by | Apr 29, 2025 | Business

GUESS, the iconic international fashion brand founded in Los Angeles, is bringing an exhilarating experience to the streets of Sydney with its very first experiential double-decker bus campaign in Australia. Taking GUESS fashion onto Sydney streets, this must-see event will surely captivate Sydney fashion enthusiasts and passersby alike, offering an immersive, high-impact fashion experience like no other.

A GUESS branded double-decker bus featuring larger than life images of Georgina Rodriguez, Argentinian model and reality television personality dressed in a series of stunning GUESS ensembles. The campaign, shot by renowned photographer Nima Benati, perfectly captures the combination of Georgina’s dynamic personality and the vision of winter luxury, timeless femininity, and sophistication.

The GUESS double-decker bus will roll into Sydney’s vibrant city streets, transforming a standard retail hub into a moving work of art and retail experience. This exciting activation will be the ultimate destination for all shoppers to discover GUESS’s Winter collection in a dynamic, immersive environment throughout Sydney.

The bus will be transporting a hand-curated selection of this season’s essentials alongside the Georgina Rodriguez edit, including ready-to-wear clothing, accessories, footwear, fragrances and more. Customers will have the chance to preview the collection before some of the pieces make their way in-store and online.

The lower deck of the bus will be designed with sleek, modern styling, showcasing on-trend handbags, shoes, jewellery, home products and GUESS iconic fragrances. The upper deck will house a selection of stunning ready-to-wear and iconic pieces with Instagram-opportune try-on, the perfect backdrop for photo opportunity.

What to Expect:

Exclusive Collections: Discover GUESS’s latest fashion-forward limited-edition pieces.Interactive Collection Preview:See, touch and try-on the collection in an exciting and intimate way.Exciting Giveaways: Complimentary GUESS merchandise and exclusive offers.Rich Photo Opportunities: Step into vibrant and creative installations, perfect for your social media.

BRINGING GUESS TO YOU will be a retail highlight in Sydney offering people a fresh, fun, and interactive customer experience to view and try pieces from the collection. Whether you’re a fashion aficionado or simply looking for a new way to shop, this event promises to deliver an unforgettable experience.

Activation Details:

Locations and dates:29thApril – Parramatta Centenary Square -11am – 4.00pm1stMay – Bondi Beach- 11am – 3.00pm3rdMay – Overseas Passenger Terminal- 11am – 4.00pm

This experiential retail event marks a milestone in GUESS’s commitment to creating immersive, memorable experiences for consumers and fans, and is the first of its kind in Australia.

Join us for this iconic moment in fashion and get ready to experience GUESS in an entirely new way.

by | Apr 29, 2025 | Business

Singapore, 29 April 2025 – In response to

recent US tariff actions that affect several Asian economies, CRIF, a global

leader in credit bureau, business information, and credit risk solutions, today

announced the launch of Tariff

Impact Assessment Score, a new analytics feature designed to assess the

potential impact of US tariffs on a company’s credit profile.

The introduction of

this assessment score marks a strategic enhancement to CRIF’s suite of business

information offerings, providing clients with a targeted, data-driven

evaluation of how tariffs may influence a company’s creditworthiness, cash

flow, and operational resilience.

Novi Rolastuti, Regional

Head of Sales for Business Information Services, Asia of CRIF said: “We

developed the Tariff Impact Assessment Score to give our clients early,

actionable insights into trade-related vulnerabilities. With global trade

dynamics shifting fast, the ability to anticipate risk and build resilience is

a competitive advantage. This score enables our clients to take proactive steps

– whether rebalancing supply chains, adjusting trade strategy, or screening new

partners.”

A Smart Gauge for

Credit Risk and Trade Exposure

The Tariff

Impact Assessement Score is a dedicated section available in CRIF

business information reports, designed to provide a clear indicator of

tariff-related vulnerabilities. The score is built on a multi-dimensional model

that takes into consideration:

· Industry Affiliation

CRIF’s market and analytics experts have

conducted scenario-based evaluations across countries to identify industries

most affected by US tariffs. This analysis helps companies better understand

sector-specific risks and dependencies.

· Company Size

Recognizing that company scale influences

agility and market responsiveness, CRIF incorporates size into its assessment

using country-specific thresholds. Larger enterprises typically posses greater

capacity to shift production or explore alternative markets, whereas smaller

businesses may face heightened exposure.

· Company-specific USA Exposure Investigation

Through direct investigation, CRIF

analysts assess a company’s reliance on US trade, measuring its exposure to

cross-border clients and suppliers to deliver a precise picture of tariff

sensitivity.

The scoring model integrates public trade data, proprietary research,

and CRIF’s structured investigation methodology. Countries and sectors with a

high export share to the US and persistent trade deficits are flagged as having

elevated tariff-related risk.

Navigating

Disruptions, Seizing Opportunity

The Tariff

Impact Assessment Score is part of CRIF’s broader framework to empower

businesses to proactively manage risks and uncover new growth opportunities

across three strategic phases:

· Early Warning (1–3

months): Monitoring emerging risks through payment delays

and identifying vulnerable clients or supplier.

· Risk Escalation (3–6

months): Triggering real-time credit alerts and

supporting contingency planning.

· Adaptation Phase

(6–12 months): Facilitating portfolio rebalancing, sourcing alternative

supplier, and identifying new growth opportunities.

Available to CRIF

clients via business information reports, the new Tariff Impact

Assessment Score is especially valuable for multinational corporations,

financial institutions, and export-driven businesses seeking to proactively

manage credit and trade risk in today’s shifting geopolitical landscape.

For more

information or to request a sample report, please contact your local CRIF

representatives or visit www.crifasia.com.

by | Apr 29, 2025 | Business

Karaoke Manekineko is adding more deliciousness to your singing sessions! Introducing our brand-new selection of onigiri flavors — hearty, satisfying, and perfect for a quick snack between songs. Freshly made and packed with flavor, these new options are sure to hit the spot!

We’re excited to announce the launch of our newest snack lineup at Karaoke Manekineko – a

collection of freshly prepared, hearty Onigiri! Carefully crafted to

offer both quality and flavor, each onigiri weighs over 200g and is the

perfect companion for your karaoke experience.

For only RM7.00++ per piece, you can savor these mouthwatering

flavors:

• Mentai Crab

• Yaki Cheese

• Sardine

• Chicken Floss Mentai – One of our best-sellers!

Each bite delivers authentic Japanese flavors and the comforting

satisfaction of a homemade meal — perfect for recharging during a singing break

or celebrating after belting out your favorite tunes!

Special Highlights:

Freshly made with

premium ingredientsGenerous 200g+

size for ultimate satisfactionOnly RM7.00++

per piece (exclusive of 6% SST and 10% service charge)

Next time you visit Karaoke

Manekineko, make sure to grab

one (or a few) of our new onigiris! Delicious

moments await between every song!

by | Apr 28, 2025 | Business

Women from the South Coast of NSW have a unique opportunity to explore the construction industry, with a behind-the-scenes tour of the Eurobodalla Regional Hospital.

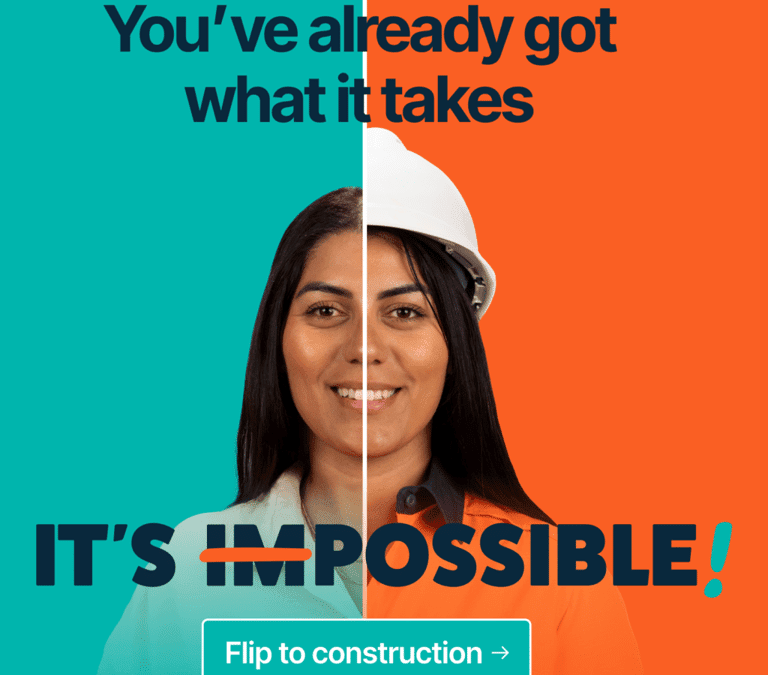

The Australian Constructors Association (ACA), supported by the NSW Government, has launched the “It’s Possible” campaign to encourage women—especially those mid-career—to consider switching to the construction industry.

ACA CEO Jon Davies said women with life experience already have the skills to succeed in construction.

“Switching to construction doesn’t mean starting from scratch. Most women who make the transition earn more and find more fulfilling work from day one,” said Mr Davies.

“By offering women the chance to visit active construction sites like the Eurobodalla Regional Hospital, they can witness firsthand the exciting opportunities the industry offers. We just need them to take the first step.”

“It also gives women the chance to see behind the scenes of a project that will leave a legacy for the wider community and support locals for decades to come.”

The Eurobodalla Regional Hospital is currently under construction and will feature a new Emergency Department, an intensive care unit, surgical and operating theatres, and a day-stay surgical unit spread across three clinical levels. Other services will include the region’s first paediatric department and a contemporary maternity unit, supporting high-quality, patient-centred care. The tour offers a chance to explore a major construction site that will shape the future of healthcare on the South Coast of NSW.

The “It’s Possible” campaign features inspiring stories from women who have successfully transitioned into construction from careers in banking, retail, hospitality and more. One of these women, Moretta, who made the leap from claims management to construction as she wanted a change.

“I was stuck at a desk ten hours. It’s the variety of career opportunities that you have in the industry is what I like the most. It’s been a really good change for me,” Moretta said.

The campaign invites women to register for exclusive, one-day-only tours of major infrastructure projects across NSW, including the Eurobodalla Regional Hospital. Participants will get an insider’s look at what it’s like to work in construction and hear from women who have made a successful career switch.

“It’s a rare opportunity to go behind the scenes and witness firsthand the lasting impact this industry has,” said Mr Davies.

“Beyond financial stability and career growth, construction offers the chance to contribute to something that will benefit future generations. If you’ve ever thought about a career change, now’s the time to take that first step.”

The Eurobodalla Regional Hospital site tour will be held on 1 May from 12 – 3pm. Spots are limited.

Register now for a site tour: www.itspossible.net.au

by | Apr 28, 2025 | Business

[Palmer Taliño Taray (middle) during the awarding ceremony of Oceanman Philippines]

DAVAO CITY—13-year-old Palmer Taliño Taray, a teenager from Davao City diagnosed with Autism Spectrum Disorder (ASD), qualified for the prestigious open water swimming competition in Dubai after triumphantly finishing the first ever Oceanman Philippines held in Siargao on 5 April 2025.

Palmer participated in the 2-kilometer course open water swim and was able to finish it within 1 hour and 44 minutes. However, due to the strong water current in the area, it was recorded that he swam around 3.7 kilometers in total, the farthest he had gone during a swimming competition. About 570 other swimmers participated in the event together with Palmer. This achievement coincides with the celebration of the World Autism Month this April which ignites a global movement aimed at understanding, accepting, and empowering people with autism.

As the first ever finisher with ASD, Palmer ranked first in the inspirational category and is set to participate in Oceanman Dubai later this year. Asked how Palmer offcially qualified for this, Coach Kirt Loven Murcia said, “He was the only one with mental health disability who participated in the event in Siargao, and the organizers were so amazed by his dedication. Per my record, he is also the first with that level of ASD to survive such a well-known swimming competition.”

The 13-year-old swimmer with special needs is the youngest son of Mr. Jerry John Taray and Mrs. Jocelyn Taliño Taray who hailed from Davao City. Following his recent achievements such as finishing the Davao-Samal Cross Channel Swim and the first Oceanman Philippines, Mrs. Taray said, “Our family is extremely proud of Palmer’s achievements, and we are very excited to participate in Oceanman Dubai this year! As his mother, I have seen how Palmer strived hard to get here. He learned discipline and was able to develop a healthy daily routine. We are also glad that we’ve finally discovered his potential, this only proves that children with ASD can also excel in different fields with the right support from family and friends.”![[Palmer together with his mother, Mrs. Jocelyn Taliño Taray, his swimming coaches, and Oceanman Asia Manager Jose Luis Larrosa]](https://slvrdlphn.com/wp-content/uploads/2025/04/public-134)

Joining the first Oceanman Philippines is a significant milestone for Palmer and his swimming coaches because it was an avenue for them to tell the world that people with autism can exceed their limitations and be achievers in their own fields. The key to this is discovering their talents and unlocking new skills by engaging them in new hobbies and activities.

Palmer only started swimming 2 years ago as a form of therapy aimed at improving his motor skills and sensory abilities. Few months after, he has shown significant progress and interest in swimming. However. the journey was challenging not only for Palmer and his family but also for his coaches because they needed to teach him how to follow instructions by implementing strict routines.

Aquatic training for children with ASD has many positive effects, it improves their motor abilities as well as their social behavior and communication skills. Similarly, it helps with emotion regulation because water naturally gives pressure on the body, which can feel calming, and this sensory feedback can help children with autism feel more grounded and in control of their emotions. Further, swimming can be a way to release built-up energy and tension among children with ASD.

In preparation for the upcoming Oceanman open-water swimming competition in Dubai this year, Palmer is set to join more local swimming competitions and marathons across the country to further gain strength and endurance. He will likewise continue his training four times a week together with Coaches Kirt Loven Murcia and Kevin Palabao.

Oceanman is a globally recognized series of open-water swimming competitions that attract swimmers of all levels—from beginners to elite athletes. Established in 2015, it has grown into one of the largest international open-water swimming circuits, hosting events across five continents and drawing over 40,000 participants annually. Amomg the well-known local personalities who joined the recently held Oceanman Philippines together with Palmer were Erwan Heusaff, Nico Bolzico, and Wil Dasovich.

You must be logged in to post a comment.