by | May 15, 2025 | Business

Discover 11 fun Telegram games that let you earn free crypto tokens and NFTs! No payments needed: just play, complete daily combos, and get rewarded. Start your crypto journey now!

Get free crypto tokens, not only through airdrop events. You can also get free crypto by playing Telegram Games.

This article will help you understand what Telegram games are currently popular and can give you lots of rewards in the form of crypto tokens to rare NFTs. Read the explanation until the end.

What is Telegram Game?

If you are new to the crypto ecosystem, then Telegram Game also has a new feel for you. Telegram game is an online game with a light capacity because it is run in the Telegram application that you can download via the AppStore or PlayStore.

How Telegram game works is simply by searching for the name of the game in the Telegram search bar. When you have found the mini-game bot, you can play it directly without registering first.

Because the Telegram game system is an online game, you can connect to many networks around the world to help each other solve puzzles in the game.

Should You Pay to Play Telegram Games?

Does playing Telegram games require payment? Absolutely not. You can play Telegram games for free without any costs. In fact, you can get reward points that can later be exchanged for free crypto tokens and can be cashed into your account.

How to play Telegram games is very easy. You can complete all the tasks provided. Each game has different tasks. However, almost every Telegram game has a daily combo feature which is a daily task and must be completed every day.

Daily combo is a puzzle-like task that is different in each Telegram game. If you have difficulty completing the daily combo, you can ask for help in the community of each Telegram game.

You can also search for answers on Google because many will provide spoiler answers, one of which is the Bitrue blog which will always provide updates on daily combo answers for various Telegram games every day in real time.

List of Telegram Games That Give Free Crypto Tokens

Here is a list of 11 Telegram games that you can play and give you free crypto tokens with various interesting events.

1. Ari Wallet

Ari Wallet is an interactive platform accessible via Telegram, offering users a daily quiz feature that tests knowledge on topics like cryptocurrency, blockchain, and financial concepts.

By participating in these quizzes, users can earn in-game rewards such as points, tokens, or other perks. This approach aims to educate users while keeping them engaged in a fun and rewarding experience.

2. Xenea Wallet

Xenea Wallet is a Layer-1 blockchain platform emphasizing secure, decentralized data storage. It features a proprietary hash file system for instant data access and high security.

Through Telegram, you can play Xenea Wallet and resolve any tasks, includes mining, quizzes, daily rewards, and referrals.

3. Dropee

Dropee is a Telegram mini-game that combines tap-to-earn mechanics with social engagement. Players tap to earn tokens, complete quests, and participate in seasonal challenges.

The game offers daily rewards and exclusive token airdrops. Developed by a next-gen gaming studio, Dropee aims to create hit games for chat super apps like Telegram, focusing on community-driven experiences.

4. Hamster Kombat

Hamster Kombat is a tap-to-earn Telegram mini-game where players manage a virtual crypto exchange as a hamster CEO. Launched in March 2024, it quickly amassed over 300 million users.

The game introduced the HMSTR token and launched its own Layer-2 network, the Hamster Network, on TON to support scalable dApps.

Season 2, titled “GameDev Heroes,” expanded the ecosystem into the HamsterVerse, integrating DAO governance and new gameplay mechanics.

5. City Holder

City Holder is a Build-To-Earn game launched on Telegram on August 1, 2024. Players assume the role of virtual city mayors, constructing and upgrading their cities by building homes, skyscrapers, factories, and parks.

The game has attracted over 4.2 million players during its development phase. A key feature is the planned release of the $CITY token, with active players eligible for airdrops and rewards.

The development team includes veterans from major crypto projects and former Riot Games developers, ensuring high-quality gameplay and continuous development.

6. Bums

Bums is a satirical tap-to-earn game on Telegram where players start as homeless characters and work their way up the social ladder. Launched in October 2024, the game combines humor, strategy, and real-world value.

Players earn in-game tokens called BumsCoins by tapping the screen, watching educational videos, and participating in lotteries. These tokens can eventually be converted into real-world assets.

7. Tomarket

Tomarket is a Telegram-based mini-app that initially planned to launch its TOMA token on TON but later migrated to the Aptos blockchain for better scalability.

The platform offers farming pools, allowing users to stake TOMA and earn various tokens like $AKE and $BOINK. Despite the migration, Tomarket continues to expand its ecosystem with new partnerships and features.

8. Spur Protocol

Spur Protocol is a Telegram-integrated platform offering various mini-games, including Wheel Spinner, Word Scramble, and Treasure Land. Users can earn $SPUR tokens by participating in these games and inviting friends.

The platform underwent its first halving event on February 25, 2025, adjusting the token claiming schedule to every 12 hours. Future decisions regarding the protocol will be made through a decentralized community via Proof of Governance (PoG).

9. Marina Protocol

Marina Protocol is a Web3 platform focusing on user engagement through activities like “surfing” to earn SURF points, which can be converted into SURF tokens.

The platform is preparing for its Token Generation Event (TGE) and is in discussions with major centralized exchanges for token listing. Marina Protocol employs a two-phase KYC process, with the second phase, “Surfer Detection,” involving facial recognition for enhanced security.

The platform also introduced “Surfboards,” NFTs that determine user tiers and influence daily BAY point earnings, which can be converted into BAY tokens.

10. Ton Station

TON Station is a Telegram mini-game platform where players earn $SOON tokens by completing tasks, challenges, and referrals. Powered by Sidus Heroes and SuperVerse, it has over 10.8 million registered users.

The platform extended its farming period to November 15, 2024, and plans to list the $SOON token on major exchanges.

11. Trump Farm

Trump Farm is a Telegram-based game that blends farming simulation with political themes, inspired by former U.S. President Donald Trump. Built on the TON blockchain, players engage in quests, manage virtual farms, and participate in PvP battles.

Conclusion

That’s a list of 11 Telegram games that you can play. By solving the daily combo of Telegram games every day, you will get more points so that later you can have the opportunity to get crypto tokens for free.

Telegram games also often hold airdrop events and can give you a lot of crypto tokens that you can claim easily.

Keep up to date with Telegram games and news about various things in the crypto ecosystem by following the Bitrue blog every day. Bitrue also often holds crypto events that provide many rewards, both crypto tokens and other prizes that benefit you.

by | May 15, 2025 | Business

Leading Forex Review Site Adds Region-Specific Broker Ratings and Style-Based Rankings to Help Asian Traders Choose Wisely

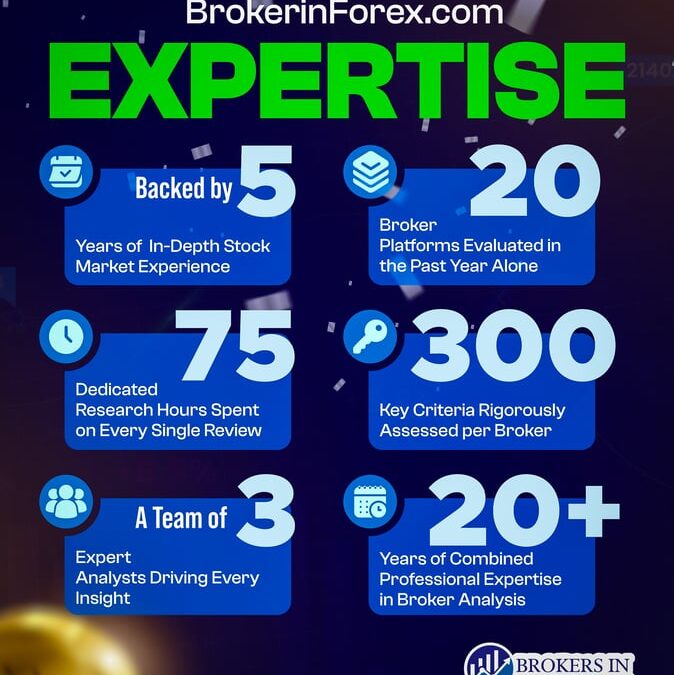

KUALA LUMPUR, Malaysia – May 13, 2025 – Brokersinforex.com, a leading forex broker review and comparison platform, today announced another targeted expansion of its services across Asia, with a stronger emphasis on region-specific evaluations and trading-style rankings. The move supports its mission to offer transparent and independently verified FX broker insights, empowering traders across Malaysia, Singapore, India, and Sri Lanka to make informed investment decisions.

The platform has become a trusted reference point for identifying the best forex brokers, offering performance-based reviews, regulatory overviews, deposit and withdrawal ease scores, and tailored comparisons aligned with trading habits. Visitors can now access expanded tools to evaluate brokers based on country, account type, and trading style – including scalping, Islamic accounts, and high-leverage preferences.

“There’s a growing demand in Asia for forex broker reviews that are reliable, unbiased and locally relevant,” said Akash Khanna, spokesperson for Brokers in Forex. “We’ve redesigned our review structure and comparison modules to meet this need – so whether a trader is in Kuala Lumpur or Mumbai, they’ll find clear answers backed by structured data.”

New Tools Make Broker Selection Easier for Asian Markets

With more than 1 million visitors and a database reviewing over 20 broker platforms, Brokersinforex.com is recognized for prioritizing transparency and usability.

In their latest update they introduced structured information for the top forex brokers in SEA, and the most suitable options for beginners or small account holders.

Brokers are rated on key metrics such as:

Minimum deposit requirement

Leverage offered

Islamic account availability

Bonus incentives

Average spreads and overall experience

Users can also explore specialized categories such as the brokers in forex for beginners, Islamic traders, scalpers, or high-leverage investors – every trader type is accounted for.

“We didn’t want to just be another review aggregator,” Khanna added. “We designed a system that factors in regulatory compliance, trading style, and even geographic needs. This isn’t just about star ratings – it’s about financially sound rationales for everyday traders, even beginners.”

Built for Clarity, Trusted Worldwide

Brokersinforex.com distinguishes itself by removing promotional bias and offering editorially reviewed analysis. All broker reviews undergo a multi-stage process that includes:

Rigorous auditing for brokers

Regulatory license verification

Real-world withdrawal tests

AI driven data point analysis

Comparison based on GEO

For those new to forex trading, the platform also provides beginner-friendly guides and quick-start tips, making it easy to evaluate and open an account with a top-rated broker in just a few steps.

by | May 15, 2025 | Business

“Treasure Fun” can mean innovation or deception; learn how to spot the difference. This in-depth guide exposes a potential scam behind the rebranded TreasureNFT and highlights real, gamified NFT projects.

In the ever-evolving digital asset landscape, the intersection of NFTs and gamification unlocks new avenues for engagement.

One term that’s recently captured attention is “Treasure Fun“, but this buzzworthy name holds two radically different meanings.

On one side lies a promising, innovative gaming experience, while on the other lurks a potential scam exploiting the same terminology.

This article offers a comprehensive exploration of both sides of the “Treasure Fun” phenomenon, particularly examining its questionable ties to the project formerly known as TreasureNFT, and how users can protect themselves from falling prey to fraudulent schemes.

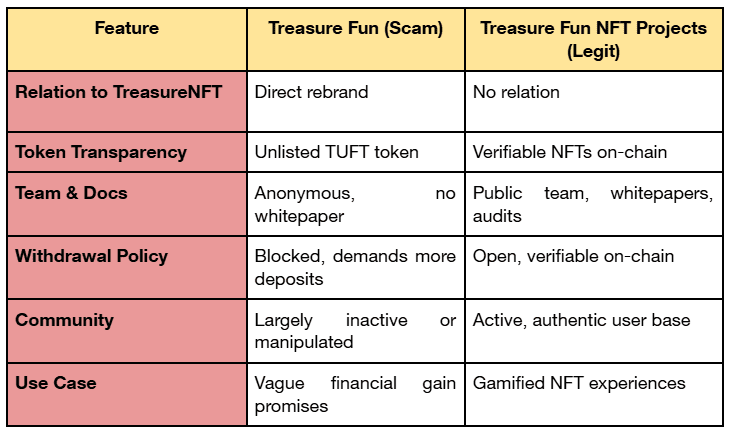

The Problematic Face of Treasure Fun: A Rebranded Scam?

Let’s begin with the concerning version of Treasure Fun, a platform that has raised numerous red flags among blockchain enthusiasts and security experts alike.

Rebranding from TreasureNFT

Treasure Fun appears to be a rebranded continuation of a previously active platform called TreasureNFT.

The rebranding was accompanied by the launch of a new token, TUFT, and was presented as part of a broader compliance and financial strategy, including a supposed SPAC (Special Purpose Acquisition Company) listing.

However, users quickly began to notice troubling behavior:

1. Withdrawal Restrictions: Despite numerous updates, Treasure Fun has repeatedly failed to resume user withdrawals, initially paused on March 24 under the pretext of a SPAC audit.

2. Manipulative Deposit Tactics: Users are prompted to deposit additional money or buy more TUFT tokens under the guise of unlocking their existing funds — a classic hallmark of Ponzi schemes.

3. Lack of Transparency: There is no verifiable team, no third-party audits, and no public token listing on recognized platforms like CoinGecko or Etherscan.

These elements suggest Treasure Fun (formerly TreasureNFT) is not a legitimate platform and should be treated with extreme caution.

The Legitimate Interpretation: Gamified Treasure NFT Projects

On the brighter side, the term “Treasure Fun” is also used more broadly in the NFT world to describe interactive, gamified NFT experiences. These legitimate projects are not related to the rebranded TreasureNFT scheme.

What Are Treasure Fun NFT Projects?

These legitimate platforms combine game mechanics with NFT utility to create exciting experiences. Examples include:

1. Treasure Hunts: Users solve puzzles, engage in quests, and hunt for rare NFTs.

2. AR/VR Integration: Projects may incorporate augmented or virtual reality, blending real-world exploration with digital rewards.

3. Blockchain Transparency: Users can verify ownership and transaction history using blockchain explorers like Etherscan or Arbiscan.

One trusted example is Treasure Market (market.treasure.lol), part of the Treasure DAO ecosystem on Arbitrum. These types of platforms are community-driven, transparent, and emphasize decentralization and engagement, not profits.

Key Differences: Scam vs. Legitimate Innovation

How to Spot a Legitimate Treasure Fun NFT Experience

To avoid becoming a victim of scams like the rebranded TreasureNFT, use these tips to verify legitimacy:

1. Verify Source & URL: Only trust official websites and verified accounts. Legitimate projects will never ask you to sign unclear transactions immediately after connecting a wallet.

2. Transparency of the Team: Genuine projects reveal real team members, often linking to LinkedIn profiles, GitHub repos, and past projects. If you can’t find who’s behind a project, stay away.

3. Avoid Unrealistic Profits & Referral Schemes: Be cautious if a project promises daily returns or has aggressive referral models, signs of Ponzi or pyramid scams.

4. Community Engagement: Legit projects have vibrant communities on Discord, Twitter, or Telegram. Look for organic discussions, not bots or paid reviewers.

5. Use Blockchain Tools: Always check token contracts on explorers like Etherscan or Polygonscan. Be wary of tokens that don’t show up on these tools.

6. Protect Your Wallet: Use a burner wallet for unknown platforms. Never connect your primary wallet or sign “Approve” transactions unless you’re sure what you’re authorizing.

The Ongoing Deception: Timeline of Broken Promises

TreasureNFT’s transformation into Treasure Fun followed a timeline of concerning developments:

1. March 24: Withdrawals paused amid promises of a 7-day delay.

2. March 29: Delay extended by 360 hours (15 days), citing compliance reviews.

3. April 15: Deadline passed with no action or update.

4. April 22: Instead of resuming withdrawals, platform promoted TUFT token presale.

5. April 24: Official launch of Treasure Fun announced — still no withdrawals.

Despite new features and token promotions, the platform continues to withhold user funds, focusing instead on new sales pitches, further eroding trust.

Conclusion: Stay Informed, Stay Safe

The name “Treasure Fun” is being used to promote both innovative gamified NFT experiences and, unfortunately, a potentially fraudulent scheme. Users must learn to distinguish between the two to protect their assets and avoid falling into well-crafted traps.

Before participating in any project:

- Do your own research (DYOR).

- Validate all project details and team information.

- Never trust high-return promises without transparency.

Platforms like Treasure Market offer a safe, decentralized way to explore gamified NFT experiences. Meanwhile, the rebranded TreasureNFT (now Treasure Fun) appears to be a classic case of a scam hidden behind exciting buzzwords.

by | May 15, 2025 | Business

Discover the TUFT token’s price prediction and investment potential. Explore expert insights on short-, mid-, and long-term forecasts, use cases, and ROI from holding 1,000,000 TUFT.

The cryptocurrency market continues to evolve rapidly, and among the many new entrants, TUFT has emerged as a token generating considerable interest.

Following the stock market debut of Treasure NFT and the anticipation surrounding TUFT’s upcoming launch, many investors are asking: What could TUFT be worth—and is it a good long-term investment?

In this comprehensive analysis, we’ll explore TUFT’s fundamentals, future value projections, and the potential returns from holding a large stake, such as 1,000,000 TUFT tokens.

Understanding TUFT: A New Player with Big Potential

TUFT is a newly introduced cryptocurrency token tied to the Treasure NFT ecosystem. Its core value lies in its utility, serving as a transactional token, staking asset, and governance tool within the platform.

With its integration into NFT marketplaces and possible DeFi applications, TUFT aims to provide real-world utility and investor appeal.

Currently, TUFT’s unofficial valuation stands at $0.004 (4,000 USDT for 1,000,000 TUFT). However, its launch on centralized exchanges and platform developments could significantly change that in the near term.

Short-Term Price Prediction: 2025 Outlook

When TUFT officially launches, experts predict a trading range of $0.08 to $0.15, assuming it secures listings on tier-1 exchanges and introduces staking opportunities.

Early volatility is expected due to profit-taking from airdrop recipients and pre-sale participants. However, if Treasure NFT successfully delivers on its roadmap, TUFT could stabilize within weeks of its debut.

Mid-Term Price Forecast: TUFT by Late 2025

Assuming the NFT marketplace is fully operational and adoption is underway, TUFT could rise to $0.25 to $0.40. Factors that could support this growth include:

- Staking rewards and fee utility

- Governance participation

- Launch of NFT creator tools

-

Increased visibility through the Treasure NFT stock listing

These real-world uses and ecosystem developments could push TUFT beyond speculative value into sustained demand.

Long-Term Outlook: 2026 and Beyond

Looking further ahead, TUFT’s future hinges on several key success factors:

1. Marketplace traction: A growing number of creators and collectors using the platform could boost on-chain activity and token demand.

2. Token burn mechanisms: If implemented, these could reduce supply and drive scarcity.

3. Community engagement: Governance voting, incentive programs, and staking yield could keep participation high.

With these dynamics in play and assuming a favorable market environment, TUFT could be valued at $0.60 to $1.00 by 2026—a 15x to 25x increase from current unofficial valuations.

Calculating Returns: What If You Hold 1,000,000 TUFT?

Let’s explore the potential gains for holders of 1,000,000 TUFT, currently worth around $4,000:

Even a modest increase to $0.50 would represent a life-changing return, while a full realization of its bullish trajectory could yield incredible profits.

Risks to Consider Before Investing

While the potential is enormous, investors should also weigh the associated risks:

1. Volatility: Crypto assets are notoriously unstable, and sharp price movements are common.

2. Regulatory scrutiny: As a token operating in the Web2 and Web3 space, TUFT may face dual compliance issues.

3. Competition: The NFT and DeFi landscape is crowded, and TUFT must compete with better-funded or faster-moving rivals.

4. Liquidity risks: Limited market activity may affect the ability to trade large volumes without slippage.

Conclusion: Is TUFT Worth Holding?

TUFT is an intriguing investment opportunity in the evolving Web3 and NFT landscape. Its utility-focused design, connection to Treasure NFT, and upcoming launch make it one to watch.

While speculative, the potential rewards of holding TUFT, especially in large quantities, could be substantial if the project hits its milestones.

For those willing to embrace some risk and play the long game, holding TUFT might be one of the smarter bets in the crypto market today.

by | May 15, 2025 | Business

Hai Robotics, a global leader in warehouse automation, proudly unveiled its latest breakthrough solution, HaiPick Climb, paving the way for a future where automated vertical warehousing is no longer limited by height, complexity, or floor space

Hai Robotics, a global leader in warehouse automation, proudly unveiled its latest breakthrough solution, HaiPick Climb, at the Hai Robotics Innovation Summit 2025 which was held on Friday, 25 April.

As Southeast Asia rapidly evolves into a global logistics hub, the demand for smarter, more space-efficient warehousing solutions has been increasing. The HaiPick Climb addresses these challenges with a game-changing robotic solution that simplifies goods-to-person automation, enabling warehouses and distribution centres to retrofit existing facilities more seamlessly. It increases throughput while reducing implementation time and costs compared to traditional Automated Storage and Retrieval Systems (ASRS), making ASRS more accessible and affordable for a wider range of facilities.

HaiPick Climb is engineered to operate in high-density storage environments, allowing robots to autonomously ascend storage racks and retrieve cases from multiple levels. This not only maximises vertical warehouse space—a critical factor in urbanised areas with limited land—but also significantly reduces the need for costly infrastructure expansion. The compact robots are ideal for narrow aisles, and their agility eliminates the need for cross-aisles, leading to a space-efficient racking design that makes the most of every square foot on the floor. HaiPick Climb’s efficient use of both horizontal and vertical space, reaching up to 12 metres (39+ feet) in height, allows for an impressive 30,000 storage locations within 1,000 square metres (10,763+ square feet), significantly enhancing space utilisation and reducing footprint.

Traveling at an impressive speed of 4 metres per second (13 feet per second) and climbing at 1 metre per second (3 feet per second), the HaiPick Climb system can process 4,000 totes per hour within a 1,000-square-meter (10,764-square-foot) space. Totes are delivered to workstations in as little as 2 minutes after order receipt — 34% faster than traditional ASRS — allowing for extended order cutoff times for same-day fulfillment.

By automating previously manual and labour-intensive vertical picking tasks, HaiPick Climb also addresses ongoing labour shortages and improves workplace safety. Moreover, the system’s integration with HaiQ, an intuitive and user-friendly warehouse management platform, enhances throughput and operational efficiency by intelligently managing order execution and robot dispatch, ensuring faster order fulfillment. Additionally, HaiQ provides real-time insights into warehouse and automation operations, supporting data-driven decision-making.

“HaiPick Climb represents a transformative step in warehouse automation,” said Nathan Zeng, President of Hai Robotics SEA & ANZ & South Korea, during the opening speech. “With the ability to climb and retrieve goods from elevated storage zones, this solution pushes the boundaries of what is possible in intelligent logistics and paves the way for smarter, more scalable operations.”

For markets like Singapore, Malaysia, Thailand, and Indonesia, where space comes at a premium and operational costs are rising, HaiPick Climb offers a timely and strategic solution. The launch of HaiPick Climb reinforces Hai Robotics’ position at the forefront of warehouse automation, enhancing efficiency and enabling global supply chains to operate at new levels of performance.

You must be logged in to post a comment.