by | May 26, 2025 | Business

Makati City, Philippines – April, 2025 – In a strategic move set to redefine the hybrid work landscape in the Asia-Pacific region, bneXt Inc., a leading digital transformation consultancy and SAP Gold Partner in the Philippines, has partnered with Canada-based Tehama Technologies, a leader in secure cybersecurity, virtual desktop infrastructure (VDI) and hybrid work enablement. The collaboration aims to deliver customizable, secure, and scalable digital workplace solutions for businesses navigating the complexities of today’s decentralized work environments and evolving security challenges.

This partnership marks a significant milestone in both companies’ missions to help organizations modernize operations, strengthen cybersecurity postures, and embrace flexible working models without compromising compliance or performance.

In the wake of global workplace transformation, organizations have recognized that flexible work is not a temporary shift but a permanent evolution. While hybrid and remote work offer numerous benefits such as employee flexibility, cost savings, and expanded talent access, they also introduce new challenges in managing cybersecurity, access control, regulatory compliance and data and AI governance.

This is where the collaboration between bneXt and Tehama Technologies becomes critical.

“Our partnership with Tehama Technologies aligns perfectly with bneXt’s commitment to deliver innovative and secure digital solutions,” said Teh Opinion, President and CEO of bneXt. “Together, we’re enabling our clients to embrace the future of work with confidence, ensuring their teams can operate securely from anywhere in the world.”

Founded on the principle that secure work shouldn’t be a barrier to innovation, Tehama Technologies uniquely combines highly secure data enclaves, integrated cybersecurity services and end point protection with VDI to deliver the most comprehensive, secure virtual workspace platform. Its Desktop-as-a-Service (DaaS) solution offers more than just remote desktop access as it combines zero-trust network access (ZTNA), encrypted communications, automated compliance, session recording, and granular role-based access controls in a single, cloud-native environment.

“Tehama’s platform complements our existing services, allowing us to offer a more comprehensive suite of solutions,” added Rensie Ubilas, Director for Technology and Platforms at bneXt. “This collaboration enhances our ability to support organizations in their digital transformation journeys, particularly in strengthening the security and compliance posture of hybrid work operations.”

bneXt, a trusted SAP Gold Partner and digital consultancy, has a track record of helping enterprises optimize their operations through innovative technology solutions.

The company is known for its expertise in SAP implementation, cloud modernization, managed services, and enterprise systems integration. Its approach is consultative, agile, and deeply rooted in solving industry-specific challenges. With digital transformation now tightly linked to employee experience and operational agility, bneXt’s expanded focus on secure hybrid work solutions comes at a pivotal time.

By integrating Tehama’s secure access platform with its existing service offerings, bneXt will now be able to provide clients with faster and secure onboarding of remote and third-party workers, end-to-end compliance with industry and government regulations, reduced IT overhead and infrastructure costs, and improved user experiences for distributed teams.

Both bneXt and Tehama see this partnership as more than a tactical collaboration. It’s a long-term strategic alliance that will leverage the expertise of both organizations to deliver quality bespoke offerings to customers from any industry and size.

Organizations can no longer treat security, compliance, and productivity as siloed or disconnected strategies. Enterprise and public sector organizations are seeking comprehensive solutions from their partners that deliver immediate value without breaking the bank or compromising their security,” says Mick Miralis, Chief Revenue Officer, Tehama Technologies.

Our partnership with bneXt delivers a gamechanger and highlights our shared commitment to providing the most advanced cybersecurity platform to businesses across APAC. Together, we aim to empower our customers to accelerate digital transformation and enhance their security posture and accessibility, from desktops to the cloud and their data.

For media inquiries or partnership opportunities, visit www.bnext.tech or email ma*******@***xt.tech.

by | May 25, 2025 | Business

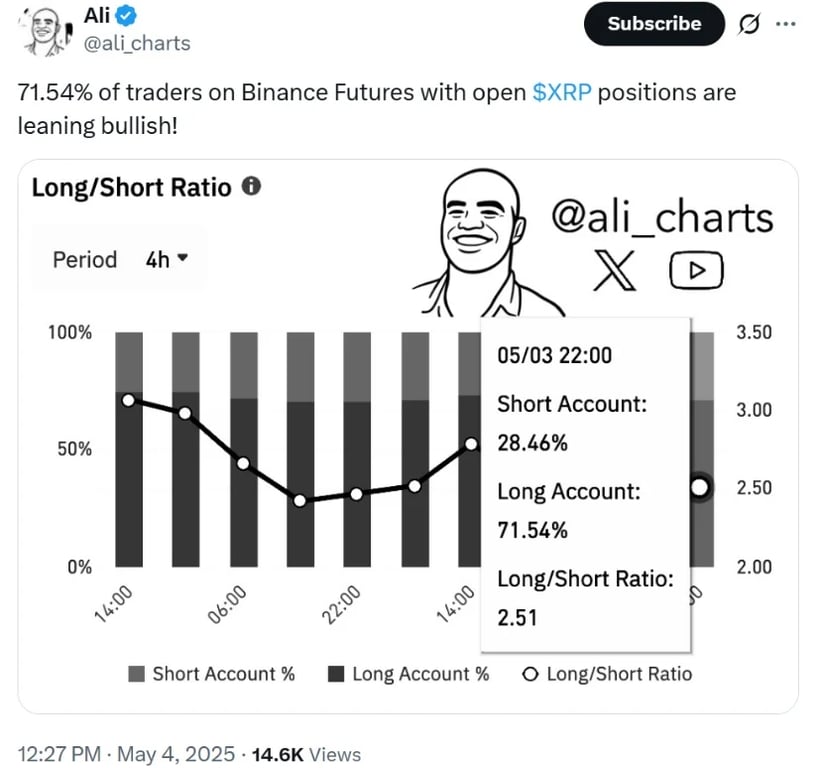

Explore Pepe Coin’s 2025 price prediction with insights into technical trends, whale activity, market sentiment, and cultural momentum. Is PEPE a smart investment next year?

The cryptocurrency market has undergone remarkable transformation, driven by innovations like blockchain technology and consensus mechanisms such as proof-of-stake (PoS), exemplified by projects like Cardano (ADA).

Within this rapidly evolving space, meme coins have carved a unique niche, fueled by social media virality and community enthusiasm.

Among them, Pepe Coin (PEPE) stands out as a rising contender, catching investor interest with its blend of cultural relevance and speculative potential.

This article offers a deep dive into Pepe Coin’s price prediction for 2025, exploring technical trends, market sentiment, investor activity, and its broader implications within the meme coin market.

What Is Pepe Coin (PEPE)?

Pepe Coin is a meme-based cryptocurrency built on the Ethereum blockchain. Inspired by Matt Furie’s iconic character Pepe the Frog, PEPE was created with a “no-tax” policy and launched with an exceptionally large supply, qualities that quickly propelled it into the spotlight of the meme coin space.

After major exchange listings, PEPE saw a dramatic spike in price and trading volume, demonstrating its viral appeal and signaling strong community-driven momentum.

With no clear utility but undeniable market impact, Pepe Coin reflects the ongoing fusion of internet culture with decentralized finance.

Key Drivers of Pepe Coin’s Price Movement

1. Technical Indicators and Chart Patterns

These signs suggest that PEPE may be on the cusp of a breakout, with analysts predicting a surge toward the $0.000027 level and beyond in the coming months.

2. Whale Activity and Trading Volume

Blockchain data confirms significant whale accumulation, with approximately 1.79 trillion PEPE tokens, worth $26.6 million, moved from Binance to a private wallet.

This trend of transferring tokens into cold storage rather than exchanges reflects long-term confidence from large holders.

Meanwhile, daily trading volume has spiked past $880 million, coinciding with a “Greed” score of 74 on the Fear & Greed Index—indicative of rising investor appetite for high-risk, high-reward assets like PEPE.

3. Market Sentiment and Community Strength

PEPE’s core strength lies in its community. Drawing power from meme culture and internet virality, the coin thrives on user-generated hype and social engagement. As long as the community remains active, the coin’s price is likely to follow suit.

Pepe Coin Price Prediction 2025: Forecast Tables and Analysis

According to aggregated data from CoinCodex and Changelly, here are the projected Pepe Coin prices across 2025.

1. Bullish Forecast

2. Bearish Outlook

Technical Breakout: The Symmetrical Triangle

Currently, PEPE has breached the upper trendline of a symmetrical triangle, a key chart formation indicating price consolidation followed by a potential breakout.

If resistance levels at $0.00001477 and $0.0000178 are broken convincingly, PEPE could post daily gains of 10–20%, possibly setting new all-time highs.

External Factors Shaping the Future of Pepe Coin

1. Macroeconomic Conditions: Bitcoin (BTC) is forecasted to hit $140K–$160K by year-end. Ethereum (ETH) is expected to rally toward $4,000. If these projections materialize, meme coins like PEPE may enjoy a sympathy rally as investors diversify into high-beta altcoins.

2. Technological Integration: With Ethereum Layer-2 solutions and DeFi integrations becoming more prevalent, coins like PEPE that exist on the Ethereum network may benefit from enhanced speed, reduced fees, and better scalability.

3. Cultural Relevance: PEPE is more than a coin, it’s a symbol of internet culture. Its future utility could emerge from integration into NFTs, games, or metaverse platforms that celebrate internet lore.

The Rise of MIND of Pepe (MIND): The AI-Powered Spin-Off

Alongside PEPE, a new Ethereum-based AI agent coin named MIND of Pepe (MIND) is gaining traction.

With over $10 million raised during its presale and plans to launch a real-time market analysis terminal, MIND is considered the next big meme coin-AI hybrid. Its beta relationship with ETH makes it a potentially explosive asset during bull runs.

Long-Term Vision: Can PEPE Recapture Its 2023 Glory?

PEPE saw meteoric gains in 2023, turning early adopters into millionaires. But this time around, the coin boasts stronger technicals, larger investor interest, and growing integration with DeFi ecosystems.

Influential voices like Kaleo suggest that PEPE could reach a market cap of $10–20 billion if the broader crypto market remains bullish.

Conclusion: Is Pepe Coin a Good Buy in 2025?

1. Short-Term: With current price action, RSI strength, and breakout patterns, PEPE looks poised for a strong rally in Q2 and Q3 2025.

2. Medium-Term: The coin could touch the $0.000027–$0.000046 range if momentum holds and resistance levels are flipped.

3. Long-Term: If meme culture continues to blend with blockchain utility and crypto markets remain bullish, PEPE could position itself as a dominant meme asset with real market longevity.

by | May 25, 2025 | Business

Explore detailed NEXPACE (NXPC) price predictions from 2025 to 2050, including market analysis, GameFi trends, and insights into NXPC’s role in the MapleStory Universe. Stay informed for smarter crypto investment decisions.

As the cryptocurrency market evolves, investors and gamers alike are increasingly curious about the future potential of niche tokens tied to the gaming ecosystem.

One such token garnering attention is NEXPACE (NXPC), a native cryptocurrency integrated within the MapleStory Universe, designed to power a decentralized content economy including NFTs and user-generated assets.

This article offers a detailed overview of NEXPACE’s current market performance, price prediction from 2025 through 2050, and the key factors influencing its future trajectory.

What is NEXPACE (NXPC)?

NEXPACE is a blockchain-based token used within MapleStory’s growing GameFi ecosystem. It functions as the core currency for NFT transactions, in-game item creation, and governance within the MapleStory metaverse.

Developed by NEXPACE, a subsidiary of Nexon Group, NXPC benefits from the backing of an established gaming company, adding credibility and potential for long-term ecosystem growth.

Current Market Overview

As of the latest data, NXPC is trading around $2.074, showing a strong recent gain of 0.34%.

Its price chart reveals a notable spike from initial prices near $1.98 to highs above $3.50, indicating heightened demand following its launch and ecosystem announcements.

Despite some profit-taking causing a slight pullback, NXPC has maintained support levels around $2.60.

Key statistics:

1. Maximum Supply: 1 billion NXPC tokens

2. Circulating Supply: Approximately 169 million NXPC (around 17% of total supply)

3. Market Behavior: High volatility driven by limited circulating supply and strong speculative interest.

NXPC is currently listed on several exchanges, including Bitrue, helping improve liquidity and market access.

How Does the NXPC Price Prediction Tool Work?

NEXPACE price prediction tools enable users to estimate potential future prices based on customizable growth rates.

By inputting positive or negative annual growth percentages, users can simulate various price trajectories, from short-term daily movements to long-term forecasts extending to 2050.

These predictions incorporate:

1. Technical Indicators: EMA, Bollinger Bands, RSI, MACD to gauge trends and momentum.

2. User Sentiment Data: Reflects community outlook on NXPC’s prospects.

3. Market Trends: Incorporates historical price movements and broader crypto market conditions.

NXPC Short-Term Price Predictions (2025)

NEXPACE’s short-term outlook for 2025 projects significant price fluctuations within a trading channel:

Analysts expect a bullish sentiment during summer months with potential for price recovery and growth. However, December 2025 shows a potential dip, reflecting usual market seasonality and volatility.

NXPC Mid to Long-Term Price Forecast (2026–2030)

Looking beyond 2025, NEXPACE’s price trajectory is expected to reflect its growing ecosystem adoption, GameFi expansion, and broader blockchain gaming trends:

1. 2026: Predicted price range of $5.80 to $7.00, driven by deeper GameFi integration, NFT ecosystem growth, and multichain support.

2. 2027: Expected to trade between $6.80 and $8.50, fueled by institutional interest and exchange expansion.

3. 2028: Price may reach $7.00 to $9.20, as decentralized governance (DAO) and community empowerment kick in.

4. 2029: Potential trading between $8.50 and $11.00 due to cross-game interoperability and partnerships.

5. 2030: Price could stabilize around $10.00 to $13.50 in a mature metaverse ecosystem, assuming sustained user engagement and innovation.

NXPC Long-Term Outlook to 2050

While the predictions become more speculative over decades, current models suggest NXPC might maintain relevance as a key utility token within a broad gamified metaverse by 2050.

However, the price forecast indicates a wide range of scenarios depending on technological advances, market dynamics, and governance outcomes.

Why Are These Predictions Important?

Price forecasts provide valuable insight for:

1. Investment Strategy: Timing buy/sell decisions and managing risk.

- Market Understanding: Tracking ecosystem adoption and sentiment trends.

3. Portfolio Diversification: Identifying promising crypto assets within gaming and NFTs.

4. Community Engagement: Fostering informed discussions and collective intelligence.

Risks and Considerations

Despite promising projections, investors should remain cautious due to:

- Market volatility and regulatory uncertainties.

- Potential oversupply as token unlocks increase circulating supply.

- Competition from other GameFi and metaverse tokens.

Adoption challenges transitioning players from traditional (Web2) gaming to blockchain-based models.

Conclusion: Is NXPC a Good Investment?

NEXPACE (NXPC) shows strong early momentum fueled by its connection to the MapleStory Universe and GameFi sector.

While short-term predictions indicate potential gains and volatility, long-term success hinges on continued ecosystem development, user adoption, and market positioning.

Investors should use price prediction tools as one of many resources, combined with fundamental analysis and risk management strategies, to navigate NXPC’s evolving market landscape.

by | May 25, 2025 | Business

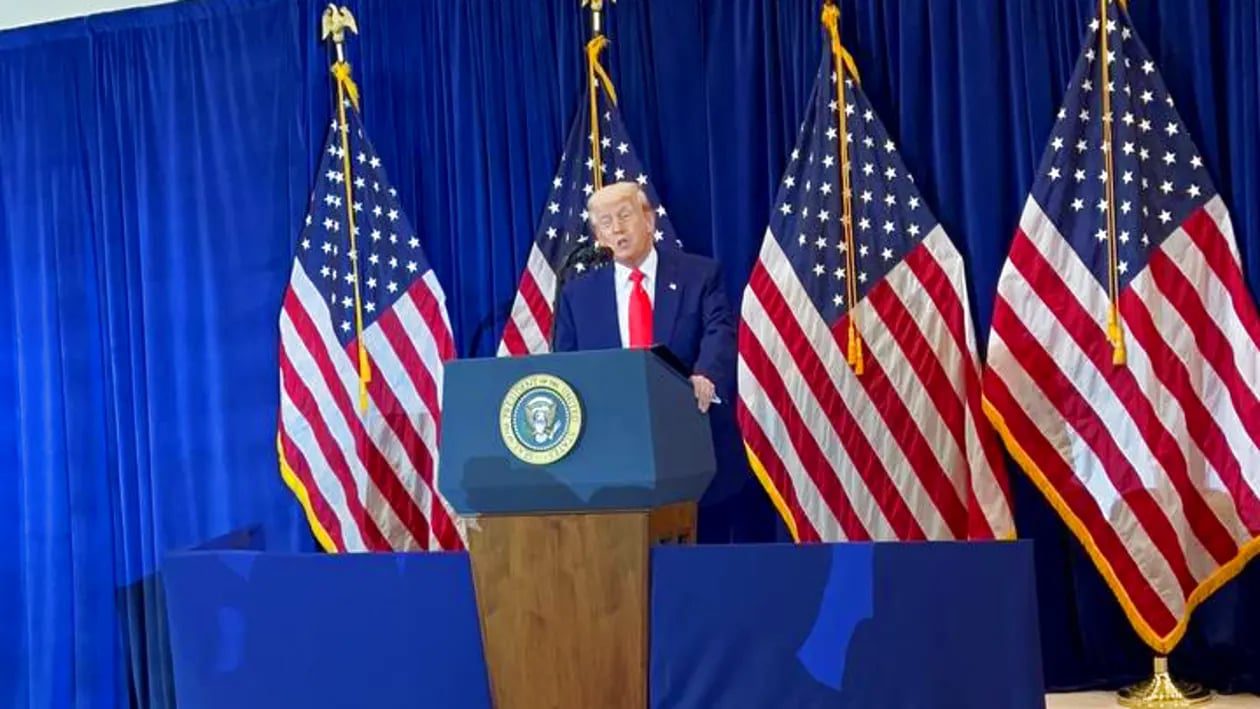

Inside Donald Trump’s $TRUMP meme coin dinner: a $394M crypto gala raising legal, ethical, and political alarms over foreign influence, campaign finance, and blockchain-era power plays.

On the evening of May 22, over 200 wealthy crypto enthusiasts, influencers, and foreign investors converged at Trump National Golf Club in Sterling, Virginia, for what was marketed as “the most exclusive invitation in the world.”

The event, a black-tie dinner hosted by President Donald Trump, was not a political fundraiser, at least not in name. It was a lavish reward for those who had invested millions into the volatile $TRUMP meme coin, a cryptocurrency intimately tied to Trump and his family.

While the evening featured filet mignon, halibut, a presidential appearance, and the flash of Richard Mille watches, the fallout from the event continues to stir legal, ethical, and political concerns.

These range from allegations of foreign influence and “pay-to-play” access to questions about cryptocurrency regulation and the future of political fundraising in the digital age.

A Crypto Contest for Presidential Access

In a modern twist on political patronage, the $TRUMP coin event promised exclusive dinner access to the 220 largest holders of the meme coin, with the top 25 receiving VIP perks including a private reception and a tour of the golf club.

According to blockchain analytics firm Nansen, these attendees spent a combined $394 million to qualify, with individual investments ranging from $55,000 to $37.7 million. On average, each participant shelled out nearly $1.8 million.

Although the event was ostensibly personal and not political, 80% of the $TRUMP coin is owned by two Trump-affiliated companies: CIC Digital and Fight Fight Fight LLC.

The companies collect transaction fees on every coin trade, generating almost $900,000 within two days of the dinner’s announcement.

Critics argue that this structure blurs the line between private gain and public office — especially when the main draw of the investment appears to be access to the President himself.

A Brief Appearance, Mixed Reactions

Despite the high price of entry, many attendees came away underwhelmed. Trump appeared for only 23 minutes, according to 25-year-old guest Nicholas Pinto. He delivered a short speech echoing previous crypto talking points before departing via helicopter without engaging meaningfully with most guests.

“He didn’t talk to any of the 220 guests, maybe the top 25,” said Pinto. “The food sucked. Wasn’t given any drinks other than water or Trump’s wine. I don’t drink, so I had water. My glass was only filled once.”

Phones were not restricted, and security was reportedly lax. After Trump’s departure, the atmosphere shifted noticeably. “Lots of people didn’t even hold the coin anymore,” Pinto added. “They were checking their phones during dinner to see if the price moved.”

Indeed, the price did move, and not in a favorable direction. Within hours of the dinner, $TRUMP’s value plummeted by 16%, casting a shadow over the event’s financial optimism.

Foreign Influence and Regulatory Red Flags

One of the most controversial aspects of the event is the heavy involvement of foreign investors. Bloomberg News reported that at least 56% of the top 220 coin holders used foreign crypto exchanges, all of which claim to ban U.S. users.

Crypto researcher Molly White estimates that 72% of the wallets tied to the contest winners likely belong to non-U.S. nationals.

The top holder, “Sun,” has been linked to Chinese-born crypto mogul Justin Sun, who faces paused SEC fraud charges and is tied to the offshore exchange HTX.

Sun’s holdings include over $22 million in $TRUMP and another $75 million in World Liberty Financial’s stablecoin project, USD1, a coin backed by U.S. Treasurys and heavily promoted by the Trump family.

This has raised serious ethical questions, as U.S. law prohibits campaign donations from foreign nationals.

While the White House insists the dinner was not a political event, critics argue it functions as a de facto fundraiser, one that bypasses campaign finance laws under the guise of a cryptocurrency promotion.

Political and Legal Backlash

Lawmakers across the political spectrum expressed concern. Democratic Senators Richard Blumenthal and Chris Murphy called the event a “pay-to-play scheme” and “the most brazenly corrupt thing a President has ever done.”

Even Republican crypto advocate Senator Cynthia Lummis admitted the event gave her “pause.”

“Congress should demand the President disclose who’s paying him tribute in the shadows,” said Tony Carrk, executive director of the watchdog group Accountable.US. “We have strict laws to prevent undue foreign influence. This event appears to mock them.”

Although presidents are largely exempt from conflict-of-interest laws that apply to other federal employees, watchdogs warn that Trump’s crypto ventures could set a dangerous precedent, blending personal profit with the aura and authority of the presidency.

Trump’s Growing Crypto Empire

This isn’t Trump’s first foray into monetizing his political persona. His family has intertwined their private businesses with his presidency before, and the $TRUMP coin represents the next iteration of that strategy, aided by blockchain anonymity and lax international enforcement.

The Trump family has heavily backed World Liberty Financial, which manages the USD1 stablecoin. Abu Dhabi’s MGX fund recently pledged $2 billion in USD1 to Binance, marking one of the largest single crypto investments to date.

Despite once calling Bitcoin a “scam against the dollar,” Trump’s administration has dismantled key crypto regulatory bodies, including the SEC’s crypto team and the Justice Department’s digital task force.

At the same time, it has promoted stablecoin legislation that could dramatically benefit Trump-affiliated ventures.

Conclusion: A Crypto Presidency?

As cryptocurrency continues to blur the lines between finance, politics, and personal branding, Donald Trump’s $TRUMP coin dinner has ignited a firestorm of questions that go well beyond digital tokens.

From foreign influence and campaign finance loopholes to regulatory rollback and potential corruption, the event illustrates how emerging technology is challenging long-standing democratic norms.

Whether this was a celebration of innovation or a symbol of systemic erosion depends largely on one’s political perspective. But one thing is clear: in the age of meme coins and blockchain politics, access to power is being redefined, one coin at a time.

by | May 25, 2025 | Business

Explore Brainrot (ROT) price predictions for 2025. Will this Solana-based meme coin regain momentum, or is high volatility a red flag for investors? Find out key forecasts, risks, and expert insights.

As meme coins continue to play a volatile yet attention-grabbing role in the cryptocurrency market, Brainrot (ROT) has emerged as a unique contender. Built on the Solana blockchain and fueled by viral internet culture, ROT represents both the unpredictability and potential of low-cap tokens.

With ROT currently trading around $0.00017 and exhibiting high volatility, many investors are asking: what lies ahead for Brainrot in 2025 and beyond?

What Is Brainrot (ROT)?

Brainrot is a low-cap meme token that rides the hype wave of internet slang and viral trends, particularly within the Solana ecosystem.

Despite its humorous branding, ROT has captured attention on platforms like Raydium—a popular decentralized exchange (DEX) on Solana. However, the project remains largely speculative, with limited information available regarding its roadmap, team, and technical whitepaper.

Current Market Status

1. Price: ~$0.00017

2. Market Cap: ~$172,000

3. 24h Volume: ~$306

4. Circulating Supply: ~999.32 million

5. Max Supply: ~999.41 million

6. Ranking: ~#5777 globally

The token is currently down nearly 55% year-to-date and trades approximately 98% below its all-time high of $0.01211.

Technical Analysis: May 2025 Overview

ROT’s current trajectory is bearish. Several key technical indicators reflect ongoing downward pressure:

1. RSI (Relative Strength Index): Current RSI: 0.00 (1-week timeframe). Indicates oversold conditions, but also reflects severe lack of buying momentum. The RSI needs to climb above 50 to signal a potential reversal.

2. Moving Averages (MA): The 50-day MA has crossed below the 200-day MA, a classic bearish signal. However, ROT’s price is trading slightly above both, suggesting neutral trend potential in the short term.

3. MACD (Moving Average Convergence Divergence): MACD shows bearish divergence with a negative histogram for the last 50 periods, indicating persistent selling pressure.

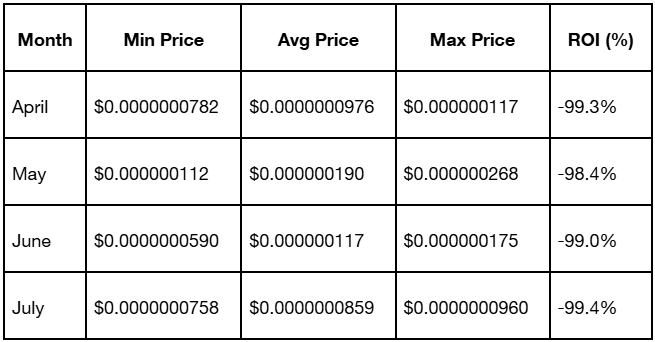

ROT Price Forecast 2025 and Beyond

1. 2025 General Forecast

While the average price suggests upside potential, short-term indicators still warn of bearish movements before any sustainable rally.

2. Monthly Price Predictions: June–December 2025

ROT may reach an annual average of $0.00008644 in 2025, implying potential recovery if macro conditions stabilize.

3. Expert Forecasts for Brainrot

1. 3Commas: Predicts a steady climb in ROT prices, with AI-assisted analysis projecting highs near $0.00020 by mid-2025.

2. TradingBeasts & Wallet Investor: Both forecast ROT’s minimum price to hover around $0.00015, with possible peaks just above $0.00020. Consensus average: $0.00017524641

Investment Outlook

According to current projections:

- Holding $1,000 in ROT may return approximately $604 profit (60.43% ROI) by December 2025—if bearish trends continue and short positions are strategically executed.

- However, predictions also show a possible drop to $0.00009503 by June 2025, a -45.23% loss if trends worsen.

Volatility remains a double-edged sword, offering both opportunity and high risk.

What Influences ROT’s Price?

Core Drivers:

1. Supply & Demand: With nearly all tokens in circulation, supply shocks are unlikely unless deflationary mechanisms are introduced.

2. Solana Network: Fast, cheap transactions make ROT easily tradable, which could aid adoption.

3. Community Hype: As with many meme coins, community engagement and viral momentum remain essential.

4. Institutional or Whale Activity: A single large sell order can drastically impact ROT’s price.

5. Regulatory Shifts: Future compliance requirements or delistings can affect market perception.

How High the Risk of ROT?

ROT is a high-risk, high-reward asset, primarily driven by speculation. With limited project documentation, unclear use cases, and very small daily trading volumes, it is not ideal for long-term conservative investors.

However, traders who understand meme coin cycles and market sentiment may find short-term opportunities in ROT’s price swings.

Conclusion

The future of brainrot (ROT) remains uncertain but not without potential. If viral traction returns, or if Solana meme coins re-enter mainstream interest, ROT could see a strong upside.

But investors should tread carefully, conduct independent research, and never invest more than they can afford to lose.

You must be logged in to post a comment.