financial landscape continues to evolve, staying informed through platforms like FintechZoom will be key to navigating the future of digital finance effectively.

You must be logged in to post a comment.