by | May 25, 2025 | Business

Bitcoin hits a historic $111K high in May 2025 amid regulatory breakthroughs and institutional demand. Explore key drivers, expert forecasts up to $1M, and what lies ahead on the road to $120,000.

May 2025 has seen Bitcoin (BTC) not just reclaim its momentum but shatter records—rising above $110,000 for the first time in history and igniting fresh waves of institutional and retail interest.

In what many analysts are calling the beginning of a new supercycle, the world’s largest cryptocurrency appears to be entering uncharted territory, driven by legislative progress, corporate adoption, and favorable macroeconomic conditions.

Historic Surge: Bitcoin Tops $110K Amid Regulatory Wins and Institutional Demand

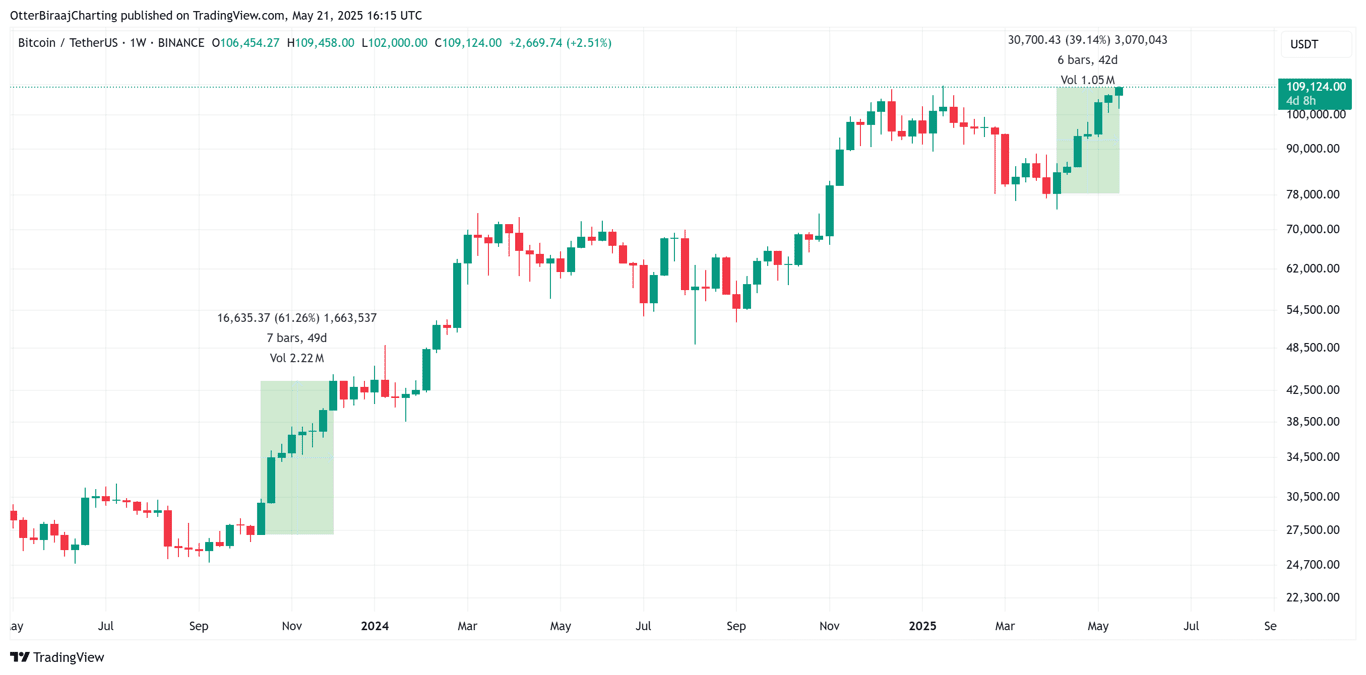

Bitcoin’s meteoric rise has captivated the financial world once again. On Wednesday, BTC soared past $110,000, hitting an all-time high of $111,999 before settling around $111,046.88—a gain of over 45% since its early April low of $76,000.

The rally marks seven consecutive weeks of green candles and pushes Bitcoin’s market capitalization to $2.17 trillion, with its realized cap reaching $911.5 billion, according to Glassnode.

This surge came on the heels of multiple bullish catalysts. Chief among them was the Senate’s advancement of the GENIUS Act, the first comprehensive stablecoin regulatory framework in the U.S., signaling a tectonic shift in how Washington approaches crypto.

President Trump, now in his second term, has made crypto regulation a legislative priority, with plans to sign the bill into law by August.

The regulatory optimism was further fueled by JPMorgan CEO Jamie Dimon’s announcement that the bank will now allow clients to purchase Bitcoin—a stunning reversal from one of crypto’s most vocal critics.

Corporate Treasuries and Institutional Adoption Fuel the Rally

Beyond policy, Bitcoin’s latest ascent is also deeply rooted in rising demand from corporate treasuries.

Michael Saylor’s MicroStrategy (MSTR) made headlines again after purchasing an additional $765 million in BTC last week, bringing its total holdings to over $63 billion.

Analysts note that such moves are no longer outliers; public companies now hold roughly 15% of the total Bitcoin supply—a 31% increase since the start of the year.

Bitcoin ETFs continue to gain traction, with consistent inflows and strong institutional engagement. Global ETPs (exchange-traded products) now manage a record volume of BTC, indicating a transition from speculative asset to strategic reserve.

Technical Landscape: Wedges, Crosses, and Price Projections

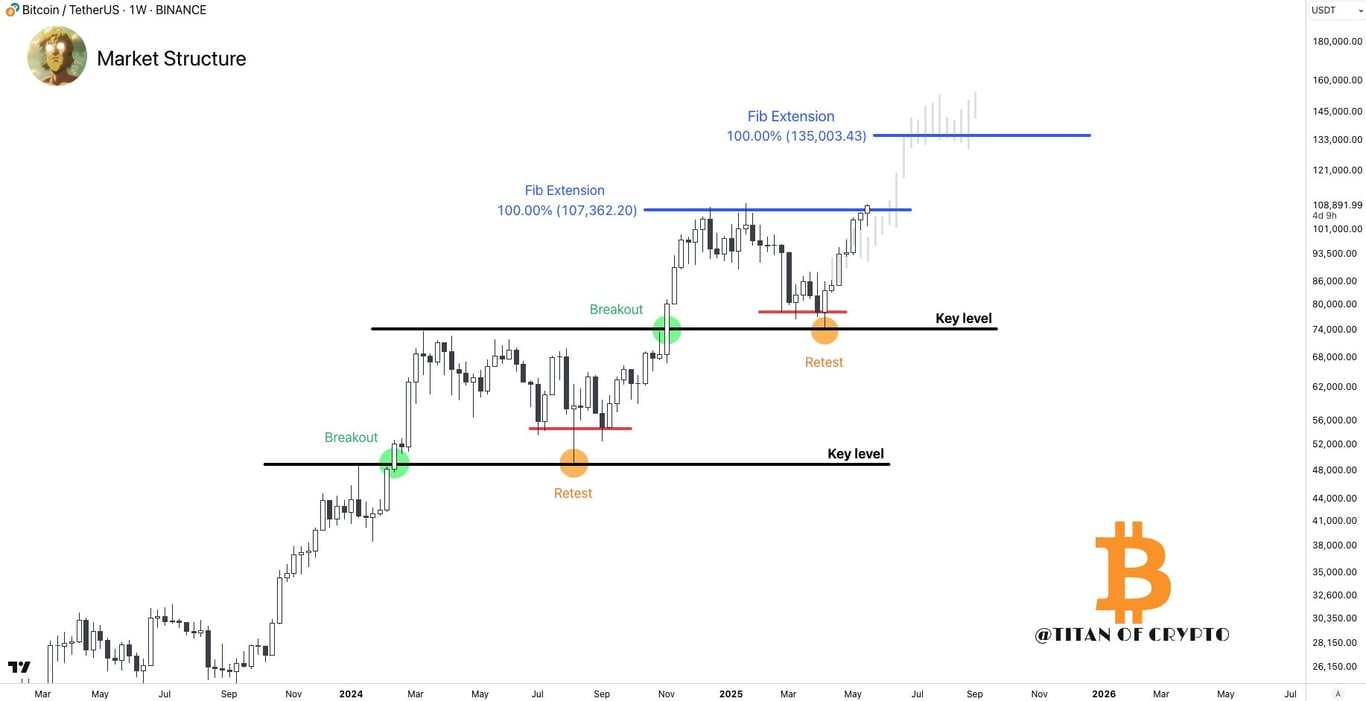

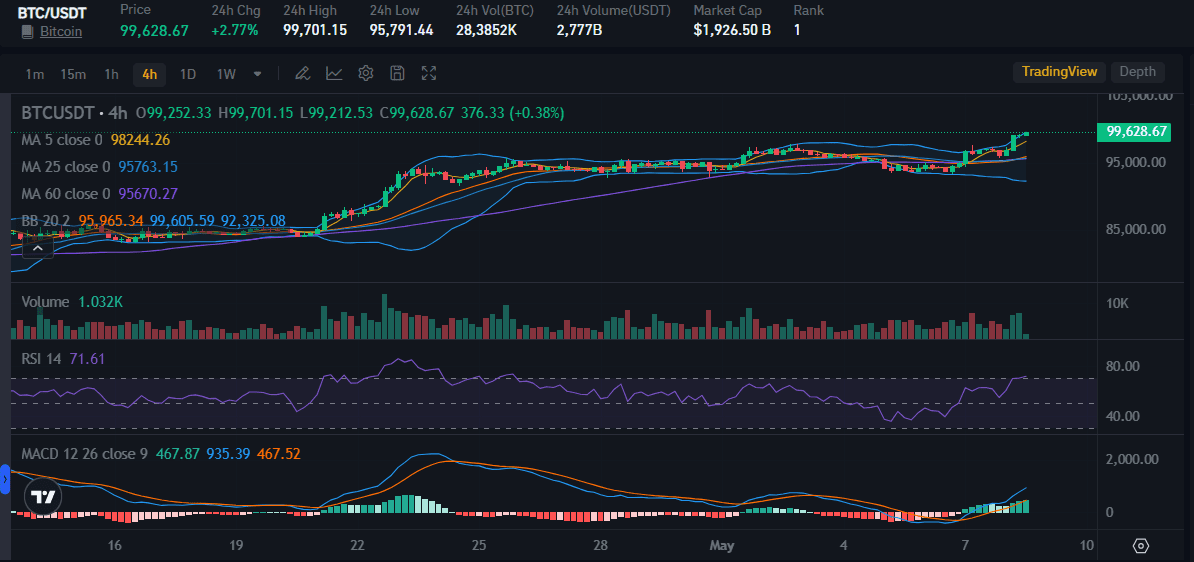

Technically, Bitcoin’s price has been moving within a rising wedge pattern since bottoming in April. While wedges often signal potential reversals, the recent breakout above the upper trendline has coincided with bullish momentum indicators.

The 50-day moving average (MA) crossed above the 200-day MA this week—forming a golden cross, typically seen as a harbinger of sustained upside.

Using the bars pattern projection method, analysts have identified a near-term bullish target of $120,000, with longer-term projections stretching even further.

The 1.618 Fibonacci extension, a favored tool in crypto forecasting, suggests a move to $135,000–$140,000 is possible later this year.

Support Levels and Cautionary Notes

Despite the bullish momentum, key support levels remain crucial. Immediate support sits around $107,000, a level formed by former resistance in December and January.

Failure to hold this could prompt a pullback to $100,000, with deeper corrections potentially targeting $92,000—a zone of significant historical trading activity.

Analysts like João Wedson of Alphractal advise investors to stay cautious. Bitcoin’s heatmaps suggest a move into high-leverage zones, which could be ripe for liquidation traps. “Public euphoria around all-time highs can be dangerous,” he warned. “Risk management is essential.”

Analyst Forecasts: From $150K to $1 Million

The latest wave of bullish projections is as diverse as it is ambitious:

- Peter Brandt sees a top between $125,000 and $150,000 by late summer.

- Arthur Hayes forecasts $150,000 in 2025, citing aggressive central bank policies.

- Tim Draper boldly expects $250,000 by year-end, calling Bitcoin adoption a corporate imperative.

-

Standard Chartered and Bernstein both predict $200,000 within this bull run.

-

Adam Back, CEO of Blockstream, envisions a $500,000 to $1 million target in this cycle, especially as institutional money deepens.

-

BlackRock CEO Larry Fink floated a long-term projection of $700,000, emphasizing the impact of sovereign wealth fund allocations.

-

Coinbase CEO Brian Armstrong went further still, stating BTC could reach the “multi-millions” eventually, citing potential nation-state adoption.

The Macro Backdrop: Trade Easing, Fed Policy, and Inflation Hedges

Bitcoin’s rise is also reflective of larger macroeconomic shifts. A temporary easing in U.S.–China trade tensions and renewed interest in non-sovereign assets amid Moody’s downgrade of U.S. debt have pushed investors toward Bitcoin as a hedge.

Despite high Treasury yields and weak equity markets, Bitcoin has decoupled from traditional financial instruments, reinforcing its narrative as “digital gold.”

The Trump administration’s Strategic Bitcoin Reserve, established earlier this year, has also bolstered sentiment, underscoring federal support for the asset’s long-term integration into the U.S. financial system.

Altcoins Follow Suit

Bitcoin’s rally has lifted the broader crypto market. Ethereum rose 5% to $2,600, XRP climbed 3.9% to $2.42, and Solana, Cardano, and Polygon posted gains between 2% and 6%.

Meme tokens such as Dogecoin and $TRUMP also surged, the latter gaining 15% on the day.

Conclusion: The New Bitcoin Era Has Arrived

With strong institutional backing, favorable regulatory winds, and increasingly bullish technicals, Bitcoin appears to be entering a transformative phase.

While corrections are inevitable and risks remain, the broader picture suggests that BTC is no longer just a speculative asset—it’s fast becoming a foundational element of modern finance.

As we look ahead, the road to $120,000 and beyond seems increasingly likely—not a question of if, but when.

by | May 25, 2025 | Business

The first-ever Sports and Fitness Expo (SFE) in the Philippines will take place from 28-31 May 2025 at the Rizal Memorial Sports Complex, showcasing exhibitors from sports, health, and wellness industries. The event will also feature the International Sports Facilities Management Conference and Trade Show, covering topics like facility management, operations, and development, in partnership with the Philippine Sports Commission.

All eyes are on the first-ever Sports and Fitness Expo (SFE)

in the Philippines, set to launch on 28-31 May 2025 at the Rizal Memorial

Sports Complex, Malate, Manila.

Promising a lineup of exhibitors from across the sports,

health, and wellness industries, SFE aims to be the premier sports and health

business trade event in the country.

At its core, the event aims to put the spotlight on the

growing sports and fitness movement in the Philippines. This is backed by a

recent shift towards adopting a healthy and active lifestyle in the country.

As part of the expo, it will host the International Sports

Facilities Management Conference and Trade Show in partnership with the

Philippine Sports Commission.

Exploring topics from sport facility management, operations,

and development, among others, it’s a must-see for any manager, director,

coach, athlete, and sports enthusiast.

Mark your calendars and gear up to be a game-changer at the

first-ever Sports and Fitness Expo!

by | May 24, 2025 | Business

Arayat, Pampanga – WalterMart continues its mission in bringing the good life to more Filipino families with the grand opening of WalterMart Arayat last May 16, 2025 – a full-service one-stop-shop community mall that answers every Kapampangan’s daily needs in one destination.

Located at Brgy. San Jose Mesulo, the new WalterMart Arayat is a mall designed with the Kapampangan family in mind. Whether it’s grocery shopping, dining, errands, or family bonding time, the new mall offers a complete, hassle-free experience—making it a go-to destination for millions of customers annually.

A Major Milestone: The 50th WalterMart Supermarket

At the heart of WalterMart Arayat is the opening of the 50th WalterMart Supermarket—a flagship branch that proudly champions local love through its Palengke Fresh initiative, a “farm-to-table” campaign that brings fresh, high-quality produce, sourced directly from local farmers. This 50th WalterMart Supertmarket also showcases a diverse selection of both international and local products, catering to every shopper’s needs. It also carries a wide array of everyday essentials, and stylish family finds—providing branded value with one-stop-shop convenience.

A Complete Mix of Shopping, Dining, and Family Spaces

WalterMart Arayat brings together essential categories—from groceries, general merchandise, appliances, pharmacy, health and wellness, to quick service restaurants—all under one roof.

Knowing how Kapampangans enjoy a wide variety of delicacies, the mall also provides a diverse dining experience, with both well-loved fast food chains such as Jollibee, Mang Inasal, and KFC, as well as S&R Pizza, HapChan, and a mix of local and popular eateries housed within a comfortable and inviting food court section.

Shoppers are also treated with a convenient and world-class shopping experience. The new WalterMart Arayat offers FREE parking for all types of vehicles, making sure that each customer visit is hassle-free. With FREE Wi-Fi access, WalterMart Arayat also promotes interactive and engaging activities that foster social connections—bringing the community together in a warm, connected, and inclusive environment.

Committed to deliver best in class shopping experience and promote family bonding, the mall also features a dedicated play area for kids, Instagrammable green lounges and cozy seating area for friends and families to hang out and socialize, a comfortable customer lounge for relaxation, and an activity center designed to host weekend family workshops, worship services, and community-driven events.

Eco-Conscious and Future-Ready

WalterMart Arayat aims to be the most Eco-conscious commercial development in the province, operating with a solar-powered system, using solar lighting, and a waste management program that recycles over 80% of operational waste—paving the way for sustainable community mall operations.

More than a mall, WalterMart Arayat is an aspirational community destination—delivering branded value, lifestyle convenience, and warm service while staying true to WalterMart’s core of building WIN-WIN-WIN partnerships among its customers, local communities, and business partners.

WalterMart Arayat is hosting Grand Opening Sale, featuring Buy 1 Take 1 deals, 50% discount on selected items, and Sulit promos until May 25, 2025 and a Family Fiesta Activity on May 31, 2025.

Have a WalterMart near you? Visit WalterMart Community Malls and enjoy the same one-stop-shop destination in all of its 44 branches!

For more information, visit www.waltermart.com.ph or follow us on our official social media pages: WalterMart Mall.

by | May 23, 2025 | Business

Manila, May 23, 2025 — VRICrew officially launches as an innovative recruitment platform that emphasizes company culture and values as the core of the hiring process. Unlike traditional job postings that focus mainly on roles and qualifications, VRICrew allows candidates to truly experience the atmosphere and vibe of a company, making the job search more transparent and meaningful.

By showcasing company values, work environment, and team dynamics, VRICrew helps organizations build a unique narrative to strengthen their employer brand. Candidates can better assess their fit with the company culture, improving long-term retention and satisfaction.

“Company culture is the heart of any successful organization. With VRICrew, we aim to connect talents and companies not only based on skills but also shared values and a comfortable working environment,” said Ferry, Co-Founder of VRICrew.

The platform features interactive elements such as company profile videos, employee stories, and highlights of core values that make each company unique. This approach fosters a more authentic relationship between candidates and employers from the very beginning.

VRICrew is now accessible at https://vricrew.com/ and ready to support companies that want to prioritize culture as a key strength in attracting top talent.

With VRICrew, recruitment is not just about filling positions but building a competitive and solid work community.

by | May 23, 2025 | Business

Rabobank has announced a package of support measures that will be made available to farming clients dealing with the impacts of devastating floods along the NSW Mid North Coast.

Rabobank state manager for NSW Toby Mendl said the specialist agribusiness bank has a range of measures in place to support clients dealing with the “record-breaking floods” across the region.

He said this support would be extended to other parts of NSW, as needed, where flooding and localised intense rainfall is impacting other areas within the state.

Mr Mendl said the record-breaking rainfall had generated massive flooding in Mid North Coast rivers, with agricultural producers facing lost produce – chiefly milk, given restricted farm access – livestock losses and damage to farm infrastructure, fencing, pasture and crops.

“It is too early for many farmers to account for the full extent of the damage,” he said. “As farmers start the task of recovery and rebuilding from the floods in the coming weeks, the full scale of the damage will become clearer.”

“Livestock welfare is a key concern for farmers and the high-water levels are delaying farmers accounting for livestock,” Mr Mendl said. “Many rivers are still too high for farmers and support personnel to be able to access paddocks and assess stock and their condition.”

Mr Mendl said many farmers across the region have been isolated on their properties, experienced water through their homes and farm buildings and had non-fixed assets carried away by floodwaters.

“The challenge, particularly for dairy and beef farmers, in the flood-impacted areas will be sourcing fodder for their stock, as flood-damaged pastures will be slow to recover through the winter months,” he said.

Mr Mendl said additional concerns for farmers include potential damage, or loss of access, to road networks – which could affect the movement of goods into and out of the region and are critical to the local dairy sector.

Mr Mendl said while the full impacts on agricultural operations and production in the region wouldn’t be known until flood waters fully subside, Rabobank’s staff had been making contact with clients to determine how the bank could provide support.

He said the bank would work directly with individual clients whose farms or agribusinesses have been affected to provide support and offer a range of assistance measures in applicable circumstances.

These included:

‘carry on’ finance to keep viable operations running,waiver of break costs on early redemption of Farm Management Deposits to allow access to needed funds,deferral of scheduled loan payments andwaiver of fees on loan increases necessary for rebuilding operations.

Mr Mendl said Rabobank’s (All in One) rural loans were also specifically designed for farmers to provide financial flexibility to manage through times of difficulty by having the option to choose whether a repayment has the effect of reducing the loan limit and the option to apply for a fixed interest option over the whole or part of the facility.

“They are flexible, generally interest-only facilities, which allow agricultural operators to opt to pay principal reductions when they choose, which is of particular benefit in times of reduced cash flow due to adverse circumstances, such as floods,” he said.

Mr Mendl said while the bank’s rural managers were reaching out to clients in affected regions, he encouraged impacted clients to contact Rabobank where assistance was needed by contacting their local branch or phoning the bank on 1800 025 484.

You must be logged in to post a comment.