by | May 4, 2025 | Business

Discover everything about Initia (INIT), a modular Layer 1 blockchain revolutionizing dApps, gaming, and AI. Explore INIT token utility, airdrop news, and long-term price predictions from 2025 to 2040.

In the fast-moving world of blockchain innovation, Initia (INIT) stands out as a forward-thinking, modular Layer 1 (L1) blockchain network purpose-built to support scalable, consumer-friendly decentralized applications (dApps).

With a special focus on gaming, social apps, and AI integration, Initia introduces a dynamic ecosystem that simplifies the developer experience while offering users seamless multi-chain interactions.

At its core, Initia combines Cosmos SDK and MoveVM, bringing together the interoperability of Cosmos with the security and performance of the Move programming language.

This architectural fusion empowers Initia to serve not just as a blockchain, but as an ecosystem enabler—fueling a vibrant world of Layer 2 rollups known as “initiums.”

What Is Initia?

Initia is a next-generation blockchain platform designed to streamline the creation and management of rollups—custom Layer 2 chains built for specific application needs.

Whether you’re a game developer, a DeFi protocol builder, or a social app founder, Initia offers the tools, scalability, and composability needed to launch your chain efficiently.

At a time when blockchain fragmentation hinders user adoption and developer momentum, Initia brings cohesion through its hybrid L1-L2 architecture, designed to provide shared security, liquidity, and interoperability across its rollup ecosystem.

Understanding Initia’s Modular Architecture

Initia’s architecture consists of three tightly integrated layers:

1. Initia Layer 1 (L1): The Central Coordination Hub

2. Interwoven Rollups: Scalable Layer 2 Chains

-

Known as initiums, these Layer 2s are fully customizable.

-

Developers can select different VMs, gas tokens, and on-chain governance models.

-

Enables high scalability for application-specific use cases such as games, social platforms, and DeFi protocols.

3. The Interwoven Stack: Simplified Blockchain Tooling

-

A plug-and-play development suite that accelerates rollup deployment.

-

Features built-in modules for AMMs, staking, oracles, and token standards.

-

Minimizes technical complexity, reducing time-to-market for projects.

INIT Token: Utility, Governance, and Ecosystem Growth

The INIT token plays a crucial role in maintaining the Initia ecosystem’s functionality and incentivizing its stakeholders:

1. Gas Fees: Used to pay for transactions on both Initia L1 and its rollups.

2. Staking: Delegators and validators stake INIT to secure the network and earn rewards.

3. Governance: Token holders vote on protocol changes, inflation rates, and network parameters.

As the number of initiums and applications grows, INIT’s utility is expected to expand into interchain DeFi, cross-rollup operations, and more complex governance mechanics.

Why Initia Is Different

1. Cosmos + MoveVM Integration

Initia is unique in blending the Inter-Blockchain Communication (IBC) protocol from Cosmos with the Move language’s safety-first, modular execution environment. This allows Initia to deliver secure, interoperable chains with greater flexibility than EVM-based competitors.

2. Rollups-as-a-Service

Initia reduces friction by enabling developers to deploy custom Layer 2 chains without starting from scratch. Preconfigured modules, customizable VMs, and built-in security drastically shorten the time to launch.

3. User-Centric Design

Initia prioritizes usability with wallet abstraction, fast finality, and multi-chain simplicity. End-users can interact across initiums and external chains without dealing with complex bridging mechanisms.

INIT Airdrop and Market Sentiment

As anticipation builds around the INIT airdrop, users and investors are closely watching Initia’s pre-launch market activity. The token currently trades in pre-markets such as Bitget and Aevo at a price range of $0.60–$0.70, giving the project an FDV of $600M–$700M.

Two key price scenarios are currently projected:

1. Without Binance Listing: INIT may trade steadily between $0.50 and $0.70, similar to how Dymension (DYM) performed post-launch.

2. With Binance Listing: INIT could launch at $1–$1.50, with its FDV reaching $1.5 billion, following a trajectory similar to Celestia (TIA) or Movement (MOVE).

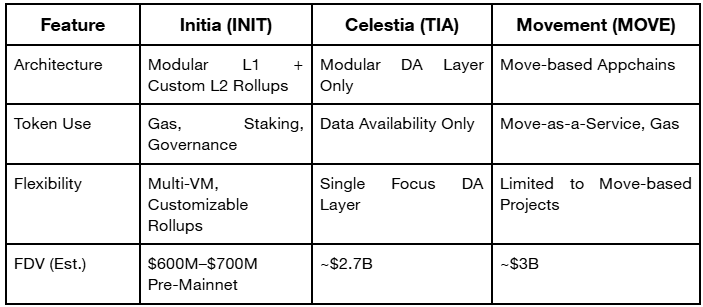

Comparative Analysis: Initia vs. Competitors

Initia’s more complete modular stack and multi-language support give it a technological edge over its peers in adaptability and composability.

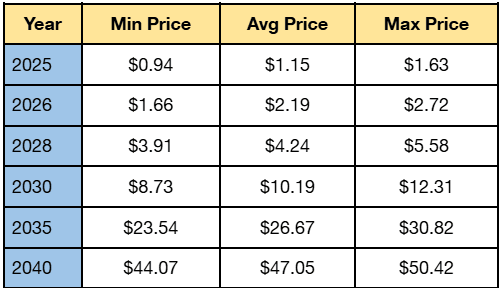

INIT Token Price Forecast (2025–2040)

A combination of algorithmic models, historical performance, and investor sentiment suggests a promising long-term outlook for INIT. Below are the Initia (INIT) yearly projections:

Monthly Projections for 2025 also highlight strong potential returns:

1. May 2025: Avg. $1.52, Max. $2.56 (ROI: 239%)

2. June 2025: Avg. $3.00, Max. $3.56 (ROI: 372%)

3. July 2025: Avg. $ 1.57, Max. $1.63 (ROI: 115.78%)

4. August 2025: Avg. $2.72, Max. $3.03 (ROI: 302%)

5. September 2025: Avg. $1.16, Max. $1.35 (ROI: 71.91%)

6. October 2025: Avg. $1.139, Max. $1.24 (ROI: 64.17%)

7. November 2025: Avg. $1.063, Max. $1.73 (ROI: 78.40%)

8. December 2025: Avg. $1.43, Max. $1.59 (ROI: 110%)

Conclusion: Why Initia Could Redefine Web3 Infrastructure

Initia presents one of the most holistic blockchain ecosystems to date—offering not only a secure and scalable base layer but also a comprehensive development environment for launching high-performance, application-specific blockchains.

With its emphasis on modularity, user-centricity, and developer accessibility, Initia is poised to attract a wide range of projects across DeFi, gaming, AI, and social networking.

As the INIT token prepares for broader distribution through its airdrop and potential exchange listings, investors and builders alike should keep a close eye on this rising multi-chain ecosystem.

by | May 4, 2025 | Business

Discover XRPL SNAP, the MetaMask Snap that brings full XRP Ledger integration to MetaMask, enabling XRP transactions, token and NFT management, asset bridging, and direct XRP purchases, all in one secure multi-chain wallet interface.

The recent integration of XRP into MetaMask marks a significant milestone in the journey of XRP adoption. With the advent of XRPL SNAP, users can now interact directly with the XRP Ledger (XRPL) using MetaMask, a wallet that was traditionally reserved for Ethereum and EVM-compatible blockchains.

This innovation bridges a long-standing gap and empowers users to manage both XRP and Ethereum assets in a single, unified interface.

What is XRPL SNAP?

XRPL SNAP is a plugin developed using MetaMask’s Snaps framework—an extension system that allows MetaMask to support non-EVM blockchains. This tool enables native interaction with the XRP Ledger from within the MetaMask wallet.

With XRPL SNAP, users can:

- View XRP balances and addresses

- Send and receive XRP

- Sign all types of XRPL transactions

-

Manage XRPL tokens and NFTs

-

Interact with XRPL dApps

-

Buy XRP using credit cards

-

Bridge assets between XRPL and Ethereum

In short, XRPL SNAP turns MetaMask into a fully functional multi-chain wallet with XRP support, significantly enhancing both its utility and convenience.

How to Use XRPL SNAP in MetaMask

Using XRPL SNAP is a straightforward process. Follow these steps to get started:

1. Step 1 – Install MetaMask: Make sure you have the MetaMask browser extension installed and set up.

2. Step 2 – Visit the XRPL SNAP Page: Go to the official Snap listing: https://snaps.metamask.io/snap/npm/xrpl-snap/

3. Step 3 – Connect and Approve the Snap: Click “Connect” to link MetaMask with the XRPL Snap; MetaMask will prompt you to review permissions; Click “Approve & Install” to proceed. The Snap is developed by @leopoldjoy, a trusted contributor in the XRPL ecosystem.

4. Step 4 – Set Up XRPL Wallet: After installation, A new XRPL wallet address will be generated in your MetaMask; You’ll be able to view your XRPL address, request Test XRP, or fund your wallet using real XRP.

5. Step 5 – Activate Your XRPL Account: New XRPL accounts must be activated with a minimum deposit of 1 XRP, a unique anti-spam mechanism built into the XRP Ledger. For testing, request free XRP using the Testnet faucet; On mainnet, transfer XRP from an exchange or another wallet.

6. Step 6 – Send XRP: To send XRP: Click “Send XRP” inside the Snap interface; Enter the recipient’s XRPL address, amount, and (optionally) a destination tag; MetaMask will sign and submit the transaction; A confirmation will appear once it’s complete.

Why Use XRPL SNAP?

The integration brings several powerful benefits:

1. Seamless Multi-Chain Management: Manage XRP, XRPL tokens, NFTs, and Ethereum assets all from MetaMask—no need for separate wallets.

2. Low Fees and Fast Transactions: The XRP Ledger is known for its sub-second confirmation times and near-zero transaction fees, making it ideal for frequent or high-volume transfers.

3. Full XRPL Functionality: Users can sign any XRPL transaction (payments, trustlines, account settings); view real-time account dashboards; access full transaction history; & create and manage XRPL accounts

4. NFT and Token Support: Store and transfer XRPL NFTs and tokens natively inside MetaMask.

5. On-Ramp XRP Purchase: Thanks to the Transak integration, users can buy XRP directly within MetaMask using a credit card, bypassing centralized exchanges entirely.

6. Cross-Chain Bridging: Effortlessly bridge assets between EVM-compatible chains and the XRP Ledger, unlocking new DeFi possibilities across ecosystems.

Security Considerations

While XRPL SNAP offers exciting new functionality, users must remain vigilant:

- XRPL SNAP is not developed by Ripple, but by independent developers.

-

Only install from the official MetaMask Snap directory to ensure safety.

-

Never share your Secret Recovery Phrase or private keys—no Snap, dApp, or extension should ever request them.

-

MetaMask’s existing security features (including hardware wallet support) still apply to XRPL SNAP transactions.

XRPL SNAP vs Traditional XRP Wallets

Conclusion: Unlocking XRPL’s Potential Through MetaMask

XRPL SNAP is a major leap forward for XRP users and the broader crypto community. It simplifies asset management, supports a wide range of transactions, and enhances the MetaMask experience by bringing in a non-EVM giant like the XRP Ledger.

Whether you’re a seasoned MetaMask user or just getting started with XRP, XRPL SNAP is a practical, secure, and powerful way to unify your crypto interactions under one roof.

by | May 4, 2025 | Business

Discover what XFree Coin (XFREE) is, how it works, how to buy or earn it through staking, and how it compares to similarly named crypto and adult platforms. A full guide to its safety, utility, and future potential.

In the ever-evolving world of cryptocurrency, the spotlight often falls on major players like Bitcoin and Ethereum. But as blockchain technology matures, a wave of utility-driven, purpose-built tokens is rising, among them, XFree Coin (XFREE).

With a blend of staking rewards, real-world payment ambitions, and a unique identity in the digital finance ecosystem, XFREE is turning heads.

This article explores what XFree Coin is, how it works, how to obtain it, and how it compares to similarly named, but fundamentally different, platforms like xfree.com and other adult-themed crypto projects.

What Is XFree Coin?

XFree Coin (XFREE) was launched in 2022 as part of the FREEdom Coin ecosystem and is built on the BNB Smart Chain (BEP-20), a popular blockchain known for its fast and cost-efficient transactions.

It’s not just another token, it’s a reward-based asset designed for users who stake the foundational FREEdom Coin (FREE).

Key Highlights:

1. Total supply cap: 10 billion XFREE (scarcity-driven).

2. Earning mechanism: Up to 40% annual returns through staking FREE Coin.

3. Platform: Built on BEP-20 for fast and inexpensive transfers.

4. Long-term vision: Integration with crypto debit cards, enabling payments via Visa, Mastercard, Google Pay, or Apple Pay.

In essence, XFree Coin functions as a staking reward and a potential spending token—a dual purpose rarely seen with newer altcoins.

How to Buy XFree Coin

If you’re interested in owning XFREE, there are three main ways to do so:

1. Centralized Exchanges (CEXs)

2. Decentralized Exchanges (DEXs) like PancakeSwap

-

Use a wallet like Trust Wallet.

-

Buy BNB, transfer it to your wallet.

-

Connect the wallet to PancakeSwap.

-

Swap BNB for XFREE using the official smart contract.

3. Stake FREEdom Coin

Why Stake FREE to Earn XFREE?

The staking model behind XFREE is one of its standout features:

1. Attractive APY: Up to 40% returns annually.

2. Passive Income: No mining equipment needed.

3. Flexibility: Convert XFREE back to FREE using DEXs.

4. Potential Spending Utility: Future debit card integration.

For users looking to generate crypto income without the energy-intensive mining model, staking FREE to earn XFREE is a smart alternative.

Is XFree Coin Safe?

Like all emerging tokens, XFREE carries some inherent risks:

1. High volatility: As a newer asset, price swings are common.

2. Limited trading history: Less data means higher uncertainty.

3. Security awareness: Only use verified platforms and keep wallets secure.

4. Regulatory flux: Crypto laws may affect newer projects disproportionately.

Due diligence is key. Only invest what you can afford to lose.

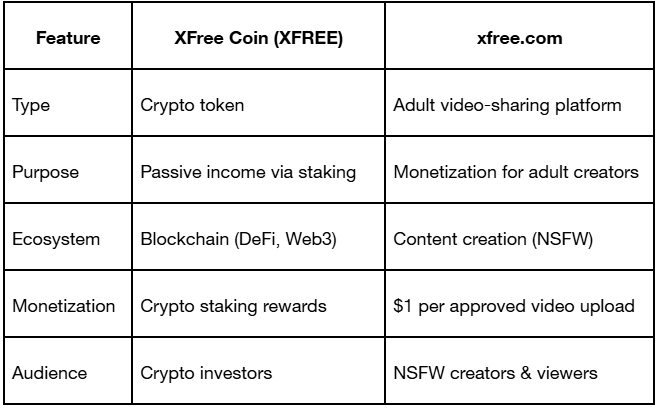

XFree Coin vs xfree.com: A Tale of Two Worlds

Don’t be fooled by the name. There’s a stark difference between XFree Coin (XFREE) and xfree.com, a mobile-first adult content platform that bills itself as the “TikTok of adult videos.”

Quick Comparison:

Despite the similar name, these platforms serve entirely different markets—one financial, the other entertainment. Their shared use of “X” signifies innovation and disruption, not affiliation.

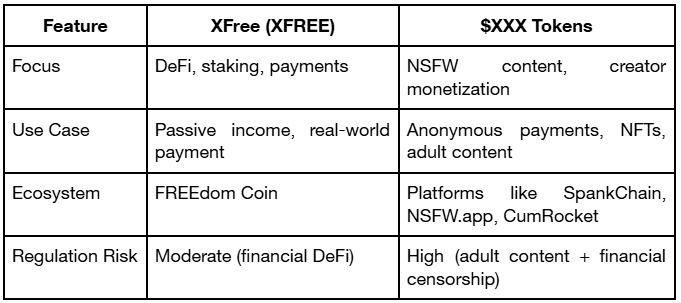

XFree Coin vs $XXX: Crypto in the Adult Sector

Another layer of confusion arises from the comparison between XFree and $XXX tokens used in adult crypto projects. While XFree is not tied to any adult themes, $XXX tokens are explicitly designed for the adult entertainment industry.

Key Differences:

XFree appeals to mainstream crypto users seeking usability and long-term rewards, while $XXX tokens solve privacy and payment challenges within adult ecosystems.

What Makes XFree Unique?

1. Utility-focused: Built with usability in mind, not just speculation.

2. Community-oriented: Tied to the FREE Coin ecosystem with a clear roadmap.

3. Listed on Bitrue: More accessible than many speculative tokens.

4. Sustainable rewards: Encourages long-term holding through staking.

In a space flooded with meme tokens and hype coins, XFree stands out for offering something practical: a tool for passive income with a vision toward mass adoption.

Conclusion: XFree Coin in a Diversified Digital Future

The crypto space is expanding far beyond digital gold and hype-driven tokens. Projects like XFree Coin reflect a maturing industry, where utility, transparency, and community matter more than marketing.

Whether you’re looking to stake for rewards, diversify your crypto holdings, or explore real-world crypto spending, XFree offers a structured and grounded opportunity.

Meanwhile, names like xfree.com and $XXX remind us of crypto’s broader reach—from DeFi to decentralized adult content. But ultimately, XFree Coin carves out its own identity: clean, scalable, and purpose-built for financial empowerment in the age of Web3.

Important note: this article is not a solicitation to buy a particular token. This article is here to provide information so that readers can do research to find out about a project in the crypto ecosystem.

by | May 4, 2025 | Business

XRP price predictions for 2035 suggest a surge to $7.50 amid rising institutional adoption, legal clarity, and ETF optimism. Explore the latest XRP news, Ripple’s evolving strategy, and key market drivers shaping its future.

In a series of pivotal developments, Ripple’s native token, XRP, is making headlines again. From large-scale whale movements to institutional endorsements, legal breakthroughs, and long-term adoption forecasts, XRP appears to be positioning itself at the core of a global financial transformation.

With the cryptocurrency market forecasted to more than double in value over the next decade, XRP could emerge as a dominant force—if ongoing momentum persists.

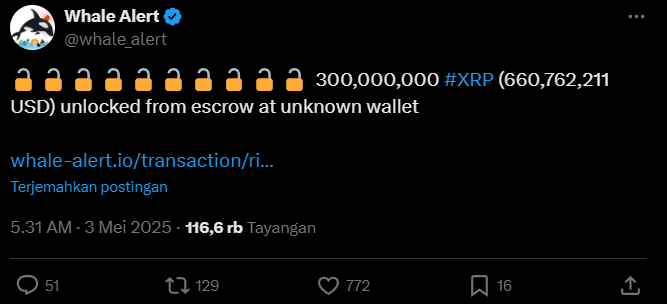

1 Billion XRP Unlocked as Ripple Adjusts Strategy

On May 3, blockchain analytics firm Whale Alert flagged three massive XRP transactions totaling 1 billion XRP.

The transfers included 200 million, 300 million, and a staggering 500 million XRP, with the latter confirmed to be initiated by Ripple itself. All transactions involved funds released from escrow to unidentified wallets.

Traditionally, Ripple has unlocked 1 billion XRP on the first of every month. However, this month’s release came on the third and followed a slightly altered structure: 700 million XRP was locked back into escrow before the new batch was released—a shift from previous protocol where escrow locking followed token distribution.

These changes reflect Ripple’s efforts to balance XRP liquidity with market discipline. A portion of the unlocked XRP is typically sold on exchanges to support operational costs, while another part is deployed within Ripple’s institutional payment network and distributed to strategic partners.

Rumors of Circle Acquisition Denied by Community

Earlier this week, reports emerged that Ripple offered to acquire Circle—the issuer of USDC—for $4 to $5 billion. After Circle declined, rumors circulated that Ripple had increased its bid to a massive $20 billion.

However, the XRP community swiftly denied these claims, with many users mocking media outlets like CoinTelegraph for perpetuating unfounded narratives.

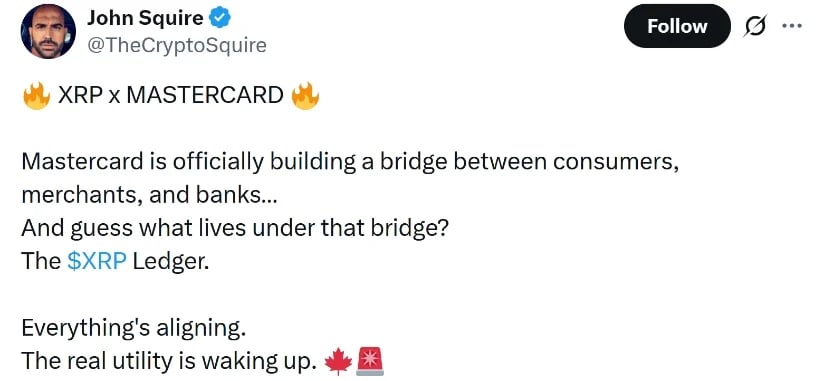

MasterCard Backs XRP as Cross-Border Bridge

In a major vote of confidence, a leaked MasterCard report titled “Blockchain Technology Fuels New Remittances Business Cases” spotlighted XRP as a viable bridge currency for international remittances.

The report specifically praised Ripple’s partnerships with institutions like SBI Remit and acknowledged the XRP Ledger’s efficiency in eliminating the need for pre-funded accounts—reducing foreign exchange costs and improving global liquidity.

MasterCard’s recognition of XRP strengthens the token’s legitimacy and may signal growing institutional integration, especially in regions underserved by traditional banking systems.

Whale Activity Signals Institutional Repositioning

Despite a dip in on-chain volume—XRP transactions dropped from 800 million to 527 million in April—analysts interpret current whale movements as signs of repositioning. Nearly 300 million XRP changed hands within 48 hours, often a precursor to significant market shifts.

Technical analysts note that XRP is consolidating within a wedge pattern, trading around $2.13. Rising support and falling resistance suggest that the token may be gearing up for a breakout.

Ripple’s Expanding Global and DeFi Footprint

Ripple is rapidly expanding its ecosystem. It recently partnered with Revolut and Zero Hash to challenge stablecoin giants like USDT and USDC.

Other notable collaborations include Portugal’s Unicâmbio for real-time transfers between Portugal and Brazil and South Korea’s BDACS, which will use Ripple Custody for XRP and the Ripple USD stablecoin (RLUSD).

Within decentralized finance (DeFi), Ripple is working with Chainlink to bring RLUSD to Ethereum-based platforms, aiming to integrate seamlessly with both decentralized and institutional finance.

Ripple has also donated $100,000 worth of XRP to California wildfire relief, reinforcing its socially conscious brand.

Media Analysts: XRP Is “Loading,” Not Lagging

Crypto analyst John Squire recently described XRP as “loading”—arguing that market players are underestimating its utility and institutional reach.

With Ripple Payments active in 55+ countries and partnerships with 350+ financial institutions—including Tranglo and Japan’s SBI—Squire believes XRP is uniquely positioned for a sustained bull run.

He also pointed to pending developments such as CME XRP futures and whispers of a BlackRock XRP trust. “XRP is battle-tested, institutionally aligned, legally resilient, and globally deployed,” said Squire.

Ripple’s Legal Battle Nears Resolution

Ripple’s legal dispute with the U.S. Securities and Exchange Commission (SEC) is approaching its conclusion. Following a partial victory in 2023, both parties recently filed a joint motion to pause the appeal, signaling the possibility of a final settlement by June 16.

If Judge Analisa Torres lifts the injunction preventing institutional XRP sales and reduces Ripple’s $125 million penalty, several critical developments could follow:

- The SEC could drop its appeal against XRP programmatic sales.

- Ripple might withdraw its cross-appeal.

- Pending spot XRP ETF applications could gain approval.

The new SEC Chair, Paul Atkins, is perceived as more crypto-friendly, further fueling optimism that XRP may soon receive ETF approval.

Price Outlook: Can XRP Hit $7.50 by 2035?

XRP’s performance remains a subject of bullish speculation. While XRP currently trading near $2.19, many analysts expect it to reach $5.75–$7.50 by 2035. This projection implies a return of 160%–240% over the next decade, or an average annual gain of 10%–13%.

Ripple’s integration into global financial infrastructure, rising institutional adoption, and potential ETF approvals could drive this growth.

Notably, XRP has historically outperformed the broader crypto market—gaining 270% over the past three years compared to the overall market’s 72% return. If this trend holds, XRP could continue to surpass expectations.

XRP’s Advantages and Risks

Why XRP Has an Edge:

- Speed & Cost: XRP settles cross-border payments in seconds at low fees, unlike SWIFT’s slow and expensive system.

-

Infrastructure: XRP Ledger is designed specifically for global payments.

-

Adoption: Ripple’s growing list of global partners indicates increasing acceptance.

-

ETF Potential: Spot ETFs could unlock demand from retail and institutional investors using traditional brokerages.

Risks to Consider:

- Volatility: Crypto markets are notoriously volatile; investors should prepare for sharp price swings.

-

Regulatory Hurdles: Despite positive momentum, the legal landscape can change quickly.

-

Adoption Lag: Ripple must accelerate institutional onboarding for long-term price growth.

Conclusion: XRP’s Next Decade May Define Its Legacy

With institutional support growing, legal clarity on the horizon, and technical upgrades in progress, XRP is more than just another digital token—it could be the backbone of a new financial era.

If Ripple continues to build bridges across banking systems, and if ETFs gain approval, XRP may not only reclaim past highs but exceed them—potentially reaching $7.50 or more by 2035.

Still, as with all crypto investments, risk management and long-term vision are key. For investors willing to weather short-term volatility, XRP remains one of the most promising contenders in the blockchain revolution.

by | May 2, 2025 | Business

7XM is a licensed online gaming platform designed for Filipino players, offering secure access to casino, slots, and sports betting. With its user-centric approach, the app is now one of the top-rated online gaming platforms in the Philippines.

MANILA, PHILIPPINES – In a rapidly growing digital entertainment landscape, 7XM Gaming App has firmly established itself as the #1 online gaming app in the Philippines, offering an unbeatable combination of top-tier games, secure mobile experience, and local-friendly features that resonate with millions of Filipino users.

CLAIM YOUR FREE 600 BONUS VIA GKASH

Launched with the vision of bringing premium gaming experiences to Filipino players, 7XM has quickly become a household name in the iGaming space. The app features a rich variety of casino games — from classic slots and fishing games to live dealer tables and sports betting — all accessible with a single tap.

“Our goal has always been to deliver an immersive, seamless, and trustworthy gaming experience tailored to the Filipino market,” said a spokesperson from 7XM. “We are proud to be recognized as the leading app in the country.”

CLAIM YOUR FREE 999 HERE

Key Reasons Why 7XM Leads the Pack:

Wide Game Selection – 7XM hosts an expansive library of top-rated games from global providers.

Mobile-Optimized Platform – Smooth, lag-free performance on Android and iOS.

Local Payment Options – Supports GCash, Maya, bank transfers, and other PH-preferred methods.

Legit and Secure – Operates under PAGCOR license and follows strict data protection protocols.

Generous Rewards – New users receive a ₱50 free bonus upon sign-up, with ongoing promos for loyal players.

With its commitment to innovation, user experience, and safety, 7XM continues to redefine online gaming in the Philippines. The app has received overwhelmingly positive reviews and maintains a strong presence across social media and affiliate platforms.

CLAIM YOUR FREE 600 BONUS VIA GKASH

Download and Join the 7XM Community Today

Players can download the app via the official website and start enjoying instant rewards, fast payouts, and nonstop gaming action.

For more information, visit: https://www.7xmph2.com/register?affiliateCode=cppvu

Media inquiries: pr***@*xm.com

You must be logged in to post a comment.