by | Jun 12, 2025 | Business

Asuene Inc. is pleased to announce a strategic capital and business alliance with Daikin Industries, Ltd., the world’s leading HVAC company. This partnership was formalized through a third-party allocation of new shares as part of Asuene’s Series C2 round second close, bringing the company’s total funding to US $73.7 million.

Through this alliance, the two companies will offer integrated decarbonization services by combining Asuene’s carbon accounting platform “ASUENE” and consultation with Daikin’s energy-saving solutions in HVAC and building management. The partnership will primarily target the North American and Japanese markets, where both companies will jointly accelerate initiatives to support corporate climate action with greater precision and scale.

Background: Addressing Global Needs for Decarbonization and Energy Optimization

As the global push toward decarbonization intensifies, CO2 emissions from buildings account for about 20 to 30 percent of the total worldwide. Optimizing energy use—particularly in air conditioning and lighting—has become a key priority. In Japan, the introduction of GX-ETS (Green Transformation Emissions Trading Scheme) and expanded disclosure requirements under the new SSBJ (Sustainability Standards Board of Japan) are driving companies to act swiftly.

Meanwhile, in the US, states, municipalities, and private companies are advancing climate initiatives from planning to execution. With growing demand for measurable, actionable solutions, there is a particular emphasis on improving energy efficiency in buildings and facilities.

“ASUENE”, carbon accounting platform, is the No.1* market share service in Asia. We had also established its US subsidiary, ASUENE USA, to deliver localized solutions and support companies in meeting regional compliance and ESG goals.

Daikin operates in over 170 countries and is the global leader in HVAC. In the US alone, its HVAC business exceeds US $10 billion in annual revenue and continues to see rapid growth.

*Based on a July 2024 study by Tokyo Shoko Research

Details of the Strategic Partnership: Building Seamless Decarbonization Solutions in Japan and North America

Asuene and Daikin share a common vision: to become globally leading decarbonization solution providers originating from Japan. This capital and business alliance, formalized through Asuene’s Series C2 funding, marks a major step toward that goal.

By integrating Asuene’s platform with Daikin’s HVAC equipment and building management systems, the partnership will provide companies with a seamless, one-stop solution to measure, reduce, and report emissions. This end-to-end approach—from carbon accounting to practical implementation—will help companies reduce energy costs and accelerate their sustainability efforts.

Together, Asuene and Daikin will strengthen their competitiveness and drive innovation across Japan and North America, working toward a more sustainable global society.

Comments from Key Executives

Masaaki Miyatake, Executive Officer, Applied Solutions Business, Daikin Industries, Ltd.

Against the backdrop of global climate action and ESG initiatives, carbon measurement and reduction have become essential. By combining Asuene’s advanced GHG accounting capabilities with Daikin’s energy-efficient HVAC systems and operational expertise, we aim to deliver actionable, one-stop decarbonization solutions. Through this collaboration, we will contribute to building a more sustainable society, both in Japan and worldwide.

Kohei Nishiwada, Founder, CEO & COO, Asuene Inc.

We are deeply honored to enter a strategic capital partnership with Daikin, a global HVAC leader. This is more than an investment—it’s a bold commitment to our shared mission of decarbonization. By combining our strengths, we are fully committed to leading the market not only in Japan but in North America as well. This collaboration marks the beginning of our next chapter, and we are driving it forward with purpose and momentum.

About Daikin Industries, Ltd.

・Company Name: Daikin Industries, Ltd.

・Representative : Naofumi Takenaka, Representative Director, President and COO

・Headquarters: Osaka Umeda Twin Towers South, 1-13-1 Umeda, Kita-ku, Osaka

・Website: https://www.daikin.com

by | Jun 11, 2025 | Business

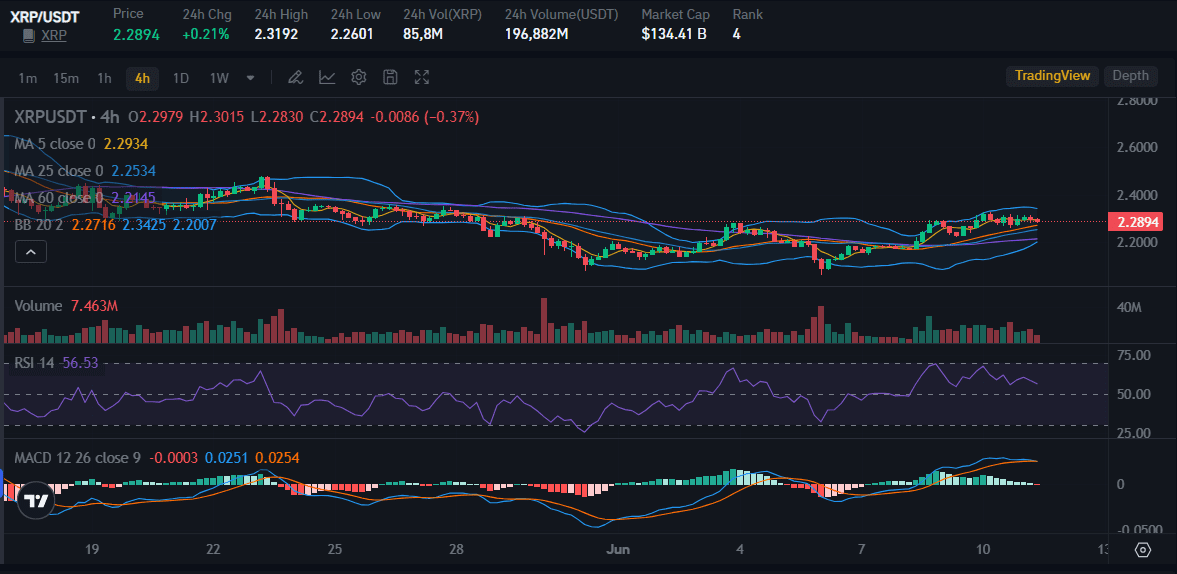

Ripple’s legal battle with the SEC, soaring ETF approval odds, and bullish chart signals are putting XRP in the spotlight. Will 2025 mark a historic breakout or a brutal crash? Here’s what investors need to know.

As the legal standoff between Ripple Labs and the U.S. Securities and Exchange Commission (SEC) continues, XRP investors closely monitor key court developments, potential ETF approvals, and bullish technical signals that could define the token’s 2025 trajectory.

With a pivotal deadline looming and speculation intensifying, XRP’s future remains tightly interwoven with regulatory actions and institutional interest.

Legal Crossroads: Ripple vs. SEC Reignites Uncertainty

On June 10, investor focus pivoted back to the SEC v. Ripple case, following fresh court filings and the approach of a critical June 16 deadline.

The SEC must submit a status report to the U.S. Court of Appeals, following the expiration of a 60-day abeyance granted in April.

The legal landscape was further complicated when Judge Analisa Torres denied the SEC’s request for an indicative ruling on the proposed settlement terms.

These terms, jointly filed by Ripple and the SEC, aimed to lift the injunction against XRP institutional sales and reduce the imposed $125 million penalty.

The denial has reintroduced legal ambiguity, prompting concerns that both parties may soon advance with their respective appeals.

Investors had anticipated another SEC request before the deadline, but the agency’s silence has cast doubt on a summer resolution.

Since Judge Torres’ decision, XRP has shown notable volatility, dropping from $2.6553 on May 12 to $2.0607 by June 5, before rebounding to around $2.30.

ETF Momentum: XRP’s Position in the Altcoin ETF Race

The prospect of spot XRP exchange-traded funds (ETFs) has become a focal point for the market. On June 10, Bloomberg Intelligence’s Eric Balchunas predicted a busy summer for altcoin ETFs, with Solana leading the way.

Although XRP is in contention, ongoing litigation has tempered its chances, placing its ETF approval odds behind Litecoin and Solana.

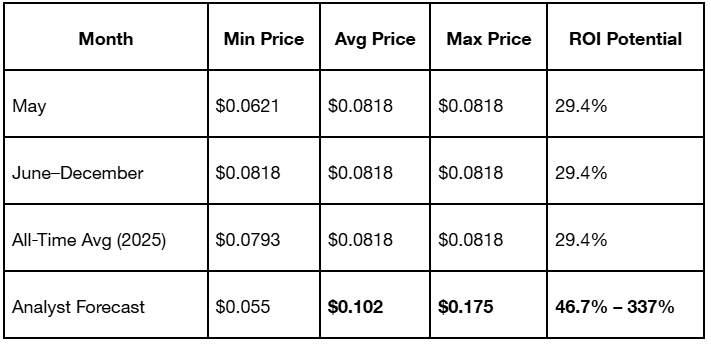

Nevertheless, market sentiment shifted sharply after Polymarket data on June 10 revealed a surge in approval odds for an XRP spot ETF, jumping to 98%, up from 68% in April.

This spike follows a wave of applications from leading firms like Bitwise, Grayscale, Franklin Templeton, and 21Shares, along with the successful May 19 launch of XRP futures ETFs by CME Group, which saw $19 million in first-day volume.

Further bolstering XRP’s institutional appeal, three companies announced plans to allocate over $471 million into XRP treasuries. Notably, Webus International filed a $300 million XRP strategic reserve with the SEC, highlighting growing corporate trust and adoption.

Traditional Finance Meets Crypto: Ripple-Guggenheim Collaboration

Ripple’s expanding influence in traditional finance was also underscored by a new partnership with Guggenheim Treasury Services. Under the deal, Guggenheim will offer its U.S. Treasury-backed commercial paper on the XRP Ledger.

Ripple will invest $10 million into the offering, which features customized maturities of up to 397 days.

This marks a significant move toward the tokenization of real-world assets (RWAs), a growing trend on Wall Street. With over $7 billion in tokenized U.S. Treasurys already issued, spearheaded by BlackRock, Franklin Templeton, and Fidelity, the partnership strengthens XRP’s position in the burgeoning RWA market.

Technical Signals: Bullish Setups Hint at Explosive Upside

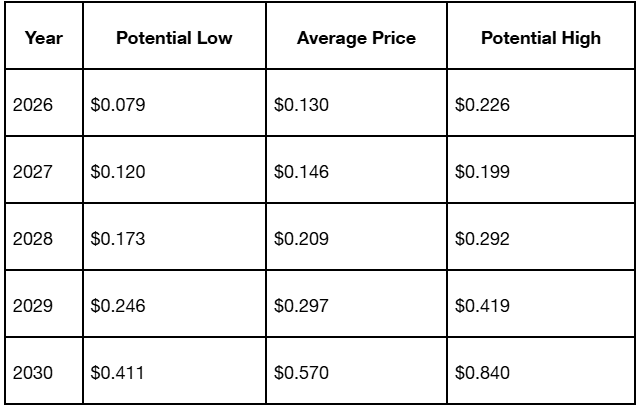

While regulatory developments weigh heavily on XRP, chart analysts are growing increasingly bullish. Crypto analyst JD (@jaydee_757) identified a hidden bullish divergence on the two-week Stochastic RSI, drawing parallels with XRP’s 2017-2018 market cycle. Back then, a similar setup led to a 20x rally.

JD noted that XRP has broken out from a multi-year symmetrical triangle originating in 2018, signaling a potential parabolic move.

He projects a price surge toward $17, followed by a dramatic correction, possibly crashing below $1, echoing the 94% drop seen post-2017 rally.

Market analyst Egrag Crypto shares a similar view, forecasting XRP to hit between $20 and $27 in 2025 before potentially retracing to around $3 during a bearish phase.

His “Guardian Arch” analysis leverages the 21-week EMA and 33-week SMA, along with the presence of a bullish flag on the monthly chart.

Price Outlook: Resistance, Support, and What’s Next

On June 10, XRP closed at $2.3064, down 0.66% on the day, slightly underperforming the broader crypto market. Currently, XRP trades at $2.2894, recovering from recent lows around $2.06 and up 9.7% over the past few days.

A move above $2.35 could spark a climb toward resistance at $2.6553 and eventually the $3.00 mark.

Surpassing this barrier may confirm the start of a parabolic uptrend with potential targets beyond $25. Conversely, failure to hold support could expose XRP to downside risk near $1.93, the 200-day EMA level.

Final Thoughts: Hope and Caution in Equal Measure

With legal clarity still pending and ETF hopes surging, XRP stands at a critical juncture. The growing integration of Ripple with institutional finance, combined with bullish chart patterns, presents a compelling narrative for XRP bulls. Yet, historical precedent and unresolved litigation caution against overexuberance.

Whether XRP fulfills its projected rise to double digits or falls victim to another dramatic correction, one thing is clear, 2025 will be a defining year for the cryptocurrency, both in court and on the charts.

by | Jun 11, 2025 | Business

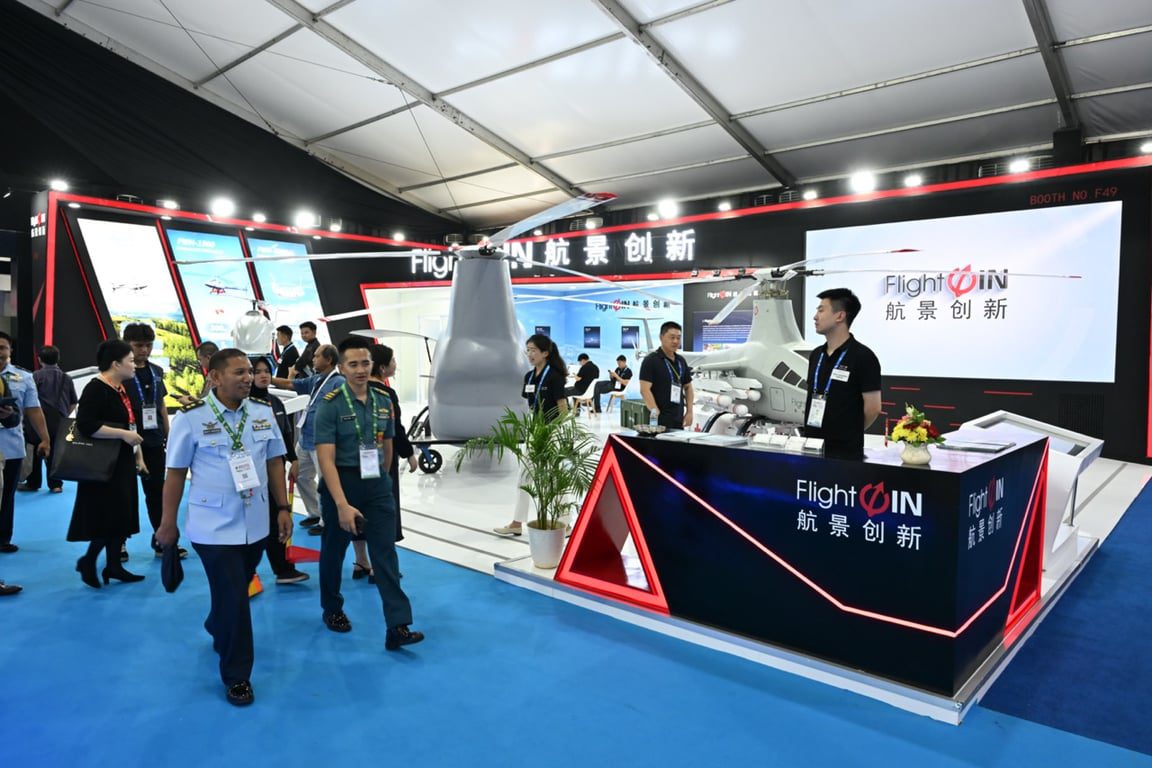

As a leading enterprise in the field of heavy-lift unmanned helicopters in China, China Flightwin-Innovation Technology Co., Ltd. (hereinafter referred to as “Flightwin”) is making its debut at the Indo Defence Expo & Forum held from June 11 to 14 at the Jakarta Convention Center in Indonesia, highlighting three star UAV products that represent its technological prowess: FWH-3000 tandem rotor unmanned helicopter, FWH-1500 ton-class unmanned helicopter, and FWH-300 unmanned helicopter. These three UAVs, with their outstanding performance parameters and mature industry solutions, have drawn wide attention from overseas users.

A Three-Model Matrix Showcasing Benchmark Technologies in Heavy-Lift UAVs

The three unmanned helicopters exhibited by Flightwin cover a payload range from 50 kg to 1000 kg, fully demonstrating the company’s full-scenario logistics transport capabilities with heavy-lift UAVs:

· FWH-3000 Tandem Rotor Unmanned Helicopter: As the largest payload unmanned helicopter platform worldwide, it adopts a tandem dual-rotor design, with a maximum take-off weight of 2300 kg and a maximum mission payload of 1000 kg. Its internal cabin space reaches 4.2 cubic meters, capable of simultaneously carrying two 500 kg standard pallets or six injured personnel. With a flight endurance of up to 5 hours and wind resistance up to scale 7, it can perform cargo delivery and medical rescue missions in extreme environments such as plateaus, deserts, and remote islands.

· FWH-1500 Ton-Class Unmanned Helicopter: A flagship product of Flightwin, it has a maximum take-off weight of 1000 kg, a maximum payload of 300 kg and the service ceiling of 6500 m. The model has proven its reliability in numerous real-world operations at home and abroad, including nighttime cross-mountain material delivery during the July 2023 flood rescue in Beijing, high-altitude delivery at 5200 meters, and multi-island cross-sea transportation tasks.

· FWH-300 Unmanned Helicopter: With a take-off weight of 220 kg and maximum payload of 50 kg, it can be equipped with electro-optical pods, firefighting bombs, and other payloads, making it suitable for tactical reconnaissance, disaster area broadcasting, and emergency material airdrop.

Full-Scope Applications, Deepening Presence in the Southeast Asian Market

Founded in 2008 and headquartered in Beijing, Flightwin is one of the few companies in China with full-industry-chain R&D and manufacturing capabilities for unmanned helicopters. Its products are widely used in emergency rescue, forest firefighting, and cargo delivery, and have achieved commercial deployment in multiple countries in the Middle East, Africa, and Southeast Asia.

At this Indo Defence Expo & Forum, Flightwin is focusing on showcasing solutions tailored to the region’s multi-island terrain and tropical rainforest climate, such as:

· The take-off and landing capability of the FWH-1500 meets the cargo delivery needs of offshore oil platforms;

· The large payload of the FWH-3000 allows rapid response for inter-island and remote area cargo transportation and medical rescue;

· Inspection and rapid suppression of forest fires with UAV extinguishing bombs dropping;

· The entire product line has passed rigorous high-temperature and high-humidity adaptation testing, ensuring stable operation in tropical climates.

Repeated International Recognition, Global Attention to Its Technological Strength

Flightwin has long been advancing its internationalization. At the 2024 UMEX exhibition in Abu Dhabi, its full product range attracted hundreds of international clients for discussions.

“This exhibition is an important opportunity for us to expand into the Southeast Asian market,” said Chen Chong, VP of Flightwin. “We look forward to using this platform to match China’s independently developed heavy-lift UAV technologies with the real needs of Indonesia and surrounding countries, promoting deeper UAV application in fields such as cargo delivery, forest fire prevention, and emergency rescue.”

by | Jun 10, 2025 | Business

Bitcoin surges past $108K in June 2025 amid whale trades, institutional inflows, and macroeconomic momentum. Analysts predict a new all-time high within weeks, possibly targeting $150K by year-end.

Bitcoin (BTC) continues to dominate headlines as its price surges past $108,000, buoyed by bullish macroeconomic signals, institutional adoption, and aggressive leveraged positions by so-called “whale” traders.

Analysts now anticipate that Bitcoin could break its all-time high (ATH) of $111,970 within the next one to two weeks, with some even projecting a path toward $150,000 by year-end.

Whale Trader Makes $54.5 Million Bet on BTC Rally

A newly funded crypto whale wallet, identified as 0x1f25, made one of the most aggressive trades of 2025, opening a 511.5 BTC position on decentralized exchange Hyperliquid using 20x leverage and $10 million USDC in margin.

The entry point for this high-stakes bet was $106,538 per BTC, with a liquidation threshold at $88,141, putting approximately $54.5 million on the line.

While the trader is already up over $11,000 in paper profits, their bold entry follows in the wake of large liquidations faced by other traders like James Wynn, who previously lost over $124 million in leveraged BTC trades but remains active in the space.

Macroeconomic Momentum: US-China Talks Fuel Risk Appetite

Bitcoin’s rally aligns with renewed optimism from US-China trade negotiations held in London.

Reports suggest the two superpowers may ease tech export restrictions and improve access to rare earth minerals, a development that sent US equities and risk-on assets, including Bitcoin, higher.

Analysts note similarities between Bitcoin’s current breakout pattern and recent moves in gold and the S&P 500.

Ted Pillows, a leading crypto strategist, emphasized that if BTC can overcome the $110K resistance level, a decisive breakout could materialize swiftly.

Institutional Inflows Hit Record Highs

Institutional interest is at an all-time high. In May alone, Bitcoin ETFs recorded $2.8 billion in net inflows, with total ETF assets under management now exceeding $122 billion.

This unprecedented demand has created a strong price floor, with large holders consistently buying dips, a traditionally bullish signal.

At the same time, Ethereum, XRP, and Dogecoin have also shown robust momentum, riding the wave of improved investor sentiment and increasing institutional participation.

Bitcoin Treasury Companies on the Rise

One of the more fascinating trends in crypto finance is the rise of bitcoin treasury companies, publicly traded firms that accumulate Bitcoin as a strategic reserve.

Among them is former budget hotel operator Metaplanet, which has transformed into a crypto-holding entity. “This is a one-way train,” said Metaplanet executive Dylan LeClair. “Nothing is going to stop this.”

The most iconic example is Strategy, which owns 582,000 BTC, nearly 3% of the total supply, more than any other company or even national government. Its shares have skyrocketed by over 3,000% in five years, eclipsing even Bitcoin’s own gains of roughly 1,000%.

As of June 2025, 61 publicly traded firms (excluding miners and ETFs) now collectively hold large amounts of BTC, with half of them averaging a purchase price of $90,000.

However, analysts warn that Bitcoin’s volatility could pressure these companies into selling during downturns to cover debts.

Crypto Stocks Soar on Altcoin Announcements

While Bitcoin remains the centerpiece, companies announcing plans to hold Ethereum or Solana have seen triple-digit stock gains. SharpLink Gaming saw its shares rise 400% after revealing plans to purchase up to $425 million in Ethereum.

Likewise, Upexi’s stock jumped over 300% after announcing a $100 million acquisition plan for Solana.

Technical Outlook: Bitcoin Eyes $150K, but Resistance Looms

Bitcoin recently tested $110,500 before retreating slightly, hovering around $109,500 at the time of writing. This follows its strongest single-day gain in over a month, driven by ETF flows and rising confidence among institutional investors.

However, technical resistance remains near the ATH of $111,970, set on May 22. Analysts believe any pullbacks toward the $100,000 or $102,000 zones should be seen as buying opportunities, while a drop below $92,000 could reverse current bullish momentum.

According to Bitfinex analysts, the lack of a clear catalyst could make BTC vulnerable to short-term corrections. Long-term holders who accumulated during Q1’s lows near $78,000 are now facing a decision: hold or distribute as the price flirts with record highs.

If Bitcoin successfully reclaims and holds above its ATH, $1.08 billion in short positions stand to be liquidated, further fueling upside volatility.

Fed Decision and Trump’s Trade Policy Could Be Key Catalysts

Looking ahead, the next Federal Reserve interest rate decision, scheduled for June 18, is expected to play a pivotal role. A rate cut would likely serve as a bullish trigger for Bitcoin and other cryptocurrencies.

However, ongoing uncertainty over President Trump’s tariff policies may continue to cloud market sentiment.

“The biggest threat to bulls right now is that nothing changes,” said Pav Hundal, lead analyst at Swyftx. “The cycle of endless tariff ultimatums is causing hesitation.”

Conclusion: Bitcoin Bulls Remain Cautiously Optimistic

The road to a new all-time high is paved with optimism, risk, and macroeconomic complexity. Between bold whale traders, rising corporate adoption, and historic institutional inflows, Bitcoin’s ascent to $150,000 is no longer a fringe forecast.

Still, with macro catalysts yet to fully materialize, the next few weeks will be crucial in determining whether Bitcoin breaks free or falls back into consolidation.

For now, the crypto market watches, and waits, as history appears ready to be rewritten once again.

by | Jun 10, 2025 | Business

UNSW leads the way for Australian universities, transitioning to renewable electric energy across all Sydney residential colleges. The replacement of outdated gas systems is a key milestone as the University strides toward its net zero emissions goal.

UNSW Sydney has ditched gas and adopted clean, renewable electric power for all student accommodation sites, kitchens, childcare, sports and hospitality facilities at the Kensington and Paddington campuses.

The current upgrade prevents around 700 tonnes of CO2 emissions per yearUniversity-wide electrification due by 2030UNSW is on track toachieve net zero by 2050.

Better facilities, healthier environments

At UNSW’s Goldstein Hall in Kensington – it’s cooking with gas, no more! The kitchen serves more than 1,300 meals daily. Senior Manager of Energy and Utilities at UNSW, Jose Bilbao, said the now fully electrified commercial kitchen had revolutionised operations.

“It has been absolutely rewarding seeing the kitchen before and after,” he said. “The fryers don’t produce fumes when we’re using them, so it’s a lot healthier here, much better air quality, it’s cooler and we’re using less energy.”

Head Chef at Goldstein Hall, Eve Wannasorn, said the change from a gas-powered to electric kitchen had been positive for both staff and students. “Making a stew for around 300 people used to take about three hours. Now it’s around 45 minutes,” she said. “The food tastes nice. It’s fresher. And chefs don’t need to waste time changing oil manually. It means the quality of the food is much better.”

Looking ahead to net zero

UNSW is leading the charge to electrification for Australian universities. This first phase of UNSW’s electrification program has reduced UNSW’s emissions from natural gas by an estimated 10%. Across all UNSW Sydney colleges, gas-powered systems have been replaced with:

34 heat pump-operated dryers and 34 washers31 induction cooktops and 10 electric barbecuesNew high-efficiency electric commercial kitchen appliances such as fryers, pressurised Bratt pans, and dishwashing systems8 domestic hot water heat pumps, with a total heating capacity of 400 kW, and 18 hot water tanks (total of more than 12,000 litres of hot water), replacing more than 20 instant hot water gas units.

All electrical amenities are powered by renewable solar energy, thanks to the University’s on-site solar system and the Sunraysia Solar Farm through a solar Power Purchase Agreement (PPA). UNSW is expected to save 1.25 million tonnes of greenhouse gas emissions over the 15-year term of agreement.

Chief Property Officer at UNSW, Timothy Beattie, said the transition had set an example for the broader Australian industry. “Electrification is not only possible, and critical to achieve the Paris agreement, but also desired as it provides so many direct and indirect benefits, like better air quality, operational efficiencies, and reduction of fugitive emissions,” he said.

“This is an important investment for the University and the community. Once the program is completed, we’ll save around 155,000 GJ of gas per year. That’s like removing more than 5,300 cars from the road.”

UNSW is one of the world’s leading universities for environmental and social sustainability, ranked 12th globally.

You must be logged in to post a comment.