by | May 11, 2025 | Business

AECH’s new single that stands out as a love letter to their homeland, Antipolo City.

AECH (pronounced “H”), a rising Filipino band mixing country and rock, just dropped a new single called “Highlands.”

Released on April 4, in commemoration of its cityhood anniversary, the song is a personal shoutout to their hometown, Antipolo City.

It’s filled with hope, pride, and hometown nostalgia, wrapped in a laidback country sound.

This release follows their debut EP The Afternoon (2024), and it’s clear—AECH is carving out their own lane in OPM.

Formed in summer 2023, the band’s been steadily gaining fans through live gigs and features—like their spot on Wish 107.5.

“Highlands” marks another big step.

The lyrics paint Antipolo clearly:

“From the highest mountains to the falling falls.”

It’s calm, proud, and real.

The hook—“Living in the Highlands, where the music plays”—feels like home.

They officially launched the single on April 5 at How ű Brewin’ Music Cafe with other indie artists: Azul, Jerry Something, Audiovault, Yes Friday, GRIDN, and Race to Valhalla.

It was small and packed with love—exactly the kind of setting that shows how tight AECH is with the local scene.

Watch the lyric video below.

by | May 11, 2025 | Business

Discover how Solayer, a Layer-2 solution on Solana, enhances scalability and liquidity through restaking, sSOL tokens, and DeFi integration—plus 2025 price predictions showing up to 358% ROI for LAYER investors.

As blockchain networks evolve, scalability, utility, and liquidity become critical components for sustainable growth. Enter Solayer, a cutting-edge Layer-2 (L2) blockchain built on top of Solana.

Designed to maximize the performance of the Solana network, Solayer introduces a powerful ecosystem that enables users to restake SOL tokens, earn rewards, and maintain liquidity through tokenized assets, while also offering promising returns for early investors.

What is Solayer?

Solayer is not just another protocol. It is a scalability-enhancing restaking infrastructure that unlocks dormant SOL tokens, allowing them to be actively used in decentralized applications (DApps) and across the Solana ecosystem.

Think of your SOL tokens as rooms in a digital building—Solayer helps you “rent them out,” reducing congestion and empowering broader network usage, all while earning you rewards.

How Solayer Works: Core Architecture and Components

Solayer’s strength lies in its modular, intelligent staking infrastructure. Here’s how the system works, component by component:

1. Layer 2 Restaking Protocol

Solayer operates as an L2 enhancement to Solana, offloading part of the staking and delegation workload. This unburdens the main network, allowing DApps to function more efficiently while maintaining decentralization and speed.

2. Restaking Pool Manager

This is the central orchestrator of the staking process. It:

3. sSOL: Liquid Staking Tokens

These are tokenized representations of staked SOL, allowing holders to retain liquidity. Instead of waiting through unstaking periods, sSOL holders can trade, use, or reinvest their assets instantly—earning yield while staying flexible.

4. Delegation Manager

The Delegation Manager determines where pooled SOL is staked by interacting with validators. This ensures secure and optimal delegation for maximum yield and decentralization.

5. Reward Accounting Unit

This component tracks staking rewards and ensures fair distribution to sSOL holders, according to their proportional share in the pool. Think of it as the accountant of the system—ensuring precision without handling the funds directly.

6. Oracle Price Feed

To ensure a stable and accurate value peg between sSOL and SOL, Solayer uses oracle price feeds. This maintains market confidence by keeping token valuations consistent and aligned with real-world SOL prices.

Step-by-Step Example: Solayer in Action

Let’s break down a real-world use case:

- You stake your SOL via Solayer.

-

The Restaking Pool Manager receives your tokens and gives you sSOL.

-

Your staked SOL is then delegated across multiple validators and DApps, guided by the Delegation Manager.

-

Rewards are tracked by the Reward Accounting Unit and periodically distributed.

All the while, oracle price feeds ensure your sSOL value reflects your earned SOL + rewards.

Result? You’re earning passive income, maintaining token flexibility, and helping to secure the Solana network—all at once.

Tokenomics: Inside the Solayer Ecosystem

Solayer operates with a multi-token economy, each with a specific role:

1. SOL: The foundational token used for staking and transactions on Solana.

2. LAYER: The primary utility token of the Solayer ecosystem, used for staking, governance, and incentives.

3. sSOL: A liquid staking token, enabling seamless participation in the ecosystem without sacrificing liquidity.

4. AVS Tokens: Issued by DApps on Solayer, these grant access to MEV (Maximum Extractable Value) and SOL yield streams.

5. sUSD: A stablecoin pegged to the US dollar, used for staking, transactions, and liquidity provision.

Price Forecast and ROI: 2025 and Beyond

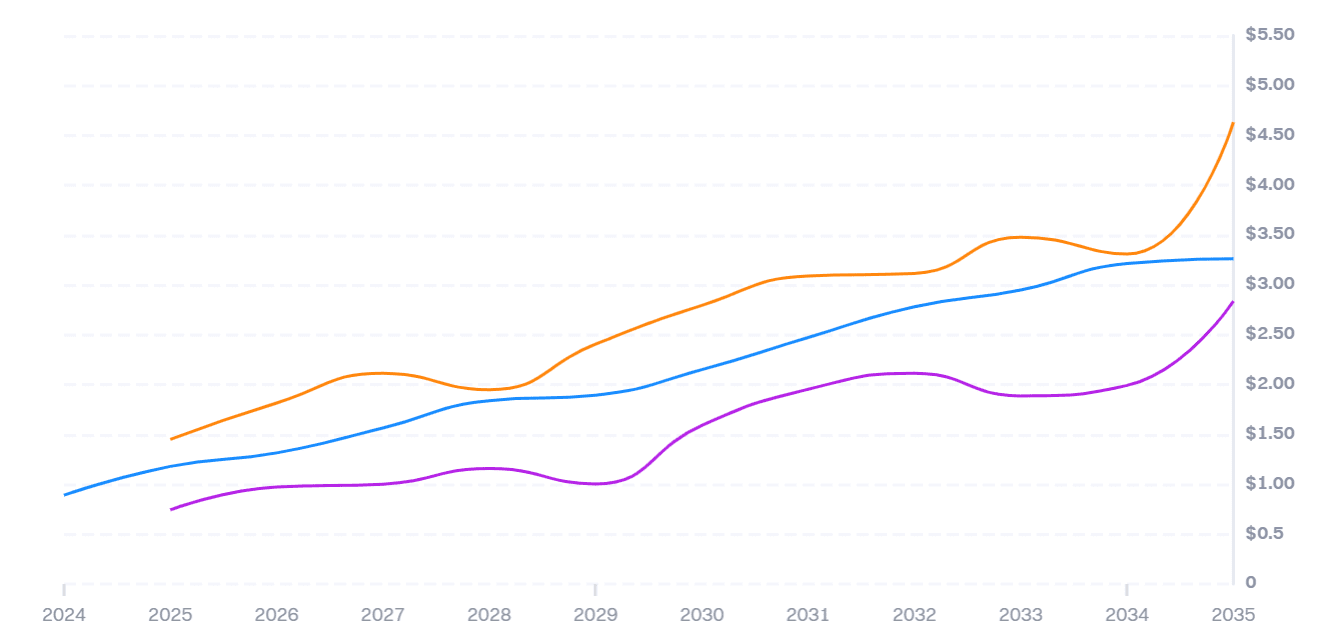

The financial outlook for LAYER—the native token of Solayer—is optimistic, with impressive ROI predictions throughout 2025:

Despite volatility, the annual average price of $3.28 for LAYER in 2025 suggests strong investor confidence and potential returns exceeding 350% for early adopters.

Long-Term Price Prediction: LAYER in 2030

Looking ahead, conservative estimates show LAYER reaching $1.50596 by 2030, marking a gradual yet steady increase in long-term value. While this may reflect cautious forecasting, it underscores a belief in Solayer’s sustained utility and network growth.

Conclusion: Why Solayer Matters

Solayer represents the next phase in DeFi innovation on Solana. By enabling restaking, liquid staking, and cross-platform utility, it unlocks powerful ways for users to grow their assets without compromising on access or flexibility.

With a robust infrastructure, diverse tokenomics, and bullish market outlook, Solayer is well-positioned to become a foundational component of Solana’s broader DeFi ecosystem.

by | May 10, 2025 | Business

Kuala Lumpur, 8 May 2025 – GA Skylight Berhad (“GA Skylight” or “the Company”, and also widely known as the Skylight Group) is delighted to announce a significant step forward in its growth journey with a formal expression of interest received from Instrak Venture Capital Berhad (IVCB) to become a strategic shareholder in the Company.

This landmark development was unveiled during Skylight’s Shareholder Day and represents a powerful endorsement of the Company’s vision, leadership, and future prospects. IVCB has placed an initial deposit and commenced a comprehensive due diligence process. The anticipated investment, ranging from RM50 million to RM100 million, is expected to be finalised within 45 days, with capital deployment staged accordingly.

This collaboration goes far beyond capital. It marks the beginning of a strategic partnership designed to empower Skylight Group’s transformation. With IVCB’s support, the Company will:

· Strengthen and modernise its organisational structure

· Expand and elevate its core management and C-Suite team

· Attract top-tier executive talent for operational excellence

Lay the foundation for long-term scalability and IPO/buyout readiness

Dato Dr. Zainalnizad Shahrim, Director of GA Skylight Berhad and CEO of Asset Skylight Berhad, stated:

” The interest from Instrak Venture Capital Berhad validates the strength of our strategy and the hard work of our team. Their investment will fortify our capital structure and ignite a new phase of growth. We welcome their partnership in shaping Skylight’s next chapter.”

Dato Dr. Kahar Kamarudin, Group Chief Executive Officer of Instrak Venture Capital Berhad, added:

“Skylight is a standout company with a clear trajectory and a results-driven culture. We are committed to providing strategic capital, strengthening leadership, and catalysing corporatisation. Together, we believe this partnership will create immense value for all stakeholders.”

GA Skylight Berhad will continue to provide timely updates as due diligence and partnership discussions progress.

About GA Skylight Berhad

A leading business corporate consultancy and investment holdings company, specifically focused in Corporate Advisory, Mergers & Acquisitions, Project Financing and Equity Participations.

About Instrak Venture Capital Berhad

Instrak Venture Capital Berhad (IVCB) is a unique Malaysian investment firm that specialises in identifying high-growth opportunities and propelling dynamic businesses forward. With over RM1.8 billion deployed across diverse sectors over two decades, IVCB through his Group CEO Dato Dr. Kahar Kamarudin is known for strategic excellence, deep market expertise, and transformative partnerships.

About Dato Dr. Kahar Kamarudin

A trusted fintech strategic advisory to over 69 companies, Dato Dr. Kahar is a recognised authority in corporate finance, fintech strategy, and turnaround expertise. His work has led to recoveries exceeding RM 3.8 billion across SMEs and large enterprises over 20 years. With a growing investment presence in the Middle East, including AED 1 billion (RM 1.2 billion) in Dubai real estate investment, he is one of the most influential financial strategists in the region.

by | May 10, 2025 | Business

Discover Dawgz AI ($DAGZ), a next-gen meme coin combining viral internet culture with AI-driven tools, staking rewards, and long-term price predictions from 2025 to 2040.

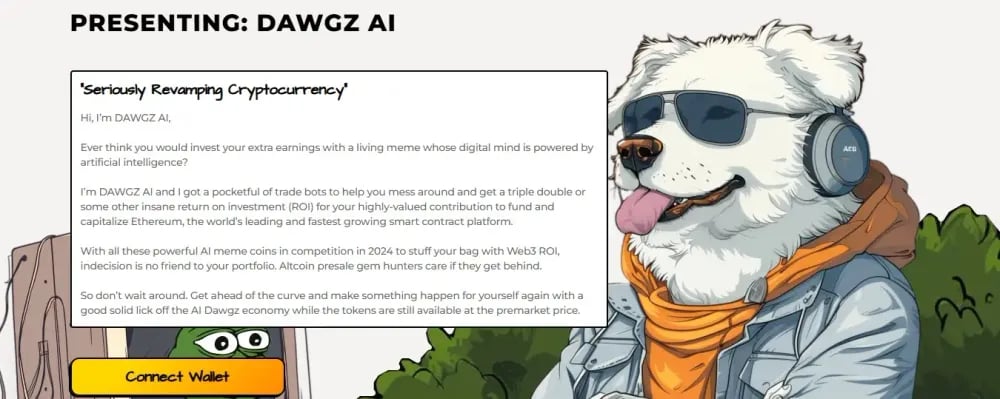

In an age where meme coins continue to surge and fade with internet trends, Dawgz AI ($DAGZ) emerges as a bold contender, fusing the humor and virality of meme culture with the precision and innovation of artificial intelligence.

Built on the Ethereum blockchain, Dawgz AI isn’t just another canine-themed token barking for attention. Instead, it offers a unique ecosystem where AI-driven tools, staking mechanics, and community rewards shape a dynamic and engaging crypto experience.

What Is Dawgz AI?

At its core, Dawgz AI is a next-gen meme coin project that goes beyond hype. It combines decentralized internet humor with real-world utility through AI-powered trading tools, gamified engagement, and a robust staking system.

Marketed as a “next-gen meme revolution,” Dawgz AI leverages artificial intelligence to generate viral memes and support algorithmic trading, creating a practical use case in a genre where few dare to innovate.

Key Features That Distinguish $DAGZ

1. ERC-20 Token Standard

Built on Ethereum, Dawgz AI enjoys the benefits of high liquidity, security, and interoperability with the broader DeFi ecosystem. As an ERC-20 token, $DAGZ is positioned for widespread exchange listings and compatibility with wallets and decentralized platforms.

2. AI Utility Layer

Dawgz AI integrates Blackbox AI algorithms, developed by experienced traders, to generate content and assist users in making informed trading decisions. This transforms the token from a meme into a tool for financial empowerment.

3. Staking and Passive Rewards

Users can stake their $DAGZ to earn passive income, encouraging long-term holding and reducing volatility from speculative trading.

4. Gamified Community Involvement

Dawgz AI introduces meme contests, AI-based games, and interactive airdrops to promote community participation, giving holders an active role in the project’s evolution.

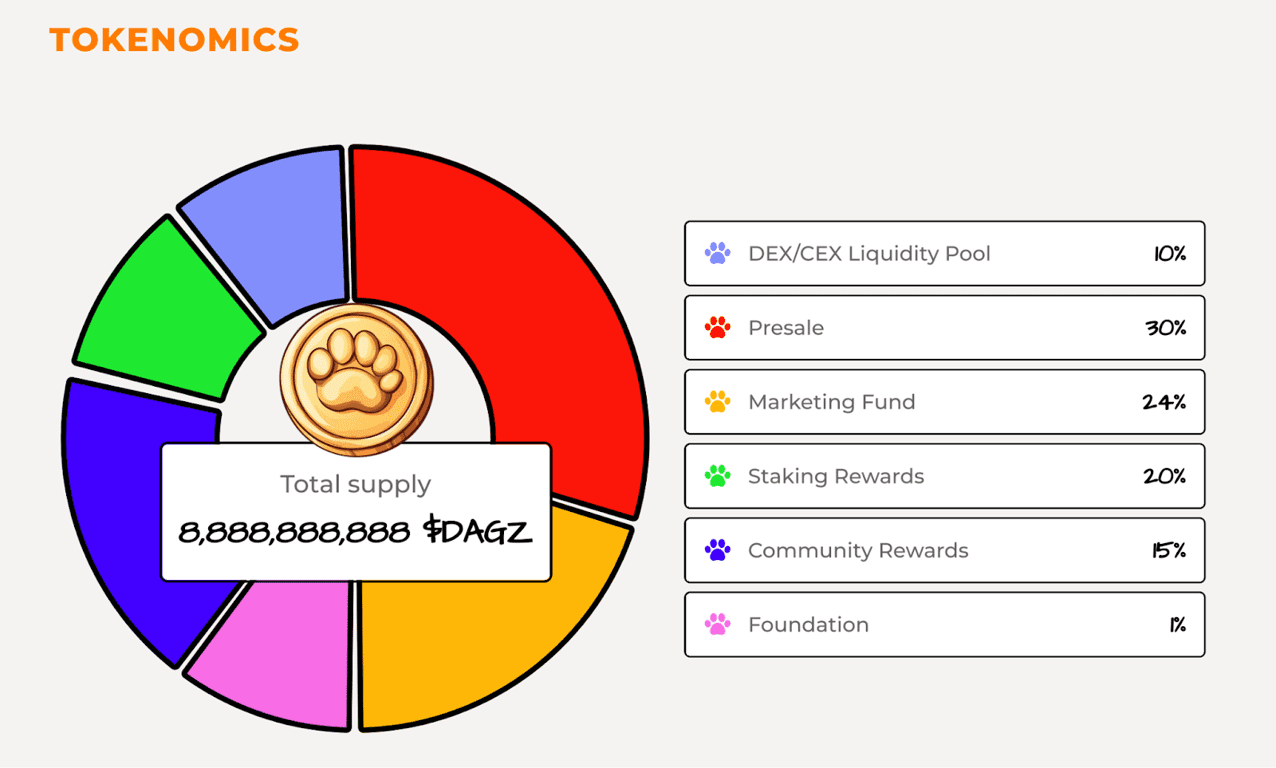

Tokenomics: A Strategic Distribution of 8.88 Billion $DAGZ

The total supply of 8,888,888,888 $DAGZ is thoughtfully allocated to fuel growth, ensure liquidity, and incentivize participation:

Roadmap: From Puppyhood to Alpha Dog

Dawgz AI’s roadmap is divided into four evolutionary phases, each aimed at expanding utility and building trust:

1. Puppyhood: Token creation and Ethereum smart contract audit by SolidProof; Presale launch and foundational marketing

2. Growing the Pack: Community building through meme campaigns, contests, and partnerships; Development of trading AI and early DEX/CEX listings

3. The Big Dog Stage: Expansion of features and gamified tools; International marketing campaigns and further AI tool enhancements

4. Alpha Dog Status: Platform maturity with institutional partnerships and advanced AI tools; Broader adoption by both retail and institutional users

Security and Transparency

In a genre often plagued by rug pulls and vaporware, Dawgz AI sets itself apart with a formal smart contract audit by SolidProof. This third-party verification signals a strong commitment to transparency, accountability, and user safety.

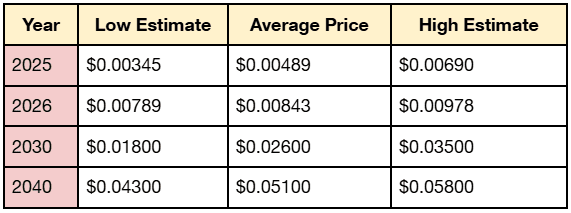

Price Predictions: Can $DAGZ Reach $1?

As of now, $DAGZ trades at approximately $0.00313. Reaching $1 would require a +28,800% increase, resulting in a market cap near $8.88 billion—comparable to projects like NEAR Protocol or Fantom.

Long-Term Price Predictions:

While hitting $1 is unlikely in the short term, strong community growth, successful exchange listings, and verifiable AI performance could significantly push valuation in the long run.

Dawgz AI’s Opportunities and Challenges

1. Growth Drivers: Expansion of AI-powered trading utilities; Strategic partnerships in AI and DeFi sectors; Large marketing fund to build momentum and user trust; Active community and gamification initiatives

2. Risks to Consider: Lack of a fully doxxed team at this stage; High token supply requiring massive adoption for significant price growth; Market volatility and competition from other meme or AI-based projects; Unproven AI tools still in development

Conclusion: Dawgz AI’s Potential in the Evolving Crypto Space

Dawgz AI represents a compelling hybrid of meme culture and artificial intelligence, offering more than the typical meme coin fare. With a solid roadmap, AI utility, community-driven vision, and strategic tokenomics, it has the foundation to build lasting relevance.

While $1 remains an aspirational price, Dawgz AI’s real strength lies in its innovation, community, and execution. For early-stage investors willing to embrace both the humor and risk of the meme coin space, $DAGZ may offer a unique opportunity.

by | May 9, 2025 | Business

Kasada, the pioneers transcending bot management by countering the human minds behind automated threats, today announced its recognition as one of Australia’s Best Workplaces™ in Technology for 2025. The prestigious honour, awarded by Great Place to Work®, celebrates Kasada’s ongoing investment in building an inclusive, empowering, and high-trust workplace culture.

In a fiercely competitive field of innovators and disruptors, Kasada’s consistent recognition reflects its commitment to creating a workplace where employees thrive. Backed by confidential employee feedback and extensive culture analytics, Kasada continues to exceed national benchmarks, proving that you don’t have to sacrifice team well-being to lead in cybersecurity innovation.

“Our team is what makes Kasada exceptional,” said Sam Crowther, CEO and Founder of Kasada. “This award highlights the culture we’ve worked hard to cultivate, one where people are trusted, supported, and motivated to make an impact. We’re building more than just world-class technology; we’re building a workplace that empowers people to do their best work, every day.”

At the heart of Kasada’s culture is a focus on care, innovation, and impact, values that shape every part of the employee experience. From remote-friendly flexibility to continuous learning and meaningful work that protects hundreds of millions of internet users from malicious bots, employees are empowered to own their careers while contributing to a mission that matters.

The Best Workplaces™ in Technology List uses the Great Place to Work For All™ methodology, evaluating how organisations cultivate trust, fairness, and innovation across their teams. For Kasada, this recognition is not just about perks or policies, it’s a reflection of its deep-rooted belief that culture is a strategic advantage.

“The 2025 Best Workplaces in Technology list highlights companies that understand culture is a business asset,” said Rebecca Moulynox, General Manager of Great Place To Work ANZ. “These organisations are showing that when you build a workplace where people feel trusted, included and supported, innovation and business success follow naturally.”

As Kasada continues to expand globally, this award reinforces its reputation not only as a cybersecurity innovator, but as a destination employer for those who want to be part of something bigger.

To learn more about career opportunities at Kasada, visit: https://www.kasada.io/join-our-team/.

You must be logged in to post a comment.